Professional Documents

Culture Documents

Bill

Uploaded by

RAVINDER PANJETA0 ratings0% found this document useful (0 votes)

10 views1 pageThis property tax notice is for a property located at Purani Sabji Mandi in Bahadurgarh. The property is owned by Smt. Santosh Vinna and has a total area of 36 square yards. It is categorized as a commercial shop on the ground floor. The calculated property tax is Rs. 432 and fire tax is Rs. 43.20, for a total of Rs. 475.20 outstanding in property and fire taxes for the 2022-2023 financial year. The notice states that if payment is made by July 31st, a 10% rebate will be applied to the current demand for property tax.

Original Description:

Original Title

bill

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis property tax notice is for a property located at Purani Sabji Mandi in Bahadurgarh. The property is owned by Smt. Santosh Vinna and has a total area of 36 square yards. It is categorized as a commercial shop on the ground floor. The calculated property tax is Rs. 432 and fire tax is Rs. 43.20, for a total of Rs. 475.20 outstanding in property and fire taxes for the 2022-2023 financial year. The notice states that if payment is made by July 31st, a 10% rebate will be applied to the current demand for property tax.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageBill

Uploaded by

RAVINDER PANJETAThis property tax notice is for a property located at Purani Sabji Mandi in Bahadurgarh. The property is owned by Smt. Santosh Vinna and has a total area of 36 square yards. It is categorized as a commercial shop on the ground floor. The calculated property tax is Rs. 432 and fire tax is Rs. 43.20, for a total of Rs. 475.20 outstanding in property and fire taxes for the 2022-2023 financial year. The notice states that if payment is made by July 31st, a 10% rebate will be applied to the current demand for property tax.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

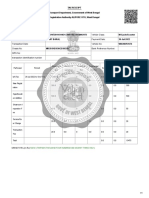

MUNICIPAL COUNCIL BAHADURGARH

Property Tax Notice Cum Bill

Property Id: BGR/W17/997 Old Property Id: Financial Year: 2022-2023

Ward No: Mobile No: Colony Name:

Particulars of Owner(s) / Occupiers(s): Plot Address: Purani Sabji Mandi Bill Print Date : 10 October 2022

Owner Name: Smt. Santosh,Vinna Permanent Address:

Property And FireTax Detail

Total Area : 36.000 SqYard

Floor Property Property Property Carpet Calculated Calculated Tax Rate Usage Property Floor Fire Tax(F) After Floor Building Rebate

Category Type SubCatego Area Area (Unit) Tax Rate Formula Tax(H) Rs Rebate(R) Rs Rebate Type Remark

ry (Sq.Feet) Rs (P)=(H+F)- Rebate

(R) Rs

GF Commercial Shop Shop 0.00 36 SqYard 12 12 Self 432.00 0.00 43.20 475.20 No Rebate 0 % - GF

Occupied

Total : 432.00 0.00 43.20 475.20

Total Property & Fire Tax Outstanding(PO): 475.20

Property Tax Arrear(A)= 0.00/- Fire Tax Arrear(FA)= 0.00/- Interest on Arrear(I)= 0.00/- Total Tax(P+A+FA+I)= 475.20/-

Outstanding as on date(AO)= 0/- Outstanding as on date(FO)= 0/- Outstanding as on date(IO)= 0/- Total Outstanding as on date(PO+AO+FO+IO)= 475.20/-

This bill pertain to current financial year only. This bill is for Property Tax collection purpose only. In case of Payment made up to 31st July of Current Financial year,

Tax Payer will get 10 % rebate on Current Demand of Property Tax.

You might also like

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Un Cyberpark TC-16TH FLR 1603Document1 pageUn Cyberpark TC-16TH FLR 1603uttamcse2021No ratings yet

- Un Cyberpark Ta-1st FLR 103-BDocument1 pageUn Cyberpark Ta-1st FLR 103-Buttamcse2021No ratings yet

- Prem NagarDocument1 pagePrem NagarvikramNo ratings yet

- Municipal Corporation Gurugram: Property Tax Notice Cum BillDocument1 pageMunicipal Corporation Gurugram: Property Tax Notice Cum Billuttamcse2021No ratings yet

- Un Cyberpark TB-7TH FloorDocument1 pageUn Cyberpark TB-7TH Flooruttamcse2021No ratings yet

- PrintBill 109Document1 pagePrintBill 109gauravNo ratings yet

- Print BillDocument1 pagePrint BillThe sukhmani AutomobileNo ratings yet

- Print BillDocument1 pagePrint BillSumit NandalNo ratings yet

- PrintBill 95Document1 pagePrintBill 95gauravNo ratings yet

- Print BillDocument1 pagePrint Billvkr4035No ratings yet

- Print Bill 343Document1 pagePrint Bill 343modi jiNo ratings yet

- Seran MamaDocument1 pageSeran MamachauhantonyNo ratings yet

- Httpsproperty Ulbharyana Gov InBillReportPrintBillPID 1KD14OO0&UlbID 61Document1 pageHttpsproperty Ulbharyana Gov InBillReportPrintBillPID 1KD14OO0&UlbID 61roopumgautam95No ratings yet

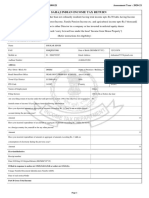

- GSTR9 33dgwpp5135e1z4 032021Document8 pagesGSTR9 33dgwpp5135e1z4 032021newquper2022No ratings yet

- Reports - 8585373500431256457PT1Document1 pageReports - 8585373500431256457PT1Muhammad Anns KhanNo ratings yet

- GSTR9 19GCBPS5582Q1ZH 032023Document8 pagesGSTR9 19GCBPS5582Q1ZH 032023nirmalku2061No ratings yet

- (I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)Document8 pages(I) (B) (Ii) (D) (Iii) (D) (Iv) (C) (V) (A) (Vi) (C) (Vii) (A) (Viii) (D) (Ix) (C) (X) (C)santosh palNo ratings yet

- GSTR9 23apjps3159l1zg 032022Document8 pagesGSTR9 23apjps3159l1zg 032022sales candoNo ratings yet

- GSTR9 33aahcb1010d1zn 032023Document8 pagesGSTR9 33aahcb1010d1zn 032023arpindlavNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Paramjeet KontNo ratings yet

- Reports - 8585153724843186061PT1Document1 pageReports - 8585153724843186061PT1khurramjaved826No ratings yet

- SDMC Property Tax Delhi 2016-17Document2 pagesSDMC Property Tax Delhi 2016-17Bhuvanesh KohliNo ratings yet

- GSTR9 27aahcb1010d1zg 032023Document8 pagesGSTR9 27aahcb1010d1zg 032023arpindlavNo ratings yet

- GSTR9 29aahcv2115k1z5 032020Document8 pagesGSTR9 29aahcv2115k1z5 032020MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- Reports - 8585146145267698249PT1Document1 pageReports - 8585146145267698249PT1Nb KashifNo ratings yet

- GSTR9 29aahcv2115k1z5 032021Document8 pagesGSTR9 29aahcv2115k1z5 032021MICO EMPLOYEES CO OPERATIVE SOCIETY LTDNo ratings yet

- NDMC Property Tax Delhi 2020-21 PDFDocument2 pagesNDMC Property Tax Delhi 2020-21 PDFravi_bhateja_2No ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9mani samiNo ratings yet

- BillNo PTAX240920200503Document1 pageBillNo PTAX240920200503Executive EngineerNo ratings yet

- Fatiha 2020 Declaration PDFDocument3 pagesFatiha 2020 Declaration PDFIkramNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Document6 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2019-20Sheikh Mohd Danish SiddiquiNo ratings yet

- GSTR9 10JHBPS7007C1ZR 032019Document8 pagesGSTR9 10JHBPS7007C1ZR 032019karanNo ratings yet

- 2019 10 20 11 11 26 114 - Cixpm4133k - 2019Document8 pages2019 10 20 11 11 26 114 - Cixpm4133k - 2019tarun mathurNo ratings yet

- 2019 03 27 19 17 48 254 - DGCPK4360Q - 2018Document5 pages2019 03 27 19 17 48 254 - DGCPK4360Q - 2018TAX GURUNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 742008690241120 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 742008690241120 Assessment Year: 2020-21suhail amirNo ratings yet

- FIN AL: Form GSTR-9Document8 pagesFIN AL: Form GSTR-9RM PlusNo ratings yet

- 1014017423-Special NoticeDocument4 pages1014017423-Special NoticeMohammadNo ratings yet

- Form PDF 139026350310819Document6 pagesForm PDF 139026350310819Density GamingNo ratings yet

- Dem-Soho 2324 208 75508 100469Document2 pagesDem-Soho 2324 208 75508 100469Ayush ChouhanNo ratings yet

- GSTR9 09aaact9363l1zq 032023Document8 pagesGSTR9 09aaact9363l1zq 032023sachinkumar.rkcjNo ratings yet

- Property Tax Check ListDocument1 pageProperty Tax Check ListVARUNNo ratings yet

- 114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Document7 pages114 (1) (Return of Income Filed Voluntarily For Complete Year) - 2023Bm ShopNo ratings yet

- Income Tax Return Sat-Ita22: Official StampDocument6 pagesIncome Tax Return Sat-Ita22: Official Stamptsere butsere50% (2)

- Sa PDFDocument1 pageSa PDFMd EkramNo ratings yet

- Form PDF 710378520091120Document7 pagesForm PDF 710378520091120asmita196No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Xen Operation DPHNo ratings yet

- GSTR9 19anypg3791m1zy 032022 PDFDocument8 pagesGSTR9 19anypg3791m1zy 032022 PDFManprit MahalNo ratings yet

- ITR FormDocument9 pagesITR FormSuman jhaNo ratings yet

- WB90E7632 Tax ADocument1 pageWB90E7632 Tax Azaid AhmedNo ratings yet

- Writing Samples Task 2Document6 pagesWriting Samples Task 2Mithun SadavarteNo ratings yet

- 2019 09 18 22 09 59 689 - Aovpb3846g - 2018Document5 pages2019 09 18 22 09 59 689 - Aovpb3846g - 2018varahalutulugu1980No ratings yet

- Draft: Veridian at Emerald Isle 11B 1502 549.82Document1 pageDraft: Veridian at Emerald Isle 11B 1502 549.82sachinNo ratings yet

- GSTR9 09abepk8302l1zh 032018Document8 pagesGSTR9 09abepk8302l1zh 032018Capraful PrabhakaranNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 183499300100121 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 183499300100121 Assessment Year: 2020-21SONU SNo ratings yet

- Ra-09 Abstract SheetDocument23 pagesRa-09 Abstract SheetYash DeoreNo ratings yet

- LC 03 Tad - at Has - v2 - Approve - p28Document1 pageLC 03 Tad - at Has - v2 - Approve - p28Manoj H MNo ratings yet

- Assignment Two CartoonsDocument3 pagesAssignment Two CartoonsAbraham Kang100% (1)

- Atelerix Albiventris MedicineDocument5 pagesAtelerix Albiventris MedicinemariaNo ratings yet

- That Thing Called Tadhana ReviewDocument5 pagesThat Thing Called Tadhana ReviewLian BastidaNo ratings yet

- Pdi Partial EdentulismDocument67 pagesPdi Partial EdentulismAnkeeta ShuklaNo ratings yet

- Protection of Information Systems: © The Institute of Chartered Accountants of IndiaDocument28 pagesProtection of Information Systems: © The Institute of Chartered Accountants of Indiajonnajon92-1No ratings yet

- (Computer Science and Engineering) : University of Engineering & Management (UEM), JaipurDocument35 pages(Computer Science and Engineering) : University of Engineering & Management (UEM), JaipurDeepanshu SharmaNo ratings yet

- Crossed Roller DesignGuideDocument17 pagesCrossed Roller DesignGuidenaruto256No ratings yet

- 1 Whats NewDocument76 pages1 Whats NewTirupati MotiNo ratings yet

- Week 2 Reflection Sept 6 To Sept 10Document2 pagesWeek 2 Reflection Sept 6 To Sept 10api-534401949No ratings yet

- Document No.: Safety CheckDocument14 pagesDocument No.: Safety CheckRodolfo Alberto Muñoz CarcamoNo ratings yet

- Detailed Lesson Plan in TLEDocument7 pagesDetailed Lesson Plan in TLEma kathrine cecille macapagalNo ratings yet

- Agricultural FinanceDocument8 pagesAgricultural FinanceYayah Koroma100% (1)

- Piano 2023 2024 Grade 6Document13 pagesPiano 2023 2024 Grade 6Lucas Moreira0% (1)

- The Invention of The Internet Connecting The WorldDocument14 pagesThe Invention of The Internet Connecting The WorldSolomia Sushko100% (1)

- IPO Process and GradingDocument9 pagesIPO Process and GradingITR 2017No ratings yet

- Predestination Vs Free WillDocument4 pagesPredestination Vs Free WillFrancis Heckman100% (2)

- Tinynet (Mytyvm) : Creating Virtual MachinesDocument38 pagesTinynet (Mytyvm) : Creating Virtual MachinesSayyam ChNo ratings yet

- Price Reference Guide For Security Services 2021Document4 pagesPrice Reference Guide For Security Services 2021Dulas DulasNo ratings yet

- Finned Surfaces: Name:Mohamed Hassan Soliman ID:190513 DR - Mohamed HassanDocument7 pagesFinned Surfaces: Name:Mohamed Hassan Soliman ID:190513 DR - Mohamed HassanMohamed HassanNo ratings yet

- 3rd Quarter DLP 20 MODULE 2Document4 pages3rd Quarter DLP 20 MODULE 2Jim Alesther LapinaNo ratings yet

- Salon Student DataDocument23 pagesSalon Student DataparthppppNo ratings yet

- Isc Touch 250 Data SheetDocument2 pagesIsc Touch 250 Data SheetUmesh KumawatNo ratings yet

- OnlineQuizPlatform 1Document3 pagesOnlineQuizPlatform 1Nathan MathewNo ratings yet

- Cia Rubric For Portfolio Project Submission 2017Document2 pagesCia Rubric For Portfolio Project Submission 2017FRANKLIN.FRANCIS 1640408No ratings yet

- Three Levels of SustainabilityDocument330 pagesThree Levels of SustainabilityChristian Prez100% (5)

- Obstetric Fistula 2015 PDFDocument86 pagesObstetric Fistula 2015 PDFRakha Sulthan Salim100% (1)

- Rms Due1012Document8 pagesRms Due1012api-273006352No ratings yet

- Decision Mathematics D1 January 2023 Question Paper Wdm11-01-Que-20230126Document28 pagesDecision Mathematics D1 January 2023 Question Paper Wdm11-01-Que-20230126VisakaNo ratings yet

- TH I Gian Làm Bài: 180'Document17 pagesTH I Gian Làm Bài: 180'Duy HảiNo ratings yet