Professional Documents

Culture Documents

Railtel Corporation of India Limited: Tax Invoice

Railtel Corporation of India Limited: Tax Invoice

Uploaded by

sunnyrunninginamazonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Railtel Corporation of India Limited: Tax Invoice

Railtel Corporation of India Limited: Tax Invoice

Uploaded by

sunnyrunninginamazonCopyright:

Available Formats

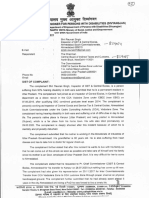

RailTel Corporation of India Limited

(A Government Of India Undertaking, Ministry Of Railways)

Tax Invoice

RCIL Address for state HARYANA:- Plateform 1, New Power House, Railway Station, Gurgaon, Haryana, 122001

CUSTOMER BILL TO Invoice No. : 2306101694

Customer Name: Haryana State Electronics Development Corporation Limited Invoice Date : 30-SEP-2023

Address: SCO 111-113 Payment Terms : IMMEDIATE

SCO 111-113, Sector 17 B, Chandigarh, 160017 Hartron:AGM(TDS):2022:1249 dt.

Customer PO No. 22.08.2022 [O&M Jul-Sep 2023]

Service Type : Hartron

CUSTOMER Supply Address Sales Order No. 3100020030

State Code: 04 and State : CHANDIGARH Billing Cycle : One Time

Billing Period : 01-JUL-2023 TO 30-SEP-2023

Customer Details RailTel Details

Customer PAN No. : AABCH1532Q Bank Name- Union Bank of India IFSC Code - UBIN0530786

Customer TAN No. : PTLH11258C Bank Account No. 307801010917906

Customer GSTIN/UIN No.: 04AABCH1532Q1ZM GSTIN : 06AABCR7176C1ZH PAN: AABCR7176C

S.No Goods/Service HSN/ Location from Location To Circuit ID DOC Qty UOM Unit Rate Billing Tax Type Tax Billing

SAC Amount Amount Amount

(Excluded (Included Tax)

Tax)

1 Operation & 998311 Haryana Chandigarh 658028 01-JAN-2023 1 No. 13512030 13512030.00 GST@18% 2432165.40 15944195.40

Management of

HSWAN (Year

01, Quarter 03 :

July to Sep

2023)

Whether Tax is Payable under Reverse Charge (Yes/No) Gross Value 13512030.00

RailTel Corporation Of India Ltd. (A Government Of India Undertaking, Ministry Of Railways)

Corporate Office: 143, Institutional Area, Sector 44, Gurugram , 122003, NCR(India), T: +91 124 2714000, F: +91 124 4236084

CIN-U64202DL2000GOI107905

RailTel Corporation of India Limited

(A Government Of India Undertaking, Ministry Of Railways)

IGST@18% 2432165.40

Amount in words: One Crore Fifty-Nine Lakh Forty-Four Thousand One Hundred Ninety-Five And Forty Paise Only Total Invoice Amount 15944195.40

Comments:

PARMOD KUMAR Digitally signed by PARMOD KUMAR

Date: 2023.10.09 16:21:13 +05'30'

(Authorized Signatory.)

Mr. Parmod Kumar

IRN Number:- 4baa28f7d935232092b10e1dd856bf8182a74323ef54afe65c90a800b331943f

Terms and Conditions.

RailTel Corporation Of India Ltd. (A Government Of India Undertaking, Ministry Of Railways)

Corporate Office: 143, Institutional Area, Sector 44, Gurugram , 122003, NCR(India), T: +91 124 2714000, F: +91 124 4236084

CIN-U64202DL2000GOI107905

RailTel Corporation of India Limited

(A Government Of India Undertaking, Ministry Of Railways)

1. TDS May be deducted as per provision of Income Tax Act 1961 of the invoice value (Excluding GST Tax).

2. If payment is not released by due date then interest @15% (or as per agreement) will be charged from the above mentioned due date of payment. GST payable in addition at applicable rates.

3. Amount of TDS required to be deducted by the deductee to Income Tax Department and the same should reflect in the 26AS statement of RailTel. If not reflected then a debit note will be issued equivalent to the

amount of TDS for the realization of the same.

4. While Making payment full details of TDS and invoice along with recovery if any to be informed to RailTel (Invoice Section).

RailTel Corporation Of India Ltd. (A Government Of India Undertaking, Ministry Of Railways)

Corporate Office: 143, Institutional Area, Sector 44, Gurugram , 122003, NCR(India), T: +91 124 2714000, F: +91 124 4236084

CIN-U64202DL2000GOI107905

You might also like

- Tax Invoice Deccan Sales & Service PVT - Ltd. (Division Deccan Earthmovers)Document1 pageTax Invoice Deccan Sales & Service PVT - Ltd. (Division Deccan Earthmovers)Jonathan KaleNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDSaikat Bose0% (3)

- Estate Tax Sample ComputationDocument3 pagesEstate Tax Sample ComputationEmir Mendoza100% (1)

- Railtel Corporation of India Limited: Tax InvoiceDocument3 pagesRailtel Corporation of India Limited: Tax InvoicesunnyrunninginamazonNo ratings yet

- Invoice No. 2404100030Document2 pagesInvoice No. 2404100030sunnyrunninginamazonNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- Invoice No. 2407100344Document2 pagesInvoice No. 2407100344sunnyrunninginamazonNo ratings yet

- 3 in 1Document3 pages3 in 1vjsigiNo ratings yet

- MSIL - InvoiceDocument1 pageMSIL - Invoicevineet.tpsNo ratings yet

- Consultancy Bill Period Mar'23Document1 pageConsultancy Bill Period Mar'23shubham paulNo ratings yet

- MH270024356Document1 pageMH270024356Manjunath ShettyNo ratings yet

- STS1036Document2 pagesSTS1036Shilpa AmitNo ratings yet

- Tax Invoice: Mudassi R Syed ZaidiDocument2 pagesTax Invoice: Mudassi R Syed ZaidiManoj KumarNo ratings yet

- F HarleyDocument4 pagesF HarleyShaon majiNo ratings yet

- Tax Invoice: Bharat Auto Agency Hero Insurance Broking India Private LimitedDocument1 pageTax Invoice: Bharat Auto Agency Hero Insurance Broking India Private Limitedbharauthero barautNo ratings yet

- 14231101105456PODocument3 pages14231101105456PONOTOFIRE PVT. LTD.No ratings yet

- Fosroc 518Document1 pageFosroc 518vinoth kumar SanthanamNo ratings yet

- 2223TBS0002254Document1 page2223TBS0002254Huskee CokNo ratings yet

- Data Services: Your Account SummaryDocument3 pagesData Services: Your Account SummaryAvijitNo ratings yet

- NDTL JLN STADIUM - Sept'23Document1 pageNDTL JLN STADIUM - Sept'23vineet.tpsNo ratings yet

- Solid Q 50 KW InvoiceDocument1 pageSolid Q 50 KW InvoiceTrisha RawatNo ratings yet

- 2223TBS0002259 PDFDocument1 page2223TBS0002259 PDFHuskee CokNo ratings yet

- Subhag Inv AgniDocument1 pageSubhag Inv AgniChandanNo ratings yet

- Customer Receipt: Being Amount Paid For On Just DialDocument2 pagesCustomer Receipt: Being Amount Paid For On Just DialSurinder GhattauraNo ratings yet

- 1page CutDocument1 page1page CutvjsigiNo ratings yet

- Ht2406i000422645Document2 pagesHt2406i000422645Kumar TNo ratings yet

- 2593 GwaliorDocument2 pages2593 GwaliorUtkarsh MalhotraNo ratings yet

- G.K Galaxy World 01.01.2023Document1 pageG.K Galaxy World 01.01.2023ashok515No ratings yet

- Inv No - 6554 PDFDocument1 pageInv No - 6554 PDFSunil PatelNo ratings yet

- Ehc MH 7 23 24Document2 pagesEhc MH 7 23 24Anand GautamNo ratings yet

- Pi 092639Document1 pagePi 092639Manmeet SunghNo ratings yet

- Domestic All GADocument1 pageDomestic All GAknpranchi111No ratings yet

- 012-PSS - IGL - GorakhpurDocument1 page012-PSS - IGL - GorakhpurNishant KumarNo ratings yet

- Accounting Voucher 65Document8 pagesAccounting Voucher 65robin.panwar50No ratings yet

- 2223TPG0008838Document1 page2223TPG0008838Huskee CokNo ratings yet

- 1176-Veermani Engineering Co.Document1 page1176-Veermani Engineering Co.NILAY VASANo ratings yet

- Invoice 1714219509Document1 pageInvoice 1714219509Himanshu Kr. BhumiharNo ratings yet

- PCB PowerDocument1 pagePCB PowerKEERTI PANDEYNo ratings yet

- InvoicePDF C2C090823099260Document2 pagesInvoicePDF C2C090823099260Bishnu KumarNo ratings yet

- Montage Enterprises PVT LTD.: Tax InvoiceDocument1 pageMontage Enterprises PVT LTD.: Tax Invoicewasu sheebuNo ratings yet

- 0069 OcilabsDocument1 page0069 OcilabsOCI LABSNo ratings yet

- GST Invoice PVA239563Document2 pagesGST Invoice PVA239563TMB ClaimNo ratings yet

- Tax Invoice: Suman JainDocument1 pageTax Invoice: Suman Jainrajeev_snehaNo ratings yet

- Tax Invoice: A-3/7, Mayapuri Industrial Area, Phase-Iimayapuriwest Delhi110064Delhi07 Cin: U74899Dl1988Ptc031785Document1 pageTax Invoice: A-3/7, Mayapuri Industrial Area, Phase-Iimayapuriwest Delhi110064Delhi07 Cin: U74899Dl1988Ptc031785MSEB WalujNo ratings yet

- MSF R.K.P Sec-13 - Aug'23Document2 pagesMSF R.K.P Sec-13 - Aug'23vineet.tpsNo ratings yet

- LARAN Sales Invoice - TT Steel 79Document3 pagesLARAN Sales Invoice - TT Steel 79likith.mallesh.14No ratings yet

- ARS-2023-24-38 With EwayDocument4 pagesARS-2023-24-38 With EwaypmmahobaNo ratings yet

- STSCN056Document1 pageSTSCN056Shilpa AmitNo ratings yet

- SOA009005567079Document2 pagesSOA009005567079Jeevan NJNo ratings yet

- Ultra Tech Bill SampleDocument2 pagesUltra Tech Bill Sampleshadanjamia96No ratings yet

- Ishan Netsol Private Limited: Tax InvoiceDocument2 pagesIshan Netsol Private Limited: Tax InvoiceSunil Patel100% (1)

- InvoiceDocument1 pageInvoicevikas bhatiNo ratings yet

- Tax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountDocument2 pagesTax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountSunil PatelNo ratings yet

- Data Services: Your Account SummaryDocument3 pagesData Services: Your Account SummaryRAVINo ratings yet

- 2223TBS0002252Document1 page2223TBS0002252Huskee CokNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceVinayak DhotreNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceSuraj KumarNo ratings yet

- Tax Invoice Deccan Sales & Service PVT - Ltd. (Division Deccan Earthmovers)Document1 pageTax Invoice Deccan Sales & Service PVT - Ltd. (Division Deccan Earthmovers)Jonathan KaleNo ratings yet

- Siya Trading Company: Tax InvoiceDocument4 pagesSiya Trading Company: Tax InvoiceGURDIAL SINGH DHIMANNo ratings yet

- 2223TBS0002250Document1 page2223TBS0002250Huskee CokNo ratings yet

- Invoice No: 90000011 Date of Invoice: 03.02.2023 Vehicle No: Bill Time: 10:17:01Document5 pagesInvoice No: 90000011 Date of Invoice: 03.02.2023 Vehicle No: Bill Time: 10:17:01Subhranil SahaNo ratings yet

- M A Economics-10 PDFDocument44 pagesM A Economics-10 PDFshubham kharateNo ratings yet

- 956 Income Computation - Worksheet BDocument1 page956 Income Computation - Worksheet Byounes keraghelNo ratings yet

- Bureau of Internal Revenue (BIR) v. First E-Bank Tower Condominium Corp.Document1 pageBureau of Internal Revenue (BIR) v. First E-Bank Tower Condominium Corp.Lucky JavellanaNo ratings yet

- Jasmine Petrovski 5/71 Pine Street Reservoir VIC 3073: Paid byDocument1 pageJasmine Petrovski 5/71 Pine Street Reservoir VIC 3073: Paid bygeorgiaNo ratings yet

- Taxation LAW: I. General PrinciplesDocument5 pagesTaxation LAW: I. General PrinciplesclarizzzNo ratings yet

- CA Final Vsi Jaipur IDT ABC Analysis For Nov 2023Document4 pagesCA Final Vsi Jaipur IDT ABC Analysis For Nov 2023Dharani SsNo ratings yet

- Unemployment Benefits: TypesDocument2 pagesUnemployment Benefits: TypesTop Artist ReviewsNo ratings yet

- EngEco 6 - CFATDocument29 pagesEngEco 6 - CFATNPCNo ratings yet

- Income From House PropertyDocument10 pagesIncome From House PropertyAnkit KumarNo ratings yet

- Tax 1 Vthsem Module 1,2, and 3Document97 pagesTax 1 Vthsem Module 1,2, and 3Sahana narayanNo ratings yet

- So 2023 2024 1966Document2 pagesSo 2023 2024 1966nawazhoney92No ratings yet

- Sales Invoice No.13CTA00090 - Alstom-CroatiaDocument3 pagesSales Invoice No.13CTA00090 - Alstom-CroatiamaxNo ratings yet

- MayaCredit - SoA - 2023MAY 3Document3 pagesMayaCredit - SoA - 2023MAY 3IVY JANE CULLAMATNo ratings yet

- CIR vs. Isabela Cultural Corp.Document1 pageCIR vs. Isabela Cultural Corp.Natsu DragneelNo ratings yet

- Atlas Consolidated Mining v. CirDocument2 pagesAtlas Consolidated Mining v. CirImmah Santos100% (1)

- ERH BusinessEntityComparisonTableDocument1 pageERH BusinessEntityComparisonTableEliss CainNo ratings yet

- Prelim TaskDocument4 pagesPrelim TaskJohn Francis RosasNo ratings yet

- Revision ExcerciseDocument2 pagesRevision Excercise--bolabolaNo ratings yet

- Template For Summary List of Sales and PurchasesDocument7 pagesTemplate For Summary List of Sales and PurchasesSuccess Technical and Vocational IncorporatedNo ratings yet

- Tax Invoice Euronics Industries PVT - LTD: Michigan Engineers Pvt. LTD Michigan Engineers Pvt. LTDDocument1 pageTax Invoice Euronics Industries PVT - LTD: Michigan Engineers Pvt. LTD Michigan Engineers Pvt. LTDSrikanth BhaskaraNo ratings yet

- Salaryslip June 2022Document2 pagesSalaryslip June 2022Raja BabuNo ratings yet

- 1022 2021Document15 pages1022 2021nfk roeNo ratings yet

- Theories 1Document2 pagesTheories 1Bruce WayneNo ratings yet

- 3tcpe Taaot: HRTRDRDocument1 page3tcpe Taaot: HRTRDRSuresh VadlamudiNo ratings yet

- Emp201 - September 2022Document1 pageEmp201 - September 2022wonderboy NkosiNo ratings yet

- Akta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta 693 Tahun 2009Document3 pagesAkta Cukai Pendapatan 1967 (Akta 53) Pindaan Sehingga Akta 693 Tahun 2009Teh Chu LeongNo ratings yet

- Tax Assessment and Collection Related Problem (In Case of Sawla Town Revenue Authority)Document31 pagesTax Assessment and Collection Related Problem (In Case of Sawla Town Revenue Authority)ዕንቁ ሥላሴ100% (2)

- Emulsion and Bitumen Rates BPCL - CBE - 01.09.11Document2 pagesEmulsion and Bitumen Rates BPCL - CBE - 01.09.11karunamoorthi_p22090% (1)