Professional Documents

Culture Documents

MBBA128L - Basic Financial Accounting

MBBA128L - Basic Financial Accounting

Uploaded by

Aashna AhujaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBBA128L - Basic Financial Accounting

MBBA128L - Basic Financial Accounting

Uploaded by

Aashna AhujaCopyright:

Available Formats

Basic Financial Accounting

MBBA128L

COURSE CONTEXT

SCHOOL School of VERSION NO. OF Version 3

Management CURRICULUM THAT

THIS COURSE IS A

PART OF

DEPARTMENT Management DATE THIS COURSE January 2024

WILL BE

EFFECTIVE FROM

DEGREE BBA VERSION NUMBER

OF THIS COURSE

COURSE BRIEF

COURSE Basic Financial PRE- None

TITLE Accounting REQUISITES

COURSE MBBA128L TOTAL CREDITS 4

CODE

COURSE Core L-T-P FORMAT 3-1-0

TYPE

COURSE SUMMARY

The main objective of this course is to lay a strong foundation of financial accounting in the

students. The students will be introduced to the recording of transactions and preparation of

final accounting statements for business organizations. The course will also enable students

to analyse the key financial statements of a firm.

PROGRAM OUTCOMES (PO)

PO1: Application: Remember functional business knowledge and apply managerial skills in

changing business environment

PO2: Critical Thinking: Demonstrate critical thinking skills to address diverse business

challenges and opportunities

PO3: Communication: Practice effective communication with different stakeholders

PO4: Lifelong Learning: Demonstrate commitment to continuous learning

PO5: Ethics: Relate and follow professional and ethical principles

Bennett University For Internal Use Only Page 6 of 6

PROGRAM-SPECIFIC LEARNING OUTCOMES (PSO)

By the end of this degree program, students should have the following knowledge, skills and

attitudes:

PSO1: Applying Business Administration knowledge in the following domains: Marketing,

Finance, Entrepreneurship, Human Resources, International Finance and Accounting and

International Business

PSO2: Engaging in self-development and independent lifelong learning

PSO3: Practicing ethical decision making for sustainable benefit to the Business, Society and

Environment

COURSE-SPECIFIC LEARNING OUTCOMES (CO)

By the end of this program, students should have the following knowledge and skills:

CO1: To understand the role of accounting in making economic and business decisions.

CO2: To have good knowledge on how to record business transactions.

CO3: To critically analyse and interpret the information conveyed in each of the basic

financial statements using various financial tools.

CO – PO/PSO MAPPING

PO2 PO4

COs PO1 PO3 PO5

Critical Lifelong

POs Application Communication Ethics PSO1 PSO2 PSO3

Thinking Learning

CO1 M H M H M H M L

CO2 M M L H M L H M

CO3 H H M H M H H M

H: High / M: Medium /L: Low

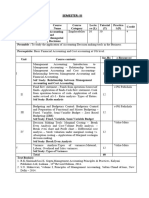

DETAILED SYLLABUS

Session Modules & Topics CO

no.

Module 1: Introduction to Accounting

1–2 1

Introduction to Accounting – Development of Accounting – Need for

Accounting – Definition of Accounting - Objectives of Accounting –

Functions of Accounting – Bookkeeping vs Accounting - Branches of

Accounting – Users of accounting information – Limitations of

Accounting.

Module 2: The Accounting Process

4–7 Accounting Principles – Concepts and Conventions – Meaning and need 1&

for convergence of India accounting standard with IFRS – Double Entry 2

Bookkeeping System – Single Entry system – Accounting Equation –

Advantages of double entry system – single entry vs double entry

8 – 15 Rules of Debit and Credit – Classification of accounts – Journal – 1&

Bennett University For Internal Use Only Page 6 of 6

Advantages of journal - Rules of Journal – Journal entries – Ledger – 2

Ledger posting – Balancing the Account – difference between Journal

and Ledger, Subsidiary Books

16 – 18 Trial Balance – Preparation of Trial Balance; Rectification of Errors

Module 3: Valuation of Assets, Liabilities and Shareholders’ Equity

19 – 21 1&

Inventories: Definition on inventories; Matching inventory cost with

2

revenues; Pricing of inventories

22 – 26 1&

Assets: Fixed Assets and Depreciation: Primer to fixed assets, cost of

2

acquisition. Introduction to Depreciation- Straight line method,

Diminishing balance method.

27 – 28 1&

Liabilities: Classification of liabilities, Characteristics of Debentures

2

30 – 31 1&

Shareholders’ Equity: Features of corporate form of organization, Types

2

of share capital, Accounting for share capital

Module 4: Understanding of Financial Statements

32 – 33 Meaning – Objectives of Preparing Final Accounts – Manufacturing 1, 2

Account – Trading Account – Profit and Loss Account - Balance Sheet – &3

Arrangement of Assets and Liabilities

34 – 38 Understanding of financial Statements of a Joint Stock Company as per

Companies Act 2013

39 – 41 Understanding the contents of a Corporate Annual General Report – 1, 2

Preparation of cash flow statements &3

Module 5: Financial Statement Analysis

42 – 45 Analysis of Comparative and Common Size Statements – Ratio Analysis 1, 2

– Analysis and interpretation of financial statement through Accounting &3

Ratios – Significance of Various Ratios – Uses and Limitations of Ratios

TEACHING-LEARNING STRATEGIES

The teaching-learning strategy includes lectures, class assignments and application-based

quizzes. Wherever possible, newspaper articles and real-life business cases are discussed so

that students can appreciate the concepts taught in the class.

STUDIO WORK / LABORATORY EXPERIMENTS:

None

REQUIRED TEXTBOOKS/LEARNING RESOURCES:

Maheshwari, S. N., Maheshwari, S. K., & Maheshwari, S. K. (2018). Financial Accounting

(6th ed.). Noida, India: Vikas Publishing House Pvt Ltd. ISBN 978-93-5271-853-5

Narayanaswamy R. Financial Accounting: A Managerial Perspective. PHI Learning Pvt. Ltd.,

Delhi

SUGGESTED TEXTBOOKS/LEARNING RESOURCES:

Horngren, C.T. (2014). Introduction to Financial Accounting (11th ed.) Pearson, ISBN:

9780133251036

Robert N. Anthony, David F. Hawkins, Kenneth A. Merchant. Accountancy- text and cases.

McGraw Hill Education (India) Private Limited, New Delhi.

Bennett University For Internal Use Only Page 6 of 6

EVALUATION STRATEGY

Components of Course Evaluation Percentage Distribution

Mid Semester Examination 20

End Semester Examination 40

Internal Evaluation 40

Total 100%

Bennett University For Internal Use Only Page 6 of 6

You might also like

- Company Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsFrom EverandCompany Valuation Under IFRS - 3rd edition: Interpreting and forecasting accounts using International Financial Reporting StandardsNo ratings yet

- NISMDocument9 pagesNISMArunim Mehrotra100% (1)

- Basic Financial Accounting and Reporting: Ishmael Y. Reyes, CPADocument39 pagesBasic Financial Accounting and Reporting: Ishmael Y. Reyes, CPAJonah Marie Therese Burlaza92% (13)

- Online - Accounting and Financial ManagementDocument2 pagesOnline - Accounting and Financial ManagementPranav KompallyNo ratings yet

- 6584financial Accounting 2021Document3 pages6584financial Accounting 2021Najia SalmanNo ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingAbbas BaiNo ratings yet

- Curriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisDocument16 pagesCurriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisAnand BabarNo ratings yet

- Syllabus Bcomacct Nep2023-2024Document12 pagesSyllabus Bcomacct Nep2023-2024trishabarik57No ratings yet

- Syllabus BCOMACCT NEP2023-2024Document13 pagesSyllabus BCOMACCT NEP2023-2024Vdj AtmaNo ratings yet

- ASM SOC B. Sc. Finance Course Syllabus 2019-20Document90 pagesASM SOC B. Sc. Finance Course Syllabus 2019-20Tapas BarikNo ratings yet

- Syllabus - B.Com (NEP) - 2023-24Document15 pagesSyllabus - B.Com (NEP) - 2023-24arghadas88242No ratings yet

- BCOM Syllabus Session 2023-24 VI SemesterDocument12 pagesBCOM Syllabus Session 2023-24 VI Semesteraizah25102000No ratings yet

- Nptel: Managerial Accounting - Video CourseDocument3 pagesNptel: Managerial Accounting - Video CourseNajlaNo ratings yet

- StudyScheme2018 Updated in 2023 (w.e.f.Fall2023forFeb.2024Exam)Document58 pagesStudyScheme2018 Updated in 2023 (w.e.f.Fall2023forFeb.2024Exam)Amir Ali LiaqatNo ratings yet

- Saintgits Institute of Management: Name of The Faculty: Jinomol P Email-Id: Mobile No. 9895142914Document7 pagesSaintgits Institute of Management: Name of The Faculty: Jinomol P Email-Id: Mobile No. 9895142914SNEHA MARIYAM VARGHESE SIM 16-18No ratings yet

- Course DetailDocument3 pagesCourse DetailNajlaNo ratings yet

- Department of Finance and Accounting: IBS, IFHE, HyderabadDocument54 pagesDepartment of Finance and Accounting: IBS, IFHE, HyderabadRUTHVIK NETHANo ratings yet

- New - OBTL Modular Fundamentals of Accounting Part1 - First Semester AY2020 2021Document6 pagesNew - OBTL Modular Fundamentals of Accounting Part1 - First Semester AY2020 2021rebecca lisingNo ratings yet

- 2022-23 - CFRA - IIMC Course Outline - SentDocument10 pages2022-23 - CFRA - IIMC Course Outline - SentAnanya DevNo ratings yet

- Sub Committee For Curriculum Development Banking & Finance Specialization Post GraduateDocument3 pagesSub Committee For Curriculum Development Banking & Finance Specialization Post Graduatevineet lakraNo ratings yet

- Handouts For Accounting For Decision MakingDocument3 pagesHandouts For Accounting For Decision MakingSneha SnehaNo ratings yet

- BBA IB Detailed Syllabus PDFDocument13 pagesBBA IB Detailed Syllabus PDFCreate Your Own SpaceNo ratings yet

- 1st Semester BCOM Syllabus 2023-24Document29 pages1st Semester BCOM Syllabus 2023-24Tamanna HassanNo ratings yet

- T2003-Financial AccountingDocument2 pagesT2003-Financial AccountingKishore KambleNo ratings yet

- T2003-Financial AccountingDocument2 pagesT2003-Financial AccountingDebadri GhoshNo ratings yet

- RPS Akuntansi Menengah IIDocument18 pagesRPS Akuntansi Menengah IIAnyaaNo ratings yet

- FRA Course Outline - PGDM 2021-23Document6 pagesFRA Course Outline - PGDM 2021-23Chetan SaxenaNo ratings yet

- New SyllabusDocument3 pagesNew SyllabusÅřījīt ÑāñdïNo ratings yet

- Syllabus B.com. First 22 23Document24 pagesSyllabus B.com. First 22 23Sadiya TufailNo ratings yet

- S. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchDocument6 pagesS. P. Mandali'S Prin L. N. Welingkar Institute of Management Development & ResearchNavil BordiaNo ratings yet

- Accounting and Managerial DecisionsDocument2 pagesAccounting and Managerial DecisionsloganathanNo ratings yet

- Name of The Faculty: Dr. Mohammed Iqbal Email Id Mobile No.: 7598438962Document5 pagesName of The Faculty: Dr. Mohammed Iqbal Email Id Mobile No.: 7598438962SSNo ratings yet

- CBSE Class 11 Accountancy Syllabus Updated For 20Document1 pageCBSE Class 11 Accountancy Syllabus Updated For 20AarushNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- Marks Weightage of CBSE Class 11 Accountancy Syllabus Term 1Document1 pageMarks Weightage of CBSE Class 11 Accountancy Syllabus Term 1AarushNo ratings yet

- R. A. Podar College of Commerce and Economics:, (Autonomous)Document45 pagesR. A. Podar College of Commerce and Economics:, (Autonomous)Rashi thiNo ratings yet

- 022 1.1.3 B.com BC404 2018-19Document1 page022 1.1.3 B.com BC404 2018-19AankuNo ratings yet

- Acc 202Document25 pagesAcc 202herueuxNo ratings yet

- Management AccountingDocument3 pagesManagement AccountingC ANo ratings yet

- CAF SyllabusDocument88 pagesCAF SyllabusTeen CharaghNo ratings yet

- Financial Reporting and Analysis: Course PlanDocument7 pagesFinancial Reporting and Analysis: Course PlanBhai ho to dodoNo ratings yet

- AY 2022-23 Mcom Part I and II (Accountancy) SyllabusDocument68 pagesAY 2022-23 Mcom Part I and II (Accountancy) Syllabusdipeshbandabe123No ratings yet

- CAF Syllabus PDFDocument88 pagesCAF Syllabus PDFAbdullah AbidNo ratings yet

- Bookkeeping and Accounting For Small Business: Ishmael Y. Reyes Aldon M. FranciaDocument35 pagesBookkeeping and Accounting For Small Business: Ishmael Y. Reyes Aldon M. FranciaTom Vargas0% (1)

- AccountDocument3 pagesAccountBalbir SinghNo ratings yet

- Accounting For ManagersDocument2 pagesAccounting For Managersvivekgarg33.vgNo ratings yet

- Accounting For Managers: Syllabus and Learning OutcomesDocument3 pagesAccounting For Managers: Syllabus and Learning OutcomesNishant SinghNo ratings yet

- ASM SOC B. Com. (Hons.) Course Syllabus 2019-22Document99 pagesASM SOC B. Com. (Hons.) Course Syllabus 2019-22Rajdeep Kumar RautNo ratings yet

- Accounting For ManagersDocument82 pagesAccounting For Managersrahul jambagiNo ratings yet

- CAF SyllabusDocument89 pagesCAF SyllabusFaheem MajeedNo ratings yet

- Course Guide: RICS School of Built EnvironmentDocument14 pagesCourse Guide: RICS School of Built EnvironmentManglam AgarwalNo ratings yet

- Accounting For Business Decisions - Syllabus and BooksDocument2 pagesAccounting For Business Decisions - Syllabus and BooksSaloni BaisNo ratings yet

- MBA501A ABM v2.1Document5 pagesMBA501A ABM v2.1Ayush SatyamNo ratings yet

- 150C2B Madras UniversityDocument3 pages150C2B Madras Universityriharajput88No ratings yet

- CAF SyllabusDocument89 pagesCAF Syllabusmanadish nawazNo ratings yet

- Financial Accounting & Reporting IIDocument6 pagesFinancial Accounting & Reporting IIKendrick PajarinNo ratings yet

- Business Management Paper-V: Financial ManagementDocument2 pagesBusiness Management Paper-V: Financial ManagementNikhil KarkhanisNo ratings yet

- Accounts 1Document24 pagesAccounts 1laale dijaanNo ratings yet

- Competency-Based Accounting Education, Training, and Certification: An Implementation GuideFrom EverandCompetency-Based Accounting Education, Training, and Certification: An Implementation GuideNo ratings yet

- Video26 CustomListDocument2 pagesVideo26 CustomListAashna AhujaNo ratings yet

- AccountingDocument104 pagesAccountingAashna AhujaNo ratings yet

- Ob Couse Outline Bba 1stDocument6 pagesOb Couse Outline Bba 1stAashna AhujaNo ratings yet

- Case Study 3Document1 pageCase Study 3Aashna AhujaNo ratings yet

- Sum and Sumifs SMDVDocument10 pagesSum and Sumifs SMDVAashna AhujaNo ratings yet

- Act1204-Quiz No. 4 Wit AnsDocument5 pagesAct1204-Quiz No. 4 Wit AnsmarkNo ratings yet

- 03 MA2 LRP AnswersDocument34 pages03 MA2 LRP AnswersKopanang LeokanaNo ratings yet

- Risk Assessment Worksheet BlankDocument5 pagesRisk Assessment Worksheet BlankisolongNo ratings yet

- AAA Day1Document37 pagesAAA Day1Zi Yuan XuNo ratings yet

- Marcella Satyarwin: Education & HonorsDocument1 pageMarcella Satyarwin: Education & HonorsMarcella SatyarwinNo ratings yet

- Harshad Mehta Scam: Career He Tried His Hand at Various JobsDocument5 pagesHarshad Mehta Scam: Career He Tried His Hand at Various JobsAnushaNo ratings yet

- CASE 1: PM Company Requirement: Compute For The Total Current Asset On Dec 31, 2X14Document3 pagesCASE 1: PM Company Requirement: Compute For The Total Current Asset On Dec 31, 2X14JanineD.MeranioNo ratings yet

- FIN081 - P2 - Q2 - Receivable Management - AnswersDocument7 pagesFIN081 - P2 - Q2 - Receivable Management - AnswersShane QuintoNo ratings yet

- PM Project 00921001719 1Document41 pagesPM Project 00921001719 1Sushank pandeyNo ratings yet

- Dub 5198522Document1 pageDub 5198522Anand BabuNo ratings yet

- Icici ResultsDocument7 pagesIcici ResultsKishore IrctcNo ratings yet

- Chap 5Document40 pagesChap 5Minh HoangNo ratings yet

- Bajaj Investor PresentationDocument51 pagesBajaj Investor PresentationjatinNo ratings yet

- Investment Analysis: A Study OnDocument77 pagesInvestment Analysis: A Study OnrameshNo ratings yet

- Operating Assets: Property, Plant, and Equipment, Natural Resources, and IntangiblesDocument35 pagesOperating Assets: Property, Plant, and Equipment, Natural Resources, and IntangiblestrijyaNo ratings yet

- English For Finance and Banking: Case Study 1: Savings/Investing PlanDocument8 pagesEnglish For Finance and Banking: Case Study 1: Savings/Investing PlanNgôThịThanhHuyềnNo ratings yet

- Class 5 Project Selection ExerciseDocument18 pagesClass 5 Project Selection ExerciseVinodshankar BhatNo ratings yet

- BDO (Banco de Oro) - We Find WaysDocument6 pagesBDO (Banco de Oro) - We Find WaysAivan NovichNo ratings yet

- Research WorkDocument74 pagesResearch Workm.com22shiudkarsudarshanNo ratings yet

- 01 - Module 1Document13 pages01 - Module 1Daniel FranciscoNo ratings yet

- Partnership 4Document12 pagesPartnership 4kakaoNo ratings yet

- Differences Between Islamic Banks & ConventionalDocument8 pagesDifferences Between Islamic Banks & Conventionalsanzo_reloadNo ratings yet

- Edelweiss Tokio Life - Edusave - : OverviewDocument2 pagesEdelweiss Tokio Life - Edusave - : OverviewarunNo ratings yet

- EXIM Finance Unit IIDocument11 pagesEXIM Finance Unit IIloganathanNo ratings yet

- NDocument36 pagesNRohitMaharjanNo ratings yet

- Sbi Form NEFTDocument2 pagesSbi Form NEFTMohammed Hassaan Ul Quadir79% (53)

- AchDocument2 pagesAchValdi PokerNo ratings yet

- Onecard Statement (20 Mar 2023 - 19 Apr 2023) : Shivam SharmaDocument3 pagesOnecard Statement (20 Mar 2023 - 19 Apr 2023) : Shivam SharmaShailendra SharmaNo ratings yet

- Annuities Examples in Retirement Planning.... DDDDDocument9 pagesAnnuities Examples in Retirement Planning.... DDDDattaullahNo ratings yet