Professional Documents

Culture Documents

Cancellation of GST Registration

Cancellation of GST Registration

Uploaded by

Yedavelli Badrinath0 ratings0% found this document useful (0 votes)

2 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageCancellation of GST Registration

Cancellation of GST Registration

Uploaded by

Yedavelli BadrinathCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

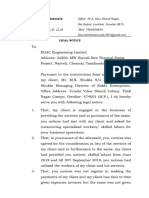

Letter Head of Taxpayer

To

The GST Department,

Ward- <> , Range- <> ,

Department of Trade & Taxes,

Vyapar Bhawan, I P Estate,

New Delhi - 110002

Sub: Application for cancellation of GST registration vide ARN No.

Respected Sir/Madam,

I, <name of authorized person>, <designation> of the business known as M/s <trade name of

taxpayer> , R/o <address of authorized person> of holding GST No. <GSTIN> hereby state

that:

I have <reason for cancellation of GSTIN> from <date> and had the NIL stock of goods are

with me on the said date. Further I declared that I have not any liability of taxes, late fee etc.

I, therefore, apply for cancellation of my registration, as I have discontinued my business, I

herewith enclose certified copy of my current bank account closure letter along-with application

letter of cancellation of GST registration filed online.

Thanking you,

Yours Faithfully,

(Authorized Signatory)

Date: <date>

Place: <place>

You might also like

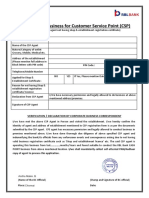

- Dispute - Form Public Bank BlankDocument1 pageDispute - Form Public Bank Blankhrz rzk100% (1)

- Wrong P2B - Indemnity LetterDocument1 pageWrong P2B - Indemnity LetterLovely Singh100% (1)

- Draft Self DeclarationDocument1 pageDraft Self DeclarationNagarajan100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Declaration Non Req of Reg Under GSTDocument1 pageDeclaration Non Req of Reg Under GSTHitendra BeedawatNo ratings yet

- DocumentDocument1 pageDocumentchiragbhatt0987No ratings yet

- GST Vendor Declaration FormDocument1 pageGST Vendor Declaration Formhimanshu goyalNo ratings yet

- Request Letter For Change User Id and PasswordDocument1 pageRequest Letter For Change User Id and PasswordAkai Akai100% (2)

- Certificate of Incorporation: WWW - Mca.gov - inDocument1 pageCertificate of Incorporation: WWW - Mca.gov - inLara B. WhiteNo ratings yet

- Non Receipt of Refund OrderDocument3 pagesNon Receipt of Refund OrderMKNo ratings yet

- Letter of Concession To The BIRDocument1 pageLetter of Concession To The BIRAndrew PanganibanNo ratings yet

- Authorization Letter TemplateDocument1 pageAuthorization Letter TemplateTuShAr DaVENo ratings yet

- Certificate of Business For CSP FinalDocument1 pageCertificate of Business For CSP FinalSyed MusyeebNo ratings yet

- ABBL Cardholder Dispute Form 1214Document1 pageABBL Cardholder Dispute Form 1214Md. Ashiqur RahmanNo ratings yet

- Certificate of Incorporation: WWW - Mca.gov - inDocument1 pageCertificate of Incorporation: WWW - Mca.gov - inamar nathNo ratings yet

- A Simple Guide To Resolve Your Rejected GST Registration ApplicationDocument6 pagesA Simple Guide To Resolve Your Rejected GST Registration ApplicationRam ADCANo ratings yet

- Application-for-Business-Retirement in MuntinlupaDocument1 pageApplication-for-Business-Retirement in MuntinlupajoycegNo ratings yet

- Sample Affidavit of ClosureDocument1 pageSample Affidavit of Closureanon_951072845No ratings yet

- PLDT Ultera Request BillingDocument1 pagePLDT Ultera Request Billingkim_santos_20No ratings yet

- PLOT NO-715, SHOP NO-5, Ananta Vihar, Phase 2, Pokhariput, BhubaneswarDocument1 pagePLOT NO-715, SHOP NO-5, Ananta Vihar, Phase 2, Pokhariput, BhubaneswarPritam Umar K DasNo ratings yet

- Rtgs Form of Syndicate BankDocument2 pagesRtgs Form of Syndicate BankshridharNo ratings yet

- 6 M 5 LfjboDocument2 pages6 M 5 LfjboaiterminalsaNo ratings yet

- Ref: Your Office Letter No 4382 CT-2010 Dated 21.12.2010Document1 pageRef: Your Office Letter No 4382 CT-2010 Dated 21.12.2010upendraetaxNo ratings yet

- Acc. 4 Value PresenterDocument1 pageAcc. 4 Value PresenterChad LangeNo ratings yet

- Anx - 2 - Bank - Details New PDFDocument1 pageAnx - 2 - Bank - Details New PDFSukhwinder SinghNo ratings yet

- State Bank of Patiala: Rtgs/Neft/Application FormDocument2 pagesState Bank of Patiala: Rtgs/Neft/Application FormAnonymous wfgcPmJYNo ratings yet

- Sub: Declaration Regarding Non-Requirement of Registration Under TheDocument2 pagesSub: Declaration Regarding Non-Requirement of Registration Under ThewardenadambayNo ratings yet

- (Your Address) (Bank/building Society Address)Document2 pages(Your Address) (Bank/building Society Address)nishaNo ratings yet

- Non Receipt of Exit PAn OptionsDocument2 pagesNon Receipt of Exit PAn OptionsMKNo ratings yet

- LOAN DOCUMENTATION Letter For Inserting DateDocument1 pageLOAN DOCUMENTATION Letter For Inserting DateovifinNo ratings yet

- Vachana-ReActivation FormDocument1 pageVachana-ReActivation FormkumardvNo ratings yet

- Registration AknowDocument1 pageRegistration AknowcachandhiranNo ratings yet

- VAT Reg AcknowDocument1 pageVAT Reg AcknowsamaadhuNo ratings yet

- Subject: Request For Revocation of Cancellation of Registration-RegDocument1 pageSubject: Request For Revocation of Cancellation of Registration-Regraj sahilNo ratings yet

- DECLARATIONDocument2 pagesDECLARATIONPENUBALLI KRISHNACHAITANYANo ratings yet

- E-Payment Format - Annexure 2Document1 pageE-Payment Format - Annexure 2aasimshaikh111No ratings yet

- Bank Procedure and FormalitiesDocument59 pagesBank Procedure and Formalitiesrakesh19865No ratings yet

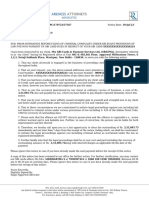

- LEGAL NOTICE - Rakhi EnterprisesDocument9 pagesLEGAL NOTICE - Rakhi Enterprisespindada10201No ratings yet

- J.2.5 Tax AffidavitDocument1 pageJ.2.5 Tax Affidavitameerm_abdullahNo ratings yet

- We Hereby Acknowledge The Receipt of Your APPLICATION FOR REGISTRATION U/S 7 (1) / 7 (2) OF THE CENTRAL SALES TAX ACT, 1956 As FollowsDocument1 pageWe Hereby Acknowledge The Receipt of Your APPLICATION FOR REGISTRATION U/S 7 (1) / 7 (2) OF THE CENTRAL SALES TAX ACT, 1956 As FollowssamaadhuNo ratings yet

- INB Transaction RightsDocument1 pageINB Transaction RightsmarkkishanNo ratings yet

- Account Approved by 1. 2.: Login Id Name Email Id Mobile NumberDocument1 pageAccount Approved by 1. 2.: Login Id Name Email Id Mobile NumberAnonymous MflTXrfhNo ratings yet

- Ref No: - DatedDocument4 pagesRef No: - DatedMustafain RazaNo ratings yet

- GST Registration - Maharashtra StateDocument1 pageGST Registration - Maharashtra StateMayank DagaNo ratings yet

- The GSTODocument1 pageThe GSTOabhishekNo ratings yet

- Sudha Singh Itr V 13Document1 pageSudha Singh Itr V 13Anurag SinghNo ratings yet

- To Whom So Ever It May Concern: PAN Declaration Cum AffidavitDocument2 pagesTo Whom So Ever It May Concern: PAN Declaration Cum AffidavitharshchatterjeeNo ratings yet

- BPLO FormsDocument6 pagesBPLO FormsLoy LoNo ratings yet

- Application Form For Business Permit - Tagaytay - Gov.phDocument2 pagesApplication Form For Business Permit - Tagaytay - Gov.phcreenciaaxdreiNo ratings yet

- Credit Application For A Business AccountDocument1 pageCredit Application For A Business Accountherry.mdnNo ratings yet

- Credit Application For A Business AccountDocument1 pageCredit Application For A Business AccountsandramraNo ratings yet

- Credit Application For A Business AccountDocument1 pageCredit Application For A Business AccountJoy Bundac ObiñetaNo ratings yet

- Letter of IntentDocument2 pagesLetter of IntentMariam SalongaNo ratings yet

- Additional Documents Real EstateDocument10 pagesAdditional Documents Real EstateSamaira SheikhNo ratings yet

- Auth Form RecurringPayment ACHDocument2 pagesAuth Form RecurringPayment ACHSantosh BillaNo ratings yet

- B9-057-VanshPatel-Assignment 2Document9 pagesB9-057-VanshPatel-Assignment 2Vansh PatelNo ratings yet

- E-Toll Confirmation / Change of Direct Debit DetailsDocument1 pageE-Toll Confirmation / Change of Direct Debit DetailsBobdNo ratings yet

- MPDFDocument1 pageMPDFPushpendra YadavNo ratings yet

- Unit - II Indirect Taxation-1Document55 pagesUnit - II Indirect Taxation-1praveensenthamarai25No ratings yet

- 2019 - 20 Criminology SolvedDocument12 pages2019 - 20 Criminology SolvedPadmesh JainNo ratings yet

- Bail Application Format POCSO ACTDocument3 pagesBail Application Format POCSO ACTPadmesh JainNo ratings yet

- Jurisprudence Assignment - Kinds of PropertyDocument12 pagesJurisprudence Assignment - Kinds of PropertyPadmesh JainNo ratings yet

- Labour Law Handwritten NotesDocument43 pagesLabour Law Handwritten NotesPadmesh JainNo ratings yet