Professional Documents

Culture Documents

Form No. 34

Form No. 34

Uploaded by

VINA LORRAINE MARASIGANCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 34

Form No. 34

Uploaded by

VINA LORRAINE MARASIGANCopyright:

Available Formats

Republic of the Philippines)

City of Calapan ) S.S.

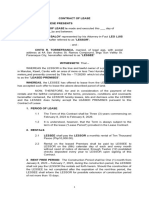

CONTRACT OF LEASE OF COMMERCIAL BUILDING

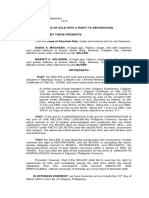

KNOW ALL MEN BY THESE PRESENTS:

That this Contract of Lease, is made and entered into by and between:

DIOSA A. MAGANDA, of legal age, Filipino, single, and with residence

and postal address at Acacia Street, Brgy. Bulusan, Calapan City, Oriental

Mindoro herein after referred to as the LESSOR;

MARIKIT A. SOLOMON, of legal age, Filipino, single, and with residence

and postal address at Mangosteen Street, Brgy. Suqui, Calapan City, Oriental

Mindoro herein after referred to as the LESSEE;

TERMS AND CONDITIONS

1.PREMISES- LESSOR hereby leases to LESSEE and

LESSEE hereby leases from LESSOR approximately Twenty

(20) square meters more or less of total land area, as is

improvement, situated in Blk. 18, Lot 42, Acacia Village, Brgy.

Bulusan, Calapan City, Oriental Mindoro which shall be referred

to as the “Premises”.

2. USE OF THE PREMISES- The Lease is for the purpose

of operating a commercial or retail business which the

corporation is engaged in. The LESSEE, at his own expense

may put up improvements upon prior consultation and written

approval of the LESSOR within the premises hereby leased for

the purpose of storage, retail, wholesale and commercial in

nature and not for any purpose whatsoever. It is being expressly

agreed that if, at any time during the existence of this lease and

without the previous written consent of the LESSOR, the said

premises are used for the purposes other than what is stated,

the LESSOR has the option of either terminating the lease or

collecting increased rental as deemed appropriate from the date

of diversion of use of the premises or to compel the LESSEE to

stop the unapproved activity.

3. TERM OF THE LEASE- The term of this Lease Contract

is for a period of Three (3) years, renewable for an unspecified

duration at terms mutually agreeable to both parties,

commencing on March 16, 2024 and ending at midnight of March

17, 2027, In case of pre-termination by the LESSEE, for any

reason whatsoever, the LESSOR has the right to collect any

remaining rentals corresponding to the unexpired portion of

the LEASE period, or until such time a new LESSEE comes.

This LEASE shall not be deemed extended or renewed

beyond the period time above-mentioned for any cause or

reason whatsoever and unless the parties agree in writing to

extend or renew or enter into a new Contract to Lease upon such

terms and conditions acceptable to them, the possession of the

Premises by the LESSEE or any persons claiming rights through

the LESSEE, after the expiration of the term thereof, shall be

illegal.

Any renewal or extension of this Contract must be

expressly agreed upon by the LESSOR and LESSEE in writing

and under no circumstances can such renewal or extension be

considered as having made impliedly.

For this purpose, the LESSEE shall notify the

LESSOR to the latter’s office in writing, of this intent to renew or

extend the Contract at least sixty (60) calendar days prior to the

expiration of the Leased period, or any extension or renewal

thereof, provided, however, that the notice as aforesaid does not

in any way vest unto the LESSEE the right to demand for such

extension or renewal of the Lease Period or any renewal or

extension thereof.

4. RENT- The monthly rental shall be scheduled as

follows, inclusive of the twelve percent (12%) Expanded Value

Added Tax (EVAT) adjustable corresponding to the subsequent

and substantial tax policy changes by the local or national

government, with an escalation of five (5) percent after two (2)

years as illustrated below. All payments must be made only

through cash/check. Without necessity of demand, the

LESSEE shall pay the monthly rental within the first five (5) days

of each calendar month, at the office of the LESSOR.

a) PENALTIES- Payment made after the said date shall

be subject to a penalty charge of 5% per month.

b) WITHOLDING TAX- The LESSEE shall furnish

the LESSOR with the original and two copies of its certificate of

creditable income tax withheld at source BIR Form 2307, not

later than 5 days after the end of each month. Failure to submit

the documents shall authorize the LESSOR to automatically add

amount to the billing.

c) BOUNCING CHECKS- Issuance of checks with no

sufficient funds for three (3) instances shall compel

the LESSEE as having pre terminated the contract and as such

the security deposit shall be considered forfeited in favor of

the LESSOR.

d) NON-PAYMENTS OF RENTS- Failure of

the LESSEE to pay the rentals herein agreed upon for two (2)

consecutive months shall be ground for termination of this

Contract of Lease and upon which the LESSEE obligates itself to

vacate and clear the premises in such tenantable conditions

without need of notice from LESSOR.

5. SECURITY DEPOSIT and ADVANCE- upon signing of

the Contract of Lease, the LESSEE shall make a Three

(3) months deposit and Three (3) month advance rental in the

total amount of Eight Thousand

Pesos (Php 8,000.00) Philippine Currency for the full and

faithful performance of each and every term, provision, covenant,

and condition of this lease, except that said deposit shall not

constitute or substitute payment of any rent.

The deposit, which is non-interest bearing, shall remain

intact during the entire term of this lease and shall not be applied

as payment for any monetary obligations of the LESSEE under

this contract, and shall be refunded to the LESSEE upon

completion of the lease.

a) The amount deposited shall answer for any unpaid

accounts of the LESSEE at the expiration of the contract as well

as for any damages which the LESSOR or any of its employees,

agents or guests might suffer by reason of the wrongful acts or

actuation, negligence, and or malfeasance of the LESSEE. It

shall not be applied to pay for the last months of occupancy of

the premises.

b) Any unappropriated amount of such deposit shall be

refundable to the LESSEE within sixty (60) days from the

termination of the contract.

c) In the event that the LESSEE terminates its contract

before its term expires, the deposit shall be deemed forfeited and

refundable, regardless of the reason for its pre-termination and

whether a sixty-day notice was given or not.

6. SUBLEASE AND OR TRANSFER OF RIGHTS-

The LESSEE shall not directly or indirectly assign, sublease, sell,

transfer, convey, mortgage, demolish or in any manner dispose

of or encumber its right under the contract in whole or in part or

any interest thereto be conferred on anyone.

7. RIGHT TO INSPECT LEASED PREMISES-

The LESSOR or its authorized agent shall, by previous notice to

the LESSEE, have the right to enter the leased premises at any

reasonable hour of the day to examine the leased premises.

8. CARE OF THE LEASED PREMISES-

The LESSEE shall examine the Leased Premises before taking

possession thereof, and LESSEE’s entry into possession shall

constitute conclusive evidence or admission by the LESSEE that

as of the date thereof, the said Premises were in good order and

satisfactory tenantable condition. The LESSEE hereby binds

itself to keep and maintain the same in such condition as a

prudent person shall do under the circumstances, ordinary wear

and tear expected. The LESSEE shall at its own expense,

improve and maintain the Leased Premises clean and free from

rubbish and dirt at all times, store all trash and garbage in proper

containers and not burn any trash and garbage in or about the

Leased Premises or anywhere within the Premises.

9. SECURITY & SANITATION- The LESSOR shall

ensure the security of the premises and provide a security guard

for the whole commercial establishment where the leased

premises are located. The LESSOR must also ensure regular

collection of garbage through the barangay garbage collector or

any private entity which shall be to the account of LESSOR.

The LESSOR also agrees to make the septic tank of the leased

premises bigger in order to accommodate more waste volume in

anticipation of more customers using the toilet.

10. INSURANCE TAKEN BY THE LESSEE- The LESSEE

shall be required to insure at his own account any LESSOR

approved permanent structure or structures constructed within

the premises with the LESSOR as co-benefactor against fire or

total loss of property. The LESSEE although not required, is also

allowed and authorized to insure its own property taken inside

the leased premises, provided that the LESSOR shall be notified

in advance of any and all kinds of insurance over the property

therein.

11. BUSINESS PERMITS, TAXES, AND COMPLIANCE

AND GOVERNMENT REGULATIONS- The LESSEE shall be

responsible for securing all the necessary governments permits

and licenses for the operation of its business and all costs

thereof shall be its sole account. Copies of the said permits and

licenses or any renewal date thereof shall be furnished to

the LESSOR not later than fifteen (15) days from the start of

the LESSEE’s business and every renewal date thereof as

required by law.

12. INTRODUCTION OF PERMANENT

IMPROVEMENTS- No permanent or fixed improvements shall be

introduced by the LESSEE on the leased premises unless with

prior written consent and approval of the LESSOR. Any such

permanent structures, if approved and allowed, shall be upon the

option of the LESSOR registered under the co-ownership of

both LESSEE and LESSOR. Furthermore, the LESSEE shall

bear the full cost of the annual real estate taxes of such

structures until expiry of lease contract and full cost of transfer of

ownership to LESSOR upon termination of contract;

13. UTILITIES AND SERVICES- The LESSEE shall be

responsible for the installation and maintenance costs of its

own electric current, telephone, water, security and other

utility services in the Leased Premises for the duration of the

lease. The LESSEE shall also clear all accounts with all

concerned utility companies upon pre-termination or expiration of

contract.

14. REVISION OF LEASE CONTRACT- Both parties may

revise this lease contract after six (6) months to one (1) year in

the event that LESSEE assigns the business with a newly-

registered business name.

IN WITNESSS WHEREOF, we have hereunto set our hands this 15th day of

March 2024 in the City of Calapan, Philippines.

DIOSA A. MAGANDA MARIKIT A. SOLOMON

LESSOR LESSEE

SIGNED IN THE PRESENCE OF:

JOY T SEGUROS BLOSSOM T. PADRILAN

Witness Witness

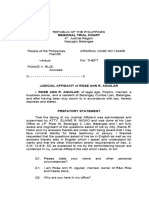

ACKNOWLEDGMENT

Republic of the Philippines)

City of Calapan ) S.S.

BEFORE ME, a Notary Public, for and in the City of Calapan, this 16th

day of March 2024 personally appeared:

Name Identification Card Issued On/At

DIOSA A. MAGANDA Driver’s License 02/01/2020, Calapan City

MARIKIT A. SOLOMON Driver’s License 02/01/2022, Calapan City

JOY T. SEGUROS Driver’s License 02/01/2023, Calapan City

BLOSSOM T. PADRILAN Driver’s License 02/01/2023, Calapan City

all known to me to be the same persons who executed the foregoing instrument

and hereby acknowledged to me that the same is their free and voluntary act and

deed. This instrument consisting of five (5) pages, including this page on which

this acknowledgment is written refers to CONTRACT OF LEASE OF

COMMERCIAL BUILDING and has been signed by the parties and their

witnesses and sealed with my notarial seal.

WITNESS MY HAND AND NOTARIAL SEAL on the date and place

above written.

NOTARY PUBLIC

Doc. No. ____;

Page No. ____;

Book No. ____;

Series of 2024.

You might also like

- Party Rental Business Playbook Everything Needed To Start a Moonwalk Business!From EverandParty Rental Business Playbook Everything Needed To Start a Moonwalk Business!No ratings yet

- The Curse of The Weregiant v1.3Document6 pagesThe Curse of The Weregiant v1.3test123No ratings yet

- Contract of Lease - So.2022Document4 pagesContract of Lease - So.2022black stalkerNo ratings yet

- 220921File-Stamped - Complaint - Worldwide NFT v. CalasseDocument71 pages220921File-Stamped - Complaint - Worldwide NFT v. CalasseGeorge SharpNo ratings yet

- Negligence IRAC MinihypoDocument2 pagesNegligence IRAC MinihypoJane SalmaNo ratings yet

- OBLICON ReviewerDocument62 pagesOBLICON ReviewerEvangeline AntonioNo ratings yet

- Contract of Lease of Commercial BuildingDocument4 pagesContract of Lease of Commercial BuildingVhe-un Lagera100% (1)

- Residential Property Lease Deed DraftDocument6 pagesResidential Property Lease Deed DraftmanjulaNo ratings yet

- Contract of Lease of Commercial SpaceDocument4 pagesContract of Lease of Commercial SpaceRois Guevarra83% (23)

- Amedex FB Group GuidelinesDocument7 pagesAmedex FB Group GuidelinesNQ ZNo ratings yet

- Warehouse Unit B Draft ContractDocument6 pagesWarehouse Unit B Draft ContractHR HaimeeNo ratings yet

- Sample Lease COntractDocument8 pagesSample Lease COntractGerard Nelson ManaloNo ratings yet

- Contract of Lease - Dwight CimafrancaDocument5 pagesContract of Lease - Dwight CimafrancaKaren Cate Ilagan PintoNo ratings yet

- Contract of LeaseDocument7 pagesContract of LeaseRoy PersonalNo ratings yet

- Commercial Lease AgreementDocument3 pagesCommercial Lease Agreementmalou ablazaNo ratings yet

- Contract of LeaseDocument4 pagesContract of LeaseJoan CalsadoraNo ratings yet

- CONTRACT OF LEASE (Muntinlupa)Document6 pagesCONTRACT OF LEASE (Muntinlupa)mrsjpendletonNo ratings yet

- Mandanas Garcia Ruling Short PaperDocument2 pagesMandanas Garcia Ruling Short PaperMimiNo ratings yet

- Lease ContractDocument5 pagesLease ContractMatel LazaroNo ratings yet

- Lease Contract ResidentialDocument11 pagesLease Contract ResidentialYran79100% (1)

- Contract of Lease (Polycentrik)Document4 pagesContract of Lease (Polycentrik)Jihani A. Salic100% (1)

- CONTRACT OF LEASE Pallocan Coopmart ExtensionDocument3 pagesCONTRACT OF LEASE Pallocan Coopmart ExtensionHoward UntalanNo ratings yet

- Contract of Lease - PDF - Adobe ReaderDocument7 pagesContract of Lease - PDF - Adobe ReaderGigi ManaloNo ratings yet

- Gayappanao v. IAC, 199 SCRA 309 (1991)Document1 pageGayappanao v. IAC, 199 SCRA 309 (1991)Lovely Grace HechanovaNo ratings yet

- Castellvi de Higgins and Higgins V. SellnerDocument1 pageCastellvi de Higgins and Higgins V. SellnerMarie Bernadette BartolomeNo ratings yet

- Contract of Lease of Commercial BuildingDocument5 pagesContract of Lease of Commercial Buildingaireen clores100% (2)

- Lease Contract ResidentialDocument5 pagesLease Contract ResidentialMatel LazaroNo ratings yet

- Alaminos Contract of LeaseDocument4 pagesAlaminos Contract of LeaseHoward UntalanNo ratings yet

- Retype Contract of LeaseDocument5 pagesRetype Contract of LeaseVILLAMAR LAW OFFICENo ratings yet

- Contract of LeaseDocument5 pagesContract of LeaseMary HazelNo ratings yet

- Contract of LeaseDocument7 pagesContract of LeaseJhoey Castillo BuenoNo ratings yet

- Contract of Lease - Option Number 2Document7 pagesContract of Lease - Option Number 2Torni JoNo ratings yet

- Lease AgreementDocument4 pagesLease Agreementcj gonzales100% (3)

- Contract of Lease of Commercial BuildingDocument7 pagesContract of Lease of Commercial BuildingSol VirtudazoNo ratings yet

- Contract of Lease of Residential SpaceDocument4 pagesContract of Lease of Residential SpaceAtty. Kristina de VeraNo ratings yet

- Gym FitnessDocument7 pagesGym FitnessMarijune LetargoNo ratings yet

- LEASE CONTRACT P de Leon Unit C-2023Document3 pagesLEASE CONTRACT P de Leon Unit C-2023TORRES, Johnelle Ashley B.No ratings yet

- CONTRACT OF LEASE Tibig Silang Revised With Comments 091522correctionsDocument7 pagesCONTRACT OF LEASE Tibig Silang Revised With Comments 091522correctionsCherie TevesNo ratings yet

- Lease Agreement: 10,000.00), Every Month. Upon Signing of This Agreement, TheDocument6 pagesLease Agreement: 10,000.00), Every Month. Upon Signing of This Agreement, TheTon BetitoNo ratings yet

- Contract of LeaseDocument7 pagesContract of LeaseEllaine D RamirezNo ratings yet

- Contract of Lease ShopreDocument3 pagesContract of Lease Shoprejlj generalNo ratings yet

- Contract of Lease - TelcoDocument7 pagesContract of Lease - TelcoGabrielAblolaNo ratings yet

- Sample Contract of LeaseDocument7 pagesSample Contract of LeaseCarissa CestinaNo ratings yet

- Contract of Lease DraftDocument3 pagesContract of Lease DraftAbz ManansalaNo ratings yet

- Contract of Lease - 168 CLOSS TRADINGDocument6 pagesContract of Lease - 168 CLOSS TRADINGWinnie UyNo ratings yet

- Unit 01-CONTRACT OF LEASEDocument5 pagesUnit 01-CONTRACT OF LEASECheyNo ratings yet

- Lease Residence - BlankDocument5 pagesLease Residence - BlankMichael Kenneth AsbanNo ratings yet

- Contract of Lease ShopreDocument3 pagesContract of Lease ShopreJlj ChuaNo ratings yet

- Contract of Lease - Knoxport 2024 (Sept-Feb)Document8 pagesContract of Lease - Knoxport 2024 (Sept-Feb)Lexter Owen ApeladoNo ratings yet

- Contract of Lease:) Day of The Month. The Monthly RentalDocument4 pagesContract of Lease:) Day of The Month. The Monthly RentalJuana Dela CruzNo ratings yet

- Katrina S. DiplomaDocument7 pagesKatrina S. DiplomaTrinca DiplomaNo ratings yet

- Lease - HC Tomson (Km99) & Sidc - Sep2019 To Dec2019Document5 pagesLease - HC Tomson (Km99) & Sidc - Sep2019 To Dec2019Howard O. UntalanNo ratings yet

- Contract Lease SampleDocument10 pagesContract Lease Samplegta0523No ratings yet

- Lease Contract Kuya OscarDocument5 pagesLease Contract Kuya OscarShiela Ravina TorrefrancaNo ratings yet

- Contract of Lease 30F HARAVARD ResidencesDocument5 pagesContract of Lease 30F HARAVARD Residencesmichel magbagayNo ratings yet

- Contract of Lease SampleDocument8 pagesContract of Lease Samplejacq hungNo ratings yet

- Manaloto, Aires S. Form No. 6Document6 pagesManaloto, Aires S. Form No. 6Aice ManalotoNo ratings yet

- Ave, Diliman, Quezon City, Philippines, and Represented in This Act by Its General Manager Christine ChoiDocument6 pagesAve, Diliman, Quezon City, Philippines, and Represented in This Act by Its General Manager Christine ChoiAIRRA LYN PAGDATONo ratings yet

- Lease Contract Bauan New WheeltekDocument3 pagesLease Contract Bauan New Wheeltekkevin donNo ratings yet

- Contract of Lease Lot OnlyDocument6 pagesContract of Lease Lot Onlygsp74gsp74No ratings yet

- Contract of LeaseDocument5 pagesContract of LeaseJKDE TAX CONSULTANCY SERVICESNo ratings yet

- Legal LLLDocument12 pagesLegal LLLGeviena Pinky Sy SarmientoNo ratings yet

- Contract of Lease-Benoza - BlankDocument3 pagesContract of Lease-Benoza - BlankPooten Law FtiNo ratings yet

- Col Asten2022Document6 pagesCol Asten2022WAYNE EARLE LIMNo ratings yet

- Contract ExistingDocument5 pagesContract ExistingJhofer Alfonso MallariNo ratings yet

- LEASE CONTRACT SampleDocument4 pagesLEASE CONTRACT SampleLittle GirlblueNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- People Vs Del RosarioDocument1 pagePeople Vs Del Rosariovina lorraine marasiganNo ratings yet

- People Vs BaloloyDocument2 pagesPeople Vs Baloloyvina lorraine marasiganNo ratings yet

- Form No. 17Document3 pagesForm No. 17vina lorraine marasiganNo ratings yet

- Document 27Document7 pagesDocument 27vina lorraine marasiganNo ratings yet

- 2021 Lease ContractDocument3 pages2021 Lease Contractvina lorraine marasiganNo ratings yet

- Statement and Argument Graphic OrganizerDocument11 pagesStatement and Argument Graphic Organizervina lorraine marasiganNo ratings yet

- Form No. 16Document2 pagesForm No. 16vina lorraine marasiganNo ratings yet

- Icj ConventionDocument14 pagesIcj Conventionvina lorraine marasiganNo ratings yet

- Last Will and TestamentDocument2 pagesLast Will and Testamentvina lorraine marasiganNo ratings yet

- Form No. 32Document2 pagesForm No. 32vina lorraine marasiganNo ratings yet

- Form No. 31Document2 pagesForm No. 31vina lorraine marasiganNo ratings yet

- Form No. 35Document2 pagesForm No. 35vina lorraine marasiganNo ratings yet

- Form No. 33Document5 pagesForm No. 33vina lorraine marasiganNo ratings yet

- Form No. 19Document3 pagesForm No. 19vina lorraine marasiganNo ratings yet

- Sangrador V ValderamaDocument2 pagesSangrador V Valderamavina lorraine marasiganNo ratings yet

- Consti 1 Ass No. 6Document12 pagesConsti 1 Ass No. 6vina lorraine marasiganNo ratings yet

- Stat Con Case Digest For September 3Document5 pagesStat Con Case Digest For September 3vina lorraine marasiganNo ratings yet

- Presidential Decree No 1152Document14 pagesPresidential Decree No 1152vina lorraine marasiganNo ratings yet

- CARLOS Vs ABELARDODocument1 pageCARLOS Vs ABELARDOvina lorraine marasiganNo ratings yet

- In RE JUDGE MARCOSDocument8 pagesIn RE JUDGE MARCOSvina lorraine marasiganNo ratings yet

- HILIPPINE ENVIRONMENT CODE Presidential Decree NoDocument8 pagesHILIPPINE ENVIRONMENT CODE Presidential Decree Novina lorraine marasiganNo ratings yet

- PRESIDENTIAL DECREE No 1121Document3 pagesPRESIDENTIAL DECREE No 1121vina lorraine marasiganNo ratings yet

- The Contingency Fund of Pondicherry Act, 1964Document3 pagesThe Contingency Fund of Pondicherry Act, 1964IT MalurNo ratings yet

- Leave Application With PerformaDocument4 pagesLeave Application With Performazeshan aslamNo ratings yet

- Ethics in Public ServiceDocument28 pagesEthics in Public ServiceSarah Mae CatralNo ratings yet

- NSW Government Gazette, 20 July 2021, Number 331 "Health and Education"Document4 pagesNSW Government Gazette, 20 July 2021, Number 331 "Health and Education"clarencegirlNo ratings yet

- P7112bgm-Catalogueb2010 0811 en A4 FullDocument810 pagesP7112bgm-Catalogueb2010 0811 en A4 FullShri ShriNo ratings yet

- (G.R. No. 221411, September 28, 2020) Italkarat 18, Inc. Petitioner, vs. Juraldine N. Gerasmio, Respondent. Decision Hernando, J.Document9 pages(G.R. No. 221411, September 28, 2020) Italkarat 18, Inc. Petitioner, vs. Juraldine N. Gerasmio, Respondent. Decision Hernando, J.Farahleen Pearl PalacNo ratings yet

- 2021 ITTF Table Tennis World Ranking Regulation - 20210414Document14 pages2021 ITTF Table Tennis World Ranking Regulation - 20210414Gomez MartiNo ratings yet

- Orcullo, Midterm ExamDocument6 pagesOrcullo, Midterm ExamCristy OrculloNo ratings yet

- Personal Non-Disclosure AgreementDocument1 pagePersonal Non-Disclosure AgreementYouth ZoomNo ratings yet

- Seoul Arbitration Lecture - John Beechey Nov. 2019Document29 pagesSeoul Arbitration Lecture - John Beechey Nov. 2019Zviagin & CoNo ratings yet

- Redemption Form: For Individuals & InstitutionsDocument2 pagesRedemption Form: For Individuals & InstitutionsAndersen HarrisNo ratings yet

- Demand Notice Construction Contract Zechariah Wakili MsomiDocument2 pagesDemand Notice Construction Contract Zechariah Wakili MsomiRANDAN SADIQNo ratings yet

- Zerodha Demat AnnexureDocument8 pagesZerodha Demat AnnexureRuchikaGosainNo ratings yet

- Mari NotesDocument4 pagesMari Notesboss expertNo ratings yet

- ARTICLES 1179-1230: Kinds OF Legal ObligationsDocument8 pagesARTICLES 1179-1230: Kinds OF Legal ObligationsErwin Labayog MedinaNo ratings yet

- Terra Living X Aza Fashions OnlineDocument3 pagesTerra Living X Aza Fashions OnlinejenitavoraNo ratings yet

- Hjs 2021Document23 pagesHjs 2021Ruchika GuptaNo ratings yet

- The Maharashtra Rent Control ActDocument40 pagesThe Maharashtra Rent Control ActPrashant WaghmareNo ratings yet

- From Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETDocument7 pagesFrom Atty. Deanabeth C. Gonzales, Professor Rizal Technological University, CBETKelvin CaldinoNo ratings yet

- Trademark Law SyllabusDocument2 pagesTrademark Law SyllabusTaraChandraChouhanNo ratings yet

- Designation of A Representative Pursuant To Art. 27 GDPR: 1. Subject Matter of This AgreementDocument5 pagesDesignation of A Representative Pursuant To Art. 27 GDPR: 1. Subject Matter of This AgreementHoang Tri MinhNo ratings yet

- Netters Essential Histology With Student Consult Access 2Nd Edition Ovalle Test Bank Full Chapter PDFDocument17 pagesNetters Essential Histology With Student Consult Access 2Nd Edition Ovalle Test Bank Full Chapter PDFtheodoreeugenef2j90% (10)