Professional Documents

Culture Documents

House

House

Uploaded by

Paras Niraula0 ratings0% found this document useful (0 votes)

1 views2 pagesSpread

Original Title

house

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSpread

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pagesHouse

House

Uploaded by

Paras NiraulaSpread

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

Gross Yearly Income: $47,250

Gross Monthly Income (Derived): $3,938

Net Monthly Income (Derived): $2,953

Yearly Property Tax (Estimated): $4,000

Monthly Property Tax (Derived): $333

Yearly Home Insurance (Estimated): $800

Monthly Home Insurance (Derived): $67

Yearly PMI (Estimated): $1,260

Monthly PMI (Derived): $105

Specials Per Year (Estimated): $2,000

Monthly Specials (Derived): $167

Monthly Car Loan Payment (Estimated): $0

Monthly Student Loan Payment: $150

Front Ratio (Percent): 29

Monthly Maximum PITI (Derived Using Front Ratio): $1,142

Back Ratio (Percent): 41

Monthly Maximum PITI + Monthly Long-Term Debt (Derived Using Back Ratio): $1,614

Monthly Maximum PI (Derived): $470

Monthly Maximum PITI (Derived): $1,142

Interest Rate (Percent): 5.000

Term (Months): 360

Maximum Loan Amount (Derived): $87,591

Purchase Price: $144,000

Down Payment (Dollars): $10,000

Down Payment Percent (Derived): 6.94%

Actual Loan Amount (Derived): $134,000

Actual Monthly PI (Derived): $716

Actual Monthly PITI (Derived): $1,388

20% Equity Value (Derived): $28,800

To Pay Until PMI Cancellation (Derived): $18,800

Tax Savings Per Month (Estimated): $150

Actual Monthly PITI + Monthly Long-Term Debt (Derived): $1,538

Left Per Month (Derived): $400

Groceries: $310

Utilities: $250

Cell Phone: $45

Gasoline: $60

Hobbies: $50

Alcohol: $50

Home Maint: $75

Car Maint: $10

Medical: $75

Clothing: $50

Gifts: $20

Dental: $20

You might also like

- Chap 12 SolutionDocument15 pagesChap 12 SolutionMarium Raza0% (1)

- Harvard Case Study - Flash Inc - AllDocument40 pagesHarvard Case Study - Flash Inc - All竹本口木子100% (1)

- Ch14 P13 ModelDocument6 pagesCh14 P13 ModelJusto Valverde0% (4)

- Valuation Report Sample FormatDocument6 pagesValuation Report Sample FormatParas Niraula0% (1)

- S15 - Goal Seek - PMTDocument5 pagesS15 - Goal Seek - PMTSRISHTI ARORANo ratings yet

- Rutland - Performance ReportDocument1 pageRutland - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Oct 2017Document1 pageOct 2017Hemal ShahNo ratings yet

- Month: % of Income SpentDocument2 pagesMonth: % of Income SpentNE MathelNo ratings yet

- 01 03 Accretion Dilution AfterDocument3 pages01 03 Accretion Dilution AfterДоминик КоббNo ratings yet

- Foley'S End Inc. Projected Statement of Earnings As at September 30 Account Titles Assumptions 2012 2013 RevenuesDocument4 pagesFoley'S End Inc. Projected Statement of Earnings As at September 30 Account Titles Assumptions 2012 2013 RevenuesLeah LiuNo ratings yet

- Foley'S End Inc. Projected Statement of Earnings As at September 30 Account Titles Assumptions 2012 2013 RevenuesDocument4 pagesFoley'S End Inc. Projected Statement of Earnings As at September 30 Account Titles Assumptions 2012 2013 RevenuesLeah LiuNo ratings yet

- 7803 Stahelin - Performance ReportDocument1 page7803 Stahelin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Don MastersDocument2 pagesDon MastersMigs CruzNo ratings yet

- 6100 Greenview - Performance ReportDocument1 page6100 Greenview - Performance ReportBay Area Equity Group, LLCNo ratings yet

- DV Compensation FormDocument1 pageDV Compensation Formdiego.bragancaNo ratings yet

- Matt Castello Monthly Annual Cash InflowsDocument1 pageMatt Castello Monthly Annual Cash InflowsMatt CastelloNo ratings yet

- BookDocument2 pagesBookJames DionedaNo ratings yet

- Maddelein - Performance ReportDocument1 pageMaddelein - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Property Investor CondoDocument1 pageProperty Investor CondoNeedsterNo ratings yet

- Sample Financial PlanDocument12 pagesSample Financial PlanSneha KhuranaNo ratings yet

- 7242 Montrose - Performance ReportDocument1 page7242 Montrose - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationpalwashaNo ratings yet

- BD Assignment Team C - Fabian and SalmaDocument2 pagesBD Assignment Team C - Fabian and SalmaSarah AnantaNo ratings yet

- Budget: % of Income SpentDocument2 pagesBudget: % of Income SpentRGHUNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationAyesha KanwalNo ratings yet

- 6693 Baldwin - Performance ReportDocument1 page6693 Baldwin - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Ellsworth - Performance ReportDocument1 pageEllsworth - Performance ReportBay Area Equity Group, LLCNo ratings yet

- 5790 Guilford - Performance ReportDocument1 page5790 Guilford - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Pinkey Street-2Document5 pagesPinkey Street-2ki100% (1)

- Merger Model Sample BIWS JobSearchDigestDocument7 pagesMerger Model Sample BIWS JobSearchDigestCCerberus24No ratings yet

- Cash Flow Duplexes - Real Estate Investment - Kansas CityDocument21 pagesCash Flow Duplexes - Real Estate Investment - Kansas CityNorada Real Estate Investments100% (5)

- Projected Budget Spreadsheet 1Document10 pagesProjected Budget Spreadsheet 1Ismail UsmanNo ratings yet

- Assignement 5Document4 pagesAssignement 5Valentin Florin Drezaliu100% (1)

- Tugas Kelompok Ke-2 (Minggu 5/ Sesi 7) Financial Modelling LaboratoryDocument13 pagesTugas Kelompok Ke-2 (Minggu 5/ Sesi 7) Financial Modelling LaboratoryRexy HannerNo ratings yet

- 1 Financial Plan Cover PageDocument5 pages1 Financial Plan Cover Pageapi-404263747No ratings yet

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasNo ratings yet

- Quiz# 1: 1. Use The Following Information For U.S. CorporationDocument6 pagesQuiz# 1: 1. Use The Following Information For U.S. CorporationesterNo ratings yet

- Budget: % of Income Spent SummaryDocument2 pagesBudget: % of Income Spent SummaryleoNo ratings yet

- Budget: % of Income Spent SummaryDocument2 pagesBudget: % of Income Spent SummarySteven KramerNo ratings yet

- tf00000035 WacDocument1 pagetf00000035 WacMihai si atatNo ratings yet

- Long-Term Financial Planning and GrowthDocument37 pagesLong-Term Financial Planning and GrowthNauryzbek MukhanovNo ratings yet

- 9941 Mansfield - Performance ReportDocument1 page9941 Mansfield - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Income Lesson One - Plan Your FutureDocument1 pageIncome Lesson One - Plan Your FutureJOHN MENDOZA GALLEGOSNo ratings yet

- Manage My Money1Document2 pagesManage My Money1RajaNo ratings yet

- Projected PaycheckDocument1 pageProjected Paycheckapi-634527561No ratings yet

- 9926 Archdale ST - Performance ReportDocument1 page9926 Archdale ST - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- Lesson 1 DebtDocument21 pagesLesson 1 DebtAlf ChingNo ratings yet

- Sales Price: Mark-Up On Total Variable Cost Per BatchDocument8 pagesSales Price: Mark-Up On Total Variable Cost Per BatchNikita SharmaNo ratings yet

- Career BudgetDocument1 pageCareer Budgetapi-435326846No ratings yet

- Expat Usd Rate Change SheetDocument4 pagesExpat Usd Rate Change SheetgowmukhiNo ratings yet

- Thomas Frank's Budget Modeler Template!Document9 pagesThomas Frank's Budget Modeler Template!Norman LefortNo ratings yet

- PADD Loan Calculator Tool: Payment Amount (Annually) : $ 556,927.71Document1 pagePADD Loan Calculator Tool: Payment Amount (Annually) : $ 556,927.71sureshstipl sureshNo ratings yet

- Ivan PriormonthDocument1 pageIvan Priormonthapi-255333441No ratings yet

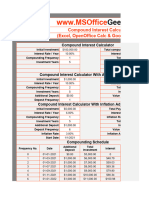

- Compound Interest CalculatorDocument14 pagesCompound Interest CalculatorSiyabongaNo ratings yet

- 9926 Archdale - Performance ReportDocument1 page9926 Archdale - Performance ReportBay Area Equity Group, LLCNo ratings yet

- Kezi Juice Company FinancialsDocument3 pagesKezi Juice Company FinancialsTendai SixpenceNo ratings yet

- Monthly CommitmentDocument3 pagesMonthly CommitmentsaufisafingiNo ratings yet

- BookDocument4 pagesBookEmily RichardsNo ratings yet

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsFrom EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNo ratings yet

- CM FAQ English-13072020Document6 pagesCM FAQ English-13072020Paras NiraulaNo ratings yet

- BarsunchetDocument53 pagesBarsunchetParas NiraulaNo ratings yet

- Subisu Cablenet 2020-05-14Document1 pageSubisu Cablenet 2020-05-14Paras NiraulaNo ratings yet

- Subisu Cablenet 2020-05-14Document1 pageSubisu Cablenet 2020-05-14Paras NiraulaNo ratings yet

- 6 Civil - Engg 6 Level 076-2-12 FinalDocument7 pages6 Civil - Engg 6 Level 076-2-12 FinalParas NiraulaNo ratings yet

- Property Valuation 1Document4 pagesProperty Valuation 1Paras NiraulaNo ratings yet

- Salary Slip (00856333 April, 2019)Document1 pageSalary Slip (00856333 April, 2019)AurangzebNo ratings yet

- Colegio de Sta. Rita Business TaxationDocument1 pageColegio de Sta. Rita Business TaxationJunivenReyUmadhayNo ratings yet

- Stansberry 2nd Homestead in DCDocument2 pagesStansberry 2nd Homestead in DCAnonymous Pb39klJNo ratings yet

- Public Finance & Taxation - Chapter 4, PT IVDocument24 pagesPublic Finance & Taxation - Chapter 4, PT IVbekelesolomon828No ratings yet

- TRAIN LAW Comparative AnalysisDocument2 pagesTRAIN LAW Comparative AnalysisElaine100% (3)

- Project Report Table of Content: 1004 Financial Planning For Salaried Employee and Strategies For Tax SavingsDocument2 pagesProject Report Table of Content: 1004 Financial Planning For Salaried Employee and Strategies For Tax SavingsSai VarunNo ratings yet

- Budget & EconomyDocument13 pagesBudget & Economysonu_dpsNo ratings yet

- Purpose:: Basic Principles of Taxationa. Taxation As An Inherent Power of The StateDocument1 pagePurpose:: Basic Principles of Taxationa. Taxation As An Inherent Power of The StateMark SorianoNo ratings yet

- Patterns of Philippine Expenditures: Prepared By: Gabiana, Marie LouDocument10 pagesPatterns of Philippine Expenditures: Prepared By: Gabiana, Marie LouAlie Gabiana100% (1)

- Employment Income TaxDocument10 pagesEmployment Income TaxHarsh Nahar100% (1)

- Amit Security Agency Popular 10Document5 pagesAmit Security Agency Popular 10Bharat DafalNo ratings yet

- Week 3 Tutorial Solutions - Fiancial AcountingDocument13 pagesWeek 3 Tutorial Solutions - Fiancial AcountingMi ThaiNo ratings yet

- Elasticity and Buoyancy of The Tax System in PakistanDocument22 pagesElasticity and Buoyancy of The Tax System in PakistanShumaisa12No ratings yet

- Sunil Kumar (DELS0210)Document1 pageSunil Kumar (DELS0210)SUNIL KUMARNo ratings yet

- Advantages and Disadvantages of TaxationDocument6 pagesAdvantages and Disadvantages of TaxationNefta Baptiste100% (3)

- Chapter 12Document38 pagesChapter 12Nguyễn Vinh QuangNo ratings yet

- DrtftyDocument1 pageDrtftySri Ganesh ComputersNo ratings yet

- Income Taxation - Finals QuizzesDocument12 pagesIncome Taxation - Finals QuizzesJalyn Jalando-onNo ratings yet

- Tax 1 Syllabus - StudentsDocument6 pagesTax 1 Syllabus - StudentsAnonymous fnlSh4KHIgNo ratings yet

- Invoice - 2023-09-20T165658.772Document2 pagesInvoice - 2023-09-20T165658.772Surendra PanwarNo ratings yet

- Calculation of Total Tax Incidence (TTI) For ImportDocument4 pagesCalculation of Total Tax Incidence (TTI) For ImportMd. Mehedi Hasan AnikNo ratings yet

- A Guide To Tax Saving Through NPS (National Pension System)Document4 pagesA Guide To Tax Saving Through NPS (National Pension System)alankar2050No ratings yet

- Aguinaldo Vs CIR #Tax-1Document2 pagesAguinaldo Vs CIR #Tax-1Earl TagraNo ratings yet

- PDF 4697270 InvoiceDocument2 pagesPDF 4697270 InvoiceAmis2018 Amis2018No ratings yet

- QUESTION 3 (B) - TAXATION OF INCOME - November 30, 2022Document4 pagesQUESTION 3 (B) - TAXATION OF INCOME - November 30, 2022Nathan NakibingeNo ratings yet

- Accounting For Income TaxDocument37 pagesAccounting For Income TaxAbdulhafiz100% (5)

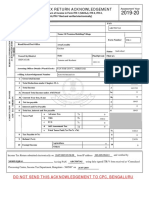

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruSmr OrganizationsNo ratings yet

- Ewt Exam - FormareDocument3 pagesEwt Exam - FormareMikaela SalvadorNo ratings yet

- Benefit of GST: It Eliminates The Cascading Effect of Tax That Happened EarlierDocument3 pagesBenefit of GST: It Eliminates The Cascading Effect of Tax That Happened EarlierArushi VermaNo ratings yet

- Fringe BenefitsDocument2 pagesFringe BenefitsFaye Cecil Posadas CuramingNo ratings yet