Professional Documents

Culture Documents

Peninsula+Land 10-6-08 PL

Uploaded by

api-3862995Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Peninsula+Land 10-6-08 PL

Uploaded by

api-3862995Copyright:

Available Formats

Peninsula Land

Results weak; in line with expectations

June 10, 2008 Results: Peninsula Land (PLL) declared weak results for 4QFY08. This was

Q4FY08 Result Update

primarily on account of the stop-work notice issued by the Municipal

Corporation of Greater Mumbai, whereby the company had to stop work

Rating Outperfomrer

on four of its Mumbai projects in Q3FY08 and Q4FY08. The company

Price Rs66 resumed some part of the work in March 2008, while the notice was fully

Target Price Rs129 withdrawn with effect from April 2, 2008. Topline for the quarter

Implied Upside 94.9% witnessed 8% YoY decline, while PAT witnessed 42% decline.

Sensex 15,066

Ashok Towers - major revenue driver: The company booked 65% of its

(Prices as on June 9, 2008)

quarterly revenue from Ashok Towers, a residential project located in

Parel. While 94% of the project has been pre-sold, 55% construction has

been completed. PLL booked another 13% of its revenue from Peninsula

Trading Data

Business Park and 17% from the sale of TDRs, which were generated from

Market Cap. (Rs bn) 18.5

the company’s Bhandup project.

Shares o/s (m) 279.5

Free Float 46.6% 117% CAGR revenue growth expected over 2 years: PLL has four on

3M Avg. Daily Vol (‘000) 1,002.9

going projects in Mumbai, which are likely to drive its revenue and

profits over FY09 and FY10. We expect revenue growth of 117%

3M Avg. Daily Value (Rs m) 98.3

accompanied with PAT growth of 119%.

Valuation: Our estimate of the company’s NAV, excluding the SEZs,

which have not been notified (as well as the newly acquired land at

Major Shareholders Hyderabad) stands at Rs101, while we attribute a value of Rs28 to the

Promoters 53.4% realty fund. At the CMP, the company is trading at 34% discount to the

Foreign 18.9% NAV. We rate the stock Outperformer.

Domestic Inst. 6.6%

Public & Others 21.1%

Key financials (Y/e March) FY07 FY08 FY09E FY10E

Revenue (Rs m) 3,272 3,574 10,858 16,842

Growth (%) 19.1 9.2 203.8 55.1

Stock Performance

EBITDA (Rs m) 1,742 1,509 5,400 8,939

(%) 1M 6M 12M PAT (Rs m) 1,294 1,321 3,526 6,302

Absolute (32.3) (55.7) (40.0) EPS (Rs) 6.1 4.7 12.6 22.5

Growth (%) (15.7) (23.1) 167.0 78.7

Relative (20.6) (29.8) (45.2)

Net DPS (Rs) 0.6 0.5 0.5 0.5

Source: Company Data; PL Research

Price Performance (RIC: PENL.BO, BB: PENL IN) Profitability & valuation FY07 FY08 FY09E FY10E

(Rs) EBITDA margin (%) 53.2 42.2 49.7 53.1

180 RoE (%) 57.6 19.1 29.5 37.3

160

RoCE (%) 26.0 17.3 38.7 44.1

EV / sales (x) 5.2 4.3 1.3 0.8

140

EV / EBITDA (x) 9.7 10.2 2.7 1.4

120

PE (x) 10.8 14.0 5.2 2.9

100 P / BV (x) 3.8 1.8 1.4 0.9

80 Net dividend yield (%) 0.01 0.01 0.01 0.01

60 Source: Company Data; PL Research

Apr-08

Dec-07

Feb-08

Jun-07

Aug-07

Oct-07

Jun-08

Kejal Mehta Subramaniam Yadav

KejalMehta@PLIndia.com SubramaniamYadav@PLIndia.com

Source: Bloomberg +91-22-6632 2246 +91-22-6632 2241

Peninsula Land

Q4FY08 result overview (Rs m)

Y/e March Q4FY08 Q4FY07 YoY gr. (%) Q3FY08 FY07 FY08 YoY gr. (%)

Net sales 1,112 1,204 (7.6) 224 3,272 3,574 9.2

Expenditure

Construction, mfg. & others 803 574 39.9 94 1,413 1,830 29.5

% of net sales 72.3 47.7 42.2 43.2 51.2

Personnel cost 57 38 47.9 50 116 235 101.7

% of net sales 5.1 3.2 22.5 3.6 6.6

Total expenditure 860 613 40.4 145 1,530 2,065 35.0

EBITDA 252 591 (57.4) 79 1,742 1,509 (13.4)

Margin (%) 22.7 49.1 35.3 53.2 42.2

Other income 77 8 867.5 0 16 108 586.1

Depreciation 10 2 405.0 5 13 26 99.7

EBIT 319 597 (46.5) 74 1,745 1,591 (8.8)

Interest (90) 18 NM (27) 129 (66) NM

PBT 409 580 (29.4) 100 1,616 1,657 2.5

Total tax 115 73 (320) 75 194 157.8

% PBT 28.0 12.5 NM 4.7 11.7

PAT 295 507 (41.9) 420 1,541 1,463 (5.0)

Extraordinary item (47) (172) (41) (252) (152)

Share of associates - - - 4 15

Minority interest - - - 1 (5)

PAT after minority int. 247 335 (26.2) 379 1,294 1,321 2.0

June 10, 2008 2

Peninsula Land

Prabhudas Lilladher Pvt. Ltd.

3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai-400 018, India.

Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209

PL’s Recommendation Nomenclature

BUY : > 15% Outperformance to BSE Sensex Outperformer (OP) : 5 to 15% Outperformance to Sensex

Market Performer (MP) : -5 to 5% of Sensex Movement Underperformer (UP) : -5 to -15% of Underperformace to Sensex

Sell : <-15% Relative to Sensex

Not Rated (NR) : No specific call on the stock Under Review (UR) : Rating likely to change shortly

This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information

and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken

as an offer to sell or a solicitation to buy or sell any security.

The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or

completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information,

statements and opinion given, made available or expressed herein or for any omission therein.

Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The

suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent

expert/advisor.

Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or

engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication.

We may from time to time solicit or perform investment banking or other services for any company mentioned in this document.

June 10, 2008 3

You might also like

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- CPA REVIEW EXAMDocument14 pagesCPA REVIEW EXAMZiee00No ratings yet

- 02 Cost Terms, Concepts and Behavior ANSWER KEYDocument4 pages02 Cost Terms, Concepts and Behavior ANSWER KEYJemNo ratings yet

- Midterm Exam Intermediate Accounting 2Document10 pagesMidterm Exam Intermediate Accounting 2Juan Dela cruzNo ratings yet

- Siemens 2Document78 pagesSiemens 2harkeshNo ratings yet

- CHAPTER 9 Guerrero Installment SalesDocument22 pagesCHAPTER 9 Guerrero Installment SalesMacoy Liceralde50% (6)

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsFrom EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsNo ratings yet

- Current Liabilities - Assignment - With Answers - For PostingDocument3 pagesCurrent Liabilities - Assignment - With Answers - For Postingemman neri50% (2)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Tugas 2 Akuntansi ManajemenDocument3 pagesTugas 2 Akuntansi ManajemenSherlin KhuNo ratings yet

- Prade Case StudyDocument12 pagesPrade Case StudyTrump Papers100% (1)

- GovTech Maturity Index: The State of Public Sector Digital TransformationFrom EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNo ratings yet

- ABG+Shipyard 11-6-08 PLDocument3 pagesABG+Shipyard 11-6-08 PLapi-3862995No ratings yet

- Angel Broking M&MDocument5 pagesAngel Broking M&Mbunny711No ratings yet

- Enil 25 8 08 PLDocument12 pagesEnil 25 8 08 PLapi-3862995No ratings yet

- IDBI Capital Century Plyboards Q1FY23 Result ReviewDocument10 pagesIDBI Capital Century Plyboards Q1FY23 Result ReviewTai TranNo ratings yet

- Bharat Forge StoryDocument4 pagesBharat Forge Storysoni_rajendraNo ratings yet

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- Vascon Engineers - Kotak PCG PDFDocument7 pagesVascon Engineers - Kotak PCG PDFdarshanmadeNo ratings yet

- Ashok Leyland: Performance HighlightsDocument9 pagesAshok Leyland: Performance HighlightsSandeep ManglikNo ratings yet

- UltraTech Cement's strong growth visibilityDocument10 pagesUltraTech Cement's strong growth visibilityLive NIftyNo ratings yet

- Q2'20 UpdateDocument26 pagesQ2'20 UpdateFred Lamert100% (2)

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- 1 31 2008 (Edelweiss) Page Industries-Result Up - Edw02410Document4 pages1 31 2008 (Edelweiss) Page Industries-Result Up - Edw02410api-3740729No ratings yet

- Icmnbo Abn AmroDocument9 pagesIcmnbo Abn AmrodivyakashNo ratings yet

- Tata Motors: Performance HighlightsDocument10 pagesTata Motors: Performance HighlightsandrewpereiraNo ratings yet

- Boi 250108Document5 pagesBoi 250108api-3836349No ratings yet

- Iiww 300710Document4 pagesIiww 300710joshichirag77No ratings yet

- Tata Elxsi 4qfy19 Result Update19Document6 pagesTata Elxsi 4qfy19 Result Update19Ashutosh GuptaNo ratings yet

- Jain Irrigation Systems LTD: AccumulateDocument6 pagesJain Irrigation Systems LTD: Accumulatesaran21No ratings yet

- Bharti Airtel Company Update - 270810Document6 pagesBharti Airtel Company Update - 270810Robin BhimaiahNo ratings yet

- Reliance Infrastructure: Negative Other Income A SurpriseDocument5 pagesReliance Infrastructure: Negative Other Income A SurpriseAnkit DuaNo ratings yet

- Zomato IPO NoteDocument9 pagesZomato IPO NoteCrest WolfNo ratings yet

- BHEL FY2009 Flash Result UpdateDocument5 pagesBHEL FY2009 Flash Result UpdateFirdaus JahanNo ratings yet

- Avenue Supermarts Sell: Result UpdateDocument6 pagesAvenue Supermarts Sell: Result UpdateAshokNo ratings yet

- Saregama 16-6-08 PLDocument3 pagesSaregama 16-6-08 PLapi-3862995No ratings yet

- Result Update Presentation - Q1 FY18: AUGUST 10, 2017Document10 pagesResult Update Presentation - Q1 FY18: AUGUST 10, 2017Mohit PariharNo ratings yet

- Buy Mayur Uniquoters - Aug'18Document6 pagesBuy Mayur Uniquoters - Aug'18Deepak GNo ratings yet

- H G Infra Engineering LTD - Q3FY22 Result Update - 07022021 - 07-02-2022 - 14Document9 pagesH G Infra Engineering LTD - Q3FY22 Result Update - 07022021 - 07-02-2022 - 14Rohan ChauhanNo ratings yet

- Deepak Fertilizers & Petrochemicals Corporation: Result As Per Expectation, Project On TimeDocument4 pagesDeepak Fertilizers & Petrochemicals Corporation: Result As Per Expectation, Project On TimeNandan AcharyaNo ratings yet

- Weak Balance Sheet Drags Profitability: Q3FY18 Result HighlightsDocument8 pagesWeak Balance Sheet Drags Profitability: Q3FY18 Result Highlightsrishab agarwalNo ratings yet

- Indian Hotel - Q4FY22 Results - DAMDocument8 pagesIndian Hotel - Q4FY22 Results - DAMRajiv BharatiNo ratings yet

- ITC 21 08 2023 EmkayDocument15 pagesITC 21 08 2023 Emkayvikram112in20002445No ratings yet

- TSLA Q3 2020 UpdateDocument29 pagesTSLA Q3 2020 UpdateSimon AlvarezNo ratings yet

- Cipla: Performance HighlightsDocument8 pagesCipla: Performance HighlightsKapil AthwaniNo ratings yet

- Endurance Technologies: CMP: INR1,400 TP: INR1,750 (+25%)Document10 pagesEndurance Technologies: CMP: INR1,400 TP: INR1,750 (+25%)Live NIftyNo ratings yet

- Q2FY24 Post Results Review - SMIFS Institutional ResearchDocument17 pagesQ2FY24 Post Results Review - SMIFS Institutional Researchkrishna_buntyNo ratings yet

- Tech Mahindra announces one of its largest deals from AT&TDocument10 pagesTech Mahindra announces one of its largest deals from AT&TdarshanmaldeNo ratings yet

- Bharti Airtel: Company FocusDocument5 pagesBharti Airtel: Company FocusthomsoncltNo ratings yet

- Motilal Oswal PVR Q2FY21 Result UpdateDocument12 pagesMotilal Oswal PVR Q2FY21 Result Updateumaj25No ratings yet

- Teamlease Services (Team In) : Q4Fy19 Result UpdateDocument8 pagesTeamlease Services (Team In) : Q4Fy19 Result Updatesaran21No ratings yet

- Wipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityDocument14 pagesWipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityPramod KulkarniNo ratings yet

- Q4'19 UpdateDocument26 pagesQ4'19 Updateeagle1965No ratings yet

- JBM Auto (Q2FY21 Result Update)Document7 pagesJBM Auto (Q2FY21 Result Update)krippuNo ratings yet

- Himatsingka Seide - 1QFY20 Result - EdelDocument12 pagesHimatsingka Seide - 1QFY20 Result - EdeldarshanmadeNo ratings yet

- India - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadDocument13 pagesIndia - Bharti Airtel - Q4 Strong Beat Leverage Benefit AheadVrajesh ChitaliaNo ratings yet

- Annual Report of Info Edge by Icici SecurityDocument12 pagesAnnual Report of Info Edge by Icici SecurityGobind yNo ratings yet

- Voltamp Transformers LTD: CMP: INR 1,145 Rating: Buy Target Price: INR 1,374Document5 pagesVoltamp Transformers LTD: CMP: INR 1,145 Rating: Buy Target Price: INR 1,374Darwish MammiNo ratings yet

- AIA Engineering Feb 19Document6 pagesAIA Engineering Feb 19darshanmaldeNo ratings yet

- Tesla Q4'19 Update LetterDocument26 pagesTesla Q4'19 Update LetterSimon AlvarezNo ratings yet

- Happiest Minds Technologies 160522Document6 pagesHappiest Minds Technologies 160522sssNo ratings yet

- Bharat Forge: Performance HighlightsDocument13 pagesBharat Forge: Performance HighlightsarikuldeepNo ratings yet

- Sonata Software (SSOF IN) : Q2FY19 Result UpdateDocument9 pagesSonata Software (SSOF IN) : Q2FY19 Result UpdateADNo ratings yet

- PSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10Document8 pagesPSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10samraatjadhavNo ratings yet

- Aarti Industries: All Round Growth ImminentDocument13 pagesAarti Industries: All Round Growth ImminentPratik ChhedaNo ratings yet

- Ultratech Cement Limited: Outlook Remains ChallengingDocument5 pagesUltratech Cement Limited: Outlook Remains ChallengingamitNo ratings yet

- GMR Infra: Robust Traffic GrowthDocument4 pagesGMR Infra: Robust Traffic GrowthRaunak MukherjeeNo ratings yet

- Tech OutlookDocument2 pagesTech Outlookapi-3862995No ratings yet

- Downlaod L&TDocument9 pagesDownlaod L&Tapi-3862995No ratings yet

- Hdfcbank 25-8-08 PLDocument5 pagesHdfcbank 25-8-08 PLapi-3862995100% (1)

- Downlaod L&TDocument9 pagesDownlaod L&Tapi-3862995No ratings yet

- Tech OutlookDocument2 pagesTech Outlookapi-3862995No ratings yet

- 2 WheelerDocument9 pages2 Wheelerapi-3862995100% (1)

- Sterlite IndustriesDocument23 pagesSterlite Industriesapi-3862995No ratings yet

- India DailyDocument30 pagesIndia Dailyapi-3862995No ratings yet

- India DailyDocument30 pagesIndia Dailyapi-3862995No ratings yet

- TU544 HDFC LTD 080624Document7 pagesTU544 HDFC LTD 080624api-3862995No ratings yet

- Notes+ +26th+june+2008Document15 pagesNotes+ +26th+june+2008api-3862995No ratings yet

- SunPharma 1-9-08 PLDocument9 pagesSunPharma 1-9-08 PLapi-3862995No ratings yet

- Financial Services 25-8-08 PLDocument2 pagesFinancial Services 25-8-08 PLapi-3862995No ratings yet

- Ambuja Cements LimitedDocument5 pagesAmbuja Cements Limitedapi-3862995No ratings yet

- Edel 230608Document9 pagesEdel 230608api-3862995No ratings yet

- Cement Monthly Update 26-8-08 PLDocument9 pagesCement Monthly Update 26-8-08 PLapi-3862995No ratings yet

- India DailyDocument36 pagesIndia Dailyapi-3862995No ratings yet

- EIH HotelsDocument2 pagesEIH Hotelsapi-3862995No ratings yet

- ENAM RanbaxyDocument2 pagesENAM Ranbaxyapi-3862995No ratings yet

- Varun Shipping LKP SharesDocument3 pagesVarun Shipping LKP Sharesapi-3862995No ratings yet

- Market StrategyDocument6 pagesMarket Strategyapi-3862995No ratings yet

- India DailyDocument15 pagesIndia Dailyapi-3862995No ratings yet

- TU535 Infosys Technologies Limited 080618Document6 pagesTU535 Infosys Technologies Limited 080618api-3862995No ratings yet

- Technicals 12062008 RCHDocument4 pagesTechnicals 12062008 RCHapi-3862995No ratings yet

- India DailyDocument17 pagesIndia Dailyapi-3862995No ratings yet

- Market StrategyDocument3 pagesMarket Strategyapi-3862995No ratings yet

- Technicals 19062008 AlsDocument3 pagesTechnicals 19062008 Alsapi-3862995No ratings yet

- IDFC SSKI+FinancialsDocument18 pagesIDFC SSKI+Financialsapi-3862995No ratings yet

- Plastics+ RNDocument4 pagesPlastics+ RNapi-3862995No ratings yet

- Multiple Choice QuestionsDocument11 pagesMultiple Choice QuestionsTULIO, Jeremy I.No ratings yet

- IFRS 1 - First-Time Adoption of International Financial Reporting StandardsDocument6 pagesIFRS 1 - First-Time Adoption of International Financial Reporting StandardsSky WalkerNo ratings yet

- Accounting For Income Tax ReviewerDocument6 pagesAccounting For Income Tax ReviewerNJ TamdangNo ratings yet

- IFRS 1 First-time Adoption SummaryDocument2 pagesIFRS 1 First-time Adoption SummarypiyalhassanNo ratings yet

- 03-04-2012Document62 pages03-04-2012Adeel AliNo ratings yet

- STRAT ReviewerDocument13 pagesSTRAT ReviewerCrisel SalomeoNo ratings yet

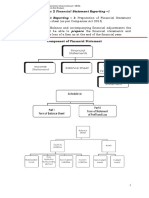

- Financial Statement ReportingDocument20 pagesFinancial Statement ReportingAshwini Khare0% (1)

- Module 2 2 Eps BVPSDocument9 pagesModule 2 2 Eps BVPSFujoshi BeeNo ratings yet

- Correcting The Trial Balance 2022Document3 pagesCorrecting The Trial Balance 2022Charlemagne Jared RobielosNo ratings yet

- 04 - PPT - Chapter 29Document29 pages04 - PPT - Chapter 29RicardoNo ratings yet

- 1.2 Responsibility Accounting Theory AnswersDocument11 pages1.2 Responsibility Accounting Theory AnswersAsnarizah PakinsonNo ratings yet

- Solution Manual For Financial ACCT 2010 1st Edition by GodwinDocument12 pagesSolution Manual For Financial ACCT 2010 1st Edition by Godwina527996566No ratings yet

- Gratuity Report IND As 19Document25 pagesGratuity Report IND As 19Prashant GaurNo ratings yet

- Working With Financial StatementsDocument33 pagesWorking With Financial StatementsAssad Hayat Niazi100% (1)

- Class - XII Accountancy Chapter-5 Part - B Cash Flow StatementDocument10 pagesClass - XII Accountancy Chapter-5 Part - B Cash Flow StatementAnonymous NSNpGa3T93No ratings yet

- Assignment - Intangible AssetDocument5 pagesAssignment - Intangible AssetJane DizonNo ratings yet

- Ac 1104 - Partnership OperationsDocument28 pagesAc 1104 - Partnership OperationsNarikoNo ratings yet

- Bharat Hotels Year 0 1 2Document7 pagesBharat Hotels Year 0 1 2YagyaaGoyalNo ratings yet

- Exam 2 SolutionsDocument5 pagesExam 2 Solutions123xxNo ratings yet

- Afm AssignmentDocument6 pagesAfm AssignmentShweta BhardwajNo ratings yet

- ACTBAS1 - Lecture 9 (Adjusting Entries) RevisedDocument44 pagesACTBAS1 - Lecture 9 (Adjusting Entries) RevisedAlejandra MigallosNo ratings yet

- MiaDocument298 pagesMiaMujahidahFaqihahNo ratings yet