Professional Documents

Culture Documents

Zomato IPO Note

Uploaded by

Crest WolfCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Zomato IPO Note

Uploaded by

Crest WolfCopyright:

Available Formats

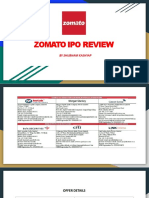

IPO Note Zomato Ltd.

July 12, 2021

SUBSCRIBE

ZOMATO LIMITED. Issue Open: July 14, 2021

ZOMATO Limited is one of the leading Food Services platforms in India. Its Issue Close: July 16, 2021

technology platform connects customers, restaurant partners and delivery partners,

f

serving their multiple needs. Zomato has two core B2C offerings, Food delivery

and Dining-out in addition to the B2B offering Hyperpure. Another important part Issue Details

of the business is Zomato Pro, which is the customer loyalty program and Face Value: `1

encompasses both food delivery and dining-out. As of 31st Mar 2021, Zomato was

Present Eq. Paid up Capital: `666.1 cr

present in 525 cities in India, with 389,932 active restaurant listings along with

presence in 23 countries outside India.

Offer for Sale: `375 cr

Positives: (a) Strong network effects driven by unique content and transaction

flywheels. (b) Company’s widespread and efficient on-demand hyperlocal delivery Fresh issue: `9000 cr

network (c) Zomato has a technology and product-first approach to business (d)

Zomato is a strong consumer brand recognized across the length and breadth of Post Eq. Paid up Capital: `784.5cr

India.

Issue size (amount): `9,375 cr

Investment concerns: (a) The company has a history of net losses and anticipates

increased expenses in the future. (b) It may not be able to sustain historical growth Price Band: `72-76

rates going forward. (c) The COVID-19 pandemic, or a similar public health threat,

has had an impact and could further impact the business, cash flows, and financial Lot Size: 195 shares and in multiple thereafter

condition of the company. (d) Failing to retain existing restaurant partners,

customers or delivery partners or failing to add new restaurant partners, delivery

partners or customers, may have an adverse impact on the business. Post-issue mkt. cap: * `56,485 cr - ** `59,623 cr

Outlook & Valuation: The IPO is being valued at price/sales of 28.6-29.9x FY2021

revenues of `1,993 crore. Post a 23.5% degrowth in revenues in FY2021 due to the Non-Promoters/Public holding Pre-Issue: 4.2%

Covid-19 pandemic, growth is expected to pick up sharply from FY2022.

Moreover, Zomato has been able to reduce its losses in FY2021 despite a Non-Promoters/Public Post-Issue: 3.57%

degrowth in topline. We expect losses to reduce further over next couple of years

due to rebound in growth and improving unit economic. Given strong delivery *Calculated on lower price band

network, high barriers to entry, expected turnaround and significant growth ** Calculated on upper price band

opportunities in tier-II and tier-III cities, we believe that Zomato will command a Book Building

premium to global peers and hence recommend to ‘SUBSCRIBE’ to the IPO.

QIBs 75% of issue

Key Financials Non-Institutional 15% of issue

Y/E March (` cr) FY2019 FY2020 FY2021

Retail 10% of issue

Net Sales 1,312.6 2,604.7 1,993.8

% chg - 98.4 -23.5

Net Profit -1,010.5 -2,385.6 -816.4 Post Issue Shareholding Pattern

% chg - 136.1 -65.8

Public 96.4%

EBITDA (%) -170.9 -88.5 -23.4

Others 3.6%

EPS (Rs)* (1.5) (3.6) (1.2)

P/E (x) (50.1) (21.2) (62.0)

P/BV (x) 19.5 71.3 6.3

ROE (%) (38.9) (336.1) (10.1) Jyoti Roy

ROCE (%) (84.5) (109.6) (7.4) +022 39357600, Extn: 6842

EV/EBITDA (26.5) (25.8) (127.0) jyoti.roy@angelbroking.com

EV/Sales 45.3 22.8 29.8

Source: Company, Angel Research.

Note: Valuation ratios at upper price band. * EPS is calculated on post issue equity capital

Please refer to important disclosures at the end of this report 1

Zomato Ltd | IPO Note

Issue details

The issue comprises of offer for sale of upto `9,375 crore in the price band of `72-

76.

Pre and post IPO shareholding pattern

No of shares (Pre-issue) % (Post-issue) %

Promoter 0 0.0 0 0.0

Non- Promoter 279,760,704 4.2 280,072,914 3.57

Public 6,381,208,446 95.8 7,565,106,762 96.4

Total 6,660,969,150 100.0 7,845,179,676 100.0

Source: Company, Angel Research & RHP.

Objectives of the Offer

Funding organic and inorganic growth initiatives; and.

General corporate purposes.

Company background

Company was incorporated as “DC Foodiebay Online Services Private Limited”

dated January 18, 2010, Delhi. Based on special resolution passed by

Shareholders on April 3, 2020, the name of the Company was changed to

“Zomato Private Limited”. As of March 31, 2021, it was present in 525 cities in

India, with 389,932 Active Restaurant Listings and also has a footprint across 23

countries outside India. Zomato’s technology platform connects customers,

restaurant partners and delivery partners, serving their multiple form to search and

discover restaurants, read and write customer generated reviews and view and

upload photos, order food delivery, book a table and make payments while

dining-out at restaurants.

On the other hand, it provides restaurant partners with industry-specific marketing

tools which enable them to engage and acquire customers to grow their business

while also providing a reliable and efficient last mile delivery service. Zomato also

operates a one-stop procurement solution, Hyperpure, which supplies high quality

ingredients and kitchen products to restaurant partners. Zomato also provides their

delivery partners with transparent and flexible earning opportunities. Going ahead,

they have taken a conscious strategic call to focus only on the Indian markets.

Platform Offerings

Zomato has two core business-to-customer (B2C) offerings – (i) Food delivery and

(ii) Dining-out, in addition to the business-to-business (B2B) offering (iii)

Hyperpure. Another important part of the business is (iv) Zomato Pro, which is the

customer loyalty program which encompasses both food delivery and dining-out.

Food delivery: Zomato has consistently gained market share over the last 4 years

to become the category leader in the food delivery space in India in terms of Gross

Order Value (GOV) from October 1, 2020 to March 31, 2021. It generates a

majority of revenues from food delivery and the related commissions charged to

restaurant partners for using the platform. Restaurant partners also spend for

advertisements on the platform. There are 3 key stakeholders in the food delivery

business: are (i) Customers, (ii) Delivery Partners, and (iii) Restaurant Partners.

July 12, 2021 2

Zomato Ltd | IPO Note

Customers: On an average, 6.8 million customers ordered food every month on

their platform in India in FY21 with an average monthly frequency of over 3 times.

In Fiscal 2021, 99.3% of their food delivery Orders came through Zomato's mobile

application.

Delivery partners: Zomato has one of India’s largest hyperlocal delivery networks

in terms of number of delivery partners as on FY21 (source: RedSeer). The delivery

network collected food from restaurant partners and delivered it to customers with

a median delivery time of approximately 30 minutes in FY21 (delivery time

calculated from the time the Order is placed on mobile application to the time the

Order is delivered to the customer). Zomato had 169,802 Active Delivery Partners

during the month of March 2021.

Restaurant partners: Zomato had 148,384 Active Food Delivery Restaurants on the

platform in March 2021. Restaurants are the backbone of the business, and they

can only be viable, if they help the restaurant industry grow and succeed more

than what it could do without them.

Dining-Out: Customers use their dining-out offerings to search and discover

restaurants, read and write customer generated reviews and view and upload

photos, book a table and make payments while dining-out at restaurants. Zomato

is a preferred destination for dining-out search and restaurant discovery in India. It

is the largest food-focused restaurant listing and reviews platform in terms of

customer base, in India, as of March 31, 2021. In FY21, 61.8 million units of

CGC was generated on Zomato’s platform vs. 157 million in FY20. They are also

the largest online table reservations platform in India with 3.3 million Covers

booked through their platform in FY21.

They currently monetize dining-out offering through advertisement sales through

which restaurant partners pay them for enhanced visibility on the platform. Zomato

currently does not monetize table reservations or dining-out payments.

B2B Supplies (Hyperpure): Hyperpure is farm-to-fork supplies offering for

restaurants in India. Zomato sources fresh, hygienic, quality ingredients and

supplies directly from farmers, mills, producers and processors to supply to

restaurant partners, helping them make their supply chains more effective and

predictable, while improving the overall quality of the food being served.

Hyperpure was started in 2019 and is growing rapidly. In the month of March

2021, they supplied to 9,225 restaurant partners across six cities in India.

Hyperpure helps increase Zomato’s engagement with restaurant partners on the

platform, and in turn retain and grow Zomato’s loyalty with them.

Zomato Pro: Zomato has an exclusive paid-membership program, Zomato Pro,

which unlocks flat percentage discounts for their customers at select restaurant

partners across both food delivery and dining-out offerings. These discounts are

available to their customers on all days in a year (except during a few pre-

determined festive days) and the Pro Restaurant Partners choose and fund the

percentage discount available to Pro Members at their restaurants. Their customers

become Pro Members by paying Zomato a membership fee. The program allows

Pro Restaurant Partners to market themselves to a select audience. As of March 31,

2021, Zomato had 1.5 million Pro Members and over 25,443 Pro Restaurant

Partners in India.

July 12, 2021 3

Zomato Ltd | IPO Note

Exhibit 1: Key Performance Indicators

Particulars Units FY2019 FY2020 FY2021

Average MAU ` Cr 2.93 4.15 3.21

Average MAU ` Cr 0.56 1.07 0.68

Active Food Delivery Restaurants (in the

No. 94,286 1,43,089 1,48,384

last month of the period)

GOV ` Cr 5,387 11,221 9,483

YOY Growth % 108.3% -15.5%

Orders Cr 19.10 40.31 23.89

YOY Growth % 111.0% -40.7%

Total Income ` Cr 1,398 2,743 2,118

YOY Growth % 96.2% -22.8%

Adjusted EBITDA ` Cr -2,144 -2,206 -325

Source: Company, Angel Research

Economics

Restaurant partner: Zomato charges their restaurant partner commissions based

on an agreed upon rate. They remit to the restaurant partner a net amount equal

to the cost of food ordered and packaging charges less the commission and any

restaurant funded discounts. Separately, the restaurant partner may pay them for

any food delivery related advertisement on the platform.

Delivery partner: Zomato remits 100% of the tips and delivery charges provided by

the customer to the delivery partner (pass-through). Incrementally, they also pay

the delivery partner an additional fee.

Zomato: Zomato retains the commission net of any Zomato funded discounts.

Additional fee to the delivery partner is paid by them. Additionally, they also earn

food delivery related advertisement sales revenue from restaurant partners.

Key Management Personnel

Kaushik Dutta is the Chairman and an Independent Director of the Company. He

is a fellow member of the Institute of Chartered Accountants of India with over 25

years of experience. He has been retained as an expert on corporate governance

by the Indian Institute of Corporate Affairs of the Ministry of Corporate Affairs in

matters relating to future of corporate governance in India.

Deepinder Goyal is the Founder and is also the Managing Director and Chief

Executive Officer of the Company. He holds an integrated master’s degree of

technology in mathematics and computing from the Indian Institute of Technology,

Delhi.

Sanjeev Bikhchandani is a Non-Executive Director of the Company, and a

nominee of Info Edge on the Board. He holds a bachelor’s degree of arts in

economics from the University of Delhi and a post graduate diploma in

management from the Indian Institute of Management, Ahmedabad.

Douglas Lehman Feagin is a Non-Executive Director of the Company, and a

nominee of Alipay on the Board.

July 12, 2021 4

Zomato Ltd | IPO Note

Exhibit 2: Consolidated Profit & Loss Statement

Y/E March (` cr) FY2019 FY2020 FY2021

Total operating income 1,312.6 2,604.7 1,993.8

% chg - 98.4 -23.5

Total Expenditure 3,556.4 4,909.4 2,461.0

Purchase of stock in trade 18.7 110.5 202.9

Changes in inventories of traded goods -2.1 -1.6 -11.0

Employee benefits expense 600.8 798.9 740.8

Other expenses 2,939.0 4,001.6 1,528.3

EBITDA -2,243.8 -2,304.7 -467.2

% chg - 2.7 -79.7

(% of Net Sales) -170.9 -88.5 -23.4

Depreciation& Amortization 43.1 84.2 137.7

EBIT -2,286.9 -2,388.9 -604.9

% chg - 4.5 -74.7

(% of Net Sales) -174.2 -91.7 -30.3

Finance costs 8.6 12.6 10.1

Other income 85.1 138.0 124.6

(% of Sales) 6.5 5.3 6.3

Recurring PBT -2,210.4 -2,263.6 -490.4

% chg - 2.4 -78.3

Exceptional item 1,199.9 -122.0 -324.8

Tax - - 1.3

PAT (reported) -1,010.5 -2,385.6 -816.4

% chg - 136.1 -65.8

(% of Net Sales) -77.0 -91.6 -40.9

Basic & Fully Diluted EPS (Rs)* -1.5 -3.6 -1.2

Source: Company, Angel Research; * EPS is calculated on post issue equity capital

July 12, 2021 5

Zomato Ltd | IPO Note

Exhibit 3: Consolidated Balance Sheet

Y/E March (` cr) FY2019 FY2020 FY2021

SOURCES OF FUNDS

Equity Share Capital 0.03 0.03 0.03

Instruments Equity in Nature 243.7 252.4 454.9

Other equity (Retained Earning) 2,356.1 457.4 7,643.8

Shareholders’ Funds 2,599.9 709.8 8,098.7

Non Controllable Interest -31.4 -6.5 -5.7

Total Loans 1.3 1.5 1.4

Other liabilities 137.5 1,474.8 92.8

Total Liabilities 2,707.3 2,179.5 8,187.2

APPLICATION OF FUNDS

Property, plant and equipment 39.8 36.4 23.4

Right of use asset 92.4 66.8 60.5

Capital work in progress 0.3 0.2 -

Goodwill 188.5 1,209.3 1,247.8

Other intangible assets 68.9 278.0 207.4

Intangible assets under development 0.4 0.8 0.1

Current Assets 2,971.8 1,263.4 4,150.5

Inventories 2.1 3.7 14.8

Investments 2,137.3 323.9 2,205.2

Trade receivables 70.3 123.1 129.9

Cash and cash equivalents 212.4 167.2 306.5

Other bank balances 26.3 192.7 597.1

Other financial assets 397.3 111.1 629.5

Tax assets (net) 9.8 40.0 44.5

Other current assets 116.4 301.6 223.0

Current Liability 706.1 720.8 516.4

Net Current Assets 2,265.7 542.5 3,634.2

Other Non-Current Asset 51.2 45.5 3,013.8

Total Assets 2,707.3 2,179.5 8,187.2

Source: Company, Angel Research

July 12, 2021 6

Zomato Ltd | IPO Note

Exhibit 4: Consolidated Cash flows

Y/E March (` cr) FY2019 FY2020 FY2021

Operating profit before working capital changes -1,903.2 -2,126.9 -279.8

Net changes in working capital 187.9 15.3 -756.7

Cash generated from operations -1,715.3 -2,111.6 -1,036.5

Direct taxes paid (net of refunds) -27.7 -32.1 18.6

Net cash flow from operating activities -1,742.9 -2,143.6 -1,017.9

Payment to acquire liquid mutual fund units -4,086.8 -2,147.9 -8,340.9

Proceeds from sale of liquid mutual fund units 2,824.6 4,012.7 6,520.8

Others -12.1 -129.6 -3,423.5

Cash Flow from Investing -1,274.3 1,735.2 -5,243.6

Proceeds from issue 2,264.5 391.6 6,608.3

Loan taken during the year - - 1.9

Loan repaid during the year -0.1 - -4.5

Transaction cost on issue of shares -2.3 -1.8 -1.2

Share based payment on cancellation - - -177.1

Income on assignment of contracts 888.1 - -

Other Financing activity -19.7 -30.9 -25.5

Cash Flow from Financing 3,130.5 358.9 6,401.9

Inc./(Dec.) in Cash 113.3 -49.5 140.3

Opening Cash balances 100.4 212.4 167.2

Forex Difference -1.3 4.3 -1.7

CCE acquired through business combination 0.0 0.0 0.7

Closing Cash balances 212.4 167.2 306.5

Source: Company, Angel Research

July 12, 2021 7

Zomato Ltd | IPO Note

Key Ratios

Y/E March FY2019 FY2020 FY2021

Valuation Ratio (x)

P/E (on FDEPS) (50.1) (21.2) (62.0)

P/CEPS (52.3) (22.0) (74.6)

P/BV 19.5 71.3 6.3

EV/Sales 45.3 22.8 29.8

EV/EBITDA (26.5) (25.8) (127.0)

Per Share Data (Rs)

EPS (Basic) (1.5) (3.6) (1.2)

EPS (fully diluted) (1.5) (3.6) (1.2)

Cash EPS (1.5) (3.5) (1.0)

Book Value 3.9 1.1 12.2

Returns (%)

ROE (38.9) (336.1) (10.1)

ROCE (84.5) (109.6) (7.4)

Turnover ratios (x)

Receivables (days) 19.6 17.3 23.8

Inventory (days) 0.6 0.5 2.7

Payables (days) 104.6 37.7 54.4

Working capital cycle (days) (84.5) (19.9) (27.9)

Source: Company, Angel Research

July 12, 2021 8

Zomato Ltd | IPO Note

Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

July 12, 2021 9

You might also like

- Zomato Limited. F: SubscribeDocument9 pagesZomato Limited. F: SubscribePrasun SharmaNo ratings yet

- Itc Clsa Oct2020Document100 pagesItc Clsa Oct2020ksatishbabuNo ratings yet

- Zomato Limited - Research ReportDocument6 pagesZomato Limited - Research ReportSunil ManoharNo ratings yet

- GoColors IPO Note AngelOneDocument7 pagesGoColors IPO Note AngelOnedjfreakyNo ratings yet

- Zomato IPODocument8 pagesZomato IPOHarish RedquestNo ratings yet

- Motilal Oswal Zomato IPO NoteDocument10 pagesMotilal Oswal Zomato IPO NoteKrishna GoyalNo ratings yet

- Zomato LTD.: Recent Acquisitions Part of Long-Term StrategyDocument4 pagesZomato LTD.: Recent Acquisitions Part of Long-Term StrategybradburywillsNo ratings yet

- Investor@radico Co inDocument19 pagesInvestor@radico Co inAshwani KesharwaniNo ratings yet

- A Report ON Valuation of Satyam Computers Services LimitedDocument15 pagesA Report ON Valuation of Satyam Computers Services LimitedAshmita DeNo ratings yet

- Investors - Presentation - 11-02-2021 Low MarginDocument32 pagesInvestors - Presentation - 11-02-2021 Low Marginravi.youNo ratings yet

- Nps 8 D17Document2 pagesNps 8 D17tesykuttyNo ratings yet

- Report On Bodhi Tree MultimediaDocument5 pagesReport On Bodhi Tree MultimediabhoomikaNo ratings yet

- Golden Midcap Portfolio: October 18, 2019Document7 pagesGolden Midcap Portfolio: October 18, 2019Arvind MeenaNo ratings yet

- RR Jubilant FoodworksDocument26 pagesRR Jubilant FoodworkssantoshpesitNo ratings yet

- LT Foods HDFC Research ReportDocument14 pagesLT Foods HDFC Research ReportjayNo ratings yet

- Parag Milk Foods: CMP: INR207 TP: INR255 (+23%) BuyDocument10 pagesParag Milk Foods: CMP: INR207 TP: INR255 (+23%) BuyNiravAcharyaNo ratings yet

- ICICI Securities Zomato Reinitiating Coverage NoteDocument13 pagesICICI Securities Zomato Reinitiating Coverage NoteClaptrapjackNo ratings yet

- AFFLE - Investor Presentation - 05-Feb-22 - TickertapeDocument26 pagesAFFLE - Investor Presentation - 05-Feb-22 - TickertapebhanupalavarapuNo ratings yet

- Peninsula+Land 10-6-08 PLDocument3 pagesPeninsula+Land 10-6-08 PLapi-3862995No ratings yet

- BCONCEPTS 12082023125430 InvestorPresentationJune23Document35 pagesBCONCEPTS 12082023125430 InvestorPresentationJune23VishalNo ratings yet

- Q2FY24 Post Results Review - SMIFS Institutional ResearchDocument17 pagesQ2FY24 Post Results Review - SMIFS Institutional Researchkrishna_buntyNo ratings yet

- Marico LTD: A Safe Parachute!: Recommendation: BUYDocument14 pagesMarico LTD: A Safe Parachute!: Recommendation: BUYAnandNo ratings yet

- Zomato Initiating Coverage Motilal Oswal 2023.04Document44 pagesZomato Initiating Coverage Motilal Oswal 2023.04darshanmaldeNo ratings yet

- Delta Corp: CMP: INR 166 TP: INR 304 (+83%) The Ship's SteadyDocument6 pagesDelta Corp: CMP: INR 166 TP: INR 304 (+83%) The Ship's SteadyJatin SoniNo ratings yet

- Indsec ABFRL Q1 FY'21Document9 pagesIndsec ABFRL Q1 FY'21PriyankaNo ratings yet

- Tatva Chintan Limited. F: SubscribeDocument7 pagesTatva Chintan Limited. F: Subscribeturbulence iitismNo ratings yet

- Research ReportDocument18 pagesResearch ReportadamkunarsmithNo ratings yet

- Jamna Auto Jamna Auto: India I EquitiesDocument16 pagesJamna Auto Jamna Auto: India I Equitiesrishab agarwalNo ratings yet

- M. Bects Fod SpeciDocument7 pagesM. Bects Fod SpeciRohit KumarNo ratings yet

- Balkrishna Industries LTD: Investor Presentation - May 2021Document31 pagesBalkrishna Industries LTD: Investor Presentation - May 2021Kpvs NikhilNo ratings yet

- Initiating Coverage - Trident LTD - 311020Document21 pagesInitiating Coverage - Trident LTD - 311020V KeshavdevNo ratings yet

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebNo ratings yet

- Tech Mahindra (Announces One of Its Largest-Ever Deals) - MOStDocument10 pagesTech Mahindra (Announces One of Its Largest-Ever Deals) - MOStdarshanmaldeNo ratings yet

- Affle (India) Limited: (P) 0124-4992914 (W) CIN: L65990MH1994PLC080451Document23 pagesAffle (India) Limited: (P) 0124-4992914 (W) CIN: L65990MH1994PLC080451stockengageNo ratings yet

- Zomato IPO ReviewDocument21 pagesZomato IPO Reviewshubham kashyapNo ratings yet

- Shanthi Gears PDFDocument10 pagesShanthi Gears PDFGurnam SinghNo ratings yet

- Care Ratings - Q4FY19 - Call Closure - 13062019 - 14-06-2019 - 09Document4 pagesCare Ratings - Q4FY19 - Call Closure - 13062019 - 14-06-2019 - 09Jai SinghNo ratings yet

- Digitally Signed by VIVEK Pritamlal Raizada Date: 2020.05.11 17:25:48 +05'30'Document20 pagesDigitally Signed by VIVEK Pritamlal Raizada Date: 2020.05.11 17:25:48 +05'30'DIPAN BISWASNo ratings yet

- 2022-08-02-ZOMT - NS-HSBC-Zomato (ZOMATO IN) - Buy 1Q23 From Over-Exuberance To Over-... - 97775767Document8 pages2022-08-02-ZOMT - NS-HSBC-Zomato (ZOMATO IN) - Buy 1Q23 From Over-Exuberance To Over-... - 97775767Daemon7No ratings yet

- BKT InvestorPresentation March2020Document34 pagesBKT InvestorPresentation March2020Rina JageNo ratings yet

- Stock Report On Baja Auto in India Ma 23 2020Document12 pagesStock Report On Baja Auto in India Ma 23 2020PranavPillaiNo ratings yet

- Aditya Birla Sun Life Amc Limited: All You Need To Know AboutDocument7 pagesAditya Birla Sun Life Amc Limited: All You Need To Know AboutSarfarazNo ratings yet

- Cipla Report - Doc Gourav Cygnus RecoveredDocument32 pagesCipla Report - Doc Gourav Cygnus RecoveredRohit BhansaliNo ratings yet

- Mahindra & Mahindra: CMP: INR672 TP: INR810 (+20%)Document14 pagesMahindra & Mahindra: CMP: INR672 TP: INR810 (+20%)Yash DoshiNo ratings yet

- Colgate-Palmolive: Performance HighlightsDocument4 pagesColgate-Palmolive: Performance HighlightsPrasad DesaiNo ratings yet

- Word Write Soln - Newell Design Manufacturing Valuation Decision MakingDocument7 pagesWord Write Soln - Newell Design Manufacturing Valuation Decision Makingalka murarkaNo ratings yet

- Zomato: IPO NoteDocument15 pagesZomato: IPO NoteManideep KumarNo ratings yet

- Expleo 2Document12 pagesExpleo 2g_sivakumarNo ratings yet

- Persistent Systems - One PagerDocument3 pagesPersistent Systems - One PagerKishor KrNo ratings yet

- Rossari BiotechDocument8 pagesRossari Biotechzeeshan_iraniNo ratings yet

- DolatCapitalMarketPvtLtd MPS-Q2FY22ResultUpdate (Buy) Oct 31 2021Document10 pagesDolatCapitalMarketPvtLtd MPS-Q2FY22ResultUpdate (Buy) Oct 31 2021Reshmi GanapathyNo ratings yet

- Realigning Estimate On Stronger Than Expected Mass Market: Bloomberry Resorts CorporationDocument8 pagesRealigning Estimate On Stronger Than Expected Mass Market: Bloomberry Resorts CorporationJajahinaNo ratings yet

- Tanla - Update - Jul23 - HSIE-202307191442519944993Document13 pagesTanla - Update - Jul23 - HSIE-202307191442519944993jatin khannaNo ratings yet

- Tech Mahindra Valuation Report FY21 Equity Inv CIA3Document5 pagesTech Mahindra Valuation Report FY21 Equity Inv CIA3safwan hosainNo ratings yet

- Castrol India LTD: November 06, 2018Document17 pagesCastrol India LTD: November 06, 2018Yash AgarwalNo ratings yet

- RADICO - Investor Presentation - 02-Nov-21 - TickertapeDocument22 pagesRADICO - Investor Presentation - 02-Nov-21 - TickertapeGyandeep KumarNo ratings yet

- Butterfly Gandhimathi Appliances LTD - Stock Update - 01.12.2021-1Document12 pagesButterfly Gandhimathi Appliances LTD - Stock Update - 01.12.2021-1sundar iyerNo ratings yet

- Quantamental Research - ITC LTDDocument1 pageQuantamental Research - ITC LTDsadaf hashmiNo ratings yet

- Income GeneratorDocument18 pagesIncome GeneratoramareswarNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- 6.B - Central BanksDocument9 pages6.B - Central BanksCrest WolfNo ratings yet

- HefxDocument5 pagesHefxCrest WolfNo ratings yet

- HefxDocument5 pagesHefxCrest WolfNo ratings yet

- Strengthening Repo PDFDocument65 pagesStrengthening Repo PDFNasrul SalmanNo ratings yet

- Decoding Global Financial MarketsDocument9 pagesDecoding Global Financial MarketsAKANKSHA SINGHNo ratings yet

- Quantitational CompetitionDocument8 pagesQuantitational CompetitionGanesh HegdeNo ratings yet

- An Empirical Study of The Foreign-Exchange Market: Test of A TheoryDocument72 pagesAn Empirical Study of The Foreign-Exchange Market: Test of A TheoryNIMMANAGANTI RAMAKRISHNANo ratings yet

- The Zomato Ipo: A Bet On Big Markets & Platforms: Valuation First PrinciplesDocument23 pagesThe Zomato Ipo: A Bet On Big Markets & Platforms: Valuation First PrinciplesCrest WolfNo ratings yet

- Quantitational CompetitionDocument8 pagesQuantitational CompetitionGanesh HegdeNo ratings yet

- Ru Qestionary Form Manufacturing en PDFDocument4 pagesRu Qestionary Form Manufacturing en PDFashily tomyNo ratings yet

- Nivestor Training Kit PDFDocument50 pagesNivestor Training Kit PDFMidhuna shajiNo ratings yet

- Bank PerformanceDocument52 pagesBank PerformanceThinh DoNo ratings yet

- CH 09Document52 pagesCH 09Cyrus Zack100% (6)

- FAC4764 Study Pack 2Document41 pagesFAC4764 Study Pack 2Muvhusi NethonondaNo ratings yet

- Time Value of Money: Discounted Cash Flow Topics CoveredDocument16 pagesTime Value of Money: Discounted Cash Flow Topics CoveredRavi Singh100% (1)

- Premier Value SaversDocument4 pagesPremier Value SaversMasilawati RahmadNo ratings yet

- Guidelines For ValuationDocument6 pagesGuidelines For ValuationparikhkashishNo ratings yet

- In House Cash Management in SAP 1689098084Document5 pagesIn House Cash Management in SAP 1689098084Himanshu MishraNo ratings yet

- IA3 - REVIEWER - Internediate 3Document38 pagesIA3 - REVIEWER - Internediate 3Mujahad QuirinoNo ratings yet

- 5.bank Reconcile Question and AnswerDocument42 pages5.bank Reconcile Question and AnswerSwarna Mishra100% (1)

- Merrimack Tractors and Mowers, Inc 1Document12 pagesMerrimack Tractors and Mowers, Inc 1KshitishNo ratings yet

- Solution Manual For Case Studies in Finance Managing For Corporate Value Creation Bruner Eades Schill 7th EditionDocument8 pagesSolution Manual For Case Studies in Finance Managing For Corporate Value Creation Bruner Eades Schill 7th EditionJames Page100% (32)

- CH 02Document9 pagesCH 02Omar YounisNo ratings yet

- Accounting Standards ProjectDocument6 pagesAccounting Standards ProjectPuneet ChawlaNo ratings yet

- ACCBCOMB - Oct 10Document13 pagesACCBCOMB - Oct 10kimkim100% (1)

- BLack BookDocument65 pagesBLack Bookabhishek mohiteNo ratings yet

- Vishal Arora (DA)Document1 pageVishal Arora (DA)aba3abaNo ratings yet

- Bea Vert Fooddict For The Month Ended March 2019: Income StatementDocument4 pagesBea Vert Fooddict For The Month Ended March 2019: Income StatementRhea May BaluteNo ratings yet

- Chapter-4: Fixed Income SecuritiesDocument52 pagesChapter-4: Fixed Income SecuritiesNati YalewNo ratings yet

- Discontinued Operation: Summary of IAS 35Document3 pagesDiscontinued Operation: Summary of IAS 35simply PrettyNo ratings yet

- Fin 9 PDFDocument2 pagesFin 9 PDFChristine AltamarinoNo ratings yet

- JHT'S Supermud: The Original Equipment Manufacturer (Oem) MarketDocument1 pageJHT'S Supermud: The Original Equipment Manufacturer (Oem) MarketNavya AgrawalNo ratings yet

- Airtel Africa PLC - Results For Half Year Ended 30 September 2023Document56 pagesAirtel Africa PLC - Results For Half Year Ended 30 September 2023Anonymous FnM14a0No ratings yet

- Defined Strategies For FinancialDocument19 pagesDefined Strategies For FinancialKaran TripathiNo ratings yet

- Paper14 PDFDocument94 pagesPaper14 PDFShilpa Arora NarangNo ratings yet

- A Z Modelling CourseDocument359 pagesA Z Modelling CourseRishabhNo ratings yet

- Analisis Keuangan - Fakhri UIDocument72 pagesAnalisis Keuangan - Fakhri UIbyfadia5No ratings yet

- The Basics of Capital Budgeting Evaluating Cash Flows: Answers TO Selected End-Of-Chapter QuestionsDocument17 pagesThe Basics of Capital Budgeting Evaluating Cash Flows: Answers TO Selected End-Of-Chapter QuestionsIka NurjanahNo ratings yet

- Basic Accounting ProblemsDocument5 pagesBasic Accounting ProblemsKaren Joy Jacinto Ello100% (1)

- George Lindsay - Selected Articles PDFDocument98 pagesGeorge Lindsay - Selected Articles PDFwebinatoNo ratings yet

- UAE Business Plan 2024Document5 pagesUAE Business Plan 2024abdulmatindip07No ratings yet

- Psut Accounting Theory Chapter 4Document34 pagesPsut Accounting Theory Chapter 4TarekAl-KiswaniNo ratings yet