Professional Documents

Culture Documents

Crisil

Crisil

Uploaded by

Pratik Priyasmit SahooOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Crisil

Crisil

Uploaded by

Pratik Priyasmit SahooCopyright:

Available Formats

hLLp//wwwcrlsllcom/cyLl

Topics

Please prepare a dissertation on any ONE oI the Iollowing topics:

Will EU survive the second decade of the new millennium?

%he European Union (EU) was Iormed to bring down economic, trade and immigration

barriers between the small and Iragmented European nations to attain economic scale and

curb nationalistic tendencies in the region. %he introduction oI Euro, as a common

currency, enhanced trade integration and Iacilitated a cross border, single market system

across Continental Europe, but sovereign spending has outstripped developments and the

union has permitted below-par countries to survive in the union, which otherwise might

have Iailed individually. Now Euro has added to the woes, where countries such as

Portugal, Italy, Ireland, Greece and Spain (PIIGS) are unable to take the usually available

monetary measures to repay their debts. In view oI the current economic crises, what will

be the Iuture oI EU? Will it survive as we know it? Or will the 'PIIGS' pull it down? Have

we seen the bottom oI the sovereign debt crisis iceberg yet? Or is it just the beginning?

Will it Iurther slowdown the global economy or will it wither away? Which countries will

do better and which will suIIer the most? Will it aIIect more countries? What will be the

impact oI various austerity measures proposed? Will it bring down governments? Or will

it make the union even stronger? What will the EU need to do to survive in the second

decade oI the new millennium?

2 Relevance of corporate governance for emerging economies

In a recent survey conducted by KPMG in India, 35 percent oI respondents consider

weak oversight and monitoring as the biggest risks to corporate governance, while 21

percent perceived management override as the greatest risk. A signiIicant majority would

preIer greater empowerment to independent directors and think that there is still a long

way to go in protecting minority shareholders. What are the major challenges and trends

Ior corporate governance in emerging markets? How do they stack up against each other

and where do they stand in its evolution process? Do the ASEAN countries and other

emerging economies show reasonable corporate governance standards? II not, what

implications is it likely to have? Where are the perceived gaps? Is it in the regulatory

Iramework? Or is it more oI an implementation issue?

3 Future of Global Research & Analytics business

%he Global Research & Analytics business in a short span oI a decade has grown into an

industry in its own right. Since its birth, it has lived through some oI the best times in the

capital markets, survived the largest ever global Iinancial crises, and constantly evolved

itselI to remain relevant to its customer and the market. Both captive and third party

business models have co-existed and the business over time has progressed Irom

'structured sell-side support' to 'ad hoc buy-side requirements'; moved Irom providing

'resource solution' to 'research solutions'; moved Irom just being a 'cost arbitrage story' to

being a 'capability enhancement story'. However, this business is yet to see landside

growth, the way its I%O and BPO cousins had witnessed at the advent oI the oIIshoring

story. Has the Global Research & Analytics business already matured? How will it

evolve, especially in the challenging atmosphere oI current global economic and Iinancial

situation? Do the business dynamics and models need a change? How will it aIIect the

value proposition oI the business? Will the business be able to make the shiIts it has

historically been able to make and stay relevant to its customer and the market? What are

the major trends and challenges awaiting this business in the near Iuture? Would it be

diIIerent Ior captives and third parties? Or would we see an entirely new business model?

4 Outreach on Social Networks: Strategy for Companies in the Service

Sector'

Increasing popularity oI social network websites has changed the Iace oI media in the

past 5 years, and has the potential to change the way marketing is done just like Google

changed the world oI advertising. However, most organizations are yet to harness the

power oI social networking sites, more so because social networks seem to work very

organically and have an intelligence oI its own, which at times can throw things out oI

control. How can CRISIL &/or other Iinancial services companies use this new powerIul

instrument to make a bigger impact in the market and serve customers better? Can this

tool be used to disseminate inIormation? Can social networks help companies better

engage with their customers, investors, market makers, and employees? Can it be used to

even 'listen' to the markets? How can companies avoid negative publicity and

misinIormation? How social networks process inIormation and pass them on? What is the

role oI large heterogeneous groups in doing so and how do they behave? Have

intelligently designed experiments aimed achieving a better understanding, shown desired

results?

5 India's infrastructure - a boon or a bane

India, since the opening oI its economy has made tremendous strides towards growth and

reIorms, thereby putting it on the global map Ior all the right reasons. But somewhere in

the recent past, the controversies around the execution oI the inIrastructure projects may

have created an adverse impact on the perceptions about the country. %he 2010 IMD

World Competitive Yearbook Ior InIrastructure ranks India 54th out oI the 58 countries

with India only beating Indonesia, Philippines, Peru and Venezuela. Although the

Government oI India's 12th Iive-year plan (2013-2018) calls Ior doubling the Iinancial

outlay Ior inIrastructure to $1 trillion, is the policy Iramework strong enough to Iacilitate

implementation oI these projects. Are India's policies dynamic enough to adapt to the

inIrastructural development needs, especially under the current governance system? What

are the solutions that are needed to bring the change and how could it happen? Will India

be able to develop the required inIrastructure, Iast enough, to sustain its economic

growth? Will it be able to catch up with other developing economies? How will the

trends evolve and what impact will it have on India's image in Iront oI the world.

6 Will Argentina be able to maintain its competitiveness in international

markets?

As a consequence oI one oI its prior economic and political crises and aIter a decade oI

having the peso pegged to the US dollar, Argentina completely abandoned the currency

board in 2002 and allowed its currency to Iloat Ireely. With the possibility oI exercising

monetary policies plus Iavourable internal as well as external Iactors, the country

experienced one oI its most illustrious periods oI growth in history. %oday, aIter almost a

decade oI walking through this new paradigm, one crucial question starts to pop up with

strength: Can Argentina maintain its competitiveness in international markets? What

policies should be implemented to sustain or even Ioster growth? What are the potential

challenges on this Iront, in the next 5 to 10 years?

7 Amid inflation and high interest rates, does the Indian economy hold good

prospects in the next one year

%he Reserve Bank oI India (RBI) has been revising interest rates since early 2010, but

inIlation has not come down. While monetary tightening is yet to lower inIlation, it has

begun to adversely impact industrial perIormance as well as investment and private

consumption. %he interest rate hikes, designed to contain inIlation, have raised the cost oI

credit and may have made availability oI credit more diIIicult. Amid high inIlation and

high interest rates, do economic prospects Ior India in next one year look good?

8 Should Poland adopt the Euro?

'%o Euro or not to Euro' has been a question long in discussion in Poland. What seemed

like a no-brainer a Iew years ago has become a more complex puzzle, demanding careIul

economic analysis oI the common currency, its constituent nations and its impact on the

Polish economy. Amid the Ialtering economies and Ialling government bond ratings in

the Eurozone, the decision on Euro adoption might again seem like a simple choice; but,

is it really so, or is timing oI the essence here?

9 Property prices in China - is a correction imminent?

Property prices in China, especially, in the %ier I and %ier II cities, have risen

substantially over the last decade. Key indicators such as price-to-income ratio and price-

to-rent ratio could lead to questions on sustainability oI these prices. %he Chinese

government has recently undertaken measures to restrict Iunding oI property projects.

Would these be eIIective in the long-run? Or would the Chinese growth juggernaut and

the resultant urbanisation easily absorb such shocks?

The Indian Placement Reporting Standards - will they succeed?

Pioneered by IIM-A and adopted by 22 other business schools, the Indian Placement

Reporting Standards (IPRS) is a Iramework aimed at standardizing reporting oI

placement statistics. %he Iramework is Ireely available in the public domain Ior voluntary

adoption by other business schools. %he IPRS speciIies the standard Iormat in which the

aggregate statistics will be reported across Iunction, sector, and location (within and

outside India) and mandates demarcation oI perIormance linked compensation Irom Iixed

salary, enabling a more realistic understanding oI oIIers on campus. Although this

initiative heralds in a new wave oI transparency in the business school sector, will these

standards meet with resounding success?

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Devops Pov 2015-12-18 FinalDocument24 pagesDevops Pov 2015-12-18 FinalPratik Priyasmit SahooNo ratings yet

- Ut This Topics, Just Reply With Particular Name of The TopicDocument3 pagesUt This Topics, Just Reply With Particular Name of The TopicPratik Priyasmit SahooNo ratings yet

- What Is ECONOMICS About?: T.J. JosephDocument32 pagesWhat Is ECONOMICS About?: T.J. JosephPratik Priyasmit SahooNo ratings yet

- Student Groups - SM II Project WorkDocument1 pageStudent Groups - SM II Project WorkPratik Priyasmit SahooNo ratings yet

- Pfizer Supply Chain Academy Success StoryDocument2 pagesPfizer Supply Chain Academy Success StoryPratik Priyasmit SahooNo ratings yet

- B StandradDocument80 pagesB StandradPratik Priyasmit SahooNo ratings yet

- International Business StrategyDocument17 pagesInternational Business StrategyPratik Priyasmit SahooNo ratings yet

- Seminar ReportDocument26 pagesSeminar ReportPratik Priyasmit SahooNo ratings yet

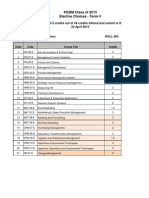

- Elective Choice Form - T5Document2 pagesElective Choice Form - T5Pratik Priyasmit SahooNo ratings yet