Professional Documents

Culture Documents

Yr 1112

Yr 1112

Uploaded by

Brian KennedyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Yr 1112

Yr 1112

Uploaded by

Brian KennedyCopyright:

Available Formats

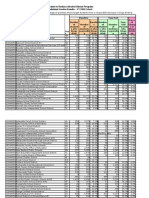

Measure5CompressionLossbyDistrict

Education

SchoolDistricts Banks#13 Beaverton#48 ForestGrove#15 Gaston#511 Hillsboro#1 LakeOswego#7J Newberg#46 Portland#11 Scappoose#117 Sherwood#88 TigardTualatin#23 Vernonia#49 WestLinn#101

TaxReduction

25,533.22 331,991.18 116,379.35 7,452.20 1,341,666.67 24,484.94 3,667.35 303,161.87 129.10 75,511.81 4,199,828.44 51.66 38,378.19

GeneralGovernment

County,Regional,Special WashingtonCounty UrbanRoadMaintenanceDistrict EnhancedSheriffPatrolDistrict MetroServiceDistrict PortofPortland TualatinHillsPark&Recreation Tigard/TualatinAquaticDistrict

TaxReduction

49,747.45 2.15 36.19 35.99 27.45 466.68 0.20

Cities Beaverton Gaston Hillsboro Portland Tualatin

2.30 45.65 7.93 6,621.08 4.59

CommunityColleges PortlandCommunityCollege

145,273.95 Fire ForestGroveRFPD GastonRFPD TualatinValleyFire&Rescue WashingtonCountyRFPD UrbanRenewalAgencies PortlandUR PortlandSpecialLevy LocalImprovementDistrictsand SpecialAssessments ManufacturedHomeDwellingFee RoadMaintenanceLID ServiceDistrictLighting#1 GovernmentTotal: 0.15 1,938.50 17,152.25 20.45

EducationServiceDistricts ClackamasESD MultnomahESD NWRegionalESD WillametteESD EducationTotal:

564.29 1,757.07 78,061.68 233.42 6,694,126.39

1,218.81 113.50

177.58 619.32 557.89 78,796.11

* Compression Reduction in taxes required by the Measure 5 property tax rate limits approved in 1990. County assessors calculate compression as a dollar amount, but it can also be expressed as a tax rate. Compression is done on a propertyby propertybasis. * Measure 5 Constitutional tax rate limitations passed by voters in November, 1990, which can be found at Article XI, Section 11b, of the Oregon Constitution. Measure 5 limited school taxes to $5 per $1,000 of assessed value and nonschool taxes to $10 per $1,000 of assessed value starting in 199192. The school limit fell by $2.50 per $1,000 each year until it reached $5 per $1,000 in 199596. The nonschool limit remains at $10 per $1,000. Levies to pay bond principal and interest for capital construction projects are outside the limitation. The Measure 5 rate limits still apply under the provisions of Measure 50, passedin1997,butnowapplytoM5value.

*Source:OregonPropertyTaxStatistics,OregonDeptofRevenue(Rev.802)

Page 7

You might also like

- Georgia Inmate Search Department of Corrections LookupDocument13 pagesGeorgia Inmate Search Department of Corrections Lookupinmatesearchinfo100% (1)

- TranscriptionDocument30 pagesTranscriptionCasdingan Bayawa AugieNo ratings yet

- School Mental Health Committee - January RecommendationsDocument10 pagesSchool Mental Health Committee - January RecommendationsBen SchachtmanNo ratings yet

- Ministry of Education: Ministry Funding Provided To School JurisdictionsDocument5 pagesMinistry of Education: Ministry Funding Provided To School JurisdictionsStarLink1No ratings yet

- Description: Tags: Flap 2004Document2 pagesDescription: Tags: Flap 2004anon-598058No ratings yet

- Are Expenses Per Student, 2010-11Document3 pagesAre Expenses Per Student, 2010-11efaustNo ratings yet

- Ministry Funding SCH JurisdictionDocument5 pagesMinistry Funding SCH JurisdictionStarLink1No ratings yet

- Ministry of Education: Ministry Funding Provided To School JurisdictionsDocument5 pagesMinistry of Education: Ministry Funding Provided To School JurisdictionsStarLink1No ratings yet

- Basic Education Program Enhancement Proposed Fiscal Year 2017 BudgetDocument4 pagesBasic Education Program Enhancement Proposed Fiscal Year 2017 BudgetWBIR Channel 10No ratings yet

- Description: Tags: Awd2007-215fDocument27 pagesDescription: Tags: Awd2007-215fanon-365969No ratings yet

- Financial Disclosure Fines Accrued Report - Fines Accrued As of September 9, 2013 925amDocument32 pagesFinancial Disclosure Fines Accrued Report - Fines Accrued As of September 9, 2013 925amIntegrity FloridaNo ratings yet

- July 2013 PopulationEstimates UVACooperCenterDocument7 pagesJuly 2013 PopulationEstimates UVACooperCenterFauquier NowNo ratings yet

- 2013 Proposed Program Budget: Village of Grafton, WisconsinDocument42 pages2013 Proposed Program Budget: Village of Grafton, Wisconsinsschuster4182No ratings yet

- LFB State Aid and Levy Information For Technical College DistrictsDocument4 pagesLFB State Aid and Levy Information For Technical College Districtskfoody5436No ratings yet

- Report From NC Board of Education and DPI To GA On Supplemental FundingDocument8 pagesReport From NC Board of Education and DPI To GA On Supplemental FundingJamie BouletNo ratings yet

- HB153 - 2011 School District RankingDocument37 pagesHB153 - 2011 School District RankingGreg MildNo ratings yet

- Education - 2006-2010 ACSDocument1 pageEducation - 2006-2010 ACSyumadataNo ratings yet

- Description: Tags: Alcohol05gpra1Document6 pagesDescription: Tags: Alcohol05gpra1anon-68489No ratings yet

- The Worst Towns in IllinoisDocument5 pagesThe Worst Towns in IllinoisJohn DodgeNo ratings yet

- Description: Tags: 215f04grantsDocument32 pagesDescription: Tags: 215f04grantsanon-461794No ratings yet

- Table App ADocument9 pagesTable App ARenaselle DollenteNo ratings yet

- High Needs LEAs ListDocument8 pagesHigh Needs LEAs ListSilvia ClayNo ratings yet

- San Juan CountylevyincreasesDocument3 pagesSan Juan Countylevyincreasescarmstrong1456No ratings yet

- Saipe Released Nov 09Document10 pagesSaipe Released Nov 09Social IMPACT Research Center at Heartland Alliance for Human Needs and Human RightsNo ratings yet

- POPULATION FORECAST (2010 To 2040) POPULATION FORECAST (2010 To 2040)Document3 pagesPOPULATION FORECAST (2010 To 2040) POPULATION FORECAST (2010 To 2040)M-NCPPCNo ratings yet

- Jackson County EMA SheltersDocument2 pagesJackson County EMA SheltersFOX54 News HuntsvilleNo ratings yet

- Into The Woods Camping GearDocument1 pageInto The Woods Camping GeargabNo ratings yet

- Tukes Valley Pto Annual Report 2014-15Document2 pagesTukes Valley Pto Annual Report 2014-15api-263935358No ratings yet

- Hypermass Online Storage Salary ReportDocument3 pagesHypermass Online Storage Salary ReportAnonymous hm78z8xNo ratings yet

- Customer TableDocument2 pagesCustomer TableMutheu TomNo ratings yet

- Fargo 2013 Financial ReportDocument16 pagesFargo 2013 Financial ReportRob PortNo ratings yet

- 8MR Regression Table ExcelDocument235 pages8MR Regression Table ExcelNazrul FamNo ratings yet

- Description: Tags: NorthdakotaDocument5 pagesDescription: Tags: Northdakotaanon-292636No ratings yet

- Game BookDocument20 pagesGame BookJacobT2No ratings yet

- The Capital District Youth Center Case Study ContentsDocument11 pagesThe Capital District Youth Center Case Study ContentsManasviJindalNo ratings yet

- POPULATION FORECAST (2010 To 2040) : Montgomery County, MarylandDocument3 pagesPOPULATION FORECAST (2010 To 2040) : Montgomery County, MarylandM-NCPPCNo ratings yet

- 2012 Assessments ResidentialDocument2 pages2012 Assessments ResidentialmdebonisNo ratings yet

- School FundingDocument13 pagesSchool FundingPennLiveNo ratings yet

- Kbc-March MikaylakostiukDocument1 pageKbc-March Mikaylakostiukapi-280637438No ratings yet

- Fy 2019 Final Action Vs Fy 2019 LBR Vs Fy 2018 Est Total State SupportDocument2 pagesFy 2019 Final Action Vs Fy 2019 LBR Vs Fy 2018 Est Total State SupportRuss LatinoNo ratings yet

- PTO Payouts To PBC Tax Appraiser Employees Over Last Five YearsDocument3 pagesPTO Payouts To PBC Tax Appraiser Employees Over Last Five YearsLynnKWalshNo ratings yet

- Description: Tags: RhodeislandDocument2 pagesDescription: Tags: Rhodeislandanon-558682No ratings yet

- FY11 Fluvanna County BudgetDocument1 pageFY11 Fluvanna County BudgetbrothamelNo ratings yet

- 2013 Snohomish County School District Levy TaxDocument2 pages2013 Snohomish County School District Levy TaxDebra KolrudNo ratings yet

- Pio DuranDocument5 pagesPio DuranErold TarvinaNo ratings yet

- ASD BudgetDocument4 pagesASD BudgetHERCasdNo ratings yet

- Senate Compromise Report PDFDocument17 pagesSenate Compromise Report PDFAndi ParkinsonNo ratings yet

- USOR Annual Report 2011Document54 pagesUSOR Annual Report 2011State of UtahNo ratings yet

- Description: Tags: MississippiDocument3 pagesDescription: Tags: Mississippianon-736997No ratings yet

- Ocjs BWC Grant Awards 2022Document4 pagesOcjs BWC Grant Awards 2022PG EdiNo ratings yet

- Gs Base Without Locality 2011Document1 pageGs Base Without Locality 2011Darrell AugustaNo ratings yet

- Hscounty ContactsDocument1 pageHscounty Contactsfamiliesofgreateralbany100% (2)

- Description: Tags: 2006pepDocument12 pagesDescription: Tags: 2006pepanon-793152No ratings yet

- Report Retrieve ControllerDocument13 pagesReport Retrieve ControllerPetra FaheyNo ratings yet

- Highlands Ranch Law Enforcement Training FacilityDocument25 pagesHighlands Ranch Law Enforcement Training FacilityCabinCr3wNo ratings yet

- Serrano Daycare: Name Pay Rate Gross Pay Fica Net Pay Total Hours Federal Taxes States Taxes Workman'S CompDocument1 pageSerrano Daycare: Name Pay Rate Gross Pay Fica Net Pay Total Hours Federal Taxes States Taxes Workman'S Compg1r1jones1No ratings yet