Professional Documents

Culture Documents

Bath and Shower in The Philippines

Uploaded by

Benjamin Jozef de LeonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bath and Shower in The Philippines

Uploaded by

Benjamin Jozef de LeonCopyright:

Available Formats

Bath and Shower in the Philippines

Euromonitor International June 2011

Bath and Shower

Philippines

List of Contents and Tables

Headlines ................................................................................................................................................................. 1 Trends ...................................................................................................................................................................... 1 Competitive Landscape .......................................................................................................................................... 2 Prospects .................................................................................................................................................................. 3 Category Data ......................................................................................................................................................... 4 Table 1 Sales of Bath and Shower by Category: Value 2005-2010 ................................................ 4 Table 2 Sales of Bath and Shower by Category: % Value Growth 2005-2010............................... 4 Table 3 Bath and Shower Premium Vs Mass % Analysis 2005-2010 ............................................ 4 Table 4 Bath and Shower Company Shares 2006-2010.................................................................. 5 Table 5 Bath and Shower Brand Shares by GBN 2007-2010 ......................................................... 5 Table 6 Bath and Shower Premium Brand Shares by GBN 2007-2010.......................................... 6 Table 7 Forecast Sales of Bath and Shower by Category: Value 2010-2015.................................. 7 Table 8 Forecast Sales of Bath and Shower by Category: % Value Growth 2010-2015 ................ 7 Table 9 Forecast Bath and Shower Premium Vs Mass % Analysis 2010-2015 .............................. 7

Euromonitor International

Page

Bath and Shower

Philippines

BATH AND SHOWER IN THE PHILIPPINES

HEADLINES

Bath and shower increases in value by 3% in 2010, rising to Ps11.3 billion Value added features define the positioning of the majority of leading brands in bath and shower Liquid soap leads growth in bath and shower during 2010, posting a value increase of 10% Unit price increases by 2% during 2010 Procter & Gamble Philippines Inc continues to lead bath and shower with a value share of 23% Bath and shower is set to decline in constant value at a CAGR of -1% over the forecast period, falling to Ps11.0 billion by 2015

TRENDS

During 2010, whitening remained the most prominent value added feature in bath and shower and was offered by several brands in response to the penchant among Filipinos for fairer complexions. Domestic brands such as SkinWhite and Silka continue to bank on their promises of delivering whiter skin to users. New features in products such as multiple purpose bath and shower products also emerged during 2010, specifically in mens grooming. Dove Men+Care was launched in the Philippines during 2010. Dove Men+Care offers a bar soap which can also be used as a facial cleanser. Along the same lines, Beiersdorf AG introduced Nivea Active 3 Shower Shampoo Shave, a product which can be used as a shower gel, shampoo and shaving cream. Anti-aging features have also spilled over into bath and shower with the formulations of Olay Age Defy and Kissa Anti-aging Soap offering anti-aging features. The 3% value growth recorded in bath and shower during 2010 was an improvement on the 2% value growth recorded during 2009. The higher growth recorded during 2010 is testament to the optimism and confidence which currently prevails in the Philippines following the recent change in political administration and the high economic growth currently being experienced in the country. Similarly, the value-added features which are now offered in bath and shower products are boosting demand for higher priced products, which is having a positive effect on value sales and bolstering value growth. Advertising campaigns which alert customers to the potential benefits of certain products also contributed to the improved performance of bath and shower in 2010. Liquid soap, which increased in value by 10% during 2010, remains the fastest growing category in bath and shower in the Philippines. The lingering fears of an influenza pandemic stemming from 2009s H1N1 scare remains vivid in the collective Filipino consciousness, boosting demand for anti-bacterial products. The need for constant anti-microbial protection has brought about a surge in sales of anti-bacterial hand sanitisers which can be conveniently carried around and used on-the-go. A number of major players are focusing on pushing liquid soap in the Philippines. For example, Splash Corp launched its Hygienix brand during 2010, which stimulated growth in liquid soap. With relatively low inflation of 3% and all-year-round price discounts offered for brands such as Dove and Safeguard, the unit prices of bath and shower products generally stabilised during 2010. The 3% growth in unit price recorded during 2010 can be largely attributed to growth in demand for bath and shower products with value-added features. Anti-aging and whitening soaps have proven able to maintain strong followings, allowing manufacturers to increase unit prices. Natural and organic products continue to cater to narrow niches of upscale consumers who are more concerned about product ingredients than the stated benefits of the products. It should be noted that papaya, the fruit of the carica papaya tree, is a popular added ingredient in bath and shower products in the Philippines for its whitening properties. The positioning of products which contain papaya focuses more on the whitening properties of papaya than it being a natural ingredient. Exfoliating/scrubbing bath and shower products are not popular in the Philippines and mainstream brands tend not to carry such variants. The widespread use of loofahs, scrub gloves and other similar exfoliating tools leads many Filipinos to the conclusion that bath and shower products which offer exfoliating benefits

Euromonitor International

Page

Bath and Shower

Philippines

are not really essential. It should be noted that the majority of exfoliants/scrubs variants in the Philippines are present only in bath salts. Segmentation in bath and shower in the Philippines tends to occur according to the benefits that products convey. For instance, as a whiter complexion is desired by both male and female consumers in the Philippines, whitening products tend not to be gender specific. The leading brand, Safeguard, is best known for its anti-bacterial protection and is positioned as a soap which suitable for the entire family to use. In terms of products positioned as beauty soaps, Dove and Olay appeal to middle income women who are less price sensitive than the average Philippine consumer. Premium bath and shower products continue to cater to a very small niche of high-end consumers due to the higher pricing strategies employed by manufacturers. During 2010, it is estimated that premium brands accounted for a meagre 2% of total bath and shower value sales, a very marginal improvement from the same figure in 2009. Luxury brands are geared towards more affluent customers and demand for these products is largely insulated from the effects of the global economic slowdown as demand from discriminating and extremely loyal customers remains undimmed by economic concerns.

COMPETITIVE LANDSCAPE

Procter & Gamble Philippines Inc remained the undisputed leader in bath and shower in the Philippines during 2010, maintaining leadership with a 23% value share. Procter & Gambles value sales in bath and shower increased to Ps2.6 billion in 2010 through the leading position of its Safeguard brand. Having been present in the Philippines for a very long period of time, Safeguard has by now become a true household name and is synonymous with anti-microbial protection for the skin. The strong brand equity enjoyed by Safeguard is supported by intensive marketing stressing the products efficacy and the potential savings on offer in terms of lower medical expenses, an advantage which extends to all members of the family. Beiersdorf AGs venture into the rapidly growing mens grooming category gave it the status of the best performer in bath and shower in the Philippines during 2010. Rising from a small base, its Nivea for Men brand managed to record 13% in shower gel during 2010. The rise of the metrosexual lifestyle in the Philippines remained the key driver for sales of mens Nivea for Men, while Beiersdorfs first mover advantage in mens grooming assured its products of steadily increasing demand. Multinationals reign supreme in bath and shower in the Philippines due to their long standing presence. These international business entities accounted for 80% of value sales in bath and shower in the Philippines during 2010. Local companies continue to lag behind as these domestic players often pursue sales among niche segments and more price sensitive low income consumers. Domestic players which currently enjoy high sales in bath and shower in the Philippines include Splash Corp, which has achieved success through its whitening brands SkinWhite, Biolink and Likas, while Green Cross Inc is maintaining its value share by positioning itself as a cheaper alternative to the anti-microbial soaps of multinational companies. However, the strong foothold enjoyed by multinational players remains unassailable for domestic companies as Filipinos are far more loyal to the more established brands of multinational companies. In partnership with UNICEF, Procter & Gambles Safeguard launched the second Global Handwashing Day in the Philippines during 2010, cementing the brand image of Safeguard as a leading anti-bacterial bath and shower product. This promotional activity emphasised the importance of washing ones hands among Filipino students and school pupils. Schools across the country were targeted by the campaign as one million handprints were collected for the project. Meanwhile, the advertising for Safeguard focused on its microbe fighting formulation, emphasising that using Safeguard products when washing ones hands could efficiently reduce sick days and help breadwinners earn more money for their families. Procter & Gamble brands including Tide, Ariel, and Safeguard, launched a series of Yaman promotions, where customers could win cash prixes by buying specially marked packages of these products. Below-the-line marketing activities abounded in bath and shower during 2010. Aside from price discounts, Dove launched two other promotional strategies: Dove Showeroke; and Dove Seven Day No Mirror Challenge. Dove Showeroke is a fun promotion which challenges customers to take a video of themselves singing in the shower while holding Dove Go Fresh Beauty Bar or a Body Wash or Deodorant Stick as a makeshift microphone, with winners invited to perform at STRUMMS, a high-end bar in Makati City. Meanwhile, the Dove Seven Day No Mirror Challenge asked customers to wash their faces with Dove for seven days whilst refraining from looking at themselves in the mirror until after seven days had passed. In

Euromonitor International

Page

Bath and Shower

Philippines

addition to this, Sanofi-Synthlabo Philippines Inc organised a marathon relay event called Woman by Lactacyd Team Run, which promoted the healthy properties of its Lactacyd brand. Private label has only a limited presence in bath and shower in the Philippines and is visible only in liquid soap. SM Bonus and Watsons are the leading private label players in liquid soap and have achieved favourable positions due to their competitive pricing strategies. Filipino consumers are less concerned about using branded hand soap.

PROSPECTS

In line with its status as a saturated category with high penetration, bath and shower in the Philippines will suffer from stagnation and declining growth during the forecast period. Bath and shower is set to decline in constant value at a CAGR of -1% over the forecast period, falling to total constant value sales of Ps11 billion in 2015. It should be noted that volume expansion will be limited by the continuous decline in population growth. Bath and shower in the Philippines is a highly saturated category as the majority of Filipinos already take a bath or shower every at least once a day. Thus, growth in population represents be the key potential driver as per capita consumption and the frequency of use of bath and shower products is already very high. In light of the already saturated demand for bath and shower, manufacturers can be expected to look towards expanding sales through product innovation that responds to emerging consumer needs. For instance, anti-aging bath and shower products will be continuously offered to women who are concerned in maintaining their youthful appearance. The trend towards whitening is likely to be sustained by innovation in terms of more effective whitening ingredients which could be incorporated in bath and shower products. Another opportunity will arise to widen demand for mens bath and shower products as more Filipino consumers place a higher value on bath and shower products which are especially formulated for their specific needs. Liquid soap remains the brightest prospect for growth in bath and shower during the forecast period as its growth stage remains relatively undeveloped. The increasing need for convenience and on-the-go antibacterial protection will be the key driver for the rising demand for hand sanitisers in the Philippines. Liquid soap is expected to increase in volume at a CAGR of 5% over the forecast period, rising to constant value sales of Ps472 million by 2015. More companies are expected to recognise the growth potential inherent in liquid soap, leading them to venture into liquid soap during the early stages of the forecast period. Unit prices will not increase significantly in bath and shower during the forecast period. Annual unit price increases of between 3% and 5% should be expected as manufacturers attempt to maintain their price increases in line with inflation and manage any rises in the manufacturing and distribution costs. Even though the rise in the availability of specially positioned products has the potential to push unit prices up, any rises will not be very high as it is not expected that any major changes will occur in the overall shares of the majority of bath and shower brands. The bath and shower products specifically for men which were launched by under the Nivea and Dove brands during 2010 are expected to fare well during the forecast period, especially as these high profile brands will continue to increase awareness of male-specific bath and shower products through advertising and promotional campaigns. Meanwhile, the performance of Hygienix Hand Sanitiser will be largely dependent on its commitment to differentiating itself from its competitors. It should be noted that despite the fact that the brands target audience consists mainly of upscale, highly educated women, it largely fails to communicate its basic benefits, particularly in comparison with the clear marketing messages of its competitors. As the usage of internet technology widens rapidly in the Philippines, bath and shower manufacturers have the opportunity to cater to the needs of younger demographics through social networking websites and blogs. Companies would be well advised to continue investing in keeping their customers updated on new product developments through these emerging communication channels. Social networks have the potential to be used to launch new promotions, address specific customer concerns and engender greater knowledge of and familiarity with products among key target audiences. Meanwhile, the proliferation of bloggers in the Philippines has the potential to develop into a significant influence over the thoughts and actions of the general population. This represents a nascent resource which could be tapped into over the forecast period

Euromonitor International

Page

Bath and Shower

Philippines

so as to promote new product launches and disseminate genuine and trustworthy independent product reviews.

CATEGORY DATA

Table 1 Ps million 2005 Bar Soap Bath Additives - Bath Foam/Gel - Bath Oil/Pearls - Bath Salts/Powder - Other Bath Additives Body Wash/Shower Gel Intimate Hygiene - Intimate Washes - Intimate Wipes Liquid Soap Talcum Powder Bath and Shower

Source:

Sales of Bath and Shower by Category: Value 2005-2010

2006 4,977.2 503.1 57.4 214.1 191.9 39.7 766.3 907.1 906.6 0.6 347.4 2,693.2 10,194.3

2007 5,066.6 537.3 60.2 231.2 203.4 42.5 788.8 1,070.3 1,069.8 0.6 357.5 2,720.1 10,540.6

2008 5,142.5 575.1 66.7 248.5 214.6 45.3 808.2 1,177.3 1,176.7 0.6 334.3 2,760.9 10,798.3

2009 5,193.9 561.1 20.7 263.4 228.5 48.5 727.4 1,259.7 1,259.1 0.6 374.4 2,843.7 10,960.2

2010 5,297.8 576.8 13.0 271.3 241.1 51.4 745.6 1,341.6 1,341.0 0.6 411.8 2,943.2 11,316.8

4,795.9 461.6 55.7 194.6 174.4 36.8 724.4 617.3 616.7 0.5 335.0 2,594.6 9,528.7

Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources

Table 2

Sales of Bath and Shower by Category: % Value Growth 2005-2010

% current value growth 2009/10 Bar Soap Bath Additives - Bath Foam/Gel - Bath Oil/Pearls - Bath Salts/Powder - Other Bath Additives Body Wash/Shower Gel Intimate Hygiene - Intimate Washes - Intimate Wipes Liquid Soap Talcum Powder Bath and Shower

Source:

2005-10 CAGR 2.0 4.6 -25.2 6.9 6.7 6.9 0.6 16.8 16.8 3.3 4.2 2.6 3.5

2005/10 TOTAL 10.5 25.0 -76.6 39.4 38.2 39.6 2.9 117.3 117.4 17.4 22.9 13.4 18.8

2.0 2.8 -37.0 3.0 5.5 6.0 2.5 6.5 6.5 3.8 10.0 3.5 3.3

Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources

Table 3 % retail value rsp

Bath and Shower Premium Vs Mass % Analysis 2005-2010

2005 Premium Mass Total

Source:

2006 1.4 98.6 100.0

2007 1.5 98.5 100.0

2008 1.6 98.3 100.0

2009 1.7 98.3 100.0

2010 1.7 98.3 100.0

1.3 98.7 100.0

Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources

Euromonitor International

Page

Bath and Shower

Philippines

Table 4 % retail value rsp Company

Bath and Shower Company Shares 2006-2010

2006 23.3 14.1 9.3 4.9 4.0 3.7 3.5 3.2 2.4 2.4 1.6 1.9 0.7 0.9 0.8 0.9 0.5 0.8 0.5 0.5 0.4 0.3 0.4 0.1 0.1 0.1 0.1 1.1 2.4 14.7 100.0

2007 22.7 13.4 8.3 4.8 4.4 4.3 3.9 3.7 2.9 2.5 1.5 1.9 0.7 1.0 0.9 1.0 0.6 0.7 0.5 0.4 0.4 0.3 0.3 0.1 0.1 0.2 0.1 1.1 2.4 14.8 100.0

2008 22.7 13.1 7.7 4.9 4.8 4.6 4.1 3.8 3.1 2.6 1.4 1.6 0.7 1.0 1.0 0.9 0.8 0.7 0.6 0.4 0.4 0.3 0.3 0.1 0.2 0.1 0.1 1.2 2.1 14.6 100.0

2009 22.9 13.5 7.6 5.0 5.0 4.9 4.3 3.9 3.2 2.5 1.7 1.4 1.2 1.0 1.0 0.9 0.8 0.8 0.6 0.4 0.3 0.3 0.3 0.2 0.2 0.1 0.1 0.1 1.3 0.6 14.0 100.0

2010 22.6 13.6 7.9 5.2 5.2 5.0 4.4 4.0 3.1 2.4 1.7 1.5 1.3 1.2 1.1 1.1 0.8 0.8 0.8 0.5 0.4 0.3 0.3 0.3 0.2 0.1 0.1 0.1 0.1 13.6 100.0

Procter & Gamble Philippines Inc Johnson & Johnson (Philippines) Inc Splash Corp Unilever Philippines Inc Colgate-Palmolive Philippines Inc Sanofi-Aventis Philippines Inc Inovitelle Inc Avon Cosmetics Inc Green Cross Inc Trinidad Cosmetics Laboratories Inc Suyen Corp Rogemson Co Inc, The Tupperware Brands Corp Rustan Group of Cos Siam Yoko Co Ltd Other Private Label JVS Worldwide Inc Amway Philippines LLC Kao Brands Co HBC Inc Dial Corp, The Galderma Philippines Inc St Ives SA, Laboratoires Philusa Corp Nu Skin Enterprises Philippines Inc Drammock International Ltd Beiersdorf AG S & J International Enterprises PCL Pigeon Corp Fuller Life Direct Selling Philippines, Inc Ascendia Brands Inc Henkel Philippines Inc Sara Lee Philippines Inc Andrew Jergens Co, The Lander Co Inc Sanofi-Synthlabo Philippines Inc Sara Lee Direct Selling Philippines, Inc Others Total

Source:

Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources

Table 5 % retail value rsp Brand Safeguard

Bath and Shower Brand Shares by GBN 2007-2010

Company Procter & Gamble

2007 17.7

2008 18.0

2009 18.6

2010 18.4

Euromonitor International

Page

Bath and Shower

Philippines

Johnson's Baby SkinWhite Dove Lactacyd pH Care Palmolive Zest Green Cross Likas Avon Avon Simply Delicate Bench Bambini Zwitsal Lush Yoko Other Private Label Tender Care The Body Shop Jergens Biolink Artistry Vitasoft Dial Cetaphil Ivory St Ives Swiss Formula Hygienix Babyflo Nu Skin Body Series Protect & Clean Nivea Body Hiyas Enfant Extract Pigeon Zwitsal Lander Others Total

Source:

Philippines Inc Johnson & Johnson (Philippines) Inc Splash Corp Unilever Philippines Inc Sanofi-Aventis Philippines Inc Inovitelle Inc Colgate-Palmolive Philippines Inc Procter & Gamble Philippines Inc Green Cross Inc Trinidad Cosmetics Laboratories Inc Avon Cosmetics Inc Avon Cosmetics Inc Suyen Corp Rogemson Co Inc, The Tupperware Brands Corp Rustan Group of Cos Siam Yoko Co Ltd Colgate-Palmolive Philippines Inc JVS Worldwide Inc Kao Brands Co Splash Corp Amway Philippines LLC HBC Inc Dial Corp, The Galderma Philippines Inc Procter & Gamble Philippines Inc St Ives SA, Laboratoires Splash Corp Philusa Corp Nu Skin Enterprises Philippines Inc Amway Philippines LLC Drammock International Ltd Beiersdorf AG Splash Corp S & J International Enterprises PCL Splash Corp Pigeon Corp Fuller Life Direct Selling Philippines, Inc Ascendia Brands Inc

13.4 6.7 4.8 4.3 3.9 3.3 4.5 2.9 2.5 2.1 1.6 1.5 1.4 0.7 1.0 0.9 1.0 1.0 0.7 1.0 0.4 0.5 0.4 0.4 0.5 0.3 0.3 0.1 0.2 0.1 0.3 0.2 0.2 0.1 1.1 2.4 15.4 100.0

13.1 6.4 4.9 4.6 4.1 3.8 4.3 3.1 2.6 2.1 1.7 1.4 1.3 0.7 1.0 1.0 1.0 0.9 0.7 0.9 0.5 0.6 0.4 0.4 0.4 0.3 0.3 0.1 0.2 0.2 0.2 0.1 0.1 0.1 1.2 2.1 14.9 100.0

13.4 6.4 4.9 4.9 4.3 4.0 4.0 3.2 2.5 2.0 1.9 1.7 1.4 1.2 1.0 1.0 1.0 0.9 0.8 0.8 0.6 0.6 0.4 0.3 0.4 0.3 0.3 0.2 0.2 0.2 0.1 0.1 0.1 0.1 0.1 1.3 0.6 14.2 100.0

13.5 6.6 5.2 5.0 4.4 4.2 3.9 3.1 2.4 2.1 1.9 1.7 1.5 1.3 1.2 1.1 1.1 1.0 0.8 0.8 0.7 0.6 0.5 0.4 0.3 0.3 0.3 0.3 0.3 0.2 0.2 0.1 0.1 0.1 0.1 0.1 0.1 13.8 100.0

Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources

Table 6 % retail value rsp Brand Artistry Others Total

Source:

Bath and Shower Premium Brand Shares by GBN 2007-2010

Company Amway Philippines LLC

2007 32.3 67.7 100.0

2008 37.0 63.0 100.0

2009 39.2 60.8 100.0

2010 39.1 60.9 100.0

Euromonitor International from official statistics, trade associations, trade press, company research, store checks, trade interviews, trade sources

Euromonitor International

Page

Bath and Shower

Philippines

Table 7 Ps million

Forecast Sales of Bath and Shower by Category: Value 2010-2015

2010 Bar Soap Bath Additives - Bath Foam/Gel - Bath Oil/Pearls - Bath Salts/Powder - Other Bath Additives Body Wash/Shower Gel Intimate Hygiene - Intimate Washes - Intimate Wipes Liquid Soap Talcum Powder Bath and Shower

Source:

2011 5,165.3 590.4 13.2 278.1 245.9 53.2 753.0 1,388.5 1,387.9 0.6 425.4 2,869.7 11,192.3

2012 5,062.0 602.9 13.3 284.5 250.3 54.8 759.1 1,434.3 1,433.7 0.6 438.1 2,803.7 11,100.1

2013 4,986.1 613.9 13.4 290.2 254.1 56.1 762.8 1,477.4 1,476.7 0.6 450.4 2,747.6 11,038.1

2014 4,936.2 623.6 13.5 295.4 257.4 57.3 760.6 1,518.7 1,518.1 0.7 461.7 2,706.4 11,007.1

2015 4,911.5 631.5 13.5 299.9 259.9 58.1 757.5 1,556.7 1,556.0 0.7 472.3 2,692.8 11,022.3

5,297.8 576.8 13.0 271.3 241.1 51.4 745.6 1,341.6 1,341.0 0.6 411.8 2,943.2 11,316.8

Euromonitor International from trade associations, trade press, company research, trade interviews, trade sources

Table 8

Forecast Sales of Bath and Shower by Category: % Value Growth 2010-2015

% constant value growth 2010-15 CAGR Bar Soap Bath Additives - Bath Foam/Gel - Bath Oil/Pearls - Bath Salts/Powder - Other Bath Additives Body Wash/Shower Gel Intimate Hygiene - Intimate Washes - Intimate Wipes Liquid Soap Talcum Powder Bath and Shower

Source:

2010/15 TOTAL -7.3 9.5 3.9 10.5 7.8 13.1 1.6 16.0 16.0 4.9 14.7 -8.5 -2.6

-1.5 1.8 0.8 2.0 1.5 2.5 0.3 3.0 3.0 1.0 2.8 -1.8 -0.5

Euromonitor International from trade associations, trade press, company research, trade interviews, trade sources

Table 9 % retail value rsp

Forecast Bath and Shower Premium Vs Mass % Analysis 2010-2015

2010 Premium Mass Total

Source:

2011 1.8 98.2 100.0

2012 1.9 98.2 100.0

2013 1.9 98.1 100.0

2014 2.0 98.0 100.0

2015 2.1 97.9 100.0

1.7 98.3 100.0

Euromonitor International from trade associations, trade press, company research, trade interviews, trade sources

Euromonitor International

Page

You might also like

- RCEF Mechanization Program FAQsDocument12 pagesRCEF Mechanization Program FAQsLinchoco Rice DealerNo ratings yet

- Organic Agriculture NC II Training ProgramDocument6 pagesOrganic Agriculture NC II Training ProgramJommel Perlas Revilla100% (1)

- Animal Production CLMDocument42 pagesAnimal Production CLMzNo ratings yet

- CBC Ems Nature FarmsDocument12 pagesCBC Ems Nature FarmsCelso E. Felipe, Jr.No ratings yet

- As A Trainer 1 Day OrientationDocument1 pageAs A Trainer 1 Day OrientationVincentnhoj L ChattoNo ratings yet

- Fresh Native Sausage Production Business P.Document10 pagesFresh Native Sausage Production Business P.Tonette OlivarezNo ratings yet

- MRS Mijan Coconut Oil ProductionDocument22 pagesMRS Mijan Coconut Oil ProductionMAVERICK MONROENo ratings yet

- Case of Cooperatives in The Cordillera Region, PhilippinesDocument24 pagesCase of Cooperatives in The Cordillera Region, Philippinesmarivic abyadoNo ratings yet

- CORE COMPETENCIES (Ruminants)Document10 pagesCORE COMPETENCIES (Ruminants)Christian Paul CasidoNo ratings yet

- KIEHL'SDocument22 pagesKIEHL'SMark Jonell EsguerraNo ratings yet

- Fruit ShakerDocument23 pagesFruit ShakerJuna Lyn RañisesNo ratings yet

- SYB Trainers Presentation Guide (Final Draft)Document38 pagesSYB Trainers Presentation Guide (Final Draft)Robinson ConcordiaNo ratings yet

- Wesleyan-University Philippines College of Business and AccountancyDocument2 pagesWesleyan-University Philippines College of Business and AccountancyKim BulanadiNo ratings yet

- FS SampleDocument35 pagesFS SampleHwang EunbiNo ratings yet

- Leyte Coconut Forum HandbookDocument16 pagesLeyte Coconut Forum HandbookJam ColasNo ratings yet

- Jollibee Foundation CSR programsDocument2 pagesJollibee Foundation CSR programsJohn Mark LedesmaNo ratings yet

- Nelson C. Batrina: Itinerary of TravelDocument4 pagesNelson C. Batrina: Itinerary of Travelton carolinoNo ratings yet

- Project ProposalDocument9 pagesProject Proposalapi-407839350No ratings yet

- Disinfectant FormulationDocument2 pagesDisinfectant FormulationPhoebe Jean MalapayNo ratings yet

- BusinessDocument6 pagesBusinessHutch Bill HernandezNo ratings yet

- Using Virgin Coconut Oil Waste Products For Chicken and Pig FeedDocument4 pagesUsing Virgin Coconut Oil Waste Products For Chicken and Pig FeedAmalia RahmahNo ratings yet

- Dole Heart Fresh: Marketing PlanDocument54 pagesDole Heart Fresh: Marketing PlanMargaret LachoNo ratings yet

- Mula Ko Achar Ko BusinessDocument23 pagesMula Ko Achar Ko BusinessGrishma Dangol100% (1)

- Marketing Plan Presentation FINALDocument53 pagesMarketing Plan Presentation FINALAmiel Carreon0% (1)

- (I) QuestionnaireDocument4 pages(I) Questionnaireganesh1433No ratings yet

- TESDA Circular No. 044-2020Document7 pagesTESDA Circular No. 044-2020Aileen Ligmayo100% (1)

- Custom Scent Perfume Business PlanDocument14 pagesCustom Scent Perfume Business PlanMarc AgamanosNo ratings yet

- Advertising and Promotional Schemes of CocacolaDocument32 pagesAdvertising and Promotional Schemes of Cocacolakumarsaurav47No ratings yet

- Itlogan Sa Dabaw FarmDocument15 pagesItlogan Sa Dabaw FarmMicka EllahNo ratings yet

- Butansapa Coco Coir BP As of 08052016Document29 pagesButansapa Coco Coir BP As of 08052016Chris PlantNo ratings yet

- Hand SanitizersDocument2 pagesHand SanitizersVijay SharmaNo ratings yet

- Square MarkeTing PlanDocument71 pagesSquare MarkeTing Plansakib3568No ratings yet

- College of Business Administration: Management and Marketing DepartmentDocument43 pagesCollege of Business Administration: Management and Marketing Departmentnina jobleNo ratings yet

- AGRICROP NC 3 PROGCHART LOUIEDocument8 pagesAGRICROP NC 3 PROGCHART LOUIEJohn JamesNo ratings yet

- Brand Management: Project Report On Happy FoodsDocument12 pagesBrand Management: Project Report On Happy FoodsphilsonmanamelNo ratings yet

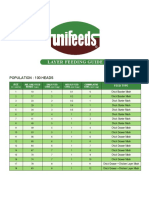

- Layer Feeding Guide With LogoDocument1 pageLayer Feeding Guide With LogoJoi EresehtNo ratings yet

- Philippine Christian University: Senior High School Department Dasmariñas CampusDocument15 pagesPhilippine Christian University: Senior High School Department Dasmariñas Campusrehina lopez100% (1)

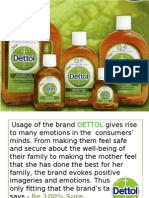

- Dettol StudyDocument7 pagesDettol StudyClubb Arup Mullick100% (1)

- A Feasibility Study On Massive Goat Production in Region 2Document13 pagesA Feasibility Study On Massive Goat Production in Region 2Raamah DadhwalNo ratings yet

- KKD SWOT Analysis of External & Internal FactorsDocument4 pagesKKD SWOT Analysis of External & Internal FactorsMatsouka KouNo ratings yet

- Brand Positioning: by Anoop Kumar Gupta MaitDocument56 pagesBrand Positioning: by Anoop Kumar Gupta MaitChetan Mahesh100% (1)

- Table of ContentsDocument3 pagesTable of ContentsAlberto DomingoNo ratings yet

- Agriculture 4Document16 pagesAgriculture 4NAVEED AHMEDNo ratings yet

- Jollibee's rise as PH's leading fast food chainDocument3 pagesJollibee's rise as PH's leading fast food chainElyanna Marie ChuaNo ratings yet

- DettolmarketingDocument68 pagesDettolmarketingDeepankar MukherjeeNo ratings yet

- Project On Chocolate IndustryDocument20 pagesProject On Chocolate IndustryCongthu JosephNo ratings yet

- Feasibility Study Soy Corn BreadDocument23 pagesFeasibility Study Soy Corn BreadArgyllTapawanNo ratings yet

- San Miguel PurefoodsDocument128 pagesSan Miguel PurefoodsSanta Anna SinagaNo ratings yet

- Guidelines of Application Form For The JICA Knowledge Co-Creation ProgramDocument26 pagesGuidelines of Application Form For The JICA Knowledge Co-Creation ProgramCindh CindhNo ratings yet

- EMIS Insights - Philippines Agriculture Sector Report 2018 - 2019 PDFDocument75 pagesEMIS Insights - Philippines Agriculture Sector Report 2018 - 2019 PDFMarco RvsNo ratings yet

- Agri-Organic Farming Business PlanDocument4 pagesAgri-Organic Farming Business PlanJonh Mark Pascual Agbuya0% (1)

- Slaughtering Operations (Large Animals) NC IIDocument100 pagesSlaughtering Operations (Large Animals) NC IIBeta TesterNo ratings yet

- Soap MakingDocument7 pagesSoap MakingLily Antonette AgustinNo ratings yet

- Scale and Slug CaterpillarDocument66 pagesScale and Slug CaterpillarPca Zdn100% (1)

- AloeVera BPDocument26 pagesAloeVera BPdivyaNo ratings yet

- College of Business, Hospitality and Tourism Studies: MKT501Sem Introduction To MarketingDocument4 pagesCollege of Business, Hospitality and Tourism Studies: MKT501Sem Introduction To MarketingMr. Sailosi Kaitabu100% (1)

- Smoothy Juice MKT PlanDocument28 pagesSmoothy Juice MKT PlanShariful Islam ShaheenNo ratings yet

- Marketing Plan for Launching an Alcohol-Based SanitizerDocument31 pagesMarketing Plan for Launching an Alcohol-Based SanitizerNipuni PeirisNo ratings yet

- VietnamDocument9 pagesVietnamAshwin Choudhary100% (1)

- MVP Strikes Again (2011)Document3 pagesMVP Strikes Again (2011)Benjamin Jozef de LeonNo ratings yet

- Connect With The InsightDocument6 pagesConnect With The InsightBenjamin Jozef de LeonNo ratings yet

- Fin Ratios NotesDocument69 pagesFin Ratios NotesBenjamin Jozef de LeonNo ratings yet

- Manny Pangilinan To Buy Philippine Airlines (PAL)Document2 pagesManny Pangilinan To Buy Philippine Airlines (PAL)Benjamin Jozef de LeonNo ratings yet

- KanaFlashcards SampleDocument12 pagesKanaFlashcards SampleBenjamin Jozef de LeonNo ratings yet

- Global Trends Report 2009Document66 pagesGlobal Trends Report 2009Benjamin Jozef de LeonNo ratings yet

- Eigasai Flyer 2010Document4 pagesEigasai Flyer 2010Benjamin Jozef de LeonNo ratings yet

- Common Rationality CentipedeDocument4 pagesCommon Rationality Centipedesyzyx2003No ratings yet

- BCG MatrixDocument5 pagesBCG MatrixAliza AliNo ratings yet

- SEMINAR KERJA PRAKTIK EVALUATES CDU FURNACESDocument41 pagesSEMINAR KERJA PRAKTIK EVALUATES CDU FURNACESMuhammad AswanNo ratings yet

- Case Digest FinalDocument13 pagesCase Digest FinalAngelo Igharas Infante60% (5)

- Green HolidaysDocument5 pagesGreen HolidaysLenapsNo ratings yet

- Sales Forecast Spreadsheet TemplateDocument6 pagesSales Forecast Spreadsheet TemplateNithya RajNo ratings yet

- Translation To The Presentation Currency/translation of A Foreign OperationDocument1 pageTranslation To The Presentation Currency/translation of A Foreign OperationdskrishnaNo ratings yet

- Karachi Stock Exchange QuotationDocument19 pagesKarachi Stock Exchange QuotationKingston KimberlyNo ratings yet

- Digital Duplicator DX 2430 Offers High-Speed PrintingDocument2 pagesDigital Duplicator DX 2430 Offers High-Speed PrintingFranzNo ratings yet

- Economics For Everyone: Problem Set 2Document4 pagesEconomics For Everyone: Problem Set 2kogea2No ratings yet

- Barclays Capital - The - W - Ides of MarchDocument59 pagesBarclays Capital - The - W - Ides of MarchjonnathannNo ratings yet

- Josh Magazine NMAT 2007 Quest 4Document43 pagesJosh Magazine NMAT 2007 Quest 4Pristine Charles100% (1)

- The End of Japanese-Style ManagementDocument24 pagesThe End of Japanese-Style ManagementThanh Tung NguyenNo ratings yet

- IAS 2 InventoriesDocument13 pagesIAS 2 InventoriesFritz MainarNo ratings yet

- Commercial Banks Customer Service EssentialDocument6 pagesCommercial Banks Customer Service EssentialGopi KrishzNo ratings yet

- G20 Leaders to Agree on Trade, CurrencyDocument5 pagesG20 Leaders to Agree on Trade, CurrencysunitbagadeNo ratings yet

- As of December 2, 2010: MHA Handbook v3.0 1Document170 pagesAs of December 2, 2010: MHA Handbook v3.0 1jadlao8000dNo ratings yet

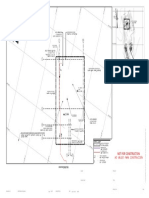

- Compressors system and residue box drawingDocument1 pageCompressors system and residue box drawingjerson flores rosalesNo ratings yet

- Far QuizDocument7 pagesFar QuizMeldred EcatNo ratings yet

- 5014 Environmental Management: MARK SCHEME For The May/June 2015 SeriesDocument3 pages5014 Environmental Management: MARK SCHEME For The May/June 2015 Seriesmuti rehmanNo ratings yet

- Zesco Solar Gyser ProjectDocument23 pagesZesco Solar Gyser ProjectGulbanu KarimovaNo ratings yet

- DonaldDocument26 pagesDonaldAnonymous V2Tf1cNo ratings yet

- Lead Dev Talk (Fork) PDFDocument45 pagesLead Dev Talk (Fork) PDFyosiamanurunNo ratings yet

- 4 AE AutomotionDocument1 page4 AE AutomotionKarthikeyan MallikaNo ratings yet

- KarachiDocument2 pagesKarachiBaran ShafqatNo ratings yet

- Informative FinalDocument7 pagesInformative FinalJefry GhazalehNo ratings yet

- EP-501, Evolution of Indian Economy Midterm: Submitted By: Prashun Pranav (CISLS)Document8 pagesEP-501, Evolution of Indian Economy Midterm: Submitted By: Prashun Pranav (CISLS)rumiNo ratings yet

- How High Would My Net-Worth Have To Be. - QuoraDocument1 pageHow High Would My Net-Worth Have To Be. - QuoraEdward FrazerNo ratings yet

- Trust Receipt Law NotesDocument8 pagesTrust Receipt Law NotesValentine MoralesNo ratings yet

- Reference BikashDocument15 pagesReference Bikashroman0% (1)