Professional Documents

Culture Documents

Bankingfinance

Uploaded by

api-121330740Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bankingfinance

Uploaded by

api-121330740Copyright:

Available Formats

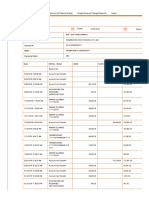

Ronald D.

Martel SUMMARY Results-driven leader with the ability to analyze, prioritize and utilize resour ces to consistently exceed objectives. Accomplished manager who has re-designed processes and implemented new procedures to achieve department goals. Significa nt knowledge and experience in back-office operations. Performance Measurement / Management Research Expert Customer Service Oriented Operational Planning Big Picture Perspective General Ledger Reconciliation Detailed Team Player PROFESSIONAL EXPERIENCE JPMORGAN CHASE (formerly Washington Mutual Bank), Stockton, CA May 1989 - Nov. 2 009 May 1989 Nov 2009 FC Reconciliation/Accounting Supervisor Aug, 1995 - Nov. 2009 Responsible for supervising the daily functions and processes of the back office bank operations team with staff levels as high as 45 employees. Operational fu nctions varied over the years from routine to highly complex and included: offic ial checks and money orders, travelers checks, treasury tax and loan payments, u nclaimed property, general ledger reconciliations and research, correspondent ba nk reconciliation, missing check research and reconstruction, teller cash and ch eck differences, and customer research. * Created and maintained a highly effective team through training, consistent co aching and regular feedback. Met with each team member weekly to discuss produc tivity performance and quality level to ensure employees had what they needed to meet monthly goals. Team achieved an average monthly productivity score of 120 % and an average quality score of 99%. Team was consistently 20% more productiv e than the baseline productivity levels. * Provided reconciliation support to more than 2,400 branches and 150 back offic e departments. Distributed reports each week to inform each branch of the progr ess of their work and also to alert them of potential fraud. Communicated regul arly with branch operations analysts to ensure branches were taking appropriate action to remedy issues. * Participated in many process improvement initiatives which resulted in a 25% s taff savings. These initiatives included reconciliation re-design, training sta ff to use research tools more effectively as well as continued process reviews t o ensure non-value added tasks were eliminated. These initiatives increased emp loyee productivity while reducing potential errors. * Collaborated with banks vendor to convert to a check image platform. Trained staff and other areas of the bank on efficient use of the check imaging system. * Led the back office team to successfully convert the Washington Mutual branche s to the JPMorgan Chase platform after the acquisition. Ensured all pre-convers ion work was completed accurately and timely prior to final hand-off which resul ted in zero backlog transferred. FC Reconciliation Accounting Clerk May 1989 - Aug, 1995 * Responsible for balancing 60 general ledger accounts * Prepare and post general ledger entries * Research and clear outstanding items

* Prepare month end reports Education Delta College - A.A. in Accounting Lodi High School Regional Occupational Training - Bank Teller Training

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NEGOTIABLE INSTRUMENTS DIGEST CASE ON REASONABLE TIME FOR PRESENTMENTDocument2 pagesNEGOTIABLE INSTRUMENTS DIGEST CASE ON REASONABLE TIME FOR PRESENTMENTRache GutierrezNo ratings yet

- Joaquin Urquiola OrderDocument5 pagesJoaquin Urquiola Orderal_crespoNo ratings yet

- Rivera vs Chua promissory note disputeDocument1 pageRivera vs Chua promissory note disputeStefanRodriguez100% (1)

- NSB Bank Account Statement GPS 511 GB 1Document3 pagesNSB Bank Account Statement GPS 511 GB 1Syed Faisal Shah BukhariNo ratings yet

- DocDocument41 pagesDocmohamed elkomyNo ratings yet

- Marilyn Anthony PO BOX 1131 Liverpool Ns B0T 1K0: November 5, 2023 Your Automobile Insurance PolicyDocument16 pagesMarilyn Anthony PO BOX 1131 Liverpool Ns B0T 1K0: November 5, 2023 Your Automobile Insurance Policymwentzell45No ratings yet

- Chapter 7 - Fraud, Internal Control, and CashDocument80 pagesChapter 7 - Fraud, Internal Control, and Cash蔚weiNo ratings yet

- MESFINMENAMOFINALPAPERMBA2018Document82 pagesMESFINMENAMOFINALPAPERMBA2018Sew 23No ratings yet

- Citibank vs. Sabeniano Case DigestDocument19 pagesCitibank vs. Sabeniano Case DigestJohn Patrick IsraelNo ratings yet

- Internship ReportDocument43 pagesInternship ReportsakibarsNo ratings yet

- E-Banking's Impact on Customer Value at Pragathi Krishna BankDocument100 pagesE-Banking's Impact on Customer Value at Pragathi Krishna BankCenu RomanNo ratings yet

- Labor PaymentDocument1 pageLabor PaymentAnaliza EspallardoNo ratings yet

- Customer Care contact details and electric bill detailsDocument2 pagesCustomer Care contact details and electric bill detailsSatkar Garment50% (2)

- Surrender FormDocument2 pagesSurrender Formvi_sharNo ratings yet

- Criminal Revision Petition MuddurajDocument14 pagesCriminal Revision Petition MuddurajPranav KbNo ratings yet

- Risk Management and Internal Controls EvaluationDocument4 pagesRisk Management and Internal Controls EvaluationJeth MahusayNo ratings yet

- Tally Solutions - Guides & TutorialsDocument16 pagesTally Solutions - Guides & TutorialsraghavsarikaNo ratings yet

- DividendsDocument17 pagesDividendsZafrul ZafNo ratings yet

- Workflow Process ActivationDocument20 pagesWorkflow Process ActivationSadasiva Reddy KalakataNo ratings yet

- XXXX BP22Document6 pagesXXXX BP22Julius Geoffrey TangonanNo ratings yet

- Preface: of Public Sector and Private Sector Banks"Document47 pagesPreface: of Public Sector and Private Sector Banks"madhuri100% (1)

- Abl System Analysis and DesignDocument18 pagesAbl System Analysis and DesignFahad Khan LangahNo ratings yet

- Practical Auditing Empleo Sol Man Chapter 3Document6 pagesPractical Auditing Empleo Sol Man Chapter 3Elaine AntonioNo ratings yet

- Checklist Under Companies Act, 1956Document6 pagesChecklist Under Companies Act, 1956Sahil SinghNo ratings yet

- Unit 7 Travel ArrangementsDocument16 pagesUnit 7 Travel ArrangementsMelissia EdwardsNo ratings yet

- Bank Reconciliation GuideDocument86 pagesBank Reconciliation GuidesreekumarNo ratings yet

- Bank Statement ICICI NOvember 2009Document2 pagesBank Statement ICICI NOvember 2009Deidra PowellNo ratings yet

- Airtel FiberDocument4 pagesAirtel FiberjitendraNo ratings yet

- Account Statement For Account:3953000400017453: Branch DetailsDocument2 pagesAccount Statement For Account:3953000400017453: Branch DetailsAbhishek PareekNo ratings yet

- History and Types of Banking ServicesDocument7 pagesHistory and Types of Banking ServicesTsitsi Gracious MugwizaNo ratings yet