Professional Documents

Culture Documents

MR 21

Uploaded by

Nalla ReddyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MR 21

Uploaded by

Nalla ReddyCopyright:

Available Formats

Sometimes we need to change the value (price) of our inventory material in order to adjust it to a certain condition.

Maybe, it because the current standard price (for material with price control procedure S) has been differed too greatly with the statistical moving average price (MAP). For a material with price control procedure S, SAP R/3 system also calculates its moving average price and save it as statistical-MAP at accounting view on material master data. This statistical MAP has no influence in material valuation.

Or, for a material with price control procedure V, we maybe need to change the price of a material because it has no movement transaction for a long time period and we want to revaluate it to the current market price (You can read our previous article to understand more about Material Valuation in SAP ).

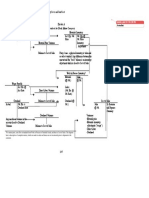

This material price change transaction usually occurs in manufacturing or trading companies. This transaction is an accounting transaction, not material transaction. It will post an accounting document but will not create a material document. It will change the price of a material at accounting view on material master data but will not change the quantity of it. The T-code fro the transaction is: MR21. The typical accounting journals for this transaction are:

If

the new price is higher than the old one.

For example, current material price is 5000, and we want to revaluate it to 6000. This transaction will increase the material value by 1000. Inventory account Revenue from material

revaluation

1000

1000

If

the new price is lower than the old one.

For example, current material price is 5000, and we want to revaluate it to 4000. This transaction will decrease the material value by 1000. Expense from material revaluation 1000

Inventory account 1000

In the end, this transaction will result the same to the Balance Sheet and Profit & Loss Statement. It because as long as the business operation of the company runs, the material that revaluated by this transaction will be used, either for internal consumption or for sales. Lets assume that there is no other transaction for this material. For first condition (new price > old price) The typical accounting journal for consumption is: Inventory account Material consumption

expense account

6000

6000

The first journal will decrease the Asset by 6000 (the new material value), so it will result 0 in Inventory account. The second journal will decrease the current year profit, so it will decrease Equity, by 6000. It will result -6000+1000 (from revenue from material revaluation account when material price change transaction was done) =-5000 (decrease in Equity). It is the same with if there is no material price change transaction before. Material consumption Inventory account expense account

5000

5000

For second condition (new price < old price) The typical accounting journal for consumption is: Material consumption Inventory account expense account

4000

4000

The first journal will decrease the Asset by 4000 (the new material value), so it will result 0 in Inventory account. The second journal will decrease the current year profit, so it will decrease Equity, by 4000. It will result -4000-1000 (from expense from material revaluation account when material price change transaction was done) =-5000 (decrease in Equity). It is the same with if there is no material price change transaction before. Material consumption Inventory account expense account

5000

5000

You might also like

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- SAP SD Pricing FundamentalsDocument14 pagesSAP SD Pricing FundamentalsSAPAPOOnlinetraining100% (3)

- Exhibit A Flowchart For Black Meter CompanyDocument1 pageExhibit A Flowchart For Black Meter CompanyiskothegreatrnNo ratings yet

- Standard Price & Moving Average Price in SAPDocument5 pagesStandard Price & Moving Average Price in SAPvSravanakumar100% (1)

- SAP SD Pricing FundamentalsDocument14 pagesSAP SD Pricing FundamentalsThiagoHanuschNo ratings yet

- SAP MM - Material ValuationDocument6 pagesSAP MM - Material ValuationYani LieNo ratings yet

- COPC Actual Costing FAQDocument19 pagesCOPC Actual Costing FAQapi-3761679100% (3)

- Fundamentals of SAP SD PricingDocument13 pagesFundamentals of SAP SD Pricingrajendrakumarsahu100% (3)

- Real Time Interview QuestionsDocument88 pagesReal Time Interview QuestionsSarang IttadwarNo ratings yet

- SUBTOTAL - Subtotal Field Is Used To Store The Intermediate CalculationDocument5 pagesSUBTOTAL - Subtotal Field Is Used To Store The Intermediate CalculationANILNo ratings yet

- Fundamentals of SAP SD PricingDocument13 pagesFundamentals of SAP SD PricingAnil SharmaNo ratings yet

- Case StudyDocument4 pagesCase StudyShruti MaheshwariNo ratings yet

- Status Object Type in CRM Business TransactionDocument41 pagesStatus Object Type in CRM Business TransactionDeepa SampathNo ratings yet

- SAP FICO Interview Questions - Account Groups and Statistical PostingsDocument4 pagesSAP FICO Interview Questions - Account Groups and Statistical PostingsRavi ShankarNo ratings yet

- 1 - Accounting For Sales and Purchasing - DemosDocument5 pages1 - Accounting For Sales and Purchasing - DemosMónica CacheuxNo ratings yet

- Deactivate, change standard prices, and optimize period-end closing in SAP Material LedgerDocument5 pagesDeactivate, change standard prices, and optimize period-end closing in SAP Material Ledgerparidasg100% (1)

- Moving Average Price Vs Standard PriceDocument9 pagesMoving Average Price Vs Standard Pricesergionico70No ratings yet

- Introduction To SAP Material LedgerDocument2 pagesIntroduction To SAP Material LedgeramaravatiNo ratings yet

- FAQon MMDocument15 pagesFAQon MMapi-3718223No ratings yet

- Logic of price difference posting in MIRO for inventory and price accountsDocument3 pagesLogic of price difference posting in MIRO for inventory and price accountspdjraoNo ratings yet

- New-MATH 1033 Module 5 and 6Document7 pagesNew-MATH 1033 Module 5 and 6Gelo AgcaoiliNo ratings yet

- Project Class Day 9Document7 pagesProject Class Day 9rahul moreNo ratings yet

- Item Category Controls in SapDocument6 pagesItem Category Controls in SapkarthikbjNo ratings yet

- AS-InventoriesDocument14 pagesAS-InventoriesPRASHANT DASHNo ratings yet

- Cost & Management AccountingDocument16 pagesCost & Management AccountingYash MaheshwariNo ratings yet

- Gross Profit Variance AnalysisDocument6 pagesGross Profit Variance AnalysisKatherine DimaunahanNo ratings yet

- Welcome To The Accounting For Sales and Purchasing TopicDocument24 pagesWelcome To The Accounting For Sales and Purchasing TopicAnna LewandowskaNo ratings yet

- Material Ledger 01Document9 pagesMaterial Ledger 01Gopal KrishnanNo ratings yet

- Accounting for Merchandising BusinessesDocument72 pagesAccounting for Merchandising Businessesdavesanity23100% (1)

- Case 4Document4 pagesCase 4Polina KarpenkovaNo ratings yet

- Countermeasure There Is Down Payment Exist For The Same VendorDocument5 pagesCountermeasure There Is Down Payment Exist For The Same VendorDikky SuryadiNo ratings yet

- Update Valuated Sales Order Stock PricesDocument3 pagesUpdate Valuated Sales Order Stock PricesGK SKNo ratings yet

- Accounting for Merchandising BusinessesDocument38 pagesAccounting for Merchandising BusinessesJeffrey JosephNo ratings yet

- Sap S4hana SDDocument38 pagesSap S4hana SDSuraj jha100% (1)

- Weighted Average Method - AccountingToolsDocument2 pagesWeighted Average Method - AccountingToolsMd Rakibul HasanNo ratings yet

- Practice Use CaseDocument3 pagesPractice Use CaseananduthamanNo ratings yet

- MAP Without Stock Coverage PostingsDocument2 pagesMAP Without Stock Coverage PostingsSilva SilvaNo ratings yet

- Break Even DescriptionDocument16 pagesBreak Even DescriptionTabrej KhanNo ratings yet

- CVP Analysis Guide: Cost-Volume-Profit Analysis ExplainedDocument16 pagesCVP Analysis Guide: Cost-Volume-Profit Analysis Explainedvaibhav guptaNo ratings yet

- SAP ML Espresso 116Document12 pagesSAP ML Espresso 116Samir Kulkarni50% (2)

- Following Questions Are Answered in This Case Study SolutionDocument5 pagesFollowing Questions Are Answered in This Case Study SolutionB.N MRUDULANo ratings yet

- Standared CostingDocument18 pagesStandared Costingiram2005No ratings yet

- Break-Even Point Analysis ExplainedDocument6 pagesBreak-Even Point Analysis ExplainedLouis FrongelloNo ratings yet

- Introduction To Material LedgerDocument2 pagesIntroduction To Material LedgergabrielsystNo ratings yet

- 16 Fields in MM Pricing ProcedureDocument9 pages16 Fields in MM Pricing Procedureashish sawantNo ratings yet

- PCA - Multiple ValuationsDocument5 pagesPCA - Multiple ValuationscitigenxNo ratings yet

- Accounting Exercise PDFDocument61 pagesAccounting Exercise PDFAbdelhamid HarakatNo ratings yet

- Sap SDDocument87 pagesSap SDSatya Bulusu100% (2)

- Inventory Management: Subhani ShaikDocument31 pagesInventory Management: Subhani ShaikJagadish JAGANNo ratings yet

- Back To The Basics - : Account Amount Profit CentreDocument14 pagesBack To The Basics - : Account Amount Profit CentreReddy BDNo ratings yet

- Screen Field's DefinitionDocument27 pagesScreen Field's Definitiondeepak soniNo ratings yet

- 3 Resource Backflush AccountingDocument7 pages3 Resource Backflush AccountingNaveed Mughal AcmaNo ratings yet

- Company Details - General, Accounting and Basic IntializationDocument23 pagesCompany Details - General, Accounting and Basic IntializationKaushik ShindeNo ratings yet

- Data Processing Service Revenues World Summary: Market Values & Financials by CountryFrom EverandData Processing Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Manifold Business Forms World Summary: Market Sector Values & Financials by CountryFrom EverandManifold Business Forms World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Accounting, Maths and Computing Principles for Business Studies V11From EverandAccounting, Maths and Computing Principles for Business Studies V11No ratings yet

- MM ReportsDocument5 pagesMM Reportsmohan329No ratings yet

- Movement TypesDocument1 pageMovement Typesmohan329No ratings yet

- Evnt KeysDocument4 pagesEvnt Keysmohan329No ratings yet

- Steps For Service PoDocument1 pageSteps For Service Pomohan329No ratings yet

- Table S DataDocument4 pagesTable S Datamohan329No ratings yet