0% found this document useful (0 votes)

284 views3 pagesP45 Attached

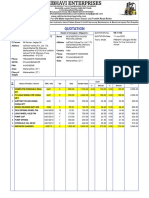

The document is a P45 form detailing the leaving information for an employee named Kevin Kaka, including his PAYE reference, National Insurance number, tax code, and total pay and tax to date. It consists of three parts: Part 1A for the employee, Part 2 for the new employer, and Part 3 for completion by the new employer. The form provides instructions for both the employee and the new employer on how to handle tax deductions and reporting to HMRC.

Uploaded by

landry kakaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

284 views3 pagesP45 Attached

The document is a P45 form detailing the leaving information for an employee named Kevin Kaka, including his PAYE reference, National Insurance number, tax code, and total pay and tax to date. It consists of three parts: Part 1A for the employee, Part 2 for the new employer, and Part 3 for completion by the new employer. The form provides instructions for both the employee and the new employer on how to handle tax deductions and reporting to HMRC.

Uploaded by

landry kakaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd