0% found this document useful (0 votes)

16 views1 pageMam Tet Reflection

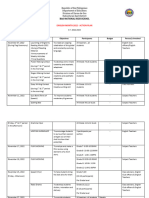

The BCG Growth-Share Matrix is a strategic tool developed by the Boston Consulting Group to evaluate business units based on market growth and market share. It categorizes products into four quadrants: Stars, Cash Cows, Question Marks, and Dogs, guiding companies on investment and resource allocation decisions. The matrix remains relevant for strategic management, emphasizing the importance of a balanced portfolio for long-term success.

Uploaded by

lopezkenneth929Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

16 views1 pageMam Tet Reflection

The BCG Growth-Share Matrix is a strategic tool developed by the Boston Consulting Group to evaluate business units based on market growth and market share. It categorizes products into four quadrants: Stars, Cash Cows, Question Marks, and Dogs, guiding companies on investment and resource allocation decisions. The matrix remains relevant for strategic management, emphasizing the importance of a balanced portfolio for long-term success.

Uploaded by

lopezkenneth929Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd