Professional Documents

Culture Documents

Market Outlook 30th March 2012

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Market Outlook 30th March 2012

Uploaded by

Angel BrokingCopyright:

Available Formats

Market Outlook

India Research

March 30, 2012

Dealers Diary

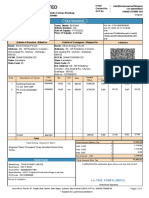

Domestic Indices Chg (%) (Pts) (Close)

The Indian markets are expected to open in the red tracing negative opening in most of the Asian indices. Asian stocks fell for a second day as growth in U.S. durable-goods orders trailed estimates. The US markets drifted lower over the course of the day on account of profit booking as some traders cashed in on the recent strength in the markets amid calls by a number of analysts for a correction. Traders also reacted negatively to the latest batch of U.S. economic data, including a report from the Labor Department showing that weekly jobless claims came in above economist estimates. However the indices recovered significantly in the later sessions and eventually ended up near the opening. Indian shares extended losses for a second consecutive session on Thursday, as concerns about growth prospects in the world's two largest economies prompted investors to square off long positions on the expiry of March series derivative contracts.

BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com

(0.4) (0.3) 0.2 0.7 0.9 (0.2) (0.2) 0.7 0.4 0.2 (1.2)

Chg (%)

(63.0) 17,059 (15.9) 9.9 45.3 59.4 (10.5) 65.7 15.0 (70.2)

(Pts)

5,179 6,201 6,497 6,506 7,128 9,910 7,865 5,951

(Close)

(17.2) 11,459 43.4 11,061

0.2 (0.3) (1.2) (0.7) (0.7) (1.4)

19.6 13,146 (9.6) (67.0) 3,095 5,742

Markets Today

The trend deciding level for the day is 17,136/5,200 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 17,232 17,342/5,231 5,267 levels. However, if NIFTY trades below 17,136/5,200 levels for the first half-an-hour of trade then it may correct up to 17,026 16,930/5,164 5,133 levels.

Indices SENSEX NIFTY S2 16,930 5,133 S1 17,026 5,164 PIVOT 17,136 5,200 R1 17,232 5,231 R2 17,342 5,267

(67.8) 10,115 (21.9) (32.7) 2,994 2,252

(1.3) (276.0) 20,609

Indian ADRs

Chg (%)

(Pts)

(Close)

INFY WIT IBN HDB

1.0 2.1 (0.2) (2.4)

0.6 0.2 (0.1) (0.8)

$56.5 $10.8 $34.0 $33.2

News Analysis

TCS to provide banking solution - BaNCS to AmBank, Malaysia NTPC Tamil Nadu Energy Co. commissions Unit I of Vallur Power Project

Refer detailed news analysis on the following page

Advances / Declines Advances

BSE

NSE

Net Inflows (March 28, 2012)

` cr FII MFs Purch 3,253 446 Sales 3,004 501 Net 249 (55) MTD 9,030 (1,416) YTD 45,328 (5,443)

1,539 1,270 105

835 643 65

Declines Unchanged

Volumes (` cr)

FII Derivatives (March 29, 2012)

` cr

Index Futures Stock Futures

BSE

Purch 5,064 8,097

Sales 5,605 7,416

Net (540) 681

Open Interest 10,127 20,997

2,004 14,690

NSE

Gainers / Losers

Gainers Company

IVRCL Ltd. Ranbaxy Labs Adani Enterprises Opto Circuits Jindal Steel

Losers Company

India Cements Mcleod Russel JSW Ispat Steel IDBI Bank Oil India

Price (`)

65 447 301 199 549

chg (%)

7.8 7.0 5.9 5.1 4.4

Price (`)

112 260 12 101 475

chg (%)

(4.7) (4.4) (4.3) (3.9) (3.8)

Please refer to important disclosures at the end of this report

Sebi Registration No: INB 010996539

Market Outlook | India Research

TCS to provide banking solution - BaNCS to AmBank, Malaysia

TCS' financial services platform, TCS BaNCS, will replace Malaysian AmBank's core banking engine. This integrated banking suite, spanning conventional and Islamic banking, will support both retail banking and lending functionalities. TCS BaNCS will help expand AmBank's business into new areas. It will also enable development and the scalability required to meet both current and future market and regulatory needs. Due to this deployment, TCS may soon have a regional support centre for TCS BaNCS in Kuala Lumpur. We maintain Accumulate rating on the stock with a target price of `1,262.

NTPC Tamil Nadu Energy Co. commissions Unit I of Vallur Power Project

NTPC Tamil Nadu Energy Co. Ltd. a JV of NTPC Ltd. and TNEB has commissioned Unit I (500 MW) of Vallur Thermal Power Project on March 28, 2012. With this, the total capacity of NTPC group has become 36,514 MW. In all NTPC group has commissioned 2,320MW of capacity in FY2012 till date, which is below the initial target of 4,320MW. At the CMP, the stock is trading at 1.6x FY2013E P/BV. We maintain a Buy on the stock with a Target Price of `199.

Economic and Political News

February infra output up 6.8% yoy Indian GDP to grow at 7.5% in FY2013: Fitch Government will clarify stance on P-Notes taxation: Finance Minister

Corporate News

Tata Motors hikes commercial vehicle prices by up to `60,000 Tata Motors to invest `600cr on defense vehicles NTPC to halt expansion of gas-based projects Bharat Forge earmarks `100cr to develop artillery gun

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

March 30, 2012

Market Outlook | India Research

Research Team Tel: 022 - 39357800

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

March 30, 2012

You might also like

- Market Outlook 2nd April 2012Document4 pagesMarket Outlook 2nd April 2012Angel BrokingNo ratings yet

- Market Outlook 10th April 2012Document3 pagesMarket Outlook 10th April 2012Angel BrokingNo ratings yet

- Market Outlook 4th January 2012Document3 pagesMarket Outlook 4th January 2012Angel BrokingNo ratings yet

- Market Outlook 28th December 2011Document4 pagesMarket Outlook 28th December 2011Angel BrokingNo ratings yet

- Market Outlook 21st March 2012Document3 pagesMarket Outlook 21st March 2012Angel BrokingNo ratings yet

- Market Outlook 26th March 2012Document4 pagesMarket Outlook 26th March 2012Angel BrokingNo ratings yet

- Market Outlook 29th November 2011Document3 pagesMarket Outlook 29th November 2011Angel BrokingNo ratings yet

- Market Outlook 27th March 2012Document4 pagesMarket Outlook 27th March 2012Angel BrokingNo ratings yet

- Market Outlook 27th December 2011Document3 pagesMarket Outlook 27th December 2011Angel BrokingNo ratings yet

- Market Outlook 29th March 2012Document3 pagesMarket Outlook 29th March 2012Angel BrokingNo ratings yet

- Market Outlook 20th March 2012Document3 pagesMarket Outlook 20th March 2012Angel BrokingNo ratings yet

- Market Outlook 12th October 2011Document4 pagesMarket Outlook 12th October 2011Angel BrokingNo ratings yet

- Market Outlook 22nd November 2011Document4 pagesMarket Outlook 22nd November 2011Angel BrokingNo ratings yet

- Market Outlook 2nd January 2012Document3 pagesMarket Outlook 2nd January 2012Angel BrokingNo ratings yet

- Market Outlook 30th Decmber 2011Document3 pagesMarket Outlook 30th Decmber 2011Angel BrokingNo ratings yet

- Market Outlook 28th March 2012Document4 pagesMarket Outlook 28th March 2012Angel BrokingNo ratings yet

- Market Outlook 9th January 2012Document3 pagesMarket Outlook 9th January 2012Angel BrokingNo ratings yet

- Market Outlook 23rd February 2012Document4 pagesMarket Outlook 23rd February 2012Angel BrokingNo ratings yet

- Market Outlook 5th January 2012Document3 pagesMarket Outlook 5th January 2012Angel BrokingNo ratings yet

- Market Outlook 24th November 2011Document3 pagesMarket Outlook 24th November 2011Angel BrokingNo ratings yet

- Market Outlook: India Research Dealer's DiaryDocument3 pagesMarket Outlook: India Research Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 11th January 2012Document4 pagesMarket Outlook 11th January 2012Angel BrokingNo ratings yet

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingNo ratings yet

- Market Outlook 27th September 2011Document3 pagesMarket Outlook 27th September 2011angelbrokingNo ratings yet

- Market Outlook 6th March 2012Document3 pagesMarket Outlook 6th March 2012Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument4 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Market Outlook 9th April 2012Document3 pagesMarket Outlook 9th April 2012Angel BrokingNo ratings yet

- Market Outlook 13th March 2012Document4 pagesMarket Outlook 13th March 2012Angel BrokingNo ratings yet

- Market Outlook 17.11.11Document3 pagesMarket Outlook 17.11.11Angel BrokingNo ratings yet

- Market Outlook 29th September 2011Document3 pagesMarket Outlook 29th September 2011Angel BrokingNo ratings yet

- Market Outlook 23rd August 2011Document3 pagesMarket Outlook 23rd August 2011angelbrokingNo ratings yet

- Market Outlook 23rd December 2011Document4 pagesMarket Outlook 23rd December 2011Angel BrokingNo ratings yet

- Market Outlook 7th September 2011Document3 pagesMarket Outlook 7th September 2011Angel BrokingNo ratings yet

- Market Outlook 29th December 2011Document3 pagesMarket Outlook 29th December 2011Angel BrokingNo ratings yet

- Market Outlook 1st March 2012Document4 pagesMarket Outlook 1st March 2012Angel BrokingNo ratings yet

- Market Outlook 14th March 2012Document3 pagesMarket Outlook 14th March 2012Angel BrokingNo ratings yet

- Market Outlook 22nd August 2011Document4 pagesMarket Outlook 22nd August 2011Angel BrokingNo ratings yet

- Market Outlook 10th January 2012Document4 pagesMarket Outlook 10th January 2012Angel BrokingNo ratings yet

- Market Outlook 6th January 2012Document4 pagesMarket Outlook 6th January 2012Angel BrokingNo ratings yet

- Market Outlook 21st February 2012Document4 pagesMarket Outlook 21st February 2012Angel BrokingNo ratings yet

- Market Outlook 8th September 2011Document4 pagesMarket Outlook 8th September 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (17214) / NIFTY (5227)Document4 pagesDaily Technical Report: Sensex (17214) / NIFTY (5227)Angel BrokingNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Market Outlook 24th August 2011Document4 pagesMarket Outlook 24th August 2011Angel BrokingNo ratings yet

- Technical Report 2nd May 2012Document4 pagesTechnical Report 2nd May 2012Angel BrokingNo ratings yet

- Market Outlook 20th December 2011Document4 pagesMarket Outlook 20th December 2011Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16897) / NIFTY (5121)Document4 pagesDaily Technical Report: Sensex (16897) / NIFTY (5121)Angel BrokingNo ratings yet

- Market Outlook 30th September 2011Document3 pagesMarket Outlook 30th September 2011Angel BrokingNo ratings yet

- Technical Format With Stock 13.09Document4 pagesTechnical Format With Stock 13.09Angel BrokingNo ratings yet

- Market Outlook 12th March 2012Document4 pagesMarket Outlook 12th March 2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16913) / NIFTY (5114)Document4 pagesDaily Technical Report: Sensex (16913) / NIFTY (5114)Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16860) / NIFTY (5104)Document4 pagesDaily Technical Report: Sensex (16860) / NIFTY (5104)Angel BrokingNo ratings yet

- Market Outlook 16th March 2012Document4 pagesMarket Outlook 16th March 2012Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16846) / NIFTY (5110)Document4 pagesDaily Technical Report: Sensex (16846) / NIFTY (5110)Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16907) / NIFTY (5121)Document4 pagesDaily Technical Report: Sensex (16907) / NIFTY (5121)Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16968) / NIFTY (5142)Document4 pagesDaily Technical Report: Sensex (16968) / NIFTY (5142)Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (16719) / NIFTY (5068)Document4 pagesDaily Technical Report: Sensex (16719) / NIFTY (5068)Angel BrokingNo ratings yet

- Market Outlook 5th September 2011Document4 pagesMarket Outlook 5th September 2011Angel BrokingNo ratings yet

- Stock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingFrom EverandStock Fundamental Analysis Mastery: Unlocking Company Stock Financials for Profitable TradingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Analysis of Hindalco's working capital managementDocument18 pagesAnalysis of Hindalco's working capital managementAbhishek RaiNo ratings yet

- Banking and Fintech in 2022Document45 pagesBanking and Fintech in 2022Shahbaz talpurNo ratings yet

- Business Calculations Level 2: LCCI International QualificationsDocument11 pagesBusiness Calculations Level 2: LCCI International QualificationsZuuko ZuuNo ratings yet

- AIPL Business Club Application-FormDocument11 pagesAIPL Business Club Application-Formbigdealsin14No ratings yet

- STATADocument58 pagesSTATARiska GrabeelNo ratings yet

- Shareholder'S Resolution Approving Dissolution of Abc CorporationDocument7 pagesShareholder'S Resolution Approving Dissolution of Abc CorporationCrystal PierceNo ratings yet

- Accounting Standard 3Document2 pagesAccounting Standard 3Veda ShahNo ratings yet

- Form B AnchorDocument4 pagesForm B Anchordr jaimanNo ratings yet

- Accounting for Ijarah and Ijarah Muntahia Bittamleek (39Document12 pagesAccounting for Ijarah and Ijarah Muntahia Bittamleek (39theintelligentgirl100% (1)

- Calculate investment earnings and loan payments over timeDocument1 pageCalculate investment earnings and loan payments over timeYss CastañedaNo ratings yet

- Profit, Loss &discountDocument2 pagesProfit, Loss &discountQUANT ADDANo ratings yet

- SESPIBANK Angkatan 64 "Operational Risk Management Strategy and Implementation"Document73 pagesSESPIBANK Angkatan 64 "Operational Risk Management Strategy and Implementation"Lisa RositaNo ratings yet

- Credit Midterm Reviewer - Loan and DepositDocument12 pagesCredit Midterm Reviewer - Loan and Depositviva_33No ratings yet

- Technical Analysis For Beginners (Second Edition) - Stop Blindly Following S PDFDocument141 pagesTechnical Analysis For Beginners (Second Edition) - Stop Blindly Following S PDFSonali100% (7)

- Cambridge IGCSE: Accounting 0452/13Document12 pagesCambridge IGCSE: Accounting 0452/13grengtaNo ratings yet

- PellaUSOnlinePayslip PDFDocument2 pagesPellaUSOnlinePayslip PDFJoshuaM.ByrneNo ratings yet

- Reply of DV ComplaintDocument17 pagesReply of DV Complaintparveensaini2146No ratings yet

- Credit Transactions CasesDocument8 pagesCredit Transactions Casesraptureready100% (1)

- 04 April 2023 Account - Statement - PDF - 1100081899996 - 09 May 2023Document16 pages04 April 2023 Account - Statement - PDF - 1100081899996 - 09 May 2023galuhNo ratings yet

- Xaria Ward-Unit 8 Cornell Notes The Fed-1-1Document4 pagesXaria Ward-Unit 8 Cornell Notes The Fed-1-1Xaria WardNo ratings yet

- Accounting Book 1 Lupisan Baysa Answer KeyDocument176 pagesAccounting Book 1 Lupisan Baysa Answer KeyNicole Anne Santiago Sibulo67% (3)

- Three Basic Candlestick Formations To Improve Your TimingDocument4 pagesThree Basic Candlestick Formations To Improve Your TimingelisaNo ratings yet

- True Power earthings invoiceDocument1 pageTrue Power earthings invoiceHaseeb TyzNo ratings yet

- 2actuarial Mathematics of Ss PensionsDocument142 pages2actuarial Mathematics of Ss PensionsFaisal AzizNo ratings yet

- Tags:: Vikram Bakshi Mcdonald'S India Hardcastle Connaught Plaza RestaurantsDocument8 pagesTags:: Vikram Bakshi Mcdonald'S India Hardcastle Connaught Plaza RestaurantsAnushree LawrenceNo ratings yet

- A Short-Term Obligation Can Be Excluded From Current Liabilities If The Company Intends To Refinance It On A Long-Term Basis.Document29 pagesA Short-Term Obligation Can Be Excluded From Current Liabilities If The Company Intends To Refinance It On A Long-Term Basis.cole sprouseNo ratings yet

- Polaris Project Business Analyst Role and Payment SystemsDocument18 pagesPolaris Project Business Analyst Role and Payment SystemsGigish ThomasNo ratings yet

- 92-FIRST PB-AUD ExamDocument11 pages92-FIRST PB-AUD ExamReynaldo corpuzNo ratings yet

- Marketing StrategyDocument99 pagesMarketing Strategymahtolalan100% (1)

- Tax 1 Competency MappingDocument1 pageTax 1 Competency MappingIan Kit LoveteNo ratings yet