Professional Documents

Culture Documents

Condor Chapterp2

Uploaded by

am13469679Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Condor Chapterp2

Uploaded by

am13469679Copyright:

Available Formats

Breakthrough Backtesting Results for IV-Based SPX Iron Condor Option Trading System -Updated To Include Impact of Market

Correction of

May-June, 2006 Part 2 Iron Condor 2003 Results Directional Year

Steve Burke

Perazzim Capital Management, Inc.

3220 Mcleod Ave, Suite 100 Las Vegas, Nv 89121

Version 2.0 June 15, 2006

2006 - Perazzim Capital Management, Inc. All Rights Reserved. www.breakthroughbacktesting.com

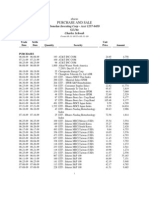

SPX Iron Condor Trades for 2003

2005 was considered a relatively non-directional year and therefore an easy year to do SPX Iron Condors. I wanted to backtest this system in a directional year to see how robust the system is. I choose 2003 since that year the market was in a relatively steady up trend coming off of the bad year of 2002. The results follow. There is important learning in the comments that discuss how adjustments were dealt with. In Part 3, we will examine the result for the first half of 2006. Part 4 will have a detailed conclusion to include key lessons from each year as well as the expected yearly profit this system currently has. Remember to visit http://www.breakthroughbacktesting.com to purchase the complete system for only $17. Table 4. SPX Iron Condor Trades Taken Every Month for 2003 Expirations Here are the trades taken in backtesting 2003 which is regarded as an up trending year. Notice how the IV is almost double what it was in 2005. This is due to 2003 following the very down trending year of 2002 which caused IV to rise.

SPX Short Call SPX Short Put Credit No shave Profit No shave

Expiration

Entry Date

SPX credit

SPX Legs 995/975, 810/800 975/950, 810/800

Margin

Profit

Comments WOW- IV is so high compared to 2005 that you get really good credits ADJUST -Rolled down 25 points to 950 since it was trending straight down except the end spurt up. This closed at 847 on 1/27 - below my 850 short. But I wait 1 day per the rules, it went back up above 850 to 858 next day, then to 864 on the day after. At this point, we may want a rule if it dips down, then up - then adjust anyway when you have the chance! - so adjust on 1/29 - after waiting a day. YES need to roll down using the rule on 1/28 towards close.

1/17/2003

12/9/2002

964.7

810.0

350

270.0

3500.0

350.0

270.0

1/17/2003

1/3/2002

475

395.0

3500.0

475

395.0

2/21/2003

1/13/2003

996.3

860.7

480

400

995/1025 , 850/825

5500

2006 - Perazzim Capital Management, Inc. All Rights Reserved. www.breakthroughbacktesting.com

Expiration

Entry Date

SPX Short Call

SPX Short Put

SPX credit

Credit No shave

SPX Legs

Margin

Profit

Profit No shave

2/21/2003

1/28/2003

2/21/2003

1/28/2003

780

930

60

-80

920/940, 800/775

4500

-420

-500

Comments Adjust after waiting 1 day using formula towards close of day when SPX is at 855. Got 85 debit with no shaving. Remember to adjust the days from 40 to 25. This adjustment of waiting a day and resetting the strikes using the formula with shorter days is preferable to the go down 50 points! I still got a credit if shaved! ADJUST -Roll down 50 points on top to 950/975 for .50 cents. I'M LISTING a no shave loss of $500 if you decided to exit early (which showed a $500 loss) or if you messed up the rolls or rolled down further when the index came close to the short the second time. This is fair Roll down 50 points on bottom 810/800 for .70 cents In order to change an adjustment that makes a debit into a credit, we need to increase margin. In this case, it should be on the upside since the down side is the trouble side SPX went down to 818 and 817 2 weeks later, but not below the 810 limit Again, this really points to following rules of looking at the CLOSE as the intraday spread DID go below 810 - which would scare you to roll down - for MORE debit!

2006 - Perazzim Capital Management, Inc. All Rights Reserved. www.breakthroughbacktesting.com

Expiration

Entry Date

SPX Short Call

SPX Short Put

SPX credit

Credit No shave

SPX Legs 925/950, 750/725

Margin

Profit

Profit No shave

Comments Had a low of 800 and a high of 895 - so OK Notice how these high IV's make the strikes wider, but you have less granular strike choices - i.e., 25 points or $2500 each side The wait a day rule really works, on 3/21, closes at 896! Wait a day and it drops 30 points to 865 The nightmare is when it approaches the short right before expiration ADJUST -Since trending up, roll up the puts on 4/3 - 2 weeks before expiration. Roll up 75 points to 775/800 due to 810/775 strike requiring too much margin 4/16 had 580/600 profit. Would most likely close out! Weird - there is no data for 4/18 - a Friday?? For any stock? But it shot up on expiration - so that leaving it on 4/17 would have lost some profit so $400

3/22/2003

2/10/2003

927

754

530

440

5000

530

440

4/18/2003

3/10/2003

894.8

727.8

525

425

900/920, 725/700

4500

525

425

4/18/2003

4/3/2003

900/920, 775/800

4500

600

400

5/16/2003

4/7/2003

949.3

812

470

400

950/975, 800/775

5000 ADJUST -On 5/2, roll up puts 50 points after going straight up. This did not do much since IV was decreasing as price increased On 5/14 - two days before expiration - we're only 10 points from the short - close out for 'only' 240 profit. Same profit if I stayed

950/975, 850/825

5000

5/16/2003

5/14/2003

950/975, 850/825

5000

240

170

2006 - Perazzim Capital Management, Inc. All Rights Reserved. www.breakthroughbacktesting.com

Expiration

Entry Date

SPX Short Call

SPX Short Put

SPX credit

Credit No shave

SPX Legs

Margin

Profit

Profit No shave

Comments in one more day!

6/20/2003

5/12/2003

998.1

894.8

365

280

1010/102 5,895/87 5 1010/102 5, 945/925 1010/102 5, 945/925

NOT COUNTED

3500

IV really dropped during this rise, so the fat credits are gone! ADJUST -Straight up - so roll up puts 50 points to 945/925 6/16 - 4 days before exp., spikes up more than 20 pts to 1010. I can exit at $240 loss or roll up both the puts and calls Roll puts up to 975/950, and calls up to 1040/1075 for a $105 debit and -$205 loss After analyzing the P&L of the roll and seeing just a $35 improvement, it is best to just close the trade and not risk more margin - plus all of the commissions. Stopped climging and traded in a range. Since in a range, did not roll up mid-cycle Another boring trading range - no rollups On 9/5 we moved up steadily to 1020 so roll up the puts 50 points to 975/950 - recalculating 1 sigma spread using 14 days and 15% IV gives 990 - we choose 975

6/20/2003

6/6/2003

3500

6/20/2003

6/16/2003

3500

-240

-325

====>

-205

-290

7/18/2003

6/9/2003

1041

915

420

330

1050/107 5, 920/900 1075/110 0, 950, 925

4500

420

330

8/15/2003

7/7/2003

1061

950

430

370

5000

430

370

9/19/2003

8/11/2003

1039

924.2

440

370

1040/106 0, 975/950

4500

2006 - Perazzim Capital Management, Inc. All Rights Reserved. www.breakthroughbacktesting.com

Expiration

Entry Date

SPX Short Call

SPX Short Put

SPX credit

Credit No shave

SPX Legs

NOT COUNTED

Margin

Profit

Profit No shave

Comments On 9/16 - 3 days before expiration, it shot up to 1030 - 10 pts below the short, then dropped on 9/17 3 points so I have a profit of $405 out of a total of $480. I would most likely get out with 2 days left on being so close to expiration If I waited and paniced and sold on 9/18 -1 day before expiration when it peaked at 1040 - the limit - then I would have lost $240 of profit at the worst. I will count this trade so we can show the LEAST return for this system Wow - IV low but the credit is really high. This went sideways so no mid-cycle rolling Another boring trading range no rollups Another boring trading range no rollups- However, went to about 1185 at expiration However, 1 day before exp on 12/18, it closed at 1090 with a profit of $335 out of $415. Probably would close the trade here and not risk 1 uncontrollable day! Our rolls are not symmetric sometimes - but not this time - we reduced margin

9/19/2003

9/16/2003

======= ===>

480

370

9/19/2003

9/18/2003 1075/110 0, 980/960 1100/112 5, 995/975 1100/112 5, 995/975

240

170

10/17/2003

9/8/2003

1084

980.7

580

520

4500

580

520

11/21/2003

10/13/2003

1099

993.4

440

380

4500

440

380

12/19/2003

11/10/2003

1097

999.6

415

335

4500

12/19/2003

12/18/2003

1100/112 5, 995/975

4500

335

255

2006 - Perazzim Capital Management, Inc. All Rights Reserved. www.breakthroughbacktesting.com

You might also like

- RRB Portal Fill in the Blanks and True/False QuestionsDocument12 pagesRRB Portal Fill in the Blanks and True/False QuestionsRambabu Tanakala100% (1)

- Scalping and Pre-set Value Trading: Horses Win MarketFrom EverandScalping and Pre-set Value Trading: Horses Win MarketNo ratings yet

- SMB - Options - Tribe - 8!20!2013 (Jeff Augen - Short Butterfly)Document8 pagesSMB - Options - Tribe - 8!20!2013 (Jeff Augen - Short Butterfly)Peter Guardian100% (4)

- Dynamic Trader Daily Report: Protective Stop AdjustmentDocument5 pagesDynamic Trader Daily Report: Protective Stop AdjustmentBudi MulyonoNo ratings yet

- Commodities Market ModuleDocument170 pagesCommodities Market ModuleSameera Kadiyala100% (1)

- WRITTEN REPORT in Local Government and RegionalDocument5 pagesWRITTEN REPORT in Local Government and RegionalRONEL GALELANo ratings yet

- Daily Technical Report: Sensex (21120) / Nifty (6277)Document4 pagesDaily Technical Report: Sensex (21120) / Nifty (6277)Raya Durai100% (1)

- Making Investment Decisions With The Net Present Value Rule: Principles of Corporate FinanceDocument25 pagesMaking Investment Decisions With The Net Present Value Rule: Principles of Corporate FinanceSalehEdelbiNo ratings yet

- Unit 2Document23 pagesUnit 2arishma raneNo ratings yet

- Quiz LaborDocument4 pagesQuiz LaborJoseph DimalantaNo ratings yet

- Compensation Income (Notes)Document6 pagesCompensation Income (Notes)Anonymous LC5kFdtc100% (1)

- Work 3Document114 pagesWork 3damienancoNo ratings yet

- Today Commodity Gold Market ReportDocument9 pagesToday Commodity Gold Market ReportRahul SolankiNo ratings yet

- Bulls and Bears On Rest: Punter's CallDocument6 pagesBulls and Bears On Rest: Punter's CallPraveenNo ratings yet

- Global Indices Global Indices Global Indices Global Indices: at A Glance at A Glance at A Glance at A GlanceDocument13 pagesGlobal Indices Global Indices Global Indices Global Indices: at A Glance at A Glance at A Glance at A GlanceindianstockmarketNo ratings yet

- Daily Technical Analysis For Equity Market For 28 MayDocument7 pagesDaily Technical Analysis For Equity Market For 28 MayTheequicom AdvisoryNo ratings yet

- DSC, 96Document30 pagesDSC, 96Venkata Ramana PothulwarNo ratings yet

- Work 4Document90 pagesWork 4damienancoNo ratings yet

- Performance of Mahurat Day Picks (Oct'2009) Till Aug'2010Document4 pagesPerformance of Mahurat Day Picks (Oct'2009) Till Aug'2010Niftyviews BlogspotNo ratings yet

- Technical Report 9th November 2011Document5 pagesTechnical Report 9th November 2011Angel BrokingNo ratings yet

- World Bank GNI per capita guidelinesDocument29 pagesWorld Bank GNI per capita guidelinesElisha WankogereNo ratings yet

- Technical Report 6th January 2012Document5 pagesTechnical Report 6th January 2012Angel BrokingNo ratings yet

- Issue & Receipt KPIs June2010Document13 pagesIssue & Receipt KPIs June2010ayazraboNo ratings yet

- Stock Picks 16/10/2009Document3 pagesStock Picks 16/10/2009Anil MadalgereNo ratings yet

- Daily Technical Report, 22.04.2013Document4 pagesDaily Technical Report, 22.04.2013Angel BrokingNo ratings yet

- Controle Mensal de Daytrade HadlerDocument29 pagesControle Mensal de Daytrade HadlerAdilson MarquesNo ratings yet

- Daily Technical Report: Sensex (16213) / NIFTY (4867)Document5 pagesDaily Technical Report: Sensex (16213) / NIFTY (4867)Angel BrokingNo ratings yet

- Free Commodity Market TipsDocument9 pagesFree Commodity Market TipsRahul SolankiNo ratings yet

- Face 2 Face V2.1Document35 pagesFace 2 Face V2.1Srinivas RNo ratings yet

- Indian Commodity Market Trading TipsDocument9 pagesIndian Commodity Market Trading TipsRahul SolankiNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily DailyTheequicom AdvisoryNo ratings yet

- IMM (CFTC) Positioning DataDocument4 pagesIMM (CFTC) Positioning Dataderailedcapitalism.comNo ratings yet

- Vishnu Trading Account Report FinvasiaDocument6 pagesVishnu Trading Account Report FinvasiaNiraj HNo ratings yet

- Today's Equity Market Report and Equity Tips 15 MayDocument7 pagesToday's Equity Market Report and Equity Tips 15 MayTheequicom AdvisoryNo ratings yet

- Technical Report 14th February 2012Document5 pagesTechnical Report 14th February 2012Angel BrokingNo ratings yet

- Technical Report 14th November 2011Document5 pagesTechnical Report 14th November 2011Angel BrokingNo ratings yet

- Weekly Journal As For 26.10Document13 pagesWeekly Journal As For 26.10indianstockmarketNo ratings yet

- 2 Jun For MembesDocument7 pages2 Jun For MembesMessageDanceNo ratings yet

- Trading Journal TemplateDocument39 pagesTrading Journal TemplateVariety VideosNo ratings yet

- Free Commodity Tips For TradersDocument9 pagesFree Commodity Tips For TradersRahul SolankiNo ratings yet

- Commodity MCX Gold and Silver Market TrendDocument9 pagesCommodity MCX Gold and Silver Market TrendRahul SolankiNo ratings yet

- 0310 Delivery - OrdercutsDocument15 pages0310 Delivery - Ordercutsshrine obenietaNo ratings yet

- Daily Technical Report: Sensex (16546) / NIFTY (5000)Document4 pagesDaily Technical Report: Sensex (16546) / NIFTY (5000)Angel BrokingNo ratings yet

- Our Presence: Epic Research India HNI & NRI Sales Contact Australia Toll Free NumberDocument8 pagesOur Presence: Epic Research India HNI & NRI Sales Contact Australia Toll Free NumberBhanuprakashReddyDandavoluNo ratings yet

- Depreciation Chart for Assets of ABC Pvt LtdDocument6 pagesDepreciation Chart for Assets of ABC Pvt LtdROHIT KUMARNo ratings yet

- A Daily Technical Report On Commodities: Recommendations For MCX, Ncdex,, Nymex, Comex, Lme, Cbot, BMD & NmceDocument4 pagesA Daily Technical Report On Commodities: Recommendations For MCX, Ncdex,, Nymex, Comex, Lme, Cbot, BMD & NmceManish ChandakNo ratings yet

- Oil and Natural Gas CorportationDocument17 pagesOil and Natural Gas CorportationChandu PatilNo ratings yet

- Daily Technical Report: Sensex (16372) / NIFTY (4906)Document5 pagesDaily Technical Report: Sensex (16372) / NIFTY (4906)Angel BrokingNo ratings yet

- Free Commodity MCX Market Research ReportDocument9 pagesFree Commodity MCX Market Research ReportRahul SolankiNo ratings yet

- Commodity Trading Tips in IndiaDocument9 pagesCommodity Trading Tips in IndiaRahul SolankiNo ratings yet

- Ibmec MBA GM EE Cases EnunciadoDocument7 pagesIbmec MBA GM EE Cases EnunciadoPaulo GarcezNo ratings yet

- Weekly Trading Highlights & OutlookDocument5 pagesWeekly Trading Highlights & OutlookDevang VisariaNo ratings yet

- Daily Technical Report: Sensex (16831) / NIFTY (5087)Document4 pagesDaily Technical Report: Sensex (16831) / NIFTY (5087)Angel BrokingNo ratings yet

- Technical Report 17th January 2012Document5 pagesTechnical Report 17th January 2012Angel BrokingNo ratings yet

- Net Income of Major Oil CompaniesDocument4 pagesNet Income of Major Oil Companiesmanish_ghai_mbaNo ratings yet

- Technical Report 12th January 2012Document5 pagesTechnical Report 12th January 2012Angel BrokingNo ratings yet

- System StrategiesDocument95 pagesSystem StrategiesAna-MariaLazarNo ratings yet

- "Soybean Volatile Week Ends in Red: Analyst SpeaksDocument10 pages"Soybean Volatile Week Ends in Red: Analyst Speaksapi-234732356No ratings yet

- Revaluation RatesDocument114 pagesRevaluation Ratespavan833No ratings yet

- Technical Report 13th October 2011Document5 pagesTechnical Report 13th October 2011Angel BrokingNo ratings yet

- Technical Report 5th January 2012Document5 pagesTechnical Report 5th January 2012Angel BrokingNo ratings yet

- Daily Technical Report, 09.05.2013Document4 pagesDaily Technical Report, 09.05.2013Angel BrokingNo ratings yet

- Technical Report 10th October 2011Document4 pagesTechnical Report 10th October 2011Angel BrokingNo ratings yet

- Crude Oil Balances - 3 Major OECD_12 Mar 2024Document11 pagesCrude Oil Balances - 3 Major OECD_12 Mar 2024phang.zhaoying.darrenNo ratings yet

- Report - Purchase and SaleDocument6 pagesReport - Purchase and Salemayurgowda143No ratings yet

- Technical Report 2nd December 2011Document5 pagesTechnical Report 2nd December 2011Angel BrokingNo ratings yet

- Equity Analysis Equity Analysis - Daily DailyDocument7 pagesEquity Analysis Equity Analysis - Daily DailyTheequicom AdvisoryNo ratings yet

- Chapter 08 Translation of Foreign Currency Financial StatementsDocument11 pagesChapter 08 Translation of Foreign Currency Financial StatementsDiana100% (1)

- REVENUE RECOGNITION LONG TERM CONSTRUCTIONDocument4 pagesREVENUE RECOGNITION LONG TERM CONSTRUCTIONCee Gee BeeNo ratings yet

- Samsung Presentation of Supply Chain CourseDocument22 pagesSamsung Presentation of Supply Chain CourseraadNo ratings yet

- Investment BankerDocument2 pagesInvestment BankerFelix OtienoNo ratings yet

- Sales Invoice: Bill To: Ship ToDocument1 pageSales Invoice: Bill To: Ship ToRoseanne CarsolaNo ratings yet

- CURRENT AFFAIRS- JANUARY: NDC SCRAPPED, JALLIKATTU ALLOWEDDocument22 pagesCURRENT AFFAIRS- JANUARY: NDC SCRAPPED, JALLIKATTU ALLOWEDPrithvi TejaNo ratings yet

- Nur Amaliyah - 041811333032 AKLDocument5 pagesNur Amaliyah - 041811333032 AKLNur AmaliyahNo ratings yet

- Payment of WagesDocument10 pagesPayment of WagesStuti DoshiNo ratings yet

- 2010 08 21 - 023852 - E15 18Document3 pages2010 08 21 - 023852 - E15 18Lương Vân TrangNo ratings yet

- Topic 6Document22 pagesTopic 6barabida3No ratings yet

- GeM 3.0 Overview PPT RevisedDocument33 pagesGeM 3.0 Overview PPT Revisednarpati100% (2)

- Six Decades, One Overriding Focus: Our Clients: Contact UsDocument8 pagesSix Decades, One Overriding Focus: Our Clients: Contact UsLeduța DomnescuNo ratings yet

- A Call For Unity, A Call To Collective ActionDocument3 pagesA Call For Unity, A Call To Collective ActionVen DeeNo ratings yet

- USADF Accelerate Africa Entrepreneurship Challenge ProposalDocument12 pagesUSADF Accelerate Africa Entrepreneurship Challenge Proposalclark philipNo ratings yet

- Clique PensDocument6 pagesClique PensNEERAJNo ratings yet

- Commerce Past Questions and AnswersDocument37 pagesCommerce Past Questions and AnswersBabucarr Nguda Jarju100% (2)

- Datamatics Ar 2015Document156 pagesDatamatics Ar 2015ajey_p1270No ratings yet

- Assignment of Product Strategy by Desta HumoDocument55 pagesAssignment of Product Strategy by Desta HumoBesufekad AmanuelNo ratings yet

- Chapter 11 - Accounting Policies, Changes in Accounting Estimates and ErrorsDocument3 pagesChapter 11 - Accounting Policies, Changes in Accounting Estimates and ErrorsFerb CruzadaNo ratings yet

- How Will You Measure Your LifeDocument19 pagesHow Will You Measure Your LifeSpencerNo ratings yet

- Portakabin Edition 16 Lesson Resource Ansoffs MatrixDocument2 pagesPortakabin Edition 16 Lesson Resource Ansoffs MatrixAwantha MaharagamaNo ratings yet

- Changshu Walsin:: Aiming To Be One of The Most Reliable and Preferred Suppliers in The High-End MarketDocument4 pagesChangshu Walsin:: Aiming To Be One of The Most Reliable and Preferred Suppliers in The High-End MarketHarish KrishnamoorthyNo ratings yet

- Differences Between Traditional and Modern BankingDocument10 pagesDifferences Between Traditional and Modern BankingVandana PrajapatiNo ratings yet