0% found this document useful (0 votes)

18 views6 pagesStatement

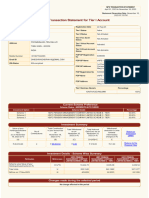

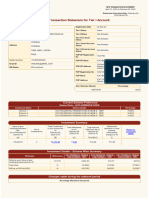

The NPS Transaction Statement for Shri Abhishek Verma covers the period from April 1, 2023, to March 31, 2024, and was generated on July 26, 2025. The statement details contributions, withdrawals, and investment performance in the Tier I account, showing a total investment value of ₹11,17,906.94 with a return on investment of 10.19%. It also outlines scheme preferences, nominee details, and transaction specifics during the reporting period.

Uploaded by

abhibeeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

18 views6 pagesStatement

The NPS Transaction Statement for Shri Abhishek Verma covers the period from April 1, 2023, to March 31, 2024, and was generated on July 26, 2025. The statement details contributions, withdrawals, and investment performance in the Tier I account, showing a total investment value of ₹11,17,906.94 with a return on investment of 10.19%. It also outlines scheme preferences, nominee details, and transaction specifics during the reporting period.

Uploaded by

abhibeeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd