Professional Documents

Culture Documents

Chap 10&11

Uploaded by

Jinee SpookOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 10&11

Uploaded by

Jinee SpookCopyright:

Available Formats

Loan Portfolio Selection and

Risk Measurement

Chapters 10 and 11

Saunders & Allen Chapters 10 & 11 2

The Paradox of Credit

Lending is not a buy and holdprocess.

To move to the efficient frontier, maximize

return for any given level of risk or

equivalently, minimize risk for any given

level of return.

This may entail the selling of loans from the

portfolio. Paradox of Credit Fig. 10.1.

Saunders & Allen Chapters 10 & 11 3

Return

The Ef f icient

Frontier

A

B

C

Risk

0

Figure 10.1 The paradox of credit.

Saunders & Allen Chapters 10 & 11 4

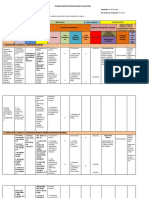

Managing the Loan Portfolio According to the

Tenets of Modern Portfolio Theory

Improve the risk-return tradeoff by:

Calculating default correlations across assets.

Trade the loans in the portfolio (as conditions

change) rather than hold the loans to maturity.

This requires the existence of a low transaction

cost, liquid loan market.

Inputs to MPT model: Expected return, Risk

(standard deviation) and correlations

Saunders & Allen Chapters 10 & 11 5

The Optimum Risky Loan

Portfolio Fig. 10.2

Choose the point on the efficient frontier

with the highest Sharpe ratio:

The Sharpe ratio is the excess return to risk

ratio calculated as:

p

f

p

rR

o

Saunders & Allen Chapters 10 & 11 6

Return (R

p

)

r

f

A

B

D

C

Risk (o

p

)

Figure 10.2 The optimum risky loan portf olio

Saunders & Allen Chapters 10 & 11 7

Problems in Applying MPT to

Untraded Loan Portfolios

Mean-variance world only relevant if

security returns are normal or if investors

have quadratic utility functions.

Need 3

rd

moment (skewness) and 4

th

moment

(kurtosis) to represent loan return distributions.

Unobservable returns

No historical price data.

Unobservable correlations

Saunders & Allen Chapters 10 & 11 8

KMVs Portfolio Manager

Returns for each loan I:

R

it

= Spread

i

+ Fees

i

(EDF

i

x LGD

i

) r

f

Loan Risks=variability around EL=EGF x

LGD = UL

LGD assumed fixed: UL

i

=

LGD variable, but independent across borrowers: UL

i

=

VOL is the standard deviation of LGD. VVOL is valuation

volatility of loan value under MTM model.

MTM model with variable, indep LGD (mean LGD): UL

i

=

) 1 ( EDF EDF

2 2

) 1 (

i i

EDFiVOL LGD EDFi EDFi +

2 2 2

) 1 ( ) 1 (

i i i

VVOL EDFi EDFiVVOL LGD EDFi EDFi + +

Saunders & Allen Chapters 10 & 11 9

Valuation Under KMV PM

Depends on the relationship between the

loans maturity and the credit horizon date:

Figure 11.1: DM if loans maturity is less

than or equal to the credit horizon date

(maturities M

1

or M

2

).

MTM if loans maturity is greater than

credit horizon date (maturity M

3

). See

Appendix 11.1 for valuation.

Saunders & Allen Chapters 10 & 11 10

0

Figure 11.1 Loan maturity ( M) v ersus loan horizon ( H).

M

1

M

2

= H M

3

Date

Saunders & Allen Chapters 10 & 11 11

Correlations

Figure 11.2 joint PD is the shaded area.

GF

= o

GF

/o

G

o

F

GF

=

Correlations higher (lower) if isocircles are

more elliptical (circular).

If JDF

GF

= EDF

G

EDF

F

then correlation=0.

) 1 ( ) 1 (

) (

F F G G

F G GF

EDF EDF EDF EDF

EDF EDF JDF

Saunders & Allen Chapters 10 & 11 12

Firm F

Firm G

Firm Fs

Debt Pay of f

100

100(1-LGD)

Market Value

of Assets - Firm G

Market Value

of Assets - Firm F

Face Value of Debt

Figure 11.2 Value correlation.

Saunders & Allen Chapters 10 & 11 13

Role of Correlations

Barnhill & Maxwell (2001): diversification can

reduce bond portfolios standard deviation from

$23,433 to $8,102.

KMV diversifies 54% of risk using 5 different

BBB rated bonds.

KMV uses asset (de-levered equity) correlations,

CreditMetrics uses equity correlations.

Correlation ranges:

KMV: .002 to .15

Credit Risk Plus: .01 to .05

CreditMetrics: .0013 to .033

Saunders & Allen Chapters 10 & 11 14

Calculating Correlations using KMV PM

Construct asset returns using OPM.

Estimate 3-level multifactor model. Estimate coefficients and then

evaluated asset variance and correlation coefficients using:

First level decomposition:

Single index model composite market factor constructed for each firm.

Second level decomposition:

Two factors: country and industry indices.

Third level decomposition:

Three sets of factors: (1) 2 global factors (market-weighted index of

returns for all firms and return index weighted by the log of MV); (2) 5

regional factors (Europe, No. America, Japan, SE Asia, Australia/NZ);

(3) 7 sector factors (interest sensitive, extraction, consumer durables,

consumer nondurables, technology, medical services, other).

Saunders & Allen Chapters 10 & 11 15

CreditMetrics Portfolio VAR

Two approaches:

Assuming normally distributed asset values.

Using actual (fat-tailed and negatively skewed)

asset distributions.

For the 2 Loan Case, Calculate:

Joint migration probabilities

Joint payoffs or loan values

To obtain portfolio value distribution.

Saunders & Allen Chapters 10 & 11 16

The 2-Loan Case Under the

Normal Distribution

Joint Migration Probabilities = the product

of each loans migration probability only if

the correlation coefficient=0.

From Table 10.1, the probability that obligor 1

retains its BBB rating and obligor 2 retains its

a rating would be 0.8693 x 0.9105 = 79.15% if

the loans were uncorrelated. The entry of

79.69% suggests a positive correlation of 0.3.

Saunders & Allen Chapters 10 & 11 17

Mapping Ratings Transitions to

Asset Value Distributions

Assume that assets are normally distributed.

Compute historic transition matrix. Figure 11.3

uses the matrix for a BB rated loan.

Suppose that historically, there is a 1.06%

probability of transition to default. This

corresponds to 2.3 standard deviations below the

mean on the standard normal distribution.

Similarly, if there is a 8.84% probability of

downgrade from BB to B, this corresponds to 1.23

standard deviations below the mean.

Saunders & Allen Chapters 10 & 11 18

Joint Transition Matrix

Can draw a figure like Fig. 11.3 for the A rated

obligor. There is a 0.06% PD, corresponding to

3.24 standard deviations below the mean; a 5.52%

probability of downgrade from A to BBB,

corresponding to 1.51 std dev below the mean.

The joint probability of both borrowers retaining

their BBB and A ratings is: the probability that

obligor 1s assets fluctuate between 1.23o to

+1.37o and obligor 2s assets between 1.51o to

+1.98o with a correlation coefficient=0.2.

Calculated to equal 73.65%.

Saunders & Allen Chapters 10 & 11 19

Class:

Transition Prob. (%):

Asset (o):

Def

1.06

2.30

CCC

1.00

2.04

B

8.84

1.23

BB

80.53

BBB

7.73

1.37

A

0.67

2.39

AA

0.14

2.93

AAA

0.03

3.43

Figure 11.3 The link between asset v alue v olatility ( )

and rating transition f or a BB rated borrower.

Saunders & Allen Chapters 10 & 11 20

Calculating Correlation

Coefficients

Estimate systematic risk of each loan the

relationship between equity returns and

returns on market/industry indices.

Estimate the correlation between each pair

of market/industry indices.

Calculate the correlation coefficient as the

weighted average of the systematic risk

factors x the index correlations.

Saunders & Allen Chapters 10 & 11 21

Two Loan Example of

Correlation Calculation

Estimate the systematic risk of each company by

regressing the stock returns for each company on

the relevant market/industry indices.

R

A

= .9R

CHEM

+ U

A

R

Z

= .74R

INS

+ .15R

BANK

+ U

Z

A,Z

=(.9)(.74)

CHEM,INS

+ (.9)(.15)

CHEM,BANK

Estimate the correlation between the indices.

If

CHEM,INS

=.16 and

CHEM,BANK

=.08, then

AZ

=0.1174.

Saunders & Allen Chapters 10 & 11 22

Joint Loan Values

Table 11.1 shows the joint migration probabilities.

Calculate the portfolios value under each of the

64 possible credit migration possibilities (using

methodology in Chap.6) to obtain the values in

Table 11.3.

Can draw the portfolio value distribution using the

probabilities in Table 11.1 and the values in Table

11.3.

Saunders & Allen Chapters 10 & 11 23

Credit VAR Measures

Calculate the mean using the values in

Table 11.3 and the probabilities in Tab 11.1.

Mean =

Variance =

Mean=$213.63 million

Standard deviation= $3.35 million

i

i

i

V p

=

64

1

2

64

1

) ( Mean V p

i

i

i

=

Saunders & Allen Chapters 10 & 11 24

Calculating the 99

th

percentile

credit VAR under normal

distribution

2.33 x $3.35 = $7.81 million

Benefits of diversification. The BBB loans

credit VAR (alone) was $6.97million.

Combining 2 loans with correlations=0.3,

reduces portfolio risk considerably.

Saunders & Allen Chapters 10 & 11 25

Calculating the Credit VAR

Under the Actual Distribution

Adding up the probabilities (from Table 11.1) in

the lowest valuation region in Table 11.3, the 99

th

percentile credit VAR using the actual (not

normal) distribution is $204.4 million.

Unexpected Losses=$213.63m - $204.4m = $9.23

million (>$7.81m).

If the current value of the portfolio = $215m, then

Expected Losses=$215m - $213.63m = $1.37m.

Saunders & Allen Chapters 10 & 11 26

CreditMetrics with More Than 2

Loans in the Portfolio

Cannot calculate joint transition matrices

for more than 2 loans because of

computational difficulties: A 5 loan

portfolio has over 32,000 joint transitions.

Instead, calculate risk of each pair of loans,

as well as standalone risk of each loan.

Use Monte Carlo simulation to obtain

20,000 (or more) possible asset values.

Saunders & Allen Chapters 10 & 11 27

Monte Carlo Simulation

First obtain correlation matrix (for each pair of

loans) using the systematic risk component of

equity prices. Table 11.5

Randomly draw a rating for each loan from that

loans distribution (historic rating migration)

using the asset correlations.

Value the portfolio for each draw.

Repeat 20,000 times! New algorithms reduce

some of the computational requirements.

The 99

th

% VAR based on the actual distribution is

the 200

th

worst value out of the 20,000 portfolio

values.

Saunders & Allen Chapters 10 & 11 28

MPT Using CreditMetrics

Calculate each loans marginal risk contribution =

the change in the portfolios standard deviation

due to the addition of the asset into the portfolio.

Table 11.6 shows the marginal risk contribution of

20 loans quite different from standalone risk.

Calculate the total risk of a loan using the

marginal contribution to risk = Marginal standard

deviation x Credit Exposure. Shown in column

(5) of Table 11.6.

Saunders & Allen Chapters 10 & 11 29

Figure 11.4

Plot total risk exposure using marginal risk

contributions (column 6 of Table 11.6) against the

credit exposure (column 5 of Table 11.4).

Draw total risk isoquants using column 5 of Table

11.6.

Find risk outliers such as asset 15 which have too

much portfolio risk ($270,000) for the loans size

($3.3 million).

This analysis is not a risk-return tradeoff. No

returns.

Saunders & Allen Chapters 10 & 11 30

0

9

8

7

6

5

4

1

2

3

0

Credit Exposure ($ Millions)

14 12 10

Isoquant Curv e of

Equal Total Risk

= $70,000

8 6 4

15

7

14

13

6

16

5

12 10

9

20 1

18

8

2 16

Figure 11.4 Credit limits and loan selection in CreditMetrics.

Saunders & Allen Chapters 10 & 11 31

Default Correlations Using Reduced Form Models

Events induce simultaneous jumps in default intensities.

Duffie & Singleton (1998): Mean reverting correlated

Poisson arrivals of randomly sized jumps in default

intensities.

Each assets conditional PD is a function of 4 parameters:

h (intensity of default process); (constant arrival prob.); k

(mean reversion rate); u (steady state constant default

intensity).

The jumps in intensity follow an exponential distribution

with mean size of jump=J.

So: probability of survival from time t to s:

p(t,s) = exp{o(s-t)+|(s-t)h(t)}

where |(t) = -(1 e

-kt

)/k

o(t) = -u[t + |(t)] [/(J+k)][Jt ln(1 - |(t)J)]

Saunders & Allen Chapters 10 & 11 32

Numerical Example

Suppose that =.002, k=.5, u=.001, J=5, h(0)=.001 (corresponds to an

initial rating of AA).

Correlations across loan default probabilities:

V

c

=common factor; V=idiosyncratic factor. As v0, corr0 As v1,

corr1.

If v=.02, V=.001, V

c

=.05: the probability that loan

i

intensity jumps

given that loan

j

has experienced a jump is = vV

c

/(V

c

+V) = 2%. If v=

.05 (instead of .02), then the probability increases to 5%.

Figure 11.5 shows correlated jumps in default intensities.

Figure 11.6 shows the impact of correlations on the portfolios risk.

= vV

c

+ V

Saunders & Allen Chapters 10 & 11 33

150

100

50

0

Marketwide

Credit Ev ent

Year

Source: Duffe and Singleton (1998), p.25.

The figure shows a portion of a simulated sample path of total default arrival

intensity (exactly 1,000 firms). An X denotes a default event.

Calendar

Time

3.4 3.2 3.8 3.6 3 2.8 2.6 2.4 2.2 4

Figure 11.5 Correlated def ault intensities.

Saunders & Allen Chapters 10 & 11 34

0

0.7

0.5

0.6

0.3

0.4

0.1

0.2

0

Time Windowm (Day s)

70

High Correlation

Medium Correlation

Low Correlation

60 90 80 50 40 30 20 10 100

Source: Duffe and Singleton (1998), p.27.

The figure shows the probabilty of an m-day interval within

10 years having four or more defaults (base case).

Figure 11.6 Portf olio def ault intended.

Saunders & Allen Chapters 10 & 11 35

Appendix 11.1: Valuing a Loan that Matures

after the Credit Horizon KMV PM

Maturity=M

3

in Figure 11.1. Use MTM to value loans.

Four Step Process:

1. Valuation of an individual firms assets using random sampling

of risk factors.

2. Loan valuation based on the EDFs implied by the firms asset

valuation.

3. Aggregation of individual loan values to construct portfolio

value.

4. Calculation of excess returns and losses for portfolio.

Yields a single estimate for expected returns (losses) for

each loan in the portfolio. Use Monte Carlo simulation

(repeated 50,000 to 200,000 times) to trace out distribution

Saunders & Allen Chapters 10 & 11 36

Step 1: Valuation of Firm Assets at

3 Time Horizons Fig. 11.7

A

0 ,

A

H ,

A

M

valuations. Stochastic process generating A

H,

A

M

:

The random component c= systematic portion f + firm-specific portion

u. Each simulation draws another risk factor.

Using A

H

and

A

M

can calculate EDF

H

and EDF

M

ln A

H

= ln A

0

+ (-.5o

2

)t

H

+ oc

H

\t

H

(11.21)

where A

H

= the asset value at the credit horizon date H,

= the expected return (drift term) on the asset valuation,

o = the volatility of asset returns,

t

H

= the credit horizon time period,

c

H

= a random risk term (assumed to follow a standard normal

distribution).

Saunders & Allen Chapters 10 & 11 37

Step 2: Loan Valuation Using

Term Structure of EDFs

Convert EDF into QDF by removing risk-adjusted ROR.

Also value loan as of credit horizon date H:

V

0

= PV

0

(1 LGD) + PV

0

(1-QDF)LGD (11.22)

where V

0

= the loans present value,

PV

0

= the present value factor using the riskfree rate to discount the loans cash flows to time t=0,

QDF = the (cumulative) risk neutral quasi-EDF,

LGD = the loss given default

V

H|ND

= C

H

+ PV

H

(1 LGD) + PV

H

(1-QDF)LGD (11.23)

where V

H|ND

= the loans expected value as of the credit horizon date given that

default has not occurred,

C

H

= the cash flow on the credit horizon date,

PV

H

= the present value factor using the riskfree rate as the discount factor to

discount the loans cash flows to time t=H.

However, there is a possibility that the loan will default on or before the credit horizon date. The expected

value of the loan given default is:

V

H|D

= (C

H

+ PV

H

)LGD

(11.24)

V

H

= (EDF) V

H|D

+ (1-EDF) V

H|ND

(11.25)

Saunders & Allen Chapters 10 & 11 38

Step 3: Aggregation to Construct Portfolio

Sum the expected values V

H

for all loans in

the portfolio.

P

t

V =

i

i

t

V (11.26)

where

P

t

V = the value of the loan portfolio at date t=0,H,

i

t

V

= the value of each loan i at date t=0,H.

Saunders & Allen Chapters 10 & 11 39

Step 4: Calculation of Excess Returns/Losses

Excess Returns on the Portfolio:

Expected Loss on the Portfolio:

Repeat steps 1 through 4 from 50,000 to 200,000 times.

H

R =

F

P

P P

H

R

V

V V

0

0

(11.27)

where R

H

= the excess return on the loan portfolio from time period 0 to

the credit

horizon date H,

P

H

V

= the expected value of the loan portfolio at the credit

horizon date,

P

V

0 = the present value of the loan portfolio,

R

F

= the riskfree rate.

0

|

V

V V

EL

H ND H

H

= (11.28)

Saunders & Allen Chapters 10 & 11 40

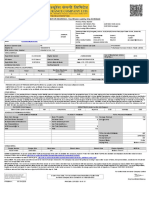

A Case Study: KMV PM valuation of 5 yr maturity

$1 loan paying a fixed rate of 10% p.a.

Using Table 11.8:

V

0

= PV

0

(1 LGD) + PV

0

(1-QDF)LGD = 1.2103(.50) + (1.0675)(.50)

= $ 1.1389

Table 11.8

Valuing the Loans Present Value

Time

Period

(1)

Cash

flows

per

period

(2)

Discount

Factor

F

tR

e

(3)

Risk-free

Present

Value of

Cashflows

(2) x (3) = (4)

EDF

i

cumulative

(5)

QDF

i

cumulative

(6)

Risky

Present

Value of

Cashflows

(7)

1 .10 .9512 .0951 .0100 .0203 .0932

2 .10 .9048 .0905 .0199 .0471 .0862

3 .10 .8607 .0861 .0297 .0770 .0795

4 .10 .8187 .0819 .0394 .1088 .0730

5 1.10 .7788 .8567 .0490 .1414 .7356

Totals 1.2103 1.0675

Saunders & Allen Chapters 10 & 11 41

Valuing the Loan at the Credit Horizon Date =1

Using Table 11.9:

V

H|ND

= C

H

+ PV

H

(1 LGD) + PV

H

(1-QDF)LGD = 0.10 +

1.1723(.50) + (1.0615)(.50) = $ 1.2169

V

H|D

= (C

H

+ PV

H

)LGD = (0.10 + 1.1723)(.50) = $ 0.63615

V

H

= (EDF) V

H|D

+ (1-EDF) V

H|ND

= (.01)(.63615) + (.99)(1.2169)

= $ 1.2111

Time

Period

(1)

Cash

flows

per

period

(2)

Discount

Factor

F

tR

e

(3)

Risk-free

Present

Value of

Cashflows

(2) x (3) = (4)

EDF

i

cumulative

(5)

QDF

i

cumulative

(6)

Risky

Present

Value of

Cashflows

(7)

1 .10 1 0

2 .10 .9512 .0951 .0100 .0203 .0932

3 .10 .9048 .0905 .0199 .0471 .0862

4 .10 .8607 .0861 .0297 .0770 .0795

5 1.10 .8187 .9006 .0394 .1088 .8026

Totals 1.1723 1.0615

Saunders & Allen Chapters 10 & 11 42

KMVs Private Firm Model

Calculate EBITDA for private firm j in industry

j

.

Calculate the average equity mulitple for industry

i

by dividing the industry average MV of equity by

the industry average EBITDA.

Obtain an estimate of the MV of equity for firm j

by multiplying the industry equity multiple by

firm js EBITDA.

Firm js assets = MV of equity + BV of debt

Then use valuation steps as in public firm model.

Saunders & Allen Chapters 10 & 11 43

Credit Risk Plus Model 2 - Incorporating Systematic

Linkages in Mean Default rates

Mean default rate is a function of factor sensitivities to different independent

sectors (industries or countries).

Table 11.7 shows as example of 2 loans sensitive to a single factor (parameters

reflect US national default rates). As credit quality declines (m gets larger),

correlations get larger.

AB

= (m

A

m

B

)

1/2

=

N

k 1

u

Ak

u

Bk

(o

k

/m

k

)

2

(11.20)

where

AB

= default correlation between obligor A and B,

m

A

= mean default rate for type A obligor,

m

B

= mean default rate for type B obligor,

u

A

= allocation of obligor A's default rate volatility across N

sectors,

u

B

= allocation of obligor B's default rate volatility across N

sectors,

(o

k

/m

k

)

2

= proportional default rate volatility in sector k.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fidp ResearchDocument3 pagesFidp ResearchIn SanityNo ratings yet

- Innovations in Land AdministrationDocument66 pagesInnovations in Land AdministrationSanjawe KbNo ratings yet

- Droplet Precautions PatientsDocument1 pageDroplet Precautions PatientsMaga42No ratings yet

- GR L-38338Document3 pagesGR L-38338James PerezNo ratings yet

- Sustainable Urban Mobility Final ReportDocument141 pagesSustainable Urban Mobility Final ReportMaria ClapaNo ratings yet

- How To Control A DC Motor With An ArduinoDocument7 pagesHow To Control A DC Motor With An Arduinothatchaphan norkhamNo ratings yet

- EnerconDocument7 pagesEnerconAlex MarquezNo ratings yet

- HealthInsuranceCertificate-Group CPGDHAB303500662021Document2 pagesHealthInsuranceCertificate-Group CPGDHAB303500662021Ruban JebaduraiNo ratings yet

- CodebreakerDocument3 pagesCodebreakerwarrenNo ratings yet

- Unit 2Document97 pagesUnit 2MOHAN RuttalaNo ratings yet

- MOTOR INSURANCE - Two Wheeler Liability Only SCHEDULEDocument1 pageMOTOR INSURANCE - Two Wheeler Liability Only SCHEDULESuhail V VNo ratings yet

- General Financial RulesDocument9 pagesGeneral Financial RulesmskNo ratings yet

- CV Ovais MushtaqDocument4 pagesCV Ovais MushtaqiftiniaziNo ratings yet

- Dike Calculation Sheet eDocument2 pagesDike Calculation Sheet eSaravanan Ganesan100% (1)

- CI Principles of EconomicsDocument833 pagesCI Principles of EconomicsJamieNo ratings yet

- Interoperability Standards For Voip Atm Components: Volume 4: RecordingDocument75 pagesInteroperability Standards For Voip Atm Components: Volume 4: RecordingjuananpspNo ratings yet

- Financial Derivatives: Prof. Scott JoslinDocument44 pagesFinancial Derivatives: Prof. Scott JoslinarnavNo ratings yet

- Gabby Resume1Document3 pagesGabby Resume1Kidradj GeronNo ratings yet

- Polytropic Process1Document4 pagesPolytropic Process1Manash SinghaNo ratings yet

- Accomplishment ReportDocument1 pageAccomplishment ReportMaria MiguelNo ratings yet

- Configuring Master Data Governance For Customer - SAP DocumentationDocument17 pagesConfiguring Master Data Governance For Customer - SAP DocumentationDenis BarrozoNo ratings yet

- Food and Beverage Department Job DescriptionDocument21 pagesFood and Beverage Department Job DescriptionShergie Rivera71% (7)

- Exp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.Document7 pagesExp. 5 - Terminal Characteristis and Parallel Operation of Single Phase Transformers.AbhishEk SinghNo ratings yet

- Walmart, Amazon, EbayDocument2 pagesWalmart, Amazon, EbayRELAKU GMAILNo ratings yet

- Gardner Denver PZ-11revF3Document66 pagesGardner Denver PZ-11revF3Luciano GarridoNo ratings yet

- Pneumatic Fly Ash Conveying0 PDFDocument1 pagePneumatic Fly Ash Conveying0 PDFnjc6151No ratings yet

- Shubham Tonk - ResumeDocument2 pagesShubham Tonk - ResumerajivNo ratings yet

- TLE - IA - Carpentry Grades 7-10 CG 04.06.2014Document14 pagesTLE - IA - Carpentry Grades 7-10 CG 04.06.2014RickyJeciel100% (2)

- Lending OperationsDocument54 pagesLending OperationsFaraz Ahmed FarooqiNo ratings yet

- 2016 066 RC - LuelcoDocument11 pages2016 066 RC - LuelcoJoshua GatumbatoNo ratings yet