Professional Documents

Culture Documents

Banking Services

Uploaded by

beautykimberly0 ratings0% found this document useful (0 votes)

23 views11 pagesOriginal Title

Kim

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views11 pagesBanking Services

Uploaded by

beautykimberlyCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 11

Banking Services

The Deposit Function

One of the most important functions of the bank is to

accept deposits from the public for the purpose of

lending. A policy document in deposits, outlines the

guiding principles in respect of formulation of various

deposit products offered by the Bank and terms and

conditions governing the conduct of account. The

document recognizes the rights of depositors and aims

at dissemination of information w/ regard to various

aspects of acceptance of deposits from the members of

the public, conduct and operations of various deposit

accounts, closure of deposit accounts, method of

disposal of deposits of deceased depositors, etc., for

the benefit of the customers.

Deposit Defined :

Money transferred into a customer's account at

a financial institution.

Types of Deposit Accounts:

While various deposit products offered by the

Bank are assigned different names. The deposit

products can be categorized broadly into the

following types. Definition of major deposits

schemes are as under:

Demand Deposits- means a deposit received by the

Bank which is withdrawable on demand.

Savings Deposits- means a form of demand

deposit which is subject to restrictions as to the number of

withdrawals as also the amounts of withdrawals permitted

by the Bank during any specified period.

Time/Term Deposits- means a deposit received

by the Bank for a fixed period, withdrawable only after

the expiry of the fixed period and include deposits such

as Recurring/ Double Benefit deposits/ Short Deposits/

Fixed Deposits.

Current Account- means a form of demand deposit

wherefrom withdrawals are allowed any number of times

depending upon the balance in the account or up to a

particular agreed amount and will also include other deposit

accounts which are neither Savings Deposit nor Term

Deposit.

Checking Account- A deposit account held at a

bank or other financial institution, for the purpose of

securely and quickly providing frequent access to funds on

demand, through a variety of different channels. Because

money is available on demand these accounts are also

referred to as demand accounts or demand deposit

accounts.

Account Opening and Operation of

Deposit Accounts

The account opening forms and other material would be

provided to the prospective depositor by the Bank. The

same will contain details of information to be furnished and

documents to be produced for verification and or for

record, it is expected of the Bank official opening the

account to explain the procedural formalities and provide

necessary clarifications sought by the prospective

depositor when he approaches for opening a deposit

account.

•For deposit products like Savings Bank Account and

Current Deposit Account, the Bank will normally stipulate

certain minimum balances to be maintained as part of

terms and conditions governing operation of such

accounts. Failure to maintain minimum balance in the

account will attract levy of charges as specified by the

Bank from time to time. For Saving Bank Account the

Bank may also place restrictions on number of

transactions, cash withdrawals, etc., for given period.

Similarly, the Bank may specify charges for issue of

cheques books, additional statement of accounts,

duplicate pass book, folio charges, etc. All such details,

regarding terms and conditions for operation of the

accounts and schedule of charges for various services

provided will be communicated to the prospective

depositor while opening the account.

•Deposit accounts can be opened by an individual in his

own name (status : known as account in single name) or

by more than one individual in their own names (status :

known as Joint Account) . Savings Bank Account can also

be opened by a minor jointly with natural guardian or with

mother as the guardian (Status : known as Minor's

Account). Minors above the age of 10 will also be allowed

to open and operate saving bank account independently.

The deposit accounts may be transferred to any other

branch of the Bank at the request of the depositor

Insurance Cover for Deposits:

Some bank deposits are covered under the insurance

scheme offered by PDIC subject to certain limits and

conditions. The details of the insurance cover in force,

will be made available to the depositor.

The End

You might also like

- DownloadDocument14 pagesDownloadashadabral.bjpNo ratings yet

- Comprehensive Deposit PolicyDocument13 pagesComprehensive Deposit PolicyShakirkapraNo ratings yet

- HSBC Model Policy on Bank DepositsDocument6 pagesHSBC Model Policy on Bank DepositsprojectbmsNo ratings yet

- Policy On Bank Deposits PreambleDocument8 pagesPolicy On Bank Deposits PreambleJOGA SINGHNo ratings yet

- DEMAND DEPOSITS: These Are The Deposit Accounts From WhichDocument3 pagesDEMAND DEPOSITS: These Are The Deposit Accounts From WhichShubhanjaliNo ratings yet

- Deposit Policy: 3.1.1 Savings AccountDocument15 pagesDeposit Policy: 3.1.1 Savings AccountKumar RockyNo ratings yet

- DIFFERENT TYPES OF DEPOSIT PRODUCTSDocument6 pagesDIFFERENT TYPES OF DEPOSIT PRODUCTSKulgeet TanyaNo ratings yet

- Policy On Bank Deposits: PreambleDocument6 pagesPolicy On Bank Deposits: PreambleLukumoni GogoiNo ratings yet

- Policy On Bank DepositsDocument11 pagesPolicy On Bank DepositsAnshuman SharmaNo ratings yet

- SIB's Policy On Bank Deposits: PreambleDocument8 pagesSIB's Policy On Bank Deposits: PreamblenithiananthiNo ratings yet

- Customer Deposit Policy 03.05.2018Document10 pagesCustomer Deposit Policy 03.05.2018Rupan ChakrabortyNo ratings yet

- Annexure: 1.0 PreambleDocument6 pagesAnnexure: 1.0 PreambleBala CoolNo ratings yet

- General GuidelinesDocument385 pagesGeneral GuidelinesRuchi SharmaNo ratings yet

- Deposit Poicy 2018 20 25082020Document27 pagesDeposit Poicy 2018 20 25082020NK PKNo ratings yet

- Types of DepOSIT 15-18-21-22Document94 pagesTypes of DepOSIT 15-18-21-22Saurab JainNo ratings yet

- Chapter 5 EditedDocument10 pagesChapter 5 EditedSeid KassawNo ratings yet

- Deposit Account: 1 Major TypesDocument3 pagesDeposit Account: 1 Major TypesdeepakNo ratings yet

- 2-Notes On Banking Products & Services-Part 1Document16 pages2-Notes On Banking Products & Services-Part 1Kirti GiyamalaniNo ratings yet

- Bank Reserves and Bank DepositsDocument2 pagesBank Reserves and Bank DepositsH-Sam PatoliNo ratings yet

- Banking Practice and Procedure Chapter TwoDocument27 pagesBanking Practice and Procedure Chapter TwoDEREJENo ratings yet

- Banker and CustomerrelationshipDocument27 pagesBanker and CustomerrelationshipVasu DevanNo ratings yet

- Customers Account With BankerDocument11 pagesCustomers Account With Bankerrkrakib073No ratings yet

- Chapter 2 Types of Bank Accounts-3-1Document36 pagesChapter 2 Types of Bank Accounts-3-1hncd6h2zyqNo ratings yet

- Bank Detail by SidDocument20 pagesBank Detail by Sidsiddhartha bhattacharjeeNo ratings yet

- Q.1 Define A Banker.: Fixed Deposit Account: Fixed Deposit Account Is Also Known As Time DepositDocument3 pagesQ.1 Define A Banker.: Fixed Deposit Account: Fixed Deposit Account Is Also Known As Time DepositYeezy YeezyNo ratings yet

- Chapter - 9 Opening and Operating Bank AccountsDocument12 pagesChapter - 9 Opening and Operating Bank AccountsMd Mohsin AliNo ratings yet

- Bank Advances Types FormsDocument11 pagesBank Advances Types FormsSachin TiwariNo ratings yet

- Assignment Banking 3Document9 pagesAssignment Banking 3Al RafiNo ratings yet

- Bank Final TheissDocument17 pagesBank Final TheissfaizanvaidaNo ratings yet

- Demand Deposits Explained: Types, Features & RegulationsDocument10 pagesDemand Deposits Explained: Types, Features & RegulationsAlexa Joy InguilloNo ratings yet

- Module 2Document57 pagesModule 2Tejaswini TejuNo ratings yet

- Traditional Banking Activities: GovernmentDocument14 pagesTraditional Banking Activities: GovernmentamitkumaraxnNo ratings yet

- Opening and Operation of Accounts-SBDocument41 pagesOpening and Operation of Accounts-SBnurul000No ratings yet

- Functions of Commercial BanksDocument52 pagesFunctions of Commercial BanksPulkit_Saini_789No ratings yet

- Unit 4: Ethiopian Bank'S Loans and Advances ProceduresDocument37 pagesUnit 4: Ethiopian Bank'S Loans and Advances Proceduresመስቀል ኃይላችን ነውNo ratings yet

- What Is A Bank AccountDocument6 pagesWhat Is A Bank AccountJan Sheer ShahNo ratings yet

- Commercial BankingDocument12 pagesCommercial BankingwubeNo ratings yet

- Bank DepositDocument8 pagesBank DepositHarmin ViraNo ratings yet

- Chap 1. Banking System in IndiaDocument24 pagesChap 1. Banking System in IndiaShankha MaitiNo ratings yet

- BankingDocument19 pagesBankingTipu SultanNo ratings yet

- What Is BankDocument19 pagesWhat Is BankSunayana BasuNo ratings yet

- CCBSDocument27 pagesCCBSNarender SinghNo ratings yet

- Name:-Satish Keshav Magar: Roll No:-33782Document22 pagesName:-Satish Keshav Magar: Roll No:-33782Satish MagarNo ratings yet

- Lession 3 OperationsDocument13 pagesLession 3 Operationssusma susmaNo ratings yet

- Important Functions of Bank: What Is A Bank?Document3 pagesImportant Functions of Bank: What Is A Bank?Samiksha PawarNo ratings yet

- 4.account Opening RequirmentsDocument16 pages4.account Opening RequirmentsTaonga Jean BandaNo ratings yet

- General BankingDocument59 pagesGeneral BankingKhaleda AkhterNo ratings yet

- Lecture # 20 Branch Banking in PakistanDocument55 pagesLecture # 20 Branch Banking in PakistanImran YousafNo ratings yet

- Types of Bank DepositeDocument4 pagesTypes of Bank DepositeShailendrasingh DikitNo ratings yet

- Banking Functions and ServicesDocument7 pagesBanking Functions and ServicesMitali aroraNo ratings yet

- 3relation Between Banker and CastomerDocument12 pages3relation Between Banker and Castomertanjimalomturjo1No ratings yet

- HDFC Bank SME Business Banking ServicesDocument15 pagesHDFC Bank SME Business Banking ServicesKartik TrivediNo ratings yet

- Functions of BanksDocument3 pagesFunctions of BanksEbne FahadNo ratings yet

- (A.) Commercial Banks - FunctionsDocument3 pages(A.) Commercial Banks - FunctionsEPP-2004 HaneefaNo ratings yet

- Major Types: Deposit Account Bank AccountDocument1 pageMajor Types: Deposit Account Bank AccountslyothersNo ratings yet

- Sources of Funds For A BankDocument9 pagesSources of Funds For A BankViral ElaviaNo ratings yet

- Banking CH 5Document22 pagesBanking CH 5Bicaaqaa M. AbdiisaaNo ratings yet

- Presentation of B&i (1) - 1Document23 pagesPresentation of B&i (1) - 1Manish ChauhanNo ratings yet

- Banking Theory and Practice Chapter TwoDocument40 pagesBanking Theory and Practice Chapter Twomubarek oumerNo ratings yet

- Materi Pertemuan Ke 9Document12 pagesMateri Pertemuan Ke 9Shelli AriestaNo ratings yet

- Join Conditions Used in Oracle Apps (GL, AP, Ar, Inv Etc) and Key TablesDocument7 pagesJoin Conditions Used in Oracle Apps (GL, AP, Ar, Inv Etc) and Key TablesSiddiq MohammedNo ratings yet

- Columban College, Inc: The Following Are The Account Titles and Their Normal BalancesDocument3 pagesColumban College, Inc: The Following Are The Account Titles and Their Normal BalancesAriaiza SanpiaNo ratings yet

- Solution To Illustrative Problem On Petty Cash FundDocument3 pagesSolution To Illustrative Problem On Petty Cash FundHoy CrushNo ratings yet

- 001-MV. Ella 1.21.00001Document1 page001-MV. Ella 1.21.00001Slamet HandokoNo ratings yet

- Chapter 1Document29 pagesChapter 1Jagriti DhatwaliaNo ratings yet

- RoundaboutDocument15 pagesRoundaboutMuhammad MuhaiminNo ratings yet

- Parcel Tracking System For Courier CompaDocument49 pagesParcel Tracking System For Courier CompaBashir IdrisNo ratings yet

- HCIP-Datacom-WAN Planning and Deployment V1.0 Training MaterialDocument701 pagesHCIP-Datacom-WAN Planning and Deployment V1.0 Training MaterialPius YeoNo ratings yet

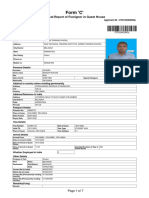

- Form 'C': Arrival Report of Foreigner in Guest HouseDocument7 pagesForm 'C': Arrival Report of Foreigner in Guest HouseGursimranjeet SinghNo ratings yet

- 3.26.24.EchoStar ExpDocument3 pages3.26.24.EchoStar Expmichael.kanNo ratings yet

- Telemedicine PPT 2Document17 pagesTelemedicine PPT 2Rikky AbdulNo ratings yet

- Packet Tracer - Point-To-Point Single-Area Ospfv2 ConfigurationDocument6 pagesPacket Tracer - Point-To-Point Single-Area Ospfv2 ConfigurationErik TampubolonNo ratings yet

- Elektronik Vizesi: Türkiye CumhuriyetiDocument1 pageElektronik Vizesi: Türkiye CumhuriyetiSajad HaidariNo ratings yet

- 7ps of ShivaniDocument9 pages7ps of ShivaniPranay JuwatkarNo ratings yet

- Saadiq SOCDocument31 pagesSaadiq SOCjoshmalikNo ratings yet

- Week 2 Marketing Channels and Value NetworksDocument55 pagesWeek 2 Marketing Channels and Value NetworksDiego OchoaNo ratings yet

- Wireless Router Market - Innovations & Competitive Analysis - Forecast - Facts and TrendsDocument2 pagesWireless Router Market - Innovations & Competitive Analysis - Forecast - Facts and Trendssurendra choudharyNo ratings yet

- Capital Adequacy Ratio (CAR) : Imam Ghozali Diponegoro UniversityDocument18 pagesCapital Adequacy Ratio (CAR) : Imam Ghozali Diponegoro UniversityDyas Aryani PutriNo ratings yet

- Grangemouth Statement Usd - Eur (Pags 1-3)Document5 pagesGrangemouth Statement Usd - Eur (Pags 1-3)Aristegui Noticias100% (1)

- APPS Rating and ReviewsDocument83 pagesAPPS Rating and ReviewsApurbh Singh KashyapNo ratings yet

- The 4 Different Types of TelepharmacyDocument8 pagesThe 4 Different Types of TelepharmacyAnonymous EAPbx6No ratings yet

- 3D Debriefing Report PPT TemplatesjDocument67 pages3D Debriefing Report PPT TemplatesjAHMED BARNATNo ratings yet

- BRS Practice QuestionsDocument2 pagesBRS Practice Questionssyed ali raza kazmiNo ratings yet

- Dealership Pricelist Format1 On Road With Accessories Aug-21 - IndividualDocument8 pagesDealership Pricelist Format1 On Road With Accessories Aug-21 - IndividualHrishikesh SwamiNo ratings yet

- Credit Collection Units 1 3Document46 pagesCredit Collection Units 1 3elle gutierrezNo ratings yet

- PhilHealth Online Access FormDocument1 pagePhilHealth Online Access FormEqual PrintsNo ratings yet

- Power of AttorneyDocument1 pagePower of AttorneyAubrien Fachi MusambakarumeNo ratings yet

- Customer Perception Towards HDFC Standard LifeDocument78 pagesCustomer Perception Towards HDFC Standard LiferahulmalladiNo ratings yet

- Switching TechniquesDocument6 pagesSwitching TechniquesNoman M HasanNo ratings yet