Professional Documents

Culture Documents

The Import-Export Process of A Product or Service From and To Colombia

Uploaded by

Miguel Angel Porras Macias0 ratings0% found this document useful (0 votes)

7 views5 pagesOriginal Title

The import-export process of a product or service from and to Colombia.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views5 pagesThe Import-Export Process of A Product or Service From and To Colombia

Uploaded by

Miguel Angel Porras MaciasCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 5

The import-export process of a product or service

from and to Colombia

Miguel Angel Porras Macas

SENA INTERNATIONAL NEGOTIATION

Colombia is one of the nations with the most promising

development in terms of its export potential, having

natural benefits such as its geographical position and the

richness of its natural diversity positions it as an

important player in the future in the trade of agricultural

products and prepares its economy for a transition from

dependence on the sale of fossil fuels for the

dollarization of its economy below we will look at the

process and documents required to carry out import and

export procedures in Colombia

In order to carry out the export procedure in Colombia, the following requirements

must be met with the corresponding authorities

Location of the tariff subheading

Registration as an exporter with DIAN

Market research and location of potential demand

Good viewing procedures: Depending on the product to be exported some

require, good viewing and/or prior export authorization permits.

Export declaration DEX

Certificate of Origin

Commercial invoice document.

Packing list document (if required).

Sanitary records or good sightings (if required by the product).

Transport documents.

In order to carry out the import procedure in Colombia, the following requirements must

be met and the corresponding documents filled out before the respective authority

Location of the tariff item

Marketing Study A market and economic feasibility study of the importation must be

carried out, analyzing among other aspects: price of the product in the international

market, international transport costs, nationalization costs and other expenses to

which it may lead.

Identification of the product The following must be taken into account before

commencing the import formalities:

Obtain all information about the product, such as: brand, reference and/or model,

technical characteristics, manufacturing materials, use, quality and whether it is new

or used merchandise.

Check the tariff position of the product to be imported so that through it, you can

know the customs taxes (tariff duty and sales tax, (VAT) and other import

requirements.

Verify if the product to be imported is subject to prior ICA, INVIMA, Ministry of Mines,

Environment, Superintendence of Surveillance and Private Security, Superintendency

of Industry and Commerce or INCODER (Entity that gathers the Incora, Inat, Inpa and

DRI) good views and inscriptions. If your product is not subject to any prerequisite, no

import registration authorization is required.

The importer must apply for the single tax registration (RUT) at the National Tax and

Customs Directorate to apply for the Tax Identification Number NIT.

Import Registration (if required)

Exchange procedure in imports: The Exchange Regime establishes the obligation to

channel payment through the intermediaries of the exchange market authorized by

law (commercial banks, financial corporations, etc.), the importer must transfer

abroad the foreign currency corresponding to the payment of the import, after

completing the form Declaration of Exchange No. 1.

Import declaration

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Palms Factsheet May 2021 60a66f688a143Document7 pagesThe Palms Factsheet May 2021 60a66f688a143Miguel Angel Porras MaciasNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

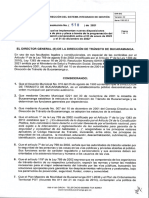

- Resolucion 519 2021 Pico y PlacaDocument11 pagesResolucion 519 2021 Pico y PlacaMiguel Angel Porras MaciasNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Lee MeDocument1 pageLee MeAlejandЯo MoЯtigo EncisoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Paint Shop Pro PhotoDocument1 pagePaint Shop Pro PhotoMiguel Angel Porras MaciasNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- w7 Loader Read MeDocument15 pagesw7 Loader Read MeAlice SmithNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Code Nan GBHFDocument1 pageCode Nan GBHFMiguel Angel Porras MaciasNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Import-Export Process of A Product or Service From and To ColombiaDocument5 pagesThe Import-Export Process of A Product or Service From and To ColombiaMiguel Angel Porras MaciasNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Call Centre Investment ProposalDocument3 pagesCall Centre Investment ProposalPredueElleNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The International Marketing ImperativeDocument12 pagesThe International Marketing Imperativeamilee_nsuNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Business Plan For Solar Energy SystemDocument40 pagesBusiness Plan For Solar Energy Systemsatsangiy89% (9)

- Magnik Final - Docx 1 PDFDocument37 pagesMagnik Final - Docx 1 PDFKate WintersNo ratings yet

- Summer Internship ReportDocument47 pagesSummer Internship Reportsomesh bubna100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Green Purchase BehaviorDocument10 pagesGreen Purchase BehaviorJoel Nolan de CarvalhoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Interbrand's Brand Valuation SDM AssignmentDocument3 pagesInterbrand's Brand Valuation SDM Assignmenttaran.bhasinNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- ResumeDocument4 pagesResumeA-g ApolloNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- De La Salle University College of Business Course Checklist: Basirec SystandDocument2 pagesDe La Salle University College of Business Course Checklist: Basirec SystandncllpdllNo ratings yet

- ACCA F2 2012 NotesDocument18 pagesACCA F2 2012 NotesThe ExP GroupNo ratings yet

- Industrial Marketing Notes 2023Document36 pagesIndustrial Marketing Notes 2023Ouni PatrickNo ratings yet

- Sustainable Supply Chain TrainingDocument10 pagesSustainable Supply Chain Trainingskmc002No ratings yet

- Syllabus Ebd 2033-Industrial OrganizationDocument4 pagesSyllabus Ebd 2033-Industrial OrganizationAdib RedzaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hershey's Strengths in Market Leadership, Social Responsibility & InnovationDocument2 pagesHershey's Strengths in Market Leadership, Social Responsibility & InnovationSamantha Dianne CalanaoNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- UT Dallas Syllabus For mkt6332.501 06s Taught by Abhijit Biswas (Axb019100)Document4 pagesUT Dallas Syllabus For mkt6332.501 06s Taught by Abhijit Biswas (Axb019100)UT Dallas Provost's Technology GroupNo ratings yet

- The Basics of Business Management Vol IIDocument340 pagesThe Basics of Business Management Vol IITran AnhNo ratings yet

- This Is MarketingDocument201 pagesThis Is Marketingmarketing joviste100% (21)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- VideoconDocument43 pagesVideoconromey231100% (2)

- Calculate park customer costs for two port optionsDocument7 pagesCalculate park customer costs for two port optionsAVINASH TOPNO100% (1)

- Business Plan DETAILDocument4 pagesBusiness Plan DETAILAnnabelle Poniente HertezNo ratings yet

- Cannes Lions 2019 - Entertainment Lions WinnersDocument1 pageCannes Lions 2019 - Entertainment Lions Winnersadobo magazineNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Cover Letter Template W ExampleDocument2 pagesCover Letter Template W ExampleNatasha Putri BalqisNo ratings yet

- Chapter 6 Human Resource PlanningDocument7 pagesChapter 6 Human Resource PlanningBrijesh ShuklaNo ratings yet

- Maybank Card - Convenience, Savings and Rewards: Maybank Islamic Berhad (787435-M)Document4 pagesMaybank Card - Convenience, Savings and Rewards: Maybank Islamic Berhad (787435-M)azjNo ratings yet

- 1st Periodical Exam in Principles of Marketing ReviewerDocument6 pages1st Periodical Exam in Principles of Marketing ReviewerJaderick BalboaNo ratings yet

- HND Project Management NotesDocument16 pagesHND Project Management Notesanon_361490068No ratings yet

- HBTU Kanpur Placement Details 2021-22Document15 pagesHBTU Kanpur Placement Details 2021-22Yakshit JoshiNo ratings yet

- Pricing Strategy Worksheet: PurposeDocument8 pagesPricing Strategy Worksheet: PurposeN. AfiqahNo ratings yet

- Payless Fashion: Increasing Sales through Luxury-Meets-Low-Price StrategyDocument13 pagesPayless Fashion: Increasing Sales through Luxury-Meets-Low-Price StrategyMitzi Villanueva PahutanNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)