Professional Documents

Culture Documents

ABM1 Branches Accounting

Uploaded by

Kassandra Kay0 ratings0% found this document useful (0 votes)

245 views17 pagesOriginal Title

ABM1-Branches-Accounting

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

245 views17 pagesABM1 Branches Accounting

Uploaded by

Kassandra KayYou are on page 1of 17

Fundamentals of Accountancy,

Business and Management 1

Lecture No. 2

Kassandra Kay K. De Roxas, MMT

Branches of Accounting

Content Standards

The learners demonstrate an understanding of the varied branches and

areas of accounting, particularly:

Financial Accounting

Management Accounting

Government Accounting

Auditing

Tax Accounting

Cost Accounting

Accounting Education

Accounting Research

Branches of Accounting

Performance Standards

The learners shall be able to:

• make a list of business within the community on the types

of accounting services they require.

• solve exercises in the identification of the branches of

accounting described through the types of services

rendered.

Branches of Accounting

Learning Competencies

The learners shall be able to :

• Differentiate the branches of accounting. (ABM_FABM11-IIIa-5)

• Explain the kinds/types of services rendered in each of

these branches. (ABM_FABM11-IIIa-5)

Branches of Accounting

Motivation:

Draw a big tree with eight branches. Label the root of

the tree as ’Accounting’.

Branches of Accounting

According to Investopedia,

(http://www.investopedia.com/university/accounting/ac

counting2.asp:

“Accounting is divided into several branches to better

serve the needs of different users with varying

information needs. These branches sometimes overlap

and they are often closely intertwined.”

Financial Accounting

• Financial accounting is the broadest branch and is focused

on the needs of external users.

• Financial accounting is primarily concerned with the

recognition, measurement and communication of economic

activities. This information is communicated in a complete

set of financial statements.

• It is assumed under this branch that the users have one

common information need.

Financial Accounting

• Financial accounting conforms with accounting standards

developed by standard-setting bodies. In the Philippines, there is a

Council created to set these standards.

• Examples of these financial reports include:

– the balance sheet (statement of financial condition)

– income statement (the profit and loss statement, or P&L)

– statement of cash flows

• Financial accounting is primarily concerned with processing

historical data. Although financial accounting generally meets the

needs of external users, internal users of accounting information

also use these information for their decision-making needs.

Management (or Managerial) Accounting

• Management accounting emphasizes the preparation and analysis

of accounting information within the organization.

• The objective of managerial accounting is to provide timely and

relevant information for those internal users of accounting

information, such as the managers and employees in their

decision-making needs.

• Oftentimes, these are sensitive information and is not distributed

to those outside the business - for example, prices, plans to open

up branches, customer list, etc.

• Managerial accounting involves financial analysis, budgeting and

forecasting, cost analysis, evaluation of business decisions, and

similar areas.

Government Accounting

• Government accounting is the process of recording, analyzing,

classifying, summarizing, communicating and interpreting

financial information about the government in aggregate and in

detail reflecting transactions and other economic events

involving the receipt, spending, transfer, usability and

disposition of assets and liabilities.

• This branch of accounting deals with how the funds of the

government are recorded and reported.

• Government accounting deals with these transactions, the

recording of inflow and outflow of funds of the government.

Auditing

• There are two types of auditing: external and internal auditing.

• External auditing

– refers to the examination of financial statements by an

independent CPA (Certified Public Accountant) with the purpose

of expressing an opinion as to fairness of presentation and

compliance with the generally accepted accounting principles

(GAAP).

– The audit does not cover 100% of the accounting records but the

CPA reviews a selected sample of these records and issues an

audit report.

Auditing

• There are two types of auditing: external and internal auditing.

• Internal auditing

– deals with determining the operational efficiency of the company

regarding the protection of the company’s assets, accuracy and

reliability of the accounting data, and adherence to certain

management policies.

– It focuses on evaluating the adequacy of a company's internal

control structure by testing segregation of duties, policies and

procedures, degrees of authorization, and other controls

implemented by management.

Tax Accounting

• Helps clients follow rules set by tax authorities.

• It includes tax planning and preparation of tax

returns.

• It also involves determination of income tax and

other taxes, tax advisory services such as ways to

minimize taxes legally, evaluation of the

consequences of tax decisions, and other tax-

related matters.

Cost Accounting

• Sometimes considered as a subset of management accounting,

cost accounting refers to the recording, presentation, and analysis

of manufacturing costs. Cost accounting is very useful in

manufacturing businesses since they have the most complicated

costing process.

• Cost accountants also analyze actual and standard costs to help

managers determine future courses of action regarding the

company's operations.

• Cost accounting will also help the owner set the selling price of his

products. For example, if the cost accounting records shows that

the total cost to produce one can of sardines is PHP50, then the

owner can set the selling price at PHP60.

Accounting Education

• This branch of accounting deals with developing future accountants

by creating relevant accounting curriculum. Accounting

professionals can become faculty members of educational

institutions.

• Accounting educators contribute to the development of the

profession through their effective teaching, publications of their

research and influencing students to pursue careers in accounting.

• Accounting teachers share their knowledge on accounting so that

students are informed of the importance of accounting and its use

in our daily lives.

Accounting Research

• Accounting research focuses on the search for new knowledge on

the effects of economic events on the process of summarizing,

analyzing, verifying, and reporting standardized financial

information, and on the effects of reported information on

economic events.

• Researchers typically choose a subject area and a methodology

on which to focus their efforts.

• The subject matter of accounting research may include information

systems, auditing and assurance, corporate governance,

financials, managerial, and tax.

• Accounting research plays an essential part in creating new

knowledge.

Accounting Research

• Academic accounting research "addresses all aspects of the

accounting profession" using a scientific method.

• Practicing accountants also conduct accounting research that

focuses on solving problems for a client or group of clients.

• The Accounting research helps standard-setting bodies around the

world to develop new standards that will address recent issues or

trend in global business.

You might also like

- Tinas Resturant AnalysisDocument19 pagesTinas Resturant Analysisapi-388014325100% (2)

- Auditing Case 3Document12 pagesAuditing Case 3Kenny Mulvenna100% (6)

- Q4 ABM Business Finance 12 Week 1 2Document3 pagesQ4 ABM Business Finance 12 Week 1 2Kinn Jay0% (1)

- Branches of AccountingDocument15 pagesBranches of AccountingIsrael Liwliwa50% (2)

- SHS 21ST CenturyDocument75 pagesSHS 21ST CenturyROGER91% (11)

- DRW Questions 2Document16 pagesDRW Questions 2Natasha Elena TarunadjajaNo ratings yet

- Java Programming: Lab Assignment 2Document17 pagesJava Programming: Lab Assignment 2Sanjana chowdary50% (4)

- Branches of Accounting ExplainedDocument54 pagesBranches of Accounting ExplainedAbby Rosales - Perez100% (1)

- SLK Fabm1 Week 2Document8 pagesSLK Fabm1 Week 2Mylene SantiagoNo ratings yet

- FABM2 Module-1Document18 pagesFABM2 Module-1Jean Carlo Delizo CacheroNo ratings yet

- FABM 1.module 2Document21 pagesFABM 1.module 2SHIERY MAE FALCONITINNo ratings yet

- FABM1 WEEK 4 finalOKCHECKEDDocument12 pagesFABM1 WEEK 4 finalOKCHECKEDMark Anthony GarciaNo ratings yet

- Types of Businesses by Activities: Service, Merchandising & ManufacturingDocument16 pagesTypes of Businesses by Activities: Service, Merchandising & ManufacturingAdrianChrisArciagaArevaloNo ratings yet

- Fundamentals of AccountancyDocument9 pagesFundamentals of AccountancyMarlyn LotivioNo ratings yet

- Cieverose College, Inc.: Fundamentals of Accountancy, Business and Management 2Document10 pagesCieverose College, Inc.: Fundamentals of Accountancy, Business and Management 2Venus Frias-Antonio100% (1)

- Fabm 2: LEARNING ACTIVITIES - Statement of Comprehensive Income (SCI)Document2 pagesFabm 2: LEARNING ACTIVITIES - Statement of Comprehensive Income (SCI)Cameron VelascoNo ratings yet

- Journalizing ProcessDocument32 pagesJournalizing ProcessMarquez, Lynn Andrea L.No ratings yet

- Week 7Document6 pagesWeek 7Anabel BahintingNo ratings yet

- FABM1 Q4 Module 13Document12 pagesFABM1 Q4 Module 13Earl Christian BonaobraNo ratings yet

- Grade11 Fabm1 Q2 Week1Document22 pagesGrade11 Fabm1 Q2 Week1Mickaela MonterolaNo ratings yet

- Learning Module: Community Colleges of The PhilippinesDocument44 pagesLearning Module: Community Colleges of The PhilippinesGianina De LeonNo ratings yet

- Books of AccountsDocument42 pagesBooks of AccountsCharlize Marie Dula-ogonNo ratings yet

- FABM 2Document261 pagesFABM 2Pep AtienzaNo ratings yet

- Statement of Changes in Equity (SCE)Document72 pagesStatement of Changes in Equity (SCE)GSOCION LOUSELLE LALAINE D.100% (1)

- Fabm1 q3 Mod1 Introductiontoaccounting FinalDocument20 pagesFabm1 q3 Mod1 Introductiontoaccounting FinalJomark RebolledoNo ratings yet

- Abm-12 Midterm ExamDocument4 pagesAbm-12 Midterm ExamMich Valencia100% (2)

- FABM1 Q4 Module 14Document15 pagesFABM1 Q4 Module 14Earl Christian BonaobraNo ratings yet

- Chapter 2: Accounting Equation and The Double-Entry SystemDocument15 pagesChapter 2: Accounting Equation and The Double-Entry SystemSteffane Mae Sasutil100% (1)

- Fabm1 PPTDocument65 pagesFabm1 PPTBenjie Galicia AngelesNo ratings yet

- Abm DLP Part 3Document10 pagesAbm DLP Part 3lyndon ReciñaNo ratings yet

- FABM1 Lesson2-1 Branches of AccountingDocument12 pagesFABM1 Lesson2-1 Branches of AccountingKassandra KayNo ratings yet

- Fabm1 Module 1 Week 1Document8 pagesFabm1 Module 1 Week 1Alma A CernaNo ratings yet

- Fundamentals of Accountancy, Business and Management 1 Accounting Cycle of A Merchandising BusinessDocument13 pagesFundamentals of Accountancy, Business and Management 1 Accounting Cycle of A Merchandising BusinessVenice100% (1)

- g12 Fabm2 Week 6Document10 pagesg12 Fabm2 Week 6Whyljyne GlasanayNo ratings yet

- Accounting as an Information SystemDocument9 pagesAccounting as an Information SystemDyvine100% (1)

- Q1WK2-accounting 1Document6 pagesQ1WK2-accounting 1Brian Reyes GangcaNo ratings yet

- Preparing SFP of Single Propriertorship BusinessDocument18 pagesPreparing SFP of Single Propriertorship Businessjudith100% (2)

- Fabm2 Module Week 1Document8 pagesFabm2 Module Week 1Mylene Santiago100% (1)

- Fundamentals of Accountancy, Business and Management 2 2: Statement of Financial Position - Report FormDocument15 pagesFundamentals of Accountancy, Business and Management 2 2: Statement of Financial Position - Report FormM i n m i n z ..No ratings yet

- No 13-AfDocument3 pagesNo 13-AfDeana Sabacan50% (4)

- Handout No. 1 in Fundamentals of Accounting, Business, and Management 2Document8 pagesHandout No. 1 in Fundamentals of Accounting, Business, and Management 2Stephanie DecidaNo ratings yet

- Users of Accounting InformationDocument21 pagesUsers of Accounting InformationEllegor Eam Gayol (girl palpak)No ratings yet

- Fabm 1 Reviewer Q1Document8 pagesFabm 1 Reviewer Q1raydel dimaanoNo ratings yet

- FABM2 - Lesson 1Document27 pagesFABM2 - Lesson 1wendell john mediana100% (1)

- Problem #3 SciDocument2 pagesProblem #3 SciJhazz Kyll100% (1)

- LUYONG - 3rd Periodical - FABM1Document4 pagesLUYONG - 3rd Periodical - FABM1Jonavi Luyong100% (2)

- Grade11 Fabm1 Q2 Week3Document14 pagesGrade11 Fabm1 Q2 Week3Mickaela MonterolaNo ratings yet

- Booklet FABM 2 Module 1Document17 pagesBooklet FABM 2 Module 1Rubelyn MoralesNo ratings yet

- Chapter 5 - Recruitment Methods and AdvantagesDocument2 pagesChapter 5 - Recruitment Methods and AdvantagesLanie Mae G. PinzonNo ratings yet

- ABM 12 - Analysis and Interpretation of FS 1Document5 pagesABM 12 - Analysis and Interpretation of FS 1Wella LozadaNo ratings yet

- Fundamentals of AccountingDocument83 pagesFundamentals of AccountingJaylien CruzzNo ratings yet

- ABM FABM1-Q4-Week-1Document26 pagesABM FABM1-Q4-Week-1Just OkayNo ratings yet

- ppt2aCCOUNTING LESSON 3Document17 pagesppt2aCCOUNTING LESSON 3Rojane L. Alcantara100% (1)

- Abm Income TaxationDocument8 pagesAbm Income TaxationNardsdel RiveraNo ratings yet

- Bus.-Finance LAS Qtr1Document36 pagesBus.-Finance LAS Qtr1Matt Yu EspirituNo ratings yet

- Chapter 1 Intro Fin MGTDocument49 pagesChapter 1 Intro Fin MGTMelissa BattadNo ratings yet

- Acctg. QB 1-2Document3 pagesAcctg. QB 1-2Jinx Cyrus RodilloNo ratings yet

- External & Internal Users of Financial InformationDocument6 pagesExternal & Internal Users of Financial InformationAlma A CernaNo ratings yet

- ABM ReviewerDocument5 pagesABM ReviewerKRISTELLE ROSARIONo ratings yet

- CFS ComponentsDocument11 pagesCFS ComponentsAlyssa Nikki VersozaNo ratings yet

- FABM1 Q4 Module 12Document11 pagesFABM1 Q4 Module 12Earl Christian Bonaobra100% (1)

- UNIT II Branches of AccountingDocument40 pagesUNIT II Branches of AccountingJOHN ,MARK LIGPUSANNo ratings yet

- Lesson 1 Introduction To AccountingDocument13 pagesLesson 1 Introduction To AccountingKelvin Jay Sebastian SaplaNo ratings yet

- Introduction to Accounting BranchesDocument13 pagesIntroduction to Accounting BranchesKelvin Jay Sebastian SaplaNo ratings yet

- Lesson 3 - Branches of AccountingDocument12 pagesLesson 3 - Branches of AccountingJoanNo ratings yet

- FABM1 Acitvity-Sheet W3Q3Document3 pagesFABM1 Acitvity-Sheet W3Q3Kassandra Kay0% (1)

- 3is Acitvity-Sheet W3-5Q3Document4 pages3is Acitvity-Sheet W3-5Q3Kassandra KayNo ratings yet

- S M A R T: Factor-Isolating Question Factor-Relating Question Situation-Relating Question Situation-Producing QuestionDocument4 pagesS M A R T: Factor-Isolating Question Factor-Relating Question Situation-Relating Question Situation-Producing QuestionKassandra KayNo ratings yet

- Introduction To Investment Maam KassDocument7 pagesIntroduction To Investment Maam KassKassandra KayNo ratings yet

- F-003 CS Form No. 4 Certification of Assumption To DutyDocument1 pageF-003 CS Form No. 4 Certification of Assumption To DutyKassandra KayNo ratings yet

- L and D Design Template KAss&RADocument8 pagesL and D Design Template KAss&RAKassandra KayNo ratings yet

- Guess The GiftDocument8 pagesGuess The GiftKassandra KayNo ratings yet

- Group 6 - 12 Kyanite. ToyangbbDocument2 pagesGroup 6 - 12 Kyanite. ToyangbbKassandra KayNo ratings yet

- De Roxas Narrative ReportDocument2 pagesDe Roxas Narrative ReportKassandra KayNo ratings yet

- FABM1 - Lesson3-1 Users of Accounting InformationDocument15 pagesFABM1 - Lesson3-1 Users of Accounting InformationKassandra KayNo ratings yet

- FABM1 Lesson2-1 Branches of AccountingDocument12 pagesFABM1 Lesson2-1 Branches of AccountingKassandra KayNo ratings yet

- FABM1 Lesson1-3 Function of AccountingDocument11 pagesFABM1 Lesson1-3 Function of AccountingKassandra KayNo ratings yet

- FABM1 Lesson1-2 Nature of AccountingDocument9 pagesFABM1 Lesson1-2 Nature of AccountingKassandra KayNo ratings yet

- Teaching Research To SHS - MsMariaReginaSibal PDFDocument61 pagesTeaching Research To SHS - MsMariaReginaSibal PDFLee Onil Romat SelardaNo ratings yet

- FABM1 - Lesson1-1 - Definition of AccountingDocument6 pagesFABM1 - Lesson1-1 - Definition of Accountingshiela mae tibleNo ratings yet

- ABM1 Intro To AccountingDocument36 pagesABM1 Intro To AccountingKassandra KayNo ratings yet

- Seat PlanDocument1 pageSeat PlanKassandra KayNo ratings yet

- Research Problem and QuestionsDocument9 pagesResearch Problem and QuestionsKassandra KayNo ratings yet

- Practical Research 1 - Chapter 3Document5 pagesPractical Research 1 - Chapter 3Kassandra KayNo ratings yet

- Practical Research 1 Qualitative 2Document112 pagesPractical Research 1 Qualitative 2Kassandra Kay100% (4)

- DE ROXAS Honor ListDocument3 pagesDE ROXAS Honor ListKassandra KayNo ratings yet

- 3rd Monthly ExamDocument2 pages3rd Monthly ExamKassandra KayNo ratings yet

- Long Test - 1Document1 pageLong Test - 1Kassandra Kay100% (2)

- OFFICIAL FORMAT For ATTENDANCE During Parent Teacher Conference Courage HEDocument1 pageOFFICIAL FORMAT For ATTENDANCE During Parent Teacher Conference Courage HEKassandra KayNo ratings yet

- Language ExamDocument2 pagesLanguage ExamKassandra KayNo ratings yet

- Official Class List - CourageDocument1 pageOfficial Class List - CourageKassandra KayNo ratings yet

- De Roxas Kassandra Ed106 Activity On Code of EthicsDocument1 pageDe Roxas Kassandra Ed106 Activity On Code of EthicsKassandra KayNo ratings yet

- Lesson 7Document20 pagesLesson 7Kassandra KayNo ratings yet

- 4 - ASR9K XR Intro Routing and RPL PDFDocument42 pages4 - ASR9K XR Intro Routing and RPL PDFhem777No ratings yet

- Mil STD 1686CDocument18 pagesMil STD 1686CNam NguyenNo ratings yet

- Ir 2101Document14 pagesIr 2101Willard DmpseyNo ratings yet

- OxygenDocument18 pagesOxygenbillllibNo ratings yet

- Ficha Técnica Lithonia-JcblDocument9 pagesFicha Técnica Lithonia-JcblEmiliano HernándezNo ratings yet

- DP8 Series Manual - English PDFDocument48 pagesDP8 Series Manual - English PDFluis enrique de la rosa sanchezNo ratings yet

- Microsystems Course Covers Sensors, DesignDocument11 pagesMicrosystems Course Covers Sensors, DesignRaviNo ratings yet

- NTPC Limited: (A Government of India Enterprise)Document7 pagesNTPC Limited: (A Government of India Enterprise)Yogesh PandeyNo ratings yet

- Storyboard TemplateDocument9 pagesStoryboard Templateapi-572813920No ratings yet

- BTP Presentation - Sem 8Document24 pagesBTP Presentation - Sem 8Nihal MohammedNo ratings yet

- Internship Report On: "Training and Development of Bengal Group of Industries."Document47 pagesInternship Report On: "Training and Development of Bengal Group of Industries."Lucy NguyenNo ratings yet

- Analyzing Air Asia in Business Competition Era: AirasiaDocument14 pagesAnalyzing Air Asia in Business Competition Era: Airasiashwaytank10No ratings yet

- Del Monte Golf Club in BukidnonDocument1 pageDel Monte Golf Club in BukidnonJackieNo ratings yet

- Geotextile Its Application To Civil Engineering ODocument7 pagesGeotextile Its Application To Civil Engineering OezequilNo ratings yet

- PMDC Renewal FormDocument3 pagesPMDC Renewal FormAmjad Ali100% (1)

- Inspection & Testing of Elastic Rail Clips PDFDocument5 pagesInspection & Testing of Elastic Rail Clips PDFfiemsabyasachi0% (1)

- Fin4010 Assignment 3Document3 pagesFin4010 Assignment 3Grace AtteNo ratings yet

- PH of Fatty Quaternary Ammonium Chlorides: Standard Test Method ForDocument2 pagesPH of Fatty Quaternary Ammonium Chlorides: Standard Test Method ForAl7amdlellahNo ratings yet

- Dee ChuanDocument4 pagesDee ChuanBurn-Cindy AbadNo ratings yet

- Key Benefits of Cloud-Based Internet of Vehicle (IoV) - Enabled Fleet Weight Management SystemDocument5 pagesKey Benefits of Cloud-Based Internet of Vehicle (IoV) - Enabled Fleet Weight Management SystemVelumani sNo ratings yet

- TP 6799Document84 pagesTP 6799Roberto Sanchez Zapata100% (1)

- How To Sell Hillstone 306. Cloudhive v2.8Document98 pagesHow To Sell Hillstone 306. Cloudhive v2.8Emmanuel CoriaNo ratings yet

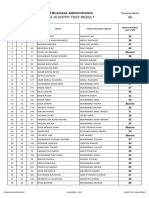

- Entry Test Result MPhil 2014 PDFDocument11 pagesEntry Test Result MPhil 2014 PDFHafizAhmadNo ratings yet

- Cebu Oxygen Acetylene Co., vs. Drilon, G.R. No. 82849, August 2, 1989Document6 pagesCebu Oxygen Acetylene Co., vs. Drilon, G.R. No. 82849, August 2, 1989JemNo ratings yet

- Writing Task 1: You Should Spend About 20 Minutes On This TaskDocument1 pageWriting Task 1: You Should Spend About 20 Minutes On This TaskRodrigo MoraesNo ratings yet