Professional Documents

Culture Documents

Impact of Acquisitions On Performance of Canadian Firms

Uploaded by

Igor Semenenko0 ratings0% found this document useful (0 votes)

10 views9 pages1) The document analyzes the impact of acquisitions by Canadian firms on performance metrics like return on equity, economic value added, and sales growth.

2) It finds that acquisitions in the US have a negative impact on growth, and large US acquisitions negatively impact return on equity and economic value added. Acquisitions in Canada also lower growth.

3) The results suggest acquisitions do not provide a technology transfer benefit and instead result in value destruction, not improving Canadian productivity gaps with the US.

Original Description:

Original Title

Impact of Acquisitions on Performance of Canadian Firms

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document analyzes the impact of acquisitions by Canadian firms on performance metrics like return on equity, economic value added, and sales growth.

2) It finds that acquisitions in the US have a negative impact on growth, and large US acquisitions negatively impact return on equity and economic value added. Acquisitions in Canada also lower growth.

3) The results suggest acquisitions do not provide a technology transfer benefit and instead result in value destruction, not improving Canadian productivity gaps with the US.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views9 pagesImpact of Acquisitions On Performance of Canadian Firms

Uploaded by

Igor Semenenko1) The document analyzes the impact of acquisitions by Canadian firms on performance metrics like return on equity, economic value added, and sales growth.

2) It finds that acquisitions in the US have a negative impact on growth, and large US acquisitions negatively impact return on equity and economic value added. Acquisitions in Canada also lower growth.

3) The results suggest acquisitions do not provide a technology transfer benefit and instead result in value destruction, not improving Canadian productivity gaps with the US.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

Impact of Acquisitions on

Performance of Canadian Firms

Igor Semenenko

Acadia University

October 17, 2013

Motivation

• Canadian’s productivity has been tanking since

early 1970s. Worker output in U.S. is $44 per hour

per worker vs $35 in Canada

• Gap widened in the last 15 years

• Tim Hortons fails in New England

• Fortress mentality and stiff-upper-lip British

heritage, eh?

• Or, maybe, competitive effects (lower competition

among Canadian companies and safety net)

Hypotheses

• Can acquisitions in the U.S. help bridge that

gap?

• Natural experiment

• Two outcomes:

- value destruction

- technology transfer

Sample

• 907 companies with assets > 100 mln from

Compustat in 1991-2010

907 firms in total

Non-acquiring firms Acquiring firms

411 496

Acquisitions in 3 areas: U.S.A. Canada Other

217 406 167

Models

• Dependent variables:

- Return on Equity

- Equity Economic Value Added =

= Net Income – Equity x Required Rate of Return

- Growth in sales

• Tested variable:

- Dummy variable = 1 in Y0 - Y5 after acquisition

- Size variable = percentage of assets in 3

jurisdictions on a 5-year rolling basis

• High Tech dummy

Main Results

• Acquisitions in U.S. have negative impact on

growth; large acquisitions in U.S. have

negative impact on ROE and EVA

• Acquisitions in Canada lower growth

• Acquisitions in other geographies have no

impact

• High Tech acquisitions lower growth in all 3

geographies

• There is no technology transfer effect

Digging Beneath the Surface

• Changes by 5-year periods

• Acquirers are more profitable, larger in size,

operating in more concentrated industries

• 20 percent of acquisitions in US and Other

jurisdictions are High Tech, only 10 percent in

Canada

• Size of acquisitions is the same in 3 areas

Propensity Score Match

• Acquirors are faster growing, less levered

firms

• When matched with firms from non-acquiring

subsample, growth impact disappears

• Impact on other metrics – ROE and EVA –

becomes even stronger

Conclusion

• Value destruction, not technology transfer

effect

• M&As are not a technology transfer channel

• Tapping into managerial talent pool in U.S.

could do it. Topic of another study

You might also like

- The New One-Page Project Manager: Communicate and Manage Any Project With A Single Sheet of PaperFrom EverandThe New One-Page Project Manager: Communicate and Manage Any Project With A Single Sheet of PaperRating: 3.5 out of 5 stars3.5/5 (16)

- World Class Manufacturing: The Next Decade: Building Power, Strength, and ValueFrom EverandWorld Class Manufacturing: The Next Decade: Building Power, Strength, and ValueRating: 3 out of 5 stars3/5 (2)

- Transfer PricingDocument25 pagesTransfer PricingMehedi HasanNo ratings yet

- Tuck Casebook 2000 For Case Interview Practice - MasterTheCaseDocument71 pagesTuck Casebook 2000 For Case Interview Practice - MasterTheCaseMasterTheCase.comNo ratings yet

- COMM 491: Business StrategyDocument33 pagesCOMM 491: Business StrategyTherese ChiuNo ratings yet

- ResilienceDocument29 pagesResilienceAmeer Akram0% (1)

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterFrom EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNo ratings yet

- Fabtek Case SolutionDocument8 pagesFabtek Case SolutionsankalpgargmdiNo ratings yet

- Crown Cork Case Study AnalysisDocument15 pagesCrown Cork Case Study AnalysisPoonam DalalNo ratings yet

- Customer Experience 3.0: High-Profit Strategies in the Age of Techno ServiceFrom EverandCustomer Experience 3.0: High-Profit Strategies in the Age of Techno ServiceRating: 5 out of 5 stars5/5 (1)

- 7.merger and AcquisitionsDocument32 pages7.merger and AcquisitionsNatani Sai KrishnaNo ratings yet

- Real Cases 2021-329-348Document20 pagesReal Cases 2021-329-348mariishaNo ratings yet

- Cases FoulkeDocument30 pagesCases FoulkeYudis Tiawan50% (4)

- Caterpillar Tractor Company: A Case Study OnDocument13 pagesCaterpillar Tractor Company: A Case Study OnWasif AzizNo ratings yet

- Managerial Economics: by Rajen Patel (AM 1112)Document8 pagesManagerial Economics: by Rajen Patel (AM 1112)Rajen PatelNo ratings yet

- Senior Capstone PresentationDocument44 pagesSenior Capstone Presentationapi-351760386No ratings yet

- Burger Chain PE Ross Case 5Document7 pagesBurger Chain PE Ross Case 5Aayush AgrawalNo ratings yet

- Mergers AND Acquisitions: BY: Piyush Bhardwaj Jaikrit VatsalDocument31 pagesMergers AND Acquisitions: BY: Piyush Bhardwaj Jaikrit Vatsalamaad4mNo ratings yet

- A Case Study OnDocument12 pagesA Case Study Onsanveet kourNo ratings yet

- MGT657 Past SemDocument19 pagesMGT657 Past SemNeykim NH67% (3)

- SM UNIT - IIIBDocument11 pagesSM UNIT - IIIBrammohan33No ratings yet

- JIM-I-1 Problem Solving FrameworkDocument51 pagesJIM-I-1 Problem Solving FrameworkSwapnanil DasNo ratings yet

- Industry Structures Along The Continuum: Bank Oligopolies VideoDocument7 pagesIndustry Structures Along The Continuum: Bank Oligopolies Videogari arolladoNo ratings yet

- Introduction - Geeli: - Bank Debt - Corporate Bonds - Private Equity - Public Listing On Chinese or Foreign ExchangesDocument13 pagesIntroduction - Geeli: - Bank Debt - Corporate Bonds - Private Equity - Public Listing On Chinese or Foreign ExchangeslabdhichopdaNo ratings yet

- Determinants of National Competitive AdvantageDocument23 pagesDeterminants of National Competitive AdvantagematejziNo ratings yet

- Unit 2Document8 pagesUnit 2martalebronvillenNo ratings yet

- Global Challenge: Introduction To The CaseDocument13 pagesGlobal Challenge: Introduction To The CaseAnandapadmanaban Muralidharan MuralidharanNo ratings yet

- Tuckefeller - Discussion Materials On Pinkerton - VfinalDocument27 pagesTuckefeller - Discussion Materials On Pinkerton - VfinalBo Wang100% (1)

- External Analysis Industry Structure: Session 3Document40 pagesExternal Analysis Industry Structure: Session 3Moidin AfsanNo ratings yet

- Session 8a-Btechonological EnvironmentDocument24 pagesSession 8a-Btechonological EnvironmentRohit Vijay PatilNo ratings yet

- The Country, and Has Made Indian Industry More Competitive in General Than What It Was Earlier, Before The Economic ReformsDocument8 pagesThe Country, and Has Made Indian Industry More Competitive in General Than What It Was Earlier, Before The Economic Reformsy2j0050No ratings yet

- Golf Swing Analyzer Sample PresentationDocument37 pagesGolf Swing Analyzer Sample Presentationzaotr100% (1)

- ACAD EDGE Edition 8 (Business Evaluation)Document10 pagesACAD EDGE Edition 8 (Business Evaluation)Damanjot SinghNo ratings yet

- Feasibility Study 1-20-10Document18 pagesFeasibility Study 1-20-10sarah_wantiezNo ratings yet

- Accenture FY19 Case Workbook One Accenture Consulting PDFDocument5 pagesAccenture FY19 Case Workbook One Accenture Consulting PDFSalah BallouliNo ratings yet

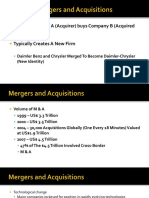

- M & A: Company A (Acquirer) Buys Company B (Acquired or Target Firm) Typically Creates A New FirmDocument12 pagesM & A: Company A (Acquirer) Buys Company B (Acquired or Target Firm) Typically Creates A New FirmGaneshRathodNo ratings yet

- Introduction. Competitiveness and Its Relation To BusinessDocument14 pagesIntroduction. Competitiveness and Its Relation To BusinessDaria OphirNo ratings yet

- Today's Agenda: Industry Analysis Return ConceptsDocument10 pagesToday's Agenda: Industry Analysis Return ConceptsTaha AhmadNo ratings yet

- SV - 2022 - Chapter 2 IBSDocument37 pagesSV - 2022 - Chapter 2 IBSKhanh Linh CaoNo ratings yet

- Vision Statement: - Vision Statements Can Take ManyDocument38 pagesVision Statement: - Vision Statements Can Take ManySaad AzamNo ratings yet

- Continuous Improvement For Engineering - MITDocument40 pagesContinuous Improvement For Engineering - MITinitiative1972No ratings yet

- Bba GB Srishti Kumari Ca1Document7 pagesBba GB Srishti Kumari Ca1Aashman FoundationNo ratings yet

- Enduring Logic of Industrial SuccessDocument18 pagesEnduring Logic of Industrial SuccessJose Carlos BulaNo ratings yet

- Porter S Diamond: (Harvard Business School, 1990)Document24 pagesPorter S Diamond: (Harvard Business School, 1990)Shrishail TengliNo ratings yet

- Constellation SoftwareDocument5 pagesConstellation SoftwareWandi ZhuNo ratings yet

- Coke Vs Pepsi-1Document34 pagesCoke Vs Pepsi-1himavalluri100% (1)

- Eastboro Machine Tools CorporationDocument19 pagesEastboro Machine Tools CorporationBeatrix X-ChenNo ratings yet

- Week 8 - Restructuring ConglomerateDocument35 pagesWeek 8 - Restructuring Conglomerateminh daoNo ratings yet

- Practising Law Institute: Developments and Trends in Compensation Practices - Aftermath of EnronDocument30 pagesPractising Law Institute: Developments and Trends in Compensation Practices - Aftermath of EnronTheodoros MaragakisNo ratings yet

- Strategic Management: Strategies in ActionDocument53 pagesStrategic Management: Strategies in ActionAli ShanNo ratings yet

- CH 8 and 9 - SlidesDocument22 pagesCH 8 and 9 - SlidesMariaNo ratings yet

- Ics Case 6Document24 pagesIcs Case 6Pui YanNo ratings yet

- Corporate Inversions Why It Happens: Veronique de Rugy Fiscal Policy Analyst The Cato InstituteDocument23 pagesCorporate Inversions Why It Happens: Veronique de Rugy Fiscal Policy Analyst The Cato InstituteAsad khanNo ratings yet

- Multiple Document Summary Theme: Strategy DevelopmentDocument45 pagesMultiple Document Summary Theme: Strategy DevelopmentAsif MahmoodNo ratings yet

- Profitability MaximizationDocument11 pagesProfitability MaximizationSanket KarNo ratings yet

- Genera L Motors: Group MembersDocument11 pagesGenera L Motors: Group MembersSriniketh SridharNo ratings yet

- Corp Fin Microsoft Slides (4) FinalsDocument30 pagesCorp Fin Microsoft Slides (4) FinalsKelvin Lim Wei LiangNo ratings yet

- 09 Paper Records Medium BainDocument8 pages09 Paper Records Medium BainkjhgfdyewqNo ratings yet

- Presentation GEDocument22 pagesPresentation GESahil KhoslaNo ratings yet

- Solutionomics: Innovative Solutions for Achieving America's Economic PotentialFrom EverandSolutionomics: Innovative Solutions for Achieving America's Economic PotentialNo ratings yet

- Rumor Mill and Merger Waves: Analysis of Aggregate Market ActivityDocument22 pagesRumor Mill and Merger Waves: Analysis of Aggregate Market ActivityIgor SemenenkoNo ratings yet

- Interest Tax and Real Estate ReturnsDocument7 pagesInterest Tax and Real Estate ReturnsIgor SemenenkoNo ratings yet

- Article PDI September 2014Document21 pagesArticle PDI September 2014Igor SemenenkoNo ratings yet

- Petro-Canada CaseDocument17 pagesPetro-Canada CaseIgor SemenenkoNo ratings yet

- Annual Reporting, Agency Costs and Firm ValuationsDocument25 pagesAnnual Reporting, Agency Costs and Firm ValuationsIgor SemenenkoNo ratings yet