Professional Documents

Culture Documents

CH 08

Uploaded by

Peterson0 ratings0% found this document useful (0 votes)

45 views20 pagesOriginal Title

ch08.ppt

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

45 views20 pagesCH 08

Uploaded by

PetersonCopyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 20

To explain the theories of purchasing power

parity (PPP) and international Fisher effect

(IFE), and their implications for exchange rate

changes; and

To compare the PPP theory, IFE theory, and

theory of interest rate parity (IRP).

When one country’s inflation rate rises

relative to that of another country, decreased

exports and increased imports depress the

country’s currency.

The theory of purchasing power parity (PPP)

attempts to quantify this inflation - exchange

rate relationship.

The absolute form of PPP, or the “law of one

price,” suggests that similar products in

different countries should be equally priced

when measured in the same currency.

The relative form of PPP accounts for market

imperfections like transportation costs,

tariffs, and quotas. It states that the rate of

price changes should be similar.

Suppose U.S. inflation > U.K. inflation.

U.S. imports from U.K. and U.S.

exports to U.K., so £ appreciates.

This shift in consumption and the appreciation

of the £ will continue until

in the U.S., priceU.K. goods priceU.S. goods, &

in the U.K., priceU.S. goods priceU.K. goods.

Assume home country’s price index (Ph) =

foreign country’s price index (Pf)

When inflation occurs, the exchange rate will

adjust to maintain PPP:

Pf (1 + If ) (1 + ef ) = Ph (1 + Ih )

where Ih = inflation rate in the home country

If = inflation rate in the foreign country

ef = % change in the value of the foreign

currency

Since Ph = Pf , solving for ef gives:

ef = (1 + Ih ) – 1

(1 + If )

If Ih > If , ef > 0 (foreign currency appreciates)

If Ih < If , ef < 0 (foreign currency depreciates)

If Ih = 5% & If = 3%, ef = 1.05/1.03 – 1 = 1.94%

From the home country perspective, both

price indexes rise by 5%.

When the inflation differential is small, the

PPP relationship can be simplified as

ef Ih _ If

Suppose IU.S. = 9%, IU.K. = 5%. Then PPP

suggests that e£ 4%.

Then, U.K. goods will cost 5+4=9% more to

U.S. consumers, while U.S. goods will cost 9-

4=5% more to U.K. consumers.

PPP may not occur consistently due to:

confounding effects, and

◦ Exchange rates are also affected by differentials in

interest rates, income levels, and risk, as well as

government controls.

lack of substitutes for traded goods.

PPP can be tested by assessing a “real”

exchange rate over time.

◦ The real exchange rate is the actual exchange rate

adjusted for inflationary effects in the two countries

of concern.

If this rate reverts to some mean level over

time, this would suggest that it is constant in

the long run.

According to the Fisher effect, nominal risk-

free interest rates contain a real rate of return

and an anticipated inflation.

If the same real return is required,

differentials in interest rates may be due to

differentials in expected inflation.

According to PPP, exchange rate movements

are caused by inflation rate differentials.

The international Fisher effect (IFE) theory

suggests that currencies with higher interest

rates will depreciate because the higher rates

reflect higher expected inflation.

Hence, investors hoping to capitalize on a

higher foreign interest rate should earn a

return no better than what they would have

earned domestically.

According to the IFE, E(rf ), the expected

effective return on a foreign money market

investment, should equal rh , the effective

return on a domestic investment.

rf = (1 + if ) (1 + ef ) – 1

if = interest rate in the foreign country

ef = % change in the foreign currency’s

value

rh = ih = interest rate in the home country

Setting rf = rh : (1 + if ) (1 + ef ) – 1 = ih

Solving for ef : ef = (1 + ih ) _ 1

(1 + if )

If ih > if , ef > 0 (foreign currency appreciates)

If ih < if , ef < 0 (foreign currency depreciates)

If ih = 8% & if = 9%, ef = 1.08/1.09 – 1 = - .92%

This will make the return on the foreign

investment equal to the domestic return.

When the interest rate differential is small,

the IFE relationship can be simplified as

ef ih _ if

If the British rate on 6-month deposits were

2% above the U.S. interest rate, the £ should

depreciate by approximately 2% over 6

months. Then U.S. investors would earn

about the same return on British deposits as

they would on U.S. deposits.

The point of the IFE theory is that if a firm

periodically tries to capitalize on higher

foreign interest rates, it will achieve a yield

that is sometimes above and sometimes

below the domestic yield.

On the average, the firm would achieve a

yield similar to that by a corporation that

makes domestic deposits only.

If the actual points of interest rates and

exchange rate changes are plotted over time

on a graph, we can see whether the points

are evenly scattered on both sides of the IFE

line.

Empirical studies indicate that the IFE theory

holds during some time frames. However,

there is also evidence that it does not

consistently hold.

Since the IFE is based on PPP, it will not hold

when PPP does not hold.

For example, if there are factors other than

inflation that affect exchange rates, the rates

will not adjust in accordance with the

inflation differential.

Unfortunately for these investors, the efforts

made by the central banks to stabilize the

currencies were overwhelmed by market

forces.

In essence, the depreciation in the Southeast

Asian currencies wiped out the high level of

interest earned.

Interest Rate Parity Forward Rate

(IRP) Discount or Premium

Interest Rate Fisher Inflation Rate

Differential Effect Differential

Purchasing

Power Parity (PPP)

International Exchange Rate

Fisher Effect (IFE) Expectations

Effect of Inflation

m

n

E CFj , t E ER j , t

j 1

Value =

t =1 1 k t

E (CFj,t ) = expected cash flows in

currency j to be received by the U.S. parent at

the end of period t

E (ERj,t ) = expected exchange rate at

which currency j can be converted to dollars at

the end of period t

You might also like

- How inflation impacts exchange rates and interest ratesDocument18 pagesHow inflation impacts exchange rates and interest ratesjahirul munnaNo ratings yet

- Chapter ObjectivesDocument20 pagesChapter ObjectivesTajrian Ahmmed 1512588630No ratings yet

- Inflation Vs Interest RatesDocument12 pagesInflation Vs Interest RatesanshuldceNo ratings yet

- International Parity Relations ExplainedDocument34 pagesInternational Parity Relations ExplainedMotiram paudelNo ratings yet

- Session 2Document33 pagesSession 2Soumik MutsuddiNo ratings yet

- Multinational Business Finance Eiteman 12th Edition Solutions ManualDocument5 pagesMultinational Business Finance Eiteman 12th Edition Solutions ManualGeorgePalmerkqgd100% (30)

- Foreign Exchange Market and Management of Foreign Exchange RiskDocument56 pagesForeign Exchange Market and Management of Foreign Exchange RiskCedric ZvinavasheNo ratings yet

- Link Between Money Supply and Interest Rates NotesDocument5 pagesLink Between Money Supply and Interest Rates NotesHusseinNo ratings yet

- International Financial Management: by Jeff MaduraDocument39 pagesInternational Financial Management: by Jeff MaduraBe Like ComsianNo ratings yet

- F9 Notes (Risk Management)Document14 pagesF9 Notes (Risk Management)CHIAMAKA EGBUKOLENo ratings yet

- IFE Theory Test of Selected Industrialized CountriesDocument11 pagesIFE Theory Test of Selected Industrialized CountriesSetyo Tyas JarwantoNo ratings yet

- Exchange Rates, Interest Rates, and Inflation RatesDocument19 pagesExchange Rates, Interest Rates, and Inflation RatesAnNa SouLsNo ratings yet

- Group G IFM PrnstationDocument12 pagesGroup G IFM PrnstationMaryamNo ratings yet

- International Fisher Effect and Exchange Rate ForecastingDocument12 pagesInternational Fisher Effect and Exchange Rate ForecastingRunail harisNo ratings yet

- Exchange Rate DeterminationDocument43 pagesExchange Rate DeterminationAmit Sinha100% (1)

- IFM - Chapter 6Document36 pagesIFM - Chapter 6Đoàn Thị QuỳnhNo ratings yet

- Parity Conditions AND Currency ForecastingDocument39 pagesParity Conditions AND Currency ForecastingSauryadeep DwivediNo ratings yet

- Group 4 - PARITY CONDITIONS IN INTERNATIONAL FINANCE AND CURRENCY FORECASTINGDocument37 pagesGroup 4 - PARITY CONDITIONS IN INTERNATIONAL FINANCE AND CURRENCY FORECASTINGadindaNo ratings yet

- Relationships Among Inflation, Interest Rates, and Exchange RatesDocument29 pagesRelationships Among Inflation, Interest Rates, and Exchange RatesClaudia ChavarriaNo ratings yet

- PPP IrpDocument29 pagesPPP IrpSam SmithNo ratings yet

- Fisher EffectDocument3 pagesFisher EffectamarbuzzearNo ratings yet

- International Arbitrage and Interest Rate ParityDocument20 pagesInternational Arbitrage and Interest Rate Parityjahirul munnaNo ratings yet

- International Parity Relationship: Topic 4Document32 pagesInternational Parity Relationship: Topic 4sittmoNo ratings yet

- Chapter 08testing The Purchasing Power Parity TheoryDocument30 pagesChapter 08testing The Purchasing Power Parity Theorybildy100% (1)

- Theories of Foreign ExchangeDocument19 pagesTheories of Foreign Exchangerockstarchandresh0% (1)

- EC 302 - Intermediate MacroeconomicsDocument20 pagesEC 302 - Intermediate MacroeconomicsDavid P Hill-GrayNo ratings yet

- Assignment 2 (Theories of Exchange Rates - PPP, IFE, IRP)Document6 pagesAssignment 2 (Theories of Exchange Rates - PPP, IFE, IRP)doraemonNo ratings yet

- International Parity Relations & Exchange Rate ForecastingDocument17 pagesInternational Parity Relations & Exchange Rate ForecastingMunyaradzi MasendekeNo ratings yet

- International Parity ConditionsDocument35 pagesInternational Parity ConditionsRashique Ul LatifNo ratings yet

- PPP IRP and IFEDocument28 pagesPPP IRP and IFEHarshSuriNo ratings yet

- Session 1bDocument29 pagesSession 1bRohil SanilNo ratings yet

- Assignment 2 (Theories of Exchange Rates - PPP, IfE, IRP)Document6 pagesAssignment 2 (Theories of Exchange Rates - PPP, IfE, IRP)doraemonNo ratings yet

- IFM5 Exc Rate Theories Parity ConditionsDocument42 pagesIFM5 Exc Rate Theories Parity Conditionsashu khetan100% (1)

- International Financial Markets: International Parity Conditions: Interest Rate and The Fisher ParitiesDocument13 pagesInternational Financial Markets: International Parity Conditions: Interest Rate and The Fisher Parities1klornaNo ratings yet

- International Finance Parity ConditionsDocument34 pagesInternational Finance Parity ConditionsEdward Joseph A. RamosNo ratings yet

- What Does International Fisher EffectDocument3 pagesWhat Does International Fisher EffectGauri JainNo ratings yet

- IFM - Chapter 6Document36 pagesIFM - Chapter 6storkyddNo ratings yet

- 1.3. Exchange Rate Determination TheoriesDocument15 pages1.3. Exchange Rate Determination TheoriesDuong NguyenNo ratings yet

- Fisher Hypothesis - Wikipedia, The Free EncyclopediaDocument2 pagesFisher Hypothesis - Wikipedia, The Free EncyclopediaParag AwateNo ratings yet

- Parity Theories: Hemchand JDocument20 pagesParity Theories: Hemchand JPrem shuklaNo ratings yet

- 27 Managing International RisksDocument11 pages27 Managing International Risksddrechsler9No ratings yet

- The Foreign Exchange MarketDocument41 pagesThe Foreign Exchange MarketUrvashi SinghNo ratings yet

- 2.1exchange Rate Parity Currency ForecastingDocument30 pages2.1exchange Rate Parity Currency ForecastingFATIN NADJWA MAZLANNo ratings yet

- Parity Conditions and Currency ForecastingDocument49 pagesParity Conditions and Currency Forecastingsiti hasmahNo ratings yet

- PPT-4 Parity Conditions and Currency ForecastingDocument42 pagesPPT-4 Parity Conditions and Currency ForecastingKamal KantNo ratings yet

- Fisher EffectDocument15 pagesFisher EffectRk BainsNo ratings yet

- Fishers EffectDocument14 pagesFishers EffectKiran NayakNo ratings yet

- Theories of Exchange RateDocument37 pagesTheories of Exchange Ratedranita@yahoo.comNo ratings yet

- tài chính quốc tế 1Document7 pagestài chính quốc tế 1Đạt Dương ThànhNo ratings yet

- Bekaert 2e SM Ch10Document11 pagesBekaert 2e SM Ch10Xinyi Kimmy LiangNo ratings yet

- FINS3616 Tutorials - Week 3, QuestionsDocument3 pagesFINS3616 Tutorials - Week 3, QuestionsLena ZhengNo ratings yet

- PPP, IRP & Exchange Rates Theory ExplainedDocument11 pagesPPP, IRP & Exchange Rates Theory ExplainedMohammed SeidNo ratings yet

- 1 Foreign Exchange Markets and Exchange RatesDocument7 pages1 Foreign Exchange Markets and Exchange RatessheetalNo ratings yet

- Purchase Power Parity & Exchange Rate DeterminantsDocument5 pagesPurchase Power Parity & Exchange Rate DeterminantsTejaliNo ratings yet

- Chapter 6. RelationshipbetwwenInterestrateandInflation (1)Document49 pagesChapter 6. RelationshipbetwwenInterestrateandInflation (1)Kim NgânNo ratings yet

- Exchange Rate TheoriesDocument28 pagesExchange Rate TheoriesRavinder Singh AtwalNo ratings yet

- Finance 407: Multinational Financial Management: Topic #6: Purchasing Power ParityDocument20 pagesFinance 407: Multinational Financial Management: Topic #6: Purchasing Power ParityTram TruongNo ratings yet

- Inflation-Conscious Investments: Avoid the most common investment pitfallsFrom EverandInflation-Conscious Investments: Avoid the most common investment pitfallsNo ratings yet

- Quantum Strategy II: Winning Strategies of Professional InvestmentFrom EverandQuantum Strategy II: Winning Strategies of Professional InvestmentNo ratings yet

- Stat Slides ch07Document104 pagesStat Slides ch07Akib xabedNo ratings yet

- Act 201 Chapter 2Document39 pagesAct 201 Chapter 2PetersonNo ratings yet

- Act 201 Chapter 3Document57 pagesAct 201 Chapter 3PetersonNo ratings yet

- Completing The Accounting Cycle: Learning ObjectivesDocument43 pagesCompleting The Accounting Cycle: Learning ObjectivesShadman Sakib FahimNo ratings yet

- Act 201 Chapter 1Document43 pagesAct 201 Chapter 1PetersonNo ratings yet

- Organizing and Graphing DataDocument83 pagesOrganizing and Graphing DataSoNotNo ratings yet

- CH 05Document129 pagesCH 05Sakib SayedNo ratings yet

- Probability: Prem Mann, Introductory Statistics, 7/EDocument127 pagesProbability: Prem Mann, Introductory Statistics, 7/EMuhammad Arslan QadirNo ratings yet

- Indroduction On StatisticsDocument34 pagesIndroduction On StatisticsPetersonNo ratings yet

- Act 201 Chapter 1Document43 pagesAct 201 Chapter 1PetersonNo ratings yet

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument39 pagesPrepared by Coby Harmon University of California, Santa Barbara Westmont CollegePetersonNo ratings yet

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument21 pagesPrepared by Coby Harmon University of California, Santa Barbara Westmont CollegePetersonNo ratings yet

- Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument54 pagesPrepared by Coby Harmon University of California, Santa Barbara Westmont CollegePetersonNo ratings yet

- Statement of Cash Flows: Learning ObjectivesDocument33 pagesStatement of Cash Flows: Learning ObjectivesPetersonNo ratings yet

- Completing The Accounting Cycle: Learning ObjectivesDocument43 pagesCompleting The Accounting Cycle: Learning ObjectivesShadman Sakib FahimNo ratings yet

- Act 201 Chapter 6Document36 pagesAct 201 Chapter 6Amir HossainNo ratings yet

- Act 201 Chapter 2Document39 pagesAct 201 Chapter 2PetersonNo ratings yet

- Fundamentals of Taxation: SalaryDocument12 pagesFundamentals of Taxation: SalaryPetersonNo ratings yet

- Act 201 Chapter 3Document57 pagesAct 201 Chapter 3PetersonNo ratings yet

- Definition Sec-31: Capital GainsDocument9 pagesDefinition Sec-31: Capital GainsMd.Shadid Ur RahmanNo ratings yet

- Section 28 & 29: Income From Business or ProfessionDocument5 pagesSection 28 & 29: Income From Business or ProfessionMd.Shadid Ur RahmanNo ratings yet

- Fundamentals of Taxation: Reasons For Tax Evasion and Tax AvoidanceDocument28 pagesFundamentals of Taxation: Reasons For Tax Evasion and Tax AvoidanceMd.Shadid Ur RahmanNo ratings yet

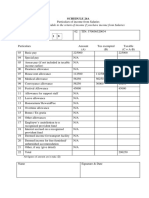

- Annex This Schedule To The Return of Income If You Have Income From SalariesDocument1 pageAnnex This Schedule To The Return of Income If You Have Income From SalariesgawtomNo ratings yet

- Income Tax Return FillingDocument4 pagesIncome Tax Return FillingAmi KarNo ratings yet

- Taxation Fundamentals on Interest, House PropertyDocument10 pagesTaxation Fundamentals on Interest, House PropertyPetersonNo ratings yet

- Fundamentals of TaxationDocument17 pagesFundamentals of TaxationPetersonNo ratings yet

- Annex This Schedule To The Return of Income If You Have Income From SalariesDocument1 pageAnnex This Schedule To The Return of Income If You Have Income From SalariesgawtomNo ratings yet

- Taxation-01 BDocument25 pagesTaxation-01 BPetersonNo ratings yet

- Chapter 8 Problems & Solutions Have Been Submitted in The PhotocopierDocument1 pageChapter 8 Problems & Solutions Have Been Submitted in The PhotocopierPetersonNo ratings yet

- Fundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?Document33 pagesFundamentals of Taxation: Isitpain? Is It Mandatory? Is It Obligatory ?PetersonNo ratings yet

- Harpreet KaurDocument2 pagesHarpreet KaurIT67% (3)

- 10 Activity 1 Costing PricingDocument3 pages10 Activity 1 Costing PricingErika SalasNo ratings yet

- IB1816104 EntrepreneurshipDocument22 pagesIB1816104 EntrepreneurshipNavdhaNo ratings yet

- David OgilvyDocument9 pagesDavid OgilvyDan DsouzaNo ratings yet

- Zalando Returns ArticleDocument29 pagesZalando Returns ArticleMushiraNo ratings yet

- Business Startup CostsDocument7 pagesBusiness Startup CostsDraft BoyNo ratings yet

- Taller 1Document2 pagesTaller 1juan camilo montenegro cañonNo ratings yet

- Seminar Brochure Ceo YtlDocument2 pagesSeminar Brochure Ceo YtlChun Fai ChoNo ratings yet

- Financial Inclusion of The Marginalised: Sharit K. Bhowmik Debdulal SahaDocument154 pagesFinancial Inclusion of The Marginalised: Sharit K. Bhowmik Debdulal SahaEnrique Szendro-MoralesNo ratings yet

- Note 1Document3 pagesNote 1Wedaje AlemayehuNo ratings yet

- Chapter 7Document21 pagesChapter 7TACIPIT, Rowena Marie DizonNo ratings yet

- Journal of Business Research 117 (2020) 163-175Document13 pagesJournal of Business Research 117 (2020) 163-175NicolasNo ratings yet

- Boom in Global Fintech InvestmentDocument16 pagesBoom in Global Fintech Investmentscrdbsr100% (2)

- Wisdom Wings Of: Summer Placement Brochure 2019-21Document44 pagesWisdom Wings Of: Summer Placement Brochure 2019-21Shivansh SinghNo ratings yet

- White Paper On E Business Tax Implementation in R 12 Presented atDocument31 pagesWhite Paper On E Business Tax Implementation in R 12 Presented atyasserlionNo ratings yet

- Data & Analytics Lead Consultant ProfileDocument5 pagesData & Analytics Lead Consultant ProfileAjay KumarNo ratings yet

- Part Five - Maintaining and Retaining Human ResourcesDocument34 pagesPart Five - Maintaining and Retaining Human ResourcesMehari Yohannes Hailemariam100% (3)

- Pooja Nikhar CVDocument1 pagePooja Nikhar CVPooja NikharNo ratings yet

- Case Study ProcessDocument15 pagesCase Study ProcessKhandelwal CyclesNo ratings yet

- Aditya Premkumar: Professional SummaryDocument3 pagesAditya Premkumar: Professional SummaryDivya NinaweNo ratings yet

- Chandigarh: Product Design and DevelopmentDocument24 pagesChandigarh: Product Design and DevelopmentEr Dinesh ChauhanNo ratings yet

- HBNDocument14 pagesHBNaNo ratings yet

- The Blue Print - Our Identity - 2016 - 04Document7 pagesThe Blue Print - Our Identity - 2016 - 04Petre LoreleyNo ratings yet

- HTM131 - What Is Tourism ABDocument17 pagesHTM131 - What Is Tourism ABCherlyNo ratings yet

- Electrical Engineering Company ProfileDocument27 pagesElectrical Engineering Company Profilesqamar68No ratings yet

- Doodle Business & Consulting Toolkit by SlidesgoDocument75 pagesDoodle Business & Consulting Toolkit by SlidesgoKiki Kiki100% (1)

- Introduction To Enterprise SystemsDocument51 pagesIntroduction To Enterprise Systemsvarsha bansodeNo ratings yet

- Theory Questions 5 PDF FreeDocument5 pagesTheory Questions 5 PDF FreeSamsung AccountNo ratings yet

- Complete Reports and Indices For UPSC Prelims 2023Document54 pagesComplete Reports and Indices For UPSC Prelims 2023AmarNo ratings yet

- Chapter 4Document2 pagesChapter 4Mariane MananganNo ratings yet