Professional Documents

Culture Documents

Commodity Evening Session

Uploaded by

vinod16950 ratings0% found this document useful (0 votes)

9 views7 pagesOriginal Title

Commodity_Evening_Session

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views7 pagesCommodity Evening Session

Uploaded by

vinod1695Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 7

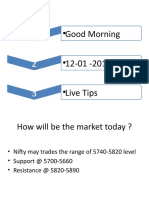

Commodity Evening Session

What are the major economic data releases which

came in during the Asian and European trading

session?

• German Flash Manufacturing PMI (Jan) declined to 60.2

against the previous value of 60.7.

• German Flash Services PMI (Jan) increased to 60 against

the previous value of 59.2.

• Euro Zone Flash Manufacturing PMI (Jan) declined to 56.9

from the previous value of 57.1.

• Euro Zone Flash Services PMI (Jan) increased to 55.2

against the previous value of 54.2.

• Euro Zone Industrial New Orders m/m declined to 2.1%

from the previous value of 1.4%.

What are the key support and resistance levels to look

out for COMEX trading session. Let us begin with Gold?

• Gold witnessed some buying interest coming during the

yesterday’s trading session after witnessing fall for two

successive days.

• Prices are hovering around the key resistance level of

$1350 ahead of the US trading session.

• $1338 will be the key support level to watch out for.

$1327 will be acting as a key support level to watch out

for if $1338 is broken with good volumes .

• RSI is currently hovering above the over sold territories

of 35.17 levels ahead of the COMEX trading session.

Silver

• Silver witnessed buying interest coming from the key support

levels of $27.5 during the Asian and European trading session.

• $28 will be the key resistance level to watch out for intraday

trading during COMEX session.

• A successful breakout above this level could see the prices

testing the next key resistance level of $28.6 on the upside.

• A successful breakdown below the key support level of $27.5

will see the prices testing the support level of $26.83.

• RSI is currently reading at 32.99 levels hovering above the over

sold territories levels ahead of the COMEX trading session.

Crude oil

• Crude oil saw selling interest coming in as the prices broke

the key support level of $89 levels.

• $89 will be the key resistance level to watch out for intraday

trading during NYMEX session.

• A successful breakout above this level could see the prices

testing the next key resistance level of $90.10 on the upside.

• A successful breakdown below the key support level of

$88(50 DSMA) could see the prices correcting to $87.69

levels.

• RSI is currently hovering around 33.53 levels ahead of the

NYMEX trading session.

Natural gas

• Natural gas witnessed continuation of Friday’s buying

interest during the today’s Asian and European trading

session.

• A correction happening from the level of $4.68 could see

the prices testing the $4.54 levels on the downside.

• $4.85 will act a s good resistance level for intraday

trading. A successful breakout above this level could see

the prices retesting the $5.00 levels on the upside.

• RSI is currently hovering around the over sold territories

of 65.23 levels in the daily charts ahead of the NYMEX

trading session.

Copper

• Copper witnessed some buying interest as the prices

managed to hold the key support level of $425.

• $425 will be acting as an intermediate support level for

intraday trading during COMEX session.

• $434 will be the upside resistance level to watch out for

in case of a successful breakout above the $444 levels.

$420 will act as a good positional support level for the

prices.

• RSI is currently approaching towards the oversold

territories of 49.33 levels in the daily charts ahead of the

COMEX trading session.

You might also like

- Tata AIG Health Insurance PDFDocument4 pagesTata AIG Health Insurance PDFSrijan Tiwari75% (4)

- HSBC - How To Create A Surprise IndexDocument18 pagesHSBC - How To Create A Surprise IndexzpmellaNo ratings yet

- Short Term Trading StrategiesDocument9 pagesShort Term Trading StrategiesMikhail Harris80% (5)

- Short Term Trading Strategies That Work by Larry Connors and Cesar AlvarezDocument61 pagesShort Term Trading Strategies That Work by Larry Connors and Cesar Alvarezgerry_strohl84% (31)

- High Probability Swing Trading Strategies: Day Trading Strategies, #4From EverandHigh Probability Swing Trading Strategies: Day Trading Strategies, #4Rating: 4.5 out of 5 stars4.5/5 (4)

- Trading with Intermarket Analysis: A Visual Approach to Beating the Financial Markets Using Exchange-Traded FundsFrom EverandTrading with Intermarket Analysis: A Visual Approach to Beating the Financial Markets Using Exchange-Traded FundsRating: 5 out of 5 stars5/5 (1)

- Let's Talk Bitcoin, Episode 86, "Virtual Worlds, Real Money"Document17 pagesLet's Talk Bitcoin, Episode 86, "Virtual Worlds, Real Money"Ben MalecNo ratings yet

- Assignment Week 1Document10 pagesAssignment Week 1victoriabhrNo ratings yet

- Bullseye Oct 13, 2014Document7 pagesBullseye Oct 13, 2014japsan27No ratings yet

- The Return of The Multi-Year Bear MarketDocument2 pagesThe Return of The Multi-Year Bear MarketValuEngine.comNo ratings yet

- Commodities Weekly Tracker 26th November 2012Document20 pagesCommodities Weekly Tracker 26th November 2012Angel BrokingNo ratings yet

- CommDocument8 pagesCommKhem RajNo ratings yet

- Commodity Weekly Technicals: Technical OutlookDocument27 pagesCommodity Weekly Technicals: Technical OutlooktimurrsNo ratings yet

- Commodities Weekly Tracker - 6th August 2012Document20 pagesCommodities Weekly Tracker - 6th August 2012Angel BrokingNo ratings yet

- HSL Commodity & Currency Focus: Retail ResearchDocument6 pagesHSL Commodity & Currency Focus: Retail ResearchumaganNo ratings yet

- Weekly Closes Above The Five-Week MMAS Are Positive.Document5 pagesWeekly Closes Above The Five-Week MMAS Are Positive.ValuEngine.com100% (1)

- Technical AnalysisDocument40 pagesTechnical Analysiskrichenaraj6931No ratings yet

- Commodities Weekly Tracker 5th March 2012Document20 pagesCommodities Weekly Tracker 5th March 2012vamsyk9No ratings yet

- Stock Newsletter Vol 1 Issue 2 1-15-14Document10 pagesStock Newsletter Vol 1 Issue 2 1-15-14Liam McMahonNo ratings yet

- Eagle Eye 22th JuneDocument1 pageEagle Eye 22th Junedhamu0202No ratings yet

- Eagle Eye 22th JuneDocument1 pageEagle Eye 22th Junedhamu0202No ratings yet

- Erivative Eport TH AR: Quity Esearch ABDocument9 pagesErivative Eport TH AR: Quity Esearch ABAru MehraNo ratings yet

- Aussie Tracked The Risk On/risk Off Change in Investor Sentiment Rallying To 0.9950 Highs During TheDocument4 pagesAussie Tracked The Risk On/risk Off Change in Investor Sentiment Rallying To 0.9950 Highs During TheGaurav DagaNo ratings yet

- Four in Four ReportDocument4 pagesFour in Four ReportValuEngine.comNo ratings yet

- Weekly Risky Levels Loom at 1406.6 SPX and 3097 NASDAQDocument1 pageWeekly Risky Levels Loom at 1406.6 SPX and 3097 NASDAQValuEngine.comNo ratings yet

- Techical Analysis-SAPMDocument34 pagesTechical Analysis-SAPMHeavy GunnerNo ratings yet

- Option Trading Playbook Prior To ExpirationDocument2 pagesOption Trading Playbook Prior To ExpirationRavi RamanNo ratings yet

- Kathy LienDocument82 pagesKathy Lienvazeli200483% (6)

- Commodity Snapshot: 123 Eased A BitDocument5 pagesCommodity Snapshot: 123 Eased A BitAmeya PagnisNo ratings yet

- Commodity Weekly Technicals: Technical OutlookDocument25 pagesCommodity Weekly Technicals: Technical OutlooktimurrsNo ratings yet

- Markets As We Approach The End of 2010Document2 pagesMarkets As We Approach The End of 2010ValuEngine.comNo ratings yet

- Technical AnalysisDocument16 pagesTechnical Analysisapi-87733769No ratings yet

- E L D 18 A: Quity Rese Arch AB: Eriva Tive R Eport TH PrilDocument9 pagesE L D 18 A: Quity Rese Arch AB: Eriva Tive R Eport TH PrilAru MehraNo ratings yet

- Trading Guide For Spot Gold and Commodity Currencies: By: Noor Shufaad MD NoraniDocument55 pagesTrading Guide For Spot Gold and Commodity Currencies: By: Noor Shufaad MD NoraniDatukjj JjNo ratings yet

- Today's Highlights - 06-27-11Document14 pagesToday's Highlights - 06-27-11timurrsNo ratings yet

- Edition 10 - Chartered 7th July 2010Document9 pagesEdition 10 - Chartered 7th July 2010Joel HewishNo ratings yet

- Market Outlook: Points To Analyse MarketDocument20 pagesMarket Outlook: Points To Analyse MarketChandra Dev SinghNo ratings yet

- Confident Currency Trader ClassDocument79 pagesConfident Currency Trader ClassethanNo ratings yet

- Unit 04Document64 pagesUnit 04Vrij PatelNo ratings yet

- Technical Analysis PDFDocument65 pagesTechnical Analysis PDFmr25000No ratings yet

- SummaryDocument36 pagesSummaryJayr NelbNo ratings yet

- Commerz Weekly Technical CommoditiesDocument21 pagesCommerz Weekly Technical CommoditiesBlackHat InvestmentsNo ratings yet

- The Risi-Moku TradeDocument6 pagesThe Risi-Moku TradeRob BookerNo ratings yet

- Basic ForexDocument76 pagesBasic ForexCPaul DonaldoNo ratings yet

- Other DerivativesDocument70 pagesOther DerivativesProf. Suyog ChachadNo ratings yet

- Trend-Reversal Trading Strategy Earned 175 Ticks Day Trading Crude Oil FuturesDocument4 pagesTrend-Reversal Trading Strategy Earned 175 Ticks Day Trading Crude Oil FuturesJoseph JamesNo ratings yet

- Beware of The Ides of OctoberDocument2 pagesBeware of The Ides of OctoberValuEngine.comNo ratings yet

- Treasury Daily 01 19 16Document4 pagesTreasury Daily 01 19 16patrick-lee ellaNo ratings yet

- Quity Esearch AB Erivativ E Eport THDocument9 pagesQuity Esearch AB Erivativ E Eport THAru MehraNo ratings yet

- Technical AnalysisDocument33 pagesTechnical AnalysisNithesh S BasrurNo ratings yet

- Focus Items: Philippine Equity ResearchDocument7 pagesFocus Items: Philippine Equity ResearchgwapongkabayoNo ratings yet

- UCurrency Markets 1.1Document36 pagesUCurrency Markets 1.1indraNo ratings yet

- Commodity Weekly Technicals: Technical OutlookDocument27 pagesCommodity Weekly Technicals: Technical OutlooktimurrsNo ratings yet

- The Stock Market Is Poised For Neutral Weekly ClosesDocument5 pagesThe Stock Market Is Poised For Neutral Weekly ClosesValuEngine.comNo ratings yet

- Unit 4 FDDocument26 pagesUnit 4 FDsaurabh thakurNo ratings yet

- Technical AnalysisDocument41 pagesTechnical AnalysisGodha ManitejaNo ratings yet

- The Multi-Year Bear Market Appears Ready To ReturnDocument2 pagesThe Multi-Year Bear Market Appears Ready To ReturnValuEngine.comNo ratings yet

- Market Tops BookletDocument16 pagesMarket Tops BookletDebarshi MajumdarNo ratings yet

- Bear Market Day Trading Strategies: Day Trading Strategies, #1From EverandBear Market Day Trading Strategies: Day Trading Strategies, #1Rating: 5 out of 5 stars5/5 (1)

- Forex Day Trading Strategies: The Most Profitable Forex Day Trading and Scalping Strategies That Work in 2022!: Day Trading Strategies, #5From EverandForex Day Trading Strategies: The Most Profitable Forex Day Trading and Scalping Strategies That Work in 2022!: Day Trading Strategies, #5No ratings yet

- The UK Stock Market Almanac 2016: Seasonality analysis and studies of market anomalies to give you an edge in the year aheadFrom EverandThe UK Stock Market Almanac 2016: Seasonality analysis and studies of market anomalies to give you an edge in the year aheadNo ratings yet

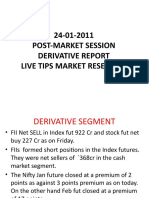

- Derivative Report-24.01.11Document5 pagesDerivative Report-24.01.11vinod1695No ratings yet

- Script Currency Noon 19.01.11Document6 pagesScript Currency Noon 19.01.11vinod1695No ratings yet

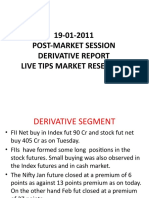

- Derivative Report-19.01.11Document5 pagesDerivative Report-19.01.11vinod1695No ratings yet

- Script Currency Noon 19.01.11Document6 pagesScript Currency Noon 19.01.11vinod1695No ratings yet

- Morning UpdatesDocument3 pagesMorning Updatesvinod1695No ratings yet

- Script Commodity Noon Session NewDocument13 pagesScript Commodity Noon Session Newvinod1695No ratings yet

- Script Commodity Noon Session NewDocument12 pagesScript Commodity Noon Session Newvinod1695No ratings yet

- Morning SessionDocument3 pagesMorning Sessionvinod1695No ratings yet

- Morning SessionDocument3 pagesMorning Sessionvinod1695No ratings yet

- Morning SessionDocument3 pagesMorning Sessionvinod1695No ratings yet

- Cost of Living Project-1Document3 pagesCost of Living Project-1Eric MendozaNo ratings yet

- Master Data BaseDocument72 pagesMaster Data Basesubudhiprasanna100% (1)

- Unit 7Document22 pagesUnit 7Sandhya ChimmiliNo ratings yet

- Protecting Malaysian Automobile Industry: A Case OnDocument10 pagesProtecting Malaysian Automobile Industry: A Case OnRamiz AhmedNo ratings yet

- Department of Labor: B9395826 5327 4EC4 8DCC B6675F1EA84DDocument21 pagesDepartment of Labor: B9395826 5327 4EC4 8DCC B6675F1EA84DUSA_DepartmentOfLaborNo ratings yet

- The Corporate Tax Rate Debate: Lower Taxes On Corporate Profits Not Linked To Job CreationDocument30 pagesThe Corporate Tax Rate Debate: Lower Taxes On Corporate Profits Not Linked To Job CreationNancy AmideiNo ratings yet

- Business Government and Society A Managerial Perspective Text and Cases 13th Edition Test Bank SteinerDocument40 pagesBusiness Government and Society A Managerial Perspective Text and Cases 13th Edition Test Bank SteinerUsman HaiderNo ratings yet

- Pyfa LK TW Iv 2016 PDFDocument63 pagesPyfa LK TW Iv 2016 PDFRobert Chou0% (1)

- Goods or Services Are Exempted From Payment of VatDocument2 pagesGoods or Services Are Exempted From Payment of Vatfikru terfaNo ratings yet

- IntroDocument16 pagesIntroNeha DobeeNo ratings yet

- Softex FormDocument13 pagesSoftex Formapi-3733759100% (1)

- (PaperzoneVN - Com) - Christ The Redeemer in Rio de JaneiroDocument14 pages(PaperzoneVN - Com) - Christ The Redeemer in Rio de Janeirokako2006No ratings yet

- Practice Questions Chapter 10 - Public GoodsDocument4 pagesPractice Questions Chapter 10 - Public GoodsTrung Kiên NguyễnNo ratings yet

- 19-075 Ref - Icdi - pv2 028 - Prop. Solar Truck RentalDocument2 pages19-075 Ref - Icdi - pv2 028 - Prop. Solar Truck RentalcheNo ratings yet

- Labor Standards Sem 1 2019Document14 pagesLabor Standards Sem 1 2019Charms QueensNo ratings yet

- Hilton Solution Chapter 3Document58 pagesHilton Solution Chapter 3Wissam JarmakNo ratings yet

- DHL Marketing MixDocument3 pagesDHL Marketing MixLé Ãñn ÍèNo ratings yet

- Overview White Paper ElectroneumDocument26 pagesOverview White Paper Electroneumriskrocks007No ratings yet

- The Lisbon Review 2004Document16 pagesThe Lisbon Review 2004World Economic Forum100% (2)

- En60068 3 112007Document8 pagesEn60068 3 112007AllamNo ratings yet

- DPI AutomotiveDocument9 pagesDPI AutomotiveUnodostres Cinco Ocho TreceNo ratings yet

- 2014-03 HERITAGE HERESY - Trenduri Strategie Consum 2014 PDFDocument44 pages2014-03 HERITAGE HERESY - Trenduri Strategie Consum 2014 PDFLiliana TiuNo ratings yet

- Ann Rep04Document27 pagesAnn Rep04Kandasamy RajaNo ratings yet

- 92 - San Miguel Corporation v. KhanDocument1 page92 - San Miguel Corporation v. KhanJoshua RiveraNo ratings yet

- Tourism Impacts On The EconomyDocument4 pagesTourism Impacts On The Economyqueenie esguerraNo ratings yet