Professional Documents

Culture Documents

Problem 25-4

Uploaded by

Rey Joyce Abuel0 ratings0% found this document useful (0 votes)

20 views3 pagesOriginal Title

Problem 25-4.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views3 pagesProblem 25-4

Uploaded by

Rey Joyce AbuelCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 3

Problem 25-4

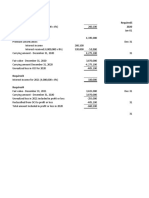

On January 1, 2017, Jam Company reported a long-term investments the following

unquoted equity securities:

Dale Company 5,000 ordinary shares ( 1% interest) 1,250,000

Ever Company 10,000 ordinary shares ( 2% interest) 1,600,000

Fox Company 25,000 ordinary shares (10% interest) 2,000,000

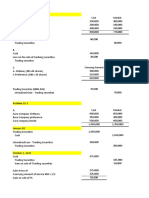

B. Journal Entries

1. On May 1, 2017, Dale Company issues a 10% stock dividend.

Memo – Received 500 ordinary shares from investee as 10% share dividend on 5000

original shares. Shares now held, 5500 shares.

2. On November 1, 2017, Dale Company paid a cash dividend of P20 share.

Cash – Dale Company (5,500 x 20) P110,000

Dividend Income P110,000

3. On January 1, 2017, Jam Company paid P5,000,000 for 50,000 additional ordinary

shares of Fox Company which represented a 20% investment in Fox Company.

Investment in associate P5,000,000

Cash P5,000,000

The fair value of all of Fox’s identifiable assets net of liabilities was equal to their carrying

amount of P20,000,000.

Jam Company’s initial 10% interest of 25,000 ordinary shares of Fox Company was

acquired on January 1, 2016 for P2,000,000.

The 10% interest was accounted for under cost method. On January 1, 2017, this 10%

existing interest had a fair value of P2,400,000.

Fair value of 10% existing interest P2,400,000

Cost of 20% new interest P5,000,000

Total cost of investment P7,400,000

Carrying amount of net assets acquired P6,000,000

(20,000,000 x 30%)

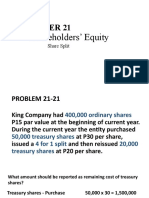

Excess of cost over carrying amount – Goodwill P1,400,000 A. Goodwill

Jam Company’s initial 10% interest of 25,000 ordinary shares of Fox Company

was acquired on January 1, 2016 for P2,000,000.

The 10% interest was accounted for under cost method. On January 1, 2017, this

10% existing interest had a fair value of P2,400,000.

Investment in associate (2,400,000 – 2,000,000) P400,000

Gain on remeasurement to equity P400,000

Investment in associate P2,400,000

Investment in equity securities P2,400,000

4. Fox Company reported net income of P6,000,000 for 2017, and paid dividend of P20

per share on December 31, 2017.

Investment in associate (6,000,000 x 30%) P1,800,000

Investment income P1,800,000

Cash (75,000 x 20) P1,500,000

Investment in associate P1,500,000

You might also like

- Chapter 31Document6 pagesChapter 31LorraineMartinNo ratings yet

- Financial Accounting Reviewer - Chapter 55Document9 pagesFinancial Accounting Reviewer - Chapter 55Coursehero PremiumNo ratings yet

- Chapter 15 ProblemsDocument7 pagesChapter 15 Problemsmercyvienho50% (2)

- Property, Plant and Equipment: Chapter 23 AnswerDocument34 pagesProperty, Plant and Equipment: Chapter 23 AnswerYuuNeko08No ratings yet

- Chapter 18 CompilationDocument21 pagesChapter 18 CompilationMaria Licuanan0% (1)

- Cost AccountingDocument12 pagesCost AccountingCamille G.No ratings yet

- Answer Key Assignment in Equity Investments - VALIX 2017Document3 pagesAnswer Key Assignment in Equity Investments - VALIX 2017Shinny Jewel VingnoNo ratings yet

- Chapter16 Equity Investments PDFDocument69 pagesChapter16 Equity Investments PDFRomuell BanaresNo ratings yet

- CHapter 25 Financial Accounting Vol1Document8 pagesCHapter 25 Financial Accounting Vol1Judith GabuteroNo ratings yet

- Problem 12-2 To 6Document3 pagesProblem 12-2 To 6MYCO PONCE PAQUENo ratings yet

- Intermediate Accounting Chapter 17 and 18Document9 pagesIntermediate Accounting Chapter 17 and 18avilastephjaneNo ratings yet

- Zeta Company Required1 Required5 2020 Required2Document2 pagesZeta Company Required1 Required5 2020 Required2AnonnNo ratings yet

- Activity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)Document6 pagesActivity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)WeStan LegendsNo ratings yet

- Problem 21-1Document7 pagesProblem 21-1camilleescote562No ratings yet

- Chapter16 BuenaventuraDocument11 pagesChapter16 BuenaventuraAnonn100% (1)

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- Ia Chapter 11-12Document4 pagesIa Chapter 11-12Marinella LosaNo ratings yet

- Chapter 31Document7 pagesChapter 31AnonnNo ratings yet

- IA Chapter 15Document12 pagesIA Chapter 15Blue Sky100% (1)

- Cabael-Ae109-Proof of CashDocument4 pagesCabael-Ae109-Proof of CashJanine MadriagaNo ratings yet

- Chap14 ProblemsDocument8 pagesChap14 ProblemsYen YenNo ratings yet

- IA Problem 17 4Document8 pagesIA Problem 17 4nenzzmariaNo ratings yet

- CHAPTER 23 Problems Answer KeyDocument2 pagesCHAPTER 23 Problems Answer KeyShane TabunggaoNo ratings yet

- Exercise ProblemsDocument6 pagesExercise ProblemsDianna Rose Vico100% (1)

- Soledad Company Required1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesSoledad Company Required1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- Chapter 18Document34 pagesChapter 18Christine Marie T. RamirezNo ratings yet

- IA 1 Valix 2020 Ver. Problem 26-6 - Problem 26-7Document5 pagesIA 1 Valix 2020 Ver. Problem 26-6 - Problem 26-7Ariean Joy DequiñaNo ratings yet

- Investment in AssociateDocument7 pagesInvestment in AssociatenenzzmariaNo ratings yet

- Chapter 20Document74 pagesChapter 20astherille caxxNo ratings yet

- Requirement A.: Acquisation of The BondsDocument3 pagesRequirement A.: Acquisation of The BondsMaria LicuananNo ratings yet

- Diamond CompanyDocument1 pageDiamond CompanyKillua ZOLDYNo ratings yet

- ACC123 InventoryCostFlowDocument3 pagesACC123 InventoryCostFlowkhryzellia lagurinNo ratings yet

- Chapter 14 AnswersevenDocument4 pagesChapter 14 AnswersevenJulianne Mejia100% (1)

- GROUP2 AE105 Chp.11 14Document26 pagesGROUP2 AE105 Chp.11 14Isabelle CandelariaNo ratings yet

- Mythical Company Provided The Following Transactions:: University - Year 2 AccountingDocument2 pagesMythical Company Provided The Following Transactions:: University - Year 2 Accountingcollegestudent2000No ratings yet

- Charisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountDocument2 pagesCharisma Company Required 1 Date Interest Received Interest Income Discount Amortization Carrying AmountAnonnNo ratings yet

- Machinery and Capitl ExpendituresDocument3 pagesMachinery and Capitl ExpendituresZes ONo ratings yet

- Mortel-BSA1202 (Inventories)Document5 pagesMortel-BSA1202 (Inventories)Aphol Joyce MortelNo ratings yet

- Razor Company Required Debit Credit 2020Document14 pagesRazor Company Required Debit Credit 2020AnonnNo ratings yet

- Ia Problem SolvingDocument3 pagesIa Problem SolvingApple RoncalNo ratings yet

- Prelim L6 Assignment TestDocument13 pagesPrelim L6 Assignment TestGarp BarrocaNo ratings yet

- Problem 22-1, Page 610 Classic Company: GivenDocument3 pagesProblem 22-1, Page 610 Classic Company: GivenDeanne LumakangNo ratings yet

- Remarkable Company - Audit On ReceivablesDocument2 pagesRemarkable Company - Audit On ReceivablesShr BnNo ratings yet

- This Study Resource Was Shared Via: Solution 23-2 Answer DDocument5 pagesThis Study Resource Was Shared Via: Solution 23-2 Answer DDummy GoogleNo ratings yet

- CHEER UP Chapter 13 Gross Profit MethodDocument7 pagesCHEER UP Chapter 13 Gross Profit MethodaprilNo ratings yet

- Machete Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageMachete Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- AmortizationDocument20 pagesAmortizationJudith Gabutero100% (2)

- Financial Asset at Amortized CostDocument20 pagesFinancial Asset at Amortized CostJudith Gabutero0% (1)

- AnswerQuiz - Module 10Document4 pagesAnswerQuiz - Module 10Alyanna Alcantara100% (1)

- Accounting - Prob.3Document2 pagesAccounting - Prob.3Dellosa, Jierstine Shaney R.No ratings yet

- Prob 21 21Document4 pagesProb 21 21Rhea Jane ParconNo ratings yet

- Chapter 20 CompilationDocument41 pagesChapter 20 CompilationMaria Licuanan0% (1)

- MiyawwDocument9 pagesMiyawwjessa mae zerdaNo ratings yet

- Chapter 27Document12 pagesChapter 27Crizel DarioNo ratings yet

- Problem 13 - 1 To Problem 13 - 8Document4 pagesProblem 13 - 1 To Problem 13 - 8Jem ColebraNo ratings yet

- Investment in Associate 2Document2 pagesInvestment in Associate 2miss independent100% (1)

- Exercises 122BDocument3 pagesExercises 122BAthena Fatmah AmpuanNo ratings yet

- Retained EarningsDocument9 pagesRetained EarningsCamille GarciaNo ratings yet

- Investment in Equity Securities 2Document2 pagesInvestment in Equity Securities 2miss independentNo ratings yet

- SheDocument4 pagesShecedrick abalosNo ratings yet

- Chapter 7 Cash & Cash Equivalents: PayableDocument2 pagesChapter 7 Cash & Cash Equivalents: PayableRey Joyce AbuelNo ratings yet

- Use The Following Information For The Next Two Questions:: Practice Set # 6: Joint ArrangementsDocument4 pagesUse The Following Information For The Next Two Questions:: Practice Set # 6: Joint ArrangementsRey Joyce Abuel0% (1)

- DL FinalDocument1 pageDL FinalRey Joyce AbuelNo ratings yet

- Assignment (To Be Submitted On Sept 4 Considered As Final Exam 2)Document1 pageAssignment (To Be Submitted On Sept 4 Considered As Final Exam 2)Rey Joyce AbuelNo ratings yet

- Chapter 10: Eucharist: Basic Description of The EucharistDocument1 pageChapter 10: Eucharist: Basic Description of The EucharistRey Joyce AbuelNo ratings yet

- Rey Joyce 2Document2 pagesRey Joyce 2Rey Joyce AbuelNo ratings yet

- Chapter 8 Accounting For Franchise Operations - Franchisor: Learning CompetenciesDocument21 pagesChapter 8 Accounting For Franchise Operations - Franchisor: Learning CompetenciesRey Joyce AbuelNo ratings yet

- Activity On Architectural Designs:: Rubric For Grading: PPT Video RubricDocument1 pageActivity On Architectural Designs:: Rubric For Grading: PPT Video RubricRey Joyce AbuelNo ratings yet

- Starry NightDocument2 pagesStarry NightRey Joyce AbuelNo ratings yet

- Gothic ArchitectureDocument2 pagesGothic ArchitectureRey Joyce AbuelNo ratings yet