Professional Documents

Culture Documents

MBA 3.5-4th-BUSA4140-13

MBA 3.5-4th-BUSA4140-13

Uploaded by

Bilal Ahmad0 ratings0% found this document useful (0 votes)

9 views14 pagesOriginal Title

MBA 3.5-4th-BUSA4140-13.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views14 pagesMBA 3.5-4th-BUSA4140-13

MBA 3.5-4th-BUSA4140-13

Uploaded by

Bilal AhmadCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 14

Irregular allotment

An allotment is irregular if it is made without complying with the

conditions precedent to a regular allotment as discussed above.

Consequences of irregular allotment depend upon the nature of

irregularity involved. These may be noted as irregularities:

1. Failure to deliver a copy of the prospectus to the Registrar

before its issue.

2. Allotment without raising minimum subscription or without

either collecting application money or collecting less than 5

percent as application money or failure to deliver a copy of

statement in lieu of prospectus at least three days before

allotment.

Effects of irregular allotment (Section-70)

• Any allotment made contrary to the provisions of the

companies ordinance 1984 relating to the allotment are

voidable at the instance of applicant.

• The applicant can avoid the allotment within 30 days;

– From the date of the holding of the statutory meeting

– From the date of the allotment

• If the company is not required to hold the statutory meeting

• If the allotment is made after the holding of statutory meeting.

Even if company goes into winding up within this period of 30 days, this right to

void allotment is not lost.

Contd…..

• It should be noted that it is the applicant who

has the right to avoid the allotment. The

company can not take the benefit of its own

irregularities and can not avoid the allotment

after it is once made.

Contd…..

• Every officer of the company responsible for

irregular allotment of shares shall, besides

others liabilities, shall be liable to compensate

the company and the allottee for any damages

or losses caused due to such allotment.

Repayment of money received for shares

not alloted (section-71).

• The company within 10 days from shares

subscription date shall decide as to whom shares are

to be allotted

• The amount of unsuccessful applicants shall be

refunded with in 10 days from the decision

Contd…

• If the refund is not made within 15 days, the directors of the

company will be jointly and severally liable to repay the

amount along with a surcharge at the rate of 1.5% for a

month .

• They are also liable for a fine up to rupees 5000 and further

fine of rupees 100 per day in case of continuing offence.

• However, a director shall not be liable if he proves that

default in making refund was not due to any misconduct or

negligence on his part.

Allotment of shares to be dealt on stock

exchange (Section 72)

Where prospectus states that an application has been made or

will be made for permission of shares to be dealt on any stock

exchange,

• Any allotment of shares shall be void if such application is not

made within 7 days from the date of issue of Prospectus or

• the permission is not granted by stock exchange within 21 days

from the date of closing of subscription lists.

• The stock exchange may extend this period for further 21 days.

Contd…

• In case of contravention to the previous, the

company shall refund all the moneys received

against application within 8 days from such

contravention.

Contd…

• In case the money is not repaid within 8 days, then all the

directors will be jointly and severally liable to repay the amount

with a surcharge at the rate of 1.5% for a month or a part thereof.

• They are also liable for a fine up to rupees 5000 and further fine

of rupees 100 per day in case of continuing offence.

• However, a director shall not be liable if he proves that default in

making refund was not due to any misconduct or negligence on

his part.

Return of Allotment (Sec 73).

• Every company whether public or private and having a share capital ans

within 30 days of allotment is required to send to the Registrar, a document

known as the "Return of Allotment".

• The return of allotment contains various details on allotment of shares such

as the nominal value of shares allotted, names and addresses of allotees,

amount paid or payable on each share

• Particulars of bonus shares and shares issued at discount. The secretary has

to see that these documents are prepared and submitted in time to the

Registrar.

The company shall file with a registrar a return of allotment within 30 days

from the date of allotment. Return of allotment should state and include;

In the case of shares issued in cash

1. The number and nominal amount of shares

allotted;

2. Particulars of each allottee

3. Amount paid on each share.

In case of shares allotted other then for cash, a duly

verified contract shall be submitted to the registrar,

stating the following

1. The number and nominal amount of shares allotted;

2. The amount to be treated as paid up;

3. Consideration for which they have been allotted

4. In case of contract is not reduce to writing, the

memorandum of contract shall be filed with the registrar.

In case of shares issued at discount

1. Copy of resolution authorizing such issue;

2. Copy of order of commission sanctioning the issue.

In case of bonus shares

1. The number and nominal amount of shares;

2. The particulars of each allottee.

3. A copy of resolution authorizing the issue.

You might also like

- 7 CLSP Shares, Debentures and AllotmentDocument21 pages7 CLSP Shares, Debentures and AllotmentSyed Mujtaba HassanNo ratings yet

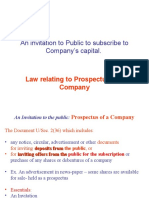

- 18.1. PROSPECTUS, ALLOTMENT EtcDocument7 pages18.1. PROSPECTUS, ALLOTMENT EtcMuzammil LiaquatNo ratings yet

- Allotment of SharesDocument17 pagesAllotment of SharesHimanshu Premani100% (1)

- Bachelor of Commerce: Company Law-BCOM 402-18 Topic-Share CapitalDocument40 pagesBachelor of Commerce: Company Law-BCOM 402-18 Topic-Share CapitalRubina RubinaNo ratings yet

- Concept of DividendDocument26 pagesConcept of DividendAnant GargNo ratings yet

- Allotment of Share & Share WarrentsDocument12 pagesAllotment of Share & Share WarrentsMuhammad RizwanNo ratings yet

- 20 CompaniesAct SharecapitalDocument17 pages20 CompaniesAct Sharecapital2022pbm5034No ratings yet

- General Principles of AllotmentDocument10 pagesGeneral Principles of AllotmentAnonymous uftmOeJxqNo ratings yet

- Allotment of Shares PDFDocument19 pagesAllotment of Shares PDFAyman KhalidNo ratings yet

- By Sriram Parthasarathy, Director Prowis Corporate Services Private LTD.Document41 pagesBy Sriram Parthasarathy, Director Prowis Corporate Services Private LTD.riteshsharda767No ratings yet

- Post-Issue: by - Abhishek SinhaDocument15 pagesPost-Issue: by - Abhishek Sinhag1sNo ratings yet

- Company Law and AllotmentDocument6 pagesCompany Law and Allotmentmahesh145m100% (1)

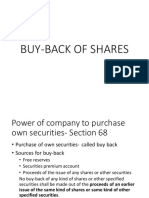

- Buy BackDocument12 pagesBuy BackNiraj PandeyNo ratings yet

- The Payment of BonusDocument21 pagesThe Payment of BonusChaudhary Rajat DubeyNo ratings yet

- Buy Back, DividentDocument13 pagesBuy Back, DividentVishal ChandakNo ratings yet

- Unit - 1Document89 pagesUnit - 1sarangNo ratings yet

- Stocks and StockholdersDocument12 pagesStocks and Stockholders123No ratings yet

- Summary Varous SectionsDocument5 pagesSummary Varous SectionsTalha SiddNo ratings yet

- SharesDocument6 pagesSharesgoyalb06062004No ratings yet

- The Following Rules Regarding Allotment of Shares Are NotedDocument3 pagesThe Following Rules Regarding Allotment of Shares Are NotedIshika AroraNo ratings yet

- 2nd Share Capital of A CompanyDocument34 pages2nd Share Capital of A Companywaqasjaved869673No ratings yet

- Note On Buy BackDocument6 pagesNote On Buy BacksravyaNo ratings yet

- Issue of SharesDocument9 pagesIssue of SharesLearn MitraNo ratings yet

- Recovery ProcessDocument5 pagesRecovery Processrajmane.ryNo ratings yet

- Rights Issue Rules-2006Document22 pagesRights Issue Rules-2006Asif Abdullah KhanNo ratings yet

- Allotment of Shares: Syed Iftikhar-Ul-Hassan ShahDocument17 pagesAllotment of Shares: Syed Iftikhar-Ul-Hassan ShahAyman KhalidNo ratings yet

- Allotment of Shares and DebenturesDocument15 pagesAllotment of Shares and DebenturesNidharshanaa V RNo ratings yet

- A Company Is An Artificial Person Created by LawDocument5 pagesA Company Is An Artificial Person Created by LawNeelabhNo ratings yet

- Shares and ShareholdersDocument15 pagesShares and ShareholdersJaysurya DebNo ratings yet

- Dividend A Brief NoteDocument7 pagesDividend A Brief NoteaakashagarwalNo ratings yet

- Buy Back of Share CapitalDocument27 pagesBuy Back of Share CapitalaveyibanayihaiNo ratings yet

- (B) Share Capital of A CompanyDocument34 pages(B) Share Capital of A CompanyGhulam Murtaza KoraiNo ratings yet

- Unit 2Document41 pagesUnit 2SharmilaNo ratings yet

- Prospectus and Allotment PRESENTATIONDocument28 pagesProspectus and Allotment PRESENTATIONgondalsNo ratings yet

- Rules of Capital Maintenance: Pranjal NeupaneDocument11 pagesRules of Capital Maintenance: Pranjal NeupaneSamish DhakalNo ratings yet

- Corporate Law - Unit 2Document17 pagesCorporate Law - Unit 2Shem W LyngdohNo ratings yet

- Deposits PresentationDocument29 pagesDeposits Presentationniraliparekh27No ratings yet

- Buy BackDocument3 pagesBuy BackSouvik BhowalNo ratings yet

- Share Capital and Its TypesDocument10 pagesShare Capital and Its TypesNimisha darakNo ratings yet

- Steps in A Pre and Post Public IssueDocument8 pagesSteps in A Pre and Post Public Issuearmailgm100% (1)

- Corpo Finals QuestionsDocument36 pagesCorpo Finals QuestionsCGNo ratings yet

- Declaration of DividendsDocument3 pagesDeclaration of DividendsAnubha DwivediNo ratings yet

- Buy Back of Securities ObjectivesDocument21 pagesBuy Back of Securities ObjectivesArchana KhapreNo ratings yet

- Companies Act 2013Document15 pagesCompanies Act 2013biplav2uNo ratings yet

- An Invitation To Public To Subscribe To Company's CapitalDocument44 pagesAn Invitation To Public To Subscribe To Company's CapitalRishabhJainNo ratings yet

- Chapter VIII Dividend FinalDocument29 pagesChapter VIII Dividend FinalSriram RamNo ratings yet

- Buyback of SharesDocument2 pagesBuyback of Sharessauravlex100% (1)

- DividendDocument9 pagesDividendr.k.sir7856No ratings yet

- Bonus Vs Issue Share2Document5 pagesBonus Vs Issue Share2SHUBHANGI SINGH 21123107No ratings yet

- Chapter-6 Allotment of SecuritiesDocument8 pagesChapter-6 Allotment of SecuritiesCA CS Umang RataniNo ratings yet

- Dividend & Accounts of ComplanyDocument38 pagesDividend & Accounts of ComplanySrikant0% (1)

- Rights Issue Bonus Issue 3Document12 pagesRights Issue Bonus Issue 3vajoansaNo ratings yet

- Company Law ProjectDocument8 pagesCompany Law ProjectDouble A CreationNo ratings yet

- Fixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeDocument4 pagesFixed Deposit Schemes: Scheme (A) - Non Cumulative Scheme (B) - CumulativeoooohlalaNo ratings yet

- CH 4 Buy Back & Reduction of Share Capital PDFDocument12 pagesCH 4 Buy Back & Reduction of Share Capital PDFYashJainNo ratings yet

- GDR, Doctrine of Constructive Notice & Indoor MGMT Prospectus, Red Herring Prospectus, Shelf Prospectus, MisstaementDocument22 pagesGDR, Doctrine of Constructive Notice & Indoor MGMT Prospectus, Red Herring Prospectus, Shelf Prospectus, MisstaementVishal ChandakNo ratings yet

- Company Law: List Any Fifteen Privileges Available To A Private Company Under The Companies Act, 1956Document18 pagesCompany Law: List Any Fifteen Privileges Available To A Private Company Under The Companies Act, 1956hiren_zalaNo ratings yet

- Capital Maintenance NotesDocument4 pagesCapital Maintenance NotesFrancis Njihia KaburuNo ratings yet

- Issue of SharesDocument14 pagesIssue of SharesSenelwa AnayaNo ratings yet

- MBA 3.5 Internship Report FormatDocument8 pagesMBA 3.5 Internship Report FormatBilal AhmadNo ratings yet

- Internship ReportDocument46 pagesInternship ReportBilal Ahmad100% (1)

- Culture Business SystemsDocument31 pagesCulture Business SystemsBilal AhmadNo ratings yet

- Brand ManagementDocument31 pagesBrand ManagementBilal AhmadNo ratings yet

- Strategy #1 Free Strategy: Flames OF Binary OptionDocument4 pagesStrategy #1 Free Strategy: Flames OF Binary OptionBilal Ahmad100% (1)

- My Candle Stick PatternsDocument21 pagesMy Candle Stick PatternsBilal AhmadNo ratings yet

- Share Capital:: - Particular Amount of Money With Which A Business Is StartedDocument8 pagesShare Capital:: - Particular Amount of Money With Which A Business Is StartedBilal AhmadNo ratings yet

- Annual Report 2014Document257 pagesAnnual Report 2014Bilal AhmadNo ratings yet

- Foreign PolicyDocument25 pagesForeign PolicyBilal AhmadNo ratings yet

- International National LawDocument21 pagesInternational National LawBilal AhmadNo ratings yet

- Insolvency ProjectDocument10 pagesInsolvency ProjectAbhijeet KumarNo ratings yet

- Guiang vs. CA, 291 SCRA 372, June 26, 1998Document2 pagesGuiang vs. CA, 291 SCRA 372, June 26, 1998rhodz 88100% (1)

- Manila Law College Mock BarDocument11 pagesManila Law College Mock Barmarcus.pebenitojrNo ratings yet

- Gene & Georgetti'sDocument4 pagesGene & Georgetti'sAnonymous 6f8RIS6No ratings yet

- Law of Obligations and Legal RemediesDocument644 pagesLaw of Obligations and Legal Remediesskyreach80% (5)

- Go PrivateDocument23 pagesGo PrivateRafe AlryadiNo ratings yet

- 05 Mayor Vs TiuDocument5 pages05 Mayor Vs TiuMac Duguiang Jr.No ratings yet

- Goran Georgijević, PHD Mauritian Tort Law: Legislation ReviewDocument20 pagesGoran Georgijević, PHD Mauritian Tort Law: Legislation ReviewStephan Jimmy Didier RAMBHORONo ratings yet

- Baltic Code 2020 - CharteringDocument3 pagesBaltic Code 2020 - CharteringMark Mirosevic-SorgoNo ratings yet

- NDA - Field Trial FormDocument3 pagesNDA - Field Trial FormFrancisco MelembeNo ratings yet

- Geojit On Power MechDocument5 pagesGeojit On Power MechDhittbanda GamingNo ratings yet

- Danan v. SerranoDocument2 pagesDanan v. SerranojenwinNo ratings yet

- Indemnity Bond FormatDocument2 pagesIndemnity Bond FormatMahadev D. BhandareNo ratings yet

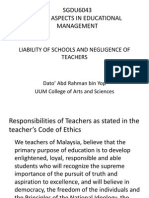

- Lecture 5 - SGDU6043 - Liability of Schools and Negligence of TeachersDocument14 pagesLecture 5 - SGDU6043 - Liability of Schools and Negligence of TeachersRaj RajindranNo ratings yet

- Corporation Code - de LeonDocument1,114 pagesCorporation Code - de Leonsam70% (23)

- PolicySchedule 14802939 20230402 144942Document4 pagesPolicySchedule 14802939 20230402 144942Acgleasing ltdNo ratings yet

- Topic 13 - Estate PlanningDocument62 pagesTopic 13 - Estate Planningaarzu dangiNo ratings yet

- Coke vs. CADocument1 pageCoke vs. CAisangbedistaNo ratings yet

- D006842245 2861592768784284 SchedulescDocument2 pagesD006842245 2861592768784284 SchedulescShubrojyoti Chowdhury0% (1)

- Alinee Rights and RemediesDocument2 pagesAlinee Rights and Remediesdiginside4meNo ratings yet

- Ritco Logistics Limited: Date: 31/03/2022Document2 pagesRitco Logistics Limited: Date: 31/03/2022Contra Value BetsNo ratings yet

- Fuji Television Network, Inc. v. Arlene S. Espiritu, GR No. 204944-45, 03 December 2014, Case DigestDocument3 pagesFuji Television Network, Inc. v. Arlene S. Espiritu, GR No. 204944-45, 03 December 2014, Case DigestSangHee ChoiNo ratings yet

- 310703-Affidavit - I (Community Hall)Document4 pages310703-Affidavit - I (Community Hall)Mayank SharmaNo ratings yet

- Affidavit of Ownership of Parcel of Land and Authority To RegisterDocument2 pagesAffidavit of Ownership of Parcel of Land and Authority To RegisterBoom Manuel100% (3)

- Narciso Gutierrez VsDocument1 pageNarciso Gutierrez VsFranz BiagNo ratings yet

- Far East Bank Vs Gold PalaceDocument2 pagesFar East Bank Vs Gold PalaceBAROPS0% (1)

- Death Claim ApplicationDocument4 pagesDeath Claim ApplicationAbhiNo ratings yet

- Insurance Law QuizDocument4 pagesInsurance Law QuizKevin Barrett100% (1)

- 64 - Lao Vs GenatoDocument2 pages64 - Lao Vs GenatoRia GabsNo ratings yet

- What Is A Condominium?: Separate InterestDocument8 pagesWhat Is A Condominium?: Separate InterestRandolph AlvarezNo ratings yet