Professional Documents

Culture Documents

Advanced Accounting: Consolidation Techniques and Procedures

Advanced Accounting: Consolidation Techniques and Procedures

Uploaded by

gabiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Advanced Accounting: Consolidation Techniques and Procedures

Advanced Accounting: Consolidation Techniques and Procedures

Uploaded by

gabiCopyright:

Available Formats

Advanced Accounting

Thirteenth Edition, Global Edition

Chapter 4

Consolidation

Techniques and

Procedures

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Consolidation Techniques: Objectives

4.1 Prepare consolidation workpaper for the year of

acquisition when the parent uses the complete equity

method to account for its investment in a subsidiary.

4.2 Prepare a consolidation workpaper for the years

subsequent to an acquisition.

4.3 Locate errors in a consolidation workpaper.

4.4 Record fair values of identifiable net assets acquired.

4.5 Prepare a consolidated statement of cash flows.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Consolidation Techniques:

Objectives (continued)

4.6 For the Students: Create an electronic spreadsheet

to prepare a consolidation workpaper.

4.7 Appendix A: Understand the alternative trial balance

workpaper format.

4.8 Appendix B: Prepare a consolidation workpaper when

parent company uses either the cost method or

incomplete equity method.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

4.1: Acquisition-Year Workpaper

Consolidation Techniques and Procedures

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

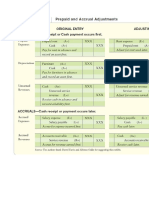

Preparing the Worksheet

Statements are entered onto the worksheet:

– Income statement

– Statement of retained earnings

– Balance sheet

Columns needed:

– Parent

– Subsidiary

– DR and CR columns for elimination entries

– Consolidated

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Completing the Worksheet (1 of 2)

1. Enter Parent and Sub. amounts at 100% of book

value. (Even if parent owns less)

2. Enter elimination entries into the DR and CR

columns. (Check totals)

3. For consolidated revenues, liabilities, and equity

(other than ending retained earnings):

– Add parent, subsidiary, less DR, plus CR.

4. For consolidated assets:

– Add parent, subsidiary, plus DR, less CR.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Completing the Worksheet (2 of 2)

5. For income, ending retained earnings and all

subtotals and totals:

– Compute directly in consolidated column.

Note:

– The total consolidated assets should equal the

total consolidated liabilities and equity.

– Expenses on the income statement and

dividends on the statement of retained earnings

are generally shown as negative numbers. So

compute the consolidated amounts as you

would for revenues

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Workpaper Entries

1. Adjust for errors & omissions

2. Eliminate intercompany profits and losses

3. Eliminate income & dividends from sub. and bring

Investment account to its beginning balance

4. Record noncontrolling interest in sub.'s earnings &

dividends

5. Eliminate reciprocal Investment & sub.'s equity

balances

6. Amortize fair value differentials

7. Eliminate other reciprocal balances

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Example: Pop & Son Data

Pop paid $176 for 80% of Son on 1/1/2016 when

Son's equity consisted of $120 capital stock and $60

retained earnings. All excess was due to unrecorded

patents with a 10-year life

Son’s income and dividends follow:

blank 2016 2017

Net income $50 $60

Dividends $30 $30

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Analysis

Cost of 80% of Son $176 Allocated to: Amt Amort.

Implied value of Son Patents $40 10 yrs

($176/.80) $220

Book value (120+60) 180

Excess $40

Unamort. Unamort.

Blank Unamort. Bal. Amortization Bal. Amortization Bal.

on on on

Blank 1/1/2016 in 2016 12/31/2016 in 2017 12/31/2017

Patents $40 $4 $36 $4 $32

Use these amounts Use these amounts in

in 2016 worksheet 2017 worksheet for

for amortization amortization expense

expense and and patents.

patents.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Income & Dividend Calculations (1 of 2)

blank

2016:

Son's net income $50 Pop's 80% share

Amortization (4) $36.8

Adjusted income $46 $24.0 NCI 20% share

Blank blank $9.2

Dividends $30 $6.0

Blank blank

2017: blank

Son's net income $60 Pop's 80% share

Amortization (4) $44.8

Adjusted income $56 $24.0

Blank blank NCI 20% share

Dividends $30 $11.2

$6.0

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pop's 2016 Worksheet Entries (1 of 3)

1. Adjust for errors & omissions

● none

2. Eliminate intercompany profits and losses

● none

3. Eliminate income & dividends from sub. and bring

Investment account to its beginning balance

Income from Son (-R, -SE) 36.8 Blank

Dividends (+SE) Blank 24.0

Investment in Son (-A) blank 12.8

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pop's 2016 Worksheet Entries (2 of 3)

4. Record noncontrolling interest in sub.'s earnings &

dividends

Noncontrolling interest share (-SE) 9.2 blank

Dividends (+SE) blank 6.0

Noncontrolling interest (+SE) blank 3.2

5. Eliminate reciprocal Investment & sub.'s equity

balances

Capital stock, Son (-SE) 120 blank

Retained earnings, Son (beginning) (-SE) 60 blank

Patents (+A) 40 blank

Investment in Son (-A) blank 176

Noncontrolling interest (+SE) blank 44

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pop's 2016 Worksheet Entries (3 of 3)

6. Amortize fair value/book value differentials

Amortization Expense (E, -SE) 4 blank

Patents (-A) blank 4

7. Eliminate other reciprocal balances

● None

Note that in the last chapter, all worksheet entries

were prepared for the balance sheet. Here worksheet

entries are prepared for the income statement,

statement of retained earnings, and balance sheet.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pop's 2016 Worksheet (1 of 2)

Year ended 12/31/2016c Pop Son DR CR Consol

Income statement blank blank blank blank blank

Revenues 500.0 130.0 blank blank 630.0

Income from Son 36.8 blank 36.8 blank 0.0

Expenses (400.0) (80.0) 4.0 blank (484.0)

Noncontrolling interest share blank blank 9.2 blank (9.2)

Net income/Controlling share 136.8 50.0 blank blank 136.8

Statement of retained earnings blank blank blank blank blank

Beginning retained earnings 10.0 60.0 60.0 blank 10.0

Add net income 136.8 50.0 blank blank 136.8

Deduct dividends (60.0) (30.0) blank 24.0 (60.0)

Blank blank blank blank 6.0 blank

Ending retained earnings 86.8 80.0 blank blank 86.8

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Balance Sheet 12/31/2016

Balance sheet, 12/31/2016 Pop Son DR CR Consol

Cash 78.0 20.0 blank blank 98.0

Other current assets 180.0 100.0 blank blank 280.0

Investment in Son 188.8 blank blank 12.8 0.0

Blank blank blank blank 176.0 blank

Plant & equipment, net 500.0 140.0 blank blank 680.0

Patents blank blank 40.0 4.0 36.0

Total 946.8 260.0 blank blank 1,054.0

Liabilities 160.0 60.0 blank blank 220.0

Capital stock 700.0 120.0 120.0 blank 700.0

Retained earnings 86.8 80.0 blank blank 86.8

Noncontrolling interest, Jan.1 blank blank blank 44.0 blank

Noncontrolling interest, Dec. 31 blank blank blank 3.2 47.2

Total 946.8 260.0 blank blank 1,054.0

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

A Look at the Income Statement

Year ended 12/31/2016c Pop Son DR CR Consol

Income statement blank blank blank blank blank

Revenues 500.0 130.0 blank blank 630.0

Income from Son 36.8 36.8 blank 0.0

Expenses (400.0) (80.0) 4.0 blank (484.0)

Noncontrolling interest share blank blank 9.2 blank (9.2)

Net income/Controlling share 136.8 50.0 blank blank 136.8

● Income from Son is eliminated.

● Expenses are adjusted for 2016 amortization, - $4

on patents.

● Noncontrolling interest is proportional to Pop's

Income from Son since Pop uses the equity method.

● $36.8 x .20/.80 = $9.2

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

A Look at Retained Earnings

Year ended 12/31/2016c Pop Son DR CR Consol

Statement of retained earnings blank blank blank blank blank

Beginning retained earnings 10.0 60.0 60.0 blank 10.0

Add net income 136.8 50.0 blank blank 136.8

Deduct dividends (60.0) (30.0) blank 24.0 (60.0)

Blank blank blank blank 6.0 blank

Ending retained earnings 86.8 80.0 blank blank 86.8

● Beginning retained earnings of Son is eliminated.

● All of Son's dividends are eliminated.

● Net income is not calculated across the line but

taken from the consolidated income statement.

● Ending retained earnings is calculated in the

consolidated column.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

A Look at Assets

– Investment in Son is eliminated.

– Patents at the start of 2016 were $20, and current

amortization is $2. They are $18 at the end of 2016.

– The total is calculated in the consolidated column.

Balance sheet, 12/31/2016 Pop Son DR CR Consol

Cash 78.0 20.0 blank blank 98.0

Other current assets 180.0 100.0 blank blank 280.0

Investment in Son 188.8 blank blank 12.8 0.0

Blank blank blank blank 176.0 blank

Plant & equipment, net 500.0 140.0 blank blank 680.0

Patents blank blank 40.0 4.0 36.0

Total 946.8 360.0 blank blank 1,054.0

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

A Look at Liabilities & Equity

– Son's capital stock is eliminated.

– Retained earnings are not calculated across the row; they

are taken from the statement of retained earnings.

– Noncontrolling interest at year-end is proportional to

Pop's Investment in Son account.

● $94.4 x .20/.80 = $23.6

Balance sheet, 12/31/2016 Pop Son DR CR Consol

Liabilities 160.0 60.0 blank blank 220.0

Capital stock 700.0 120.0 120.0 blank 700.0

Retained earnings 86.8 80.0 blank blank 86.8

Noncontrolling interest, Jan.1 blank blank blank 44.0 blank

Noncontrolling interest, Dec. 31 blank blank blank 3.2 47.2

Total 946.8 260.0 blank blank 1,054.0

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

4.2: Workpapers in Subsequent Years

Consolidation Techniques and Procedures

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Analysis, for 2017

Cost of 80% of Son $176 Allocated to: Amt Amor.

Implied value of Son ($88/.80) $220 Patents $40 10 yrs

Book value (120+60) 180

Excess $40

Unamort. Unamort. Unamort.

Blank Bal. Amortization Bal. Amortization Bal.

on on on

Blank 1/1/2016 in 2016 12/31/2016 in 2017 12/31/2017

Patents $40 $4 $36 $24 $32

Use these amounts in Use these amounts in

2016 worksheet for 2017 worksheet for

amortization expense amortization expense

and patents and patents.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Income & Dividend Calculations (2 of 2)

2016: blank

Son's net income $50

Pop's 80% share

Amortization (4) $36.8

Adjusted income $46 $24.0 NCI 20% share

Blank blank $9.2

Dividends $30 $6.0

2017: Blank

Son's net income $60 Pop's 80% share

Amortization (4) $44.8

Adjusted income $56 $24.0

Blank blank NCI 20% share

Dividends $30 $11.2

$6.0

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pop's Worksheet Entries for 2017 (1 of 3)

1. Adjust for errors & omissions

● none

2. Eliminate intercompany profits and losses

● none

3. Eliminate income & dividends from sub. and bring

Investment account to its beginning balance

Income from Son (-R, -SE) 44.8 blank

Dividends (+SE) blank 24.0

Investment in Son (-A) blank 20.8

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pop's Worksheet Entries for 2017 (2 of 3)

4. Record noncontrolling interest in sub.'s earnings &

dividends

Noncontrolling interest share (-SE) 11.2 blank

Dividends (+SE) blank 6.0

Noncontrolling interest (+SE) blank 5.2

5. Eliminate reciprocal Investment & sub.'s equity

balances

Capital stock, Son (-SE) 120 blank

Retained earnings, Son (beginning) (-SE) 80 blank

Patents (+A) 36 blank

Investment in Son (-A) blank 188.8

Noncontrolling interest (+SE) blank 47.2

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Eliminating Investment in Son

Entry 5 eliminates the Investment in Son and establishes the

Noncontrolling Interest as of the beginning of the current year.

Implied value of Son at acquisition $176/.80 $220

Add the increase in retained earnings from acquisition

to the beginning of the current year

$80 at 1/1/2017 minus $60 at 1/1/2016 20

Less amortization for all prior periods

$4 patent amortization for 2016 (4)

Adjusted value of Son at 1/1/2017 $236

– Investment in Son (80% x $236) = $188.8

– Noncontrolling interest (20% x $236) = $47.2

– Verify the $236 from the debits in Entry 5 (120 + 80 + 36).

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pop's Worksheet Entries for 2017 (3 of 3)

6. Amortize fair value differentials

Amortization Expense (E, -SE) 4 blank

Patents (-A) blank 4

7. Eliminate other reciprocal balances

Note payable – Pop (-L) 20 blank

Note receivable – Son (-A) blank 20

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pop's 2016 Worksheet (2 of 2)

Year ended 12/31/2016 Pop Son DR CR Consol

Income statement blank blank blank blank blank

Revenues 600.0 150.0 blank blank 750.0

Income from Son 44.8 blank 44.8 blank 0.0

Expenses (488.0) (90.0) 4.0 blank (582.0)

Noncontrolling interest share blank blank 11.2 blank (11.2)

Net income/Controlling share 156.8 60.0 blank blank 156.8

Statement of retained earnings blank blank blank blank blank

Beginning retained earnings 86.8 80.0 80.0 blank 86.8

Add net income 156.8 60.0 blank blank 156.8

Deduct dividends (90.0) (30.0) blank 24.0 (90.0)

Blank blank blank blank 6.0 blank

Ending retained earnings 153.6 110.0 blank blank 153.6

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pop’s Balance Sheet 12/31/2017

Balance sheet, 12/31/2017 Pop Son DR CR Consol

Cash 90.0 40.0 blank blank 130.0

Note receivable – Son 20.0 blank blank 20.0 0.0

Other current assets 194.0 140.0 blank blank 334.0

Investment in Son 209.6 blank Blank 20.8 0.0

Blank blank blank Blank 188.8 blank

Plant & equipment, net 480.0 120.0 blank blank 600.0

Patents blank blank 36.0 4.0 32.0

Total 993.6 300.0 blank blank 1,096.0

Note payable – Pop blank 20.0 20.0 blank blank

Liabilities 140.0 50.0 blank blank 190.0

Capital stock 790.0 120.0 120.0 blank 700.0

Retained earnings 153.6 110.0 blank blank 153.6

Noncontrolling interest, Jan.1 blank blank blank 47.2 blank

Noncontrolling interest, Dec. 31 blank blank blank 5.2 52.4

Total 993.6 300.0 blank blank 1,096.0

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

4.3: Errors in the Workpapers

Consolidation Techniques and Procedures

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Errors

Most errors show up when the consolidated balance

sheet does not balance.

● Check for common omissions:

– Noncontrolling interest share (income)

– Goodwill

– Noncontrolling interest (equity)

● Check equality of DR and CR adjustments.

● Verify totals for parent and subsidiary statements.

● Re-calculate the consolidated amounts.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

4.4: Assigning Fair Value

Consolidation Techniques and Procedures

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Example with Excess Allocated

● Pam paid $360 for 90% of Sun on 12/31/2016

when Sun's equity consisted of $200 capital stock

and $50 retained earnings.

● Inventory (sold in 2016), land, and buildings (20

years) were undervalued by $10, $30, and $80,

respectively. Equipment (10 years) was overvalued

by $20.

● Sun's income and dividends for 2017 were $60 and

$20.

● At year-end, Sun has dividends payable of $10,

which Pam has not yet recorded. There is $20 cash

in transit from Sun to Pam for the note.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Analysis at Acquisition

Cost of 90% of Sun $360 Allocated to: Amt Amort

Implied value of Son ($360/.90) $400 Inventories $10 1st yr

Book value (200+50) 250 Land 30 -

Excess $150 Building 80 20 yrs

Blank blank Equipment (20) 10 yrs

Noncontrolling interest, Goodwill 50 -

10%(400) $40 blank 150 blank

blank Unamort. Bal. Amortization Unamort. Bal.

blank 12/31/2016 * in 2017 * on 12/31/2017

* Use the

Inventories $10 ($10) $0 12/31/2016

Land 30 0 30 and 2017

Building 80 (4) 76 amortization

Equipment (20) 2 (18) in worksheet

Goodwill 50 0 50 entries for

blank $150 ($12) $138 2017.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Sun's Income & Dividends

blank 2017

Pam's 90% share

Sun's net income $60 $43.2

Amortization ($12) $18.0

Adjusted income $48

blank blank

Sun's dividends $20

NCI 10% share

$4.8

$2.0

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pam's Worksheet Entries (1 of 4)

1. Adjust for errors & omissions

Dividends receivable (+A) 9.0 blank

Investment in Sun (-A) blank 9.0

Cash (+A) 20.0 blank

Note receivable, Sun (-A) blank 20.0

2. Eliminate intercompany profits and losses

● none

3. Eliminate income & dividends from sub. and bring

Investment account to its beginning balance

Income from Sun (-R, -SE) 43.2 blank

Dividends (+SE) blank 18.0

Investment in Sun (-A) blank 25.2

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pam's Worksheet Entries (2 of 4)

4. Record noncontrolling interest in sub.'s earnings &

dividends

Noncontrolling interest share (-SE) 4.8 blank

Dividends (+SE) blank 2.0

Noncontrolling interest (+SE) blank 2.8

5a. Eliminate reciprocal Investment & sub.'s equity

balances (with unamortized excess)

Capital stock (-SE) 200 blank

Retained earnings, Sun (beginning) (-SE) 50 blank

Unamortized excess (+A) 150 blank

Investment in Sun (-A) blank 360

Noncontrolling interest (+SE) blank 40

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pam's Worksheet Entries (3 of 4)

5b. Allocate the unamortized excess according to

beginning-of-year balances.

Cost of Goods Sold (-SE) 10 blank

Land (+A) 30 blank

Building, net (+A) 80 blank

Goodwill (+A) 50 blank

Equipment, net (-A) blank 20

Unamortized excess (-A) blank 150

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pam's Worksheet Entries (4 of 4)

6. Amortize fair value/book value differentials

Operating (depreciation) expense (E, -SE) 4 blank

Buildings, net (-A) blank 4

Equipment, net (-A) 2 blank

Operating (depreciation) expense (-E, SE) blank 2

7. Eliminate other reciprocal balances

Dividends payable (-L) 9.0 blank

Dividends receivable (-A) blank 9.0

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pam's 2017 Worksheet

Year ended 12/31/2017 Pam Sun DR CR Consol

Income statement blank blank blank blank blank

Revenues 900.0 300.0 blank blank 1,200.0

Income from Sun 43.2 blank 43.2 blank 0.0

Cost of goods sold (600.0) (150.0) 10.0 blank (760.0)

Operating expenses (190.0) (90.0) 4.0 2.0 (282.0)

Noncontrolling interest share blank blank 4.8 blank (4.8)

Net income/Controlling share 153.2 60.0 blank blank 153.2

Statement of retained earnings blank blank blank blank blank

Beginning retained earnings 120.0 50.0 50.0 blank 120.0

Add net income 153.2 60.0 blank blank 153.2

Deduct dividends (100.0) (20.0) blank 18.0 (100.0)

Blank blank blank blank 2.0 blank

Ending retained earnings 173.2 90.0 blank blank 173.2

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Pam’s Balance sheet 12/31/2017

Balance sheet, 12/31/2017 Pam Sun DR CR Consol

Cash 13.0 15.0 20.0 blank 48.0

Accounts receivable, net 76.0 25.0 blank blank 101.0

Note receivable – Sun 20.0 blank blank 20.0 0.0

Inventories 90.0 60.0 10.0 10.0 150.0

Land 60.0 30.0 30.0 blank 120.0

Building, net 190.0 110.0 80.0 4.0 376.0

Equipment, net 150.0 120.0 2.0 20.0 252.0

Investment in Sun 394.2 blank blank 9.0 0.0

blank blank blank blank 25.2 blank

blank blank blank blank 360.0 blank

Dividends receivable blank blank 9.0 9.0 0.0

Goodwill blank blank 50.0 blank 50.0

Unamortized excess blank blank 150.0 150.0 0.0

Total 993.2 360.0 blank blank 1,097.0

Accounts payable 120.0 60.0 blank blank 180.0

Dividends payable blank 10.0 9.0 blank 1.0

Capital stock 700.0 200.0 200.0 blank 700.0

Retained earnings 173.2 90.0 blank blank 173.2

Noncontrolling interest, Jan.1 blank blank blank 40.0

Noncontrolling interest, Dec. 31 blank blank blank 2.8 42.8

Total 993.2 360.0 blank blank 1,097.0

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

4.5: Consolidated Statement of Cash

Flows

Consolidation Techniques and Procedures

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Consolidated Cash Flows

The consolidated statement of cash flows is prepared

from:

– Consolidated balance sheets, beginning &

ending

– Consolidated income statement

– Other information

Procedure similar to an "unconsolidated" statement

of cash flows

Look at items specific to companies with:

– Subsidiaries

– Equity investments

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Investing & Financing Cash Flows

Investing cash flows:

– Include cash acquisition and/or disposition of

subsidiaries

– Include cash acquisition and/or disposition of

equity investees

Financing cash flows:

– Include cash dividends paid to noncontrolling

interests

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Operating Cash Flows

Direct method:

– Include cash dividends received from equity

investees (not equity method income)

Indirect method:

– Start with controlling share of net income

– Add the noncontrolling interest share

– Deduct the excess of equity method income over

cash dividends received from equity investees

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

4.7: Appendix A – Trial Balance Format

Consolidation Techniques and Procedures

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Alternative (Trial Balance) Worksheet

Format

Worksheet format presented earlier used the basic

financial statements

Alternative uses the ADJUSTED trial balances of the

parent and subsidiary.

Columns on worksheet:

– Parent and subsidiary adjusted trial balances,

– DR and CR adjustments,

– Income statement,

– Statement of retained earnings, and

– Balance sheet columns

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Completing the Worksheet

1. Enter worksheet elimination entries into the DR

and CR columns.

2. Add accounts as needed (e.g., noncontrolling

interest, goodwill, noncontrolling interest share).

3. Carry consolidated balances to income statement,

retained earnings, or balance sheet columns, as

appropriate.

4. Move controlling share of income to the retained

earnings column.

5. Move ending retained earnings to the balance

sheet column.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

4.8: Appendix B – Consolidation

Worksheet

Consolidation Techniques and Procedures

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Worksheet: Incomplete Equity Method (1 of 2)

Under the complete equity method, the parent

company’s net income equals the controlling share of

consolidated net income, and the parent company’s

retained earnings equal consolidated retained

earnings.

If these equalities are not present, then the

incomplete equity method is used.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Worksheet: Incomplete Equity Method (2 of 2)

1. Results from an incorrect application of the equity

method or use of the cost method of subsidiary

accounting.

2. This is not considered a violation of GAAP as long

as the consolidated financial statements prepared

for stockholders are correct.

3. An approach to preparing consolidation working

papers under an incomplete equity method is to

convert the parent company’s accounts to the

equity method as the first working paper entry.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

Worksheet: Cost Method

Subsidiary income only recognized when dividends

are declared.

1. Conversion to equity approach

2. Use traditional working paper entries to

consolidate parent and subsidiary under the cost

method.

3. This is easier in year of acquisition, but becomes

more complicated in years after, especially if

there are intercompany activities.

Copyright © 2018 Pearson Education, Ltd. All Rights Reserved.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 3 Year Projected Balance SheetDocument4 pages3 Year Projected Balance SheetJohn Cedrick0% (1)

- Final Accounts With AdjustmentsDocument4 pagesFinal Accounts With AdjustmentsDivyaman RamawatNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- ch09 Beams12ge SMDocument31 pagesch09 Beams12ge SMMutia Wardani50% (2)

- ACCA P2 - Latest Revision NotesDocument198 pagesACCA P2 - Latest Revision NotesFive Fifth100% (1)

- Jawaban E15-18 Dan E15-22 Intermediate Accounting WKKDocument6 pagesJawaban E15-18 Dan E15-22 Intermediate Accounting WKKMutia Wardani67% (3)

- Summary of CH 9 Assessing The Risk of Material MisstatementDocument19 pagesSummary of CH 9 Assessing The Risk of Material MisstatementMutia WardaniNo ratings yet

- Working With Financial StatementsDocument44 pagesWorking With Financial StatementsLayal KibbiNo ratings yet

- Pacific Grove Spice Company Case CalculationsDocument11 pagesPacific Grove Spice Company Case CalculationsMinh Hà33% (3)

- Chapter 2 Basic Financial StatementsDocument34 pagesChapter 2 Basic Financial StatementsAddisalem Mesfin100% (6)

- Entrepreneur ObjDocument93 pagesEntrepreneur ObjNitin Bhardwaj0% (1)

- Problems Audit of InvestmentsDocument15 pagesProblems Audit of InvestmentsKm de Leon75% (4)

- Summary of CH 8 Auditing Planning and MaterialityDocument17 pagesSummary of CH 8 Auditing Planning and MaterialityMutia WardaniNo ratings yet

- Jawaban E 5-7 E5-8 Advanced AccountingDocument3 pagesJawaban E 5-7 E5-8 Advanced AccountingMutia Wardani67% (3)

- Cp7-1 Principal EccountingDocument6 pagesCp7-1 Principal EccountingMutia WardaniNo ratings yet

- AKM CH 2Document8 pagesAKM CH 2Mutia WardaniNo ratings yet

- TA Chapter 7 PDFDocument29 pagesTA Chapter 7 PDFMutia WardaniNo ratings yet

- Account Titles Trial Balance Adjustment DR CR DR: Vang Management ServicesDocument9 pagesAccount Titles Trial Balance Adjustment DR CR DR: Vang Management ServicesMutia WardaniNo ratings yet

- Kuliah 8 Stock and Their ValuationDocument31 pagesKuliah 8 Stock and Their ValuationMutia WardaniNo ratings yet

- Kuliah 10 The Basic of Capital BudgetingDocument31 pagesKuliah 10 The Basic of Capital BudgetingMutia WardaniNo ratings yet

- TA Chapter 17 PDFDocument26 pagesTA Chapter 17 PDFMutia WardaniNo ratings yet

- Accounting Theory: Conceptual Issues in A Political and Economic EnvironmentDocument29 pagesAccounting Theory: Conceptual Issues in A Political and Economic EnvironmentdevitaNo ratings yet

- CH 5 - Intercompany Transaction - InventoriesDocument14 pagesCH 5 - Intercompany Transaction - InventoriesMutia WardaniNo ratings yet

- cp7-1 Principal EccountingDocument6 pagescp7-1 Principal EccountingMutia WardaniNo ratings yet

- BRIEF EXERCISE Chapter 15 Number 1-3 Solution Intermediate AccountingDocument1 pageBRIEF EXERCISE Chapter 15 Number 1-3 Solution Intermediate AccountingMutia WardaniNo ratings yet

- Integrated Case 8-23 Financial ManagementDocument1 pageIntegrated Case 8-23 Financial ManagementMutia WardaniNo ratings yet

- Jawaban CH 3Document2 pagesJawaban CH 3Mutia WardaniNo ratings yet

- Jawaban P5-6 Intermediate AccountingDocument3 pagesJawaban P5-6 Intermediate AccountingMutia WardaniNo ratings yet

- 0 MasterfileDocument598 pages0 MasterfileAngel VenableNo ratings yet

- Answers To QuestionsDocument17 pagesAnswers To QuestionsElie YabroudiNo ratings yet

- Half Year FY21 Results.: 25 February 2021Document35 pagesHalf Year FY21 Results.: 25 February 2021Nima MoaddeliNo ratings yet

- IAS 39 MacrohedgingDocument64 pagesIAS 39 MacrohedgingMariana MirelaNo ratings yet

- Solved On June 30 2017 Perfect Party Planners PPP Had ADocument1 pageSolved On June 30 2017 Perfect Party Planners PPP Had ADoreenNo ratings yet

- FAR Diagnostic Exam PDFDocument9 pagesFAR Diagnostic Exam PDFReach Moon DaddyNo ratings yet

- Annual Report 2021Document1,210 pagesAnnual Report 2021SohaNo ratings yet

- Class Activity, Adjustments & WORK SHEETDocument18 pagesClass Activity, Adjustments & WORK SHEETkhanNo ratings yet

- ERP AcountsDocument61 pagesERP AcountsALI ASGHAR MUSTAFANo ratings yet

- Balance SheetDocument2 pagesBalance SheetJonathan TanNo ratings yet

- Reading 13 Integration of Financial Statement Analysis Techniques - AnswersDocument21 pagesReading 13 Integration of Financial Statement Analysis Techniques - Answerstristan.riolsNo ratings yet

- PIPFA 2012solutions OptDocument56 pagesPIPFA 2012solutions OptshahzebkhansNo ratings yet

- BRISKResources Andre Proite Asset Liability Managementin Developing Countries ABalance Sheet ApproachDocument36 pagesBRISKResources Andre Proite Asset Liability Managementin Developing Countries ABalance Sheet ApproachZainab ShahidNo ratings yet

- Financial Management Handbook 1704942604Document45 pagesFinancial Management Handbook 1704942604alenNo ratings yet

- Working Capital Management - Current AssetsDocument11 pagesWorking Capital Management - Current AssetsJeanice CeciliaNo ratings yet

- Partnership Formation Problem 4Document4 pagesPartnership Formation Problem 4RJ Kristine DaqueNo ratings yet

- Substantive Testing For PPEDocument11 pagesSubstantive Testing For PPEPaul Anthony AspuriaNo ratings yet

- Finanacial Performance Analysis of HDFC BankDocument54 pagesFinanacial Performance Analysis of HDFC BankSharuk KhanNo ratings yet

- Accounting Task 4 Group 7Document6 pagesAccounting Task 4 Group 7Mega ZhafarinaNo ratings yet

- Chapter 6 LectureDocument21 pagesChapter 6 LectureDana cheNo ratings yet

- Bsa Lecture Discussion On AccrualsDocument8 pagesBsa Lecture Discussion On AccrualsGarp BarrocaNo ratings yet

- CH02TBV7Document21 pagesCH02TBV7AAAMMMBBBNo ratings yet