Professional Documents

Culture Documents

Integrated Case 8-23 Financial Management

Uploaded by

Mutia WardaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Integrated Case 8-23 Financial Management

Uploaded by

Mutia WardaniCopyright:

Available Formats

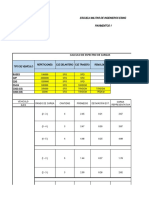

Returns on Alternative Investments

Estimated Rate of Return

High Tech Collectio U.S. Market 2-Stock

State of the Economy Prob. T-Bills ns Rubber Portofolio Portofolio

Recession 0.1 5.5% -27.0% 27.0% 6.0% -17.0% 0.0%

Below Avg. 0.2 5.5% -7.0% 13.0% -14.0% -3.0% 3.0%

Average 0.4 5.5% 15.0% 0.0% 3.0% 10.0% 7.5%

Above Avg. 0.2 5.5% 30.0% -11.0% 41.0% 25.0% 9.5%

Boom 0.1 5.5% 45.0% -21.0% 26.0% 38.0% 12.0%

r-hat 5.5% 12.4% 1.0% 9.8% 10.5%

Std. dev. (s) 0.0% 20.0% 13.2% 18.8% 15.2% 3.4%

Coeff. of Var. (CV) 0.0% 1.6% 13.2% 1.9% 1.4% 0.5%

beta (b) 0.00 1.32 -0.87 0.88 1.00

r-hat high tech 0,1(-27,0%)+0,2(-7,0%)+0,4(15,0%)+0,2(30,0%)+0,1(45,0%) 12.4%

use the same formula to calculate r-hat for the other alternatives

r-hat T-bills 0,1(5,5%)+0,2(5,5%)+0,4(5,5%)+0,2(5,5%)+0,1(5,5%) 5.5%

r-hat collections 0,1(27,0%)+0,2(13,0%)+0,4(0,0%)+0,2(-11,0%)+0,1(-21,0%) 1.0%

r-hat u.s. rubber 0,1(6,0%)+0,2(-14,0%)+0,4(3,0%)+0,2(41,0%)+0,1(26,0%) 9.8%

r-hat market 0,1(-17,0%)+0,2(-3,0%)+0,4(10,0%)+0,2(25,0%)+0,1(38,0%) 10.5%

[((-27,0-12,4)^2)(0,1)+((-7,0-12,4)^2)(0,2)+((15,0-12,4)^2)(0,4)+

s high tech 20.1%

((30,0-12,4)^2)(0,2)+((45,0-12,4)^2)(0,1)]^1/2

[((5,5-12,4)^2)(0,1)+((5,5-12,4)^2)(0,2)+((5,5-12,4)^2)(0,4)+((5,5-

s T-bills 2.4%

12,4)^2)(0,2)+((5,5-12,4)^2)(0,1)]^1/3

[((-27,0-12,4)^2)(0,1)+((-7,0-12,4)^2)(0,2)+((15,0-12,4)^2)(0,4)+

s collections 20.1%

((30,0-12,4)^2)(0,2)+((45,0-12,4)^2)(0,1)]^1/4

[((-27,0-12,4)^2)(0,1)+((-7,0-12,4)^2)(0,2)+((15,0-12,4)^2)(0,4)+

s u.s. rubber 20.1%

((30,0-12,4)^2)(0,2)+((45,0-12,4)^2)(0,1)]^1/5

[((-27,0-12,4)^2)(0,1)+((-7,0-12,4)^2)(0,2)+((15,0-12,4)^2)(0,4)+

s market 20.1%

((30,0-12,4)^2)(0,2)+((45,0-12,4)^2)(0,1)]^1/6

You might also like

- Business Statistics 3rd Edition Sharpe Solutions ManualDocument34 pagesBusiness Statistics 3rd Edition Sharpe Solutions ManualPatriciaStonebwyrq100% (71)

- 24.lampiran 4 Zona HambatDocument4 pages24.lampiran 4 Zona HambatSukaina AdibiNo ratings yet

- Rule of 40 Glideslope PlanningDocument2 pagesRule of 40 Glideslope PlanningramblingmanNo ratings yet

- Valuation TemplateDocument23 pagesValuation TemplateEduardo Lopez-vegue DiezNo ratings yet

- LSDDocument7 pagesLSDkasuwedaNo ratings yet

- 18 - Mohamed Sayed Mohamed Hassan Fadl - Assigenment 2Document12 pages18 - Mohamed Sayed Mohamed Hassan Fadl - Assigenment 2Mohamed Sayed FadlNo ratings yet

- Book2 DataDocument3 pagesBook2 DataShravan DeshmukhNo ratings yet

- CH 8 Integrated Case - Merryl LynchDocument12 pagesCH 8 Integrated Case - Merryl LynchNicolaus BagaskaraNo ratings yet

- R L V K D: Elapsed Time (Min) Tem P (°C) Activat e Hyd Readin G (Ra) Correcti On Hyd Reading (RC) CT % Fine RDocument1 pageR L V K D: Elapsed Time (Min) Tem P (°C) Activat e Hyd Readin G (Ra) Correcti On Hyd Reading (RC) CT % Fine RRidwan ArifinNo ratings yet

- Solution Manual For Cfin2 2nd Edition by BesleyDocument5 pagesSolution Manual For Cfin2 2nd Edition by BesleyAmandaHarrissftia100% (79)

- Likhitha InfraDocument26 pagesLikhitha InfraMoulyaNo ratings yet

- Capital Planning Consultants: Case 50Document2 pagesCapital Planning Consultants: Case 50Jorge RomeroNo ratings yet

- M5 - Risk and ReturnDocument76 pagesM5 - Risk and ReturnZergaia WPNo ratings yet

- Tabel HidroDocument2 pagesTabel HidroRidwan ArifinNo ratings yet

- Zero BetaDocument4 pagesZero Betaoverhear sbyNo ratings yet

- 18 - Mohamed Sayed Mohamed Hassan Fadl - Assigenment 2Document12 pages18 - Mohamed Sayed Mohamed Hassan Fadl - Assigenment 2Mohamed Sayed FadlNo ratings yet

- Cfin 3 3rd Edition Besley Solutions ManualDocument5 pagesCfin 3 3rd Edition Besley Solutions Manualcleopatrasang611py100% (23)

- Nerolac - Solution PDFDocument5 pagesNerolac - Solution PDFricha krishnaNo ratings yet

- Industry Median 2018 2017 2016 2015 2014 2013 2012Document10 pagesIndustry Median 2018 2017 2016 2015 2014 2013 2012AnuragNo ratings yet

- Finding A Minimum-Risk PortfolioDocument5 pagesFinding A Minimum-Risk PortfolioBhargaviNo ratings yet

- Discounted Cash Flow Model (TEMPLATE)Document1 pageDiscounted Cash Flow Model (TEMPLATE)Ignacio de DiegoNo ratings yet

- ResiduosDocument2 pagesResiduosengdiego13No ratings yet

- Gamma Distribution: (Shape Parameter) α: 9 (Scale Parameter) β: 0.5 (Lower Bound of X) l: 0 (Upper Bound of x) u: 7Document5 pagesGamma Distribution: (Shape Parameter) α: 9 (Scale Parameter) β: 0.5 (Lower Bound of X) l: 0 (Upper Bound of x) u: 7SpreadsheetZONENo ratings yet

- Tugas Teori Tes KlasikDocument7 pagesTugas Teori Tes KlasiksatryazegbiNo ratings yet

- Rezultate Studenti 2010Document6 pagesRezultate Studenti 2010radunicolae2007No ratings yet

- Actual 2018 Per Club - OperationDocument59 pagesActual 2018 Per Club - OperationAnonymous 3QWXb5qxfNNo ratings yet

- Risk and Return For PortfolioDocument5 pagesRisk and Return For PortfolioferuzbekNo ratings yet

- Tamaño de Mercado y Participación TemplateDocument5 pagesTamaño de Mercado y Participación Templatefabrizio.combinaNo ratings yet

- 1 Agency and Term LimitsDocument3 pages1 Agency and Term LimitsJosephine BrownNo ratings yet

- Cfin 3 3rd Edition Besley Solutions ManualDocument36 pagesCfin 3 3rd Edition Besley Solutions Manualgarrywolfelsjftl100% (11)

- hw3s 04Document9 pageshw3s 04Hasan TahsinNo ratings yet

- Score Card For Tutorial01Document9 pagesScore Card For Tutorial01Thomas LouarnNo ratings yet

- Tutorial Business Case - Key - Apr22Document6 pagesTutorial Business Case - Key - Apr22Minh Phuong DangNo ratings yet

- GARCH (1,1) : Relatives WeightsDocument14 pagesGARCH (1,1) : Relatives WeightsPritam Kumar GhoshNo ratings yet

- AASHTO T27-T21 Sieve Analysis of Fine and Coarse Aggregates PDFDocument14 pagesAASHTO T27-T21 Sieve Analysis of Fine and Coarse Aggregates PDFSajedur Rahman Mishuk0% (1)

- Actividad 2 Pavimentos 1Document10 pagesActividad 2 Pavimentos 1JorgeAlbertoGamboaAriasNo ratings yet

- Della Rifka - Tugas Individu SKP Meet 14Document7 pagesDella Rifka - Tugas Individu SKP Meet 14Wildan Bisyri AzizNo ratings yet

- Tutor 13Document7 pagesTutor 13Kamarulnizam ZainalNo ratings yet

- Latest Seminar Case Study 2Document4 pagesLatest Seminar Case Study 2Farhanie Nordin100% (1)

- Chapters 12&13 Practice Problems Solution: ER R P ER R PDocument13 pagesChapters 12&13 Practice Problems Solution: ER R P ER R PAnsleyNo ratings yet

- Baûng Tính Theùp Cho Phaàn Töû CoätDocument3 pagesBaûng Tính Theùp Cho Phaàn Töû CoätNguyen Quoc LamNo ratings yet

- 150 MM CHB (Plastered) 2.7 100 MM CHB (Plastered) 2.1 Window 0.38 Door 0.4Document1 page150 MM CHB (Plastered) 2.7 100 MM CHB (Plastered) 2.1 Window 0.38 Door 0.4Jerome AdduruNo ratings yet

- Veto SwitchgearsDocument44 pagesVeto Switchgearssingh66222No ratings yet

- Corrigé TD 5Document8 pagesCorrigé TD 5Zeghari AymaneNo ratings yet

- ST Lecture 4&5 WorkingsDocument15 pagesST Lecture 4&5 WorkingsSunnie SongNo ratings yet

- Balanced Scorecard Report: Corporate Owner Fresnillo OperationsDocument4 pagesBalanced Scorecard Report: Corporate Owner Fresnillo OperationsShun De VazNo ratings yet

- Finance in A Nutshell Javier Estrada FT Prentice Hall, 2005: Answer Key To Challenge SectionsDocument63 pagesFinance in A Nutshell Javier Estrada FT Prentice Hall, 2005: Answer Key To Challenge Sectionssanucwa6932No ratings yet

- cạnh tranh hoàn hảoDocument3 pagescạnh tranh hoàn hảobetonamu2003.jpNo ratings yet

- Recession Below Average Average Above Average Boom Expected Rate of ReturnDocument2 pagesRecession Below Average Average Above Average Boom Expected Rate of ReturnAngel Kaye Nacionales JimenezNo ratings yet

- Tabla de AconDocument2 pagesTabla de AconAntonio Jesus Jaen LopezNo ratings yet

- StatisikaDocument4 pagesStatisikaRayhan MaulanaNo ratings yet

- Polymers of Styrene, in Primary FormsDocument1 pagePolymers of Styrene, in Primary FormslyesNo ratings yet

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialDocument37 pagesTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialVipulNo ratings yet

- Excel ExamDocument16 pagesExcel ExamNonso NdibeNo ratings yet

- Ind-Swift LabsDocument44 pagesInd-Swift Labssingh66222No ratings yet

- Complete DCF Template v3Document1 pageComplete DCF Template v3javed PatelNo ratings yet

- Cfin 4 4th Edition Besley Solutions ManualDocument8 pagesCfin 4 4th Edition Besley Solutions Manualwadeperlid9d98k100% (29)

- Last Quanitative To Be SubmitedDocument16 pagesLast Quanitative To Be SubmitedZelalem JemberuNo ratings yet

- E19-2&9 Accounting PrinciplesDocument3 pagesE19-2&9 Accounting PrinciplesMutia WardaniNo ratings yet

- EFM4, CH 05, Slides, 07-02-18Document44 pagesEFM4, CH 05, Slides, 07-02-18Ainun Nisa NNo ratings yet

- Kuliah 8 Stock and Their ValuationDocument31 pagesKuliah 8 Stock and Their ValuationMutia WardaniNo ratings yet

- Kuliah 6b Interest Rate, Risk and Rate of ReturnDocument21 pagesKuliah 6b Interest Rate, Risk and Rate of ReturnMutia WardaniNo ratings yet

- Analysisof FSDocument35 pagesAnalysisof FSJihan Mae RiveraNo ratings yet

- Cp7-1 Principal EccountingDocument6 pagesCp7-1 Principal EccountingMutia WardaniNo ratings yet

- AKM CH 2Document8 pagesAKM CH 2Mutia WardaniNo ratings yet

- Account Titles Trial Balance Adjustment DR CR DR: Vang Management ServicesDocument9 pagesAccount Titles Trial Balance Adjustment DR CR DR: Vang Management ServicesMutia WardaniNo ratings yet

- CFFM9, CH 07, Slides - 10-14-15Document44 pagesCFFM9, CH 07, Slides - 10-14-15Sanjna ChimnaniNo ratings yet

- CFFM9, CH 10, Slides - 10-14-15Document31 pagesCFFM9, CH 10, Slides - 10-14-15Sanjna ChimnaniNo ratings yet

- Kuliah 11 Cash Flow Estimation and Risk AnalysisDocument39 pagesKuliah 11 Cash Flow Estimation and Risk AnalysisMutia WardaniNo ratings yet

- Chapter 5 - Postulates, Principles, and ConceptsDocument29 pagesChapter 5 - Postulates, Principles, and ConceptselizabethNo ratings yet

- Kuliah 12 Real Option and Other Topics in Capital BudgetingDocument19 pagesKuliah 12 Real Option and Other Topics in Capital BudgetingMutia WardaniNo ratings yet

- Kuliah 10 The Basic of Capital BudgetingDocument31 pagesKuliah 10 The Basic of Capital BudgetingMutia WardaniNo ratings yet

- TA Chapter 7 PDFDocument29 pagesTA Chapter 7 PDFMutia WardaniNo ratings yet

- TA Chapter 17 PDFDocument26 pagesTA Chapter 17 PDFMutia WardaniNo ratings yet

- Chapter 2 - Accounting Theory and Accounting ResearchDocument19 pagesChapter 2 - Accounting Theory and Accounting Researchelizabeth100% (1)

- Kuliah 11 Cash Flow Estimation and Risk AnalysisDocument39 pagesKuliah 11 Cash Flow Estimation and Risk AnalysisMutia WardaniNo ratings yet

- CH 5 - Intercompany Transaction - InventoriesDocument14 pagesCH 5 - Intercompany Transaction - InventoriesMutia WardaniNo ratings yet

- TA Chapter 4 PDFDocument21 pagesTA Chapter 4 PDFMutia WardaniNo ratings yet

- Chapter 6 - The Search For ObjectivesDocument26 pagesChapter 6 - The Search For ObjectiveselizabethNo ratings yet

- Chapter 1 - An Introduction To Accounting TheoryDocument23 pagesChapter 1 - An Introduction To Accounting TheoryelizabethNo ratings yet

- Accounting Theory: Conceptual Issues in A Political and Economic EnvironmentDocument29 pagesAccounting Theory: Conceptual Issues in A Political and Economic EnvironmentdevitaNo ratings yet

- CH 4 - Consolidated Techniques and ProceduresDocument18 pagesCH 4 - Consolidated Techniques and ProceduresMutia WardaniNo ratings yet

- cp7-1 Principal EccountingDocument6 pagescp7-1 Principal EccountingMutia WardaniNo ratings yet

- CH 3 - Intro To Consolidated Fin StatDocument16 pagesCH 3 - Intro To Consolidated Fin StatMutia WardaniNo ratings yet

- Kuliah 1 Overview of Financial ManagementDocument10 pagesKuliah 1 Overview of Financial ManagementMutia WardaniNo ratings yet

- Kuliah 12 Real Option and Other Topics in Capital BudgetingDocument19 pagesKuliah 12 Real Option and Other Topics in Capital BudgetingMutia WardaniNo ratings yet

- BRIEF EXERCISE Chapter 15 Number 1-3 Solution Intermediate AccountingDocument1 pageBRIEF EXERCISE Chapter 15 Number 1-3 Solution Intermediate AccountingMutia WardaniNo ratings yet

- E19-2&9 Accounting PrinciplesDocument3 pagesE19-2&9 Accounting PrinciplesMutia WardaniNo ratings yet

- House Bill 1406: Washington State Wealth TaxDocument11 pagesHouse Bill 1406: Washington State Wealth TaxGeekWireNo ratings yet

- 10000001667Document79 pages10000001667Chapter 11 DocketsNo ratings yet

- Darycet QuotationDocument2 pagesDarycet QuotationChukwuma Emmanuel OnwufujuNo ratings yet

- Times-Trib 43 MGDocument28 pagesTimes-Trib 43 MGnewspubincNo ratings yet

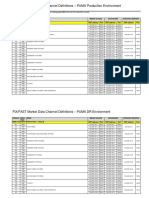

- FIX/FAST Market Data Channel Definitions - PUMA Production EnvironmentDocument3 pagesFIX/FAST Market Data Channel Definitions - PUMA Production EnvironmentVaibhav PoddarNo ratings yet

- IB QuestionsDocument12 pagesIB QuestionsjitenNo ratings yet

- Balance Sheet Quarterly RestatedDocument12 pagesBalance Sheet Quarterly RestatedKhurram Sadiq (Father Name:Muhammad Sadiq)No ratings yet

- Narvre Unit 19 Newsletter of March 2015Document2 pagesNarvre Unit 19 Newsletter of March 2015api-167123914No ratings yet

- Closure of Adamjee Jute Mills Ominous SignDocument4 pagesClosure of Adamjee Jute Mills Ominous SignAzad MasterNo ratings yet

- 332022Document2 pages332022samNo ratings yet

- CFO SVP VP Finances in Houston TX Resume Christopher EdwardsDocument4 pagesCFO SVP VP Finances in Houston TX Resume Christopher EdwardsChristopher EdwardsNo ratings yet

- CFPB v. Mackinnon, Et Al. 1:16-cv-00880-FPG-HKSDocument31 pagesCFPB v. Mackinnon, Et Al. 1:16-cv-00880-FPG-HKSPacer CasesNo ratings yet

- Income Recognition and Asset ClassificationDocument21 pagesIncome Recognition and Asset Classificationsagar7No ratings yet

- S.No Code Bank Name Netbanking Debit Card Sponsor Bank: Bank Status in API E-MandateDocument2 pagesS.No Code Bank Name Netbanking Debit Card Sponsor Bank: Bank Status in API E-MandateRajuNo ratings yet

- Skim Penyelesaian Pinjaman Kecil Small Debt Resolution SchemeDocument6 pagesSkim Penyelesaian Pinjaman Kecil Small Debt Resolution SchemeFikri HijazNo ratings yet

- Jesse - Livermore Market ThoughtsDocument5 pagesJesse - Livermore Market ThoughtsbrijeshagraNo ratings yet

- Role of NBFC in Indian Financial MarketDocument40 pagesRole of NBFC in Indian Financial MarketPranav Vira100% (1)

- 02-06-09 Lynn Federal Court OrderDocument6 pages02-06-09 Lynn Federal Court OrdermderigoNo ratings yet

- Millward Brown ModelDocument14 pagesMillward Brown ModeljbaksiNo ratings yet

- 243-Aznar v. CTA G.R. No. L-20569 August 23, 1974Document15 pages243-Aznar v. CTA G.R. No. L-20569 August 23, 1974Jopan SJNo ratings yet

- Quiz (Dicky Irawan - C1i017051)Document3 pagesQuiz (Dicky Irawan - C1i017051)DICKY IRAWAN 1No ratings yet

- New Salary 12 Bps OfficersDocument12 pagesNew Salary 12 Bps Officersdas.nilay09No ratings yet

- First Metro Investment vs. Este. Del SolDocument3 pagesFirst Metro Investment vs. Este. Del SolAce MarjorieNo ratings yet

- Fei2123PS3 SolnDocument11 pagesFei2123PS3 SolnBrenda WijayaNo ratings yet

- Business Account I 05 Gree I A LaDocument440 pagesBusiness Account I 05 Gree I A Lablu_qwertyNo ratings yet

- Leg Res 3Document4 pagesLeg Res 3Aj GuanzonNo ratings yet

- Complaint BlankDocument3 pagesComplaint BlankRoger Montero Jr.No ratings yet

- Chapter 7Document35 pagesChapter 7kiranaishaNo ratings yet

- WACCDocument27 pagesWACCGeorge Renard SpinellyNo ratings yet