Professional Documents

Culture Documents

Forward Rate Agreements: Session 3 - Derivatives & Risk MGT

Uploaded by

MayankSharma0 ratings0% found this document useful (0 votes)

10 views15 pagesOriginal Title

3_InterestRatesForwards.pptx

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views15 pagesForward Rate Agreements: Session 3 - Derivatives & Risk MGT

Uploaded by

MayankSharmaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 15

Forward Rate Agreements

Session 3 – Derivatives & Risk Mgt

What are spot rates?

• Spot rates – the interest rate applicable for a specific

period starting from today

• Also known as zero coupon rates

• Spot rate curve constructed from spot rates for

various maturities

• Spot rates are not directly observed in the market

• Derived from the normal yield curve by the

bootstrapping method

What are forward rates?

• Suppose an investor has a one-year investment horizon

• He has 2 alternatives:

▪ Buy a 1-year Treasury Bill

▪ Buy a 6-month Treasury Bill and after it matures in six

months, buy another 6-month T-Bill

• The investor will be indifferent between the 2 alternatives when

both alternatives give him the same return over his one year

horizon

• Investor knows the spot rates on the 6-month T-Bill and 1-year T-

Bill

• What will be the spot rate for a 6-month T-Bill purchased 6

months from now?

Why compute forward rates?

• Forward rates implied from current spot rates indicate the

interest rates expected to prevail in the future

• An investor’s strategy will depend on whether his expectations

are different from that of the market

• Example

– An investor wants to invest Rs.50 lakhs for a one-year horizon

– He can either invest directly for one year at the one-year spot rate or

invest for six months at the 6-month rate and renew the deposit at the

end of 6 months at the rate prevailing then

– The six month spot rate is 7% and the one-year spot rate is 6%

– This implies a rate of 5% for the six-month period starting 6 months

from now

– What will the investor do?

Computation of forward rates

When period is less than 1 year, the general formula is

Where rf is forward rate, rl = long-

term deposit rate, rs=short-term

deposit rate, nl =number of days in

long term, ns=number of days in

short-term and nf=number of days

in forward period

Computation of forward rates

When period is more than 1 year, the general formula is

(1+rl)nl/12 = (1+rs)ns/12 * (1+f)nf/12

Where rl = rate for long period and nl =number of months in long

period, rs = rate for short period and ns=number of months in short

period, f =forward rate and nf =number of months in forward period

An example

An investor has a 5-year investment

horizon. Should he (a) Invest in a 5-year

bond or (b) Invest in a 2 year-bond

today and roll over the maturity

proceeds into a 3-year bond?

Investment for 5 years starting today will yield (1+.095)^5

Investment for 2 years starting today will yield (1+.088)^2

Investment for 3 years starting 2 yrs from now will yield (1+f)^(3)

Hence f =(( (1+.095)^5)/((1+.088)^2))^(1/3)-1

The implied 3-year forward rate starting 2 years from now is 9.97%

If the investor’s view is that the 3-year interest rate 2 years from now will

be lower than 9.97%, he should go for (a) else go for (b)

Forward Rate Agreements

• A product to hedge against interest rate

fluctuations for short periods

• Can be used to lock in a rate of interest for a

borrowing or investment for a fixed period

starting n periods from now

• Can be used for hedging against expected rise

as well as decline in interest rates

Mechanics of the FRA

• The party with a long position enters into an agreement at time

T0 to borrow from the party with the short position

• a predetermined amount P

• at a fixed interest rate k

• for the period [T1, T2]

• There is no exchange of principal at any time under the FRA

• The difference between the reference rate at time T1 denoted

by l and the agreed upon fixed rate k, if positive (negative), is

received (paid) by the long position fro the short position

• This difference is settled at time T1 by discounting the

cashflows from T2 to T1

Pricing a new FRA

•

Pricing a new FRA - example

• Suppose the current 3-month and 6-month

LIBOR rates are 4% and 4.50%. Assuming

that there are 92 days in the first 3-month

period and 91 days in the second three-month

period what is the price of a new 3 X 6 FRA?

Valuing an existing FRA

•

FRA valuation example

• Consider the 3X6 FRA of the earlier example.

The principal amount is Rs.25,00,000. One

month has passed since entering into the FRA.

Assume that the current 2-month and 5-month

interest rates are 5.50% and 6% respectively,

what is the value of the FRA today? Assume

that there are 61 days in the first two-month

period and 91 days in the next three-month

period.

Borrower’s FRA

• A company wants to borrow Rs.50 crore three months

from now for a project which will take around 6

months. Its current borrowing cost is 9%. The

Company anticipates the central bank to raise interest

rates in December. The bankers are quoting a 3/9

FRA at 9.25%-9.75%. How can the Company hedge

against the rise in interest rates? What will be the

effective cost of borrowing for the Company if the

interest rate is 10% at the end of three months from

today? What if interest rate is at 8%?

Investor’s FRA

• A company expects a cash dividend of Rs.50 crore

from its subsidiary three months from now. The CFO

does not anticipate any requirement for these funds

for a period of 6 months. Six-month bulk deposit rate

is around 8.50% today. The CFO apprehends a

decline in interest rates around December. The

bankers are quoting a 3/9 FRA at 8.45%-8.75%. How

can the Company hedge against a decline in interest

rates? What will be the effective yield earned on the

deposit if the interest rate is 8 % at the end of three

months from today? What if interest rate is at 9%?

You might also like

- Lecture 3 - InterestRatesForwardsDocument10 pagesLecture 3 - InterestRatesForwardsscribdnewidNo ratings yet

- DRM-CLASSWORK - 11th JuneDocument2 pagesDRM-CLASSWORK - 11th JuneSaransh MishraNo ratings yet

- Term Structure of Interest Rates: For 9.220, Term 1, 2002/03 02 - Lecture7Document20 pagesTerm Structure of Interest Rates: For 9.220, Term 1, 2002/03 02 - Lecture7tiamojuanNo ratings yet

- EFB344 Lecture07, FRAs and SwapsDocument35 pagesEFB344 Lecture07, FRAs and SwapsTibet LoveNo ratings yet

- FM Ch-3 Time Value of MoneyDocument40 pagesFM Ch-3 Time Value of MoneyMifta ShemsuNo ratings yet

- Para Sa Mga Anak NG DiyosDocument26 pagesPara Sa Mga Anak NG DiyosJohn Michael M. Montarde0% (1)

- Bonds ValuationsDocument57 pagesBonds ValuationsarmailgmNo ratings yet

- L5 - Farm Investment AnalysisDocument57 pagesL5 - Farm Investment Analysischampikadeshappriya152No ratings yet

- Forward Rate Agreements 517Document10 pagesForward Rate Agreements 517stannis69420No ratings yet

- Interest Rate DerivativesDocument58 pagesInterest Rate DerivativesIndia Forex100% (2)

- Basics of Bond Valuation: Government Securities (G-SEC, or GS) / Treasury BondsDocument39 pagesBasics of Bond Valuation: Government Securities (G-SEC, or GS) / Treasury BondsVrinda GargNo ratings yet

- CCRA Session 6Document17 pagesCCRA Session 6Amit GuptaNo ratings yet

- Forward Rate AgreementDocument17 pagesForward Rate AgreementSumit SharmaNo ratings yet

- Test Your Knowledge: 2.2.4.2 Pricing of SwaptionsDocument11 pagesTest Your Knowledge: 2.2.4.2 Pricing of SwaptionsRITZ BROWNNo ratings yet

- 2 Forward Rate AgreementDocument8 pages2 Forward Rate AgreementRicha Gupta100% (1)

- International Financial Management PgapteDocument30 pagesInternational Financial Management Pgapterameshmba100% (1)

- Bootstrapping Spot RateDocument37 pagesBootstrapping Spot Ratevirgoss8100% (1)

- Duration of BondDocument9 pagesDuration of BondUbaid DarNo ratings yet

- Time Value of MoneyDocument5 pagesTime Value of Moneysmwanginet7No ratings yet

- Chapter 3Document19 pagesChapter 3GODNo ratings yet

- Module II Capital BudgetingDocument43 pagesModule II Capital BudgetingSrinibashNo ratings yet

- Business Finance 7Document25 pagesBusiness Finance 7Trisha ElecerioNo ratings yet

- What Are FMPS??: Fixed Maturity Plans (FMPS) Are Back in VogueDocument2 pagesWhat Are FMPS??: Fixed Maturity Plans (FMPS) Are Back in VogueShravan KumarNo ratings yet

- Forward & Futures PricingDocument41 pagesForward & Futures Pricingasifanis100% (3)

- The Structure of Interest RatesDocument72 pagesThe Structure of Interest RatesMarwa HassanNo ratings yet

- Forward and Futures ContractsDocument55 pagesForward and Futures Contractsben tenNo ratings yet

- SM 714 ME The Time Value of MoneyDocument39 pagesSM 714 ME The Time Value of MoneyAnushka DasNo ratings yet

- DHA-BHI-404 - Unit4 - Time Value of MoneyDocument17 pagesDHA-BHI-404 - Unit4 - Time Value of MoneyFë LïçïäNo ratings yet

- Module 7. Annuities: 1. Simple AnnuityDocument19 pagesModule 7. Annuities: 1. Simple AnnuityMori OugaiNo ratings yet

- Term Structure of Interest RatesDocument21 pagesTerm Structure of Interest RatestoabhishekpalNo ratings yet

- Interest Rates Chapter: Key ConceptsDocument6 pagesInterest Rates Chapter: Key ConceptsAn HoàiNo ratings yet

- Determinants of Interest Rates (Revilla & Sanchez)Document12 pagesDeterminants of Interest Rates (Revilla & Sanchez)Kearn CercadoNo ratings yet

- Interest Rate Risk I (CH 8)Document13 pagesInterest Rate Risk I (CH 8)Mahbub TalukderNo ratings yet

- Ch5 Interest RatesDocument25 pagesCh5 Interest Rateszey9991No ratings yet

- Project Financial Analysis StepsDocument42 pagesProject Financial Analysis StepsAsnake MekonnenNo ratings yet

- Mathematics of FinanceDocument25 pagesMathematics of FinanceJulianna CortezNo ratings yet

- Accounting and Audit for Financial Sector - Understanding Bank Interest and its CalculationsDocument19 pagesAccounting and Audit for Financial Sector - Understanding Bank Interest and its CalculationsTanay ShahNo ratings yet

- Financial Management: Lecture#11Document21 pagesFinancial Management: Lecture#11SULEMAN BUTTNo ratings yet

- TVM Concepts ExplainedDocument15 pagesTVM Concepts ExplainedIstiaque AhmedNo ratings yet

- FINC4101 Term Structure AnalysisDocument28 pagesFINC4101 Term Structure AnalysisAjeet YadavNo ratings yet

- Long Term Debt and Preferred Stock Financing ExplainedDocument8 pagesLong Term Debt and Preferred Stock Financing ExplainedSuvash KhanalNo ratings yet

- Fixed Maturity Plans (FMP) : Retail ResearchDocument2 pagesFixed Maturity Plans (FMP) : Retail Researcharun_algoNo ratings yet

- Interest Rates and Bond Valuation: All Rights ReservedDocument28 pagesInterest Rates and Bond Valuation: All Rights ReservedFahad ChowdhuryNo ratings yet

- TVM Seminar 3 NotesDocument34 pagesTVM Seminar 3 Notes朱艺璇No ratings yet

- Interest Rate FutureDocument19 pagesInterest Rate FutureDivyesh GandhiNo ratings yet

- 4 - Term Structures TheoriesDocument15 pages4 - Term Structures Theoriesmajmmallikarachchi.mallikarachchiNo ratings yet

- Chapter 3 FMDocument79 pagesChapter 3 FMHananNo ratings yet

- Topic 4 Mathematics of FinanceDocument66 pagesTopic 4 Mathematics of FinanceAndrew PillayNo ratings yet

- Valuation of Bonds and SharesDocument21 pagesValuation of Bonds and ShareszlnpjbcckbeqwnzgojNo ratings yet

- GENERAL MATHDocument7 pagesGENERAL MATHAleah TulauanNo ratings yet

- NPVDocument7 pagesNPVJowelYabotNo ratings yet

- Chapter 5: Interest Rate Risks: Lecturer: Amadeus GABRIEL La Rochelle Business SchoolDocument25 pagesChapter 5: Interest Rate Risks: Lecturer: Amadeus GABRIEL La Rochelle Business SchoolJuana BoresNo ratings yet

- Time Value of Money - Part1Document28 pagesTime Value of Money - Part1Alex JavierNo ratings yet

- Understanding the Term Structure of Interest Rates and DurationDocument31 pagesUnderstanding the Term Structure of Interest Rates and DurationBraulio GarayNo ratings yet

- 03 How To Calculate Present Values-2Document23 pages03 How To Calculate Present Values-2melekkbass10No ratings yet

- Interest Rate Models and Derivatives 2019Document69 pagesInterest Rate Models and Derivatives 2019Elisha MakoniNo ratings yet

- 5 Simple Interest and DiscountDocument69 pages5 Simple Interest and DiscountJUSTIN HECTOR BRENT SAJULGANo ratings yet

- Rowe Lawler CookeDocument10 pagesRowe Lawler CookeDesi DiPierroNo ratings yet

- Derivatives and Risk Management: Session 1 - Introduction Prof. Aparna BhatDocument22 pagesDerivatives and Risk Management: Session 1 - Introduction Prof. Aparna BhatMayankSharmaNo ratings yet

- Forward Rate Agreements: Session 3 - Derivatives & Risk MGTDocument15 pagesForward Rate Agreements: Session 3 - Derivatives & Risk MGTMayankSharmaNo ratings yet

- Swaps: Derivatives & Risk ManagementDocument17 pagesSwaps: Derivatives & Risk ManagementMayankSharmaNo ratings yet

- Forward Rate Agreements: Session 3 - Derivatives & Risk MGTDocument15 pagesForward Rate Agreements: Session 3 - Derivatives & Risk MGTMayankSharmaNo ratings yet

- Derivatives Risk ManagementDocument61 pagesDerivatives Risk ManagementMayankSharmaNo ratings yet

- Derivatives Risk ManagementDocument61 pagesDerivatives Risk ManagementMayankSharmaNo ratings yet

- Swaps: Derivatives & Risk ManagementDocument17 pagesSwaps: Derivatives & Risk ManagementMayankSharmaNo ratings yet

- Forward Rate Agreements: Session 3 - Derivatives & Risk MGTDocument15 pagesForward Rate Agreements: Session 3 - Derivatives & Risk MGTMayankSharmaNo ratings yet

- Test FileDocument1 pageTest FileghanshyamNo ratings yet

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronNo ratings yet

- PACER - Leber vs. Konigsberg - Konigsberg ResponseDocument9 pagesPACER - Leber vs. Konigsberg - Konigsberg Responsejpeppard100% (1)

- Single Index ModelDocument4 pagesSingle Index ModelNikita Mehta DesaiNo ratings yet

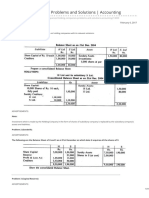

- Holding Companies Problems and Solutions AccountingDocument11 pagesHolding Companies Problems and Solutions AccountingGenarul IslamNo ratings yet

- Investing Options for Inherited MoneyDocument7 pagesInvesting Options for Inherited MoneyDaphne ManalastasNo ratings yet

- Basics of Share Market OperationsDocument8 pagesBasics of Share Market Operationslelesachin100% (2)

- Investment TrackerDocument12 pagesInvestment TrackerJoe VincentNo ratings yet

- Vol-6 CFD Trading Guide PDFDocument19 pagesVol-6 CFD Trading Guide PDFمحمد سفيان أفغوليNo ratings yet

- Guidelines For Foreign Exchange Transactions - Bangladesh BankDocument441 pagesGuidelines For Foreign Exchange Transactions - Bangladesh BankAshiq RayhanNo ratings yet

- Everett V Asia BankDocument2 pagesEverett V Asia BankEM RGNo ratings yet

- Analysis of Demat Account & Online Trading Karvy Stock Brocking Limited (M.Com Project)Document64 pagesAnalysis of Demat Account & Online Trading Karvy Stock Brocking Limited (M.Com Project)VRUKSHITNo ratings yet

- Russia M&ADocument48 pagesRussia M&Adshev86No ratings yet

- Commissioner of Internal Revenue v. Covanta Energy Philippine Holdings, Inc. DigestDocument3 pagesCommissioner of Internal Revenue v. Covanta Energy Philippine Holdings, Inc. DigestCharmila Siplon100% (1)

- Business Combinations - PPADocument83 pagesBusiness Combinations - PPAAna SerbanNo ratings yet

- Macroeconomic & Industry Fundamental AnalysisDocument27 pagesMacroeconomic & Industry Fundamental AnalysischarymvnNo ratings yet

- Financial Statement Analysis of Fauji Fertilizer Company FFC Vs Engro CorporationDocument6 pagesFinancial Statement Analysis of Fauji Fertilizer Company FFC Vs Engro Corporationqurban balochNo ratings yet

- Exercise A3 - AnswersDocument12 pagesExercise A3 - AnswersCorinne Kelly100% (1)

- Msci Indonesia Esg Leaders Index Usd GrossDocument3 pagesMsci Indonesia Esg Leaders Index Usd GrossputraNo ratings yet

- General Angel FundDocument8 pagesGeneral Angel FundinforumdocsNo ratings yet

- Motilal Oswal ProjectDocument54 pagesMotilal Oswal Projectmathibettu100% (2)

- Abhishek Tiwari (Stir)Document84 pagesAbhishek Tiwari (Stir)himanshu sethNo ratings yet

- Issue of SharesDocument11 pagesIssue of SharesRamesh KumarNo ratings yet

- Citi Bank Internship ReportDocument74 pagesCiti Bank Internship ReportMajid YaseenNo ratings yet

- Chapter 8Document37 pagesChapter 8AparnaPriomNo ratings yet

- Futures West 1998Document30 pagesFutures West 1998Muh Akbar ZNo ratings yet

- Company Name Company Stages Website Geographic LocationsDocument4 pagesCompany Name Company Stages Website Geographic LocationsPriyanshu BhattacharyaNo ratings yet

- MRAT Mustika Ratu Tbk Company Report and Share PriceDocument3 pagesMRAT Mustika Ratu Tbk Company Report and Share PriceFebrianty HasanahNo ratings yet

- CHAPTER 2.1 Strategic Financial ManagementDocument23 pagesCHAPTER 2.1 Strategic Financial ManagementKarl BarnuevoNo ratings yet

- Special Report - Gas Dispute NewDocument10 pagesSpecial Report - Gas Dispute NewInternational Business Times100% (1)