Professional Documents

Culture Documents

Top 40 Exempted Incomes in India

Uploaded by

Aylwin zechariah John0 ratings0% found this document useful (0 votes)

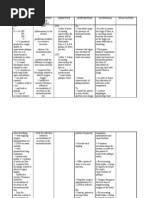

18 views13 pagesThis document outlines various categories of exempted incomes in India that are not subject to income tax. It discusses exempted incomes that apply to all assessees, institutions, and employees. Some examples of exempted incomes for all assessees include agricultural income, interest from tax-free government securities, life insurance payouts, and long-term capital gains from equity investments. Exempted incomes for institutions include those of local authorities, research organizations, pension funds, and trade unions. Exempted incomes for employees encompass allowances such as leave travel, house rent, and special allowances for certain expenditures.

Original Description:

Original Title

income tax

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines various categories of exempted incomes in India that are not subject to income tax. It discusses exempted incomes that apply to all assessees, institutions, and employees. Some examples of exempted incomes for all assessees include agricultural income, interest from tax-free government securities, life insurance payouts, and long-term capital gains from equity investments. Exempted incomes for institutions include those of local authorities, research organizations, pension funds, and trade unions. Exempted incomes for employees encompass allowances such as leave travel, house rent, and special allowances for certain expenditures.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views13 pagesTop 40 Exempted Incomes in India

Uploaded by

Aylwin zechariah JohnThis document outlines various categories of exempted incomes in India that are not subject to income tax. It discusses exempted incomes that apply to all assessees, institutions, and employees. Some examples of exempted incomes for all assessees include agricultural income, interest from tax-free government securities, life insurance payouts, and long-term capital gains from equity investments. Exempted incomes for institutions include those of local authorities, research organizations, pension funds, and trade unions. Exempted incomes for employees encompass allowances such as leave travel, house rent, and special allowances for certain expenditures.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

EXEMPTED

INCOMES

AYLWIN ZECHARIAH JOHN

ROLL NO. 43

BCOM FINANCE

Exempted incomes means incomes which are not chargeable to income tax

Three categories are:

● Exempted Incomes For All Assessees

● For Institutions

● For Employees

EXEMPTED INCOMES FOR ALL

ACCESSES

● Agricultural income [section 10 (1)]

● Amount received from H. U. F [section 10 (2)]

● Share of income of a partner from the firm [section 10 (2A)]

● Payments under Bhopal Gas Leak Disaster Act, 1985 [section 10 (10 BB)]

● Compensation of disaster [section 10 (10 BC)]

● Life Insurance Money [section 10 (10 D)]

● Interest on tax-free Government securities [section 10 (15)]

● Educational Scholarship [section 10 (16)]7

● Allowances of Members Of Parliament, MLAs and MLCs [section 10 (17)]

● Awards in cash or in Kind [section 10 (17A)]

● Pension of gallantry awardee [section 10 (18)]

● Family pension of a member of the Armed Forces [section 10 (19)]

● Annual value of one palace of Rulers of Indian States [section 10 (19)]

● Income of Scheduled Tribes [section 10 (26)]

● Certain Incomes of Sikkimese [section 10 (26 AAA)]

● Subsidy from Tea Board [section 10 (30)]

● Subsidy received by planters [section 10 (31)]

● Income of a minor child [section 10 (32)]

● Invome from units of Unit Scheme, 1964 [section 10(33)]

● Dividend income [section 10 (34)]

● Income from units of a mutual fund [section 10 (35)]

● Income from Equity Shares [section 10 (36)]

● Capital gains on transfer of Agricultural land in an urban area [section 10 (37)]

● Long-term capital gains on transfer of a listed Equity Share or a unit of equity linked fund after 30.09.2004

subject to certain conditions [section 10 (38)]

● Income from an international sporting event [section 10 (39)]

● Income from a subsidiary company [section 10 (40)]

● Any notified Incomes of a body or Authority constituted by the Central Government [section 10 (42)]

● Allowance or perquisites paid to the chairman of Union Public Service Commission [section 10(45)]

● Income from newly established industrial undertaking in Free Trade Zone [section 10 A]

● Income from newly established 100% export oriented undertaking [section 10 B]

For Institutions

● Income of a Local Authority [section 10 (20)]

● Income of Research Association approved [section 10 (21)]

● Income of News Agency [section 10 (22 B)]

● Income of Professional Institutes [section 10 (23 A)]

● Income of Pension Fund set up by LIC or other Insurers [section 10 (23 AAB)]

● Income of Khadi and Village Industries [section 10 (23 B)]

● Income of Specified Charitable Fund [section 10 (23 C)]

● Income of Venture Capital Fund [section 10 (23 FB)]

● Income of Registered Trade Unions [section 10 (24)]

● Income of Provident Funds [section 10 (25)]

● Income of Employees’ State Insurance Fund [section 10 (25 A)]

● Income of a body for promoting interest of Scheduled Castes or Scheduled Tribes [section 10 (26 B)]

● Income of a political party [section 13 A]

● Income of an Electoral Trust [section 13 B]

● Income of Prasar Bharati (Broadcasting Corporation of India)

● Any income of a Securitisation Trust from the activity of securitisation [section 10 (23 DA]

● Any income by way of contributions received from a depository [section 10 (23 ED)]

● Any income on account of buy-back of unlisted shares by domestic Co. [section 10) 34 A)]

For Employees

● Leave travel consession [section 10 (5)]

● Allowances or perquisites outside India [section 10 (7)]

● Gratuity [section 10 (10)]

● Commuted pension [section 10 (10 A)]

● Encashment of Earned Leave [section 10 (10 Aa)]

● Compensation on retrenchment [section 10 (10 B)]

● Compensation on voluntary retirement [section 10 (10 C)]

● Tax paid by employer on perquisites [section 10 (10 CC)]

● Payment from Statutory Provident Fund [section 10 (11)]

● Payment from Recognized Provident Fund [section 10 12)]

● Payment from Approved Super Annexation Fund [section 10 (13)]

● House rent allowance [section 10 (13A)]

● Special allowances for meeting certain expenditure [section 10 (14)]

THANK YOU

You might also like

- Exempted IncomesDocument13 pagesExempted IncomesAylwin zechariah JohnNo ratings yet

- Exempted Incomes: Sourev Suresh Roll No: 52 S5 Bcom FinanceDocument13 pagesExempted Incomes: Sourev Suresh Roll No: 52 S5 Bcom FinanceAylwin zechariah JohnNo ratings yet

- Income Exempt From TaxDocument4 pagesIncome Exempt From Taxdhruv prabhakerNo ratings yet

- Exempted IncomesDocument17 pagesExempted IncomesMuskanNo ratings yet

- Income Exempt From Taxsection-10 To 13Document15 pagesIncome Exempt From Taxsection-10 To 13Rohit MohanNo ratings yet

- Exempted Income Tax Sec 10Document3 pagesExempted Income Tax Sec 10Sreepada KameswariNo ratings yet

- Exemptions and DeductionsDocument72 pagesExemptions and DeductionsSyed Parveez AlamNo ratings yet

- Direct Taxes Ready ReckonerDocument74 pagesDirect Taxes Ready ReckonerNeha GuptaNo ratings yet

- Exempted Incomes Under Section 10Document18 pagesExempted Incomes Under Section 10Komal NandanNo ratings yet

- Incomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToDocument49 pagesIncomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToAnkitaNo ratings yet

- 62287bos50449 Mod1 cp3Document51 pages62287bos50449 Mod1 cp3monicabhat96No ratings yet

- Incomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToDocument50 pagesIncomes Which Do Not Form Part of Total Income: After Studying This Chapter, You Would Be Able ToLilyNo ratings yet

- Donations Eligible For 100% Deduction Without Qualifying LimitDocument11 pagesDonations Eligible For 100% Deduction Without Qualifying LimitShravani ShravNo ratings yet

- Unit 4Document14 pagesUnit 4Rupesh PatilNo ratings yet

- Exempted Incomes For Different CategoriesDocument10 pagesExempted Incomes For Different Categorieskmr_arnNo ratings yet

- Income ExemptDocument25 pagesIncome Exemptapi-3832224No ratings yet

- CS - Tax LawssdDocument724 pagesCS - Tax Lawssdsvkraja007No ratings yet

- As Amended by Finance Act, 2017Document3 pagesAs Amended by Finance Act, 2017JonnyNo ratings yet

- Tax Exemptions Under Section 10Document22 pagesTax Exemptions Under Section 10AnshuNo ratings yet

- Income ExemptDocument21 pagesIncome Exemptapi-3832224100% (1)

- Tax Laws Updates For June 2013 ExamsDocument68 pagesTax Laws Updates For June 2013 Examsnisarg_No ratings yet

- Tax Laws Updates For December 2013Document72 pagesTax Laws Updates For December 2013Archana ThirunagariNo ratings yet

- Basics of Direct Taxes in India - Income Tax, Capital Gains TaxDocument41 pagesBasics of Direct Taxes in India - Income Tax, Capital Gains TaxrokuveNo ratings yet

- Income Exempt From TaxDocument20 pagesIncome Exempt From TaxSaad AliNo ratings yet

- List of Important Sections Income Tax May 23 by CA Kishan KumarDocument9 pagesList of Important Sections Income Tax May 23 by CA Kishan KumarNarayan choudharyNo ratings yet

- Section-10: Income Exempt From TaxDocument21 pagesSection-10: Income Exempt From TaxJitendra VernekarNo ratings yet

- IT-03 Incomes Exempt From TaxDocument18 pagesIT-03 Incomes Exempt From TaxAkshat GoyalNo ratings yet

- Taxation & Auditing: Income & Its ClassificationDocument9 pagesTaxation & Auditing: Income & Its ClassificationAshiqul HaqueNo ratings yet

- Exempted Incomes U/S 10: B.Satyanarayana Rao Asso - Prof in Commerce ST - Joseph'S Degree & PG College King Koti, HyderabadDocument25 pagesExempted Incomes U/S 10: B.Satyanarayana Rao Asso - Prof in Commerce ST - Joseph'S Degree & PG College King Koti, HyderabadKumar RupeshNo ratings yet

- EXEMPT INCOME UNDER SECTION 10Document3 pagesEXEMPT INCOME UNDER SECTION 10Om JogiNo ratings yet

- Exempted IncomeDocument35 pagesExempted IncomeNaman GoyalNo ratings yet

- Income Tax Exemptions: Income Type Under SectionDocument17 pagesIncome Tax Exemptions: Income Type Under Section12345566788990100% (2)

- Income from Business or Profession GuideDocument23 pagesIncome from Business or Profession Guiderohanfyaz00No ratings yet

- Deduction u/s 10A and 10B for undertakings in FTZ and SEZDocument46 pagesDeduction u/s 10A and 10B for undertakings in FTZ and SEZAkhilesh Kumar0% (3)

- Module-1: Basic Concepts and DefinitionsDocument35 pagesModule-1: Basic Concepts and Definitions2VX20BA091No ratings yet

- Income Not Forming Part OF Total IncomeDocument35 pagesIncome Not Forming Part OF Total IncomeBeing HumaneNo ratings yet

- 11 TaxDocument37 pages11 TaxArpita KapoorNo ratings yet

- Section-10: Income Exempt From TaxDocument21 pagesSection-10: Income Exempt From TaxRakesh SharmaNo ratings yet

- Chapter - 1: Page - 1Document7 pagesChapter - 1: Page - 1Arunangsu ChandaNo ratings yet

- 11.tax Free Incomes FinalDocument40 pages11.tax Free Incomes FinalKARTHIK ANo ratings yet

- EXEMPTED INCOME Sec10Document2 pagesEXEMPTED INCOME Sec10jishnu surendranNo ratings yet

- @CACell Inter Income Tax Important Sections List Nov22Document8 pages@CACell Inter Income Tax Important Sections List Nov22Srushti AgarwalNo ratings yet

- Income Exempt from Tax SectionsDocument12 pagesIncome Exempt from Tax SectionsAkshay SrivastavaNo ratings yet

- 11.tax Free Incomes FinalDocument35 pages11.tax Free Incomes Finalpraveenr5883No ratings yet

- Taxes - Companies and Unincorporated Businesses: B17 Income Exempt FromDocument12 pagesTaxes - Companies and Unincorporated Businesses: B17 Income Exempt FromKen ChiaNo ratings yet

- Incomes Exempt Under Section 10Document10 pagesIncomes Exempt Under Section 10Rahul TiwariNo ratings yet

- 1.2 Module 1 Part 2Document4 pages1.2 Module 1 Part 2Arpita ArtaniNo ratings yet

- 11 - Exemptions and DeductionsDocument42 pages11 - Exemptions and DeductionsmanikaNo ratings yet

- 11.tax Free Incomes FinalDocument40 pages11.tax Free Incomes FinalGhs ShahpurkandiNo ratings yet

- Agricultural IncomeDocument2 pagesAgricultural IncomezxcNo ratings yet

- Exempted IncomeDocument6 pagesExempted Incomeshyam visanaNo ratings yet

- Schedules To Bombay Shops & Establishments Act 1948Document93 pagesSchedules To Bombay Shops & Establishments Act 1948zxrajput5218100% (1)

- Agricultural Income Under Section 10Document7 pagesAgricultural Income Under Section 10Apurva KuvalekarNo ratings yet

- Tax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainDocument52 pagesTax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainVrind JainNo ratings yet

- Income Exempt From TaxDocument4 pagesIncome Exempt From TaxKartikNo ratings yet

- Income Exemptions Under Sections 10 and 13BDocument33 pagesIncome Exemptions Under Sections 10 and 13BAleti NithishNo ratings yet

- Tax Planning For Setting New BusinessDocument6 pagesTax Planning For Setting New BusinessHardipsinh Yadav56% (9)

- Income Tax Deduction in Concern With CompaniesDocument17 pagesIncome Tax Deduction in Concern With Companieshansdeep479No ratings yet

- Tax Exemptions Under Indian Income Tax LawDocument3 pagesTax Exemptions Under Indian Income Tax LawSneha PotekarNo ratings yet

- Sde649 PDFDocument201 pagesSde649 PDFKALPANA M NNo ratings yet

- I Ntroducti ONDocument42 pagesI Ntroducti ONAylwin zechariah JohnNo ratings yet

- Theory of Capital Markets: A Review of Literature: Worapot Ongkrutaraksa, PH.DDocument7 pagesTheory of Capital Markets: A Review of Literature: Worapot Ongkrutaraksa, PH.DAylwin zechariah JohnNo ratings yet

- 18 08 20Document1 page18 08 20Aylwin zechariah JohnNo ratings yet

- Theory of Capital Markets: A Review of Literature: Worapot Ongkrutaraksa, PH.DDocument7 pagesTheory of Capital Markets: A Review of Literature: Worapot Ongkrutaraksa, PH.DAylwin zechariah JohnNo ratings yet

- BCOM - INCOME TAX1 (2) Law and PracticeDocument17 pagesBCOM - INCOME TAX1 (2) Law and PracticeGifi koshyNo ratings yet

- CPSC5125 - Assignment 3 - Fall 2014 Drawing Polygons: DescriptionDocument2 pagesCPSC5125 - Assignment 3 - Fall 2014 Drawing Polygons: DescriptionJo KingNo ratings yet

- MalayoDocument39 pagesMalayoRoxanne Datuin UsonNo ratings yet

- Artificial Intelligence in Practice How 50 Successful CompaniesDocument6 pagesArtificial Intelligence in Practice How 50 Successful CompaniesKaran TawareNo ratings yet

- Mental Health and Mental Disorder ReportDocument6 pagesMental Health and Mental Disorder ReportBonJovi Mojica ArtistaNo ratings yet

- Kundalini Reiki Manual: Paul CrickDocument17 pagesKundalini Reiki Manual: Paul CrickKkkk100% (1)

- Language Learning Enhanced by Music and SongDocument7 pagesLanguage Learning Enhanced by Music and SongNina Hudson100% (2)

- G3335-90158 MassHunter Offline Installation GCMSDocument19 pagesG3335-90158 MassHunter Offline Installation GCMSlesendreNo ratings yet

- Research On Evolution Equations Compendium Volume 1Document437 pagesResearch On Evolution Equations Compendium Volume 1Jean Paul Maidana GonzálezNo ratings yet

- Likes and Dislikes 1Document2 pagesLikes and Dislikes 1LAURA MELISSA SANCHEZ SUAREZ50% (2)

- Bohol - Eng5 Q2 WK8Document17 pagesBohol - Eng5 Q2 WK8Leceil Oril PelpinosasNo ratings yet

- Density Functional Theory Investigations of Bismuth VanadateDocument7 pagesDensity Functional Theory Investigations of Bismuth VanadateNurSalahuddinNo ratings yet

- Punctuation-Worksheet 18666Document2 pagesPunctuation-Worksheet 18666WAN AMIRA QARIRAH WAN MOHD ROSLANNo ratings yet

- Wayside Amenities GuidelinesDocument8 pagesWayside Amenities GuidelinesUbaid UllahNo ratings yet

- Sensory Evaluation of FoodDocument38 pagesSensory Evaluation of FoodKHOZA SBUSISIWENo ratings yet

- CIMA Financial Accounting Fundamentals Past PapersDocument107 pagesCIMA Financial Accounting Fundamentals Past PapersAnonymous pwAkPZNo ratings yet

- A Gringa in Oaxaca PDFDocument54 pagesA Gringa in Oaxaca PDFPeggy BryanNo ratings yet

- 515 AMA Must DO QuestionsDocument217 pages515 AMA Must DO QuestionsVenkataRajuNo ratings yet

- Cut Nyak Dhien: Aceh's Legendary Resistance LeaderDocument5 pagesCut Nyak Dhien: Aceh's Legendary Resistance LeaderKhoerudin KhoerudinNo ratings yet

- Juice in PakistanDocument9 pagesJuice in Pakistanrize1159100% (1)

- 21st Century Theories of EducationDocument53 pages21st Century Theories of Educationdaffodil198100% (1)

- Wind LoadsDocument5 pagesWind LoadsMGNo ratings yet

- NCP For Ineffective Airway ClearanceDocument3 pagesNCP For Ineffective Airway ClearanceJennelyn BayleNo ratings yet

- Effectiveness of Drug and Substance Abuse Prevention Programs PDFDocument245 pagesEffectiveness of Drug and Substance Abuse Prevention Programs PDFjohn gooco100% (2)

- Decision Criteria For Ethical ReasoningDocument14 pagesDecision Criteria For Ethical ReasoningZara ImranNo ratings yet

- FisikaDocument46 pagesFisikaNurol Hifzi Putri RizkiNo ratings yet

- Songs Masters Campfire SongbookDocument50 pagesSongs Masters Campfire SongbookGuillaume Metz86% (7)

- The Paul Sellers Router PlaneDocument6 pagesThe Paul Sellers Router PlaneAjay Vishwanath100% (1)

- Doctor Who - In-Vision 074 - Resurrection of The Daleks PDFDocument19 pagesDoctor Who - In-Vision 074 - Resurrection of The Daleks PDFTim JonesNo ratings yet

- 0611CT1001net PDFDocument272 pages0611CT1001net PDFAdrian M FahriNo ratings yet

- Covid19-Drug StudyDocument7 pagesCovid19-Drug StudynicoleNo ratings yet