Professional Documents

Culture Documents

Cash Flows and Capital Budgeting Solutions

Uploaded by

Zarieq Eric0 ratings0% found this document useful (0 votes)

35 views12 pagesThis document presents a case study on capital budgeting and cash flows for an automation project. It provides details on the initial costs, operating cash flows, tax rates, depreciation schedule, and salvage value to calculate the net present value (NPV) and internal rate of return (IRR) of the project. The NPV is calculated in two ways, either treating the cash flows as individual amounts or as annuities. Both methods result in a positive NPV of approximately $293,000 and an IRR of 28.13%, indicating the project should be accepted.

Original Description:

Original Title

solution-cf-cash-flow-practice-problem-2

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document presents a case study on capital budgeting and cash flows for an automation project. It provides details on the initial costs, operating cash flows, tax rates, depreciation schedule, and salvage value to calculate the net present value (NPV) and internal rate of return (IRR) of the project. The NPV is calculated in two ways, either treating the cash flows as individual amounts or as annuities. Both methods result in a positive NPV of approximately $293,000 and an IRR of 28.13%, indicating the project should be accepted.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views12 pagesCash Flows and Capital Budgeting Solutions

Uploaded by

Zarieq EricThis document presents a case study on capital budgeting and cash flows for an automation project. It provides details on the initial costs, operating cash flows, tax rates, depreciation schedule, and salvage value to calculate the net present value (NPV) and internal rate of return (IRR) of the project. The NPV is calculated in two ways, either treating the cash flows as individual amounts or as annuities. Both methods result in a positive NPV of approximately $293,000 and an IRR of 28.13%, indicating the project should be accepted.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 12

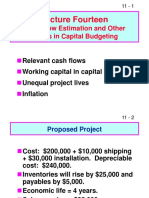

CHAPTER 12

Cash Flows and Other Topics

in Capital Budgeting

Time line for Solution Practice Problem 2

Cash Flows

Initial Terminal

outlay Cash flow

$590,000

0 1 2 3 4 5 6 7 8

$197,500 $197,500 $197,500 $197,500 $197,500 $158,400 $158,400 $158,400+

$41,400 =

$199,800

Annual Cash Flows

Automation Project:

Problem 2

Cost of equipment = $550,000.

Shipping & installation will be $25,000.

$15,000 in net working capital required at setup.

8-year project life, 5-year class life.

Simplified straight line depreciation.

Current operating expenses are $640,000 per yr.

New operating expenses will be $400,000 per yr.

Already paid consultant $25,000 for analysis.

Salvage value after year 8 is $40,000.

Cost of capital = 14%, marginal tax rate = 34%.

Problem 2

Initial Outlay:

(550,000) Cost of new machine

+ (25,000) Shipping & installation

(575,000) Depreciable asset

+ (15,000) NWC investment

(590,000) Net Initial Outlay

For Years 1 - 5: Problem 2

240,000 Cost decrease

(115,000) Depreciation increase

125,000 EBIT

(42,500) Taxes (34%)

82,500 EAT

115,000 Depreciation reversal

197,500 = Annual Cash Flow

CALCULATION OF ANNUAL

DEPRECIATION FOR NEW MACHINE:

Depreciable asset/class life =$575,000/5 yrs

= $115,000

The machine is used only for 5 years. From

years 6-10, no depreciation; therefore

depreciation will be $0 for these last 5 years.

Problem 2

For Years 6 - 8:

240,000 Cost decrease

( 0) Depreciation increase

240,000 EBIT

(81,600) Taxes (34%)

158,400 EAT

0 Depreciation reversal

158,400 = Annual Cash Flow

Problem 2

Terminal Cash Flow:

40,000 Salvage value

(13,600) Tax on capital gain

15,000 Recapture of NWC

41,400 Terminal Cash Flow

CALCULATION OF TERMINAL CASH FLOW

Annual depreciation of new machine=$115,000

(from slide 7)

Book value = Depreciable asset – Total

amount depreciated

= $575,000 - $115,000(5yrs)

= $0

Capital gain = Salvage value-Book Value

= $40,000-$0 = $40,000

Tax on capital gain = 34% x $40,000

= $13,600 (refer slide 8)

Problem 2 Solution

NPV and IRR:

CF(year 0) = -$590,000 (slide 4)

CF(years 1 - 5) =$197,500 (slide 5)

CF(years 6 - 7) = $158,400 (slide 7)

CF(year 8) = $158,400 + $41,400

= $199,800 (slides 7 + 8)

Discount rate = 14%.

IRR = 28.13%

NPV = $293,543.

We would accept the project.

FINDING NPV-

1st method (annuity + individual CF)

NPV = -$590,000 (year 0)

+ $197,500 (PVIFA 14%, years 1-5) (years 1-5)

+ $158,400 (PVIF 14%, 6th yr) (year 6)

+ $158,400 (PVIF 14%, 7th yr) (year 7)

+ $199,800 (PVIF 14%, 8th yr) (year 8)

= -$590,000

+ $197,500(3.4331)

+ $158,400 ( (0.4556)

+ $158,400 ( (0.3996)

+ $199,800 (0.3506)

= -$590,000 +$678,037 +$72,167 +$63,297 +$70,050

= -$590,000 +$883,551 = $293,551

Accept the project since NPV is positive.

FINDING NPV-

2nd method (annuities)

NPV = -$590,000 (year 0)

+ $197,500 (PVIFA 14%, 5years) (years 1-5)

+ $158,400 (PVIFA 14%, 2 years,6&7) (PVIF 14%, 5)

(annuities years 6-7)(bring back to time 0). Refer

to TVM ppt, slides 68-71 for understanding.

+ $199,800 (PVIF 14%,10th year) (year 8)

= -$590,000

+ $197,500(3.4331)

+ $158,400 (1.6467)(0.5194)

+ $199,800 (0.3506)

= -$590,000 +$678,037 +$135,479 +$70,050

= -$590,000 +$883,556 = $293,566

Accept the project since NPV is positive.

You might also like

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Hospitality Financial Accounting 2nd Edition Weygandt Solutions ManualDocument12 pagesHospitality Financial Accounting 2nd Edition Weygandt Solutions Manualasbestinepalama3rzc6100% (21)

- Practice Problems Chapter 12 Corporate Cash Flow and Project AnalysisDocument57 pagesPractice Problems Chapter 12 Corporate Cash Flow and Project AnalysiszoeyNo ratings yet

- NPV and IRR Analysis of Equipment Replacement and Project SelectionDocument16 pagesNPV and IRR Analysis of Equipment Replacement and Project SelectionsheldonNo ratings yet

- Tugas GSLC Corp Finance Session 16Document6 pagesTugas GSLC Corp Finance Session 16Javier Noel ClaudioNo ratings yet

- Gitman IM Ch03Document15 pagesGitman IM Ch03tarekffNo ratings yet

- Issues in Capital Budgeting: 9-1 Project Investment NPV PIDocument6 pagesIssues in Capital Budgeting: 9-1 Project Investment NPV PILyam Cruz FernandezNo ratings yet

- Exercise Cash FlowDocument5 pagesExercise Cash FlowSiti AishahNo ratings yet

- Isna Wirda Lutfiyah - 17 - 4-17Document10 pagesIsna Wirda Lutfiyah - 17 - 4-17DewaSatriaNo ratings yet

- Lec 3 After Mid TermDocument11 pagesLec 3 After Mid TermsherygafaarNo ratings yet

- Quiz 3Document14 pagesQuiz 3K L YEONo ratings yet

- MK Cap Budgeting CH 9 - 10 Ross PDFDocument17 pagesMK Cap Budgeting CH 9 - 10 Ross PDFSajidah PutriNo ratings yet

- Solutions Guide: Capital Budgeting Case StudyDocument5 pagesSolutions Guide: Capital Budgeting Case StudySri SardiyantiNo ratings yet

- Chapter 12Document14 pagesChapter 12Naimmul FahimNo ratings yet

- Mahmoud Megahed - Str. Fin. Mgmt. - Assginment 2Document20 pagesMahmoud Megahed - Str. Fin. Mgmt. - Assginment 2Mahmoud MegahedNo ratings yet

- BudgetingDocument44 pagesBudgetingYellow CarterNo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- Benito Juhantyo Wibbowo 1714422056 NPVDocument6 pagesBenito Juhantyo Wibbowo 1714422056 NPVBenito JuhantyoNo ratings yet

- Developing Financial Insights Using Present and Future Value ApproachesDocument3 pagesDeveloping Financial Insights Using Present and Future Value ApproachesRahma Putri HapsariNo ratings yet

- Sneakers 2013Document5 pagesSneakers 2013Felicia FrancisNo ratings yet

- Chapter 2 Financial Statements Cash Flow and TaxesDocument7 pagesChapter 2 Financial Statements Cash Flow and TaxesM. HasanNo ratings yet

- EE - Assignment Chapter 9-10 SolutionDocument11 pagesEE - Assignment Chapter 9-10 SolutionXuân ThànhNo ratings yet

- PaybackDocument14 pagesPaybackHema LathaNo ratings yet

- Chapter 11Document10 pagesChapter 11Syed Sheraz AliNo ratings yet

- Acct 3503 Test 2 Format, Instuctions and Review Section A FridayDocument22 pagesAcct 3503 Test 2 Format, Instuctions and Review Section A Fridayyahye ahmedNo ratings yet

- Hospitality Financial Accounting 2Nd Edition Weygandt Solutions Manual Full Chapter PDFDocument33 pagesHospitality Financial Accounting 2Nd Edition Weygandt Solutions Manual Full Chapter PDFJeremyMitchellkgaxp100% (10)

- FFM 9 Im 12Document31 pagesFFM 9 Im 12Mariel CorderoNo ratings yet

- Financial analysis and NPV calculation of a company over 5 yearsDocument3 pagesFinancial analysis and NPV calculation of a company over 5 yearsMohitNo ratings yet

- NPV CalculationDocument6 pagesNPV CalculationAbhimanu GoyalNo ratings yet

- Manajemen Keuangan: Chapter 6: Making Capital Investment DecisionDocument9 pagesManajemen Keuangan: Chapter 6: Making Capital Investment Decision21. Syafira Indi KhoirunisaNo ratings yet

- Final RevisionDocument13 pagesFinal Revisionaabdelnasser014No ratings yet

- Assignment 1-11 ManAccDocument13 pagesAssignment 1-11 ManAccMay Grethel Joy PeranteNo ratings yet

- project and risk analysisDocument2 pagesproject and risk analysisvipukNo ratings yet

- Chapter 2 DoneDocument30 pagesChapter 2 Doneellyzamae quiraoNo ratings yet

- Constructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmDocument5 pagesConstructing A Capital Budget: File C5-241 August 2013 WWW - Extension.iastate - Edu/agdmBhavesh MaruNo ratings yet

- Libo On Capital Budgeting AssignmentDocument4 pagesLibo On Capital Budgeting AssignmentRyhanna Lou ReyesNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- Practice Problems Ch12Document57 pagesPractice Problems Ch12Kevin Baconga100% (2)

- Error CDocument20 pagesError CkleeNo ratings yet

- Chapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1Document8 pagesChapter 13 Capital Budgeting Estimating Cash Flow and Analyzing Risk Answers To End of Chapter Questions 13 3 Since The Cost of Capital Includes A Premium For Expected Inflation Failure 1ghzNo ratings yet

- AC550 Week Four AssigmentDocument8 pagesAC550 Week Four Assigmentsweetpr22No ratings yet

- Lecture Fourteen: Cash Flow Estimation and Other Topics in Capital BudgetingDocument38 pagesLecture Fourteen: Cash Flow Estimation and Other Topics in Capital BudgetingHồng KhánhNo ratings yet

- Solution Assignment Chapter 9 10 1Document14 pagesSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuNo ratings yet

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Document6 pagesGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90salsabilla rpNo ratings yet

- GSLC Session 16 NPV AnalysisDocument6 pagesGSLC Session 16 NPV AnalysisJavier Noel ClaudioNo ratings yet

- Cap Buget ProblemsDocument8 pagesCap Buget ProblemsramakrishnanNo ratings yet

- Lecture Notes Topic 4 Part 2Document34 pagesLecture Notes Topic 4 Part 2sir bookkeeperNo ratings yet

- Financial Management - Capital Budgeting TechniquesDocument14 pagesFinancial Management - Capital Budgeting Techniquesankit mehtaNo ratings yet

- M C R E ,: Inicase: Onch Epublic LectronicsDocument4 pagesM C R E ,: Inicase: Onch Epublic Lectronicsnara100% (3)

- Brigham Chap 11 Practice Questions Solution For Chap 11Document11 pagesBrigham Chap 11 Practice Questions Solution For Chap 11robin.asterNo ratings yet

- Soal BaruDocument14 pagesSoal BaruDella Lina100% (1)

- Npv Analysis Of New Product LaunchDocument8 pagesNpv Analysis Of New Product LaunchFelicity YuanNo ratings yet

- Solutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment DecisionsDocument12 pagesSolutions To Chapter 8 Using Discounted Cash-Flow Analysis To Make Investment Decisionshung TranNo ratings yet

- Alifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcDocument9 pagesAlifaldo Daffa Darmawan - 242221075 - Calculating NPV EtcFaldo DaffaNo ratings yet

- Excel Busi Finance FinDocument2 pagesExcel Busi Finance Finapi-258913756No ratings yet

- Corporate Finance Tutorial 4 - SolutionsDocument22 pagesCorporate Finance Tutorial 4 - Solutionsandy033003No ratings yet

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (27)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Borang Kolej KediamanDocument3 pagesBorang Kolej KediamanMUHAMMAD NUR ASYRAF BIN RAHSID MoeNo ratings yet

- Basque and Catalan nationalism before the Spanish Civil War: Explaining differences in programmatic characterDocument30 pagesBasque and Catalan nationalism before the Spanish Civil War: Explaining differences in programmatic charactergerardglledaNo ratings yet

- Transfer of Property Act, 1882 Definition and Scope of Immovable PropertyDocument4 pagesTransfer of Property Act, 1882 Definition and Scope of Immovable PropertyHARSH KUMARNo ratings yet

- Recent Advances in Indian Law for Mental HealthDocument53 pagesRecent Advances in Indian Law for Mental HealthChalla Krishna VasanNo ratings yet

- Income Tax in India - Wikipedia, The Free EncyclopediaDocument13 pagesIncome Tax in India - Wikipedia, The Free EncyclopediaAnonymous utfuIcnNo ratings yet

- Auditing VocabularyDocument15 pagesAuditing Vocabularyvaheh Geragosian100% (1)

- Last Revised: February 3, 2020Document7 pagesLast Revised: February 3, 2020Abhishek GhoshNo ratings yet

- C TS410 2020-SampleDocument5 pagesC TS410 2020-Samplerahulg.sapNo ratings yet

- Class SuspensionDocument1 pageClass SuspensionMarife MagsinoNo ratings yet

- Compal Confidential: VALEA/VALEB Schematics DocumentDocument52 pagesCompal Confidential: VALEA/VALEB Schematics Documentkolargol72No ratings yet

- What Is Gendered LanguageDocument3 pagesWhat Is Gendered LanguageMaria Agustina SabatéNo ratings yet

- L5 - Nature of Clinical Lab - PMLS1Document98 pagesL5 - Nature of Clinical Lab - PMLS1John Daniel AriasNo ratings yet

- Guide to Analyzing and Interpreting Financial InformationDocument80 pagesGuide to Analyzing and Interpreting Financial InformationBoogy Grim100% (1)

- Robert Demichele v. Greenburgh Central School District No. 7, and Arnold B. Green, Individually, 167 F.3d 784, 2d Cir. (1999)Document12 pagesRobert Demichele v. Greenburgh Central School District No. 7, and Arnold B. Green, Individually, 167 F.3d 784, 2d Cir. (1999)Scribd Government DocsNo ratings yet

- IEEE STD 56-2016Document86 pagesIEEE STD 56-2016RoySnk100% (2)

- Judgement pRAVIN jUNEJADocument6 pagesJudgement pRAVIN jUNEJApriyadarshi manishNo ratings yet

- Internet Archive v. Shell - Document No. 2Document1 pageInternet Archive v. Shell - Document No. 2Justia.comNo ratings yet

- Income Taxation Mcqs&ProblemsDocument14 pagesIncome Taxation Mcqs&ProblemsJayrald LacabaNo ratings yet

- CaseeDocument10 pagesCaseehardworker1821No ratings yet

- Barclays PDD PDD Holdings Inc. - Q4 Results Were Strong But Street ExpDocument12 pagesBarclays PDD PDD Holdings Inc. - Q4 Results Were Strong But Street Expoldman lokNo ratings yet

- Paseo Realty v. CADocument2 pagesPaseo Realty v. CAMary BoaquiñaNo ratings yet

- School Readiness Checklist Deped Computerization ProgramDocument1 pageSchool Readiness Checklist Deped Computerization ProgramMark Gilbert TandocNo ratings yet

- 10 20F - 516878aDocument349 pages10 20F - 516878aBaikaniNo ratings yet

- American Vs Director of PatentsDocument1 pageAmerican Vs Director of PatentsKidrelyne vic BonsatoNo ratings yet

- Busorg1 DigestDocument5 pagesBusorg1 DigestOwie JoeyNo ratings yet

- General Assembly: United NationsDocument17 pagesGeneral Assembly: United NationsHayZara MadagascarNo ratings yet

- Adjusting Entries For StudentsDocument57 pagesAdjusting Entries For Studentsselvia egayNo ratings yet

- Working Capital Analysis of Reliance IndustriesDocument33 pagesWorking Capital Analysis of Reliance IndustriesDeepak kumar KamatNo ratings yet

- Branch JointDocument2 pagesBranch Jointskipina74No ratings yet

- Manupatra - Your Guide To Indian Law and Business and PolicyDocument69 pagesManupatra - Your Guide To Indian Law and Business and PolicyRabiul IslamNo ratings yet