Professional Documents

Culture Documents

Pricing Optimization: How To Find The Price That Maximizes Your Profit?

Uploaded by

KARAN SEHGAL0 ratings0% found this document useful (0 votes)

21 views75 pagesOriginal Title

PricingOptimization

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views75 pagesPricing Optimization: How To Find The Price That Maximizes Your Profit?

Uploaded by

KARAN SEHGALCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 75

Pricing Optimization: How to find the price

that maximizes your profit?

The main idea behind this problem is the

following question: As manager of a

company/store, how much should I charge in

order to maximize my revenue or profit?

• MS-Excel

• Excel Solver

• Free Pricing Calculator

• LINGO

• R

• A contribution margin is the amount of

money a business has to cover its fixed costs

and contribute to net profit or loss after paying

variable costs.

Contribution margin = Revenue − Variable Costs

For example, if the price of your product is $20

and the unit variable cost is $4, then the unit

contribution margin is $16.

5400

56

What Is the Demand Curve?

The demand curve is a graphical representation of the relationship between the price of a

good or service and the quantity demanded for a given period of time. In a typical

representation, the price will appear on the left vertical axis, the quantity demanded on the

horizontal axis.

Model Formulation

• Decision variables -mathematical symbols representing

levels of activity of a firm.

• Objective function -a linear mathematical relationship

describing an objective of the firm, in terms of decision

variables -this function is to be maximized or minimized.

• Constraints –requirements or restrictions placed on the

firm by the operating environment, stated in linear

relationships of the decision variables.

• Parameters -numerical coefficients and constants used in

the objective function and constraints.

• A monopoly is a structure in which a single supplier produces and sells a

given product or service. If there is a single seller in a certain market and

there are no close substitutes for the product, then the market structure

is that of a "pure monopoly“

• An unregulated monopoly has market power and can influence prices.

Examples: Microsoft and Windows, DeBeers and diamonds, your local natural

gas company.

• Imagine a company that has been selling the

product which follows the demand curve

above for a while (one year changing prices

daily), testing some prices over time. The

following time-series is what we should expect

for the historical revenue, profit and cost of the

company:

We can recover the demand curve using the historical data (that is how it is done in the

real world).

• And now we need to apply equation 2 and

equation 3.

The final plot with the estimated prices:

As you can see, the estimated Revenue and

estimated Profit curves are quite similar to the

true ones without noise and the expected

revenue for our estimated optimal policies

looks very promising. Although the linear and

monopolist assumption looks quite restrictive,

this might not be the case

References

• Phillips, Robert Lewis. Pricing and revenue optimization. Stanford

University Press, 2005.

• Besbes, Omar, and Assaf Zeevi. “On the (surprising) sufficiency of

linear models for dynamic pricing with demand learning.”

Management Science 61.4 (2015): 723-739.

• Cooper, William L., Tito Homem-de-Mello, and Anton J. Kleywegt.

“Learning and pricing with models that do not explicitly

incorporate competition.” Operations research 63.1 (2015): 86-103.

• Talluri, Kalyan T., and Garrett J. Van Ryzin. The theory and practice

of revenue management. Vol. 68. Springer Science & Business

Media, 2006.

You might also like

- Fire Protection Yellow Book Volume 1Document92 pagesFire Protection Yellow Book Volume 1uashinde100% (3)

- Group9 - SectionB - TruEarth Case AnalysisDocument3 pagesGroup9 - SectionB - TruEarth Case AnalysisKARAN SEHGALNo ratings yet

- The Complete Investment Banker ExtractDocument19 pagesThe Complete Investment Banker ExtractJohn MathiasNo ratings yet

- Chapter 7 Revenue Models and FinancingDocument59 pagesChapter 7 Revenue Models and FinancingJuliannaViktoriia0% (1)

- The Discipline of Market Leaders (Review and Analysis of Treacy and Wiersema's Book)From EverandThe Discipline of Market Leaders (Review and Analysis of Treacy and Wiersema's Book)No ratings yet

- Price Analytics: Dr. Keerti Jain NIIT University, NeemranaDocument88 pagesPrice Analytics: Dr. Keerti Jain NIIT University, NeemranaTushar GoelNo ratings yet

- Class 1 and 2Document29 pagesClass 1 and 2Protanu GhoshNo ratings yet

- Comparable Company Analysis SlidesDocument15 pagesComparable Company Analysis SlidesParvesh AghiNo ratings yet

- Introduction MBA I (13 15) FDocument17 pagesIntroduction MBA I (13 15) Fmanishkhandal88No ratings yet

- Chapter 13 Marketing in Asia Building the Price FoundationDocument73 pagesChapter 13 Marketing in Asia Building the Price FoundationMaj Icalina CulatonNo ratings yet

- Cost-Volume-Profit (CVP) AnalysisDocument21 pagesCost-Volume-Profit (CVP) AnalysisDr. Alla Talal YassinNo ratings yet

- Darden Casebook 2004 For Case Interview Practice - MasterTheCaseDocument95 pagesDarden Casebook 2004 For Case Interview Practice - MasterTheCaseMasterTheCase.comNo ratings yet

- The Role of Marketing Mix (6P) in Business ModelsDocument16 pagesThe Role of Marketing Mix (6P) in Business Modelsadroit625271No ratings yet

- The Identification Problem The Identification Problem: Lecture ObjectivesDocument10 pagesThe Identification Problem The Identification Problem: Lecture Objectivesdayah3490No ratings yet

- Welcome To Business MathematicsDocument25 pagesWelcome To Business Mathematicsopti mizerNo ratings yet

- Lec-8 Price OptimizationDocument9 pagesLec-8 Price OptimizationPavan YadavNo ratings yet

- Krishna Consultancy - GUIDEDocument3 pagesKrishna Consultancy - GUIDESakshamChauhanNo ratings yet

- Economics Assignments Set-1 (WITH GRAPH)Document7 pagesEconomics Assignments Set-1 (WITH GRAPH)Kamalakshya SahaNo ratings yet

- MA Notes Unit 2 CompleteDocument19 pagesMA Notes Unit 2 CompleteTisha JainNo ratings yet

- BREAK-EVEN ANALYSIS GUIDEDocument14 pagesBREAK-EVEN ANALYSIS GUIDEBabacar Tall100% (1)

- Name Roll No.Document6 pagesName Roll No.Shakeel ShahNo ratings yet

- PricingDocument65 pagesPricingRivu MukherjeeNo ratings yet

- Managerial Eco1Document190 pagesManagerial Eco1ManojNo ratings yet

- Revenue Management and Dynamic Pricing: Group 2 Rohan Raghatate Amartya Bose Rohit KumarDocument10 pagesRevenue Management and Dynamic Pricing: Group 2 Rohan Raghatate Amartya Bose Rohit Kumaranon_974035635No ratings yet

- Revenue Models For StartupsDocument28 pagesRevenue Models For StartupsMiheret AyeleNo ratings yet

- Marks) 10 Marks: EVA Net Operating Profit After Taxes - A Capital Charge (The Residual Income Method)Document8 pagesMarks) 10 Marks: EVA Net Operating Profit After Taxes - A Capital Charge (The Residual Income Method)Rahul ThekkiniakathNo ratings yet

- Break Even Analysis FMDocument6 pagesBreak Even Analysis FMRahul RajwaniNo ratings yet

- JIM-I-1 Problem Solving FrameworkDocument51 pagesJIM-I-1 Problem Solving FrameworkSwapnanil DasNo ratings yet

- Break Even AnalysisalanDocument15 pagesBreak Even AnalysisalanFelipe Irazábal0% (1)

- MGN815: Business Models: Ajay ChandelDocument41 pagesMGN815: Business Models: Ajay ChandelSam RehmanNo ratings yet

- Market Based ValuationDocument12 pagesMarket Based ValuationhiralltaylorNo ratings yet

- Unit 2 KMBN MK02Document36 pagesUnit 2 KMBN MK02RATANNo ratings yet

- Lecture Two - Goals, Constraints, CostsDocument30 pagesLecture Two - Goals, Constraints, CostsClive NyowanaNo ratings yet

- Session BusinessModelDocument44 pagesSession BusinessModelgil.alessrochaNo ratings yet

- 16 Potential Key Performance Indicators For HospitalsDocument3 pages16 Potential Key Performance Indicators For HospitalsSyed Murtuza BakshiNo ratings yet

- Up-selling and cross-selling strategies maximize revenue and satisfactionDocument11 pagesUp-selling and cross-selling strategies maximize revenue and satisfactionThomas GeorgeNo ratings yet

- DCF Valuation GuideDocument27 pagesDCF Valuation GuideDhrupal TripathiNo ratings yet

- Chapter II.3 - Report 7Document10 pagesChapter II.3 - Report 7Gellie Mae Bonilla-IranNo ratings yet

- Rgression in EconomicsDocument20 pagesRgression in EconomicsMuhammad Umer Farooq AwanNo ratings yet

- 21 Cost Volume Profit AnalysisDocument31 pages21 Cost Volume Profit AnalysisBillal Hossain ShamimNo ratings yet

- Demand EstimationDocument10 pagesDemand EstimationMargaret DivyaNo ratings yet

- E-Business Models & MarketsDocument53 pagesE-Business Models & Marketsanmol guleriaNo ratings yet

- Economics For Engineers Amit Kumar ChoudharyDocument6 pagesEconomics For Engineers Amit Kumar Choudharyankit.real12No ratings yet

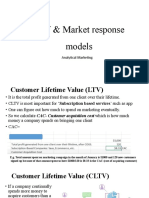

- LTV and Market Response ModelDocument33 pagesLTV and Market Response ModelAnushree GawadNo ratings yet

- Pricing With Market PowerDocument65 pagesPricing With Market PowerCarl Adrian ValdezNo ratings yet

- Revenue Model: - Assess The Potential Sources of RevenueDocument32 pagesRevenue Model: - Assess The Potential Sources of RevenueChaitali KeluskarNo ratings yet

- Cost Analysis PDFDocument36 pagesCost Analysis PDFSteeeeeeeeph100% (1)

- It Entrepreneurship: Business ModelDocument41 pagesIt Entrepreneurship: Business ModelNurZul HealMeNo ratings yet

- Value Drivers and KPIsDocument12 pagesValue Drivers and KPIsJAN PAOLO LUMPAZNo ratings yet

- Break Even Analysis ThesisDocument7 pagesBreak Even Analysis Thesisangeljordancincinnati100% (2)

- Short Notes 510 1 Set Question CommonDocument9 pagesShort Notes 510 1 Set Question CommonSHAFI Al MEHEDINo ratings yet

- Lesson 4Document5 pagesLesson 4Apple Allyssah ComabigNo ratings yet

- Introduction To Business-to-Business Marketing: Prepared by John T. Drea, Western Illinois UniversityDocument17 pagesIntroduction To Business-to-Business Marketing: Prepared by John T. Drea, Western Illinois UniversityNikita PatraNo ratings yet

- Pricing Strategies and TechniquesDocument40 pagesPricing Strategies and TechniquesHUONG NGUYEN VU QUYNHNo ratings yet

- Topic 8Document35 pagesTopic 8Áliyà ÀliNo ratings yet

- Literature Review On Break Even AnalysisDocument6 pagesLiterature Review On Break Even Analysisafdtfhtut100% (1)

- Chapter2 Managerial-Economics P1Document15 pagesChapter2 Managerial-Economics P1Yve LuelleNo ratings yet

- Lec-14 Sales ForecastingDocument13 pagesLec-14 Sales ForecastingPavan YadavNo ratings yet

- ECO 001 ReviewerDocument7 pagesECO 001 ReviewerDE LARA, MA. KRISTEL JEAN D.No ratings yet

- Material No. 4Document10 pagesMaterial No. 4rhbqztqbzyNo ratings yet

- Darden 2004Document95 pagesDarden 2004henrique.oliveir09No ratings yet

- Revenue Growth Model-Chief Revenue Officer's Guide to B2B Sales SuccessFrom EverandRevenue Growth Model-Chief Revenue Officer's Guide to B2B Sales SuccessNo ratings yet

- Zara IT for fast fashionDocument2 pagesZara IT for fast fashionKARAN SEHGALNo ratings yet

- Case 1-Amazon, Apple, Facebook, and GOOGLE 2018: Four Giants Hold The Four Sectors of Internet MarketingDocument12 pagesCase 1-Amazon, Apple, Facebook, and GOOGLE 2018: Four Giants Hold The Four Sectors of Internet MarketingKARAN SEHGALNo ratings yet

- Case 1-Amazon, Apple, Facebook, and GOOGLE 2018: Four Giants Hold The Four Sectors of Internet MarketingDocument12 pagesCase 1-Amazon, Apple, Facebook, and GOOGLE 2018: Four Giants Hold The Four Sectors of Internet MarketingKARAN SEHGALNo ratings yet

- Case 1-Amazon, Apple, Facebook, and GOOGLE 2018: Four Giants Hold The Four Sectors of Internet MarketingDocument12 pagesCase 1-Amazon, Apple, Facebook, and GOOGLE 2018: Four Giants Hold The Four Sectors of Internet MarketingKARAN SEHGALNo ratings yet

- Analytical Hierarchy ProcessDocument22 pagesAnalytical Hierarchy ProcessKARAN SEHGALNo ratings yet

- Case 1-Amazon, Apple, Facebook, and GOOGLE 2018: Four Giants Hold The Four Sectors of Internet MarketingDocument12 pagesCase 1-Amazon, Apple, Facebook, and GOOGLE 2018: Four Giants Hold The Four Sectors of Internet MarketingKARAN SEHGALNo ratings yet

- Analytical Hierarchy ProcessDocument22 pagesAnalytical Hierarchy ProcessKARAN SEHGALNo ratings yet

- Spract 4Document24 pagesSpract 4Jennifer SmithNo ratings yet

- SBPM Testing in Bothkennar Clay Structure EffectsDocument8 pagesSBPM Testing in Bothkennar Clay Structure Effectssgaluf5No ratings yet

- 2017-2018 New CatalogueDocument218 pages2017-2018 New CataloguerobmndzNo ratings yet

- Cisco Virtual Update Cisco Sdwan ViptelaDocument55 pagesCisco Virtual Update Cisco Sdwan ViptelaSanjeev MoghaNo ratings yet

- Photo Studio: User's GuideDocument243 pagesPhoto Studio: User's GuideAfonso BuenoNo ratings yet

- Trabajo Fisica IDocument5 pagesTrabajo Fisica IMVAZ233No ratings yet

- Soil Organic Carbon: Relating The Walkley-Black Wet Oxidation Method To Loss On Ignition and Clay ContentDocument8 pagesSoil Organic Carbon: Relating The Walkley-Black Wet Oxidation Method To Loss On Ignition and Clay ContentAmin MojiriNo ratings yet

- Design Codes and StandardsDocument22 pagesDesign Codes and StandardsFederico.IoriNo ratings yet

- AntennasDocument5 pagesAntennasMiguel Ferrando Rocher100% (1)

- Digital Signal Processing Questions and Answers - Implementation of Discrete Time SystemsDocument193 pagesDigital Signal Processing Questions and Answers - Implementation of Discrete Time Systemsstark reddyNo ratings yet

- Astm D3776-07Document5 pagesAstm D3776-07matersci_ebay100% (1)

- EngineeringDocument8 pagesEngineeringkumarNo ratings yet

- T&D UK Hazardous Area Electrical Equipment DistributorDocument8 pagesT&D UK Hazardous Area Electrical Equipment DistributorJayadevDamodaranNo ratings yet

- D77003 enDocument57 pagesD77003 enzliangNo ratings yet

- Problems On Trigonometric Identities With SolutionsDocument7 pagesProblems On Trigonometric Identities With SolutionsLeonarda Bagtindon LicayanNo ratings yet

- Step by Step To Building A Computer LabDocument7 pagesStep by Step To Building A Computer LabRaiyan RahmanNo ratings yet

- DSM 510Document56 pagesDSM 510Eduardo Puma LlanoNo ratings yet

- Uncovering the secrets of Eduard Kruspe’s legendary ‘Prof. Weschke’ trombone modelDocument17 pagesUncovering the secrets of Eduard Kruspe’s legendary ‘Prof. Weschke’ trombone modelMa FarmNo ratings yet

- Optimization of Logistics and Warehouse Operations Using Operations Research TechniquesDocument10 pagesOptimization of Logistics and Warehouse Operations Using Operations Research Techniquessahil singhNo ratings yet

- CFM56Document5 pagesCFM56Anonymous wkL8YVBENo ratings yet

- Learn 2D AutoCAD Commands in 40 CharactersDocument10 pagesLearn 2D AutoCAD Commands in 40 CharactersAnne SotalboNo ratings yet

- Sample Question: Mathematics Sample Paper: Aviation ThrustDocument4 pagesSample Question: Mathematics Sample Paper: Aviation ThrustAisha SaNo ratings yet

- Topographic Map of Mount NeboDocument1 pageTopographic Map of Mount NeboHistoricalMapsNo ratings yet

- Analysis On Spatial Variation of Rainfall and Groundwater Fluctuation in Hebballa Watershed, Mysore District, Karnataka, IndiaDocument7 pagesAnalysis On Spatial Variation of Rainfall and Groundwater Fluctuation in Hebballa Watershed, Mysore District, Karnataka, IndiaEditor IJTSRDNo ratings yet

- Long QuizDocument2 pagesLong QuizDavid Mikael Nava TaclinoNo ratings yet

- Internal Architecture 8086Document3 pagesInternal Architecture 8086firoz83% (6)

- Energy Recovery From Landing AircraftDocument8 pagesEnergy Recovery From Landing AircraftRaniero FalzonNo ratings yet

- ASDFGHJKLDocument57 pagesASDFGHJKLIvancho BarreraNo ratings yet

- Cloud AnekaDocument49 pagesCloud Anekashreyasvidyarthi100% (1)