Professional Documents

Culture Documents

Merger and Acquisition Modelling Overview

Uploaded by

Manav RahejaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Merger and Acquisition Modelling Overview

Uploaded by

Manav RahejaCopyright:

Available Formats

Definition of Terms Used in Mergers and Overview

Merger and Acquisition Modelling Mar 5, 2021 1

Merger and Acquisition Background

• A few terms that will be used throughout the course.

• Mergers and Acquisitions are valuation and capital budgeting problems, but:

• The value of synergies and management strategy in M&A are difficult to

quantify with financial models

• Costs and benefits of a merger can be measured in various different

ways (DCF Valuation, Equity IRR, EPS changes, credit quality, NPV)

• Accounting, tax, and regulatory issues can be complex in modeling

(goodwill, tax step-ups, re-financing)

• Methods of quantifying the costs and benefits of M&A with financial model

• Merger or consolidation; performance of combined company in terms of

EPS and credit quality (as well as DCF of target company)

• Acquisition; model the rate of return earned assuming that the company

will be re-sold after a holding period and evaluate EPS effects (as well

as DCF of target company)

Merger and Acquisition Modelling Mar 5, 2021 2

Merger Terms

• Synergy

• Increase in revenue and/or decrease in expense and/or

decrease in capital expenditure that occurs because two

companies operate as one.

• Premium

• Increase in target share price from before the merger to after

the merger

• Dilution/Accretion

• Effect of merger or acquisition on earnings per share or

some other measure – accretion is increase from merger

and decrease is dilution.

Merger and Acquisition Modelling Mar 5, 2021 3

Premium

• .

Merger and Acquisition Modelling Mar 5, 2021 4

Example of Synergy Estimate

• .

Merger and Acquisition Modelling Mar 5, 2021 5

Negative Synergies and Costs to Achieve

Merger and Acquisition Modelling Mar 5, 2021 6

Synergy and Premium

NRG Price: $22/Share

264 million shares

NRG Market Cap:

$5,810 Million

Premium: $2.1 Billion

37% of $5,810 Million

After Tax Synergies

$1 bill - $1.8 billion

Less: Costs 360

Net Synergies

$720 – 1,440 million

Merger and Acquisition Modelling Mar 5, 2021 7

Example of Accretion/Dilution Analysis

Merger and Acquisition Modelling Mar 5, 2021 8

Earnings Analysis Should Include Constraint of Credit

Rating

• .

Merger and Acquisition Modelling Mar 5, 2021 9

Merger Terms

• Purchase Accounting

• Purchase accounting is normally used in M&A. Assets and

liabilities are measured at fair value rather than original cost

and the common equity of the company is eliminated.

Alternative method is pooling of interests.

• Goodwill

• Asset arising from purchase accounting that arises from the

difference between equity that was on the balance sheet and

equity that is paid for the company.

• Minority Interest

• The share of the company (assets and income) that is not

owned by shareholders of the corporation.

Merger and Acquisition Modelling Mar 5, 2021 10

Merger Terms

• Consideration:

• How the payment is made for the equity value of the target

company. This can be share exchange, cash, preferred stock,

option or other creative forms of financing.

• Uses and Sources of Funds in Acquisition

• Uses of funds include consideration and fees and may include

repayment of existing debt. Sources are debt, equity (public

offering or share exchange), surplus cash of target etc.

Sources can also include the sale of business units.

• Purchase Price Allocation:

• In an stock purchase, can elect to have the transaction treated

as an asset purchase implying a step-up in value

Merger and Acquisition Modelling Mar 5, 2021 11

Merger Terms – Example

Amount paid for the

equity of the target

What the equity

holders of the Includes debt of the

target receive target

Merger and Acquisition Modelling Mar 5, 2021 12

Example of Sources and Uses and Credit Constraints

Merger and Acquisition Modelling Mar 5, 2021 13

Merger Terms

• Exchange Ratio and Share Exchange

• The number of shares received for the new merged firm that will

be received for existing shares of the target. The starting point for

evaluation should be the relative share prices before the merger.

• Transaction Multiples

• Financial ratios such as the price to earnings ratio, the market to

book ratio and the enterprise value to EBITDA ratio that are

computed from the amount paid for other transactions.

Transaction multiples contrast with public company multiples.

• Transaction Value

• Enterprise value (equity value plus net debt (market value) plus the

transaction fees

Merger and Acquisition Modelling Mar 5, 2021 14

When the acquirer share

Floating Collar price increases, then the

exchange ratio declines

To evaluate the band in exchange ratio,

could adjust the sources and uses of

funds statement

When the acquirer share

price declines, the exchange

ratio increases

Merger and Acquisition Modelling Mar 5, 2021 15

Definitions of Success

• Accounting

• Earnings Accretion is Success

• Earnings Dilution is Failure

• Economics

• Net present value of free cash flow

• Net Present Value of Synergies > Premium is Success

• Net Present Value of Synergies <= Premium is Failure

• Finance

• Compute the Equity IRR with Exit Multiples over Holding Period

• Stock Price Increases Relative to Comparable Companies

Merger and Acquisition Modelling Mar 5, 2021 16

Alternative Methods of Analysis

• There are alternative methods for analysis of an acquisition, all of which

have advantages and disadvantages:

• Discounted Cash Flow

•Compute DCF of Target on Standalone Basis

•Add after-tax PV of Synergies

• Acquisition Model

•Compute Equity Cash Flow with Actual Financing Structure

•Evaluate Equity IRR and Variation in Equity IRR

• Integrated Merger Model

•Compute the Effect of Acquisition on EPS and Other Ratios

•Evaluate Credit Ratios and EPS Changes

Merger and Acquisition Modelling Mar 5, 2021 17

Alternative Valuation - DCF

Merger and Acquisition Modelling Mar 5, 2021 18

Use of Multiples in M&A Valuation

• .

Merger and Acquisition Modelling Mar 5, 2021 19

Evaluation of EV/EBITDA Ratio

• .

Merger and Acquisition Modelling Mar 5, 2021 20

Accretion Objective Mergers

Premium received by

target company and

added benefits if

continue interest in

the new company

EPS Accretion from

the perspective of

acquiring company

Merger and Acquisition Modelling Mar 5, 2021 21

Analysis in M&A

Merger and Acquisition Modelling Mar 5, 2021 22

Objectives of Model Overview Section

• Provide a general understanding of M&A models as background for

subsequent sections

•Read through actual models to gain general familiarity with

transaction

•Understand why and sheets and modules are added in models

•Find key components of common to M&A models

• How M&A models can be used to evaluate the benefits and costs of a

transaction with alternative structures.

•M&A Accounting

•M&A Financing

•M&A Synergies

•Target Valuation

•Model Assumptions

Merger and Acquisition Modelling Mar 5, 2021 23

Merger and Acquisition Accounting

Merger and Acquisition Modelling Mar 5, 2021 24

Accounting for Acquisitions (Majority Stake)

• Purchase Accounting

• Assets of acquired firm must be reported at fair market value

• Goodwill is created – difference between purchase price and

estimated fair market value of net assets

• Goodwill no longer has to be amortized – assets are

essentially marked-to-market annually and goodwill is

adjusted and treated as an expense if the market value of

the assets has decreased

• Pooling of interests

• Pooling accounting is meant to reflect situations in which

there is no ownership change, but the uniting of business

interests

Merger and Acquisition Modelling Mar 5, 2021 25

Accounting for Acquisitions (Alternative Stakes)

• Consolidation

•When the investor controls more than 50% of the voting shares

•Line by line consolidation of financial statements

•Eliminate inter-company transactions

•Minority interest

• Equity Method

•Investor holds between 20% and 50% of a company

•Investment stated at net asset value

•Dividends received treated as adjustment to investment

•Earnings recorded as percent of companies earnings

• Fair Value Method

•Investor holds less than 20%

•Dividends treated as income

Merger and Acquisition Modelling Mar 5, 2021 26

Purchase Accounting

• Cash and Accounts Receivable

•Generally valued at carrying values prior to the acquisition

• Marketable Securities

•Net realizable value

• Inventories

•Replacement cost; eliminate LIFO reserves

• Property plant and equipment

•Booked at fair market value

• Accounts payable and accrued expenses

•Carrying values prior to acquisition

• Debt

•Value at current interest rates

• Intangible Assets (Customer listes etc.)

Merger and Acquisition Modelling Mar 5, 2021 27

Treatment of Goodwill

• Goodwill -- The intangible assets of the acquired firm arising from the

acquiring firm paying more for them than their book value.

• Formerly, goodwill could not be amortized for more than 40 years for

“financial accounting purposes.” and goodwill charges are generally

deductible for “tax purposes” over 15 years.

• Now Goodwill is amortized only when determined that there has been a

permanent “impairment”

(Thus, firm has some discretion in when it is recognized as an expense)

• Impairment of goodwill is not tax deductible (for tax purposes, can still

amortize goodwill)

• Kitchen Sink Quarter: Digging through their vaults, dredging anything

that looked shaky, and writing it off – getting it over with.

Merger and Acquisition Modelling Mar 5, 2021 28

Steps in Goodwill Calculation to Compute Goodwill

• Step 1:

• Purchase Price of Equity less Book Value of Target

• Step 2:

• Add Transaction Cost (Like increase in the purchase price

that is capitalized)

• Step 3:

• Deduct asset write-ups (Like increase in the book value of

equity of the target)

• Step 4:

• Add liability write-ups (Like reduction in the book value of

equity of the target)

Merger and Acquisition Modelling Mar 5, 2021 29

Steps in Purchase Allocation and Write-Up

• Begin with Purchase Price – Enterprise Value

• Equity Consideration

• Plus: Existing Debt and Fees

• Less: Surplus Cash Used

• Subtract

• Existing Net working Capital (Other than surplus cash)

• Net Other Assets and Other Liabilities

• Existing Value of Fixed Assets

• Goodwill (Value as Zero)

• Equals

• Asset Write-up

Merger and Acquisition Modelling Mar 5, 2021 30

Goodwill and Purchase Price Allocation

• Goodwill • Purchase Price

• GW = Equity Purchase price – • Purchase price is the amount of

Book Value of Target + Fees the fixed assets plus the net

Allowed – Asset Write-ups + goodwill (analogous to the

Liability Write-ups enterprise value)

• Using Abbreviations • Using Abbreviations

• GW = EqPrice – BVeq + Fees – • PP = EqPrice + Debt + Fees =

Write-up Existing Assets + Write-up +

Goodwill + Net WC

• Or since BVeq = Existing Assets

– Debt + Net WC • GW = PP - Existing Assets -

Write-up - Net WC

• GW = EqPrice – Existing Assets

+ Ex Debt – Net WC - Write-up

Merger and Acquisition Modelling Mar 5, 2021 31

Transaction Fees–Summary

Merger and Acquisition Modelling Mar 5, 2021 32

Goodwill versus Intangible Assets – Tyco Example

• If intangible assets are created, then subsequent earnings are

affected. Consider the example of Tyco:

• By minimizing or marking down the value of intangible assets

and maximizing or marking-up, goodwill, Tyco can inflate its

earnings. The earnings lift comes because Tyco can treat

the goodwill differently from real assets, which under

accounting rules lose value over time.

• In addition, if Tyco sells the assets it has marked down at the

time of the acquisition, it can make a larger profit.

• Over the last three years, Tyco has spent about $30 billion

on acquisitions and created the same amount of goodwill.

Merger and Acquisition Modelling Mar 5, 2021 33

Goodwill Calculation Example

•Compute goodwill and goodwill amortization as a function of

purchase price of the target company.

Book value of equity plus net

asset write-ups

Separately add deferred taxes

and fees

Merger and Acquisition Modelling Mar 5, 2021 34

Example of Purchase Price Allocation

• This example shows how the balance sheet is reconciled with valuation of

assets at market values and use of goodwill.

Merger and Acquisition Modelling Mar 5, 2021 35

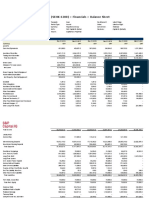

Begin with Consideration for the

Example of Purchase Price Allocation equity and then add the debt

assumed to derive purchase

price.

-in thousands TXOK Power Gas Winchester

Acquisition, Inc. Marketing & Energy

Transmission, Inc. Company, Ltd.

Purchase price:

Carrying value of initial investment in TXOK Acquisition, Inc. $ 21,531

Net

$

purchase

—

price is the

$ —

Acquisition of preferred stock, including accrued and unpaid dividends 158,750 consideration

— paid (including fees)

—

Value of preferred stock redemption premium 4,667 plus the net

— debt —

Cash payments for acquired equity — 63,615 1,095,028

Assumption of debt:

Term loan, plus accrued interest 202,755 — —

Revolving credit facility plus accrued interest 309,701 13,096 —

Assumption of derivative financial instruments — 38,098 —

Less cash acquired (32,261) (1,839) (118)

Net purchase price $ 665,143 $ 112,970 $ 1,094,910

Allocation of purchase price:

Oil and natural gas properties—proved $ 489,076 $ 122,972 $ 583,683

Oil and natural gas properties—unproved 60,840 Allocate

421 the purchase price

154,291 to

Gathering and other fixed assets 20,079 2,573 151,149

fixed assets and net working

Goodwill 64,887 21,249

capital. The remainder163,935

is

Current and non-current assets 37,460 2024 31,872

Deferred income taxes 26,783 goodwill

(31,424) —

Accounts payable and other accrued expenses (30,377) (3,318) (39,420)

Asset retirement obligations (8,203) (1,527) (7,793)

Fair value of oil and natural gas derivatives 4,598 — 57,193

Total purchase price allocation $ 665,143 $ 112,970 $ 1,094,910

Merger and Acquisition Modelling Mar 5, 2021 36

Bargain Purchase and Negative Goodwill

• Negative goodwill is allocated to reduce the pro-rata values

assigned to purchased assets excluding cash, financial assets,

accounts receivable, inventories and other assets held for sale.

• If all of the negative goodwill cannot be absorbed, then record

income.

Merger and Acquisition Modelling Mar 5, 2021 37

Restructuring Charges in Business Combinations

Restructuring charges

• Costs associated with the exit or disposal of activities.

• Fall into three main classes:

1. One-time benefits provided to employees being

involuntarily terminated.

2. Costs of terminating contracts.

3. Costs of moving employees or consolidating operations.

Merger and Acquisition Modelling Mar 5, 2021 38

Restructuring Charges in Business Combinations (continued)

If restructuring costs provide future benefits to the

combined company–

• They are not recognized as a liability on the transaction date.

• Instead, they are recognized as expenses in the future periods when

they are incurred.

• The fair value of target’s preexisting restructuring liabilities recognized by

the acquirer at the acquisition date and included as part of the target’s

total liabilities for the calculation of transaction goodwill.

Merger and Acquisition Modelling Mar 5, 2021 39

Introductory Case Exercise

Merger and Acquisition Modelling Mar 5, 2021 40

Case Exercise

• Given two standalone models

• Determine the combined ratios

• Assume two private companies

• Assume no synergies in initial case

• Use template model with titles

Merger and Acquisition Modelling Mar 5, 2021 41

Analysis with Consolidation Analysis

• Alternative synergies

• Alternative purchase prices

• Alternative debt and equity issues

• Alternative asset write-up and write-down policies

• Alternative dividend policy

Merger and Acquisition Modelling Mar 5, 2021 42

How M&A Models are Put Together

• An M&A Model Accepts

•Corporate models from both companies (with financial

statements)

•Purchase price for target company

•Financing of purchase

•Transaction costs and synergies

• M&A Model Outputs

•Financial performance of new company (EPS and financial

ratios)

•Credit quality of new company (credit quality ratios of new

company)

Merger and Acquisition Modelling Mar 5, 2021 43

Inputs, Outputs and Valuation in Standalone Corporate

Models

• Inputs to Derive Free Cash Flow

• Capital Expenditures

• Revenues

• Expenses

• Debtors and Creditors

• Tax Rates

• Plant Life

• Calculations are simple: Revenues – Expenses – Working Capital Movement, net of tax

• Inputs to Derive Net Cash Flow

• Debt to Capital

• Interest Rates

• Debt Repayment

• Dividends

• Net cash flow is: Operating Cash – Interest – Debt Repayment – Dividends

• The basic structure of corporate models are easy to understand without being a modelling

expert

• The balance sheet must balance – by far the most effective check on calculations

Merger and Acquisition Modelling Mar 5, 2021 44

Goodwill Calculation

• Goodwill is computed as the

amount paid for equity less the

equity book value.

• Goodwill is lowered from asset

write-ups (increases in book

value) and eliminations of

deferred tax (reductions in

liabilities).

• Goodwill is increased from asset

write-downs, deferred tax asset

elimination and transaction fees

that are effectively a reduction in

purchase price.

Merger and Acquisition Modelling Mar 5, 2021 45

Pro-forma Balance Sheet

• Purpose: establish the initial balance sheet for modeling. Existing book equity of

the target company should be eliminated. All of the other adjustments including

goodwill, debt and equity issues and retirements and asset write-ups are from

the sources and uses and the goodwill analysis.

Merger and Acquisition Modelling Mar 5, 2021 46

Reasons for Mergers and Acquisitions

Merger and Acquisition Modelling Mar 5, 2021 47

Basic Merger Points

• The market for corporate control is efficient

• Easy deals that add value are difficult to find

• Most successful deals are from highly disciplined deal making such

as General Electric

This implies that you

• Better deals come from: should compute the

ROIC and understand

• Believable and unique synergies differences

• Lower price premiums

• Smaller companies in related businesses (not diversification)

• ROIC and Related Industry

• Better run acquirers (higher ROI relative to the industry

average)

• Same Industry – asset base is similar so you would expect the

same ROIC

Merger and Acquisition Modelling Mar 5, 2021 48

Example of Merger Analysis -- J.P. Morgan

• The elements of J.P. Morgan's analyses included:

• Assessing the potential value creation as a result of the

merger;

• Assessing the sharing of the combined pro forma entity

given the historical and forecast contributions of each

company, and the sharing of the potential value creation;

• Testing the results on pro-forma Exxon earnings per

share for the potential accretion/dilution of earnings for the

next 3 years; and,

• Checking the premium to be paid by Exxon in the merger

against market precedent.

Merger and Acquisition Modelling Mar 5, 2021 49

Successful M&A

• Characteristics of successful M&A transactions:

• Focus on quickly improving operating performance (revenue

synergies are difficult to achieve; cost synergies are more

believable)

• Extract investment within five years

• Created incentives for top management

• Concentrate on cash flow rather than earnings

• Personal wealth involved in the deal

• Value investing (low P/E) rather than glamour investing (high

multiples)

• Paying with cash has had more success than issuing shares

through share exchange

• M&A as a way to use excess cash has not been successful

Merger and Acquisition Modelling Mar 5, 2021 50

Studies of Merger Benefits

• Value to target is significant

• Value to buyer is subject to debate

• General conclusion of many studies is that economic profit is

about zero, with high variance.

• Problems with studies

•Event studies

•Surveys

•Return on Investment

• George Stigler: Rational people don’t do stupid things repeatedly.

This disputes the notion that M&A continually destroys value.

Merger and Acquisition Modelling Mar 5, 2021 51

Merger Failures

• Here are my top 10 most common, preventable merger failure modes.

One is enough to spell doom, but the more the merrier the train wreck:

• 1. Flawed corporate strategy for either or both companies

2. One company sugarcoats the truth, the other buys a PowerPoint pitch

3. Sub-optimum integration strategy for the situation

4. Cultural misfit, loss of key employees after retention agreements are up

5. Acquiring company's management team inexperienced at M&A

6. Flawed assumptions in synergies calculation

7. Ineffective corporate governance, plain and simple

8. Two desperate companies merge to form one big desperate company

9. CEO of one or both companies sells board and shareholders a bill of

goods

10. An impulse buy or panic sell gets shoved down the board's throat

Merger and Acquisition Modelling Mar 5, 2021 52

Theoretical Reasons for Mergers and Acquisitions

• Theoretical explanations for M&A activity outcomes:

• Synergy theory – expects that there is really “something out

there” which enables the merged entity to create shareholders

value

• Managerialism theory – claims that these combinations are

driven by empire building not by shareholders wealth objective

• Managerial hubris – managers make unconscious mistakes

being overconfident about transportability of their

successfulness

• Comparable acquisitions – legal issue; shareholders of target

are protected by the law, while acquirer’s shareholders are not

Merger and Acquisition Modelling Mar 5, 2021 53

Strategic Reasons for Mergers and Acquisitions

• Increased market power

• Capitalizing on core competencies

• Overcome entry barriers

• Bypass cost of new product development:

• Increased speed to market

• Increased diversification

• Avoiding excessive competition

Merger and Acquisition Modelling Mar 5, 2021 54

Reasons for Acquisitions Continued

• Increased Market Power

• Acquisition intended to reduce the competitive balance of the

industry

•Example: British Petroleum’s acquisition of U.S. Amoco

•Sportmart and SportsAuthority

• Overcome Barriers to Entry

• Acquisitions overcome costly barriers to entry which may make

“start-ups” economically unattractive

•Example: Belgian-Dutch Fortis’ acquisition of American Banker’s

Insurance Group

• Lower Cost and Risk of New Product Development

• Buying established businesses reduces risk of start-up ventures

•Example: Watson Pharmaceuticals’ acquisition of TheraTech

Merger and Acquisition Modelling Mar 5, 2021 55

Questionable Reasons for Acquisitions

• Diversification

• Investors can diversify for themselves at lower cost and

more efficiently through capital markets

• Stockholder wealth may actually decrease after the merger

because the reduction in risk in effect transfers wealth from

the stockholders to the bondholders

• Securing access to inputs or sales of outputs

• This may be valid, but presumes there are inefficient or

uncompetitive markets

• Creating the appearance of growth

• Increased EPS

Merger and Acquisition Modelling Mar 5, 2021 56

Reasons for Problems in

Acquisitions Achieving Success

Increased Integration

market power difficulties

Overcome Inadequate

entry barriers evaluation of target

Cost of new Large or

product development extraordinary debt

Increased speed Inability to

to market achieve synergy

Lower risk

compared to developing Too much

new products diversification

Increased Managers overly

diversification focused on acquisitions

Avoid excessive

competition Too large

Merger and Acquisition Modelling Mar 5, 2021 57

M&A Intermediaries

• Business brokers

• Accountants

• Lawyers

• Consultants

• Business valuation firms

• Commercial banks

• Investment banks

Merger and Acquisition Modelling Mar 5, 2021 58

Reason for Acquisition Activity: Investment Banker and Legal

Fees in Mergers

• Exxon Mobil

• We estimate that merger-related fees and expenses, consisting

primarily of SEC filing fees, fees and expenses of investment

bankers, attorneys and accountants, and financial printing and other

related charges, will be approximately $90 million. We estimate that

costs of approximately $2.0 billion will be incurred for severance and

other integration-related expenses, including the elimination of

duplicate facilities and excess capacity, operational realignment and

related workforce reductions.

• Chevron Texaco

• We estimate that merger-related fees and expenses, consisting

primarily of SEC filing fees, fees and expenses of investment

bankers, attorneys and accountants, and financial printing and other

related charges, will total approximately $150 million.

Merger and Acquisition Modelling Mar 5, 2021 59

Example of Merger Financial and Economic Objectives

Each objective

should be

quantified with

a financial

model

Merger and Acquisition Modelling Mar 5, 2021 60

General Themes of Course

Merger and Acquisition Modelling Mar 5, 2021 61

Value In M&A Comes from Economic Profit

• An investor can invest in risk free securities and earn the risk free

rate of interest. If a strategy is to be effective, you must make

profit over and above opportunity cost -- you must make economic

profit and be able to grow the profit. If you are in a very

competitive industry and a price taker, you can earn economic

profit through cost efficiency. In a less competitive industry, you

can try to differentiate your product, and keep up barriers to entry.

• The P/E and other valuation ratios are driven by the rate of

return earned above the cost of capital and the ability to grow

real profits (valuation from ROIC and growth);

• Net present value is computed as the value of cash flow

relative to the opportunity cost of capital;

• The return on invested capital should be gauged against the

weighted average cost of capital.

Merger and Acquisition Modelling Mar 5, 2021 62

Valuation is Very Important, But You are Fooling Yourself if

You Think it is Precise

• Valuation may be the most important skill for a business professional and

there are a number of different techniques that can be used to measure

value ranging from discounted free cash flow to earnings multiples to

discounted earnings. However:

• None of the valuation methods gives you a precise value number

from a practical perspective and none of the approaches is perfect

from a theoretical perspective.

• You can come up with vastly different valuations if you apply

different discount rates or different terminal value methods.

• You should acknowledge that there is a range in values and

evaluate the downside risk and upside potential in value with

different assumptions.

• If you use DCF, measure risk directly through scenario, sensitivity and

break-even analysis rather than focusing on the discount rate in the base

case.

Merger and Acquisition Modelling Mar 5, 2021 63

Assess Costs and Benefits of M&A with Financial

Models

• Because of the difficulty in valuation, it is often more effective to

assess strategies through measuring the effect of the strategy on

financial measures such as earnings per share, return on invested

capital and other financial ratios rather than attempting to gauge

the value impacts.

• Measure the earnings per share and credit quality before

and after the merger using similar economic assumptions

for the target and the acquirer;

• Measure the effects of different purchase price premiums

financing strategies, share price dilution, purchase price and

transactions costs;

• Measure the impact of the financing constraints through

evaluating prospective credit ratings and debt capacity.

Merger and Acquisition Modelling Mar 5, 2021 64

Relevance of Free Cash Flow

• In theory, value comes from free cash flow that is independent of

the financing of the firm. Equity and debt are the claims on that

free cash flow. Even if the theory is not completely practical for

valuation, it does have a number of relevance in M&A;

• Debt capacity in a leveraged buyout comes from the level

and the volatility in free cash flow

• Valuation of synergies and strategies from free cash flow

using the WACC;

• Creation of structured debt issues from a free cash flow;

• Use of free cash flow to determine debt capacity in LBO.

Merger and Acquisition Modelling Mar 5, 2021 65

Corporate Model Functions in M&A

• The corporate model serves many functions in an M&A

transaction:

• The model is the data collection point – for example if an

item from due diligence is important in the transaction it

should be included in the corporate model.

• The corporate model provided in the offering memo can be

the basis of negotiation.

• The corporate model is used to make presentations to

creditors in raising debt for the transaction.

Merger and Acquisition Modelling Mar 5, 2021 66

To be Most Effective in Negotiating M&A Transactions, You

Need to Understand Value

• To develop strategies that result in outcomes and compromises

that are perceived as being advantageous to both parties, you

need to understand the perspective of the other party in the

negotiation. Specifically, you need to understand how the other

side perceives value. What is the valuation method used, what

assumptions does the other side make, what item of value is

most important.

• Contract negotiation, M&A, financing fees.

• Develop financial projections for the other side, compute

IRR for the other side.

• Know the value of financial instruments from different

perspectives

Merger and Acquisition Modelling Mar 5, 2021 67

Reference Slides

Merger and Acquisition Modelling Mar 5, 2021 68

Transaction Type – Stocks versus Assets

• Type of transaction depends on tax considerations, legal

requirements, and the ability to attain shareholder approval.

• In reality virtually all transactions are acquisitions by one

company, even though some are called mergers after the fact.

• Leveraged transactions are similar to other transactions except

that a high level of debt is used to finance the transaction:

• High level of debt makes the transaction more complex with

covenants, cash flow waterfalls and other restrictions.

Merger and Acquisition Modelling Mar 5, 2021 69

Stock Offer

• Fixed exchange ratio.

• # of acquirer shares to be exchanged for each target share is set at

the time of the offer.

• Floating exchange ratio.

• Value to be paid is agreed upon at the time of offer, ratio floats until

closing.

• Collar.

• Upper and lower limits on shares to be offered (floating).

• Upper and lower limits on price to be paid (fixed).

• Walk-away.

• Target can walk from fixed if acquirer’s stock falls too low.

• Acquirer can walk from floating if it’s stock falls too low.

Merger and Acquisition Modelling Mar 5, 2021 70

M&A Terms - Merger

• Merger

• Definition: A transaction where the purchasing company

buys all of the assets and assumes all the liabilities of the

target company. Both prior companies cease to exist and the

new company combines both.

• Modeling: Model mergers with exchange ratios and/or with

integrated model.

• Approval: 50% or more of the shareholders of each firm.

• Tax: No write-up of assets; no taxable gain for target

shareholders, surviving firm can use net operating loss. In

the old days, the accounting would use pooling of interests.

• Other: Assume contracts, no minority shareholders remain

Merger and Acquisition Modelling Mar 5, 2021 71

Merger Terms – Acquisition -- Purchase of Stock

• Stock Purchase Acquisition – The distinction is more important for

legal and tax purposes

• Definition: A transaction where one firm buys all or the majority of

the stock of another (target) company.

• Tax: Avoids tax for the target on a corporate basis (it is as if targets

company just changed shareholders).

•Cannot write-up or step-up assets for tax purposes.

•Can use the NOL

• Acquirer is main shareholder; can have minority interest

• Contracts remain in place, accept undisclosed liabilities

• Modeling: Model acquisitions with capital expenditure addition to

corporate model along with an equity issue.

Merger and Acquisition Modelling Mar 5, 2021 72

Merger Terms – Acquisition -- Asset Purchase

• Asset Purchase Acquisition

• Financing: Generally cash transactions

• Approval: Sale of division does not require approval; sale of 50% or

more of assets usually requires approval

• Taxes: Treated as an asset sale for tax purposes

• Target company is subject to taxes at the corporate level; buyer can step-

up and amortize goodwill for taxes

• Taxes paid by the target company and personal taxes on capital gains

result in double taxation

–Amortize goodwill over 15 years for tax

–Not allowed to use NOL of target

• May avoid some contractual liabilities if only purchase the assets

Merger and Acquisition Modelling Mar 5, 2021 73

M&A Objectives

• …acquisitions that complement existing products and services, enhance

the Company's product lines and/or expand its customer base. The

Company begins formulating exit plans as part of the acquisition

approval process. The company determines what it is willing to pay for

an acquisition, partially based on its expectation that it can cost effectively

integrate the products and services of an acquired company into Tyco's

existing infrastructure and improve earnings by removing costs in areas

where there are duplicate sales, administrative or other facilities and

functions. In addition, the Company utilizes existing infrastructure (e.g.,

established sales force, distribution channels, customer relations, etc.) of

acquired companies to cost effectively introduce products to new

geographic areas. The Company also targets companies that are

perceived to be experiencing depressed financial performance. All of

these factors contribute to acquisition prices in excess of the fair value of

identifiable net assets acquired and the resultant goodwill.

Merger and Acquisition Modelling Mar 5, 2021 74

Example of Goodwill and Purchase Price Allocation

• Actual Example of

Goodwill and Fair

Value adjustments –

note the asset and

liability categories that

had the largest impact

Merger and Acquisition Modelling Mar 5, 2021 75

Other Terms

• Pre-emptive Bid

• Target destroys the credibility of the offeror before making a

bid

• Bear Hug

• Target makes bid for Offereor before Offeror makes bid for

target

• Pac Man

• Target makes bid for Offeror after Offeror makes bid for

target

Merger and Acquisition Modelling Mar 5, 2021 76

Types of Mergers

• From Perspective of Buyers

• Horizontal

• Vertical – upstream or downstream

• Conglomerate/Diversification

• Financial

• Private versus Public

• Public – fixed pricing, many rules, high documentation

Merger and Acquisition Modelling Mar 5, 2021 77

Terms

• Perfuming the pig

• Stuffing the distribution channels

• Over-optimistic projections

• Disguising head count

• Treating recurring costs and one-off

• Under-funding capital expenditures and SG&A

• Due Diligence

• Buyer conducts an investigation of the business

•Can result in calling off a deal

•Can result in adjustments to price

• Also employed by banks in IPO

Merger and Acquisition Modelling Mar 5, 2021 78

Earnings Exchange Analysis

Merger and Acquisition Modelling Mar 5, 2021 79

EV/EBITDA Adjsutments

Merger and Acquisition Modelling Mar 5, 2021 80

• .

Merger and Acquisition Modelling Mar 5, 2021 81

Synergy Questions

• .

Merger and Acquisition Modelling Mar 5, 2021 82

You might also like

- D. Co Increases, But Cu Decreases. Solution: As Cost of The Product Increases, The Lost Margin (Cu) Decreases. at TheDocument5 pagesD. Co Increases, But Cu Decreases. Solution: As Cost of The Product Increases, The Lost Margin (Cu) Decreases. at TheAbhishek BatraNo ratings yet

- Mid MonthDocument4 pagesMid Monthcipollini50% (2)

- Social Impact Bond CaseDocument21 pagesSocial Impact Bond CaseTest123No ratings yet

- UCCM2233 - Chp6.1 Estimation and Hypothesis Testing - Answer WbleDocument35 pagesUCCM2233 - Chp6.1 Estimation and Hypothesis Testing - Answer WbleVS ShirleyNo ratings yet

- Corporate Debt Value, Bond Covenants, and Optimal Capital Structure ModelDocument36 pagesCorporate Debt Value, Bond Covenants, and Optimal Capital Structure Modelpedda60100% (1)

- Case Study BDODocument2 pagesCase Study BDOSaumya GoelNo ratings yet

- Debt management ratios analysisDocument4 pagesDebt management ratios analysisJohn MuemaNo ratings yet

- VALUATION OF BONDS, STOCKS AND PREFERENCE SHARESDocument32 pagesVALUATION OF BONDS, STOCKS AND PREFERENCE SHARESSangram Jagtap100% (1)

- Discounted Cash Flow (DCF) Definition - InvestopediaDocument2 pagesDiscounted Cash Flow (DCF) Definition - Investopedianaviprasadthebond9532No ratings yet

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- Mergers, LBOs, Divestitures, and Business FailureDocument65 pagesMergers, LBOs, Divestitures, and Business FailureArieAnggono100% (1)

- FX Risk Management Transaction Exposure: Slide 1Document55 pagesFX Risk Management Transaction Exposure: Slide 1prakashputtuNo ratings yet

- Discounted Cash Flow Valuation The Inputs: K.ViswanathanDocument47 pagesDiscounted Cash Flow Valuation The Inputs: K.ViswanathanHardik VibhakarNo ratings yet

- Operating ExposureDocument31 pagesOperating ExposureMai LiênNo ratings yet

- Limitations of Ratio AnalysisDocument9 pagesLimitations of Ratio AnalysisThomasaquinos Gerald Msigala Jr.No ratings yet

- Bega Cheese FY19-20 Financial Analysis: 11% EBITDA Growth & 384% PAT RiseDocument8 pagesBega Cheese FY19-20 Financial Analysis: 11% EBITDA Growth & 384% PAT RiseHaroon KhanNo ratings yet

- Free Cash Flow Valuation: Wacc FCFF VDocument6 pagesFree Cash Flow Valuation: Wacc FCFF VRam IyerNo ratings yet

- Investment Banking ExcelDocument28 pagesInvestment Banking ExcelJohn ChiwaiNo ratings yet

- Controller vs CFO: Which Role is Right for Your BusinessDocument6 pagesController vs CFO: Which Role is Right for Your BusinessJuan LamasNo ratings yet

- CHP 1 - Introduction To Merchant BankingDocument44 pagesCHP 1 - Introduction To Merchant BankingFalguni MathewsNo ratings yet

- Sample Deal Discussions: Sell-Side Divestiture Discussion & AnalysisDocument11 pagesSample Deal Discussions: Sell-Side Divestiture Discussion & AnalysisAnonymous 45z6m4eE7pNo ratings yet

- Bank Risk Management Is Used Mostly in The FinancialDocument9 pagesBank Risk Management Is Used Mostly in The FinancialYash PratapNo ratings yet

- Captive Shared Service Centers For S&L Industry PDFDocument8 pagesCaptive Shared Service Centers For S&L Industry PDFsongaonkarsNo ratings yet

- Limited Risk Models - Sept 4 2013Document40 pagesLimited Risk Models - Sept 4 2013sriramrangaNo ratings yet

- Hiring Manager Satisfaction Survey PDFDocument2 pagesHiring Manager Satisfaction Survey PDFSara LoneNo ratings yet

- Cap Budeting FinanaceDocument11 pagesCap Budeting FinanaceShah ZazaiNo ratings yet

- International Finance Exam SolutionsDocument171 pagesInternational Finance Exam SolutionsCijaraNo ratings yet

- Long-Term Financial Planning and Growth StrategiesDocument26 pagesLong-Term Financial Planning and Growth StrategiespushmbaNo ratings yet

- Functions of Treasury MGTDocument5 pagesFunctions of Treasury MGTk-911No ratings yet

- Brealey. Myers. Allen Chapter 32 SolutionDocument5 pagesBrealey. Myers. Allen Chapter 32 SolutionHassanSheikhNo ratings yet

- CFIB: Building A Succession PlanDocument56 pagesCFIB: Building A Succession PlanEquicapita Income TrustNo ratings yet

- Human Resources and CultureDocument27 pagesHuman Resources and Cultureashwani2084No ratings yet

- Chapter 23 Sojan & SreehariDocument19 pagesChapter 23 Sojan & SreehariSojanuNo ratings yet

- How to structure investments to protect downsideDocument6 pagesHow to structure investments to protect downsidehelloNo ratings yet

- M&a Private FirmsDocument24 pagesM&a Private FirmsmarwanNo ratings yet

- Parrino 2e PowerPoint Review Ch04Document34 pagesParrino 2e PowerPoint Review Ch04Khadija AlkebsiNo ratings yet

- Variable Interest 2013Document246 pagesVariable Interest 2013gligorjan100% (1)

- Capital Budgeting - 01Document23 pagesCapital Budgeting - 01ru4angelNo ratings yet

- Calculating Incremental ROIC's: Corner of Berkshire & Fairfax - NYC Meetup October 14, 2017Document19 pagesCalculating Incremental ROIC's: Corner of Berkshire & Fairfax - NYC Meetup October 14, 2017Anil GowdaNo ratings yet

- Greek Fiscal Crisis: Is A First World Debt Crisis in The Making?Document32 pagesGreek Fiscal Crisis: Is A First World Debt Crisis in The Making?Babasab Patil (Karrisatte)No ratings yet

- Global Strategy Context Chapter 10Document17 pagesGlobal Strategy Context Chapter 10Lloyd M. StallingsNo ratings yet

- Rose Mwaniki CVDocument10 pagesRose Mwaniki CVHamid RazaNo ratings yet

- PPT3-Measuring and Evaluating Financial PerformanceDocument70 pagesPPT3-Measuring and Evaluating Financial PerformanceAbdul AzizNo ratings yet

- Exchange Rate Risk Assessment and Internal Techniques ofDocument19 pagesExchange Rate Risk Assessment and Internal Techniques ofSoumendra RoyNo ratings yet

- CFO VP Finance Controller in Austin TX USA Resume Penny LozanoDocument3 pagesCFO VP Finance Controller in Austin TX USA Resume Penny LozanoPennyLozanoNo ratings yet

- Measuring Value for M&ADocument18 pagesMeasuring Value for M&Arishit_93No ratings yet

- Financial Statement Analysis (Fsa)Document32 pagesFinancial Statement Analysis (Fsa)Shashank100% (1)

- RWJ Chapter 1 Introduction To Corporate FinanceDocument21 pagesRWJ Chapter 1 Introduction To Corporate FinanceAshekin Mahadi100% (1)

- Week 2 Managerial FinanceDocument64 pagesWeek 2 Managerial FinanceCalista Elvina JesslynNo ratings yet

- Spotting Earning ManagementDocument14 pagesSpotting Earning ManagementTri SutrisnoNo ratings yet

- Nestle Strategic Plan Final Project 4M1 Group. (Major - Marekting)Document50 pagesNestle Strategic Plan Final Project 4M1 Group. (Major - Marekting)mohaNo ratings yet

- Two Stage Dividend Growth ModelDocument11 pagesTwo Stage Dividend Growth ModelmichaelwainsteinNo ratings yet

- Welcome To Our Presentation: Your Date HereDocument16 pagesWelcome To Our Presentation: Your Date HereMD ShahriarNo ratings yet

- Company Analysis and ValuationDocument13 pagesCompany Analysis and ValuationAsif Abdullah KhanNo ratings yet

- 108 04 Merger Model AC Case Study AfterDocument2 pages108 04 Merger Model AC Case Study AfterPortgas H. NguyenNo ratings yet

- Macroeconomics EssayDocument7 pagesMacroeconomics EssayAchim EduardNo ratings yet

- Beyond Meat valuation reportDocument73 pagesBeyond Meat valuation reportKathir K100% (1)

- Risk WorkshopDocument28 pagesRisk WorkshopShravan MentaNo ratings yet

- Forecasting of Financial StatementsDocument9 pagesForecasting of Financial StatementssamaanNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- The Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondFrom EverandThe Financial Advisor M&A Guidebook: Best Practices, Tools, and Resources for Technology Integration and BeyondNo ratings yet

- Sales Closing Techniques ExplainedDocument2 pagesSales Closing Techniques ExplainedManav RahejaNo ratings yet

- GAPs Model in RetailDocument1 pageGAPs Model in RetailManav RahejaNo ratings yet

- Auditing Project Guidelines.Document2 pagesAuditing Project Guidelines.Manav RahejaNo ratings yet

- Sales Closing Techniques ExplainedDocument2 pagesSales Closing Techniques ExplainedManav RahejaNo ratings yet

- WCM Project GuidelinesDocument2 pagesWCM Project GuidelinesManav RahejaNo ratings yet

- In Fs Indian Accounting Standards Scheduled Commercial Banks 2016 NoexpDocument4 pagesIn Fs Indian Accounting Standards Scheduled Commercial Banks 2016 NoexpManav RahejaNo ratings yet

- Table Program - 2020Document4 pagesTable Program - 2020Manav RahejaNo ratings yet

- Table Program - 2020Document4 pagesTable Program - 2020Manav RahejaNo ratings yet

- Excel 102 ExercisesDocument87 pagesExcel 102 Exercisesaashi98No ratings yet

- Page 1 Delete LaterDocument1 pagePage 1 Delete LaterManav RahejaNo ratings yet

- Symbiosis Centre For Management Studies, Pune: Induction For The Batch 2020-23Document5 pagesSymbiosis Centre For Management Studies, Pune: Induction For The Batch 2020-23Manav RahejaNo ratings yet

- Symbiosis Centre For Management Studies, Pune: Induction For The Batch 2020-23Document5 pagesSymbiosis Centre For Management Studies, Pune: Induction For The Batch 2020-23Manav RahejaNo ratings yet

- Introduction To BLDocument2 pagesIntroduction To BLManav RahejaNo ratings yet

- Social Sciences: Quality Culture of Manufacturing Enterprises: A Possible Way To Adaptation To Industry 4.0Document25 pagesSocial Sciences: Quality Culture of Manufacturing Enterprises: A Possible Way To Adaptation To Industry 4.0Manav RahejaNo ratings yet

- PLACEMENT CELL REPORT (June - October)Document1 pagePLACEMENT CELL REPORT (June - October)Manav RahejaNo ratings yet

- Us Covid 19 World Remade Higher Education PDFDocument20 pagesUs Covid 19 World Remade Higher Education PDFAna CarlaNo ratings yet

- Legal MaximDocument5 pagesLegal MaximManav RahejaNo ratings yet

- Introduction To BLDocument2 pagesIntroduction To BLManav RahejaNo ratings yet

- Introduction To Legal SystemDocument5 pagesIntroduction To Legal SystemManav RahejaNo ratings yet

- Meaning of Law and Justice: Introduction to Legal Systems & ConceptsDocument24 pagesMeaning of Law and Justice: Introduction to Legal Systems & ConceptsManav RahejaNo ratings yet

- Hot Topic Coronavirus Coso Icfr FRMWKDocument7 pagesHot Topic Coronavirus Coso Icfr FRMWKManav RahejaNo ratings yet

- Agricultural Bank of China Limited (1288) Balance Sheet OverviewDocument3 pagesAgricultural Bank of China Limited (1288) Balance Sheet OverviewJaime Vara De ReyNo ratings yet

- FM-Chapter OneDocument150 pagesFM-Chapter Onesamuel kebedeNo ratings yet

- AP 59 FinPB - 5.06Document8 pagesAP 59 FinPB - 5.06Anonymous Lih1laaxNo ratings yet

- Stockholders' Equity: Paid-In Capital: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking CasesDocument46 pagesStockholders' Equity: Paid-In Capital: Overview of Brief Exercises, Exercises, Problems, and Critical Thinking CasesRosenna99No ratings yet

- Chapter 7Document49 pagesChapter 7Dr. Menna KadryNo ratings yet

- Financial Statement Analysis Lecture v2Document8 pagesFinancial Statement Analysis Lecture v2Yaj CruzadaNo ratings yet

- Financial Plan For MyMuesli (Only Market Research)Document14 pagesFinancial Plan For MyMuesli (Only Market Research)mevasaNo ratings yet

- VOYA JPM InitiationDocument42 pagesVOYA JPM InitiationEnterprisingInvestorNo ratings yet

- Reviewer On Partnership AccountingDocument27 pagesReviewer On Partnership AccountingannegelieNo ratings yet

- Depreciation and Amortization QuestionsDocument43 pagesDepreciation and Amortization QuestionsSittie Ainna Acmed UnteNo ratings yet

- Cambridge International Examinations General Certificate of Education Advanced Level Accounting Paper 3 Multiple Choice May/June 2003 1 HourDocument12 pagesCambridge International Examinations General Certificate of Education Advanced Level Accounting Paper 3 Multiple Choice May/June 2003 1 HourRoukaiya PeerkhanNo ratings yet

- ParCor 2019 Chapter 4Document8 pagesParCor 2019 Chapter 4Layla MainNo ratings yet

- Comparing Depreciation at Delta Air Lines and Singapore AirlinesDocument110 pagesComparing Depreciation at Delta Air Lines and Singapore AirlinesSiratullah ShahNo ratings yet

- CompilationDocument10 pagesCompilationZandrea LopezNo ratings yet

- Pequity Company Purchased 85 of The Common Stock of SequityDocument1 pagePequity Company Purchased 85 of The Common Stock of SequityMuhammad ShahidNo ratings yet

- Since 1977: Corporate Liquidation EstimatesDocument7 pagesSince 1977: Corporate Liquidation EstimatesFernando III PerezNo ratings yet

- ACC 1701X Mock Exam #1 SolutionDocument13 pagesACC 1701X Mock Exam #1 SolutionShaunny BravoNo ratings yet

- Business Combination NotesDocument3 pagesBusiness Combination NotesKenneth Calzado67% (3)

- CH 9 in Class ProblemsDocument2 pagesCH 9 in Class ProblemsAbdullah alhamaadNo ratings yet

- Ambuja & ACC Final RatiosDocument23 pagesAmbuja & ACC Final RatiosAjay KudavNo ratings yet

- AFAR02 Accounting For Business CombinationsDocument17 pagesAFAR02 Accounting For Business CombinationsJefferson ArayNo ratings yet

- Total P 1,200,000: Refer PDF Problem 1Document2 pagesTotal P 1,200,000: Refer PDF Problem 1Joanna Rose DeciarNo ratings yet

- Common Stock and Investment Banking ProcessDocument26 pagesCommon Stock and Investment Banking ProcessRamji BhandariNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8Th Edition Wahlen Solutions Manual Full Chapter PDFDocument53 pagesFinancial Reporting Financial Statement Analysis and Valuation 8Th Edition Wahlen Solutions Manual Full Chapter PDFanthelioncingulumgvxq100% (9)

- C o n p a s2 0 2 2 A c c o u n t a n c y S e t Q u e s t i o n P a p e rDocument10 pagesC o n p a s2 0 2 2 A c c o u n t a n c y S e t Q u e s t i o n P a p e rJabez JeenaNo ratings yet

- Capital Investment Decisions: Prof. Liu Bin (Ph. D) Dalian Maritime UniversityDocument48 pagesCapital Investment Decisions: Prof. Liu Bin (Ph. D) Dalian Maritime UniversitymarkkenNo ratings yet

- Accounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsDocument14 pagesAccounting 423 Professor Kang: Practice Problems For Chapter 2 Consolidation of Financial StatementsJoel Christian MascariñaNo ratings yet

- ACCELE2Document8 pagesACCELE2Karylle AnneNo ratings yet

- HW 12aDocument6 pagesHW 12aBAurNo ratings yet