Professional Documents

Culture Documents

Audit Receivables and Sales

Uploaded by

Joris Yap0 ratings0% found this document useful (0 votes)

68 views10 pagesThe document discusses substantive audit procedures for receivables and sales. It outlines the audit objectives to assess existence, completeness, cut-off, valuation, accuracy, rights and obligations, and presentation and disclosure. Key procedures listed include reconciling subsidiary ledgers to general ledgers, confirming receivables and reviewing cash receipts, analyzing notes receivable, evaluating allowance accounts, and performing cutoff tests. Considerations for confirmation requests are also provided.

Original Description:

Original Title

Substantive_Test_of_Receivables

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses substantive audit procedures for receivables and sales. It outlines the audit objectives to assess existence, completeness, cut-off, valuation, accuracy, rights and obligations, and presentation and disclosure. Key procedures listed include reconciling subsidiary ledgers to general ledgers, confirming receivables and reviewing cash receipts, analyzing notes receivable, evaluating allowance accounts, and performing cutoff tests. Considerations for confirmation requests are also provided.

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

68 views10 pagesAudit Receivables and Sales

Uploaded by

Joris YapThe document discusses substantive audit procedures for receivables and sales. It outlines the audit objectives to assess existence, completeness, cut-off, valuation, accuracy, rights and obligations, and presentation and disclosure. Key procedures listed include reconciling subsidiary ledgers to general ledgers, confirming receivables and reviewing cash receipts, analyzing notes receivable, evaluating allowance accounts, and performing cutoff tests. Considerations for confirmation requests are also provided.

Copyright:

© All Rights Reserved

You are on page 1of 10

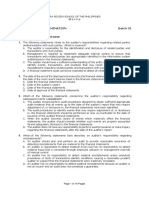

Substantive Test

Receivables and Sales

Learning Objectives

• Identify the audit objectives for receivables, sales and related

accounts.

• Describe the primary substantive audit procedures for

receivables, sales and related accounts.

• Identify assertions addressed by audit procedures for

receivables, sales and related accounts.

Introduction

• The audit of receivables and revenue represents significant

audit risk because:

a) Many incidences of financial statement fraud have involved

the overstatement of receivables and revenue;

b) Revenue recognition may be based on complex accounting

rules; and

c) Receivables and revenue are usually subject to valuation

using significant accounting estimates.

Assertions and Audit Objectives

• Existence or Occurrence – All receivables on the statement of

financial position are authentic claims of the entity and all sales have

really occurred and pertain to the entity.

• Completeness – All authentic claims of the entity for amounts

receivable are included on the statement of financial position and all

sales have been included in the statement of comprehensive income.

Assertions and Audit Objectives

• Cut-off – Sales have been recorded in the proper accounting period.

• Valuation and Allocation – Receivables are carried at their net

realizable (collectible) value.

• Accuracy – Sales have been accurately recorded in the statement of

comprehensive income.

Assertions and Audit Objectives

• Rights and Obligations – The entity owns, or has a legal right to all

the receivables on the statement of financial position at the reporting

date.

• Presentation & Disclosure and Classification – Receivables and sales

are properly classified, described, and disclosed in the financial

statements, including notes, in accordance with PFRS.

• Pledged, discounted, or assigned accounts receivable are properly disclosed.

Related party receivables and sales are properly disclosed.

Audit Procedures for Receivables and

Sales

1. Reconciliation of Subsidiary ledger with General Ledger;

2. Confirming receivables and reviewing subsequent cash

receipts;

3. Analyzing notes receivable and related interest;

4. Evaluating the adequacy of the allowance for doubtful

accounts including the appropriateness of the

methodology used to calculate the allowance;

5. Performing accounts receivable and sales cutoff;

Audit Procedures for Receivables and

Sales

6. Checking the appropriate valuation of accounts receivables

denominated in foreign currencies;

7. Investigating any transactions with or related party

receivables;

8. Analyzing credit balances and unusual items;

9. Ascertaining whether any receivables have been pledged or

assigned; and

10. Performing analytical procedures.

Audit considerations when using

confirmation

• The confirmation request should describe that it is not a

request for payment, but merely to confirm the account;

• The confirmation request should be prepared and sent to the

customer under the control of the auditor;

• The auditor may include in the confirmation request the

details of the transactions, such as customer’s purchase

order numbers to improve the response rate;

Audit considerations when using

confirmation

• The confirmation request should be mailed in envelopes

bearing the CPA firm’s return address to ensure that all

confirmation requests that are undeliverable by the post

office are returned directly to the audit firm;

• Receipt or reply of confirmation request should be under the

control of the auditor; and

• Retain copies of all confirmation in the working papers.

You might also like

- Chapter 7: Receivables: Principles of AccountingDocument50 pagesChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- Accounts Receivable - Demo TeachingDocument59 pagesAccounts Receivable - Demo TeachingNicole Flores100% (1)

- PAS 8, 16 Accounting Policies, PPEDocument7 pagesPAS 8, 16 Accounting Policies, PPEalliahnahNo ratings yet

- 03 - Partnership DissolutionDocument38 pages03 - Partnership DissolutionDonise Ronadel SantosNo ratings yet

- A-Standards of Ethical Conduct For Management AccountantsDocument4 pagesA-Standards of Ethical Conduct For Management AccountantsChhun Mony RathNo ratings yet

- Audit of Investment-LectureDocument15 pagesAudit of Investment-LecturemoNo ratings yet

- Accounting Standard-18: Related Party DisclosureDocument26 pagesAccounting Standard-18: Related Party DisclosurelulughoshNo ratings yet

- CFAS ReviewerDocument6 pagesCFAS ReviewerAziNo ratings yet

- Notes Receivable DiscountingDocument33 pagesNotes Receivable DiscountingKristia AnagapNo ratings yet

- Sales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitDocument5 pagesSales 140, 800 Less: Cost of Sales (84, 480) Gross ProfitMichaela KowalskiNo ratings yet

- 11 - Bank Reconciliation NotesDocument3 pages11 - Bank Reconciliation NotesJann GataNo ratings yet

- IA For Prelims FinalDocument438 pagesIA For Prelims FinalCeline Therese BuNo ratings yet

- Financial Asset MILLANDocument6 pagesFinancial Asset MILLANAlelie Joy dela CruzNo ratings yet

- Provisions, Contingent Liabilities and Assets ExplainedDocument116 pagesProvisions, Contingent Liabilities and Assets ExplainedSyrell NaborNo ratings yet

- Bsat 2019Document23 pagesBsat 2019rowena adobasNo ratings yet

- Pas 7 - Statement of Cash Flows - W RecordingDocument14 pagesPas 7 - Statement of Cash Flows - W Recordingwendy alcoseba100% (1)

- Chapter 8 - Introduction To Pervasive ControlsDocument18 pagesChapter 8 - Introduction To Pervasive ControlsMark Lawrence Yusi100% (1)

- Acctg 15 - Midterm ExamDocument6 pagesAcctg 15 - Midterm ExamAngelo LabiosNo ratings yet

- Ap 06 REO Receivables - PDF 074431Document19 pagesAp 06 REO Receivables - PDF 074431ChristianNo ratings yet

- Chapter 4 Underlying AssumptionsDocument7 pagesChapter 4 Underlying AssumptionsMicsjadeCastilloNo ratings yet

- Toa PreboardDocument9 pagesToa PreboardLeisleiRagoNo ratings yet

- Pas 8Document1 pagePas 8Ella MaeNo ratings yet

- Questionnaire Expenditure CycleDocument1 pageQuestionnaire Expenditure Cycleleodenin tulangNo ratings yet

- Answering Difficult Accounting QuestionsDocument4 pagesAnswering Difficult Accounting QuestionsRosemarie Miano TrabucoNo ratings yet

- Client Selection and RetentionDocument20 pagesClient Selection and RetentionJurie MayNo ratings yet

- (PPT) Investment Property, Exploration For and Evaluation of Mineral Resources Assets, and NCA HFSDocument21 pages(PPT) Investment Property, Exploration For and Evaluation of Mineral Resources Assets, and NCA HFS수지100% (1)

- Chapter 4 The Revenue CycleDocument9 pagesChapter 4 The Revenue Cycleangelie mendozaNo ratings yet

- Accounting Chapter 9Document7 pagesAccounting Chapter 9Angelica Faye DuroNo ratings yet

- BS in Accountancy in The PhilippinesDocument7 pagesBS in Accountancy in The PhilippinesCharlie Magne G. SantiaguelNo ratings yet

- What Are The Pros and Cons of Joining in JPIA?: JPIA's Contributory Factors ACC C610-302A Group 2Document6 pagesWhat Are The Pros and Cons of Joining in JPIA?: JPIA's Contributory Factors ACC C610-302A Group 2kmarisseeNo ratings yet

- Inventory Estimation MethodsDocument14 pagesInventory Estimation Methodskrisha milloNo ratings yet

- Project C Manual For Counters ReviewedDocument30 pagesProject C Manual For Counters ReviewedDarlynSilvanoNo ratings yet

- Ifrs - 9Document6 pagesIfrs - 9Sajoy P.B.No ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- FAR 1st Monthly AssessmentDocument5 pagesFAR 1st Monthly AssessmentCiena Mae AsasNo ratings yet

- Pas 1 - Presentation of Financial StatementsDocument30 pagesPas 1 - Presentation of Financial StatementsClint Baring Arranchado100% (1)

- Module 2Document8 pagesModule 2ysa tolosaNo ratings yet

- ACP 314 Answer KeyDocument3 pagesACP 314 Answer KeyJastine Rose CañeteNo ratings yet

- Psa 610 Using The Work of Internal Auditors: RequirementsDocument2 pagesPsa 610 Using The Work of Internal Auditors: RequirementsJJ LongnoNo ratings yet

- Apc 301 Week 8Document2 pagesApc 301 Week 8Angel Lourdie Lyn HosenillaNo ratings yet

- Horizontal Analysis Interpretation PDFDocument2 pagesHorizontal Analysis Interpretation PDFAlison JcNo ratings yet

- Petty Cash, Part 3 - Kuya Joseph's BlogDocument5 pagesPetty Cash, Part 3 - Kuya Joseph's BlogCM LanceNo ratings yet

- Parcor QuizbowlDocument38 pagesParcor QuizbowlKrestyl Ann GabaldaNo ratings yet

- Fundamentals of Assurance ServicesDocument32 pagesFundamentals of Assurance ServicesDavid alfonsoNo ratings yet

- Responsibility AccountingDocument3 pagesResponsibility AccountinglulughoshNo ratings yet

- Cash & Cash Equivalents Composition & Other Topics CashDocument5 pagesCash & Cash Equivalents Composition & Other Topics CashEurich Gibarr Gavina EstradaNo ratings yet

- Chapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseDocument4 pagesChapter 9: Substantive Test of Receivables and Sales The Audit of Receivables and Revenue Represents Significant Audit Risk BecauseGirlie SisonNo ratings yet

- Revenue Cycle TestsDocument3 pagesRevenue Cycle TestsFaith Reyna TanNo ratings yet

- Accounting For Receivables: Accounting Principles, Ninth EditionDocument43 pagesAccounting For Receivables: Accounting Principles, Ninth EditionNuttakan MeesukNo ratings yet

- Final Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursDocument84 pagesFinal Exam: Fall 1997 This Exam Is Worth 30% and You Have 2 HoursJatin PanchiNo ratings yet

- Chapter 9 Use of Computer Assisted Audit TechniquesDocument4 pagesChapter 9 Use of Computer Assisted Audit TechniquesSteffany RoqueNo ratings yet

- Cash With Cash EqualantDocument5 pagesCash With Cash EqualantkaviyapriyaNo ratings yet

- Accounting ReviewerDocument21 pagesAccounting ReviewerAdriya Ley PangilinanNo ratings yet

- Auditing of ReceivablesDocument20 pagesAuditing of ReceivablesMary April Masbang100% (1)

- Substantive Tests of Expenditure Cycle Accounts Substantive TestsDocument3 pagesSubstantive Tests of Expenditure Cycle Accounts Substantive TestsJuvelyn RedutaNo ratings yet

- AP.3401 Audit of InventoriesDocument8 pagesAP.3401 Audit of InventoriesMonica GarciaNo ratings yet

- Psa 580Document11 pagesPsa 580shambiruarNo ratings yet

- CH 6 Audit of Conversion CycleDocument24 pagesCH 6 Audit of Conversion CyclerogealynNo ratings yet

- Handout 2 - Introduction To Auditing and Assurance of Specialized IndustriesDocument2 pagesHandout 2 - Introduction To Auditing and Assurance of Specialized IndustriesPotato CommissionerNo ratings yet

- At-91 PW (Part 2)Document12 pagesAt-91 PW (Part 2)Joris YapNo ratings yet

- RFBT Preweek 91Document30 pagesRFBT Preweek 91Joris YapNo ratings yet

- Final Preboard ExaminationDocument14 pagesFinal Preboard ExaminationJoris YapNo ratings yet

- Manila MAY 5, 2022 Preweek Material: Management Advisory ServicesDocument25 pagesManila MAY 5, 2022 Preweek Material: Management Advisory ServicesJoris YapNo ratings yet

- MAS AbitiagoDocument6 pagesMAS AbitiagoJoris YapNo ratings yet

- At-91 PW (Part 1)Document11 pagesAt-91 PW (Part 1)Joris YapNo ratings yet

- Afar Self TestDocument8 pagesAfar Self Testfor youNo ratings yet

- Final Preboard Batch 91 Reviewees PDFDocument18 pagesFinal Preboard Batch 91 Reviewees PDFJoris YapNo ratings yet

- AUD Final Preboard Examination QuestionnaireDocument16 pagesAUD Final Preboard Examination QuestionnaireJoris YapNo ratings yet

- 91 - Final Preaboard Afar (Weekends)Document18 pages91 - Final Preaboard Afar (Weekends)Joris YapNo ratings yet

- Final Audpb-91st-Apr 2022 (Solutions)Document5 pagesFinal Audpb-91st-Apr 2022 (Solutions)Joris YapNo ratings yet

- Batch 91 Final Preboard April 2022 - SolutionsDocument6 pagesBatch 91 Final Preboard April 2022 - SolutionsJoris YapNo ratings yet

- Batch 91 Final Preboard April 2022Document13 pagesBatch 91 Final Preboard April 2022Joris YapNo ratings yet

- AFAR Preweek Lecture Part 2Document18 pagesAFAR Preweek Lecture Part 2Joris YapNo ratings yet

- Advanced Financial Accounting and Reporting Preweek LectureDocument19 pagesAdvanced Financial Accounting and Reporting Preweek LectureVanessa Anne Acuña DavisNo ratings yet

- 7019 - Preweek Lecture FAR TheoryDocument6 pages7019 - Preweek Lecture FAR TheoryJoris YapNo ratings yet

- AP-PW 91: Review Problems-1Document9 pagesAP-PW 91: Review Problems-1Joris YapNo ratings yet

- 2010-2015 Tax Bar Based On The 2015 Bar Syllabus PDFDocument124 pages2010-2015 Tax Bar Based On The 2015 Bar Syllabus PDFNin BANo ratings yet

- 7017 - Preweek Lecture FAR ProblemsDocument8 pages7017 - Preweek Lecture FAR ProblemsJohn Paul ArrozaNo ratings yet

- Audit of InventoriesDocument9 pagesAudit of InventoriesJoris YapNo ratings yet

- 91 - Final Preaboard AFAR Solutions (WEEKENDS)Document9 pages91 - Final Preaboard AFAR Solutions (WEEKENDS)Joris YapNo ratings yet

- 7018 - Preweek Lecture FAR ProblemsDocument9 pages7018 - Preweek Lecture FAR ProblemsJoris YapNo ratings yet

- Business Law and Regulations ReviewerDocument6 pagesBusiness Law and Regulations ReviewerJoris YapNo ratings yet

- GROUP 1 - Sec 53-58Document3 pagesGROUP 1 - Sec 53-58Joris YapNo ratings yet

- YAP Joris - BSA 22 - Midterms Online Quiz 1Document3 pagesYAP Joris - BSA 22 - Midterms Online Quiz 1Joris YapNo ratings yet

- B-Tmas401 Sy 2021 - 2022Document17 pagesB-Tmas401 Sy 2021 - 2022Joris YapNo ratings yet

- YAP Joris - BSA 22 - Midterms Online Quiz 1 - Item 2Document1 pageYAP Joris - BSA 22 - Midterms Online Quiz 1 - Item 2Joris YapNo ratings yet

- Detailed Class Schedules B-TMAS401Document1 pageDetailed Class Schedules B-TMAS401Joris YapNo ratings yet

- Peza LawDocument31 pagesPeza LawFebz CanutabNo ratings yet

- List of Operating Medical Tourism Zone: Total No. 2Document28 pagesList of Operating Medical Tourism Zone: Total No. 2Joris YapNo ratings yet

- BT - FBT Examiners Report Sept19-Aug20Document8 pagesBT - FBT Examiners Report Sept19-Aug20Amna ZamanNo ratings yet

- Supplementary Material Module 5Document10 pagesSupplementary Material Module 5Darwin Dionisio ClementeNo ratings yet

- Balance Sheets and Its ConceptsDocument34 pagesBalance Sheets and Its ConceptsKamal KantNo ratings yet

- π=R R C Q Q Q Q: Practice problems on Module 3 (Markets) / Solutions to Questions 1 and 4Document2 pagesπ=R R C Q Q Q Q: Practice problems on Module 3 (Markets) / Solutions to Questions 1 and 4ShivamNo ratings yet

- Second Quiz in MASDocument5 pagesSecond Quiz in MASPraise BuenaflorNo ratings yet

- Business Model Canvas Explained - A Step-by-Step Guide With ExamplesDocument13 pagesBusiness Model Canvas Explained - A Step-by-Step Guide With ExamplesDaniel N. ResurreccionNo ratings yet

- AppleDocument2 pagesAppleSULEIMANNo ratings yet

- International Strategy Miniso and HamleysDocument16 pagesInternational Strategy Miniso and HamleyskonikaNo ratings yet

- Managerial Economics Lecture 1 - Evaluating Business Decisions Using Value MaximizationDocument4 pagesManagerial Economics Lecture 1 - Evaluating Business Decisions Using Value MaximizationCymah Nwar RAo100% (2)

- Channel Establishment PlanDocument1 pageChannel Establishment PlanrimaNo ratings yet

- Why Monopoly Can Be HarmDocument5 pagesWhy Monopoly Can Be Harmzakuan79No ratings yet

- MathematicsDocument316 pagesMathematicsParth Joshi100% (4)

- 5021 Solutions 6Document5 pages5021 Solutions 6americus_smile7474100% (1)

- Y3 - Module 8 - Evaluate The Business1Document7 pagesY3 - Module 8 - Evaluate The Business1Maria Lyn Victoria AbriolNo ratings yet

- KB - 2023 SurveyDocument40 pagesKB - 2023 SurveymikeNo ratings yet

- Design for Manufacturing GuideDocument46 pagesDesign for Manufacturing GuidexxxpressionNo ratings yet

- 3.concepts of Productivity MeasureDocument23 pages3.concepts of Productivity MeasureRizal M Muhammad0% (1)

- MGT402CostAccountingSOLVEDMCQSMoreThan500 PDFDocument60 pagesMGT402CostAccountingSOLVEDMCQSMoreThan500 PDFUsman KhalidNo ratings yet

- 3P.Controls in The Traditional EnvironmentDocument8 pages3P.Controls in The Traditional EnvironmentAlia NursyifaNo ratings yet

- MM - Group 6 - Cadbury PresentationDocument22 pagesMM - Group 6 - Cadbury PresentationJatin BalaniNo ratings yet

- Case Study Blueprint - The Complete Guide To Freelancing (ZTM Paul Mendes)Document11 pagesCase Study Blueprint - The Complete Guide To Freelancing (ZTM Paul Mendes)faraz baigNo ratings yet

- Business Plan Reality Market AnalysisDocument2 pagesBusiness Plan Reality Market AnalysisCynthia DikeNo ratings yet

- StarbucksDocument24 pagesStarbucksgrish shahNo ratings yet

- 9-204-066 Dividend Policy - 204702-XLS-ENGDocument17 pages9-204-066 Dividend Policy - 204702-XLS-ENGValant Rivas DerteNo ratings yet

- Cash and ReceivablesDocument74 pagesCash and ReceivablesChitta LeeNo ratings yet

- Chapter 10b - Long Term Finance - EquitiesDocument5 pagesChapter 10b - Long Term Finance - EquitiesTAN YUN YUNNo ratings yet

- Test - Management (Robbins & Coulter) - Chapter 9 - Quizlet 2Document5 pagesTest - Management (Robbins & Coulter) - Chapter 9 - Quizlet 2Muhammad HaroonNo ratings yet

- IMChap 004Document38 pagesIMChap 004Aaron Hamilton100% (4)

- Test Bank For Labor Relations 12th Edition by FossumDocument32 pagesTest Bank For Labor Relations 12th Edition by FossumValerie Gilliam100% (31)

- FVG Fair Value Gap LessonDocument9 pagesFVG Fair Value Gap LessontotoNo ratings yet