Professional Documents

Culture Documents

Chapter 11 Investments - Additional Concepts

Chapter 11 Investments - Additional Concepts

Uploaded by

Ana Leah Delfin0 ratings0% found this document useful (0 votes)

18 views15 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views15 pagesChapter 11 Investments - Additional Concepts

Chapter 11 Investments - Additional Concepts

Uploaded by

Ana Leah DelfinCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 15

(Intermediate Accounting 1A)

LECTURE AID

2019

ZEUS VERNON B. MILLAN

Chapter 11 INVESTMENTS – ADDITIONAL

CONCEPTS

Learning Objectives

• Account for regular way purchase or sale of financial assets.

• Account for the reclassification of financial assets.

• Account for the impairment of financial assets measured at

FVOCI (mandatory).

• Account for dividends received from investments.

• Account for stock rights.

• State the types of risks that are disclosed in the financial

statements.

INTERMEDIATE ACCTG 1A (by:

MILLAN)

Regular way purchase or sale of financial assets

• A regular way purchase or sale is a purchase or sale of a financial

asset under a contract whose terms require delivery of the asset

within the time frame established generally by regulation or

convention in the marketplace concerned.

• Trade date accounting vs. Settlement date accounting

a. Under trade date accounting, the financial asset purchased (s0ld) is

recognized (derecognized) at the trade date (i.e., the date the entity

commits to purchase or sell the financial asset).

b. Under settlement date accounting, the financial asset purchased

(s0ld) is recognized (derecognized) at the settlement date (i.e., the

date the ownership of the financial asset is transferred).

INTERMEDIATE ACCTG 1A (by:

MILLAN)

Fair value change between trade date & settlement date

• For purchases of FVPL and FVOCI assets (but not

amortized cost), the buyer recognizes the change in fair

value between the trade date and the settlement date.

• For sale transactions, the seller does not recognize the

change in fair value between the trade date and the

settlement date.

INTERMEDIATE ACCTG 1A (by:

MILLAN)

Reclassification

• After initial recognition, financial assets are reclassified only when

the entity changes its business model for managing financial

assets.

• Reclassification date is the first day of the first reporting period

following the change in business model that results in an entity

reclassifying financial assets.

INTERMEDIATE ACCTG 1A (by:

MILLAN)

Reclassification of debt-type financial assets

INTERMEDIATE ACCTG 1A (by:

MILLAN)

Reclassification of debt-type financial assets

INTERMEDIATE ACCTG 1A (by:

MILLAN)

Notes on reclassification

• Only debt instruments can be reclassified. Equity instruments

(e.g., investments in shares of stocks) cannot be reclassified.

• Financial assets cannot be reclassified into or out of the “designated

at FVPL” and “FVOCI - election” classifications.

• The initial measurement is fair value at reclassification date,

except for a reclassification from FVOCI to Amortized cost where the

fair value on reclassification date is adjusted for the cumulative

balance of gains and losses previously recognized in OCI.

INTERMEDIATE ACCTG 1A (by:

MILLAN)

Impairment

• The impairment requirements of PFRS 9 apply equally to debt-type

financial assets that are measured either at amortized cost or at

FVOCI.

• Impairment gains or losses on debt instruments measured at FVOCI

are recognized in profit or loss. However, the loss allowance is

recognized in OCI and does not reduce the carrying amount of the

financial asset in the statement of financial position.

INTERMEDIATE ACCTG 1A (by:

MILLAN)

Dividends

• Only cash and property dividends received from equity securities

may be recognized as dividend revenue.

INTERMEDIATE ACCTG 1A (by:

MILLAN)

Stock rights

• Stock rights, being equity instruments, are measured at fair value.

INTERMEDIATE ACCTG 1A (by:

MILLAN)

Disclosure of Risks on financial instruments

1. Credit risk - The risk that one party to a financial instrument will cause a

financial loss for the other party by failing to discharge an obligation.

2. Liquidity risk - The risk that an entity will encounter difficulty in meeting

obligations associated with financial liabilities that are settled by delivering cash or

another financial asset.

3. Market risk - The risk that the fair value or future cash flows of a financial

instrument will fluctuate because of changes in market prices. Market risk

comprises the following.

a) Interest rate risk

b) Currency risk

c) Other price risk

INTERMEDIATE ACCTG 1A (by:

MILLAN)

APPLICATION OF CONCEPTS

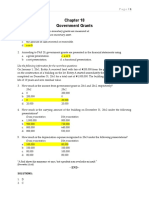

PROBLEM 2: FOR CLASSROOM DISCUSSION

INTERMEDIATE ACCTG 1A (by: MILLAN)

OPEN FORUM

QUESTIONS????

REACTIONS!!!!!

INTERMEDIATE ACCTG 1A (by: MILLAN)

END

INTERMEDIATE ACCTG 1A (by: MILLAN)

You might also like

- Chapter 14 Investments in AssociatesDocument17 pagesChapter 14 Investments in AssociatesElla GraceNo ratings yet

- Chapter 9 InvestmentsDocument21 pagesChapter 9 InvestmentsAna Leah Delfin100% (1)

- Chapter 6 Receivables - Additional ConceptsDocument15 pagesChapter 6 Receivables - Additional ConceptsAnas Alimoda100% (2)

- Chapter 19 Borrowing CostsDocument22 pagesChapter 19 Borrowing Costsmariel evangelistaNo ratings yet

- Chapter 16 Ppe (Part 2)Document27 pagesChapter 16 Ppe (Part 2)honeyjoy salapantanNo ratings yet

- Chapter 19 Borrowing CostsDocument17 pagesChapter 19 Borrowing CostsjuennaguecoNo ratings yet

- This Study Resource Was: InvestmentsDocument5 pagesThis Study Resource Was: InvestmentsMs Vampire100% (1)

- Chapter 12 - Other Long-Term InvestmentsDocument3 pagesChapter 12 - Other Long-Term InvestmentsJEFFERSON CUTENo ratings yet

- Chapter 7 InventoriesDocument25 pagesChapter 7 InventoriesAna Leah DelfinNo ratings yet

- Ia 1 Millan Test BankDocument193 pagesIa 1 Millan Test BankJon Paul DonatoNo ratings yet

- Chapter 20 AgricultureDocument32 pagesChapter 20 AgricultureCharice Anne Villamarin100% (1)

- Actvity 4.1Document4 pagesActvity 4.1Marie Frances SaysonNo ratings yet

- Sol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1a - 2020 EditionDocument18 pagesSol. Man. - Chapter 3 - Bank Reconciliation - Ia Part 1a - 2020 EditionMervin AliviadoNo ratings yet

- Pas 36 - Impairment of AssetsDocument20 pagesPas 36 - Impairment of AssetsCyril Grace Alburo BoocNo ratings yet

- 2nd Grading Exams Key AnswersDocument19 pages2nd Grading Exams Key AnswersUnknown WandererNo ratings yet

- Quiz Chapter 10 Investments in Debt Securities Ia 1 2020 EditionDocument7 pagesQuiz Chapter 10 Investments in Debt Securities Ia 1 2020 EditionChristine Jean MajestradoNo ratings yet

- Notes ReceivableDocument16 pagesNotes Receivabledenice.dimantagaNo ratings yet

- Intermediate Accounting 1 Second Grading Examination Key AnswersDocument12 pagesIntermediate Accounting 1 Second Grading Examination Key AnswersAbegail Joy De GuzmanNo ratings yet

- Receivables - Additional Concepts: Long QuizDocument9 pagesReceivables - Additional Concepts: Long Quizfinn mertens100% (1)

- First Periodical Examination Part 1. Multiple Choice (1 Pt. Each)Document6 pagesFirst Periodical Examination Part 1. Multiple Choice (1 Pt. Each)Febby Grace Villaceran Sabino0% (1)

- Intermediate Accounting 1 Final Grading ExaminationDocument18 pagesIntermediate Accounting 1 Final Grading ExaminationKrissa Mae LongosNo ratings yet

- Quiz - Chapter 11 - Investments - Additional Concepts - Ia 1 - 2020 EditionDocument2 pagesQuiz - Chapter 11 - Investments - Additional Concepts - Ia 1 - 2020 EditionJennifer RelosoNo ratings yet

- Government Grants: Use The Following Information For The Next Three QuestionsDocument2 pagesGovernment Grants: Use The Following Information For The Next Three QuestionsJEFFERSON CUTENo ratings yet

- Notes Receivable - Ia 1Document4 pagesNotes Receivable - Ia 1Aldrin CabangbangNo ratings yet

- Inventory Estimation: QuizDocument2 pagesInventory Estimation: QuizAngela Ricaplaza ReveralNo ratings yet

- The Accounting ProcessDocument5 pagesThe Accounting ProcessXienaNo ratings yet

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDocument13 pagesProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseJannelle SalacNo ratings yet

- Sol Man Chapter 4 Accounts Receivable Ia Part 1a 2020 EditionDocument21 pagesSol Man Chapter 4 Accounts Receivable Ia Part 1a 2020 EditionAngela RuedasNo ratings yet

- First Quiz in Prac 1Document10 pagesFirst Quiz in Prac 1ai shiNo ratings yet

- Chapter 8 Inventory EstimationDocument13 pagesChapter 8 Inventory EstimationAna Leah DelfinNo ratings yet

- PAS 38 Intangible Assets: Lecture AidDocument18 pagesPAS 38 Intangible Assets: Lecture Aidwendy alcosebaNo ratings yet

- Quiz - Chapter 10 - Investments in Debt Securities - Ia 1 - 2020 EditionDocument3 pagesQuiz - Chapter 10 - Investments in Debt Securities - Ia 1 - 2020 EditionJennifer RelosoNo ratings yet

- Quiz - Chapter 1 - Current Liabilities - 2021Document3 pagesQuiz - Chapter 1 - Current Liabilities - 2021Jennifer RelosoNo ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Sol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1BDocument3 pagesSol. Man. - Chapter 17 - Depletion of Mineral Resources - Ia Part 1BMahasia MANDIGANNo ratings yet

- Sol. Man. - Chapter 5 - Notes Receivable - Ia Part 1aDocument11 pagesSol. Man. - Chapter 5 - Notes Receivable - Ia Part 1aKaisser Niel Mari FormentoNo ratings yet

- Acc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long QuizDocument5 pagesAcc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long Quizemielyn lafortezaNo ratings yet

- CFASDocument4 pagesCFASBruce Devin Pabayos SolanoNo ratings yet

- Financial Asset at Amortized CostDocument18 pagesFinancial Asset at Amortized CostJay-L Tan100% (1)

- Inventory Estimation Problems With SolutionsDocument36 pagesInventory Estimation Problems With SolutionsPRINCESS JUDETTE SERINA PAYOT100% (2)

- PAS 36 Impairment of AssetsDocument3 pagesPAS 36 Impairment of AssetsRia GayleNo ratings yet

- Investments in Debt Securities: Problem 1: True or FalseDocument27 pagesInvestments in Debt Securities: Problem 1: True or FalseAlarich CatayocNo ratings yet

- This Study Resource Was: InvestmentsDocument9 pagesThis Study Resource Was: InvestmentsMs VampireNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument6 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aRezzan Joy Camara MejiaNo ratings yet

- Activity Chapter 5: Effect On December 31, 20X1: Using Straight Line MethodDocument2 pagesActivity Chapter 5: Effect On December 31, 20X1: Using Straight Line MethodRandelle James FiestaNo ratings yet

- CHAPTER 15 PPE (PART 1) - Reviewer - For Distribution PDFDocument20 pagesCHAPTER 15 PPE (PART 1) - Reviewer - For Distribution PDFemman neriNo ratings yet

- Pas 37 38 40 41 PFRS 1Document5 pagesPas 37 38 40 41 PFRS 1LALALA LULULUNo ratings yet

- Financial Markets (Chapter 10)Document3 pagesFinancial Markets (Chapter 10)Kyla Dayawon100% (1)

- Millan Conceptual Framework and Accounting StandardsDocument11 pagesMillan Conceptual Framework and Accounting StandardsMichael Angelo Guillermo AlemanNo ratings yet

- Notes Receivable: Problem 1: True or FalseDocument11 pagesNotes Receivable: Problem 1: True or FalseJamie Rose Aragones50% (2)

- PAS 41 AgricultureDocument4 pagesPAS 41 AgricultureCarlo B Cagampang100% (1)

- Quiz 1Document3 pagesQuiz 1White LeafNo ratings yet

- QUIZ - PAS 26 - printingACCTG & REPTG BY RETIREMENT BENEFIT PLANSDocument1 pageQUIZ - PAS 26 - printingACCTG & REPTG BY RETIREMENT BENEFIT PLANSHassanhor Guro Bacolod100% (1)

- FAR 02 23 Leases PDFDocument13 pagesFAR 02 23 Leases PDFSherri BonquinNo ratings yet

- Chapter 11 Investments Additional ConceptsDocument15 pagesChapter 11 Investments Additional ConceptsPrincess Ann FranciscoNo ratings yet

- Module 2c Additional Concepts - ReceivablesDocument15 pagesModule 2c Additional Concepts - ReceivablesMelanie RuizNo ratings yet

- Chapter 6 Receivables Additional ConceptsDocument14 pagesChapter 6 Receivables Additional ConceptsElaiza RegaladoNo ratings yet

- Chapter 1 - Current LiabilitiesDocument17 pagesChapter 1 - Current LiabilitiesCaladhiel100% (1)

- Chapter 1Document17 pagesChapter 1Mydel AvelinoNo ratings yet

- Chapter 9 InvestmentsDocument19 pagesChapter 9 Investmentsjuennagueco100% (2)

- Chapter 8 Inventory EstimationDocument13 pagesChapter 8 Inventory EstimationAna Leah DelfinNo ratings yet

- Chapter 3 - Bank ReconciliationDocument13 pagesChapter 3 - Bank ReconciliationAna Leah DelfinNo ratings yet

- Chapter 7 InventoriesDocument25 pagesChapter 7 InventoriesAna Leah DelfinNo ratings yet

- Chap002 National Differences in Political EconomyDocument16 pagesChap002 National Differences in Political EconomyAna Leah DelfinNo ratings yet

- A Country Report of IraqDocument5 pagesA Country Report of IraqAna Leah DelfinNo ratings yet

- Chapter 4 Accounts ReceivableDocument13 pagesChapter 4 Accounts ReceivableAna Leah DelfinNo ratings yet

- Chapter 2 Cash and Cash EquivalentsDocument13 pagesChapter 2 Cash and Cash EquivalentsAna Leah DelfinNo ratings yet

- Chap001 GlobalizationDocument22 pagesChap001 GlobalizationAna Leah DelfinNo ratings yet

- Acc 223a - Answers To CH 15 AssignmentDocument7 pagesAcc 223a - Answers To CH 15 AssignmentAna Leah DelfinNo ratings yet

- Business Plan: Presented To The Faculty of Business AdministrationDocument23 pagesBusiness Plan: Presented To The Faculty of Business AdministrationAna Leah Delfin100% (2)

- Chapter 14 Assignment Exercise 1: Department 1 2 4 TotalDocument18 pagesChapter 14 Assignment Exercise 1: Department 1 2 4 TotalAna Leah DelfinNo ratings yet

- WhatDocument1 pageWhatAna Leah DelfinNo ratings yet

- LEASE1Document3 pagesLEASE1Ana Leah DelfinNo ratings yet

- FinalDocument21 pagesFinalAna Leah DelfinNo ratings yet

- Chapter 2Document55 pagesChapter 2Ana Leah DelfinNo ratings yet

- Technology and Academic Performance of Senior High School StudentsDocument44 pagesTechnology and Academic Performance of Senior High School StudentsAna Leah Delfin88% (8)

- Chapter 01Document45 pagesChapter 01Ana Leah DelfinNo ratings yet

- Models For Measuring HUMAN ASSETSDocument16 pagesModels For Measuring HUMAN ASSETSashish_laddaNo ratings yet

- Davao City Executive Summary 2014Document6 pagesDavao City Executive Summary 2014Cristina ChiNo ratings yet

- Kps p4 Notes Topic FourDocument14 pagesKps p4 Notes Topic Fouraly10No ratings yet

- Cash and Cash Equivalent S: Intermediate Accounting 1 Prepared By: Joseph F. Glorioso, CPADocument46 pagesCash and Cash Equivalent S: Intermediate Accounting 1 Prepared By: Joseph F. Glorioso, CPAJohn SenaNo ratings yet

- FEATURE Market MeasureDocument20 pagesFEATURE Market MeasureAnnie Rose CarredoNo ratings yet

- Pre-Test Entreprenuership Grade-12 Choose The Best AnswerDocument5 pagesPre-Test Entreprenuership Grade-12 Choose The Best AnswerMark Gil GuillermoNo ratings yet

- Fab-Form Industries LTDDocument20 pagesFab-Form Industries LTDiroeinrgre9302bNo ratings yet

- Chapter 1 SlidesDocument19 pagesChapter 1 Slidesazade azamiNo ratings yet

- ACCT 201: Reporting and Analyzing InventoryDocument22 pagesACCT 201: Reporting and Analyzing InventoryDuygu YılmazNo ratings yet

- FAR05Document5 pagesFAR05Mitchie FaustinoNo ratings yet

- Practice 2AssetAcquisitionDocument11 pagesPractice 2AssetAcquisitionEllen KokaliNo ratings yet

- Mas Cup 21 - QuestionsDocument4 pagesMas Cup 21 - QuestionsPhilip CastroNo ratings yet

- CMALS1 - Session1 - Ver 2010Document159 pagesCMALS1 - Session1 - Ver 2010vipul_khemkaNo ratings yet

- IFRS - A Comparison With Indian Generally Accepted Accounting PrinciplesDocument47 pagesIFRS - A Comparison With Indian Generally Accepted Accounting PrinciplesEshetieNo ratings yet

- Pas 16Document44 pagesPas 16Justine VeralloNo ratings yet

- Unit I: Audit of Investment PropertyDocument11 pagesUnit I: Audit of Investment PropertyAnn SarmientoNo ratings yet

- Accounting Termini LogyDocument15 pagesAccounting Termini LogyAsif AliNo ratings yet

- My Business-PlanDocument23 pagesMy Business-PlanJep Jep PanghulanNo ratings yet

- Crescent Bahuman FinalDocument22 pagesCrescent Bahuman FinalShahid Ashraf100% (1)

- Lkas 23Document20 pagesLkas 23Dhanushika Samarawickrama100% (1)

- Drill Problems-Wps OfficeDocument6 pagesDrill Problems-Wps OfficeJp Ayalde0% (1)

- Sample Study Materials For Sebi Grade A 2020 PDFDocument36 pagesSample Study Materials For Sebi Grade A 2020 PDFupendarNo ratings yet

- Difference Between Creative Accounting and WindowDocument6 pagesDifference Between Creative Accounting and WindowAhtishamNo ratings yet

- Problems: Final Review Intermediate 1Document33 pagesProblems: Final Review Intermediate 1Nguyên NguyễnNo ratings yet

- Entrepreneurship Development (BM-302) : Assignment 1Document7 pagesEntrepreneurship Development (BM-302) : Assignment 1AbhishekNo ratings yet

- Laporan Strategic Planning PT Ultrajaya TBK (FINAL)Document201 pagesLaporan Strategic Planning PT Ultrajaya TBK (FINAL)Maharani MustikaNo ratings yet

- Igcse Accounting Capital Revenue Expenditure PDFDocument2 pagesIgcse Accounting Capital Revenue Expenditure PDFSiddarthNo ratings yet

- Class 11 Accountancy NCERT Textbook Chapter 7 Depreciation, Provisions and ReservesDocument56 pagesClass 11 Accountancy NCERT Textbook Chapter 7 Depreciation, Provisions and ReservesPathan KausarNo ratings yet

- 2023 - Q1 Press Release BAM - FDocument9 pages2023 - Q1 Press Release BAM - FJ Pierre RicherNo ratings yet

- BPM-SMA 13-Best Practice Model Example 2Document27 pagesBPM-SMA 13-Best Practice Model Example 2Ahmad DeebNo ratings yet