Professional Documents

Culture Documents

ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts Practice Notes

Uploaded by

Muhammad Azam0 ratings0% found this document useful (0 votes)

11 views3 pagesACCA Financial Accounting, F3,FA1,FA2,F7 Notes

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentACCA Financial Accounting, F3,FA1,FA2,F7 Notes

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views3 pagesACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts Practice Notes

Uploaded by

Muhammad AzamACCA Financial Accounting, F3,FA1,FA2,F7 Notes

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 3

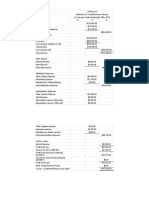

CH#5 Practice

Prepared by: Muhammad Azeem Tariq

For further assistance, online lectures, or notes contact on this email:

azeemtariq89@gmail.com

Tax on sales (Output tax):

Exclusive = = $95,000

Tax = Inclusive – Exclusive

11910 Tax = $109,250 – $95,000

Tax = $14,250

Tax on purchases (Input tax):

Sales Tax account

Tax = Net value x Tax rate

$ $ Tax = $64000 x 15%

Input tax 9600 Balance b/d 4540 Tax = $9,600

Cash paid 11910 ? Output tax 14250

Balance c/d 2720

21510 21510

Total sales = $140,000

Sales exempted from tax= $20,000

Sales with Tax = $120,000

Tax on sales (Output tax):

Exclusive = = $100,000

Sales Tax account

Tax = Inclusive – Exclusive

$ $

Tax = $120,000 – $100,000

Input tax 13000 Output tax 20000 Tax = $20,000

Cash paid 7000 ?

Tax on purchases (Input tax):

20,000 20,000 Tax = Net value x Tax rate

Tax = $65000 x 20%

Tax = $13,000

You might also like

- Solution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, RaoDocument5 pagesSolution Manual For Contemporary Financial Management 13th Edition Moyer, McGuigan, Raoa289899847No ratings yet

- Pittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Document12 pagesPittman Company Is A Small But Growing Manufacturer of Telecommunications Equipment.Kailash KumarNo ratings yet

- ACCA F3 CH#10: Accruals and Prepayments NotesDocument26 pagesACCA F3 CH#10: Accruals and Prepayments NotesMuhammad AzamNo ratings yet

- Chapter 8 Output VAT ZERO-Rated Sales Chapter 8 Output VAT ZERO - Rated SalesDocument9 pagesChapter 8 Output VAT ZERO-Rated Sales Chapter 8 Output VAT ZERO - Rated SalesSunny DaeNo ratings yet

- Solutions To RSB ExamDocument2 pagesSolutions To RSB ExamSheila PandeaguaNo ratings yet

- Solving Tax ProblemsDocument4 pagesSolving Tax ProblemsPaupauNo ratings yet

- Income Statement Breakdown Under 40 CharactersDocument2 pagesIncome Statement Breakdown Under 40 CharactersHIEU Nguyen HoangNo ratings yet

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts Practice NotesDocument11 pagesACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts Practice NotesMuhammad AzamNo ratings yet

- Solutions Chapter 2Document8 pagesSolutions Chapter 2Vân Anh Đỗ LêNo ratings yet

- Business Tax - Output VAT ActivityDocument4 pagesBusiness Tax - Output VAT ActivityDrew BanlutaNo ratings yet

- Chapter 8 Output Vat Zero-Rated SalesDocument8 pagesChapter 8 Output Vat Zero-Rated SalesJamaica DavidNo ratings yet

- FUNDALES BTAX MidtermsDocument4 pagesFUNDALES BTAX MidtermsE. RobertNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- Profit and Loss Account TemplatesDocument2 pagesProfit and Loss Account TemplatesSpam JunkNo ratings yet

- Tax: Classification of Individual Taxpayers Income Tax For Individual TaxpayersDocument20 pagesTax: Classification of Individual Taxpayers Income Tax For Individual TaxpayersKezia SantosidadNo ratings yet

- Parnevik Corp Income Statement Analysis 2010 Net Income EPSDocument4 pagesParnevik Corp Income Statement Analysis 2010 Net Income EPSkoftaNo ratings yet

- Sale To Government (TRAIN LAW)Document8 pagesSale To Government (TRAIN LAW)June Mariel ArroyoNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Name: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingDocument2 pagesName: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingIrish C. BamuyaNo ratings yet

- RWJJ Chapter 2 SolutionsDocument9 pagesRWJJ Chapter 2 SolutionsvzzrNo ratings yet

- Aral Pan 9 EquationDocument5 pagesAral Pan 9 EquationRashiel Jane Paronia CelizNo ratings yet

- Cash Flow Statement Lyst4093Document24 pagesCash Flow Statement Lyst4093Asma SaeedNo ratings yet

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- Solutions To ProblemsDocument22 pagesSolutions To ProblemsSyeed AhmedNo ratings yet

- Philhealth and Pag-IBIG contribution tables explainedDocument5 pagesPhilhealth and Pag-IBIG contribution tables explainedMaraiah InciongNo ratings yet

- VALUE ADDED TAX UpdatedDocument25 pagesVALUE ADDED TAX UpdatedLEEN MERCADONo ratings yet

- Chapter 3 Problems Tax CalculationsDocument23 pagesChapter 3 Problems Tax Calculationsohmyme sungjaeNo ratings yet

- Compensation Income Tax CalculationDocument4 pagesCompensation Income Tax Calculationlena cpaNo ratings yet

- Income Statement Yason 2DDocument1 pageIncome Statement Yason 2DKiwii CodmNo ratings yet

- Income in Foreign Country: Two WaysDocument3 pagesIncome in Foreign Country: Two WaysPaul Anthony AspuriaNo ratings yet

- Chapter 2 AssignmentDocument8 pagesChapter 2 AssignmentRoss John JimenezNo ratings yet

- Section TWO 2024Document5 pagesSection TWO 2024basuonyshowNo ratings yet

- Income StatementDocument6 pagesIncome StatementMohamed Yusuf KarieNo ratings yet

- EquityDocument3 pagesEquityshajiNo ratings yet

- May 2019 #2 - Sheet1 PDFDocument2 pagesMay 2019 #2 - Sheet1 PDFStephano OlliviereNo ratings yet

- Chapter 5&6 Case 1Document3 pagesChapter 5&6 Case 1Erlangga DharmawangsaNo ratings yet

- Quiz Btaxxx 1Document3 pagesQuiz Btaxxx 1John LucaNo ratings yet

- TAX 1 SampleDocument2 pagesTAX 1 SamplerhieelaaNo ratings yet

- Tugasan 6 Bab 6Document4 pagesTugasan 6 Bab 6azwan88No ratings yet

- Business TaxDocument9 pagesBusiness TaxChristian Dela PenaNo ratings yet

- The Statement of Cash Flotest Your UunderstandingDocument3 pagesThe Statement of Cash Flotest Your UunderstandingPalesaNo ratings yet

- Income TaxationDocument5 pagesIncome Taxationangellachavezlabalan.cpalawyerNo ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Entrepreneurship in BME - Session 6Document8 pagesEntrepreneurship in BME - Session 6Joungson JoestarNo ratings yet

- Lecture 20 IA 2022 EELUDocument48 pagesLecture 20 IA 2022 EELUGeorge SobhyNo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNo ratings yet

- Sales Tax QuestionDocument3 pagesSales Tax QuestionKhushi SinghNo ratings yet

- Income Tax ExercisesDocument3 pagesIncome Tax ExercisesLaguna HistoryNo ratings yet

- FormatsDocument15 pagesFormatsMohamed ShaminNo ratings yet

- Financial Reporting & AnalysisDocument9 pagesFinancial Reporting & AnalysisNuman Rox0% (1)

- Tax On Individuals - QuizDocument3 pagesTax On Individuals - QuizJM NoynayNo ratings yet

- Tax 9Document2 pagesTax 9Anusha SharmaNo ratings yet

- Management Accounting Case SolutionDocument4 pagesManagement Accounting Case SolutionhadiNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument3 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- Direction: Answer The Problem and Provide Your Solution in Good FormDocument1 pageDirection: Answer The Problem and Provide Your Solution in Good FormRenzo KarununganNo ratings yet

- Theory: Business Within The PhilippinesDocument3 pagesTheory: Business Within The PhilippinesIvan AnaboNo ratings yet

- Trần Hoài Anh Hs150639 Ib1602Document3 pagesTrần Hoài Anh Hs150639 Ib1602Vũ Nhi AnNo ratings yet

- Tax AssigmentDocument1 pageTax Assigmentasdfg qwertNo ratings yet

- VAT Guide for Small BusinessesDocument8 pagesVAT Guide for Small BusinessesAllen KateNo ratings yet

- Very Awkward Tax: A bite-size guide to VAT for small businessFrom EverandVery Awkward Tax: A bite-size guide to VAT for small businessNo ratings yet

- ACCA F3 CH#10: Accruals and Prepayments Practice NotesDocument13 pagesACCA F3 CH#10: Accruals and Prepayments Practice NotesMuhammad AzamNo ratings yet

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesDocument40 pagesACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesMuhammad AzamNo ratings yet

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts Practice NotesDocument11 pagesACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts Practice NotesMuhammad AzamNo ratings yet