Professional Documents

Culture Documents

INVESTMENT

INVESTMENT

Uploaded by

juhirul islam0 ratings0% found this document useful (0 votes)

2 views13 pagesInvestment involves committing funds to assets for a period of time to receive future returns. There are two main types of investment: short term and long term. Short term investment decisions involve investing working capital surpluses in low-risk assets for a short time period. Long term investments are commitments of funds to new projects or assets for longer periods aimed at generating income or reducing costs. The key is balancing investment risk and return over the time period.

Original Description:

investment management

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInvestment involves committing funds to assets for a period of time to receive future returns. There are two main types of investment: short term and long term. Short term investment decisions involve investing working capital surpluses in low-risk assets for a short time period. Long term investments are commitments of funds to new projects or assets for longer periods aimed at generating income or reducing costs. The key is balancing investment risk and return over the time period.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views13 pagesINVESTMENT

INVESTMENT

Uploaded by

juhirul islamInvestment involves committing funds to assets for a period of time to receive future returns. There are two main types of investment: short term and long term. Short term investment decisions involve investing working capital surpluses in low-risk assets for a short time period. Long term investments are commitments of funds to new projects or assets for longer periods aimed at generating income or reducing costs. The key is balancing investment risk and return over the time period.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 13

Corporate Finance

Investment

Investment is uses of fund/ capital to

obtain future return.

Investment Decision

- is a commitment of funds to assets

for a particular period with an

anticipation of receiving larger

cashflow in the future.

Funds

Cash

Equity

Loans

Assets

FinancialAssets

Real Assets

A Particular Period

• Investment Period

• Holding Period

Investment Criteria

Risk

Return

Types of Investment

1. Short Term Investment

2. Long Term Investment

Short Term Investment Decision

Investment of working capital

Surplus

Working capital surplus depends

on working capital investment

policy

Working Capital Investment Policy

Moderate WC investment Policy Aggressive WC investment Policy

Standard Norm : 2:1 (Current Standard Norm 1:1 (Current Ratio)

Ratio)

I II III I II III

CA 7k 10k 12k 4k 5k 6k

CL 5k 5k 5k 5k 5k 5k

WC S/D (3k) 0 2k (1k) 0 1k

Financing needed Short term investment Financing S.T Investment

What will happen if Working capital surplus is

not invested?

Opportunity cost will be high

Profit will be low

It will not remain surplus. It will

be used in unproductive sector.

Where to invest surplus WC?

It depends on

- The amount of Surplus

- How long it remains as surplus

What do you mean by Short Term

Investment

Maximum Return

Minimum Risk

What do you mean by long term

investment?

-Investment in a new project

-Investment on purchase of fixed assets.

Investment in BMRE for the purposes of

1. Income/revenue generating investment

2. Cost Savings investment

Is called long term investment decision.

You might also like

- Capital Budgeting FinalDocument78 pagesCapital Budgeting FinalHarnitNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Shapiro CapBgt IMDocument76 pagesShapiro CapBgt IMjhouvanNo ratings yet

- Capital Investment DecisionDocument16 pagesCapital Investment DecisionAbraham LinkonNo ratings yet

- Ceilli 2011Document242 pagesCeilli 2011Peter YowNo ratings yet

- 3.1 Cost of Capital For ClassDocument88 pages3.1 Cost of Capital For ClassSrilakshmi MaduguNo ratings yet

- ACCA Financial Management: Topic Area: - Investment Appraisal - Part 2 - Supplementary Notes - Practice QuestionsDocument17 pagesACCA Financial Management: Topic Area: - Investment Appraisal - Part 2 - Supplementary Notes - Practice QuestionsTaariq Abdul-MajeedNo ratings yet

- ACCA Financial Management: Topic Area: - Investment Appraisal - Part 2 - Supplementary Notes - Practice QuestionsDocument24 pagesACCA Financial Management: Topic Area: - Investment Appraisal - Part 2 - Supplementary Notes - Practice QuestionsTaariq Abdul-MajeedNo ratings yet

- Chapter-8 Cap Bud ReportDocument7 pagesChapter-8 Cap Bud ReportGrazielle DiazNo ratings yet

- Lecture 1Document41 pagesLecture 1faisalNo ratings yet

- CIA Ama NotesDocument32 pagesCIA Ama NotesamnaNo ratings yet

- Chapter 12 Notes - Capital Budgeting DecisionDocument6 pagesChapter 12 Notes - Capital Budgeting DecisionrbarronsolutionsNo ratings yet

- Financial Appraisal, Sensitivity and Scenario Analysis: R.Ganesh, SR - Faculty, SBSC, HydDocument25 pagesFinancial Appraisal, Sensitivity and Scenario Analysis: R.Ganesh, SR - Faculty, SBSC, HydHinaAbbasNo ratings yet

- Investment Decisions: (Capital Budgeting Techniques)Document69 pagesInvestment Decisions: (Capital Budgeting Techniques)Dharmesh GoyalNo ratings yet

- Chapter 5 NotesDocument13 pagesChapter 5 NotesZakariya PkNo ratings yet

- Module1-Investments & Risk & DerivativesDocument169 pagesModule1-Investments & Risk & DerivativesLMT indiaNo ratings yet

- PTM 3 Portfolio TheoryDocument68 pagesPTM 3 Portfolio TheoryDevi SavitriNo ratings yet

- Acca p4 - Advance Investment AppraisalDocument11 pagesAcca p4 - Advance Investment AppraisalkichuNo ratings yet

- Chapter 13Document34 pagesChapter 13Aryan JainNo ratings yet

- Week 10 - 11 - Investment Appraisal TechniquesDocument15 pagesWeek 10 - 11 - Investment Appraisal TechniquesJoshua NemiNo ratings yet

- Lec 6Document26 pagesLec 6Mohamed AliNo ratings yet

- Pert 5 - Hedge Net Invest and Embeded Derivatives - PostDocument26 pagesPert 5 - Hedge Net Invest and Embeded Derivatives - PostSwanbellyNo ratings yet

- Investment Analysis and Portfolio Management: Lecture Presentation SoftwareDocument57 pagesInvestment Analysis and Portfolio Management: Lecture Presentation SoftwareAssfaw KebedeNo ratings yet

- Capital BudgetingDocument11 pagesCapital BudgetingSumit AroraNo ratings yet

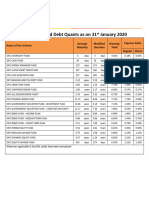

- Debt Fund Yeilds As On 31st Jan 2020Document2 pagesDebt Fund Yeilds As On 31st Jan 2020Yogesh PoteNo ratings yet

- Financial Management Unit II I) Capital BudgetingDocument7 pagesFinancial Management Unit II I) Capital BudgetingRajesh KumarNo ratings yet

- Chapter 13 Capital Investment DecisionsDocument28 pagesChapter 13 Capital Investment Decisionsmuhammad alfariziNo ratings yet

- Ammetlife - Ceilli (Eng) - Mas 2014Document159 pagesAmmetlife - Ceilli (Eng) - Mas 2014Suthakar SubramaniamNo ratings yet

- Chapter 12 Assigned Question SOLUTIONSDocument61 pagesChapter 12 Assigned Question SOLUTIONSDang ThanhNo ratings yet

- 2023 Tutor Guide Session 2 Investment Securities FinalDocument30 pages2023 Tutor Guide Session 2 Investment Securities Finalolwethup29No ratings yet

- PNA FInancial Management 10 Short TermDocument28 pagesPNA FInancial Management 10 Short TermanggibekNo ratings yet

- Acc 301 - Fin 301 - Lectures Four - SixDocument13 pagesAcc 301 - Fin 301 - Lectures Four - SixFolarin EmmanuelNo ratings yet

- Cyclical Forecasting 2018Document17 pagesCyclical Forecasting 2018mweng407No ratings yet

- Fin3 Midterm ExamDocument8 pagesFin3 Midterm ExamBryan Lluisma100% (1)

- Chapter - 6 Investment EvaluationDocument33 pagesChapter - 6 Investment EvaluationbelaynehNo ratings yet

- LFPP5800 - Unit 1 - Investment Planning 2020Document29 pagesLFPP5800 - Unit 1 - Investment Planning 2020Kekeletso MoshoeshoeNo ratings yet

- Myconstant From ForumDocument14 pagesMyconstant From ForumAnneNo ratings yet

- Finance Midterm QuestionsDocument3 pagesFinance Midterm QuestionsAnonymous x4LL5ecNCRNo ratings yet

- SIP KARO NISCHINT RAHO (For MOAMC Schemes) - November 2022Document14 pagesSIP KARO NISCHINT RAHO (For MOAMC Schemes) - November 2022coinage capitalNo ratings yet

- Chapter 1 Cost of Capital PDFDocument58 pagesChapter 1 Cost of Capital PDFGiáng Hương VũNo ratings yet

- Capital Budgeting - Part 1Document6 pagesCapital Budgeting - Part 1Aurelia RijiNo ratings yet

- Dba 3 June 2016Document14 pagesDba 3 June 2016Mabvuto PhiriNo ratings yet

- KC 2 Pilot PaperDocument10 pagesKC 2 Pilot Paperxanax_1984No ratings yet

- Fundsmith Equity Fund EUR AccDocument4 pagesFundsmith Equity Fund EUR AccSrinivasa Rao KanaparthiNo ratings yet

- Chapt 13 Capital Investment DecisionsDocument28 pagesChapt 13 Capital Investment DecisionsDebi Fitra YandaNo ratings yet

- Capital BudgetingDocument32 pagesCapital BudgetingRushi RudrawarNo ratings yet

- Capital Budgeting Techniques PDFDocument21 pagesCapital Budgeting Techniques PDFAvinav SrivastavaNo ratings yet

- Why Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)Document33 pagesWhy Mutual Fund?: AMFI IAP (Association of Mutual Funds India Investor Awareness Program)shoaib zamanNo ratings yet

- DBH 1st Mutual FundDocument34 pagesDBH 1st Mutual Fundrishav_agarwal_1No ratings yet

- CA-Inter-Accounts Iqtdar-MalikDocument31 pagesCA-Inter-Accounts Iqtdar-MalikSUMANTO BARMANNo ratings yet

- IFS - Mutual FundsDocument36 pagesIFS - Mutual FundsBun From BakeryNo ratings yet

- Project By: Bhanuchand: Apita L Struct URE OR King Capit ALDocument9 pagesProject By: Bhanuchand: Apita L Struct URE OR King Capit ALBhanu ChandNo ratings yet

- Management Accounting: Student EditionDocument28 pagesManagement Accounting: Student EditionTri OktavianiNo ratings yet

- Adv - NBFCDocument7 pagesAdv - NBFCrshyams165No ratings yet

- Dba 3 June 2016-1Document14 pagesDba 3 June 2016-1Mabvuto PhiriNo ratings yet

- MAS 10 - Capital BudgetingDocument10 pagesMAS 10 - Capital BudgetingClint AbenojaNo ratings yet

- Kotak Multi Asset Allocation Fund A4 Leaflet (Digital Copy)Document4 pagesKotak Multi Asset Allocation Fund A4 Leaflet (Digital Copy)AnanthNo ratings yet

- Assignment 3Document4 pagesAssignment 3Rabia KhalidNo ratings yet

- Beyond the J Curve: Managing a Portfolio of Venture Capital and Private Equity FundsFrom EverandBeyond the J Curve: Managing a Portfolio of Venture Capital and Private Equity FundsNo ratings yet