Professional Documents

Culture Documents

GST

Uploaded by

Celina Alex0 ratings0% found this document useful (0 votes)

30 views9 pagesOriginal Title

GST PPT

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views9 pagesGST

Uploaded by

Celina AlexCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 9

GOODS AND SERVICES TAX (GST)

• GST or "Goods and Services Tax" is a comprehensive Indirect Tax

which has replaced many Indirect Taxes in India. The Goods and

Service Tax Act was passed in the Parliament on 29th March, 2017.

The Act came into effect on 1st July, 2017. It is a comprehensive,

multi-stage, destination-based tax that is levied on every value

addition. GST has been identified as one of the most important tax

reforms post-independence. The Government of India implemented

GST following the credo of ‘One Nation and One Tax' and wanting a

unified market in order to ensure the smooth flow of goods and

services across the country.

• Tax apart from being a source of revenue for growth also plays a key role in making

the State accountable to its taxpayers. Effective taxation ensures that public funds are

effectively employed in fulfilling social objectives for sustainable development

• Among other benefits, GST is expected to improve the ease of doing business in

tax compliance, reduce the tax burden by eliminating tax-on-tax, improve tax

administration, mitigate tax evasion, broaden the organised segment of the economy and

boost tax revenues.

• GST has replaced 17 in at has replaced 17 indirect taxes (like Value Added Tax Service Tax,

Excise Duty, Sales Tax, etc.) and 23 cesses of the Centre and the States, thereby

eliminating the need for multiple returns and assessments. It has rationalised the tax

treatment of goods and services wong the supply chain from producers to consumers.

• GST is charged at each stage of value addition and the supplier off-sets the levy on inputs

in the previous stages of value chain through the tax credit mechanism.

• The last dealer in the supply chain passes on the added GST to the consumer, making GST a

destination-based consumption tax.

• The provision of availing input credit at each stage of value chain helps in avons cascading

effect (tax on tax) under GST, which is expected to reduce prices of commodities and

benefit the consumers.

Types of Taxes under GST

• The types of taxes levied under GST are:

• Central Goods and Services Tax (CGST): It is the GST levied on the

'Intra-State' supply of goods or services by the Centre.

• State Goods and Services Tax (SGST): It is the GST levied on the

‘Intra-State' supply of goods or services by the State (including Union

Territories with legislature).

• Integrated Goods and Services Tax (IGST): It is the GST levied on the

Inter-State' supply of goods or services and is collected by the Centre.

IGST is equivalent to the sum total of CGST and SGST.

Some Facts About GST

• Single Tax Structure: GST aims to subsume a multiple taxes into one

single tax across the country and make goods uniformly priced across

India. Though, in this process, some goods become costly and some

become cheaper.

• Effect on Prices: With the implementation of GST, luxury goods have

become costlier, while items of mass consumption have become cheaper.

• Consumption Based Tax: GST is a 'Consumption Based Tax', i.e. the tax

is received by the state in which the goods or services are consumed and

not by the state in which such goods are manufactured. For example, if a

product is manufactured in Tamil Nadu and travels through the country

before it reaches Delhi, where the buyer or consumer pays tax

INPUT TAX CREDIT UNDER GST

• Input Tax Credit means reducing the taxes paid on inputs from taxes to

be paid on output. When anu supply of services or goods are supplied

to a taxable person, the GST charged is known as Input Tax. The

supplier at each stage is permitted to avail credit of GST paid on the

purchase of goods and/or services and can set off this credit against

the GST payable on the supply of goods and services to be made by

him. Thus, the final consumer bears the GST charged by the last

supplier in the supply chain, with set-off benefits at all the previous

stages. Hence, the tax will be levied only on the value added, which

results in avoiding double taxation. For example, if tax payable by a

manufacturer on the output, i.e. final product is * 450 and he has

already paid tax of 300 on input, i.e. purchases, then he can claim

'Input Credit' of 300 and he needs to deposit only * 150 in taxes.

KEY FEATURES OF GST

• Applicability of GST: The territorial spread of GST is the whole country, including Jammu

and Kashmir

• Applicable on Supply of Goods and Services: GST is applicable on the 'supply' of goods or

services as against the earlier concept of tax on the manufacture or sale of goods or on the

provision of services.

• Consumption Based Tax: It is based on the principle of destination-based consumption

• tax against the earlier principle of origin-based taxation.

• GST on Imports: Import of goods and services is treated as inter-State supplies and would be

subject to IGST in addition to the applicable customs duties.

• GST Rates: CGST, SGST and IGST are levied at rates mutually agreed upon by the Centre

• and the States under the aegis of the GST Council. There are four tax slabs namely 5%, 12%,

18% and 28% for all goods or services. Exports and supplies to SEZ are zero-rated.

• Payment of GST: There are various modes of payment of tax available to the

taxpayer, including Internet banking, debit/credit card and National Electronic Funds

Transfer (NEFT)/Real Time Gross Settlement (RTGS).

GST COUNCIL

• Goods and Services Tax Council is a constitutional body for making recommendations to the

Union and State Government on issues related to Goods and Service Tax.

• Constitution: As per Article 279A of the amended Constitution, the GST Council which will be a

joint forum of the Centre and the States, shall consist of the following members:

• Chairperson: Finance Minister.

• Vice Chairperson: Chosen amongst the Ministers of State Government.

• Members: MoS (Finance) and all Ministers of Finance / Taxation of each State.

• Quorum: 50% of the total number of Members of the Goods and Services Tax Council

shall constitute the quorum at its meetings.

• Majority required for taking Decisions: Every decision of the GST Council shall be taken at a

meeting, by a majority of not less than 75% of the weighted votes of the members present and

voting, in accordance with the following principles, namely:

• Vote of the Central Government shall have a weightage of one-third of the total votes cast, and

• Votes of all the State Governments taken together shall have a weightage of two-thirds of the

total votes cast, in that meeting.

THANK YOU…

You might also like

- GST Economics ProjectDocument11 pagesGST Economics ProjectAbeer ChawlaNo ratings yet

- Goods & Services Tax (GST) - (One Nation One Tax)Document40 pagesGoods & Services Tax (GST) - (One Nation One Tax)sumukh0% (1)

- Goods and Service Tax (GST)Document19 pagesGoods and Service Tax (GST)Saurabh Kumar SharmaNo ratings yet

- Chargeble GSTDocument87 pagesChargeble GSTgopaljha84No ratings yet

- Handbook On Exempted Supplies Under GSTDocument205 pagesHandbook On Exempted Supplies Under GSTkaaryafacilitiesNo ratings yet

- 51 GST Flyer - Chapter 47 - TDS On GSTDocument5 pages51 GST Flyer - Chapter 47 - TDS On GSTRanjanNo ratings yet

- GST Pracital Class 2Document7 pagesGST Pracital Class 2Nayan JhaNo ratings yet

- Reading Material AccountantDocument123 pagesReading Material Accountantsatyanweshi truthseeker100% (1)

- Implementing GST will boost India's economyDocument3 pagesImplementing GST will boost India's economyVasundhara SinghNo ratings yet

- Goods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLADocument30 pagesGoods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLAKrishna ShuklaNo ratings yet

- GST PPT Tkil FinalDocument53 pagesGST PPT Tkil FinalVikas SharmaNo ratings yet

- GST STeps To File ReturnDocument22 pagesGST STeps To File ReturnAnnu KashyapNo ratings yet

- Understanding Goods and Services TaxDocument23 pagesUnderstanding Goods and Services TaxTEst User 44452No ratings yet

- GST PPT TaxguruDocument30 pagesGST PPT TaxgurupraveerNo ratings yet

- GST Accounting PDFDocument17 pagesGST Accounting PDFBOO KIANG MINGNo ratings yet

- Supply GSTDocument16 pagesSupply GSTMehak Kaushikk100% (1)

- Material - GSTDocument18 pagesMaterial - GSTDeepak NimmojiNo ratings yet

- Uncommon GST TopicsDocument36 pagesUncommon GST TopicsEugeniePaxtonNo ratings yet

- Dr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawDocument9 pagesDr. Shakuntala Misra National Rehabilitation University: Lucknow Faculty of LawVimal SinghNo ratings yet

- GST BookDocument100 pagesGST BookNaman ChopraNo ratings yet

- E-Book On GST by CA. (DR.) G. S. Grewal - 2020Document58 pagesE-Book On GST by CA. (DR.) G. S. Grewal - 2020Aarav DhingraNo ratings yet

- GST GuideDocument46 pagesGST GuideVikasNo ratings yet

- All About GST REFUNDS - Refrence ManualDocument451 pagesAll About GST REFUNDS - Refrence ManualSwarnadevi GanesanNo ratings yet

- GST Oct 17Document23 pagesGST Oct 17himanNo ratings yet

- Calculation of GSTDocument13 pagesCalculation of GSTSukanta PalNo ratings yet

- E Way Bill Under GST 1.2Document43 pagesE Way Bill Under GST 1.2Kunal KapadiaNo ratings yet

- GST Registration PPT Ver6 28042017Document46 pagesGST Registration PPT Ver6 28042017Sonal AggarwalNo ratings yet

- Vision Collage of Management Kanpur Submitted To, Miss Keerti Tiwari Submitted By, M/S. Anam FatimaDocument24 pagesVision Collage of Management Kanpur Submitted To, Miss Keerti Tiwari Submitted By, M/S. Anam FatimaAnam FatimaNo ratings yet

- Accounting Reports in TallyDocument49 pagesAccounting Reports in TallyBackiyalakshmi VenkatramanNo ratings yet

- GST Debit Note Format in ExcelDocument4 pagesGST Debit Note Format in ExcelVivek PadoleNo ratings yet

- Import Export Under GSTDocument9 pagesImport Export Under GSTVijaya PawarNo ratings yet

- GST Study MaterialDocument30 pagesGST Study Materialkowc kousalyaNo ratings yet

- Guide To CGST, SGST and IGST: Inter-State Vs Intra-StateDocument6 pagesGuide To CGST, SGST and IGST: Inter-State Vs Intra-StateSuman IndiaNo ratings yet

- GN Anti Profiteering GSTDocument174 pagesGN Anti Profiteering GSTABC 123No ratings yet

- Anil's Commerce +3 3Rd Yr Unit - 3Document26 pagesAnil's Commerce +3 3Rd Yr Unit - 3Justin ChanduNo ratings yet

- GST User ManuelDocument195 pagesGST User Manuelsakthi raoNo ratings yet

- Flaws of GST Bill Exposed in Strong ArgumentDocument3 pagesFlaws of GST Bill Exposed in Strong ArgumentKshitij Gaur100% (3)

- GST in India: An overview of the Goods and Services TaxDocument57 pagesGST in India: An overview of the Goods and Services Taxmurali140No ratings yet

- Impact of GST On Warehousing and Supply ChainDocument39 pagesImpact of GST On Warehousing and Supply ChainSundaravaradhan Iyengar100% (6)

- Mathematics Class 10: Goods and Service Tax (GS T)Document10 pagesMathematics Class 10: Goods and Service Tax (GS T)Mohd Yousha AnsariNo ratings yet

- Financial Statements SummaryDocument53 pagesFinancial Statements Summaryrachealll100% (1)

- GST PDFDocument81 pagesGST PDFPankaj JainNo ratings yet

- GST NotesDocument2 pagesGST NotesImtiaz KhanNo ratings yet

- Accounting Standards - E-Notes - Udesh Regular - Group 1Document135 pagesAccounting Standards - E-Notes - Udesh Regular - Group 1Uday TomarNo ratings yet

- GST - Hospitality IndustryDocument68 pagesGST - Hospitality IndustrySOPHIA POLYTECHNIC LIBRARYNo ratings yet

- Honda Activa 4G Owners ManualDocument75 pagesHonda Activa 4G Owners ManualRoyal ENo ratings yet

- PPT-on-GST Annual-ReturnDocument33 pagesPPT-on-GST Annual-Returnshrutha p jainNo ratings yet

- GST Advance Receipts: Advance Receipts If Turnover Is Less Than Rs. 1.5 CroresDocument29 pagesGST Advance Receipts: Advance Receipts If Turnover Is Less Than Rs. 1.5 CroresVidyadhara HegdeNo ratings yet

- Central ExciseDocument22 pagesCentral ExcisesadathnooriNo ratings yet

- GST - A Game Changer: 2. Review of LiteratureDocument3 pagesGST - A Game Changer: 2. Review of LiteratureMoumita Mishra100% (1)

- Direct Tax Vs Indirect TaxDocument44 pagesDirect Tax Vs Indirect TaxShuchi BhatiaNo ratings yet

- GST Into1Document45 pagesGST Into1PremNo ratings yet

- Calculation of Tax Liability Assignment: Rishabh KaushikDocument22 pagesCalculation of Tax Liability Assignment: Rishabh KaushikLkNo ratings yet

- Complete GST Book PDFDocument351 pagesComplete GST Book PDFAGNIHOTRAM RAM NARAYANANo ratings yet

- GST Annual Return and AuditDocument10 pagesGST Annual Return and AuditRachit ChhedaNo ratings yet

- GST FillingDocument74 pagesGST FillingTasmay Enterprises100% (1)

- Goods and Services Tax ': A Destination Based Consumption TaxDocument46 pagesGoods and Services Tax ': A Destination Based Consumption TaxyennamNo ratings yet

- Types of Taxes Under GSTDocument4 pagesTypes of Taxes Under GSTDiya SharmaNo ratings yet

- Goods and Services Tax: Chapter-4Document34 pagesGoods and Services Tax: Chapter-4RohitNo ratings yet

- How to Handle Goods and Service Tax (GST)From EverandHow to Handle Goods and Service Tax (GST)Rating: 4.5 out of 5 stars4.5/5 (4)

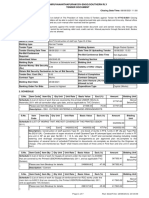

- Order EX0011168035: Mode of Payment: PREPAIDDocument1 pageOrder EX0011168035: Mode of Payment: PREPAIDRahul DattNo ratings yet

- physicalCustomerInvoice 4118 2023 06 03 physicalCustomerInvoice-9407603014-4118-f7ef1e26 24aa 45c4 9595 3b571c1be741qBHT42yLLr-4927682657Document1 pagephysicalCustomerInvoice 4118 2023 06 03 physicalCustomerInvoice-9407603014-4118-f7ef1e26 24aa 45c4 9595 3b571c1be741qBHT42yLLr-4927682657Shirishma RajuNo ratings yet

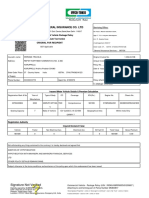

- Invoice HRPL 139Document1 pageInvoice HRPL 139Sunil PatelNo ratings yet

- Invoice 5371888557Document2 pagesInvoice 5371888557vaibhav agrawalNo ratings yet

- TDS U - S. 194J Not Deductible On Payment For Outright Purchase of Copyright and Technical Know-HowDocument10 pagesTDS U - S. 194J Not Deductible On Payment For Outright Purchase of Copyright and Technical Know-HowheyaanshNo ratings yet

- Hyd Airport To HotelDocument3 pagesHyd Airport To HotelAmit Kumar NaiduNo ratings yet

- Congratulations! You Are On One Airtel 1349 PlanDocument11 pagesCongratulations! You Are On One Airtel 1349 PlanPrakash RajNo ratings yet

- 2208238392Document1 page2208238392NEW GENERATIONSNo ratings yet

- Summer Internship Project Report (GST)Document75 pagesSummer Internship Project Report (GST)Md jadav100% (1)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Arun MmohantyNo ratings yet

- ACT Storm Internet Bill DetailsDocument2 pagesACT Storm Internet Bill DetailsThulasi VijayNo ratings yet

- Reliance Retail tax invoice and receipt for JioFiber planDocument2 pagesReliance Retail tax invoice and receipt for JioFiber planDevops LearningNo ratings yet

- Poonawalla TowersDocument3 pagesPoonawalla TowersezycredNo ratings yet

- Tax Invoice Cum ChallanDocument6 pagesTax Invoice Cum ChallanSunil PatelNo ratings yet

- TVC DIV-ENGG TENDER FOR STAFF QRS CONSTRUCTIONDocument7 pagesTVC DIV-ENGG TENDER FOR STAFF QRS CONSTRUCTIONGNANU GLORYNo ratings yet

- E-Way Bill: Government of IndiaDocument1 pageE-Way Bill: Government of IndiaVIVEK N KHAKHARANo ratings yet

- R & B Department Invites Online Tenders ForDocument5 pagesR & B Department Invites Online Tenders ForMAULIK RAVALNo ratings yet

- Book ERS ticket onlineDocument1 pageBook ERS ticket onlineKrishna PrasadNo ratings yet

- Iffco - Tokio General Insurance Co. LTDDocument2 pagesIffco - Tokio General Insurance Co. LTDkRiZ kRiShNaNo ratings yet

- Optimum Daily Current Affairs 1 April by Karan SinhaDocument9 pagesOptimum Daily Current Affairs 1 April by Karan Sinhaaditya vermaNo ratings yet

- Document DetailsDocument1 pageDocument DetailszaidkhanNo ratings yet

- Quotation for electrical suppliesDocument21 pagesQuotation for electrical suppliesSudarshan ShindeNo ratings yet

- User Charge Invoice5506516254Document1 pageUser Charge Invoice5506516254ganesanbhuvanesh241003No ratings yet

- DCB BANK - Statement of AccountDocument2 pagesDCB BANK - Statement of Accountzuber shaikhNo ratings yet

- Banking & Economy Question PDF 2018 (April To June) - June Updated by AffairsCloud PDFDocument62 pagesBanking & Economy Question PDF 2018 (April To June) - June Updated by AffairsCloud PDFNishok INo ratings yet

- Electronic Reservation Slip (ERS) : 6614519767 20501/tejas Express Ac 3 Tier Sleeper (3A)Document2 pagesElectronic Reservation Slip (ERS) : 6614519767 20501/tejas Express Ac 3 Tier Sleeper (3A)Mithan DebnathNo ratings yet

- Ride Details Bill Details: 30 Nov, 2020 Invoice Serial Id:DFELEBZ220523Document3 pagesRide Details Bill Details: 30 Nov, 2020 Invoice Serial Id:DFELEBZ220523Krupanka GowdaNo ratings yet

- Audit Checklist For Goods and Services TaxDocument4 pagesAudit Checklist For Goods and Services Taxmani1970% (1)

- Blocked Credits Under GST Section 17 (5) of CGST ACT, 2017Document8 pagesBlocked Credits Under GST Section 17 (5) of CGST ACT, 2017ajayNo ratings yet

- Challan 32Document1 pageChallan 32Aditya Kumar KaushikNo ratings yet