Professional Documents

Culture Documents

Concept of Cost of Capital

Uploaded by

Devyansh Gupta0 ratings0% found this document useful (0 votes)

6 views25 pagesOriginal Title

Lecture 10 Cost Of Capital

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views25 pagesConcept of Cost of Capital

Uploaded by

Devyansh GuptaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 25

Cost of Capital

Concept of Cost of Capital

Learning Outcomes

1. To find the meaning of cost of capital

2. To find the advantages of cost of capital

News TODAY

Govt extends income tax returns filing deadline

for individuals to December 31

Topic: Cost of Capital

Outcome of the lecture:

1.To understand how the companies get money

from various sources(Financing).

2.To understand the meaning of components of

cost.

3.To understand the meaning of cost of capital

which is different for every component of cost.

Cost of Capital

Definition: As it is evident from the name, cost

of capital refers to the weighted average cost of

various capital components, i.e. sources of

finance, employed by the firm such as equity,

preference or debt.

Cost of Capital

In finer terms, it is the rate of return, that must

be received by the firm on its investment

projects, to attract investors for investing capital

in the firm and to maintain its market value.

Cost of Capital

• The factors which determine the cost of capital

are:

• Source of finance

• Corresponding payment for using finance.

Cost of Capital

On raising funds from the market, from various

sources, the firm has to pay some additional

amount(Like Interest, dividend etc.) apart from

the principal itself.

The additional amount is nothing but the cost of

using the capital, i.e. cost of capital which is

either paid in lump sum or at periodic intervals.

Components of Cost of Capital

Classification of Cost of Capital

• Explicit cost of capital:

It is the cost of capital in which firm’s cash

outflow is oriented towards utilization of capital

which is evident, such as payment of interest to

the loan givers (debenture holders), etc.

Classification of Cost of Capital

• Implicit cost of capital:

It does not involve any cash outflow, but it

denotes the opportunity foregone while opting

for another alternative opportunity.

Example: Dividend or Retention for Equity

Shareholders.

Why Cost of Capital?

1.It helps in assessing firm’s new projects.

Hence, it establishes a benchmark, which must

be met out by the project.

Importance of Cost of Capital

• Evaluating the investment options:

By converting the future cash flows of the

investment avenues into present value by

discounting it various projects are evaluated.

Importance of Cost of Capital

• Capital budgeting decisions:

Long term investment decisions are called

capital budgeting decisions.Cost of capital helps

in taking such investment decisions.

Example: The promoters of a paper mill

definitely make analysis of cost and incomes

involved in the project.

Importance of Cost of Capital

Designing the optimal capital structure

Cost of capital is vital to help a firm to maximize

its value.

Firm’s value is maximum WHERE the cost of

capital is minimum.

Importance of Cost of Capital

• It can also be used to appraise the

performance of specific projects by

comparing the performance against the cost of

capital.

Importance of Cost of Capital

• It is useful in framing optimum credit policy,

i.e. at the time of deciding credit period to be

allowed to the customers or debtors, it should

be compared with the cost of allowing credit

period.

MCQ

Equity has---------cost of capital.

1.Explicit

2.Implicit

MCQ

Equity has---------cost of capital.

1.Explicit

2.Implicit

Example: There is never seen an Equity Share

with explicit rate viz. 15%Equity Share of

Rs.100 each.]

MCQ

Debenture has-----cost of capital.

1. Explicit

2. Implicit

MCQ

Debenture has-----cost of capital.

1. Explicit

2. Implicit

[12%; 5Years Redeemable Debenture of Rs.1000 ]

MCQ

Cost of capital is the -------return expected from

a unit of money.

1. Minimum

2. Maximum

3. Average

4. None of the above.

MCQ

Cost of capital is the -------return expected from

a unit of money.

1. Minimum

2. Maximum

3. Average

4. None of the above.

MCQ

When a company uses different components for

financing then the hurdle rate to be used as cost

of capital is---------?

1.Individual cost of each component

2. Weighted average cost of capital

3. Both 1 and 2

4. None of the above.

MCQ

When a company uses different components for

financing then the hurdle rate to be used as cost

of capital is---------?

1.Individual cost of each component

2. Weighted average cost of capital

3. Both 1 and 2

4. None of the above.

You might also like

- Cost of CapitalDocument55 pagesCost of CapitalSaritasaruNo ratings yet

- Chapter 8 Cost of CapitalDocument18 pagesChapter 8 Cost of CapitalKenyi Kennedy SokiriNo ratings yet

- Ms-42 em 20-21Document16 pagesMs-42 em 20-21nkNo ratings yet

- Cost of Capital NotesDocument9 pagesCost of Capital NotesSoumendra RoyNo ratings yet

- MS 42 SolutionDocument16 pagesMS 42 SolutionVimal KumarNo ratings yet

- The Concept of Cost of CapitalDocument4 pagesThe Concept of Cost of CapitalMaria TariqNo ratings yet

- FM Lesson45Document10 pagesFM Lesson45kimaniNo ratings yet

- Cost of Capital and Capital Structure TheriesDocument4 pagesCost of Capital and Capital Structure Theriessarath cmNo ratings yet

- Unit 2Document38 pagesUnit 2Anonymous 0wXXmp1No ratings yet

- Unit 2 - CFDocument74 pagesUnit 2 - CFRajat SharmaNo ratings yet

- Chapter 3Document16 pagesChapter 3ezanaNo ratings yet

- Capital Requirement, Raising Cost of Capital: Lecture FiveDocument32 pagesCapital Requirement, Raising Cost of Capital: Lecture FiveAbraham Temitope AkinnurojuNo ratings yet

- Unit 2nd Financial Management BBA 4thDocument14 pagesUnit 2nd Financial Management BBA 4thnikitagaur55No ratings yet

- Unit 2Document5 pagesUnit 2Aditya GuptaNo ratings yet

- EET455 - M5 Ktunotes - inDocument41 pagesEET455 - M5 Ktunotes - inrajkumarNo ratings yet

- Module 4 - The Cost of CapitalDocument10 pagesModule 4 - The Cost of CapitalMarjon DimafilisNo ratings yet

- Unit 2Document19 pagesUnit 2Navin DixitNo ratings yet

- Cost of CapitalDocument6 pagesCost of CapitalTesfayé HailuNo ratings yet

- Fin3 Midterm ExamDocument8 pagesFin3 Midterm ExamBryan Lluisma100% (1)

- Financial Management Unit 2Document10 pagesFinancial Management Unit 2Janardhan VNo ratings yet

- Unit 1Document36 pagesUnit 1Rishabh Gupta100% (1)

- Answers MS 42Document13 pagesAnswers MS 42SHRIYA TEWARINo ratings yet

- Lesson: 7 Cost of CapitalDocument22 pagesLesson: 7 Cost of CapitalEshaan ChadhaNo ratings yet

- Cost of Capital: Prof. V. Ramachandran Faculty-SiescomsDocument36 pagesCost of Capital: Prof. V. Ramachandran Faculty-SiescomsManthan KulkarniNo ratings yet

- Importance of Cost of CapitalDocument3 pagesImportance of Cost of CapitalmounicaNo ratings yet

- Cost of Capital-OverviewDocument8 pagesCost of Capital-OverviewEkta Saraswat VigNo ratings yet

- Definition of Cost of CapitalDocument2 pagesDefinition of Cost of Capitalmd nahidNo ratings yet

- 05 - Unit-VDocument12 pages05 - Unit-VIshan GuptaNo ratings yet

- Cost of Capital Meaning, Concept, DefinitionDocument16 pagesCost of Capital Meaning, Concept, DefinitionSahil KapoorNo ratings yet

- BITTTTDocument12 pagesBITTTTMohamed RaaziqNo ratings yet

- Financial Decision PDFDocument72 pagesFinancial Decision PDFDimple Pankaj Desai100% (1)

- CH 4 Financing DecisionsDocument72 pagesCH 4 Financing DecisionsAnkur AggarwalNo ratings yet

- FM 3Document28 pagesFM 3Sami Boz DigamoNo ratings yet

- Cost of CapitalDocument12 pagesCost of CapitalMohamed RaaziqNo ratings yet

- Financial Decision Making: MCCOM2005C04Document72 pagesFinancial Decision Making: MCCOM2005C04GLBM LEVEL 1No ratings yet

- Timothy - Chap 9Document33 pagesTimothy - Chap 9Chaeyeon Jung0% (1)

- Cost of Capital: Kevin D. AsentistaDocument53 pagesCost of Capital: Kevin D. Asentistakristel rapadaNo ratings yet

- Cost of Capital-VINAYDocument27 pagesCost of Capital-VINAYKavita SinghNo ratings yet

- Chapter 02 - Cost of CapitalDocument30 pagesChapter 02 - Cost of Capitalpasan.17No ratings yet

- Module in Financial Management - 08Document15 pagesModule in Financial Management - 08Karla Mae GammadNo ratings yet

- Financial Management: - The Concept of Finance Includes Capital, Funds, Money, and AmountDocument23 pagesFinancial Management: - The Concept of Finance Includes Capital, Funds, Money, and AmountNarendraVukkaNo ratings yet

- Cost of Capital: Vivek College of CommerceDocument31 pagesCost of Capital: Vivek College of Commercekarthika kounderNo ratings yet

- Cost of Capital-Lecture Notes 1 - Basics ConceptDocument16 pagesCost of Capital-Lecture Notes 1 - Basics Conceptಯೋಗೇಶ್ ಪಿNo ratings yet

- Cost of CapitalDocument15 pagesCost of CapitalShainaNo ratings yet

- Cost of CapitalDocument15 pagesCost of CapitalKaran JaiswalNo ratings yet

- DM On CapExp - StudentDocument24 pagesDM On CapExp - StudentrbnbalachandranNo ratings yet

- Capital StructureDocument10 pagesCapital StructureSargun KaurNo ratings yet

- Unit IVDocument48 pagesUnit IVGhar AjaNo ratings yet

- Cost of Capital - New (With WACC)Document15 pagesCost of Capital - New (With WACC)Hari chandanaNo ratings yet

- Financial Management I Sem 4Document60 pagesFinancial Management I Sem 4trashbin.dump123No ratings yet

- International Capital Burgeting AssignmentDocument18 pagesInternational Capital Burgeting AssignmentHitesh Kumar100% (1)

- CFINDocument10 pagesCFINAnuj AgarwalNo ratings yet

- BCH-503-SM11 Cost of CapitalDocument4 pagesBCH-503-SM11 Cost of Capitalsugandh bajajNo ratings yet

- Cost of Capital - MarkedDocument8 pagesCost of Capital - MarkedSundeep MogantiNo ratings yet

- FinQuiz Curriculum Note Study Session 11 Reading 36 PDFDocument7 pagesFinQuiz Curriculum Note Study Session 11 Reading 36 PDFKdot KdotNo ratings yet

- What Is Weighted Average Cost of CapitalDocument12 pagesWhat Is Weighted Average Cost of CapitalVïñü MNNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingHarshitaNo ratings yet

- Unit 3 - Scoman2Document10 pagesUnit 3 - Scoman2christian guile figueroaNo ratings yet

- 21MGH202T FM Unit IV Study MaterialsDocument19 pages21MGH202T FM Unit IV Study Materialslogashree175No ratings yet

- Lecture 6 Environment Act, 1986Document4 pagesLecture 6 Environment Act, 1986Devyansh GuptaNo ratings yet

- Scala NotesDocument71 pagesScala NotesDevyansh GuptaNo ratings yet

- Lecture 7 Ethical Issues in Human Resource ManagementDocument9 pagesLecture 7 Ethical Issues in Human Resource ManagementDevyansh GuptaNo ratings yet

- Unit 2Document13 pagesUnit 2Devyansh GuptaNo ratings yet

- CSR - A Strategic Tool For BusinessDocument19 pagesCSR - A Strategic Tool For BusinessDevyansh GuptaNo ratings yet

- Unit 1Document14 pagesUnit 1Devyansh GuptaNo ratings yet

- Unit 3Document17 pagesUnit 3Devyansh GuptaNo ratings yet

- What Is Ensemble LearningDocument4 pagesWhat Is Ensemble LearningDevyansh GuptaNo ratings yet

- Lecture 18 MGNM571Document33 pagesLecture 18 MGNM571Devyansh GuptaNo ratings yet

- Unit 5Document20 pagesUnit 5Devyansh GuptaNo ratings yet

- Indian Partnership ActDocument5 pagesIndian Partnership ActDevyansh GuptaNo ratings yet

- Lecture 16 MGNM571Document14 pagesLecture 16 MGNM571Devyansh GuptaNo ratings yet

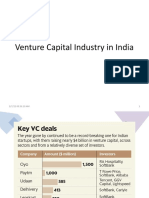

- Venture Capital Industry in IndiaDocument69 pagesVenture Capital Industry in IndiaDevyansh GuptaNo ratings yet

- Lecture 4 (Efficient Market Hypothesis)Document46 pagesLecture 4 (Efficient Market Hypothesis)Devyansh GuptaNo ratings yet

- Lecture 8.1 (Beta and CAPM)Document17 pagesLecture 8.1 (Beta and CAPM)Devyansh GuptaNo ratings yet

- Lecture 0Document33 pagesLecture 0Devyansh GuptaNo ratings yet

- Lecture 8.2 (Capm and Apt)Document30 pagesLecture 8.2 (Capm and Apt)Devyansh GuptaNo ratings yet

- Lecture 1 (Introduction To Security Analysis)Document44 pagesLecture 1 (Introduction To Security Analysis)Devyansh GuptaNo ratings yet

- Lecture 2.3 (Risk and Return)Document47 pagesLecture 2.3 (Risk and Return)Devyansh GuptaNo ratings yet

- Lecture 2.1 (Risk and Return)Document40 pagesLecture 2.1 (Risk and Return)Devyansh GuptaNo ratings yet

- Lecture (Free Cash Flow Model - DDM)Document23 pagesLecture (Free Cash Flow Model - DDM)Devyansh GuptaNo ratings yet

- Unit 2 Measures of Central Tendency: Dr. Pooja Kansra Associate Professor Mittal School of BusinessDocument49 pagesUnit 2 Measures of Central Tendency: Dr. Pooja Kansra Associate Professor Mittal School of BusinessDevyansh GuptaNo ratings yet

- Central TendencyDocument32 pagesCentral TendencyDevyansh GuptaNo ratings yet

- Lecture 2 Investment Banking - The Emerging ChallengesDocument3 pagesLecture 2 Investment Banking - The Emerging ChallengesDevyansh GuptaNo ratings yet

- QTTM509 Research Methodology-I: What It's All About?Document30 pagesQTTM509 Research Methodology-I: What It's All About?Devyansh GuptaNo ratings yet

- Buy-Backs AND De-Listings: Unit 4Document48 pagesBuy-Backs AND De-Listings: Unit 4Devyansh GuptaNo ratings yet

- Book Building: IPO Price Discovery MechanismDocument35 pagesBook Building: IPO Price Discovery MechanismDevyansh GuptaNo ratings yet

- Acc501 2nd Quiz 2012Document16 pagesAcc501 2nd Quiz 2012Devyansh GuptaNo ratings yet

- Lecture 1 Investment BankingDocument35 pagesLecture 1 Investment BankingDevyansh GuptaNo ratings yet

- Lecture 4Document28 pagesLecture 4Devyansh GuptaNo ratings yet

- 2391 6920 2 PBDocument17 pages2391 6920 2 PBMary MendezNo ratings yet

- Chapter 15 Problems, International Economics by SalvatoreDocument6 pagesChapter 15 Problems, International Economics by SalvatoreBùi Hà LinhNo ratings yet

- Quiz 1 - Attempt ReviewDocument7 pagesQuiz 1 - Attempt ReviewViky Rose EballeNo ratings yet

- Marketing ManagementDocument316 pagesMarketing ManagementCBSE UGC NET EXAMNo ratings yet

- International Capital MarketsDocument11 pagesInternational Capital MarketsAmbika JaiswalNo ratings yet

- Cost Concepts Classification BehaviorDocument46 pagesCost Concepts Classification BehaviorrhearomefranciscoNo ratings yet

- CH 01 Intercorporate Acquisitions and Investments in Other EntitiesDocument38 pagesCH 01 Intercorporate Acquisitions and Investments in Other Entitiesosggggg67% (3)

- How To Use Volume Oscillator To Boost Your ProfitsDocument15 pagesHow To Use Volume Oscillator To Boost Your ProfitsJoe D100% (2)

- HFOF Letter To Ivy ClientsDocument1 pageHFOF Letter To Ivy ClientsAbsolute ReturnNo ratings yet

- 01 Valuation ModelsDocument24 pages01 Valuation ModelsMarinaGorobeţchiNo ratings yet

- Deep IPO NationalizationDocument29 pagesDeep IPO NationalizationdsfasfdNo ratings yet

- Screener Setup - GersteinDocument86 pagesScreener Setup - Gersteinsreekesh unnikrishnanNo ratings yet

- Growth, Corporate Profitability, and Value Creation: Cyrus A. Ramezani, Luc Soenen, and Alan JungDocument12 pagesGrowth, Corporate Profitability, and Value Creation: Cyrus A. Ramezani, Luc Soenen, and Alan JungAbhishek DoshiNo ratings yet

- Procter and GambleDocument29 pagesProcter and Gamblepanchitoperez2014No ratings yet

- Chapter 11 SolutionsDocument9 pagesChapter 11 Solutionsbellohales0% (2)

- SFO 200811 - Dan Harvey ReprintDocument5 pagesSFO 200811 - Dan Harvey Reprintslait73No ratings yet

- IC Detailed Financial Projections Template 8821 UpdatedDocument27 pagesIC Detailed Financial Projections Template 8821 UpdatedRozh SammedNo ratings yet

- Why Is Balance of Payment (BOP) Vital For A CountryDocument2 pagesWhy Is Balance of Payment (BOP) Vital For A Countryshibashish PandaNo ratings yet

- Societe Generale Ghana PLC 2021 Audited Financial StatementsDocument2 pagesSociete Generale Ghana PLC 2021 Audited Financial StatementsFuaad DodooNo ratings yet

- Module 1Document27 pagesModule 1bhumiNo ratings yet

- Construction Economics and Finance - Cash Flow ManagementDocument50 pagesConstruction Economics and Finance - Cash Flow ManagementMilashuNo ratings yet

- Persistent Systems - One PagerDocument3 pagesPersistent Systems - One PagerKishor KrNo ratings yet

- Bookkeeping FinalDocument67 pagesBookkeeping FinalKatlene JoyNo ratings yet

- AnswerQuiz - Module 8Document4 pagesAnswerQuiz - Module 8Alyanna AlcantaraNo ratings yet

- Ngli Ke ToanDocument121 pagesNgli Ke ToanJF FNo ratings yet

- Accounts Project JK TyreDocument16 pagesAccounts Project JK Tyresj tjNo ratings yet

- PAAPlus3 6KJOHNDEMDocument8 pagesPAAPlus3 6KJOHNDEMMoktar Pandarat Maca-arabNo ratings yet

- NIF 2011 Financial StatermentsDocument33 pagesNIF 2011 Financial StatermentsWeAreNIFNo ratings yet

- BBA VI Sem. - International Finance - Practical ProblemsDocument16 pagesBBA VI Sem. - International Finance - Practical ProblemsdeepeshmahajanNo ratings yet

- Use The Following Information For The Next Three Questions:: Book Value Per ShareDocument6 pagesUse The Following Information For The Next Three Questions:: Book Value Per ShareYazNo ratings yet