Professional Documents

Culture Documents

Practice Financial Management

Uploaded by

William OConnor0 ratings0% found this document useful (0 votes)

17 views12 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views12 pagesPractice Financial Management

Uploaded by

William OConnorCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 12

Practice Financial Management

Buy In’s for new Dr’s and

overall Succession and

Growth Planning

Presented by Wm O’Connor, CPA Pathway Financial Mgmt Advisors LLC

Practice Financial Management

How can you sell your

practice (for $1 million) and

NOT pay taxes? With good

advanced planning!

Presented by Wm O’Connor, CPA –pathwaykc@gmail.com

Pathway Financial Mgmt Advisors LLC

Dental Succession Planning

You can setup a Defined

Benefit Pension Plan & make

LARGE contributions to your

retirement plan—tax

deductible

Presented by Wm O’Connor, CPA - pathwaykc@gmail.com

Pathway Financial Mgmt Advisors LLC

Dental Succession Planning

AND we DO NOT sell those

plans! HA. We are CPA’s. Your

advisors. We explain and

analyze– slowly & surely

Presented by Wm O’Connor, CPA- pathwaykc@gmail.com

Pathway Financial Mgmt Advisors LLC

Dental Succession Planning

What’s the key- start early. It

takes at least 5 years-new

dentist(s) buy in two+ phases,

3-6 years apart

Presented by Wm O’Connor, CPA- pathwaykc@gmail.com

Pathway Financial Mgmt Advisors LLC

Dental Succession Planning

Here’s how- “Selling” Dr. sells

40% of practice. “Buying” Dr.

obtains loan & pays “Seller”

over 5 years.

Presented by Wm O’Connor, CPA- pathwaykc@gmail.com

Pathway Financial Mgmt Advisors LLC

Dental Succession Planning

So, Selling Dr. receives cash-she or

he uses that cash to establish a

new Pension Plan & she/he puts

$140,000, per year into that DB

Pension Plan—deductibly.

Presented by Wm O’Connor, CPA- pathwaykc@gmail.com

Pathway Financial Mgmt Advisors LLC

Dental Succession Planning

Now the second stage—it’s 5

years later “Buying” Dr. has paid

off the first practice purch note &

they are ready to purchase the

remaining 60%-- how do we do

that without losing 46% to tax?

Presented by Wm O’Connor, CPA- pathwaykc@gmail.com

Pathway Financial Mgmt Advisors LLC

Dental Succession Planning

Here’s how- “selling” Dr. can terminate

their DB Pension Plan the year they sell

the final 60%. That creates a “final

funding obligation”—to put 5 years

worth of pension contrib’s into their

Plan- deductibly.

Presented by Wm O’Connor, CPA- pathwaykc@gmail.com

Pathway Financial Mgmt Advisors LLC

Dental Succession Planning

So, “Selling” dentist has a large gain on

sale of the 60% (sounds like a tax bill

coming) BUT they have a LARGE

PENSION contribution that offsets the

gain on the sale– Sale $ end up in Dr.’s

Pension Plan—where they grow tax

deferred.

Presented by Wm O’Connor, CPA- pathwaykc@gmail.com

Pathway Financial Mgmt Advisors LLC

Dental Succession Planning

Please feel free to email Bill O’Connor,

CPA at pathwaykc@gmail.com OR call us

at 816-200-2071. We are located on the

Plaza, @ www.pathwaykc.com-- we like

explaining how things work-we’ve been

doing that since 1986!

Presented by Wm O’Connor, CPA- pathwaykc@gmail.com

Pathway Financial Mgmt Advisors LLC

Buy Insurance from Chad!!!

I free poodle with every purchase

You might also like

- The Sky's The Limit Credit Repair - Greetings - $40 SaleDocument4 pagesThe Sky's The Limit Credit Repair - Greetings - $40 SaleCarolNo ratings yet

- Build Issue 1 v2Document22 pagesBuild Issue 1 v2Rich DiazNo ratings yet

- Beginner Guide To Financial PlanningDocument114 pagesBeginner Guide To Financial PlanningVikas AcharyaNo ratings yet

- Small Business Turnaround StrategiesDocument6 pagesSmall Business Turnaround StrategiesDave WestfallNo ratings yet

- All the Money You Will Ever Need: 3 Books in 1: Financial Freedom, Passive Income Ideas, High Credit Score SecretsFrom EverandAll the Money You Will Ever Need: 3 Books in 1: Financial Freedom, Passive Income Ideas, High Credit Score SecretsNo ratings yet

- Financial Coaching Business Plan TemplateDocument21 pagesFinancial Coaching Business Plan TemplatesolomonNo ratings yet

- Financial planning is key to securing your futureDocument24 pagesFinancial planning is key to securing your futurervarathanNo ratings yet

- TIH Financial Freedom EbookDocument15 pagesTIH Financial Freedom EbookRajeev Kumar PandeyNo ratings yet

- Debt Relief Program EligibilityDocument3 pagesDebt Relief Program EligibilityMildred Lucero100% (6)

- Financial Planning GodrejDocument199 pagesFinancial Planning GodrejriteshnaikNo ratings yet

- Investing For The Long RunDocument119 pagesInvesting For The Long RunSIVVA2100% (1)

- 03 03 Technical Interview Basic PDFDocument9 pages03 03 Technical Interview Basic PDFAgung Racers WeightliftingNo ratings yet

- Accounting Test TravelokaDocument8 pagesAccounting Test TravelokaGabriella CikaNo ratings yet

- FPA BrochureDocument20 pagesFPA BrochuresilkepoortmanNo ratings yet

- 2016 Outsourcer Rolodex PDFDocument68 pages2016 Outsourcer Rolodex PDFAnonymous 8BfkY0PcS100% (1)

- Joint Venture ProposalDocument4 pagesJoint Venture ProposalNickson Kerua100% (1)

- Deed of Real Estate MortgageDocument3 pagesDeed of Real Estate MortgageNielgem BejaNo ratings yet

- Pri FactoidsDocument11 pagesPri FactoidsPaul Lish CarsonNo ratings yet

- Financial Empowerment - A Step-by-Step Guide to Achieving Financial FreedomFrom EverandFinancial Empowerment - A Step-by-Step Guide to Achieving Financial FreedomNo ratings yet

- Thrifty Ideas For Turbulent Time: Financial WellnessDocument9 pagesThrifty Ideas For Turbulent Time: Financial WellnessTrainer AongNo ratings yet

- Reason You Need Financial AdvisorsDocument3 pagesReason You Need Financial AdvisorsXaomi MobiNo ratings yet

- Wage Assignment - Secure Your Financial FutureDocument20 pagesWage Assignment - Secure Your Financial Futureh68007q5No ratings yet

- Don't Forget The Final Salary Process Is A Little Longer. Needs A UK FCA Report.Document4 pagesDon't Forget The Final Salary Process Is A Little Longer. Needs A UK FCA Report.Michael McmullenNo ratings yet

- Optima Financial Solutions Wishes You A Life of AbundanceDocument16 pagesOptima Financial Solutions Wishes You A Life of AbundanceoptimavasuNo ratings yet

- It's December 31. Do You Know Where Your Money Is?: Collaborative Financial Solutions, LLCDocument4 pagesIt's December 31. Do You Know Where Your Money Is?: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- First, Make It MatterDocument24 pagesFirst, Make It MatterDinalva GomesNo ratings yet

- Dci 04-2013Document12 pagesDci 04-2013api-249217077No ratings yet

- Managerial Finance Homework HelpDocument8 pagesManagerial Finance Homework Helpcjd0cxwj100% (1)

- The Renaissance Review: Yes We Did!!!!Document9 pagesThe Renaissance Review: Yes We Did!!!!Cathy LeeNo ratings yet

- December Seminar InviteDocument2 pagesDecember Seminar InviteVictoria MoralesNo ratings yet

- Bus. Finance W3 - C4 (Answer)Document4 pagesBus. Finance W3 - C4 (Answer)Rory GdLNo ratings yet

- Come See The New Digs!: Meet Our Team !Document4 pagesCome See The New Digs!: Meet Our Team !magicvalleytaxNo ratings yet

- NO-MONEY-UPFRONT-LOC-APPLICATION-NEW-Sept-2017Document11 pagesNO-MONEY-UPFRONT-LOC-APPLICATION-NEW-Sept-2017agray43No ratings yet

- RSUs What You Need To Know 1705957055Document26 pagesRSUs What You Need To Know 1705957055aarthijayakumarNo ratings yet

- Cost ProjectDocument48 pagesCost ProjectBhavyaNo ratings yet

- First Financial Consulting Celebrates 45 Years of Real Financial AdviceDocument4 pagesFirst Financial Consulting Celebrates 45 Years of Real Financial AdvicePR.comNo ratings yet

- Finance Operations SupervisorDocument4 pagesFinance Operations SupervisorТетяна Леонідівна МешкоNo ratings yet

- The Insider May-June 2014 Energy Super NewsletterDocument7 pagesThe Insider May-June 2014 Energy Super Newsletterapi-280946911No ratings yet

- It all begins with Insights: A quick guide to maximizing the value of your businessFrom EverandIt all begins with Insights: A quick guide to maximizing the value of your businessNo ratings yet

- Pivotal Planning Autumn EditionDocument9 pagesPivotal Planning Autumn EditionAnthony WrightNo ratings yet

- What If I Want To Recruit A Key EmployeeDocument2 pagesWhat If I Want To Recruit A Key EmployeeDave SeemsNo ratings yet

- Sample Financial Plan (Planning Toolkit 5) : Prepared ForDocument49 pagesSample Financial Plan (Planning Toolkit 5) : Prepared ForPraveen SankisaNo ratings yet

- Suncorp Bank Financial PlanningDocument2 pagesSuncorp Bank Financial PlanningSuncorp-BankNo ratings yet

- Plan B Financial PlanningDocument6 pagesPlan B Financial PlanningKevin MossNo ratings yet

- 2021 Final Benefits BookDocument48 pages2021 Final Benefits BookBruna NascimentoNo ratings yet

- 1on1 Brochure - Prince - RoadmapDocument17 pages1on1 Brochure - Prince - RoadmapChris PearsonNo ratings yet

- Financial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesFrom EverandFinancial Behavior Modification Starter Guide: A Simple Guide to Managing Your FinancesRating: 3 out of 5 stars3/5 (1)

- June 2014: Top 10 Tax Breaks You'll Miss in 2014Document4 pagesJune 2014: Top 10 Tax Breaks You'll Miss in 2014Income Solutions Wealth ManagementNo ratings yet

- SRP or Self Rolling PlanDocument5 pagesSRP or Self Rolling PlanMel100% (3)

- Making More Money: Strategies for Negotiating a Higher SalaryFrom EverandMaking More Money: Strategies for Negotiating a Higher SalaryNo ratings yet

- Home Financial Consumers Learn Financial Planning BasicsDocument4 pagesHome Financial Consumers Learn Financial Planning BasicsVJ BrajdarNo ratings yet

- Ifp 1 Introduction To Financial PlanningDocument5 pagesIfp 1 Introduction To Financial PlanningSukumarNo ratings yet

- Ifp 1 Introduction To Financial Planning PDFDocument5 pagesIfp 1 Introduction To Financial Planning PDFIMS ProschoolNo ratings yet

- Paris Financial 8 Steps For Practice Startups 2017Document18 pagesParis Financial 8 Steps For Practice Startups 2017BobbyNo ratings yet

- Financial Planning IntroductionDocument28 pagesFinancial Planning IntroductionZoubida SamlalNo ratings yet

- 5 Tips For Hiring AFinancial Advisor - Script For YOUTUBE - PODCAST - Finished ProductDocument7 pages5 Tips For Hiring AFinancial Advisor - Script For YOUTUBE - PODCAST - Finished ProductMahnaz AsifNo ratings yet

- Buried in Debt - Mahmoud ArtilDocument65 pagesBuried in Debt - Mahmoud ArtilMahmoud Artil100% (1)

- Mid-Year Financial Check-InDocument7 pagesMid-Year Financial Check-InVickfor LucaniNo ratings yet

- The 401K First Aid Kit: Stop Your Portfolio Bleeding and Get Back to Financial HealthFrom EverandThe 401K First Aid Kit: Stop Your Portfolio Bleeding and Get Back to Financial HealthNo ratings yet

- Case Project FinalDocument30 pagesCase Project Finalapi-301778234No ratings yet

- Gen Math Module2Document35 pagesGen Math Module2Des SireeNo ratings yet

- ChallanFormDocument1 pageChallanFormhp agencyNo ratings yet

- Taxation of Individuals 2018 Edition 9th Edition Spilker Test BankDocument61 pagesTaxation of Individuals 2018 Edition 9th Edition Spilker Test Bankanthonywilliamsfdbjwekgqm100% (27)

- Accounts Subsidiary WorksheetDocument9 pagesAccounts Subsidiary WorksheettanishaNo ratings yet

- Agreement. MotorcycleDocument2 pagesAgreement. MotorcycleLei SomodioNo ratings yet

- Common Bankruptcy Questions and AnswersDocument1 pageCommon Bankruptcy Questions and AnswersTâm Anh MạcNo ratings yet

- E0023 - Home Loans - HDFC BankDocument79 pagesE0023 - Home Loans - HDFC BankwebstdsnrNo ratings yet

- Engineering Economics Lecture 3 Time Value of MoneyDocument44 pagesEngineering Economics Lecture 3 Time Value of MoneyNavinPaudelNo ratings yet

- Banco Filipino vs. CADocument1 pageBanco Filipino vs. CAElmer Dela CruzNo ratings yet

- TraveleenDocument5 pagesTraveleenshahrukhNo ratings yet

- Indostar Capital Finance Limited: Repayment ScheduleDocument1 pageIndostar Capital Finance Limited: Repayment ScheduleSumitSinghNo ratings yet

- Authority To InvestDocument3 pagesAuthority To InvestThemba MaviNo ratings yet

- BR OA 0001.0518 Things To Consider Before You Transfer and DC Form FDocument4 pagesBR OA 0001.0518 Things To Consider Before You Transfer and DC Form FbucalaeteclaudialoredanaNo ratings yet

- TC-06 RespondentDocument34 pagesTC-06 RespondentDisha BafnaNo ratings yet

- Cash Book 2023Document4 pagesCash Book 2023barangaysecretary18No ratings yet

- 1 LicDocument1 page1 LicAshish BatraNo ratings yet

- Amrik 21 22.Document2 pagesAmrik 21 22.MoghAKaranNo ratings yet

- 2022 Hari Raya Bonus ExtendedDocument1 page2022 Hari Raya Bonus ExtendedZahrul affendy JamaludinNo ratings yet

- Suraj CIBIL ReportDocument335 pagesSuraj CIBIL Reportblinkfinance7No ratings yet

- Statement of Axis Account No:921010029361795 For The Period (From: 30-12-2022 To: 29-03-2023)Document2 pagesStatement of Axis Account No:921010029361795 For The Period (From: 30-12-2022 To: 29-03-2023)WONDERLAND CLEARANCENo ratings yet

- Naveen 2Document2 pagesNaveen 2Ubfinancial ServicesNo ratings yet

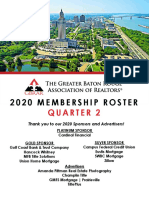

- Gbrar Roster Q2 20201Document101 pagesGbrar Roster Q2 20201brightNo ratings yet

- Swiss Cottage 2023 Prelim P1 AnswersDocument5 pagesSwiss Cottage 2023 Prelim P1 Answersvikalp.singh.sengarNo ratings yet

- Banking Law 2Document18 pagesBanking Law 2ShiyaNo ratings yet

- Interpreting Nominal & Effective Interest RatesDocument3 pagesInterpreting Nominal & Effective Interest RatesRon Andi RamosNo ratings yet

- Module - Final Term Lesson 2-3 StudentDocument16 pagesModule - Final Term Lesson 2-3 StudentGieselle kate AbadNo ratings yet

- LU10 Mathematics of Finance IIDocument27 pagesLU10 Mathematics of Finance IICJNo ratings yet

- Marathon 1 - Time Value of MoneyDocument116 pagesMarathon 1 - Time Value of Moneypriyanshusingh.inboxNo ratings yet