Professional Documents

Culture Documents

Function of Financial Markets

Function of Financial Markets

Uploaded by

Bretana joan0 ratings0% found this document useful (0 votes)

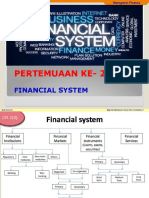

3 views6 pagesThe document discusses the functions and classifications of financial markets. It describes three main functions: 1) allowing transfers of funds from those without investment opportunities to those with them, 2) improving economic efficiency, and 3) transferring funds over different periods of one's life. It then covers different classifications of financial markets including by type of financial instrument (debt vs equity), primary vs secondary markets, organization of secondary markets (exchanges vs over-the-counter), and maturity (money market vs capital market).

Original Description:

Original Title

chap_2

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses the functions and classifications of financial markets. It describes three main functions: 1) allowing transfers of funds from those without investment opportunities to those with them, 2) improving economic efficiency, and 3) transferring funds over different periods of one's life. It then covers different classifications of financial markets including by type of financial instrument (debt vs equity), primary vs secondary markets, organization of secondary markets (exchanges vs over-the-counter), and maturity (money market vs capital market).

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views6 pagesFunction of Financial Markets

Function of Financial Markets

Uploaded by

Bretana joanThe document discusses the functions and classifications of financial markets. It describes three main functions: 1) allowing transfers of funds from those without investment opportunities to those with them, 2) improving economic efficiency, and 3) transferring funds over different periods of one's life. It then covers different classifications of financial markets including by type of financial instrument (debt vs equity), primary vs secondary markets, organization of secondary markets (exchanges vs over-the-counter), and maturity (money market vs capital market).

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 6

Function of Financial Markets

1. Allows transfers of funds from

person or business without investment

opportunities to one who has them

2.Improves economic efficiency

3.Transfer funds over life horizon

© 2004 Pearson Addison-Wesley. All rights reserved 2-1

Direct and Indirect Finance

• Direct finance: lenders hold direct claims on

borrowers’ assets or future income.

• Indirect finance: Lenders hold claims on financial

intermediary, which in turn hold claims on

borrowers. (q)

© 2004 Pearson Addison-Wesley. All rights reserved 2-2

Classifications of Financial Markets I

By Financial Instruments

1. Debt Markets

Short-term (maturity < 1 year)

Long-term (maturity > 10 year)

2. Equity Markets

Common stocks (owner a residual claimant)

Securities are assets for holders, but liabilities for issuers. (q)

The value of debt instruments was $20 trillion in 2002 while

the value of equity was $11 trillion.

© 2004 Pearson Addison-Wesley. All rights reserved 2-3

Classifications of Financial Markets II

• 1. Primary Market (often behind closed doors)

New security issues sold to initial buyers

• 2. Secondary Market

Securities previously issued are bought and sold

• Investment Bank.

• Role of Brokers and Dealers. (q)

• Liquidity and Valuation Provided by the

Secondary Market.

© 2004 Pearson Addison-Wesley. All rights reserved 2-4

Classifications of Financial Markets III

By Organization of Secondary Market

• 1. Exchanges

Trades conducted in central locations (NYSE,ASE)

• 2. Over-the-Counter (OTC) Markets

Dealers at different locations buy and sell

• U.S. Gov’t Bond Market Organized as an OTC

market with 40 or so dealers.

© 2004 Pearson Addison-Wesley. All rights reserved 2-5

Classifications of Financial Markets IV

By Maturity

1. Money Market (< 1 year debt instruments)

2. Capital Market (longer term debt and equity)

.

© 2004 Pearson Addison-Wesley. All rights reserved 2-6

You might also like

- Fmi 2Document41 pagesFmi 2Lebbe PuthaNo ratings yet

- Zohra 69 4325 1 M02 MISH1520 06 PPW C02Document54 pagesZohra 69 4325 1 M02 MISH1520 06 PPW C02Aadil Hassan ShaikhNo ratings yet

- 8513 PresentationDocument14 pages8513 PresentationNoaman AkbarNo ratings yet

- Mishkin PPT Ch02Document17 pagesMishkin PPT Ch02atulkirar100% (1)

- Overview of The Financial System: All Rights ReservedDocument44 pagesOverview of The Financial System: All Rights ReservedAfaq AhmedNo ratings yet

- CH - 02 Overview of The Financial SystemDocument35 pagesCH - 02 Overview of The Financial SystemmahadiparvezNo ratings yet

- Chapter 2 - Overview of Financial System (Autosaved)Document56 pagesChapter 2 - Overview of Financial System (Autosaved)michellebaileylindsaNo ratings yet

- Function of Financial MarketsDocument50 pagesFunction of Financial Marketsshahidul0No ratings yet

- Chapter 2 NotesDocument30 pagesChapter 2 NotesMaathir Al ShukailiNo ratings yet

- Banking Chapter 1Document7 pagesBanking Chapter 1Shasharu Fei-fei LimNo ratings yet

- Lecture 2Document33 pagesLecture 2Nursyahidah SafwanaNo ratings yet

- 2 Overview of The Financial SystemDocument36 pages2 Overview of The Financial Systemhấu.No ratings yet

- Chapter-2-Financial Assets & Financial TransactionsDocument33 pagesChapter-2-Financial Assets & Financial TransactionsImran KhanNo ratings yet

- Course TitleDocument66 pagesCourse TitleKassahunNo ratings yet

- Chapter 2Document116 pagesChapter 2Jaja SutejaNo ratings yet

- Financial EconomicsDocument159 pagesFinancial EconomicsLakachew GetasewNo ratings yet

- Lec 2 FM NumlDocument22 pagesLec 2 FM Numlpal 8311No ratings yet

- Financial Markets and Institutions: Required Reading: Mishkin, Chapter 1 andDocument43 pagesFinancial Markets and Institutions: Required Reading: Mishkin, Chapter 1 andrudraarjunNo ratings yet

- Lecture No. 1 Introduction To Securities Markets / Financial MarketsDocument5 pagesLecture No. 1 Introduction To Securities Markets / Financial MarketsNk WooNo ratings yet

- Unit # 1 Introduction To Financial InstitutionsDocument4 pagesUnit # 1 Introduction To Financial InstitutionsZaheer Ahmed SwatiNo ratings yet

- BST CH 10Document21 pagesBST CH 10Dilip KumarNo ratings yet

- Ch01-A Financial SystemDocument19 pagesCh01-A Financial SystemHồ ThảoNo ratings yet

- Financial Markets and InstrumentDocument30 pagesFinancial Markets and InstrumentAbdul Fattaah Bakhsh 1837065No ratings yet

- CH 2 Financial Market EnvironmentDocument17 pagesCH 2 Financial Market EnvironmentAkash KarNo ratings yet

- An Overview of The Financial System: © 2005 Pearson Education Canada IncDocument12 pagesAn Overview of The Financial System: © 2005 Pearson Education Canada IncYasser AlmishalNo ratings yet

- An Overview of The Financial System: © 2005 Pearson Education Canada IncDocument12 pagesAn Overview of The Financial System: © 2005 Pearson Education Canada IncCarolina Granger MarinNo ratings yet

- Overview of The Financial SystemDocument61 pagesOverview of The Financial SystemIndira PriyadarsiniNo ratings yet

- Indian Financial System SyllabusDocument32 pagesIndian Financial System SyllabusAkashNo ratings yet

- Lecture 1 - Basics of Financial MarketsDocument46 pagesLecture 1 - Basics of Financial MarketsNitesh BhaktaNo ratings yet

- 3 - Unit I - Introduction To Financial Systems and Financial MarketDocument32 pages3 - Unit I - Introduction To Financial Systems and Financial MarketAmparo ReyesNo ratings yet

- Chapter # 2: Overview of The Financial SystemDocument16 pagesChapter # 2: Overview of The Financial SystemMuzammil_ims2507No ratings yet

- Financial Markets and InstitutionsDocument31 pagesFinancial Markets and InstitutionsBUBOYNo ratings yet

- 12 Business Studies CH 10 Financial MarketsDocument11 pages12 Business Studies CH 10 Financial MarketsRiyasat khanNo ratings yet

- Chapter 8Document18 pagesChapter 8Marie Sheaneth BalitangNo ratings yet

- 3 - Unit I - Introduction To Financial Systems and Financial MarketDocument41 pages3 - Unit I - Introduction To Financial Systems and Financial MarketAlexis Ann Angan AnganNo ratings yet

- Element OneDocument17 pagesElement OneSena MulugetaNo ratings yet

- Financial Markets and Institutions: ReadingsDocument10 pagesFinancial Markets and Institutions: ReadingsQuang NguyenNo ratings yet

- CH 2 An OverviewDocument12 pagesCH 2 An Overviewxiexie itsmeNo ratings yet

- CH 02Document12 pagesCH 02Kusumanchi AshishNo ratings yet

- Financial Institutions Chapter-4Document64 pagesFinancial Institutions Chapter-4Eyuel NebiyuNo ratings yet

- Financial Markets and InstitutionsDocument12 pagesFinancial Markets and InstitutionsThox SicNo ratings yet

- Financial EconomicsDocument19 pagesFinancial Economicsseifeldin374No ratings yet

- Class 12 Businessstudy Notes Chapter 10 Studyguide360Document28 pagesClass 12 Businessstudy Notes Chapter 10 Studyguide360sandipNo ratings yet

- Finance Vs Financial SystemDocument61 pagesFinance Vs Financial Systempriyasumit100% (1)

- Financial Market ReviewerDocument9 pagesFinancial Market ReviewerBryan NograNo ratings yet

- 12 Business Studies Notes CH10 Financial MarketsDocument11 pages12 Business Studies Notes CH10 Financial MarketsJilThesiyaNo ratings yet

- Introduction To Financial MarketDocument30 pagesIntroduction To Financial Marketmaria evangelistaNo ratings yet

- Overview of The Financial SystemDocument46 pagesOverview of The Financial SystemAhmad Rahhal100% (1)

- Unit Saving and Investment Process Role O F Financial SystemDocument65 pagesUnit Saving and Investment Process Role O F Financial SystemMisbah JahanNo ratings yet

- Financial MarketDocument7 pagesFinancial MarketDavid DavidNo ratings yet

- Introduction To Financial MarketsDocument18 pagesIntroduction To Financial MarketsMostafa ElgendyNo ratings yet

- Chapter 5 Acctg235Document21 pagesChapter 5 Acctg235Ronnel Villaceran SaysonNo ratings yet

- NAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsDocument2 pagesNAME: Jimenez, Ross John C. Year-Course-Section: 3-BSMA-A: InstrumentsRoss John JimenezNo ratings yet

- 1 Lesson 2 Financial Institutions, Instrument and MarketDocument20 pages1 Lesson 2 Financial Institutions, Instrument and MarketRoi Vincent MontenegroNo ratings yet

- FINMARDocument28 pagesFINMARrou ziaNo ratings yet

- Chap. 2. Financial MarketsDocument40 pagesChap. 2. Financial MarketsMichaelAngeloBattungNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- InvestmentDocument42 pagesInvestmentBretana joanNo ratings yet

- Amtg 122 Midterm Exam Bsaet 1aDocument6 pagesAmtg 122 Midterm Exam Bsaet 1aBretana joanNo ratings yet

- Integrating Exponential FunctionsDocument7 pagesIntegrating Exponential FunctionsBretana joanNo ratings yet

- Deformation Problems 1Document1 pageDeformation Problems 1Bretana joanNo ratings yet

- Antidifferentiation by SubstitutionDocument14 pagesAntidifferentiation by SubstitutionBretana joanNo ratings yet

- Industry and Environment Analysis Business Operation IdenDocument22 pagesIndustry and Environment Analysis Business Operation IdenBretana joanNo ratings yet

- Integral 1Document31 pagesIntegral 1Bretana joanNo ratings yet

- The Squeeze Theorem: X A X A X ADocument7 pagesThe Squeeze Theorem: X A X A X ABretana joanNo ratings yet

- Chapter 03Document16 pagesChapter 03Bretana joanNo ratings yet

- Sampling DistributionsDocument92 pagesSampling DistributionsBretana joanNo ratings yet

- Automotive Sales Energy Generation and Storage Property, Plan and EquipmentDocument30 pagesAutomotive Sales Energy Generation and Storage Property, Plan and EquipmentBretana joan0% (1)

- Mechanics of Materials: Problem 1Document2 pagesMechanics of Materials: Problem 1Bretana joanNo ratings yet

- Unit 10Document52 pagesUnit 10Bretana joanNo ratings yet

- Integral 1Document31 pagesIntegral 1Bretana joanNo ratings yet

- Anti DerivativesDocument15 pagesAnti DerivativesBretana joanNo ratings yet

- Electric Charge and Coulomb's LawDocument27 pagesElectric Charge and Coulomb's LawBretana joanNo ratings yet

- Applied Economics Basic Economic Problems and The Philippine Socio - Economic Development in The 21 CenturyDocument33 pagesApplied Economics Basic Economic Problems and The Philippine Socio - Economic Development in The 21 CenturyBretana joanNo ratings yet