Professional Documents

Culture Documents

Inrtoduction To Cost Accounting - Md. Monowar Uddin Talukdar

Uploaded by

Md. Monowar Uddin Talukdar0 ratings0% found this document useful (0 votes)

6 views7 pagesInrtoduction to Cost Accounting_Md. Monowar Uddin Talukdar

Original Title

Inrtoduction to Cost Accounting_Md. Monowar Uddin Talukdar

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInrtoduction to Cost Accounting_Md. Monowar Uddin Talukdar

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views7 pagesInrtoduction To Cost Accounting - Md. Monowar Uddin Talukdar

Uploaded by

Md. Monowar Uddin TalukdarInrtoduction to Cost Accounting_Md. Monowar Uddin Talukdar

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 7

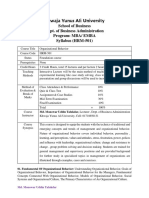

Cost Accounting

Md. Monowar Uddin Talukdar

Lecturer

Department of Business Administration

Khwaja Yunus Ali University

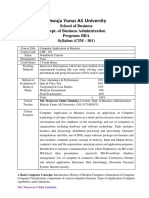

Cost Accounting:

• Cost accounting is a quantitative method that accumulates , classifies,

summarizes and interprets financial and non-financial information for

three major purposes, viz.

• Ascertainment of cost of a product or service;

• Operational planning and control; and

• Decision making.

Types of costs:

• Historical cost

• Estimated cost

• Standard cost

• Total cost

• Marginal cost

• Average cost

Types of costs:

• Marginal cost

• Differential cost

• Replacement cost

• Opportunity costs

• Imputed costs

• Sunk costs

Types of costs:

• Discretionary costs

• Controllable costs

• Relevant costs

• Policy costs

• Locked in costs

Cost and Expenses:

Function of an Organisation:

Cost Accountant

• Research & • Design • Production • Marketing • Customer

Development service

Mainstream

Upstream Activities Downstream activities

Activities

You might also like

- CVP Relationship - Md. Monowar Uddin TalukdarDocument60 pagesCVP Relationship - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- Khwaja Yunus Ali University: School of Business Dept. of Business Administration Program: BBA Syllabus (BUS-302)Document2 pagesKhwaja Yunus Ali University: School of Business Dept. of Business Administration Program: BBA Syllabus (BUS-302)Md. Monowar Uddin TalukdarNo ratings yet

- Material Cost Management or Cost Control of Material - Md. Monowar Uddin TalukdarDocument28 pagesMaterial Cost Management or Cost Control of Material - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- Syllabus - Organisational Behavior - Md. Monowar Uddin TalukdarDocument2 pagesSyllabus - Organisational Behavior - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- 103 MCQ Statistics Question - Md. Monowar Uddin TalukdarDocument17 pages103 MCQ Statistics Question - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- Chapter-07 (Regression Analysis) - Md. Monowar Uddin TalukdarDocument31 pagesChapter-07 (Regression Analysis) - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- Khwaja Yunus Ali University: School of Business Dept. of Business Administration Program: MBA/ EMBA Syllabus (BUS-541)Document2 pagesKhwaja Yunus Ali University: School of Business Dept. of Business Administration Program: MBA/ EMBA Syllabus (BUS-541)Md. Monowar Uddin TalukdarNo ratings yet

- Syllabus Computer Application in Business - Md. Monowar Uddin TalukdarDocument2 pagesSyllabus Computer Application in Business - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- Syllabus - Product and Brand Management - Md. Monowar Uddin TalukdarDocument3 pagesSyllabus - Product and Brand Management - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- Chapter-03 (Presentation of Statistical Data) - Md. Monowar Uddin TalukdarDocument109 pagesChapter-03 (Presentation of Statistical Data) - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- ACT 303 Auditing and TaxationDocument2 pagesACT 303 Auditing and TaxationMd. Monowar Uddin TalukdarNo ratings yet

- OBE Cost and Management Accounting - Md. Monowar Uddin TalukdarDocument9 pagesOBE Cost and Management Accounting - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- Chapter-1 (Introduction To Statistics) - Md. Monowar Uddin TalukdarDocument24 pagesChapter-1 (Introduction To Statistics) - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- OBE Computer Application in Business - Md. Monowar Uddin TalukdarDocument9 pagesOBE Computer Application in Business - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- ACT 303 Auditing and TaxationDocument3 pagesACT 303 Auditing and TaxationMd. Monowar Uddin TalukdarNo ratings yet

- OBE Business Research Methods - Md. Monowar Uddin TalukdarDocument8 pagesOBE Business Research Methods - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- Principles of Auditing and Taxation (Session Plan) - Spring (April To October) 2019 - LandscapeDocument7 pagesPrinciples of Auditing and Taxation (Session Plan) - Spring (April To October) 2019 - LandscapeMd. Monowar Uddin TalukdarNo ratings yet

- Auditing - Chapter - 10 (Audit Evidence and Audit Procedures) - Md. Monowar Uddin TalukdarDocument15 pagesAuditing - Chapter - 10 (Audit Evidence and Audit Procedures) - Md. Monowar Uddin TalukdarMd. Monowar Uddin TalukdarNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)