Professional Documents

Culture Documents

Business Implementation 8

Uploaded by

claire0 ratings0% found this document useful (0 votes)

96 views50 pagesThe document provides guidance on properly implementing a business plan through several key steps:

1. Set clear and realistic objectives for the business.

2. Define specific tasks needed to achieve each objective and assign responsibilities.

3. Establish a timeline to complete all tasks.

4. Regularly monitor progress on tasks and objectives, making adjustments when needed.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides guidance on properly implementing a business plan through several key steps:

1. Set clear and realistic objectives for the business.

2. Define specific tasks needed to achieve each objective and assign responsibilities.

3. Establish a timeline to complete all tasks.

4. Regularly monitor progress on tasks and objectives, making adjustments when needed.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

96 views50 pagesBusiness Implementation 8

Uploaded by

claireThe document provides guidance on properly implementing a business plan through several key steps:

1. Set clear and realistic objectives for the business.

2. Define specific tasks needed to achieve each objective and assign responsibilities.

3. Establish a timeline to complete all tasks.

4. Regularly monitor progress on tasks and objectives, making adjustments when needed.

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 50

Business Implementation

Directions: Read the statements carefully.

Write TRUE if the statement is

correct and FALSE if the statement is wrong.

• 1. Record keeping can be both physical and electronics.

• ______ 2. Record keeping can measure the profit and

performance of the

• enterprise.

• ______ 3. Bookkeeping is only important to the accountant.

• ______ 4. Professional advice is not needed during the

business operation.

• ______ 5. Professional advice is necessary before starting

the business.

• ______ 6. Records are sources of documents.

• 7. Tasks before starting the business should have a time

• allotment.

• ______ 8. The objective of the businessman should be clear.

• ______ 9. Record keeping is beneficial to the owner.

• ______ 10.Record keeping is not necessary in business

operation.

• ______ 11.You cannot start your business without a consultant.

• ______ 12.Employers are the only one to pay contribution at

the Social

• Security System (SSS).

• 13.You go to the Bureau of Internal Revenue when

you get Tax

• Identification Number (TIN)

• ______ 14.The office to visit when registering your

solely owned business

• is Securities and Exchange Commission (SEC).

• ______ 15.You go to the office of the Department

of Industry (DTI) if you

• will register your corporation business.

• Whether a business is a start-up or already established,

business

• implementation becomes the responsibility of all the

employees.

• Implementation is the process of executing a plan or policy so

that a concept

• becomes a reality. To implement a plan properly, managers

should

• communicate clear goals and expectations, and supply

employees with the

• resources needed to help the company achieve its goals.

• Direction: What are the services offered from the following

offices below?

• Write your answer in your answer sheet.

• 1. Department of Trade and Industry

(DTI)_____________________

• 2. Securities and Exchange Commission

(SEC)_________________

• 3. Bureau of Internal Revenue

(BIR)____________________________

• 4. Mayor’s Office____________________________________

• 5. Social Security System

(SSS)________________________________

• 6.

Philhealth_____________________________

_____________________

• 7. Pag-ibig Fund_______________

How to implement a business plan

• Writing a business plan is actually quite a

daunting prospect. Most

• start-ups do not know where they will be in

one month’s time, let alone five

• years. Many business plans are unrealistic, as

people dream of setting up the

• next “unicorn”.

• The concept of having a solid business that

simply makes money and is

• sustainable seems to be lost. However, even

the most realistic well-thoughtout business

plan is just a stack of paper if it isn’t

implemented. So how do

• you implement a business plan?

Your business plan has to be realistic

• First and foremost you have to go back to the

beginning. Is your business

• plan realistic and does it have clear goals,

objectives and aims that suit your

• aspirations? Do not get sucked into following the

mass opinion of what your

• plan should be like. Although the list below is not

exhaustive, your business

• plan should contain a clear outline of the following:

• Business proposition – What is your product/service? Who

are your clients?

• Who is your competition? How are you going to sell your

product or service?

• • Management team – Who is your management team –

directors, key

• personnel and any strategic partners and alliances you may

have?

• • Marketing – How are you going to promote (marketing,

including market

• research, and pricing) your product or service?

• Staff – Who do you need to employ and what is your organizational

• structure?

• • Operations – More information about your office premises, and

• infrastructure needed, such as IT, website, telecoms, and similar.

• • Infrastructure – What is your trading entity, insurance needed,

lawyers and

• accountants you will be using?

• • Finances – More information about your profit and loss forecasts,

cash flow,

• finance needed, and investment opportunities.

• Set out your objectives

• Once you have your business plan you should set out

your objectives,

• for example, in the recruitment industry, some of

your objectives could

• include the following:

• • Secure your first deal within two months of trading.

• • Make one business deal every month from there on

for the first year.

• Set tasks to reach your objectives

• Once you have set out your objectives,

consider what tasks need to be

• completed so you can achieve these. Assign a

person who is responsible for

• each step so that roles are clearly defined and

there is accountability in

• completing the tasks. Avoid micromanaging

people with detailed explanations

• of how to complete each task.

• Some generic examples of this could be:

• • Setting up an established company – You

• • Finding an office – Office manager

• • Setting up internet, phones and computers – Office manager

• • Marketing collateral - Marketing manager

• • Recruitment – HR manager Securing new clients and

business - Business

• development manager

• • Opening company bank account – You

• • Social media management – Marketing manager

• Time allocation

• Each task should be paired with an appropriate time frame for

• completion. You should be aggressive, but reasonable with your

time

• allocation in order to ensure, not just completion but

competent work as well.

• For assistance in framing this timescale, create your own Gantt

chart – a

• helpful tool that shows how long it will take to complete

different tasks and in

• what order the tasks should be finished.

• Progress and review

• You or a member of your management team needs to be in charge

of

• monitoring each task’s progress and the completion percentage of

each

• objective. When delays occur, try to get to the root of the problem.

Did the

• person responsible drop the ball? Did he or she have too many

responsibilities

• to handle? Did a third party, such as a supplier or the bank, fail to

hold up

• its end of a deal?

• While the above steps may seem like overkill, the

early days of a startup are critically important –

it’s a time when good management patterns are

• set and also probably a lean era when revenue

has yet to start rolling in.

• The more efficiently you start implementing your

business plan, the more

• likely it is that you will survive this early period.

• Keep a tab on your finances

• Keep reviewing your finances. Are you hitting your

targets? If not, why

• not? Implement changes to tackle this. Have a regular

review with your

• accountant to manage income, costs and any tax

liabilities. It is so important

• to keep disciplined, focused and motivated by cash flow,

even more so in the

• early stages of your business.

• Join a trade association or networking group

• Business plans are always dynamic. Make sure you join a

networking

• group so you can keep up to date with on the ground

market knowledge,

• connections, and legal and financial updates. You may

need to react and

• change accordingly. Don’t get totally blinkered into your

business plan, you

• always have to see what is going on around you.

Guidelines for successful business plan

implementation:

• 1. Objectives- the entrepreneur should have a

clear idea on what is his

• purpose of putting up his enterprise.

• 2. Tasks- this means that the entrepreneur

must know what the tasks are he

• has to perform in order that his objectives will

be realized.

• 3. Time allocation- This means that the

entrepreneur should have a

• timetable or a schedule to follow every task, so

that it will be accomplish

• on time and realize his objective.

• 4. Progress- This means that the entrepreneur

should monitor the

• development of the tasks and the

accomplishment of the objective.

• In Operating a business, the entrepreneur

should first consult professional

• for advices, like accountants or consultants

from small enterprises. In your

• case, you can consult your teacher in

entrepreneurship or anyone you think

• that could help you.

The following are the basic requirements to

start a business in the Philippines:

• Securities and Exchange Commission (SEC) Registration -

for partnership

• or Corporation. https://www.sec.gov.ph

• Department of Trade and Industry (DTI) Registration - for

your business

• trade name.Department of Trade and Industry

Philippines www1.dti.gov.ph

• Mayor’s Business Permit - for getting the license to

operate in the city or

• municipality and payment of your local business taxes

• Bureau of Internal Revenue (BIR) Registration - for getting TIN,

official

• receipts and invoices, registering your books of accounts and paying

your

• national Internal revenue taxes. Bureau of Internal Revenue |

Official Gazette

• of the Republic ...www.officialgazette.gov.ph

• SSS, PhilHealth, and Pag-Ibig Fund registration - for registering

yourself

• or company as an employer and for remitting your employees’

contribution

• together with your employer’s share.

• Other steps to follow before operating a

Business are as follows:

• 1. Set up an accounting system or hire an

accountant. Knowing how the

• business is doing financially is important for

planning and survival.

• 2. Advertise the business. No one will buy the

products or services if

• customers do not know that the company

exists. You can make use of the

• social media.

• 3. Secure insurance for the business. Liability

insurance protects the

• business in the event of litigation. Consider life

and disability insurance,

• health insurance and fire insurance when you

are leasing an office or

• storefront.

• Keeping Business Records

• Good record keeping can help protect the business, measure the

performance

• and maximize profit.

• Records are the source documents, both physical and electronic,

that specify

• transaction dates and amounts, legal agreements and private

customer and

• business details.

• Developing system to log, store and dispose of records can benefit

the

• business. A systematic recording allows you to;

• A. Plan and work more efficiently

• B. Meet legal and tax requirements

• C. Measure profit and performance

• D. Protect your rights, and

• E. Manage potential risks

• Proper business record keeping provides the

business a real advantage

• over the competition in different ways.

• 1. It helps you to manage your accounts, interests, taxes

and working

• costs effectively.

• 2. Tells about cash in hand

• 3. Act as resource for new strategies.

• 4. Helps in finding solutions for business issues.

• 5. Tells about the customer service and employee

efficiency.

• 6. Helps in monitoring company growth rate and profit.

• 7. How your business performs against your competitors.

• 8. Tells about hidden and unexpected costs.

• 9. And most of all it is the most resourceful

adviser whenever your

• business is in serious trouble.

• Directions: Do the activity below. Write your

answer in a 1 whole sheet.

• Look for the nearest store in your place or a

neighbor that is engage in

• business that is operating for more than a year

now. Ask how they started

• their business and how it is being managed.

• Directions: Make a short/mini Business plan

by filling up the table, make a

• vision of your business, note this is just a

plan/forecasting base on your ideal

• business.

MY BUSINESS PLAN

• Business proposition

• Management team

• Marketing

• Staff

• Operations

• Infrastructure

• Finances

• Directions: Now that you are finished

accomplishing the module, let us check

• what you have learned. Choose the letter of

the correct answer and write in in

• your answer sheet.

• 1. Which office will you go to register your

single owned business?

• A. SEC C. BIR

• B. DTI D. Mayor’s Office

• 2. Which office do you visit to register

partnership or corporation business?

• A. SEC C. BIR

• B. DTI D. Mayor’s Office

• 3. To secure Tax Identification Number (TIN), which

office will you go?

• A. SEC C. BIR

• B. DTI D. Mayor’s Office

• 4. SSS, Philhealth and Pag-ibig fund contributions

is made by _________.

• A. Employees only C. Both Employees and

Employers

• B. Employers only D. None of the choices

• 5. Which of the following is not a step to

follow before operating a business?

• A. Register your business

• B. Set up accounting system

• C. Advertise the business using Facebook

• D. Selling the product

• 6. Which of the following is true?

• A. Good record keeping is not important to the

business owner.

• B. Good record keeping is important only to the

accountant.

• C. Good record keeping gives benefits to the

enterprise.

• D. Good record keeping gives no importance at

all.

• 7. Which of the following is NOT a benefit to

the enterprise?

• A. Plan and work more efficiently.

• B. Meet legal and tax requirements.

• C. Can check if the business is doing well.

• D. It cannot protect the rights of the owner.

• 8. The objectives of the entrepreneur should be

_______________.

• A. Specific and clear B. Specific and long term

• C. Short and blurred D. Long and not specific

• 9. The tasks before operating the business must be

_____________.

• A. Specified to be accomplished by the owner alone

• B. In detail so that the owner will know what to do

• C. Kept by the owner for future reference

• D. None of the choices

• 10. The tasks to be accomplished before operating the business

should

• have:

• A. Design C. Time allotment

• B. Decoration D. Measurement

• 11. Which of the statements is true?

• A. Before starting a business, the entrepreneur may not consult

a

• professional for advice.

• B. Before starting a business, the entrepreneur should consult a

• professional for advice.

• C. Before starting a business, the entrepreneur

must start selling

• when there are available buyers.

• D. None of the choices

• 12. To register your Business Trade name is

done in the office of?

• A. SEC C. Mayor’s Office

• B. DTI D. Philhealth Office

• 13. The sources of documents are called?

• A. Income statement B. Balance sheet

• C. Record D. Record Keeping

• 14. Which of the following is not a benefit of record

keeping?

• A. It will not help in managing potential risks.

• B. It will measure profit and performance.

• C. It will protect the rights of the owner.

• D. It will not let you know how much you are earning.

• 15. Which of the following statements is true?

• A. Professional advice is only needed before

starting the business.

• B. Professional advice is needed all throughout

the life of the

• business.

• C. Professional advice is made only by consultants.

• D. Professional advice is only a waste of money.

• “Proper business record keeping provides the

business a real advantage over

• the competition in different ways.”

• Give some thoughts of the above statement.

You might also like

- You Need A Business PlanDocument31 pagesYou Need A Business Planabidemi kolawoleNo ratings yet

- Writing A Business Plan: Pinky SharmaDocument34 pagesWriting A Business Plan: Pinky SharmavikramNo ratings yet

- Entrep: Business PlanningDocument38 pagesEntrep: Business PlanningJeremiah DumalagNo ratings yet

- Quarter 2 - Module 9Document11 pagesQuarter 2 - Module 9Hanna DlsmNo ratings yet

- Enter PreDocument21 pagesEnter Prezille HumaNo ratings yet

- Business Plan ImplementationDocument33 pagesBusiness Plan ImplementationAnya EleginoNo ratings yet

- Chapter 5 The Business PlanDocument21 pagesChapter 5 The Business PlanEileen Enriquez100% (1)

- Corporate RegistrationDocument19 pagesCorporate Registrationsheisbonjing PHNo ratings yet

- ENTREPRENEURSHIP 12 Q2 M9 Business ImplementationDocument12 pagesENTREPRENEURSHIP 12 Q2 M9 Business ImplementationMyleen CastillejoNo ratings yet

- Enterprenuship SlidesDocument22 pagesEnterprenuship Slideschaudhary samavaNo ratings yet

- Entrepreneurship 5 Business PlanDocument33 pagesEntrepreneurship 5 Business Planjimmy mlelwaNo ratings yet

- EntrepreneurshipDocument276 pagesEntrepreneurshipLekshmi Chidambaram100% (3)

- Sitxfin004 VactsDocument34 pagesSitxfin004 VactsNaween WageeshaNo ratings yet

- Mod9 Business-Implementation v2Document10 pagesMod9 Business-Implementation v2MARY JOY RUSTIANo ratings yet

- ENTREP Introduction-2Document22 pagesENTREP Introduction-2水流MizukiNo ratings yet

- Business PlanDocument32 pagesBusiness Planruv.asn17No ratings yet

- How To Write A Business PlanDocument13 pagesHow To Write A Business PlanSodiq adisa100% (1)

- Lecture 2 PresentationDocument40 pagesLecture 2 PresentationEmmanuel CykukuNo ratings yet

- A Guide To Starting New BusinessDocument12 pagesA Guide To Starting New BusinessSmadAvira Al-KasperSkyNo ratings yet

- How To Start Your Business?Document11 pagesHow To Start Your Business?Resti GamiarsiNo ratings yet

- Module 10 Business Plan DevelopmentDocument27 pagesModule 10 Business Plan DevelopmentHeidi100% (1)

- Writing Business PlanDocument8 pagesWriting Business Planu04ajf3No ratings yet

- Entrep RevieweDocument4 pagesEntrep Reviewewilson dela cruzNo ratings yet

- 5 Roles of SocietyDocument4 pages5 Roles of SocietyIris OnidaNo ratings yet

- Implementation of The Business Plan Implementation Is The Process That Turns Strategies and Plans Into Actions in Order ToDocument4 pagesImplementation of The Business Plan Implementation Is The Process That Turns Strategies and Plans Into Actions in Order ToAnalyn CabilloNo ratings yet

- Entrepreneurship CH 7Document21 pagesEntrepreneurship CH 7Wiz Nati XvNo ratings yet

- Final EntrepDocument13 pagesFinal EntrepArnel De Los SantosNo ratings yet

- Chapter 8 The Business PlanDocument25 pagesChapter 8 The Business PlanKATE ANDRE MENDOZANo ratings yet

- Entrep Chap5 Writing The Business Plan Sir EdDocument41 pagesEntrep Chap5 Writing The Business Plan Sir EdSaturnino MojarNo ratings yet

- Management Concepts & AccountingDocument51 pagesManagement Concepts & Accountingarupghosh88No ratings yet

- CIMA Business PlanDocument29 pagesCIMA Business PlanRonan NilandNo ratings yet

- Sample Daycare Business Plan PDFDocument13 pagesSample Daycare Business Plan PDFsujrulz100% (2)

- Chapter 2 Business PlanDocument21 pagesChapter 2 Business PlanZekariyas AbushaNo ratings yet

- Starting Your Childcare Business Factsheet Jan 11 CHDocument13 pagesStarting Your Childcare Business Factsheet Jan 11 CHspringboardy100% (2)

- DPPM Business Plan-2Document38 pagesDPPM Business Plan-2Edgar MugaruraNo ratings yet

- Business Plan IntroDocument97 pagesBusiness Plan Introvscolegit shoppeNo ratings yet

- EntrepreneurshipDocument10 pagesEntrepreneurshipRohit ShramaNo ratings yet

- Group 6Document15 pagesGroup 6giselle.ruizNo ratings yet

- ACCT1046 Topic 5 Slides - S1Document32 pagesACCT1046 Topic 5 Slides - S1李灰No ratings yet

- How To Prepare A Business PlanDocument32 pagesHow To Prepare A Business PlansuosvannakNo ratings yet

- Digital Marketing Planning, Budgeting, ForecastingDocument51 pagesDigital Marketing Planning, Budgeting, ForecastingJinny AsyiqinNo ratings yet

- How To Write: Highly EffectiveDocument10 pagesHow To Write: Highly EffectiveCok digitalNo ratings yet

- Business PlanDocument16 pagesBusiness PlanbaskorosanjayaNo ratings yet

- Business PlanningDocument90 pagesBusiness PlanningVincent NollanNo ratings yet

- Business PlanDocument20 pagesBusiness Planmailme07100% (1)

- Entrepreneurship: Quarter 2 - Module 9 Business ImplementationDocument10 pagesEntrepreneurship: Quarter 2 - Module 9 Business ImplementationGian Carlo Devera71% (7)

- Business PlanDocument4 pagesBusiness PlanSpectre 7575No ratings yet

- Balancecd ScorecardDocument12 pagesBalancecd ScorecardRamaswamy SrinivasanNo ratings yet

- Business PlansDocument41 pagesBusiness Planssahara1999_991596No ratings yet

- ENTREP.Q2 M9 For Digitized StudentsDocument11 pagesENTREP.Q2 M9 For Digitized StudentsDos DosNo ratings yet

- Chapter 3B Writing A Business PlanDocument20 pagesChapter 3B Writing A Business PlanRosewin SevandalNo ratings yet

- Chapter1 TextbookDocument16 pagesChapter1 Textbooketiennerafael2No ratings yet

- Introduction-to-Acctg 1 2Document27 pagesIntroduction-to-Acctg 1 2Aenna Carmille TangubNo ratings yet

- Business Plan GuideDocument3 pagesBusiness Plan GuidebhupathireddyoNo ratings yet

- Bif4 A Guide To Writing A Business PlanDocument5 pagesBif4 A Guide To Writing A Business PlanericksetiyawanNo ratings yet

- Module 9 Business ImplementationDocument46 pagesModule 9 Business ImplementationMheg SiegaNo ratings yet

- LESSON 7 - Using A Business PlanDocument3 pagesLESSON 7 - Using A Business PlanJOHN LLOYD BRILLANTENo ratings yet

- Unit 4 5 Cse332Document91 pagesUnit 4 5 Cse332Dharmendra TripathiNo ratings yet

- DBMS110 - M01 Lab AssignmentDocument7 pagesDBMS110 - M01 Lab AssignmentgenesNo ratings yet

- Accounting Entries Sub-ContractingDocument10 pagesAccounting Entries Sub-Contractingcap gemNo ratings yet

- BIR 1905 Form (Update or Transfer of RDO)Document4 pagesBIR 1905 Form (Update or Transfer of RDO)lily mayersNo ratings yet

- CarphoneDocument1 pageCarphoneDev SethosNo ratings yet

- Your Consolidated Statement: Contact UsDocument5 pagesYour Consolidated Statement: Contact UsSAM50% (2)

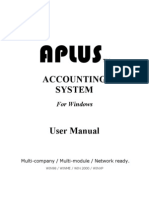

- Aplus - User ManualDocument148 pagesAplus - User ManualEkin Nordin100% (1)

- 14c CashManagementDocument76 pages14c CashManagementali iqbalNo ratings yet

- PS2014 Utility ManualDocument88 pagesPS2014 Utility ManualpapuNo ratings yet

- Iloilo City Tax Ordinance 2007-016Document196 pagesIloilo City Tax Ordinance 2007-016Iloilo City Council88% (8)

- Policies and Procedures: To Follow On Daily, Weekly and Monthly BasisDocument20 pagesPolicies and Procedures: To Follow On Daily, Weekly and Monthly BasisKarim AmmourNo ratings yet

- Lessee Information StatementDocument4 pagesLessee Information StatementDarryl Jay Medina67% (3)

- HPG-requirements For RestampingDocument9 pagesHPG-requirements For RestampingKevin BonaobraNo ratings yet

- Sap FiDocument82 pagesSap FivenkatreddyNo ratings yet

- Special Condition of ContractDocument4 pagesSpecial Condition of ContractEmmanuel Sto TomasNo ratings yet

- EBS 122 Cum RCD FINDocument112 pagesEBS 122 Cum RCD FINmohamed-mofNo ratings yet

- Financial Accounting & Reporting 2: PX - Set SolutionDocument15 pagesFinancial Accounting & Reporting 2: PX - Set SolutionGabrielle Marie Rivera33% (3)

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDocument6 pagesCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsCyrill L. MarkNo ratings yet

- R12 CE How To Reconcile Multiple Statement Lines To One Receipt or Payment or Journal Lines and Related QA (Doc ID 420940.1)Document2 pagesR12 CE How To Reconcile Multiple Statement Lines To One Receipt or Payment or Journal Lines and Related QA (Doc ID 420940.1)anind_1980No ratings yet

- TVML019234 PDFDocument2 pagesTVML019234 PDFSIDHARTH TiwariNo ratings yet

- Revenue and Receipt CycleDocument16 pagesRevenue and Receipt CycleAldrin ZolinaNo ratings yet

- Odoo StarterkitDocument37 pagesOdoo StarterkitMuhammad Yasir Khan100% (1)

- C - TS4FI - 2020 - Certification MCQs (71 Questions) - Part 1-2Document25 pagesC - TS4FI - 2020 - Certification MCQs (71 Questions) - Part 1-2Yinka FaluaNo ratings yet

- F1DJWQ8BDTWDDocument1 pageF1DJWQ8BDTWDCuong Nguyen QuangNo ratings yet

- Tally NotesDocument44 pagesTally NotesJaydeep Paul100% (4)

- Fabm2: Quarter 1 Week 5 Module 5Document18 pagesFabm2: Quarter 1 Week 5 Module 5Micah GNo ratings yet

- Western Mindanao Power Corporation V CIRDocument4 pagesWestern Mindanao Power Corporation V CIRTintin CoNo ratings yet

- YCM Factsheet Updated As of 30 Mar 2022Document48 pagesYCM Factsheet Updated As of 30 Mar 2022Lecarl LimNo ratings yet

- Purchase Vs Consumption Based Accounting Accounting Entries in SapDocument10 pagesPurchase Vs Consumption Based Accounting Accounting Entries in SapAAPS ACGSNo ratings yet

- 2.1 Compositon, Exemptions, TOS, VOSDocument23 pages2.1 Compositon, Exemptions, TOS, VOSvenkatesh grietNo ratings yet

- CepswamDocument5 pagesCepswamImran KaiNo ratings yet