Professional Documents

Culture Documents

Operations KPIs 2023

Uploaded by

HamZa Ali0 ratings0% found this document useful (0 votes)

17 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views3 pagesOperations KPIs 2023

Uploaded by

HamZa AliCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 3

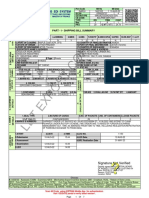

KPI Proposal – Branches 2022 vs 2023

Main KPIs

SEGMENT COMPONENT 2022 2023

COC conversion - 5

Business Segments KYC (CDD/EDD) (Time Resolution/Disc) 5 5

NTB 5 10

Voucher Ticking 5 5

Internal Controls

ICD Exceptions Rectification & Non-Repetition 5 5

Customer Loyalty measured through Deposit Retention 10 -

S & Q ISMs (EQ & AOF Upload) 2.5 2.5

S & Q Health Checks 7.5 7.5

Customer Service

Branch Complaints 5 5

Account opening Accuracy 5 5

ATM Uptime 7 7

Audit Audit Rating 10 10

Dashboard Timely Resolution & Incorrect Closures 5 5

Procedural Compliance

Proof Balancing 2 -

Evolving Regulatory Mandatory Leaves 2.5 2.5

Compliance Exercise Module / Campaign Module 5 4

SOD/EOD Checklist Submission/DOM Visit & Punctuality 3 3

Cash in Till 7.5 7.5

Admin Cash Transportation Expense 3 -

Expense Indicator 3 5

Security Visits 2 -

Digital Channel Migration - 6

Grand Total 100 100

KPI Proposal – Branches 2022 vs 2023

Bonus Scoring Zone

SEGMENT COMPONENT 2022 2023

YTD AVG Current Growth - 10

Dormant Activation - 5

Bonus Point Cross Sell of CA(to SA Customers) - 3

(1 point for every Rs.10 M cross selling)

KYC QA legacy 5 5

Headcount(Budget completion - 95% on ground staff - 2

KPI Proposal – Branches 2022 vs 2023

Negative Scoring Zone

SEGMENT COMPONENT 2022 2023

Proof balancing - -2

Negative Scoring Security Visits -

-2

Fraud* - -5

* Will be catered on Case to Case basis

You might also like

- Key Role Areas and Key Performance Indicators of Procurement ExecutiveDocument2 pagesKey Role Areas and Key Performance Indicators of Procurement ExecutiveMark Carlo HazNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Screens Not PreparedDocument4 pagesScreens Not PreparedAries BautistaNo ratings yet

- Credit Securitisations and Derivatives: Challenges for the Global MarketsFrom EverandCredit Securitisations and Derivatives: Challenges for the Global MarketsNo ratings yet

- Accomplished RCA: KYC Quality ReportDocument1 pageAccomplished RCA: KYC Quality ReportHan Htun OoNo ratings yet

- PSAK 71, 72, 73 PwC-2019-Annual-Technical-Update-RUN-2Document89 pagesPSAK 71, 72, 73 PwC-2019-Annual-Technical-Update-RUN-2Ervin Khouw100% (2)

- Achieving Market Integration: Best Execution, Fragmentation and the Free Flow of CapitalFrom EverandAchieving Market Integration: Best Execution, Fragmentation and the Free Flow of CapitalNo ratings yet

- DOE 2021-ScorecardsDocument1 pageDOE 2021-ScorecardsPaolo AimanNo ratings yet

- Chapter 09Document23 pagesChapter 09PUTRI AVERINANo ratings yet

- International Business Control, Reporting and Corporate Governance: Global business best practice across cultures, countries and organisationsFrom EverandInternational Business Control, Reporting and Corporate Governance: Global business best practice across cultures, countries and organisationsRating: 5 out of 5 stars5/5 (2)

- IREC-KPI-F01 - KPI - Civil Eng. & Construction ++Document1 pageIREC-KPI-F01 - KPI - Civil Eng. & Construction ++Zainarul Aswad RazaliNo ratings yet

- Agile Procurement: Volume II: Designing and Implementing a Digital TransformationFrom EverandAgile Procurement: Volume II: Designing and Implementing a Digital TransformationNo ratings yet

- 2 How To - Tests of Copy Configuration From Client 000 - Note 2838358 - Part3Document15 pages2 How To - Tests of Copy Configuration From Client 000 - Note 2838358 - Part3Helbert GarofoloNo ratings yet

- Establishing A CGMP Laboratory Audit System: A Practical GuideFrom EverandEstablishing A CGMP Laboratory Audit System: A Practical GuideNo ratings yet

- TOS-BAPAUD-Finals 1Document2 pagesTOS-BAPAUD-Finals 1Lester Glenn LimheyaNo ratings yet

- Opportunity Prioritization MatrixDocument8 pagesOpportunity Prioritization MatrixShishir SinghNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Common EP&MEA Accounts Receivable Process V6.0 July PDFDocument152 pagesCommon EP&MEA Accounts Receivable Process V6.0 July PDFNico TuscaniNo ratings yet

- Test of Controls': School of Business Studies ACCA F8 - Audit & Assurance P2P Session by SK - Test of Controls (TOC) 1/2Document44 pagesTest of Controls': School of Business Studies ACCA F8 - Audit & Assurance P2P Session by SK - Test of Controls (TOC) 1/2Falguni PurohitNo ratings yet

- ValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Document4 pagesValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Achint KumarNo ratings yet

- BOI Perfomance Analysis Q2FY 23Document45 pagesBOI Perfomance Analysis Q2FY 23virshin shahNo ratings yet

- Presentasi Action Plant 2022Document14 pagesPresentasi Action Plant 2022iventory auditNo ratings yet

- Samit Weekly Activity Tracker 30sepDocument13 pagesSamit Weekly Activity Tracker 30sepAksh GillNo ratings yet

- Dealer Self Evaluation Sheet - SalesDocument1 pageDealer Self Evaluation Sheet - SalesNiraj KumarNo ratings yet

- Paper20A Set2Document8 pagesPaper20A Set2Ramanpreet KaurNo ratings yet

- Task 3 - Model AnswerDocument2 pagesTask 3 - Model AnswerVidehi Bajaj0% (1)

- Task 3 - Model AnswerDocument1 pageTask 3 - Model Answernipun sharmaNo ratings yet

- EXT CSP 2021 Requirements Service Bureau SWIFT CSP 2021 For Kyriba CusDocument20 pagesEXT CSP 2021 Requirements Service Bureau SWIFT CSP 2021 For Kyriba Cusgautam_86No ratings yet

- Safety Performance Score ReviewDocument5 pagesSafety Performance Score ReviewwjeenicNo ratings yet

- Fundcard: Baroda Pioneer Treasury Advantage Fund - Direct PlanDocument4 pagesFundcard: Baroda Pioneer Treasury Advantage Fund - Direct Planravinandan_pNo ratings yet

- Notification IDBI Specialist Cadre Officer PostsDocument39 pagesNotification IDBI Specialist Cadre Officer PostsSachin AnandNo ratings yet

- Mahindra Manulife Credit Risk FundDocument1 pageMahindra Manulife Credit Risk FundYogi173No ratings yet

- Varanasi DCCB Par 31.03.2023Document28 pagesVaranasi DCCB Par 31.03.2023Anuj Kumar SinghNo ratings yet

- Topics Details in Past PapersDocument12 pagesTopics Details in Past PapersMuhammad YousafNo ratings yet

- GrdydygtDocument23 pagesGrdydygtSME AerospaceNo ratings yet

- Goa Strategic MeetDocument12 pagesGoa Strategic Meetaakanksha.chipkarNo ratings yet

- ValueResearchFundcard AxisBanking&PSUDebtFund DirectPlan 2017aug13Document4 pagesValueResearchFundcard AxisBanking&PSUDebtFund DirectPlan 2017aug13Jeet MehtaNo ratings yet

- CAF 8 Volume 2 TOC & SP IT WD LogoDocument549 pagesCAF 8 Volume 2 TOC & SP IT WD LogoZarian NadeemNo ratings yet

- Corporate & Management Accounting: Chapterwise WeightageDocument1 pageCorporate & Management Accounting: Chapterwise WeightagekhushaaliNo ratings yet

- Notes - Financial Statement AnalysisDocument61 pagesNotes - Financial Statement AnalysisBel NochuNo ratings yet

- B3 Tech Software Development Status JAN-9-23Document9 pagesB3 Tech Software Development Status JAN-9-23John FrancisNo ratings yet

- Risk Management Training.1 - 1664858285Document4 pagesRisk Management Training.1 - 1664858285cejuanaabetriaNo ratings yet

- VIDYA SAGAR Analysis-AccountsDocument3 pagesVIDYA SAGAR Analysis-AccountsIndhuja MNo ratings yet

- 2012 - AIPSM KPI - Corporate ScorecardDocument3 pages2012 - AIPSM KPI - Corporate Scorecardzizu1234No ratings yet

- Docslide. - Final Anniversary 2012 2013 Evaluation For Lavanya Roseline Nxls - OdsDocument22 pagesDocslide. - Final Anniversary 2012 2013 Evaluation For Lavanya Roseline Nxls - OdsKritika Aggarwal100% (1)

- Model Monitoring Report - Q3-2023Document12 pagesModel Monitoring Report - Q3-2023Mutomba TichaonaNo ratings yet

- System Standard ManualDocument37 pagesSystem Standard ManualmightyakshatNo ratings yet

- Module 4 - Monitoring of Progress of Obtaining Appraised Values of PropertiesDocument7 pagesModule 4 - Monitoring of Progress of Obtaining Appraised Values of PropertiesD8patrikkNo ratings yet

- Annual Report 2020 21Document213 pagesAnnual Report 2020 21AATMIK SHARMANo ratings yet

- CMA CHAPTERWISE WEIGHTAGE-Executive-RevisionDocument1 pageCMA CHAPTERWISE WEIGHTAGE-Executive-RevisionRevanthi DNo ratings yet

- 08.03.05 - Quality Assurance - Construction Works at Project Site-R2Document5 pages08.03.05 - Quality Assurance - Construction Works at Project Site-R2tanmayascribdNo ratings yet

- AIC General Assembly Report 2023 Draft 2 After 11.25.2023 Meeting3.17pm Sunday RevisionDocument3 pagesAIC General Assembly Report 2023 Draft 2 After 11.25.2023 Meeting3.17pm Sunday RevisionDelia Remerata ElmidoNo ratings yet

- CA Inter Adv Acc CompilerDocument1,306 pagesCA Inter Adv Acc CompilerAnanya SharmaNo ratings yet

- CODocument192 pagesCOsravan_basa100% (2)

- KRA Sheet EMR FY23Document15 pagesKRA Sheet EMR FY23BHUVANESH MNo ratings yet

- Lec 5 NotesDocument4 pagesLec 5 NotesVeli NgwenyaNo ratings yet

- Dry Cleaning Home Delivery Business PlanDocument39 pagesDry Cleaning Home Delivery Business PlanDivya AggarwalNo ratings yet

- Term Paper-Production & Operations Management of Nitol Motors LTD (Service) (Md. Tanzimul Islam-ID-M8190C007)Document14 pagesTerm Paper-Production & Operations Management of Nitol Motors LTD (Service) (Md. Tanzimul Islam-ID-M8190C007)Salim RezaNo ratings yet

- Course Project Specifications: (Type Topic Here)Document3 pagesCourse Project Specifications: (Type Topic Here)Igiboy FloresNo ratings yet

- Advanced Audit and Assurance: Acca AaaDocument4 pagesAdvanced Audit and Assurance: Acca AaaZainabNo ratings yet

- TSC Wealth DeclarationDocument4 pagesTSC Wealth DeclarationMutai Kiprotich100% (2)

- TupperwareDocument6 pagesTupperwareSunil PatleNo ratings yet

- RIPARODocument1 pageRIPAROPEA CHRISTINE AZURIASNo ratings yet

- Abm - TIMELINE FEASIBILITY 3I and WI 2022 1Document4 pagesAbm - TIMELINE FEASIBILITY 3I and WI 2022 112 ABM 2A-BORRES, JEAN ROSENo ratings yet

- Jainism in Odisha Chapter 1Document13 pagesJainism in Odisha Chapter 1Bikash DandasenaNo ratings yet

- The Kingsmen IIM B VFDocument19 pagesThe Kingsmen IIM B VFSupriya MurdiaNo ratings yet

- Ch183 Process Cost Systemsdocx PDF FreeDocument52 pagesCh183 Process Cost Systemsdocx PDF FreeROLANDO II EVANGELISTANo ratings yet

- Delivery Hero SE Q2 2019 Presentation VFFFDocument26 pagesDelivery Hero SE Q2 2019 Presentation VFFFGiang NguyenNo ratings yet

- Chapter 2 Revision Exercises + SolutionsDocument12 pagesChapter 2 Revision Exercises + SolutionsSanad RousanNo ratings yet

- Headlines Publishing Company HPC Specializes in InternationalDocument1 pageHeadlines Publishing Company HPC Specializes in InternationalAmit PandeyNo ratings yet

- LAtihan CH 18Document19 pagesLAtihan CH 18laurentinus fikaNo ratings yet

- WHLP Fabm2 Sy 2022 2023 Q1Document9 pagesWHLP Fabm2 Sy 2022 2023 Q1Ja MesNo ratings yet

- Ethiopia Customs Guide v3Document160 pagesEthiopia Customs Guide v3Sarah سارةNo ratings yet

- Fedai Daily Quiz Questions Archives - Bank Accounts: Correct Answer: 2 Correct Answer: 2Document22 pagesFedai Daily Quiz Questions Archives - Bank Accounts: Correct Answer: 2 Correct Answer: 2Somdutt Gujjar100% (2)

- Business CommunicationDocument56 pagesBusiness CommunicationDipayan_luNo ratings yet

- Ia Eco121Document10 pagesIa Eco121Quach Hai My (K17 CT)No ratings yet

- AEconQ1 Quiz1Document16 pagesAEconQ1 Quiz1Rienalyn GalsimNo ratings yet

- What Is Lean Six Sigma & How Does It Work - Part 2 - 3 - THE QHSE GROUPDocument7 pagesWhat Is Lean Six Sigma & How Does It Work - Part 2 - 3 - THE QHSE GROUPAna SilvaNo ratings yet

- Maria Ialongo 84-23 Manton Street Apt 3E Briarwood Ny 11435-1813Document4 pagesMaria Ialongo 84-23 Manton Street Apt 3E Briarwood Ny 11435-1813Keiver jimenezNo ratings yet

- Tax3703 2Document61 pagesTax3703 2mariechen13koopmanNo ratings yet

- Assignment #2 FABMDocument5 pagesAssignment #2 FABMIce Voltaire B. Guiang100% (1)

- Shape - Cutting - Game Scissors One Person TeamDocument3 pagesShape - Cutting - Game Scissors One Person TeamIshita FudduNo ratings yet

- Goodyear AnalysisDocument2 pagesGoodyear AnalysisSakshi ShardaNo ratings yet

- SEAL AR 2020 (Final) (Resize)Document130 pagesSEAL AR 2020 (Final) (Resize)BenjaminNo ratings yet

- 342210210082022INAPL6SB22120820221409Document7 pages342210210082022INAPL6SB22120820221409INTERWORLD PACIFIC CONTAINER LINENo ratings yet

- Fin 404 AssignmentDocument2 pagesFin 404 AssignmentIrfanul HoqueNo ratings yet