Professional Documents

Culture Documents

Er BK

Uploaded by

shaaqib mansuri0 ratings0% found this document useful (0 votes)

3 views4 pagesAnalysis of BK Industries

Original Title

ER BK

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAnalysis of BK Industries

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views4 pagesEr BK

Uploaded by

shaaqib mansuriAnalysis of BK Industries

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 4

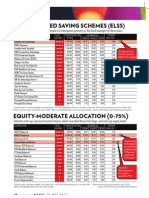

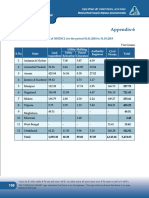

EFFICIENCY RATIOS

Days payable Days receivable Inventory Days RANK

MRF 50.19 51.69 110.26 1. Green

2. Orange

Balkrishna Inds 39.58 44.75 105.07 3. yellow

Apollo Tyres 58.56 21.01 128.98

CEAT 72.01 36.31 87.54

Goodyear India 60.37 45.99 45.86

RETURN RATIOS

ROE ROIC ROA

MRF 12.26 15.07 9.94

Balkrishna Inds 17.07 19.18 14.25

Apollo Tyres 4.76 4.38 2.76

CEAT 8.77 9.10 5.27

Goodyear India 9.97 10.11 9.63

LEVERAGE RATIO

Debt / Equity Int Coverage

MRF 0.15 5.53

Balkrishna Inds 0.15 111.35

Apollo Tyres 0.61 2.00

CEAT 0.59 2.95

Goodyear India 0.02 26.38

GROWTH RATIO

5 year sales growth 5 year profit growth

MRF 4.03 9.41

Balkrishna Inds 4.76 11.79

Apollo Tyres 4.96 -14.51

CEAT 3.51 -4.81

Goodyear India 2.22 -2.53

Current ratio Quick ratio

MRF 1.51 1.15

Balkrishna Inds 1.31 0.83 LIQUIDITY RATIO

Apollo Tyres 1.15 0.69

CEAT 0.74 0.42

Goodyear India 2.58 2.33

VALUATION RATIOS

EPS 12M . P/E CMP / Sales PEG CMP / BV EV / EBITDA

MRF 3170.69 25.41 2.36 2.70 2.72 12.15

Balkrishna In 49.71 34.64 6.59 2.94 6.15 20.50

ds

Apollo Tyres 5.54 38.06 0.81 -2.62 1.15 8.09

CEAT 62.24 16.76 0.75 -3.48 1.59 8.00

Goodyear In 29.76 32.46 1.48 -12.83 2.39 10.64

dia

1.2

0.8

0.6

0.4

0.2

0

1 2 3 4 5 6 7 8 9 10 11

-0.2

-0.4

sales growth OM

You might also like

- DCF Valuation and WACC CalculationDocument1 pageDCF Valuation and WACC CalculationJennifer Langton100% (1)

- Calf Fattening FeasibilityDocument19 pagesCalf Fattening FeasibilityMuammad Sanwal100% (2)

- Performance of Select Stocks Over Last 20 Years (2000-2020)Document12 pagesPerformance of Select Stocks Over Last 20 Years (2000-2020)GANESHNo ratings yet

- Competition: Balance Sheet P&L Account Cash Flows Quarterly Half Yearly 9 Monthly YearlyDocument2 pagesCompetition: Balance Sheet P&L Account Cash Flows Quarterly Half Yearly 9 Monthly YearlyumamaheshkNo ratings yet

- Petro Chemi ExcelDocument3 pagesPetro Chemi ExcelshreejaNo ratings yet

- Olm Page38 20110518Document1 pageOlm Page38 20110518OutlookMagazineNo ratings yet

- Sources of Funds of Various Companies As On 31st MarchDocument5 pagesSources of Funds of Various Companies As On 31st MarchDeepika Kapoor0% (1)

- Fundamental Analysis and Stock Picks of Top Auto Ancillary CompaniesDocument10 pagesFundamental Analysis and Stock Picks of Top Auto Ancillary CompaniesHarsh parasher (PGDM 17-19)No ratings yet

- Stock MarketDocument11 pagesStock MarketMufaddal DaginawalaNo ratings yet

- Top companies in NIFTY by market capitalizationDocument2 pagesTop companies in NIFTY by market capitalizationShakti ShuklaNo ratings yet

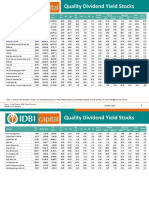

- Quality Dividend Yield Stocks Jan 22 03 January 2022 478756522Document4 pagesQuality Dividend Yield Stocks Jan 22 03 January 2022 478756522Jaikanth MuthukumaraswamyNo ratings yet

- Apparel Sector SheetDocument3 pagesApparel Sector SheetSmriti DurehaNo ratings yet

- Sno Share Price 6Th Jun (RS) Share Capital (Rs CR) No of Shares (CR) Market Cap (Rs CR)Document6 pagesSno Share Price 6Th Jun (RS) Share Capital (Rs CR) No of Shares (CR) Market Cap (Rs CR)ramsiva354No ratings yet

- WCM Oil GasDocument50 pagesWCM Oil GasCma Pushparaj KulkarniNo ratings yet

- Etwm MP 21 1 Col R1.inddDocument1 pageEtwm MP 21 1 Col R1.inddsekhargNo ratings yet

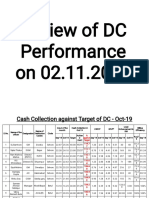

- Review of DC Performance On 02.11.2019Document21 pagesReview of DC Performance On 02.11.2019Subhash DhakarNo ratings yet

- Pricetiming - Alpha ListDocument1 pagePricetiming - Alpha Listdodda1981No ratings yet

- Financial Analysis Division: Telecom Regulatory Authority of IndiaDocument12 pagesFinancial Analysis Division: Telecom Regulatory Authority of Indiasayan0406No ratings yet

- Telecom Regulatory Authority of India: Financial Analysis DivisionDocument11 pagesTelecom Regulatory Authority of India: Financial Analysis Divisionbhanu.garg4243No ratings yet

- Company Symbol (Nse) Symbol (Bse) EPS (RS.)Document26 pagesCompany Symbol (Nse) Symbol (Bse) EPS (RS.)budhaditya.choudhury2583No ratings yet

- Fastest growing Australian startupsDocument1 pageFastest growing Australian startupsRomon YangNo ratings yet

- ACDVol 2020 2021Document16 pagesACDVol 2020 2021guillaumeNo ratings yet

- ACDVol 2019 2020Document12 pagesACDVol 2019 2020guillaumeNo ratings yet

- ValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Document4 pagesValueResearchFundcard DSPBlackRockMicroCapFund RegularPlan 2017mar14Rahul AnandNo ratings yet

- Delisting Candidates111Document6 pagesDelisting Candidates111abhimani5472No ratings yet

- Sirius XM Holdings IncDocument7 pagesSirius XM Holdings Inckishore112wwNo ratings yet

- TRAI FINANCIAL DATA FOR TELECOM PROVIDERS Q1 2012Document15 pagesTRAI FINANCIAL DATA FOR TELECOM PROVIDERS Q1 2012Reckon IndepthNo ratings yet

- Stock Screener203557Document6 pagesStock Screener203557Sde BdrNo ratings yet

- Indian Company Net Profits 2012-2014Document46 pagesIndian Company Net Profits 2012-2014Raj Kumar JhaNo ratings yet

- Fundcard: Franklin India Taxshield FundDocument4 pagesFundcard: Franklin India Taxshield FundvinitNo ratings yet

- Consolidated Data On Commission and Expenses Paid To Distributors During FY 2020-21 and Additional DisclosuresDocument16 pagesConsolidated Data On Commission and Expenses Paid To Distributors During FY 2020-21 and Additional DisclosuresChandra PrakashNo ratings yet

- Pivot Example 1Document35 pagesPivot Example 1Satish CherryNo ratings yet

- Rising Net Cash Flow and Cash From Operating Activity Aug 10Document3 pagesRising Net Cash Flow and Cash From Operating Activity Aug 10KabirNo ratings yet

- Kotak 50 Regular Plan Fund Rating and Performance SummaryDocument4 pagesKotak 50 Regular Plan Fund Rating and Performance SummaryrdhNo ratings yet

- Top 75 companies by CSR spend in India (FY 2020-21Document12 pagesTop 75 companies by CSR spend in India (FY 2020-21Venkata JayanthNo ratings yet

- Top 5 ELLSDocument11 pagesTop 5 ELLSvidyaNo ratings yet

- ACDVol 2018 2019Document15 pagesACDVol 2018 2019Nirav ShahNo ratings yet

- ACDVol 2018 2019 PDFDocument15 pagesACDVol 2018 2019 PDFTesthdjNo ratings yet

- 3 PDFDocument24 pages3 PDFAmit PoddarNo ratings yet

- 17 AppendicesDocument63 pages17 AppendiceshjghNo ratings yet

- ValueResearchFundcard HDFCEquity 2012jul30Document6 pagesValueResearchFundcard HDFCEquity 2012jul30Rachit GoyalNo ratings yet

- Performance 2020 121Document1 pagePerformance 2020 121kajavatan2020No ratings yet

- Stocks Listed by Price to Earnings RatioDocument3 pagesStocks Listed by Price to Earnings RatioGeorge Khris DebbarmaNo ratings yet

- ICICIdirect ExpectedHighDividendYieldStocksDocument2 pagesICICIdirect ExpectedHighDividendYieldStocksRamesh RajagopalanNo ratings yet

- DSP FIDELITYWorksheetDocument6 pagesDSP FIDELITYWorksheetvivek_recNo ratings yet

- Retail MG T Pack June 21Document10 pagesRetail MG T Pack June 21muthum44499335No ratings yet

- L&T Midcap Fund - Direct Plan Rating: Low Risk, High ReturnDocument4 pagesL&T Midcap Fund - Direct Plan Rating: Low Risk, High ReturnreachrajatNo ratings yet

- Reliance Industries Limited Annual Report 1990-91 HighlightsDocument61 pagesReliance Industries Limited Annual Report 1990-91 HighlightsSurjya BanerjeeNo ratings yet

- Reliance Tax Saver Fund Rating Performance Risk ReturnDocument6 pagesReliance Tax Saver Fund Rating Performance Risk ReturnKumar DeepanshuNo ratings yet

- HDFC EquityDocument6 pagesHDFC EquityDarshan ShettyNo ratings yet

- Annual Report English 2018-19-110Document1 pageAnnual Report English 2018-19-110Q C ShamlajiNo ratings yet

- India's Top Performing Mutual Funds TablesDocument3 pagesIndia's Top Performing Mutual Funds TablespbsoodNo ratings yet

- Sugar Companies ListDocument3 pagesSugar Companies ListINSIGNIA LABS - DATANo ratings yet

- AQI Index24nov PDFDocument436 pagesAQI Index24nov PDFsahilNo ratings yet

- Rakesh Jhunjhunwala's stock holdingsDocument2 pagesRakesh Jhunjhunwala's stock holdingsneotroniks2853No ratings yet

- Gillette (India) Ltd. Key DataDocument3 pagesGillette (India) Ltd. Key DataRavindra DananeNo ratings yet

- Laporan Harian: Senin, 26 Juli 2021Document6 pagesLaporan Harian: Senin, 26 Juli 2021hendro RukytoNo ratings yet

- NSE Nifty 50 Quarterly Financial Analysis With EPSDocument1 pageNSE Nifty 50 Quarterly Financial Analysis With EPSRajeev NaikNo ratings yet

- Competitio N: MRF Balkrishna Ind Apollo Tyres Ceat JK Tyre & Ind TVS Srichakra PTL Enterprises Elgi RubberDocument1 pageCompetitio N: MRF Balkrishna Ind Apollo Tyres Ceat JK Tyre & Ind TVS Srichakra PTL Enterprises Elgi RubberShubham MehtaNo ratings yet

- Stock DetailsDocument2 pagesStock DetailsNilesh DhandeNo ratings yet

- Fileadminasian-Powerliftingdataresultspowerlifting2022men Eq PDFDocument5 pagesFileadminasian-Powerliftingdataresultspowerlifting2022men Eq PDFGhaidaNo ratings yet

- Rubber Nanocomposites: Preparation, Properties, and ApplicationsFrom EverandRubber Nanocomposites: Preparation, Properties, and ApplicationsNo ratings yet

- AGMnotice-9th July 2020 PDFDocument325 pagesAGMnotice-9th July 2020 PDFNandani AnandNo ratings yet

- Annual Report Final 2019 20 PDFDocument147 pagesAnnual Report Final 2019 20 PDFShadab KhanNo ratings yet

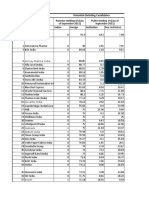

- ER - BalKrishna Industries - Group 3Document17 pagesER - BalKrishna Industries - Group 3shaaqib mansuriNo ratings yet

- Balkrishna Industries - SharanDocument4 pagesBalkrishna Industries - Sharanshaaqib mansuriNo ratings yet

- Day Count ConventionDocument11 pagesDay Count Conventiontimothy454No ratings yet

- Technical Analysis For Beginners (Second Edition) - Stop Blindly Following S PDFDocument141 pagesTechnical Analysis For Beginners (Second Edition) - Stop Blindly Following S PDFSonali100% (7)

- Pallada ManualDocument9 pagesPallada ManualamansyahNo ratings yet

- 1+UOB BnF+Recruitment+Forum+2019Document6 pages1+UOB BnF+Recruitment+Forum+2019fatma1351No ratings yet

- Documents Checklist-BBDocument8 pagesDocuments Checklist-BBMd Rafat ArefinNo ratings yet

- Incomes Which Do Not Form OF Total Income (Section 10) : Dr. P.Sree Sudha, Associate Professor, DsnluDocument48 pagesIncomes Which Do Not Form OF Total Income (Section 10) : Dr. P.Sree Sudha, Associate Professor, Dsnluleela naga janaki rajitha attiliNo ratings yet

- ICM Text Book UpdateDocument78 pagesICM Text Book UpdatemariposaNo ratings yet

- Trainee Relocation Policy NHS Lothian 2015 FINAL DRAFTDocument13 pagesTrainee Relocation Policy NHS Lothian 2015 FINAL DRAFTjkNo ratings yet

- Chilime Annual Report 2078-79Document92 pagesChilime Annual Report 2078-79Arun LuitelNo ratings yet

- Caf 1 IaDocument4 pagesCaf 1 IaaskermanNo ratings yet

- Xaria Ward-Unit 8 Cornell Notes The Fed-1-1Document4 pagesXaria Ward-Unit 8 Cornell Notes The Fed-1-1Xaria WardNo ratings yet

- Bauxite Loi - Bai - GusDocument2 pagesBauxite Loi - Bai - GusTri haryoNo ratings yet

- Mah Sing Annual Report 2013Document221 pagesMah Sing Annual Report 2013ETDWNo ratings yet

- LANECO v. PGLN Dispute Over Unpaid Real Property TaxesDocument2 pagesLANECO v. PGLN Dispute Over Unpaid Real Property TaxesLucas MenteNo ratings yet

- Commissioner of Internal Revenue, INCORPORATED, RespondentDocument10 pagesCommissioner of Internal Revenue, INCORPORATED, RespondentRufino Gerard Moreno IIINo ratings yet

- Movable Property by AnticipationDocument14 pagesMovable Property by AnticipationJesus MenguriaNo ratings yet

- LGC of Quezon City Vs - Bayan TelDocument2 pagesLGC of Quezon City Vs - Bayan Telgeorge almedaNo ratings yet

- 6 Receivables ManagementDocument12 pages6 Receivables ManagementShreya BhagavatulaNo ratings yet

- Chapter 3 Direct Capital Value ComparisonDocument10 pagesChapter 3 Direct Capital Value ComparisonMurtaza A ZaveriNo ratings yet

- Acct Statement - XX2168 - 14102023Document6 pagesAcct Statement - XX2168 - 14102023imad karariNo ratings yet

- Sifc 1Document2 pagesSifc 1Alexandra MihaelaNo ratings yet

- Dinesh Kumar MehrotraDocument20 pagesDinesh Kumar MehrotraRajeev JhaNo ratings yet

- Request for Loan Modification Due to Job LossDocument2 pagesRequest for Loan Modification Due to Job LossFiona W100% (2)

- 03101210000616Document1 page03101210000616Amit SinghNo ratings yet

- Bangladesh Bank: (Base Year: 2020, Job ID: 10147)Document1 pageBangladesh Bank: (Base Year: 2020, Job ID: 10147)Touhid IslamNo ratings yet

- Millat Tractors LTD - Annual Report 2008Document131 pagesMillat Tractors LTD - Annual Report 2008Monis Ali100% (2)

- Banking and Fintech in 2022Document45 pagesBanking and Fintech in 2022Shahbaz talpurNo ratings yet

- Chapter 14Document36 pagesChapter 14l NguyenNo ratings yet