Professional Documents

Culture Documents

Macroeconomics - Money and Banking System

Uploaded by

გიორგი კაციაშვილი0 ratings0% found this document useful (0 votes)

6 views16 pagesmacroeconomics- money and banking system

Original Title

macroeconomics- money and banking system

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentmacroeconomics- money and banking system

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views16 pagesMacroeconomics - Money and Banking System

Uploaded by

გიორგი კაციაშვილიmacroeconomics- money and banking system

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 16

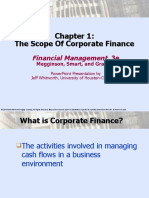

Money and the Banking

System

Full Length Text — Part: 3 Chapter: 13

Macro Only Text — Part: 3 Chapter: 13

To Accompany “Economics: Private and Public Choice 13th ed.”

James Gwartney, Richard Stroup, Russell Sobel, & David Macpherson

Slides authored and animated by:

Joseph Connors, James Gwartney, & Charles Skipton

Copyright ©2010 Cengage Learning. All rights reserved.

Next page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

Functions of Money

• A medium of exchange:

an asset used to buy and sell goods and services

• A store of value:

an asset that allows people to transfer

purchasing power from one period to another

• A unit of account:

a unit of measurement used by people to post

prices and keep track of revenues and costs.

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

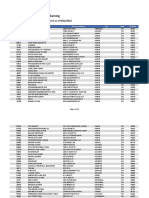

How the Money Supply is Measured

• Two basic measurements of the money

supply are M1 and M2.

• The components of M1 are:

• currency,

• checking deposits

(including demand deposits and

interest-earning checking deposits)

• M2 (a broader measure of money) includes:

• M1,

• savings,

• time deposits, and,

• money market mutual funds.

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

The Composition of US Money Supply, 2020

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

The Monetary Base

• The monetary base is equal to the currency in

circulation plus the reserves of commercial banks held

at the Fed

• The monetary base is important because it provides

the foundation for the money supply

• The expansion in Fed purchases and extension of loans

caused the monetary base to approximately double

during the 9 months following August 2008

• Fiat money - Money that has neither intrinsic value

nor the backing of a commodity

Jump to first page

with intrinsic value.

Copyright ©2010 Cengage Learning. All rights reserved.

May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

The Monetary Base, M1 and Reserves

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

The Ratio of Bank Reserves to Checking Deposits and the

Monetary Base to the M1 Money Supply

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

The Functions of Commercial

Banking Institutions

Consolidated Balance Sheet of Commercial Banking Institutions

April 2009 (billions of $)

Assets Liabilities

Vault cash $ 40 Checking deposits $ 600

Reserves at the Fed 672 Savings and time deposits 6,851

Loans outstanding 7,051 Borrowings 2,400

U.S. government securities 1,265 Other liabilities 928

Other securities 1,412 Net worth 1,291

Other assets 1,630

Total $ 12,070 $ 12,070

• Banks provide services and pay interest to attract checking,

savings, and time deposits (liabilities).

• Most of these deposits are invested and loaned out,

providing interest income for the bank.

• Banks hold a portion of their assets as reserves (either as cash

or deposits with the Fed) to meet their daily obligations toward

Copyright ©2010 Cengage Learning. All rights reserved.

their depositors. Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

Fractional Reserve Banking

• The most central banking system is a fractional reserve

system; banks are required to maintain only a fraction of

their assets as reserves against the deposits of their

customers (required reserves).

• Vault cash and deposits held with the central bank

account as reserves.

• Excess reserves (actual reserves in excess of the legal

requirement) can be used to extend new loans and make

new investments.

• Under a fractional reserve system, an increase in

deposits will provide the bank with excess reserves and

place it in a position to extend additional loans, and

thereby expand the money supply.

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

Creating Money from New Reserves

New cash Potential demand

deposits: New deposits created by

Bank Actual Reserves Required Reserves extending new loans

Initial deposit (bank A) $1,000.00 $200.00 $800.00

Second stage (bank B) 800.00 160.00 640.00

Third stage (bank C) 640.00 128.00 512.00

Fourth stage (bank D) 512.00 102.40 409.60

Fifth stage (bank E) 409.60 81.92 327.68

Sixth stage (bank F) 327.68 65.54 262.14

Seventh stage (bank G) 262.14 52.43 209.71

All others (other banks) 1,048.58 209.71 838.87

Total $5,000.00 $1,000.00 $4,000.00

• When banks are required to maintain 20% reserves

against demand deposits, the creation of $1,000 of new

reserves will potentially increase the supply of money

by $5,000.

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

Central Bank’s Monetary Policy Instruments:

• Defining Reserve requirements

• setting the fraction of assets that banks must hold as reserves,

against their checking deposits

• Open market operations

• the buying and selling of the government securities and other

assets in the open market

• Setting interest rates of Loans

• control of the volume of loans to banks and other financial

institutions

• Interest paid on excess bank reserves

• setting the interest rate paid banks on reserves held at the

central bank.

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

Federal funds market

• A private loanable funds market where banks with

excess reserves extend short-term loans to other

banks trying to meet their reserve requirements

• The interest rate in this market is called

the federal funds rate

• The Fed controls the federal funds rate through open

market operations.

• The Fed can reduce the fed funds rate by buying

bonds, which will inject additional reserves into

the banking system.

• The Fed can increase the fed funds rate by

selling bonds, which drains reserves from

the banking system.

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

Longer-Term Loans Extended by the Fed

• Prior to 2008, the Fed extended only short-term discount

rate loans, and they were extended only to member banks.

• In 2008, the Fed established several new procedures for

the extension of credit and began extending longer-term

loans, including some to non-banking institutions.

• The most important of these was the Term Auction

Facility (TAF) which created an auction procedure

through which depository institutions bid for credit

provided by the Fed for an 84 day period.

• In 2008, the Fed also began making loans to non-bank

financial institutions (such as insurance companies and

brokerage firms) and these loans have often been for

lengthy time periods (5-10 years).

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

Recent Fed Policy and the Money Supply

• Prior to the financial crisis of 2008, the Fed controlled

the money supply almost exclusively through open

market operations

• During 2008, the Fed vastly expanded its purchase

of corporate bonds, mortgage backed securities, and

commercial paper issued by private businesses

• Moreover, there was a huge increase in Fed loans to

non-banking institutions such as brokerage firms and

insurance companies

• Fed assets ballooned from $940 billion in July 2008 to

$3 trillion in December 2008

• This vast increase in the purchase of assets and extension

of loans by the Fed led to a sharp increase in bank

reserves and the monetary base.

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

Problems with measurement of the money

supply (either M1 or M2)

• In the past, economists have generally used the growth

rate of the money supply to gauge the direction of

monetary policy

• Two changes during the past several decades have

altered the nature of money and the reliability of money

supply growth figures:

- Widespread use of the U.S. dollar outside of the United States;

- Substitution of electronic payments for checks and cash.

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

საქართველოს ეროვნული

ბანკის მონეტარული

პოლიტიკის დეტალების

შესახებ შეგიძლიათ ნახოთ

მის ვებ-გვერდზე:

https://nbg.gov.ge

Copyright ©2010 Cengage Learning. All rights reserved.

Jump to first page May not be scanned, copied or duplicated, or posted to a

publicly accessible web site, in whole or in part.

You might also like

- DU FBS EMBA Admission Test Questions and Suggestions - CombinedDocument93 pagesDU FBS EMBA Admission Test Questions and Suggestions - CombinedSheikh AnikNo ratings yet

- Type C Sports Gaming: Host Pre-Approval List As of 8/12/2022Document32 pagesType C Sports Gaming: Host Pre-Approval List As of 8/12/2022Marcus DiNittoNo ratings yet

- Chapter 29 The Monetary SystemDocument41 pagesChapter 29 The Monetary SystemYashrajsing LuckkanaNo ratings yet

- Working Capital Management - BrighamDocument34 pagesWorking Capital Management - BrighamAldrin ZolinaNo ratings yet

- Kuratko9eCh08 - Sources of Capital For Entrepreneurial Ventures - Class 10Document41 pagesKuratko9eCh08 - Sources of Capital For Entrepreneurial Ventures - Class 10Chowdhury Mobarrat Haider AdnanNo ratings yet

- Business Finance Q2 W1 Mod1checkedDocument13 pagesBusiness Finance Q2 W1 Mod1checkedLeonila Oca100% (5)

- I4 KD TAp HXVPG 1 KH 6Document8 pagesI4 KD TAp HXVPG 1 KH 6Srikanth reddyNo ratings yet

- How Interest Rates Affect The Stock MarketDocument7 pagesHow Interest Rates Affect The Stock MarketSandeep BabajiNo ratings yet

- Bank Financial Statements 2020 SDocument54 pagesBank Financial Statements 2020 SSuvajitLaikNo ratings yet

- Investment, The Capital Market, and The Wealth of Nations: Full Length Text - Micro Only TextDocument34 pagesInvestment, The Capital Market, and The Wealth of Nations: Full Length Text - Micro Only TextGvantsa MorchadzeNo ratings yet

- Its Function, Performance, and Potential As An Investment OpportunityDocument20 pagesIts Function, Performance, and Potential As An Investment OpportunityGvantsa MorchadzeNo ratings yet

- 21 Thrift OperationsDocument38 pages21 Thrift OperationsPaula Ella BatasNo ratings yet

- Chapter 8 How Banks WorkDocument19 pagesChapter 8 How Banks WorkZedie Leigh VioletaNo ratings yet

- FRA#4-Special Industries AnalysisDocument50 pagesFRA#4-Special Industries AnalysisMasoom ZahraNo ratings yet

- Chapter 3 - Islamic Banking Sources and Uses of FundsDocument21 pagesChapter 3 - Islamic Banking Sources and Uses of Fundsmohammeddubale06No ratings yet

- 19 Bank ManagementDocument48 pages19 Bank ManagementPaula Ella BatasNo ratings yet

- Chapter 2 - International Flows of FundDocument58 pagesChapter 2 - International Flows of FundHưng NguyễnNo ratings yet

- Extra Note-Bank (Eco211)Document6 pagesExtra Note-Bank (Eco211)Amsyar AmsNo ratings yet

- Financial Management - Chapter 02Document21 pagesFinancial Management - Chapter 02Aruzhan TanirbergenNo ratings yet

- How Do Banks Work and How Do They Make A Profit? (4 Marks)Document13 pagesHow Do Banks Work and How Do They Make A Profit? (4 Marks)Mohamed ShaniuNo ratings yet

- TATCNH P1 U1 PPT Funtions of Financial MarketDocument70 pagesTATCNH P1 U1 PPT Funtions of Financial MarketTrà My NguyễnNo ratings yet

- Part 2 - Chapter 26 Saving, Investment, and The Financial SystemDocument20 pagesPart 2 - Chapter 26 Saving, Investment, and The Financial SystemCon CừuNo ratings yet

- Acroeconomics: Principles ofDocument50 pagesAcroeconomics: Principles ofHarsh TodiNo ratings yet

- Financial Markets, Saving, and InvestmentDocument18 pagesFinancial Markets, Saving, and InvestmentDustin WardNo ratings yet

- Chapter 13 Financial Markets Saving InvestmentDocument61 pagesChapter 13 Financial Markets Saving Investmentlei dcNo ratings yet

- Managing in A Global Economy Demystifying International Macroeconomics 2nd Edition Marthinsen Solutions ManualDocument9 pagesManaging in A Global Economy Demystifying International Macroeconomics 2nd Edition Marthinsen Solutions Manualreumetampoeqnb100% (32)

- International Financial Management Abridged 10 Edition: by Jeff MaduraDocument13 pagesInternational Financial Management Abridged 10 Edition: by Jeff MaduraHiếu Nhi TrịnhNo ratings yet

- Bonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskDocument36 pagesBonds and Their Valuation: Key Features of Bonds Bond Valuation Measuring Yield Assessing RiskJaneNo ratings yet

- Seminar Questions Set II-1Document4 pagesSeminar Questions Set II-1fanuel kijojiNo ratings yet

- Short TermDocument4 pagesShort Termjeanniemae100% (2)

- Chapter 16 Macroeconomics Principle - The Monetary SystemDocument52 pagesChapter 16 Macroeconomics Principle - The Monetary SystemNaufal Mohammad0% (1)

- Kuratko9eCh08 - Sources of Capital For Entrepreneurial Ventures - ClassDocument41 pagesKuratko9eCh08 - Sources of Capital For Entrepreneurial Ventures - Classbristikhan405No ratings yet

- Answers To Problem Sets: An Overview of Corporate FinancingDocument4 pagesAnswers To Problem Sets: An Overview of Corporate FinancingTracywongNo ratings yet

- Chapter 01 Asia PPT 2019Document27 pagesChapter 01 Asia PPT 2019Art JtsNo ratings yet

- Tutorial 4 AnswersDocument4 pagesTutorial 4 Answerskung siew houngNo ratings yet

- Banks of QuestionsDocument28 pagesBanks of QuestionsViệt Hưng ĐặngNo ratings yet

- Finished Bank 3Document12 pagesFinished Bank 3fatima ezzahra FAKIRNo ratings yet

- Financial Markets and InstitutionsDocument16 pagesFinancial Markets and InstitutionsAdamNo ratings yet

- Slides 07Document44 pagesSlides 07Vinay Gowda D MNo ratings yet

- Week 1 ch01 MKDocument23 pagesWeek 1 ch01 MKStenly WangNo ratings yet

- Chapter12 Money and Money SupplyDocument34 pagesChapter12 Money and Money SupplyDavid WongNo ratings yet

- Regulations of Financial Institutions IDocument8 pagesRegulations of Financial Institutions IRikardasNo ratings yet

- Max I Chapter 6Document13 pagesMax I Chapter 6HengGuitaristNo ratings yet

- International Financial Management Abridged 10 Edition: by Jeff MaduraDocument11 pagesInternational Financial Management Abridged 10 Edition: by Jeff MaduraHiếu Nhi TrịnhNo ratings yet

- TOPIC 4-Federal and Monetary PolicyDocument28 pagesTOPIC 4-Federal and Monetary Policygs69466No ratings yet

- Solution Manual For Bank Management 7th Edition by Koch Complete Downloadable File atDocument7 pagesSolution Manual For Bank Management 7th Edition by Koch Complete Downloadable File atNguyễn Minh PhươngNo ratings yet

- in The Sequential Tranche Paydown Structure, ForDocument60 pagesin The Sequential Tranche Paydown Structure, ForRimpy SondhNo ratings yet

- Malaysia VC Development Venture DebtDocument28 pagesMalaysia VC Development Venture DebtWei Cong TanNo ratings yet

- FRR-ALM Ch1Document69 pagesFRR-ALM Ch1Marek KurzyńskiNo ratings yet

- Sources of Capital For Entrepreneurial VenturesDocument36 pagesSources of Capital For Entrepreneurial Ventureslobna_qassem7176No ratings yet

- Bank Management Koch 8th Edition Solutions ManualDocument8 pagesBank Management Koch 8th Edition Solutions ManualAnna Young100% (24)

- Long-Term Liabilities: Bonds and Notes: Warren Reeve DuchacDocument92 pagesLong-Term Liabilities: Bonds and Notes: Warren Reeve DuchacDewi ShafirahNo ratings yet

- AGibson 12e Ch06 AISEDocument42 pagesAGibson 12e Ch06 AISEYi QiNo ratings yet

- The Monetary System: © 2008 Cengage LearningDocument31 pagesThe Monetary System: © 2008 Cengage LearningLuthfia ZulfaNo ratings yet

- BH eFM3 PPT ch02Document18 pagesBH eFM3 PPT ch02LIM HUI YI / UPMNo ratings yet

- CH 04Document44 pagesCH 04Sumaiya tuliNo ratings yet

- Unit 5 - Financial Information and Decisions IGCSE O'Levels Business StudiesDocument1 pageUnit 5 - Financial Information and Decisions IGCSE O'Levels Business StudiesQliqbaitNo ratings yet

- t7. The Monetary SystemDocument49 pagest7. The Monetary Systemmimi960% (1)

- Econ6049 Economic Analysis, S1 2021: Week 7: Unit 10 - Banks, Money and The Credit MarketDocument27 pagesEcon6049 Economic Analysis, S1 2021: Week 7: Unit 10 - Banks, Money and The Credit MarketTom WongNo ratings yet

- Chapter 9 Government's Role in BankingDocument24 pagesChapter 9 Government's Role in BankingZedie Leigh VioletaNo ratings yet

- Session 1 Goal and Function of FinanceDocument59 pagesSession 1 Goal and Function of FinanceMayank PatelNo ratings yet

- Mekanisme Global Eksor ImporDocument9 pagesMekanisme Global Eksor ImporAzizah MutmainnahNo ratings yet

- Working Capital ManagementDocument25 pagesWorking Capital ManagementJaveria LeghariNo ratings yet

- Job Costing - ExcercisesDocument31 pagesJob Costing - Excercisesგიორგი კაციაშვილიNo ratings yet

- CVP-analysis ExcercisesDocument31 pagesCVP-analysis Excercisesგიორგი კაციაშვილიNo ratings yet

- Lecture 4 - AD-AS ModelDocument18 pagesLecture 4 - AD-AS Modelგიორგი კაციაშვილიNo ratings yet

- Lecture - 3 MacroeconomicsDocument23 pagesLecture - 3 Macroeconomicsგიორგი კაციაშვილიNo ratings yet

- Research and Practice in Human Resource ManagementDocument10 pagesResearch and Practice in Human Resource ManagementAlexandru NaeNo ratings yet

- Full Statement: Ramaphosa Announces 21-Day LockdownDocument13 pagesFull Statement: Ramaphosa Announces 21-Day LockdownCityPressNo ratings yet

- Pagos Efectuados A LaboratoriosDocument14 pagesPagos Efectuados A LaboratoriosCronista.comNo ratings yet

- Foreign Investment and Its Necessity: Introductory: Saroj K GhimireDocument28 pagesForeign Investment and Its Necessity: Introductory: Saroj K GhimireChandra Shekhar PantNo ratings yet

- Topics Covered: Does Debt Policy Matter ?Document11 pagesTopics Covered: Does Debt Policy Matter ?Tam DoNo ratings yet

- ECB Cuts Rates and Boosts QE To Ratchet Up Eurozone StimulusDocument24 pagesECB Cuts Rates and Boosts QE To Ratchet Up Eurozone StimulusstefanoNo ratings yet

- Business CycleDocument26 pagesBusiness CycleNalin08100% (7)

- Dolores Armengot 20 - Carlos SilvaDocument36 pagesDolores Armengot 20 - Carlos SilvaJosé Vicente Álvarez FernándezNo ratings yet

- Optimisation Problems of Bicycle Using Ms Excel SolverDocument2 pagesOptimisation Problems of Bicycle Using Ms Excel SolverAnjan SapkotaNo ratings yet

- Proposal Batik SurinameDocument5 pagesProposal Batik SurinameFirman NugrahaNo ratings yet

- UPSC EPFO EOAO and APFC 1Document143 pagesUPSC EPFO EOAO and APFC 1Raj KumarNo ratings yet

- Africa Worksheet PDFDocument3 pagesAfrica Worksheet PDFSamarthNo ratings yet

- Accounting Cycle ProblemsDocument3 pagesAccounting Cycle ProblemsCHRISHA PARAGASNo ratings yet

- Article On The Gig EconomyDocument4 pagesArticle On The Gig Economyines alvaro feliuNo ratings yet

- Class 12 Eco Unit Test 2 2021-22Document13 pagesClass 12 Eco Unit Test 2 2021-22Ayush MishraNo ratings yet

- Cons of Global Free TradeDocument4 pagesCons of Global Free TradeGlydel Mae LaidanNo ratings yet

- 2023 03 06 Zambias Developing International Relations VandomeDocument35 pages2023 03 06 Zambias Developing International Relations VandomeNazia RuheeNo ratings yet

- Swot Analysis of AssetsDocument8 pagesSwot Analysis of Assetsshinjan bhattacharyaNo ratings yet

- Kenya S Industrial Transformation ProgrammeDocument20 pagesKenya S Industrial Transformation ProgrammeLuigi BoardNo ratings yet

- The Contribution of Tourism To Socio-Economic Development: Myth or Reality?Document29 pagesThe Contribution of Tourism To Socio-Economic Development: Myth or Reality?Ken ReyesNo ratings yet

- Auto Servis Bondowoso EMM Catalogus 2020 Colad Hamach RoninTools LRDocument104 pagesAuto Servis Bondowoso EMM Catalogus 2020 Colad Hamach RoninTools LRsupriyanto yusufNo ratings yet

- 1YHB00000001451 1yhb00000001451Document2 pages1YHB00000001451 1yhb00000001451juan jose loja obregonNo ratings yet

- ת"א 5976-05-20 XL אנרג'י נ' מוטי גרינוולדDocument338 pagesת"א 5976-05-20 XL אנרג'י נ' מוטי גרינוולדAlice AbramovichNo ratings yet

- Pengaruh Komposisi Media Tanam Terhadap Pertumbuhan Dan Hasil Tanaman Pakcoy (Brassica Chinensis L.)Document10 pagesPengaruh Komposisi Media Tanam Terhadap Pertumbuhan Dan Hasil Tanaman Pakcoy (Brassica Chinensis L.)Purwita Sari NugrainiNo ratings yet

- Adventure Works SalesDocument392 pagesAdventure Works SalesJohn F. RNo ratings yet

- Financial Management Assignment 1Document8 pagesFinancial Management Assignment 1Puspita RamadhaniaNo ratings yet