Professional Documents

Culture Documents

Chapter 2

Uploaded by

Jose Carlos Souza0 ratings0% found this document useful (0 votes)

33 views25 pagesCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views25 pagesChapter 2

Uploaded by

Jose Carlos SouzaCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 25

Horngren’s Accounting

Volume One, Eleventh Canadian Edition

Chapter 2

Recording Business

Transactions

Copyright © 2020 Pearson Canada Inc. 2-1

Learning Objective (1 of 5)

• Define and use key accounting terms

– What are the key terms used when recording transactions?

Copyright © 2020 Pearson Canada Inc. 2-2

The Accounting Cycle – Where It’s

Covered

CHP 2 1. Identify and analyze transactions as they occur

2. Record transactions in a journal

3. Post (copy) from the journal to the ledger accounts

4. Prepare the unadjusted trial balance

CHP 3 5. Journalize and post adjusting entries

6. Prepare an adjusted trial balance

7. Prepare the financial statements

CHP 4 8. Journalize and post the closing entries

9. Prepare the post-closing trial balance

Start with the balances in the ledger at the

beginning of the period

Copyright © 2020 Pearson Canada Inc. 2-3

The Account, the Journal, the Ledger

and the Trial Balance

• All accounting systems include:

– ACCOUNT – analyze the transaction to identify changes in

accounts; for example, an account is required for Cash (bank

account) transactions

– JOURNAL – accountants record transactions first in a journal;

chronological record of transactions

– LEDGER – copy (post) the data to the ledger; like a binder, with

each page in the binder representing one account

– TRIAL BALANCE – a list of all the ledger accounts and their

balances

Copyright © 2020 Pearson Canada Inc. 2-4

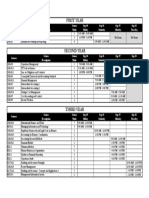

Chart of Accounts (1 of 2)

• List of all accounts used by the entity

• Account names are listed along with the account numbers

• The numbering system often follows a general structure

• Account numbers begin with:

– 1 = Assets

– 2 = Liabilities

– 3 = Owner’s Equity

– 4 = Revenues

– 5 = Expenses

Copyright © 2020 Pearson Canada Inc. 2-5

Chart of Accounts (2 of 2)

Copyright © 2020 Pearson Canada Inc. 2-6

Learning Objective (2 of 5)

• Apply the rules of debit and credit

– How do we track changes in accounts?

Copyright © 2020 Pearson Canada Inc. 2-7

Double-Entry Accounting

• Accounting uses the double-entry system

• Every transaction affects at least two accounts

• There is a receiving side and a giving side; examples:

• A cash purchase of supplies; what are the dual effects of

this transaction?

1. Increases supplies (the business received supplies)

2. Decreases cash (the business gave cash)

• A purchase of a truck (made with a bank loan):

1. Increases vehicles (the business received the truck)

2. Increases the bank loan payable (the business gave a promise to

pay in the future)

Copyright © 2020 Pearson Canada Inc. 2-8

The T-Account

• T-account is a quick way to

Account Title

show the effect of

Debit Credit

(Dr) (Cr) transactions on a particular

account

LEFT RIGHT

SIDE SIDE • A useful shortcut or tool

Debits are not “good” or • Not part of the formal

“bad.” Neither are credits.

accounting records

Debits are not always

increases, and credits are • Debit = left side

not always decreases. Debit

simply means left side, and • Credit = right side

credit means right side.

Copyright © 2020 Pearson Canada Inc. 2-9

The Accounting Equation and the Rules

of Debit and Credit

• The type of an account (asset, liability, owner’s equity)

determines how we record increases and decreases

– Assets – increase on Debit side; decrease on Credit side

– Liabilities and Owner’s Equity – increase on Credit side; decrease

on Debit side

Copyright © 2020 Pearson Canada Inc. 2 - 10

An Example (1 of 2)

• Lisa Hunter invested $250,000 cash to start her business

• The company received cash, and gave owner’s equity

Assets = Liabilities + Owner’ Equity

Cash L. Hunter, Capital

Debit for Blank Blank Credit for

increase, increase,

$250,000 $250,000

Copyright © 2020 Pearson Canada Inc. 2 - 11

An Example (2 of 2)

• Lisa Hunter invested $250,000 cash to begin HES

• $100,000 cash purchase of land

Assets = Liabilities + Owner’ Equity

Cash L. Hunter, Capital

250,000 100,000 Blank 250,000

Balance Blank

150,000

Land

100,000 Blank

Copyright © 2020 Pearson Canada Inc. 2 - 12

Expanding the Rules of Debit and

Credit: Revenues and Expenses

Copyright © 2020 Pearson Canada Inc. 2 - 13

Normal Balance of an Account

• The normal balance appears

One way to memorize this is to

on the side of the account- use an acronym, such as AWE

debit or credit – where ROL. In this case, the (A)sset,

increases are recorded (W)ithdrawal, and (E)xpense

accounts all have debit

• Depending on the account, this balances,while the (R)evenue,

could be a debit or credit (O)wner’s Equity, and (L)iability

accounts all have credit balances.

• The normal balances are: Or memorize which side has the

– Asset accounts = debit “+” (increase), and then all the “−”

(decreases) are the opposite. This

– Liability accounts = credit way you only

– Capital accounts = credit have to memorize half of them!

Try DR. AWE—the debits

– Revenue accounts = credit

(dr) belong with the (A)sset,

– Expense accounts = debit (W)ithdrawal, and (E)xpense

– Withdrawal accounts = debit accounts.

Copyright © 2020 Pearson Canada Inc. 2 - 14

Learning Objective (3 of 5)

• Analyze and record transactions in the journal

– How do we record business transactions?

Copyright © 2020 Pearson Canada Inc. 2 - 15

Source Documents – The Origin of

Transactions

• Source documents are the evidence of a transaction

• Bank deposit slip – shows amount of money received by

the business and deposited in the bank

• Purchase invoice – Document that tells the business how

much to pay and when to pay the vendor.

• Bank cheque – Document that tells the amount and the

date of cash payments.

• Sales invoice – Document sent to the customer when a

business sells goods or services and tells the business

how much revenue to record

Copyright © 2020 Pearson Canada Inc. 2 - 16

Recording Transactions in the Journal

• Journalizing a transaction is the chronological record of the

entity’s transaction

• Process of journalizing transactions is as follows:

– Transaction: identify the transaction from the source documents

– Analysis: identify each account affected by the transaction;

determine increase / decrease in accounts affected and apply the

rules of debit and credit

– Accounting Equation: Verify that the accounting equation is still in

balance

– Journal Entry: record the transaction in the journal with an

explanation or description; total debits must = total credits

Copyright © 2020 Pearson Canada Inc. 2 - 17

Journal Entries include….

• The date of the transaction

• The title of the account debited and the dollar amount

• Title of the account credited and the dollar amount

• A short explanation of the transaction

Copyright © 2020 Pearson Canada Inc. 2 - 18

Learning Objective (4 of 5)

Post from the journal to the ledger

• What is the next step after recording the transaction?

Copyright © 2020 Pearson Canada Inc. 2 - 19

Posting (Transferring Information) from

the Journal to the Ledger

• Posting is the transferring (copying) of the data from the

journal to the ledger

• The ledger tracks all transactions related to an account

• A T-Account can be used as short form for a ledger

Copyright © 2020 Pearson Canada Inc. 2 - 20

Learning Objective (5 of 5)

Prepare and use a trial balance

• How can we check if the records are in balance?

Copyright © 2020 Pearson Canada Inc. 2 - 21

The Trial Balance (1 of 3)

• A trial balance summarizes the ledger by listing all

accounts with their balances

• Assets first, followed by liabilities and then owner’s equity,

revenues and expenses

• Before computers, the trial balance provided a check on

accuracy by showing whether total debits equal total

credits

• The trial balance is still useful as a summary of all the

accounts and their balances

Do not confuse the Trial Balance with the Balance Sheet

Copyright © 2020 Pearson Canada Inc. 2 - 22

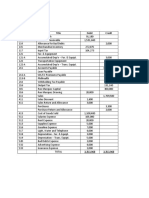

The Trial Balance (2 of 3)

Exhibit 2–12 Trial Balance

HUNTER ENVIRONMENTAL CONSULTING

Unadjusted Trial Balance

April 30, 2019

Blank Blank Balance Blank

Account Number Account Debit Credit

1100 Cash $172,000 Blank

1200 Accounts receivable 10,000 Blank

1400 Office supplies 7,000 Blank

1900 Land 100,000 Blank

2100 Accounts payable Blank $ 2,000

3000 Lisa Hunter, capital Blank 250,000

3100 Lisa Hunter, withdrawals 6,000 Blank

Copyright © 2020 Pearson Canada Inc. 2 - 23

The Trial Balance (3 of 3)

Exhibit 2–12 Trial Balance

HUNTER ENVIRONMENTAL CONSULTING

Unadjusted Trial Balance

April 30, 2019

Blank Blank Balance Blank

Account Number Account Debit Credit

4000 Service revenue Blank 55,000

5100 Rent expense 4,000 Blank

5200 Salaries expense 6,500 Blank

5300 Utilities expense 1,500 _______

Blank Total $307,000 $307,000

Copyright © 2020 Pearson Canada Inc. 2 - 24

Correcting Trial Balance Errors

• Search for missing accounts

• Search the journal for the amount of the difference

• Divide the difference between total debits and total credits

by 2 – when you mix a debit and credit, you double the

impact of the error

• Divide the out-of-balance amount by 9 – helps to identify

slide errors ($610 instead of $61) or transposition errors

($16 instead of $61)

Copyright © 2020 Pearson Canada Inc. 2 - 25

You might also like

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Accounting TransactionsDocument28 pagesAccounting TransactionsPaolo100% (1)

- Recording Transactions: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDDocument34 pagesRecording Transactions: Powerpoint Presentation by Phil Johnson ©2015 John Wiley & Sons Australia LTDShiTheng Love UNo ratings yet

- Debits and Credits: Analyzing and Recording Business TransactionsDocument45 pagesDebits and Credits: Analyzing and Recording Business TransactionsJesse JaucianNo ratings yet

- Session 2 - Income Statement and Transaction AnalysisDocument42 pagesSession 2 - Income Statement and Transaction Analysishieucaiminh155No ratings yet

- PPT 2 - Business TransactionDocument29 pagesPPT 2 - Business Transactionthinkaboutbe14No ratings yet

- Chapter 02Document50 pagesChapter 02Huy HoangNo ratings yet

- Recording Business Transactions: 2-1 © 2015 Pearson Education, LimitedDocument39 pagesRecording Business Transactions: 2-1 © 2015 Pearson Education, LimitedRalph TahtouhNo ratings yet

- Nobles Acctg10 PPT 02Document39 pagesNobles Acctg10 PPT 02Tayar ElieNo ratings yet

- Week 3 Double Entry Bookkeeping: Prepared By: Ms DorisDocument33 pagesWeek 3 Double Entry Bookkeeping: Prepared By: Ms DorisKaitlyne FooNo ratings yet

- Introduction To Financial Accounting (FFA/FAB) : DR Ahmad AlshehabiDocument55 pagesIntroduction To Financial Accounting (FFA/FAB) : DR Ahmad AlshehabiKye SimpsonNo ratings yet

- The Recording Process: Pertemuan Ke-3Document39 pagesThe Recording Process: Pertemuan Ke-3Nadhiela AdaniNo ratings yet

- Basic AccountingDocument48 pagesBasic Accounting3122No ratings yet

- Presentation On Accounting BasicDocument20 pagesPresentation On Accounting BasicKrishna Kumar SinghNo ratings yet

- BUSN7008 Week 2 Recording Business TransactionsDocument37 pagesBUSN7008 Week 2 Recording Business TransactionsberfamenNo ratings yet

- (Accounting) Chapter 3. Recording TransactionsDocument40 pages(Accounting) Chapter 3. Recording TransactionsHuy Nguyễn NgọcNo ratings yet

- Lec 5Document56 pagesLec 5Sara Abdelrahim MakkawiNo ratings yet

- Accounting Concepts & PrinciplesDocument26 pagesAccounting Concepts & PrinciplesThy Ngoc100% (1)

- Horngrens Accounting 12th Edition Nobles Solutions ManualDocument109 pagesHorngrens Accounting 12th Edition Nobles Solutions ManualAnnGregoryDDSytidk100% (16)

- Recording Business TransactionsDocument29 pagesRecording Business TransactionsDheeraj SinghalNo ratings yet

- Accounting - 2. The Accounting ProcessDocument19 pagesAccounting - 2. The Accounting ProcessChi Kei KeungNo ratings yet

- Class NotesDocument45 pagesClass NotesNaveed Whatsapp Status100% (1)

- Recording Business Transactions in Primary BooksDocument45 pagesRecording Business Transactions in Primary BooksarifehsanNo ratings yet

- Topic 3 - Recording Transactions (STU)Document60 pagesTopic 3 - Recording Transactions (STU)thiennnannn45No ratings yet

- ch02 The Recording ProcessDocument12 pagesch02 The Recording ProcessMạnh Hoàng Phi ĐứcNo ratings yet

- Module 1 - Financial Statements Presentation and Preparation PDFDocument8 pagesModule 1 - Financial Statements Presentation and Preparation PDFKeiszcha Dela VegaNo ratings yet

- Lecture 1 - 2-Basics of AccountingDocument29 pagesLecture 1 - 2-Basics of AccountingRavi KumarNo ratings yet

- Fa PPT CH 2 - 7eDocument59 pagesFa PPT CH 2 - 7eMaria GomezNo ratings yet

- Xpacoac A101 5 8Document33 pagesXpacoac A101 5 8TeamACEsPH Back-up AccountNo ratings yet

- Financial Accounting - Information For Decisions - Session 1 - Chapter 2 PPT pBGEaElvpiDocument27 pagesFinancial Accounting - Information For Decisions - Session 1 - Chapter 2 PPT pBGEaElvpimukul3087_305865623No ratings yet

- 2.double-Entry Recording Process - CLCDocument48 pages2.double-Entry Recording Process - CLCTrang NguyenNo ratings yet

- Lesson 1 Analyzing Recording TransactionsDocument6 pagesLesson 1 Analyzing Recording TransactionsklipordNo ratings yet

- Chapter 3 2021Document79 pagesChapter 3 2021Nguyen Cong Tuan AnhNo ratings yet

- Chapter 2 - Recording Business TransactionsDocument6 pagesChapter 2 - Recording Business TransactionsHa Phuoc HauNo ratings yet

- Intermediate Accounting: Eleventh Canadian EditionDocument62 pagesIntermediate Accounting: Eleventh Canadian EditionthisisfakedNo ratings yet

- Accounting Basics Using Quickbooks: Presented by Mike KimutaiDocument17 pagesAccounting Basics Using Quickbooks: Presented by Mike KimutaiMike Kimutai 'Sonko'No ratings yet

- CHAPTER 1 - PPT Intro To AccountingDocument14 pagesCHAPTER 1 - PPT Intro To AccountingAmrinNo ratings yet

- Chapter Two - Fundamentals of AcctDocument14 pagesChapter Two - Fundamentals of AcctGedionNo ratings yet

- Module 4 - Double Entry Bookkeeping System and The Accounting EquationDocument9 pagesModule 4 - Double Entry Bookkeeping System and The Accounting EquationMark Christian BrlNo ratings yet

- Lecture#3 ContinueDocument45 pagesLecture#3 ContinueBeluga GamerTMNo ratings yet

- Unit IiDocument20 pagesUnit IinamianNo ratings yet

- Lesson 2 - Recording The Business TransactionsDocument6 pagesLesson 2 - Recording The Business TransactionsUnknownymousNo ratings yet

- Topic 2 Financial Statements, Taxes and CashflowsDocument22 pagesTopic 2 Financial Statements, Taxes and CashflowsQianyiiNo ratings yet

- Accountancy: Shaheen Falcons Pu CollegeDocument13 pagesAccountancy: Shaheen Falcons Pu CollegeMohammed RayyanNo ratings yet

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BDocument5 pagesThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburNo ratings yet

- Unit 2 FMDocument91 pagesUnit 2 FMDhakshnamoorthiNo ratings yet

- BSA Review Mod 3Document11 pagesBSA Review Mod 3Johar MesugNo ratings yet

- FA-I (Lecture Note Ch-2)Document51 pagesFA-I (Lecture Note Ch-2)samioro746No ratings yet

- CHAPTER # 2 Double Entry BookkeepingDocument17 pagesCHAPTER # 2 Double Entry BookkeepingWaleed NasirNo ratings yet

- Chapter 5-4Document40 pagesChapter 5-4Joel Sam BiljiNo ratings yet

- Debit and CreditDocument33 pagesDebit and CreditBasma ShaalanNo ratings yet

- Announcements: Time: Friday, April 14, From 1:30 P.M. To 3:30 P.M. Location: ContentDocument81 pagesAnnouncements: Time: Friday, April 14, From 1:30 P.M. To 3:30 P.M. Location: ContentManav PatelNo ratings yet

- 02-General Ledger AccountingDocument96 pages02-General Ledger AccountingRirinNo ratings yet

- 2-Accounting Equation & Journal Entries, Posting To LedgersDocument12 pages2-Accounting Equation & Journal Entries, Posting To LedgershattarvapeNo ratings yet

- Lecture 3 DoubleentrysystemDocument47 pagesLecture 3 Doubleentrysystem叶祖儿No ratings yet

- Accounting CycleDocument15 pagesAccounting CycleDeligateaux MalaysiaNo ratings yet

- 2 - FSA1 Handout (Topic 2) - MechanicsDocument59 pages2 - FSA1 Handout (Topic 2) - MechanicsGuyu PanNo ratings yet

- Lecture NotesDocument5 pagesLecture NotesLyaman TagizadeNo ratings yet

- Ch.3 Balance SheetDocument19 pagesCh.3 Balance Sheetyfzhizhi0214No ratings yet

- Principle of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahDocument35 pagesPrinciple of Double Entry & Trial Balance: Prepared By: Nurul Hassanah HamzahNur Amira NadiaNo ratings yet

- Kieso IFRS4 TB ch02Document67 pagesKieso IFRS4 TB ch023ooobd1234No ratings yet

- Chapter 9 ValuationDocument85 pagesChapter 9 ValuationSaravanaaRajendran100% (1)

- DivyanshuJoshi 202221020 BasicsOfAccounting Ch1Document10 pagesDivyanshuJoshi 202221020 BasicsOfAccounting Ch1Divyanshu JoshiNo ratings yet

- Capsim Round 1Document14 pagesCapsim Round 1AjitNo ratings yet

- MAS Diagnostic ExamDocument10 pagesMAS Diagnostic ExamDanielNo ratings yet

- Unit 7 Audit of Property Plant and Equipment Handout Final t21516Document10 pagesUnit 7 Audit of Property Plant and Equipment Handout Final t21516Mikaella BengcoNo ratings yet

- Introduction To AccountancyDocument5 pagesIntroduction To AccountancyVipin Mandyam KadubiNo ratings yet

- JSS 2016053009190527Document105 pagesJSS 2016053009190527ushaNo ratings yet

- GPB Financial Statement 2014Document60 pagesGPB Financial Statement 2014wan farid imranNo ratings yet

- UPDATED SCHEDULE Departmental Quiz 1Document1 pageUPDATED SCHEDULE Departmental Quiz 1Elaine AntonioNo ratings yet

- FA Study Text 2019 PDFDocument476 pagesFA Study Text 2019 PDFsmlingwa100% (1)

- MGMT201 Application 3 (Case Only) - 2021Document4 pagesMGMT201 Application 3 (Case Only) - 2021hieu maiNo ratings yet

- 1 - Accounting - Crossword 3Document2 pages1 - Accounting - Crossword 3Mercy Dioselina Torres SantamariaNo ratings yet

- CS2 Speaking TestDocument9 pagesCS2 Speaking TesthansanakarunanayakeNo ratings yet

- Agenda Item 4-G: ISA 300 (Redrafted) Planning An Audit of Financial StatementsDocument16 pagesAgenda Item 4-G: ISA 300 (Redrafted) Planning An Audit of Financial StatementsHusseinNo ratings yet

- Journal Entries, Ledger and Trial BalanceDocument8 pagesJournal Entries, Ledger and Trial BalanceDan Ryan0% (1)

- Release Notes - Oracle R12Document164 pagesRelease Notes - Oracle R12Eric C NgNo ratings yet

- FORM TP 2017101 Test Code 01239010 MAY/JUNE 2017: Paper 01 - General ProficiencyDocument14 pagesFORM TP 2017101 Test Code 01239010 MAY/JUNE 2017: Paper 01 - General ProficiencyChelsea BynoeNo ratings yet

- Trial Balance February 28, 20X1Document3 pagesTrial Balance February 28, 20X1Angelica MaeNo ratings yet

- Advanced Accounting Baker Chapter 4 AnswersDocument58 pagesAdvanced Accounting Baker Chapter 4 AnswersOksana McCord86% (7)

- Sap Accounting EntriesDocument9 pagesSap Accounting Entriesswayam100% (1)

- Q 4 Results Intimation 240522Document29 pagesQ 4 Results Intimation 240522kumar sunnyNo ratings yet

- Grier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300Document150 pagesGrier, Waymond A. - Credit Analysis of Financial Institutions-Euromoney Books (2012) - 151-300HILDA IDANo ratings yet

- Tarea 2 - METODOSDocument19 pagesTarea 2 - METODOSROGER GONZALES BECERRANo ratings yet

- Chapter 5 Non Integrated AccountsDocument52 pagesChapter 5 Non Integrated AccountsmahendrabpatelNo ratings yet

- WWF Tanzania Vacancies AugustDocument24 pagesWWF Tanzania Vacancies AugustSaumu MbanoNo ratings yet

- Understanding Accruals R12 05012013Document58 pagesUnderstanding Accruals R12 05012013prasanthbab7128No ratings yet

- CH 04Document25 pagesCH 04Beast aNo ratings yet

- T24 Accounting Introduction - R14.01Document165 pagesT24 Accounting Introduction - R14.01JEGADEESWARINo ratings yet