Professional Documents

Culture Documents

CH 07

Uploaded by

Rabie Haroun0 ratings0% found this document useful (0 votes)

3 views52 pagesprinciples of accounting

Original Title

ch07

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentprinciples of accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views52 pagesCH 07

Uploaded by

Rabie Harounprinciples of accounting

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 52

Accounting Principles

Thirteenth Edition

Weygandt ● Kimmel ● Kieso

Chapter 7

Accounting Information Systems

This slide deck contains animations. Please disable animations if they cause issues with your device.

Chapter Outline

Learning Objectives

LO 1 Explain the basic concepts of an accounting

information system.

LO 2 Describe the nature and purpose of a subsidiary

ledger.

LO 3 Record transactions in special journals.

Copyright ©2018 John Wiley & Sons, Inc. 2

Accounting Information Systems (1 of 2)

Collects and processes transaction data and

communicates financial information to decision makers.

Includes:

• All steps in the accounting cycle

• Documents that provide evidence of transactions and

the records, trial balances, worksheets, and financial

statements that result

• Manual or computerized accounting system

Copyright ©2018 John Wiley & Sons, Inc. 3

Accounting Information Systems (2 of 2)

Cost-Effectiveness

• Benefits of information must outweigh costs of providing it

Useful Output

• Information must be understandable, relevant, reliable,

timely, and accurate

• Must consider needs and knowledge of various users

Flexibility

• Should accommodate a variety of users and changing

information needs

Copyright ©2018 John Wiley & Sons, Inc. 4

Computerized Accounting Systems (1 of 2)

• Software programs (functions include sales, purchases,

receivables, payables, cash receipts and disbursements, and

payroll)

• Generate financial statements

• Advantages:

o Typically enter data only once

o Many human errors are eliminated

o More timely information

Copyright ©2018 John Wiley & Sons, Inc. 5

Computerized Accounting Systems (2 of 2)

Choosing a Software Package

Entry-Level Software

• Easy data access and report preparation

• Audit trail

• Internal control

• Customization

• Network-Compatibility

Enterprise Resource Planning Systems

Copyright ©2018 John Wiley & Sons, Inc. 6

Manual Accounting Systems

• Perform each step in accounting cycle by hand

• Satisfactory with a low volume of transactions

• Must understand manual accounting systems to

understand computerized accounting systems

Copyright ©2018 John Wiley & Sons, Inc. 7

Do It! 1: Basic AIS Concepts (1 of 2)

Indicate whether the following statements are true or false. If false, indicate how

to correct the statement.

1. An accounting information system collects and processes transaction data

and communicates financial information to decision-makers.

2. A company typically enters data only once in a manual accounting system.

3. Enterprise resource planning (ERP) systems are typically used by companies

with revenues of less than $5 million and up to 20 employees.

Solution:

1.

2.

3.

Copyright ©2018 John Wiley & Sons, Inc. 8

Do It! 1: Basic AIS Concepts (2 of 2)

Indicate whether the following statements are true or false. If false, indicate how

to correct the statement.

1. An accounting information system collects and processes transaction data

and communicates financial information to decision-makers.

2. A company typically enters data only once in a manual accounting system.

3. Enterprise resource planning (ERP) systems are typically used by companies

with revenues of less than $5 million and up to 20 employees.

Solution:

1. True

2. False. A company typically enters data only once in a computerized

accounting system.

3. False. Enterprise resource planning (ERP) systems are typically used by

manufacturing companies with more than 500 employees and $500

million in sales.

Copyright ©2018 John Wiley & Sons, Inc. 9

Subsidiary Ledgers (1 of 2)

Used to keep track of individual balances.

Two common subsidiary ledgers are:

1. Accounts receivable (customers’)

2. Accounts payable (creditors’)

Copyright ©2018 John Wiley & Sons, Inc. 10

Subsidiary Ledgers (2 of 2)

Copyright ©2018 John Wiley & Sons, Inc. 11

Subsidiary Ledgers Example

Copyright ©2018 John Wiley & Sons, Inc. 12

Advantages of Subsidiary Ledgers

1. Show in a single account transactions affecting one

customer or one creditor.

2. Free the general ledger of excessive details.

3. Help locate errors in individual accounts.

4. Make possible a division of labor.

Copyright ©2018 John Wiley & Sons, Inc. 13

Do It! 2: Subsidiary Ledgers (1 of 2)

Presented below is information related to Sims Company for its first month of

operations. Determine the balances that appear in the accounts payable

subsidiary ledger for each company.

Devon Co.: $4,000 ($11,000 − $7,000)

Shelby Co.: $5,000 ($7,000 − $2,000)

Taylor Co.: $5,000 ($14,000 − $9,000)

Copyright ©2018 John Wiley & Sons, Inc. 14

Do It! 2: Subsidiary Ledgers (2 of 2)

Presented below is information related to Sims Company for its first month of

operations. What Accounts Payable balance appears in the general ledger at

the end of January?

General ledger Accounts Payable balance: $14,000 ($4,000 + $5,000 +

$5,000)

Copyright ©2018 John Wiley & Sons, Inc. 15

Special Journals

If a transaction cannot be recorded in a special journal, the

company records it in the general journal.

Copyright ©2018 John Wiley & Sons, Inc. 16

Special Journals (1 of 4)

Each of the following is a subsidiary ledger except the:

a. Accounts receivable ledger

b. Accounts payable ledger

c. Customer’s ledger

d. General ledger

Copyright ©2018 John Wiley & Sons, Inc. 17

Special Journals (2 of 4)

Each of the following is a subsidiary ledger except the:

a. Accounts receivable ledger

b. Accounts payable ledger

c. Customer’s ledger

d. Answer: General ledger

Copyright ©2018 John Wiley & Sons, Inc. 18

Special Journals (3 of 4)

All of the following are advantages of using subsidiary

ledgers except they:

a. show transactions affecting one customer or one

creditor in a single account.

b. Free the general ledger of excessive details.

c. Eliminate errors in individual accounts.

d. Make possible a division of labor.

Copyright ©2018 John Wiley & Sons, Inc. 19

Special Journals (4 of 4)

All of the following are advantages of using subsidiary

ledgers except they:

a. show transactions affecting one customer or one

creditor in a single account.

b. Free the general ledger of excessive details.

c. Answer: Eliminate errors in individual accounts.

d. Make possible a division of labor.

Copyright ©2018 John Wiley & Sons, Inc. 20

Sales Journals (1 of 5)

Journalizing Credit Sales

Copyright ©2018 John Wiley & Sons, Inc. 21

Posting the Sales Journal (2 of 5)

Copyright ©2018 John Wiley & Sons, Inc. 22

Posting the Sales Journal (3 of 5)

Note: This posting sequence results in a credit balance in

Inventory, which exists only until the other journals are posted.

Copyright ©2018 John Wiley & Sons, Inc. 23

Proving the Ledgers (4 of 5)

Copyright ©2018 John Wiley & Sons, Inc. 24

Advantages of the Sales Journal (5 of 5)

• One-line entry for each sales transaction saves time

• Only totals, rather than individual entries, are posted to

general ledger

• Division of labor results

Copyright ©2018 John Wiley & Sons, Inc. 25

Cash Receipts Journal (1 of 4)

To illustrate we continue with May transactions of Karns Wholesale Supply.

Entries in the cash receipts journal are based on the following cash receipts.

May 1 D. A. Karns makes an investment of $5,000 in the business.

7 Cash sales of merchandise total $1,900 (cost, $1,240).

10 Received a check for $10,388 from Abbot Sisters in payment of invoice No.

101 for $10,600 less a 2% discount.

12 Cash sales of merchandise total $2,600 (cost, $1,690).

17 Received a check for $11,123 from Babson Co. in payment of invoice No. 102

for $11,350 less a 2% discount.

22 Received cash by signing a note for $6,000.

23 Received a check for $7,644 from Carson Bros. in full for invoice No. 103 for

$7,800 less a 2% discount.

28 Received a check for $9,114 from Deli Co. in full for invoice No. 104 for $9,300

less a 2% discount.

Copyright ©2018 John Wiley & Sons, Inc. 26

Cash Receipts Journal (2 of 4)

Copyright ©2018 John Wiley & Sons, Inc. 27

Cash Receipts Journal (3 of 4)

Not all of the subsidiary or

general ledger accounts are

shown on the illustration to

the right. See Illustration 7.9

for the complete illustration.

Copyright ©2018 John Wiley & Sons, Inc. 28

Proving the Ledgers (4 of 4)

Copyright ©2018 John Wiley & Sons, Inc. 29

Cash Receipt Journal (1 of 4)

Cash sales of merchandise are recorded in the

a. Cash payments journal

b. Cash receipts journal

c. General journal

d. Sales journal

Copyright ©2018 John Wiley & Sons, Inc. 30

Cash Receipt Journal (2 of 4)

Cash sales of merchandise are recorded in the

a. Cash payments journal

b. Answer: Cash receipts journal

c. General journal

d. Sales journal

Copyright ©2018 John Wiley & Sons, Inc. 31

Cash Receipt Journal (3 of 4)

Which of the following is not one of the credit columns in

the cash receipts journal:

a. Other accounts

b. Accounts payable

c. Accounts receivable

d. Sales

Copyright ©2018 John Wiley & Sons, Inc. 32

Cash Receipt Journal (4 of 4)

Which of the following is not one of the credit columns in

the cash receipts journal:

a. Other accounts

b. Answer: Accounts payable

c. Accounts receivable

d. Sales

Copyright ©2018 John Wiley & Sons, Inc. 33

Journalizing and Posting Purchases Journal

(1 of 3)

Copyright ©2018 John Wiley & Sons, Inc. 34

Posting Purchases Journal to General Ledger

(2 of 3)

Copyright ©2018 John Wiley & Sons, Inc. 35

Proving the Ledgers (3 of 3)

Copyright ©2018 John Wiley & Sons, Inc. 36

Journalizing Cash Payments Journal (1 of 3)

Copyright ©2018 John Wiley & Sons, Inc. 37

Posting Cash Payments Journal (2 of 3)

Copyright ©2018 John Wiley & Sons, Inc. 38

Posting Cash Payments Journal to General

Ledger

Copyright ©2018 John Wiley & Sons, Inc. 39

Proving the Ledgers (3 of 3)

Copyright ©2018 John Wiley & Sons, Inc. 40

Purchase Journal (1 of 2)

Credit purchases of equipment or supplies other than

merchandise are recorded in the:

a. Cash payments journal

b. Cash receipts journal

c. General journal

d. Purchases journal

Copyright ©2018 John Wiley & Sons, Inc. 41

Purchase Journal (2 of 2)

Credit purchases of equipment or supplies other than

merchandise are recorded in the:

a. Cash payments journal

b. Cash receipts journal

c. Answer: General journal

d. Purchases journal

Copyright ©2018 John Wiley & Sons, Inc. 42

Cash Payment Journal (1 of 2)

Cash payment of merchandise are recorded in the:

a. Cash payments journal

b. Cash receipts journal

c. General journal

d. Purchases journal

Copyright ©2018 John Wiley & Sons, Inc. 43

Cash Payment Journal (2 of 2)

Cash payment of merchandise are recorded in the:

a. Answer: Cash payments journal

b. Cash receipts journal

c. General journal

d. Purchases journal

Copyright ©2018 John Wiley & Sons, Inc. 44

Effects of Special Journals on the General

Journal (1 of 3)

• Special journals substantially reduce the number of

entries that companies make in the general journal

• Only transactions that cannot be entered in a special

journal are recorded in the general journal

• Correcting, adjusting, and closing entries are made in

the general journal

Copyright ©2018 John Wiley & Sons, Inc. 45

Effects of Special Journals on the General

Journal (2 of 3)

To illustrate, assume that on May 31, Karns Wholesale

Supply returns $500 of merchandise for credit to Fabor

and Son. Illustration 7.18 shows the entry in the general

journal and the posting of the entry.

Copyright ©2018 John Wiley & Sons, Inc. 46

Effects of Special Journals on the General

Journal (3 of 3)

Copyright ©2018 John Wiley & Sons, Inc. 47

Do It! 3: Special Journals

Swisher Company had the following transactions during March.

1. Collected cash on account from Oakland Company.

2. Purchased equipment by signing a note payable.

3. Sold merchandise on account.

4. Purchased merchandise on account.

5. Paid $2,400 for a 2-year insurance policy.

Identify the journal in which each transactions is recorded.

Solution:

1. Cash receipts journal 4. Purchases journal

2. General journal 5. Cash payments journal

3. Sales journal

Copyright ©2018 John Wiley & Sons, Inc. 48

A Look at IFRS (1 of 3)

Key Points

Similarities

• The basic concepts related to an accounting

information system are the same under GAAP and IFRS.

• The use of subsidiary ledgers and control accounts, as

well as the system used for recording transactions, are

the same under GAAP and IFRS.

Copyright ©2018 John Wiley & Sons, Inc. 49

A Look at IFRS (2 of 3)

Key Points

Differences

• Many companies will be going through a substantial

conversion process to switch from their current

reporting standards to IFRS.

• Upon first-time adoption of IFRS, a company must

present at least one year of comparative information

under IFRS.

Copyright ©2018 John Wiley & Sons, Inc. 50

A Look at IFRS (3 of 3)

Looking to the Future

The basic recording process shown in this textbook is followed

by companies around the globe. It is unlikely to change in the

future. The definitional structure of assets, liabilities, equity,

revenues, and expenses may change over time as the I ASB

and FASB evaluate their overall conceptual framework for

establishing accounting standards. In addition, high-quality

international accounting requires both high-quality

accounting standards and high-quality auditing. Similar to the

convergence of GAAP and IFRS, there is a movement to

improve international auditing standards.

Copyright ©2018 John Wiley & Sons, Inc. 51

Copyright

Copyright © 2018 John Wiley & Sons, Inc.

All rights reserved. Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Act without the express written permission of the

copyright owner is unlawful. Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies

for his/her own use only and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the use of these programs or

from the use of the information contained herein.

Copyright ©2018 John Wiley & Sons, Inc. 52

You might also like

- ch18 ANALYZING FINANCIAL STATEMENTSDocument67 pagesch18 ANALYZING FINANCIAL STATEMENTSUpal MahmudNo ratings yet

- Accounting Principles: The Recording ProcessDocument55 pagesAccounting Principles: The Recording ProcessSayed Farrukh AhmedNo ratings yet

- CH 13Document77 pagesCH 13Mohammed SamyNo ratings yet

- CH 17Document77 pagesCH 17Nasim Rosin100% (1)

- CH 02Document57 pagesCH 02Fd AhNo ratings yet

- CH 02Document59 pagesCH 0263D-026-Md Golam Muktadir AsifNo ratings yet

- CH 02Document59 pagesCH 02Linda Anadya TastyaNo ratings yet

- Ch2 4e - Recording ProcessDocument59 pagesCh2 4e - Recording ProcessChâu HàNo ratings yet

- Financial Accounting: Weygandt KimmelDocument59 pagesFinancial Accounting: Weygandt KimmelAnh LýNo ratings yet

- CH 02Document59 pagesCH 02thucnhi.2003hnntNo ratings yet

- Intermediate: AccountingDocument115 pagesIntermediate: AccountingDieu NguyenNo ratings yet

- CH 02Document53 pagesCH 02Hoàng Lâm NguyễnNo ratings yet

- Intermediate Accounting: Full Disclosure in Financial ReportingDocument89 pagesIntermediate Accounting: Full Disclosure in Financial ReportingJoshua KhanNo ratings yet

- Chapter 1 IntroductionDocument34 pagesChapter 1 IntroductionLinda LiongNo ratings yet

- Ch2 4e - Recording Process 2021Document51 pagesCh2 4e - Recording Process 2021Nhung CaoNo ratings yet

- Accounting Principles: Corporations: Organization and Capital Stock TransactionsDocument55 pagesAccounting Principles: Corporations: Organization and Capital Stock TransactionsBLESSEDNo ratings yet

- CH 03Document60 pagesCH 03Dr. Murad SalehNo ratings yet

- The Accounting Information System: Kimmel Weygandt Kieso Trenholm Irvine BurnleyDocument23 pagesThe Accounting Information System: Kimmel Weygandt Kieso Trenholm Irvine Burnleyandrea ortegaNo ratings yet

- ch03 Kieso IFRS4 PPT SentDocument121 pagesch03 Kieso IFRS4 PPT SentPhee SiwakornNo ratings yet

- Ch1 4e Acc in Action.Document54 pagesCh1 4e Acc in Action.Phương NguyễnNo ratings yet

- Chapter 2 PPT (To Students)Document64 pagesChapter 2 PPT (To Students)歩美桜井No ratings yet

- 07 - Subsidiary Ledger and Special Journals Course MaterialsDocument49 pages07 - Subsidiary Ledger and Special Journals Course MaterialserilNo ratings yet

- Acounting and Financial ManagementDocument144 pagesAcounting and Financial ManagementyoursonesNo ratings yet

- CH 03Document114 pagesCH 03Sabbir ahmedNo ratings yet

- Lecture 9 - Statement of Cash FlowsDocument51 pagesLecture 9 - Statement of Cash FlowsTabassum Sufia Mazid100% (1)

- Chapter 1 - Accounting in ActionDocument68 pagesChapter 1 - Accounting in ActionNgân TrươngNo ratings yet

- CH 01Document54 pagesCH 01Ngân Hà ĐỗNo ratings yet

- Chapter 3-Adjusting The AccountsDocument69 pagesChapter 3-Adjusting The AccountsMahmud Al HasanNo ratings yet

- CH 01Document56 pagesCH 01thucnhi.2003hnntNo ratings yet

- CH 01Document53 pagesCH 01Ismadth2918388No ratings yet

- Chapter 3Document90 pagesChapter 3임재영100% (1)

- Accounting Eng 5+6 المحاضرة الخامسة والسادسةDocument26 pagesAccounting Eng 5+6 المحاضرة الخامسة والسادسة01326567536mNo ratings yet

- Chapter 1Document54 pagesChapter 1Phước Hà NgôNo ratings yet

- Chap 2 SlideDocument30 pagesChap 2 Slidehainguyen.31231022080No ratings yet

- Accounting For RecievableDocument64 pagesAccounting For Recievableaderagaming 2719No ratings yet

- Financial Accounting: Recording Business TransactionsDocument64 pagesFinancial Accounting: Recording Business Transactionsirma makharoblidzeNo ratings yet

- CH 01Document53 pagesCH 01Triệu Nguyễn MinhNo ratings yet

- chapter 2Document64 pageschapter 2beyzakeklikNo ratings yet

- Survey of Accounting: Introduction To Financial StatementsDocument33 pagesSurvey of Accounting: Introduction To Financial StatementsTiaraNo ratings yet

- Ch01 Note in ClassDocument50 pagesCh01 Note in ClassThanh ThủyNo ratings yet

- CH 10Document94 pagesCH 10Ashish YadavNo ratings yet

- FDIFA - Chapter 1Document61 pagesFDIFA - Chapter 121073045 Nguyễn Thị Thu TrangNo ratings yet

- FDIFA - Chapter 1Document61 pagesFDIFA - Chapter 1Nguyễn Thu TrangNo ratings yet

- Financial AccountingDocument66 pagesFinancial AccountingFaisal SaleemNo ratings yet

- CH 02Document64 pagesCH 02Sabbir ahmedNo ratings yet

- CH 03Document91 pagesCH 03R and F Love ForeverNo ratings yet

- CH 03Document91 pagesCH 03R and F Love ForeverNo ratings yet

- Accounting PrinciplesDocument45 pagesAccounting PrinciplesDella SamsuddinNo ratings yet

- ch03Document34 pagesch03Nirupa DudhatraNo ratings yet

- 2100 Solutions - CH8Document58 pages2100 Solutions - CH8ds hhNo ratings yet

- Ch1 4e - Acc in Action 2021Document50 pagesCh1 4e - Acc in Action 2021Nhung CaoNo ratings yet

- Ch1 4e - Acc in Action 2021Document50 pagesCh1 4e - Acc in Action 2021K59 Vu Thi Thu HienNo ratings yet

- CH 1 - Student - 13th Edition - PP Slides - Ryan McDanielDocument10 pagesCH 1 - Student - 13th Edition - PP Slides - Ryan McDanielRyan McdanielNo ratings yet

- Chap 2Document66 pagesChap 2Syed Ali RehanNo ratings yet

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsDocument7 pages# 2 Assignment On Financial and Managerial Accounting For MBA Studentsobsa alemayehuNo ratings yet

- Basic Accounting Concepts and Financial Statements ExplainedDocument8 pagesBasic Accounting Concepts and Financial Statements ExplainedLouiseNo ratings yet

- Question and Answer - 3Document31 pagesQuestion and Answer - 3acc-expertNo ratings yet

- ch01 STDocument24 pagesch01 STThái DungNo ratings yet

- Financial Accounting: Analyzing Transactions and Their Effects On Financial StatementsDocument52 pagesFinancial Accounting: Analyzing Transactions and Their Effects On Financial StatementsSebastián GómezNo ratings yet

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionFrom EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionNo ratings yet

- CH 07Document4 pagesCH 07flrnciairnNo ratings yet

- CH 08Document79 pagesCH 08Nabila EramNo ratings yet

- CH 03Document91 pagesCH 03Sayed Farrukh AhmedNo ratings yet

- Handout 3 - Plant Assets, Natural Resources, and Intangible AssetsDocument81 pagesHandout 3 - Plant Assets, Natural Resources, and Intangible Assetsyoussef abdellatifNo ratings yet

- Accounting For RecievableDocument64 pagesAccounting For Recievableaderagaming 2719No ratings yet

- Partnership Accounting Chapter SummaryDocument31 pagesPartnership Accounting Chapter SummaryJason Cabrera0% (1)

- CH 06Document6 pagesCH 06Rabie HarounNo ratings yet

- CH 06Document66 pagesCH 06Rabie HarounNo ratings yet

- Chapter 9.docpart 1 FinalDocument15 pagesChapter 9.docpart 1 FinalRabie HarounNo ratings yet

- Mid Term RevisionDocument9 pagesMid Term RevisionRabie HarounNo ratings yet

- Revision 2022Document10 pagesRevision 2022Rabie HarounNo ratings yet

- CH 1 Part 1Document5 pagesCH 1 Part 1Rabie HarounNo ratings yet

- Lecture 9Document6 pagesLecture 9Rabie HarounNo ratings yet

- Lecture 10Document13 pagesLecture 10Rabie HarounNo ratings yet

- Lecture 5Document15 pagesLecture 5Rabie HarounNo ratings yet

- Lecture 11Document13 pagesLecture 11Rabie HarounNo ratings yet

- Lecture 2Document10 pagesLecture 2Rabie HarounNo ratings yet

- CH 2 Part 3 2023 FinalDocument4 pagesCH 2 Part 3 2023 FinalRabie HarounNo ratings yet

- Lecture 8Document7 pagesLecture 8Rabie HarounNo ratings yet

- Chapter008 1Document21 pagesChapter008 1Rabie HarounNo ratings yet

- Lecture 6Document10 pagesLecture 6Rabie HarounNo ratings yet

- Lecture 3Document12 pagesLecture 3Rabie HarounNo ratings yet

- CH 06Document6 pagesCH 06Rabie HarounNo ratings yet

- Lecture 7Document11 pagesLecture 7Rabie HarounNo ratings yet

- Accounting for Merchandising Operations Problems: Set CDocument4 pagesAccounting for Merchandising Operations Problems: Set CRabie Haroun0% (1)

- Quiz 2Document1 pageQuiz 2Rabie HarounNo ratings yet

- Function of Financial Markets - DocfinalDocument4 pagesFunction of Financial Markets - DocfinalRabie HarounNo ratings yet

- Exam On CH 2Document1 pageExam On CH 2Rabie HarounNo ratings yet

- Feasibility StudyDocument3 pagesFeasibility StudyRabie HarounNo ratings yet

- Exam 1 On CH 3Document1 pageExam 1 On CH 3Rabie HarounNo ratings yet

- Accounting for Dividends and Preference SharesDocument16 pagesAccounting for Dividends and Preference Sharesruth san joseNo ratings yet

- SN54273, SN54LS273, SN74273, SN74LS273 Octal D-Type Flip-Flop With ClearDocument8 pagesSN54273, SN54LS273, SN74273, SN74LS273 Octal D-Type Flip-Flop With Clearsas999333No ratings yet

- Address:: Terminal Road 1 Corner, F. Imperial Street, Legazpi Port District, Legazpi City, Albay, PhilippinesDocument4 pagesAddress:: Terminal Road 1 Corner, F. Imperial Street, Legazpi Port District, Legazpi City, Albay, PhilippinesYani BarriosNo ratings yet

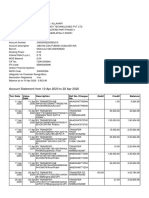

- Account activity and balance from 10 Apr to 22 AprDocument2 pagesAccount activity and balance from 10 Apr to 22 AprSRIDHAR allhari0% (1)

- 018 005 WaterproofingDocument7 pages018 005 WaterproofingSujani MaarasingheNo ratings yet

- Kautilya and Modern EconomicsDocument5 pagesKautilya and Modern EconomicssreejithNo ratings yet

- LL 131 LL3Document134 pagesLL 131 LL3PETGET GENERAL CONSULTING GROUPNo ratings yet

- Residences by Armani CasaDocument2 pagesResidences by Armani CasaHakanNo ratings yet

- Assignment Help Journal Ledger and MyodDocument9 pagesAssignment Help Journal Ledger and MyodrajeshNo ratings yet

- Christianity in The 1st CenturyDocument23 pagesChristianity in The 1st CenturyMarvin John YpilNo ratings yet

- Groupon Derivative SuitDocument31 pagesGroupon Derivative Suitjeff_roberts881No ratings yet

- Serban Nichifor: Forbidden Forest Interludes 1936-1939Document13 pagesSerban Nichifor: Forbidden Forest Interludes 1936-1939Serban NichiforNo ratings yet

- Time and Stress Management Online Training AttendeesDocument5 pagesTime and Stress Management Online Training AttendeesAtm AdnanNo ratings yet

- SSS P.E.S.O. Fund Enrollment FormDocument2 pagesSSS P.E.S.O. Fund Enrollment FormMark BagamaspadNo ratings yet

- Assignment 21 - EXERCISE 4.0Document2 pagesAssignment 21 - EXERCISE 4.0Ravi TNo ratings yet

- Application Form Draft Print For AllDocument2 pagesApplication Form Draft Print For AllAkNo ratings yet

- Obligations of The VendorDocument4 pagesObligations of The VendorHenri VasquezNo ratings yet

- The Sacrament of ReconciliationDocument6 pagesThe Sacrament of ReconciliationJohn Lester M. Dela CruzNo ratings yet

- Dao 1992-25 (Nipas Irr)Document28 pagesDao 1992-25 (Nipas Irr)Martin L T. SantosNo ratings yet

- Assignment # 4 MomentsDocument9 pagesAssignment # 4 MomentsKalidNo ratings yet

- ART Act 2020Document9 pagesART Act 2020LCCRA DSLSANo ratings yet

- Pestlem Eu2Document8 pagesPestlem Eu2Deepak PatilNo ratings yet

- The Dawn of Filipino NationalismDocument15 pagesThe Dawn of Filipino NationalismJoyce Anne GarduqueNo ratings yet

- Англійська моваDocument42 pagesАнглійська моваUyên Trâm TrầnNo ratings yet

- NPA Recruitment Strategy EDITEDDocument55 pagesNPA Recruitment Strategy EDITEDLisha Binong100% (1)

- Bad Debt & Provision for Doubtful Debts GuideDocument9 pagesBad Debt & Provision for Doubtful Debts GuideJavariaNo ratings yet

- Psref 325Document285 pagesPsref 325Alex OmegaNo ratings yet

- GE 3 Phil-His Finals-ModuleDocument20 pagesGE 3 Phil-His Finals-ModuleElsie Joy LicarteNo ratings yet

- German Education SystemDocument9 pagesGerman Education Systemrhona toneleteNo ratings yet

- Billy's Farewell: Look! Through The Port Comes The Moonshine Astray! Billy BuddDocument9 pagesBilly's Farewell: Look! Through The Port Comes The Moonshine Astray! Billy BuddJoseph JaeKwon KimNo ratings yet