Professional Documents

Culture Documents

Intermediate: Accounting

Uploaded by

Dieu NguyenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Intermediate: Accounting

Uploaded by

Dieu NguyenCopyright:

Available Formats

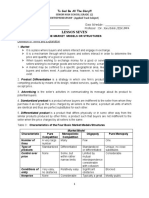

Intermediate Accounting

Seventeenth Edition

Kieso; Weygandt; Warfield

Chapter 3

The Accounting Information

System

This slide deck contains animations. Please disable animations if they cause issues

with your device.

Learning Objectives

After studying this chapter, you should be able to:

1. Describe the basic accounting information system.

2. Record and summarize basic transactions.

3. Identify and prepare adjusting entries.

4. Prepare financial statements from the adjusted trial

balance and prepare closing entries.

5. Prepare financial statements for a merchandising

company.

Copyright ©2019 John Wiley & Sons, Inc. 2

Preview of Chapter 3 (1 of 5)

The Accounting Information System

Accounting Information System

• Basic terminology

• Debits and credits

• Accounting equation

• Financial statements and ownership structure

• The accounting cycle

Copyright ©2019 John Wiley & Sons, Inc. 3

Preview of Chapter 3 (2 of 5)

The Accounting Information System

Record and Summarize Basic Transactions

• Journalizing

• Posting

• Chart of accounts

• Recording process illustrated

• Trial balance

Copyright ©2019 John Wiley & Sons, Inc. 4

Preview of Chapter 3 (3 of 5)

The Accounting Information System

Adjusting Entries

• Types of adjusting entries

• Deferrals

• Accruals

• Adjusted trial balance

Copyright ©2019 John Wiley & Sons, Inc. 5

Preview of Chapter 3 (4 of 5)

The Accounting Information System

Preparing Financial Statements

• Closing

• Post-closing trial balance

• Reversing entries

• Summary

Copyright ©2019 John Wiley & Sons, Inc. 6

Preview of Chapter 3 (5 of 5)

The Accounting Information System

Financial Statements for Merchandisers

• Income statement

• Retained earnings statement

• Balance sheet

• Closing entries

Copyright ©2019 John Wiley & Sons, Inc. 7

Learning Objective 1

Describe the Basic Accounting Information

System

Copyright ©2019 John Wiley & Sons, Inc. 8

Accounting Information System (1 of 4)

Accounting information system

• Collects and processes transaction data

• Disseminates financial information to interested parties

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 9

Accounting Information System (2 of 4)

Helps management answer such questions as:

• How much and what kind of debt is outstanding?

• Were sales higher this period than last?

• What assets do we have?

• What were our cash inflows and outflows?

• Did we make a profit last period?

• Are any of our product lines or divisions operating at a loss?

• Can we safely increase our dividends to stockholders?

• Is our rate of return on net assets increasing?

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 10

Accounting Information System (3 of 4)

Basic Terminology

• Event • Journal

• Transaction • Posting

• Account • Trial Balance

• Real Account • Adjusting Entries

• Nominal Account • Financial Statements

• Ledger • Closing Entries

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 11

Accounting Information System (4 of 4)

Debits and Credits

• An account shows the effect of transactions on a given

asset, liability, equity, revenue, or expense account

• Double-entry accounting system (two-sided effect)

• Recording done by debiting at least one account and

crediting another

• Debits must equal Credits

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 12

Debits and Credits (1 of 5)

The Account

• Record of increases and decreases in a specific asset, liability,

stockholders’ equity, revenue, or expense item.

• Debit = “Left”

• Credit = “Right”

An account can be

illustrated in a

T-account form.

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 13

Debits and Credits (2 of 5)

If the sum of Debit entries are greater than the sum of

Credit entries, the account will have a debit balance.

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 14

Debits and Credits (3 of 5)

If the sum of Credit entries are greater than the sum of

Debit entries, the account will have a credit balance.

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 15

Debits and Credits (4 of 5)

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 16

Debits and Credits (5 of 5)

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 17

The Accounting Equation (1 of 5)

Relationship among the asset, liability and stockholders’

equity accounts of a business:

The equation must be in balance after every transaction.

For every Debit there must be a Credit.

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 18

The Accounting Equation (2 of 5)

1. Owners invest $40,000 in exchange for common stock.

2. Disburse $600 cash for administrative wages.

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 19

The Accounting Equation (3 of 5)

3. Purchase office equipment priced at $5,200, giving a 10 percent

promissory note in exchange.

4. Receive $4,000 cash for services performed.

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 20

The Accounting Equation (4 of 5)

5. Pay off a short-term liability of $7,000.

6. Declare a cash dividend of $5,000.

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 21

The Accounting Equation (5 of 5)

7. Convert a long-term liability of $80,000 into common stock.

8. Pay cash of $16,000 for a delivery van.

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 22

Financial Statements and Ownership

Structure

• Stockholders’ equity section of the balance sheet reports

common stock and retained earnings

• Income statement reports revenues and expenses

• Retained earnings statement reports net income/loss and

dividends

• Because dividends, revenues, and expenses are transferred to

retained earnings at the end of the period, a change in any

one of these three items affects stockholders’ equity

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 23

Financial Statements

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 24

Ownership Structure

Effects of Transactions on Equity Accounts

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 25

The Accounting Cycle

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 26

Identify and Recording Transactions and

Other Events

What to Record?

The FASB uses the phrase “transactions and other events

and circumstances that affect a business enterprise.”

Types of Events:

• External – between an entity and its environment

• Internal – event occurring entirely within an entity

LO 1 Copyright ©2019 John Wiley & Sons, Inc. 27

Learning Objective 2

Record and Summarize Basic Transactions

Copyright ©2019 John Wiley & Sons, Inc. 28

Journalizing (1 of 2)

A company records in accounts those transactions and

events that affect assets, liabilities, equities, revenues,

and expenses.

General Ledger – contains all the asset, liability,

stockholders’ equity, revenue, and expense accounts.

General Journal – a chronological record of transactions.

Journal Entries are recorded in the journal.

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 29

Journalizing (2 of 2)

Illustration: On September 1, Softbyte Inc.'s shareholders

invested $15,000 cash in the corporation in exchange for shares of

stock. On the same date, Softbyte Inc. purchased computer

equipment for $7,000 cash.

GENERAL JOURNAL J1

Date Account Titles and Explanations Ref. Debit Credit

2020

Sept. 1 Cash 15,000

Common Stock 15,000

1 Equipment 7,000

Cash 7,000

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 30

Posting

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 31

Chart of Accounts (1 of 2)

The chart of accounts lists the accounts and account

numbers that identify their location in the ledger. The

numbering system that identifies the accounts usually

starts with the balance sheet accounts and follows with

the income statement accounts.

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 32

Chart of Accounts (2 of 2)

Pioneer Advertising

Chart of Accounts

Assets Stockholders’ Equity

101 Cash 311 Common Stock

112 Accounts Receivable 320 Retained Earnings

113 Allowance for Doubtful Accounts 332 Dividends

126 Supplies 350 Income Summary

130 Prepaid Insurance

157 Equipment

158 Accumulated Depreciation— Revenues

Equipment 400 Service Revenue

Expenses

Liabilities 631 Supplies Expense

200 Notes Payable 711 Depreciation Expense

201 Accounts Payable 722 Insurance Expense

209 Unearned Service Revenue 726 Salaries and Wages Expense

212 Salaries and Wages Payable 729 Rent Expense

230 Interest Payable 732 Utilities Expense

905 Interest Expense

910 Bad Debt Expense

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 33

Recording Process Illustrated (1 of 11)

The following illustrations show the basic steps in the

recording process, using the October transactions of

Pioneer Advertising.

• Pioneer’s accounting period is a month

• A basic analysis and a debit-credit analysis precede the

journalizing and posting of each transaction

• We use the T-account form in the illustrations instead of

the standard account form

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 34

Recording Process Illustrated (2 of 11)

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 35

Recording Process Illustrated (3 of 11)

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 36

Recording Process Illustrated (4 of 11)

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 37

Recording Process Illustrated (5 of 11)

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 38

Recording Process Illustrated (6 of 11)

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 39

Recording Process Illustrated (7 of 11)

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 40

Recording Process Illustrated (8 of 11)

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 41

Recording Process Illustrated (9 of 11)

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 42

Recording Process Illustrated (10 of 11)

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 43

Recording Process Illustrated (11 of 11)

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 44

Trial Balance (1 of 3)

• List of accounts and their balances at a given time

• Usually prepared at end of an accounting period

• Lists accounts in order they appear in ledger, with debit

balances listed in left column and credit balances in right

column

• Totals of the two columns must agree

• Proves mathematical equality of debits and credits after

posting

• Also uncovers errors in journalizing and posting

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 45

Trial Balance (2 of 3)

Pioneer Advertising

Trial Balance

October 31, 2020

Debit Credit

Cash $ 80,000

Accounts Receivable 72,000

Supplies 25,000

Prepaid Insurance 6,000

Equipment 50,000

Notes Payable $ 50,000

Accounts Payable 25,000

Unearned Service Revenue 12,000

Common Stock 100,000

Dividends 5,000

Service Revenue 100,000

Salaries and Wages Expense 40,000

Rent Expense 9,000 .

$287,000 $287,000

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 46

Trial Balance (3 of 3)

Does not prove that a company recorded all transactions or

that the ledger is correct. Trial balance may balance even

when a company:

1. Fails to journalize a transaction.

2. Omits posting a correct journal entry.

3. Posts a journal entry twice.

4. Uses incorrect accounts in journalizing or posting.

5. Makes offsetting errors in recording the amount of a

transaction.

LO 2 Copyright ©2019 John Wiley & Sons, Inc. 47

Learning Objective 3

Identify and Prepare Adjusting Entries

Copyright ©2019 John Wiley & Sons, Inc. 48

Adjusting Entries

Make it possible to:

• Report on balance sheet appropriate assets, liabilities,

and stockholders’ equity at statement date

• Report on income statement proper revenues and

expenses for the period

Adjusting entries are required every time a company

prepares financial statements.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 49

Types of Adjusting Entries

Deferrals:

1. Prepaid expenses: Expenses paid in cash before they are used

or consumed.

2. Unearned revenues: Cash received before services are

performed.

Accruals:

1. Accrued revenues: Revenues for services performed but not yet

received in cash or recorded.

2. Accrued expenses: Expenses incurred but not yet paid in cash or

recorded.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 50

Adjusting Entries for Deferrals

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 51

Prepaid Expenses (1 of 8)

Prepaid Expenses. Assets paid for and recorded before a

company uses them.

Cash Payment Before Expense Recorded

Prepayments often occur in regard to:

• Insurance • Rent

• Supplies • Buildings and equipment

• Advertising

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 52

Prepaid Expenses (2 of 8)

Supplies. Pioneer Advertising purchased advertising

supplies costing $25,000 on October 5. This account

shows a balance of $25,000 in the October 31 trial

balance. An inventory count at the close of business on

October 31 reveals that $10,000 of supplies are still on

hand. Thus, the cost of supplies used is $15,000

($25,000 − $10,000).

The analysis and adjustment for advertising supplies is

summarized in the following illustration.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 53

Prepaid Expenses (3 of 8)

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 54

Prepaid Expenses (4 of 8)

Insurance. On October 4, Pioneer Advertising paid $6,000

for a one-year fire insurance policy. Coverage began on

October 1. Pioneer debited the cost of the premium to

Prepaid Insurance at that time. This account still shows a

balance of $6,000 in the October 31 trial balance.

The analysis and adjustment for insurance is summarized

in the following illustration.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 55

Prepaid Expenses (5 of 8)

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 56

Prepaid Expenses (6 of 8)

Depreciation. The process of allocating the cost of an

asset to expense over its useful life in a rational and

systematic manner.

Pioneer Advertising estimates depreciation on its office

equipment to be $4,800 a year (cost $50,000 less salvage

value $2,000 divided by useful life of 10 years), or $400

per month.

The analysis and adjustment for depreciation is

summarized in the following illustration.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 57

Prepaid Expenses (7 of 8)

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 58

Prepaid Expenses (8 of 8)

Depreciation Statement Presentation. Accumulated

Depreciation—Equipment is a contra asset account. A contra

asset account offsets an asset account on the balance sheet.

Equipment $50,000

Less: Accumulated depreciation—equipment 400 $49,600

The book value of any depreciable asset is the difference

between its cost and its related accumulated

depreciation.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 59

Unearned Revenues (1 of 3)

Receipt of cash before the services are performed is

recorded as a liability called unearned revenues.

Cash Receipt Before Revenue Recorded

Unearned revenues often occur in regard to:

• Rent • Magazine subscriptions

• Airline tickets • Customer deposits

• Tuition

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 60

Unearned Revenues (2 of 3)

Pioneer Advertising received $12,000 on October 2 from R.

Knox for advertising services expected to be completed by

December 31. Pioneer credited the payment to Unearned

Service Revenue. This liability account shows a balance of

$12,000 in the October 31 trial balance. Based on an

evaluation of the service Pioneer performed for Knox during

October, the company determines that it should recognize

$4,000 of revenue in October.

The analysis and adjustment for unearned revenue is

summarized in the following illustration.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 61

Unearned Revenues (3 of 3)

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 62

Adjusting Entries for Accruals

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 63

Accrued Revenues (1 of 3)

Revenues recorded for services performed but cash has yet to

be received at the statement date.

Adjusting entry results in:

Revenue Recorded Before Cash Receipt

Accrued revenues often occur in regard to:

• Rent

• Interest

• Services performed

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 64

Accrued Revenues (2 of 3)

In October, Pioneer Advertising performed services worth

$2,000 that were not billed to clients on or before

October 31. Because these services are not billed, they

are not recorded. The accrual of unrecorded service

revenue increases an asset account, Accounts Receivable.

It also increases stockholders’ equity by increasing a

revenue account, Service Revenue.

The analysis and adjustment for accrued revenue is

summarized in the following illustration.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 65

Accrued Revenues (3 of 3)

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 66

Adjusting Entries for Accrued Expenses

Expenses incurred but not yet paid in cash or recorded.

Adjusting entry results in:

Expense Recorded Before Cash Payment

Accrued expenses often occur in regard to:

• Rent • Taxes

• Interest • Salaries

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 67

Accrued Expenses (1 of 8)

Accrued Interest. Pioneer Advertising signed a three-

month note payable in the amount of $50,000 on

October 1. The note requires interest at an annual rate of

12 percent. Three factors determine the amount of the

interest accumulation:

Face Value Annual Time

of Note × Interest × in Terms of = Interest

Rate One Year

$50,000 × 12% × 1 / 12 = $500

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 68

Accrued Expenses (2 of 8)

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 69

Accrued Expenses (3 of 8)

Accrued Salaries and Wages. At October 31, the salaries and

wages for these days represent an accrued expense and a

related liability to Pioneer. The employees receive total

salaries of $10,000 for a five-day work week, or $2,000 per

day.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 70

Accrued Expenses (4 of 8)

Accrued Salaries and Wages. There are 3 days in the

adjustment period from October 29 to 31. Thus, accrued

salaries and wages at October 31 are $6,000 ($2,000 × 3).

The analysis and adjustment process is summarized in the

following illustration.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 71

Accrued Expenses (5 of 8)

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 72

Accrued Expenses (6 of 8)

Accrued Salaries and Wages. On November 23, Pioneer

will again pay total salaries and wages of $40,000.

Prepare the entry to record the payment of salaries on

November 23.

Salaries and Wages Payable 6,000

Salaries and Wages Expense 34,000

Cash 40,000

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 73

Accrued Expenses (7 of 8)

Bad Debts. Companies estimate uncollectible accounts at

the end of each period. This ensures that receivables are

reported on the balance sheet at their net realizable

value.

Assume that, based on past experience, Pioneer

Advertising reasonably estimates a bad debt expense for

the month of $1,600. The analysis and adjustment

process for bad debts is summarized in the following

illustration.

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 74

Accrued Expenses (8 of 8)

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 75

Adjusted Trial Balance (1 of 2)

Shows the balance of all accounts, after adjusting entries, at the

end of the accounting period.

Pioneer Advertising

Adjusted Trial Balance

October 31, 2020

Debit Credit

Cash $ 80,000

Accounts Receivable 74,000

Allowance for Doubtful Accounts $ 1,600

Supplies 10,000

Prepaid Insurance 5,500

Equipment 50,000

Accumulated Depreciation—Equipment 400

Notes Payable 50,000

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 76

Adjusted Trial Balance (2 of 2)

Debit Credit

Accounts Payable 25,000

Interest Payable 500

Unearned Service Revenue 8,000

Salaries and Wages Payable 6,000

Common Stock 100,000

Dividends 5,000

Service Revenue 106,000

Salaries and Wages Expense 46,000

Supplies Expense 15,000

Rent Expense 9,000

Insurance Expense 500

Interest Expense 500

Depreciation Expense 400

Bad Debt Expense 1,600 .

$297,500 $297,500

LO 3 Copyright ©2019 John Wiley & Sons, Inc. 77

Learning Objective 4

Prepare Financial Statements from the

Adjusted Trial Balance and Prepare Closing

Entries

Copyright ©2019 John Wiley & Sons, Inc. 78

Preparing Financial Statements (1 of 3)

Financial Statements are prepared directly from the

Adjusted Trial Balance.

• Income Statement

• Retained Earnings Statement

• Balance Sheet

LO 4 Copyright ©2019 John Wiley & Sons, Inc. 79

Preparing Financial Statements (2 of 3)

LO 4 Copyright ©2019 John Wiley & Sons, Inc. 80

Preparing Financial Statements (3 of 3)

LO 4 Copyright ©2019 John Wiley & Sons, Inc. 81

Closing

Closing Entries

• To reduce balance of nominal (temporary) accounts to zero

in order to prepare accounts for next period’s transactions

• To transfer all income statement account balances to the

Retained Earnings account in stockholders’ equity

• Balance sheet (asset, liability, and equity) accounts are

not closed

• Dividends are closed directly to the Retained Earnings

account.

LO 4 Copyright ©2019 John Wiley & Sons, Inc. 82

Closing Entries

LO 4 Copyright ©2019 John Wiley & Sons, Inc. 83

Posting Closing Entries

LO 4 Copyright ©2019 John Wiley & Sons, Inc. 84

Post-Closing Trial Balance

Pioneer Advertising Account Debit Credit

Post-Closing Trial Balance Cash $ 80,000

October 31, 2020 Accounts Receivable 74,000

Allowance for Doubtful Accounts $ 1,600

Supplies 10,000

Prepaid Insurance 5,500

Equipment 50,000

Accumulated Depreciation—Equipment 400

Notes Payable 50,000

Accounts Payable 25,000

Unearned Service Revenue 8,000

Salaries and Wages Payable 6,000

Interest Payable 500

Common Stock 100,000

Retained Earnings 28,000

$219,500 $219,500

LO 4 Copyright ©2019 John Wiley & Sons, Inc. 85

Accounting Cycle Summarized

1. Enter the transactions of the period in appropriate journals.

2. Post from the journals to the ledger (or ledgers).

3. Prepare an unadjusted trial balance (trial balance).

4. Prepare adjusting journal entries and post to the ledger(s).

5. Prepare a trial balance after adjusting (adjusted trial balance).

6. Prepare the financial statements from the adjusted trial balance.

7. Prepare closing journal entries and post to the ledger(s).

8. Prepare a post-closing trial balance (optional).

9. Prepare reversing entries (optional) and post to the ledger(s).

LO 4 Copyright ©2019 John Wiley & Sons, Inc. 86

Learning Objective 5

Prepare Financial Statements for a

Merchandising Company

Copyright ©2019 John Wiley & Sons, Inc. 87

Statements of a

Merchandising

Company (1 of 3)

LO 5 Copyright ©2019 John Wiley & Sons, Inc. 88

Statements of a Merchandising

Company (2 of 3)

Uptown Cabinet corp.

Retained Earnings Statement

For the Year Ended December 31, 2020

Retained earnings, January 1 $16,200

Add: Net income 12,200

28,400

Less: Dividends 2,000

Retained earnings, December 31 $26,400

LO 5 Copyright ©2019 John Wiley & Sons, Inc. 89

Statements of a

Merchandising

Company (3 of 3)

LO 5 Copyright ©2019 John Wiley & Sons, Inc. 90

Learning Objective 6

Differentiate the Cash Basis of Accounting

from the Accrual Basis of Accounting

Copyright ©2019 John Wiley & Sons, Inc. 91

Appendix 3A: Cash-Basis Accounting

Versus Accrual-Basis Accounting (1 of 3)

Most companies use accrual-basis accounting. They recognize

• revenue when the performance obligation is satisfied and

• expenses in the period incurred, without regard to the time of

receipt or payment of cash.

Under the strict cash basis, companies record

• revenue only when they receive cash

• expenses only when they disperse cash

Financial statements are not in conformity with GAAP.

LO 6 Copyright ©2019 John Wiley & Sons, Inc. 92

Appendix 3A: Cash-Basis Accounting

Versus Accrual-Basis Accounting (2 of 3)

Illustration: Quality Contractor signs an agreement to

construct a garage for $22,000. In January, Quality begins

construction, incurs costs of $18,000 on credit, and by the

end of January delivers a finished garage to the buyer. In

February, Quality collects $22,000 cash from the

customer. In March, Quality pays the $18,000 due the

creditors.

LO 6 Copyright ©2019 John Wiley & Sons, Inc. 93

Appendix 3A: Cash-Basis Accounting

Versus Accrual-Basis Accounting (3 of 3)

LO 6 Copyright ©2019 John Wiley & Sons, Inc. 94

Appendix 3A

LO 6 Copyright ©2019 John Wiley & Sons, Inc. 95

Conversion from Cash Basis to Accrual Basis (1 of 4)

Illustration: Dr. Diane Windsor, like many small business owners,

keeps her accounting records on a cash basis. In the year 2020, Dr.

Windsor received $300,000 from her patients and paid $170,000 for

operating expenses, resulting in an excess of cash receipts over

disbursements of $130,000 ($300,000 − $170,000). At January 1 and

December 31, 2020, she has accounts receivable, unearned service

revenue, accrued liabilities, and prepaid expenses as shown here.

January 1, 2020 December 31, 2020

Accounts receivable $12,000 $9,000

Unearned service revenue -0- 4,000

Accrued liabilities 2,000 5,500

Prepaid expenses 1,800 2,700

LO 6 Copyright ©2019 John Wiley & Sons, Inc. 96

Conversion from Cash Basis to Accrual Basis (2 of 4)

Service Revenue Computation

Illustration: Calculate service revenue on an accrual basis.

Cash receipts from customers $300,000

− Beginning accounts receivable $(12,000)

+ Ending accounts receivable 9,000

+ Beginning unearned service revenue -0-

− Ending unearned service revenue (4,000) (7,000)

Service revenue (accrual) $293, 000

January 1, 2020 December 31, 2020

Accounts receivable $12,000 $9,000

Unearned service revenue -0- 4,000

Accrued liabilities 2,000 5,500

Prepaid expenses 1,800 2,700

LO 6 Copyright ©2019 John Wiley & Sons, Inc. 97

Conversion from Cash Basis to Accrual Basis (3 of 4)

Operating Expense Computation

Illustration: Calculate operating expenses on an accrual basis.

Cash paid for operating expenses $170,000

+ Beginning prepaid expense $ 1,800

− Ending prepaid expense (2,700)

− Beginning accrued liabilities (2,000)

+ Ending accrued liabilities 5,500 2,600

Operating expenses (accrual) $172, 600

January 1, 2020 December 31, 2020

Accounts receivable $12,000 $9,000

Unearned service revenue -0- 4,000

Accrued liabilities 2,000 5,500

Prepaid expenses 1,800 2,700

LO 6 Copyright ©2019 John Wiley & Sons, Inc. 98

Conversion from Cash Basis to Accrual Basis (4 of 4)

LO 6 Copyright ©2019 John Wiley & Sons, Inc. 99

Appendix 3A: Cash-Basis Accounting

Versus Accrual-Basis Accounting

Theoretical Weaknesses of the Cash Basis

Today’s economy is considerably more lubricated by

credit than by cash.

The accrual basis, not the cash basis, recognizes all

aspects of the credit phenomenon.

Investors, creditors, and other decision makers seek

timely information about a company’s future cash flows.

LO 6 Copyright ©2019 John Wiley & Sons, Inc. 100

Learning Objective 7

Identifying Adjusting Entries That May Be

Reversed

Copyright ©2019 John Wiley & Sons, Inc. 101

Appendix 3B: Using Reversing Entries

(1 of 3)

Illustration of Reversing Entries—Accruals

LO 7 Copyright ©2019 John Wiley & Sons, Inc. 102

Appendix 3B: Using Reversing Entries

(2 of 3)

Illustration of Reversing Entries—Deferrals

LO 7 Copyright ©2019 John Wiley & Sons, Inc. 103

Appendix 3B: Using Reversing Entries

(3 of 3)

Summary of Reversing Entries

1. All accruals should be reversed.

2. All deferrals for which a company debited or credited the

original cash transaction to an expense or revenue account

should be reversed.

3. Adjusting entries for depreciation and bad debts are not

reversed.

Recognize that reversing entries do not have to be used.

Therefore, some accountants avoid them entirely.

LO 7 Copyright ©2019 John Wiley & Sons, Inc. 104

Learning Objective 8

Prepare a 10-Column Worksheet

Copyright ©2019 John Wiley & Sons, Inc. 105

Appendix 3C: Using a Worksheet: The Accounting

Cycle Revisited (1 of 4)

A company prepares a worksheet either

• on columnar paper or

• within a computer spreadsheet.

A company uses the worksheet to

• adjust account balances and

• prepare financial statements.

LO 8 Copyright ©2019 John Wiley & Sons, Inc. 106

Appendix 3C: Using a Worksheet: The Accounting

Cycle Revisited (2 of 4)

Worksheet Columns

• Trial Balance

• Adjustments

• Adjusted Trial Balance

• Income Statement

• Balance Sheet

LO 8 Copyright ©2019 John Wiley & Sons, Inc. 107

Appendix 3C: Using a

Worksheet: The

Accounting Cycle

Revisited (3 of 4)

LO 8 Copyright ©2019 John Wiley & Sons, Inc. 108

Appendix 3C: Using a Worksheet: The Accounting

Cycle Revisited (4 of 4)

Items (a) through (g) below serve as the basis for the adjusting entries made in

the worksheet for Uptown shown on the previous slide:

a. Depreciation of equipment at the rate of 10 percent per year based on

original cost of $67,000.

b. Estimated bad debts of $1,000, based on an aging of Accounts Receivable.

c. Insurance expired during the year $360.

d. Interest accrued on notes receivable as of December 31, $800.

e. The Rent Expense account contains $500 rent paid in advance, which is

applicable to next year.

f. Property taxes accrued December 31, $2,000.

g. Income taxes payable estimated $3,440.

LO 8 Copyright ©2019 John Wiley & Sons, Inc. 109

Learning Objective 9

Compare the Accounting Information

Systems Under GAAP and IFRS

Copyright ©2019 John Wiley & Sons, Inc. 110

IFRS Insights (1 of 4)

Relevant Facts

Similarities

• International companies use the same set of procedures and records to keep

track of transaction data. Thus, the material in this chapter dealing with the

account, general rules of debit and credit, and steps in the recording process—the

journal, ledger, and chart of accounts—is the same under both G AAP and IFRS.

• Transaction analysis is the same under I FRS and GAAP but, as you will see in later

chapters, different standards sometimes impact how transactions are recorded.

• Both the IASB and FASB go beyond the basic definitions provided in this text for

the key elements of financial statements, that is, assets, liabilities, equity,

revenues, and expenses.

LO 9 Copyright ©2019 John Wiley & Sons, Inc. 111

IFRS Insights (2 of 4)

Relevant Facts

Similarities

• A trial balance under I FRS follows the same format as shown in the text.

As shown in the text, dollar signs are typically used only in the trial

balance and the financial statements. The same practice is followed

under IFRS, using the currency of the country in which the reporting

company is headquartered.

Differences

• Rules for accounting for specific events sometimes differ across countries.

For example, European companies rely less on historical cost and more

on fair value than U.S. companies. Despite the differences, the double-

entry accounting system is the basis of accounting systems worldwide.

LO 9 Copyright ©2019 John Wiley & Sons, Inc. 112

IFRS Insights (3 of 4)

Relevant Facts

Differences

• Internal controls are a system of checks and balances designed to

prevent and detect fraud and errors. While most companies have these

systems in place, many have never completely documented them nor

had an independent auditor attest to their effectiveness. Both of these

actions are required under SOX. Enhanced internal control standards

apply only to large public companies listed on U.S. exchanges.

LO 9 Copyright ©2019 John Wiley & Sons, Inc. 113

IFRS Insights (4 of 4)

On the Horizon

The basic recording process shown in this text is followed by companies

around the globe. It is unlikely to change in the future. The definitional

structure of assets, liabilities, equity, revenues, and expenses may change

over time as the IASB and FASB evaluate their overall conceptual

framework for establishing accounting standards. In addition, high-quality

international accounting requires both high-quality accounting standards

and high-quality auditing. Similar to the convergence of GAAP and IFRS,

there is a movement to improve international auditing standards. The

International Auditing and Assurance Standards Board (I AASB) functions

as an independent standard-setting body. It works to establish high-

quality auditing and assurance and quality-control standards throughout

the world. Whether the IAASB adopts internal control provisions similar

to those in SOX remains to be seen.

LO 9 Copyright ©2019 John Wiley & Sons, Inc. 114

Copyright

Copyright © 2019 John Wiley & Sons, Inc.

All rights reserved. Reproduction or translation of this work beyond that permitted in

Section 117 of the 1976 United States Act without the express written permission of the

copyright owner is unlawful. Request for further information should be addressed to the

Permissions Department, John Wiley & Sons, Inc. The purchaser may make back-up copies

for his/her own use only and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the use of these programs or

from the use of the information contained herein.

Copyright ©2019 John Wiley & Sons, Inc. 115

You might also like

- CH 03Document114 pagesCH 03Sabbir ahmedNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- CH 02Document59 pagesCH 02thucnhi.2003hnntNo ratings yet

- CH 02Document59 pagesCH 02Linda Anadya TastyaNo ratings yet

- Ch2 4e - Recording Process 2021Document51 pagesCh2 4e - Recording Process 2021Nhung CaoNo ratings yet

- CH 02Document57 pagesCH 02Fd AhNo ratings yet

- Ch2 4e - Recording ProcessDocument59 pagesCh2 4e - Recording ProcessChâu HàNo ratings yet

- Financial Accounting: Weygandt KimmelDocument59 pagesFinancial Accounting: Weygandt KimmelAnh LýNo ratings yet

- CH 02Document53 pagesCH 02Hoàng Lâm NguyễnNo ratings yet

- ch03 Kieso IFRS4 PPT SentDocument121 pagesch03 Kieso IFRS4 PPT SentPhee SiwakornNo ratings yet

- Chapter 1- IntroductionDocument37 pagesChapter 1- Introductionthanhtrang.ngole.hcmiuNo ratings yet

- Chap 2 SlideDocument30 pagesChap 2 Slidehainguyen.31231022080No ratings yet

- Intermediate: AccountingDocument108 pagesIntermediate: AccountingDieu NguyenNo ratings yet

- CH 02Document42 pagesCH 02Lê JerryNo ratings yet

- BBAW2103 - Tutorial 1Document69 pagesBBAW2103 - Tutorial 1M THREE THOUSAND RESOURCESNo ratings yet

- Accounting PrinciplesDocument45 pagesAccounting PrinciplesDella SamsuddinNo ratings yet

- AccountingDocument34 pagesAccountingdr.a.youssryNo ratings yet

- CH 07Document52 pagesCH 07Rabie HarounNo ratings yet

- CH 01Document24 pagesCH 01Lê JerryNo ratings yet

- Lecture 2Document38 pagesLecture 2Preet LohanaNo ratings yet

- Chapter 3Document90 pagesChapter 3임재영100% (1)

- CH 02Document53 pagesCH 02Linh Trần Thị KhánhNo ratings yet

- CH 01Document53 pagesCH 01Ismadth2918388No ratings yet

- Supplementary 1 - Financial StatementsDocument21 pagesSupplementary 1 - Financial StatementsQuốc Khánh100% (1)

- Ch1 4e Acc in Action.Document54 pagesCh1 4e Acc in Action.Phương NguyễnNo ratings yet

- CH 01Document53 pagesCH 01Triệu Nguyễn MinhNo ratings yet

- Chapter 1Document54 pagesChapter 1Phước Hà NgôNo ratings yet

- CH 02Document59 pagesCH 0263D-026-Md Golam Muktadir AsifNo ratings yet

- Basics of Accounting: Zafar MehsudDocument28 pagesBasics of Accounting: Zafar MehsudatifNo ratings yet

- Ch1 4e - Acc in Action 2021Document50 pagesCh1 4e - Acc in Action 2021Nhung CaoNo ratings yet

- Ch1 4e - Acc in Action 2021Document50 pagesCh1 4e - Acc in Action 2021K59 Vu Thi Thu HienNo ratings yet

- CH 01Document56 pagesCH 01thucnhi.2003hnntNo ratings yet

- CH 01Document35 pagesCH 01Azure JohnsonNo ratings yet

- Chapter 1Document59 pagesChapter 1Denny ramadhan100% (1)

- CH 02Document53 pagesCH 02Phương AnhhNo ratings yet

- Accounting Principles: The Recording ProcessDocument55 pagesAccounting Principles: The Recording ProcessSayed Farrukh AhmedNo ratings yet

- ch02 STDocument28 pagesch02 STThái DungNo ratings yet

- CH 17Document77 pagesCH 17Nasim Rosin100% (1)

- CH 13Document77 pagesCH 13Mohammed SamyNo ratings yet

- Chapter 1 IntroductionDocument34 pagesChapter 1 IntroductionLinda LiongNo ratings yet

- ch01 2Document58 pagesch01 2Lê JerryNo ratings yet

- CH 01Document54 pagesCH 01Ngân Hà ĐỗNo ratings yet

- Events: The Accounting Information SystemDocument13 pagesEvents: The Accounting Information Systemkayla tsoiNo ratings yet

- CH 05Document107 pagesCH 05Sabbir ahmedNo ratings yet

- Class NotesDocument45 pagesClass NotesNaveed Whatsapp Status100% (1)

- L2 - Accounting Equation & Transaction Analysis - Edited With AnsswerDocument39 pagesL2 - Accounting Equation & Transaction Analysis - Edited With AnsswerEslam SamyNo ratings yet

- Accounting Pre Q1 Mid-Term Review 11thDocument36 pagesAccounting Pre Q1 Mid-Term Review 11thOscar Armando Villeda AlvaradoNo ratings yet

- CH 03Document60 pagesCH 03Dr. Murad SalehNo ratings yet

- ACCT 101 Debits & Credits GuideDocument28 pagesACCT 101 Debits & Credits GuideAldo CalderaNo ratings yet

- Financial Statements and Business DecisionsDocument37 pagesFinancial Statements and Business DecisionsHARMAN SINGHNo ratings yet

- ch07 STDocument31 pagesch07 STquangle.31221025758No ratings yet

- CH 11Document94 pagesCH 11JesussNo ratings yet

- BASIC ACCOUNTINGDocument36 pagesBASIC ACCOUNTINGKawaii SevennNo ratings yet

- Lecture 3 - Adjusting The AccountsDocument72 pagesLecture 3 - Adjusting The AccountsAsim FahimNo ratings yet

- Lecture 3 DoubleentrysystemDocument47 pagesLecture 3 Doubleentrysystem叶祖儿No ratings yet

- Accounting Concepts & PrinciplesDocument26 pagesAccounting Concepts & PrinciplesThy Ngoc100% (1)

- ACCT6174 - Introduction To Financial Accounting: Week 1 Accounting in ActionDocument24 pagesACCT6174 - Introduction To Financial Accounting: Week 1 Accounting in ActionFatimatuz ZahroNo ratings yet

- Recording Business TransactionsDocument29 pagesRecording Business TransactionsDheeraj SinghalNo ratings yet

- Lecture 3 - Adjusting The AccountsDocument72 pagesLecture 3 - Adjusting The AccountsS. M. Fahmidunnabi 2035150660No ratings yet

- Intermediate: AccountingDocument108 pagesIntermediate: AccountingDieu NguyenNo ratings yet

- Intermediate: AccountingDocument64 pagesIntermediate: AccountingDieu NguyenNo ratings yet

- Intermediate: AccountingDocument76 pagesIntermediate: AccountingDieu NguyenNo ratings yet

- Syllabus - Management in Financial Institutions - FIN460Document10 pagesSyllabus - Management in Financial Institutions - FIN460Dieu NguyenNo ratings yet

- Banking Sector Overview: Definitions, Regulation, FunctionsDocument39 pagesBanking Sector Overview: Definitions, Regulation, FunctionsDieu NguyenNo ratings yet

- NSTP (Swot Analysis)Document1 pageNSTP (Swot Analysis)Jerson PepinoNo ratings yet

- Multiple Choice Questions Chapter 1Document6 pagesMultiple Choice Questions Chapter 1Bayan Sharif0% (1)

- EfqmDocument6 pagesEfqmPraveen KumarNo ratings yet

- PA 201 (KarenSio) - TERM PAPERDocument24 pagesPA 201 (KarenSio) - TERM PAPERKaren SioNo ratings yet

- 4 - Change in Capital StructureDocument18 pages4 - Change in Capital Structurelou-924No ratings yet

- Burshane Petroleum Income Statement AnalysisDocument25 pagesBurshane Petroleum Income Statement AnalysisCorolla GrandeNo ratings yet

- Understanding Corporate StrategyDocument12 pagesUnderstanding Corporate StrategylovenanuinNo ratings yet

- AP AR NettingDocument3 pagesAP AR NettingMr. JalilNo ratings yet

- Perancangan Model Data Warehouse Dan Perangkat Analitik Untuk Memaksimalkan Proses Pemasaran Hotel: Studi Kasus Pada Hotel AbcDocument10 pagesPerancangan Model Data Warehouse Dan Perangkat Analitik Untuk Memaksimalkan Proses Pemasaran Hotel: Studi Kasus Pada Hotel Abcfaisal zafryNo ratings yet

- Organisational Climate Study of Ambuja Cement FactoryDocument17 pagesOrganisational Climate Study of Ambuja Cement FactoryParidhi BhandariNo ratings yet

- SRM 4 Step ProcessDocument53 pagesSRM 4 Step Processex4182No ratings yet

- SHS LESSON 7 Market Models or StructuresDocument12 pagesSHS LESSON 7 Market Models or StructuresPaul AnteNo ratings yet

- Digital Transformation Study in SMEsDocument20 pagesDigital Transformation Study in SMEssilfiNo ratings yet

- Brand Management Proposal for Delhi RestaurantDocument3 pagesBrand Management Proposal for Delhi RestaurantParamveer SinghNo ratings yet

- Importance of Labor Law Knowledge To The HRDocument5 pagesImportance of Labor Law Knowledge To The HRMohammad Khaled100% (1)

- Atlantic Computer A Bundle of Pricing OptionsDocument2 pagesAtlantic Computer A Bundle of Pricing OptionsShipra100% (1)

- ECON254 Lecture3 Costs-SupplyDocument37 pagesECON254 Lecture3 Costs-SupplyKhalid JassimNo ratings yet

- Argumentative Essay ExampleDocument2 pagesArgumentative Essay Exampleapi-264112842100% (2)

- Report ThursdayDocument6 pagesReport ThursdayReginald ValenciaNo ratings yet

- Nature & Significance of ManagementDocument49 pagesNature & Significance of ManagementPalak Gupta100% (2)

- S Residence Painting WorksDocument4 pagesS Residence Painting WorksRON JAYSON ARCIAGANo ratings yet

- Availability As of December 1, 2020: Classification Phase LOT Area List Price Exclusive of Vat & Oc Allocation StatusDocument7 pagesAvailability As of December 1, 2020: Classification Phase LOT Area List Price Exclusive of Vat & Oc Allocation StatusMia NungaNo ratings yet

- Draft PKS Trend Sukapura MandiriDocument8 pagesDraft PKS Trend Sukapura MandiriFirly Fania HQNo ratings yet

- Baumol ModelDocument5 pagesBaumol ModelGargiNo ratings yet

- Business PlanDocument13 pagesBusiness PlanShilpaNo ratings yet

- Calculating interest rate risk using duration gap analysisDocument14 pagesCalculating interest rate risk using duration gap analysissushant ahujaNo ratings yet

- Further Scope of The Study Regarding Investment BankingDocument3 pagesFurther Scope of The Study Regarding Investment BankingMehedi HassanNo ratings yet

- Strategy Formulation ProcessDocument2 pagesStrategy Formulation Processnidhink18100% (1)

- Week 5 - Performance Task 2Document2 pagesWeek 5 - Performance Task 2Eurika Nicole BeceosNo ratings yet

- Assignment PDFDocument31 pagesAssignment PDFKhanNo ratings yet